Make A Decision That Best Fits Your Business And Employees

Based on all the considerations listed above, its easy to see how small business owners will need to devote a significant amount of time to vetting the different group health insurance options available. Its important to remember that this wont be a snap decision to make, and you dont want it to be. You will be making a significant financial commitment, and it makes sense to take time making that decision.

Moreover, its important to get it right the first time. While its possible to switch plans during the open enrollment period , changing plans means you and your employees may need to find new doctors and adapt to the ins and outs of a brand new company. That can be highly annoying and stressful, too.

Offering your employees health insurance benefits makes you competitive in the job market, improves employee morale and can qualify you for tax breaks. Its worth getting it right when youre making such a huge decision that affects everyone on your staff.

It Boosts Employee Productivity

Worrying about healthcare coverage and neglecting preventative care because of healthcare costs can lead to stress and illness, both of which lower employee productivity at work. According to the Center for Disease Control, healthier employees are more productive and are less likely to call in sick for work. Offering health care coverage to employees can reduce stress levels and encourage workers to get the care they need to maintain their health and stay productive.

How Many Employees Do You Need To Qualify For Group Health Insurance

Group health insurance is a cost-effective way for small businesses to offer health insurance, as its cheaper than buying individual plans.

A company has to have fewer than 50 employees to qualify for group health insurance. You also have to have an office of some sort in the state where youre applying for coverage, and you need to enroll at least 70% of your uninsured employees.

If youre a family-run business, you need to check your eligibility for group health insurance, as you need to have workers who are not related to or the spouse of the owner of the company. If you only employ family members, youll need to apply for a family health insurance plan instead. Sole proprietors also cannot apply for group health insurance.

Part-time employees and seasonal workers do not count as part of the group, but you can still choose to offer them group health insurance. You can also provide individual health insurance to specific workers alongside your group plan.

Read Also: How Do I Get Health Insurance If I Retire Early

Pros Of Offering Health Insurance Benefits

In addition to attracting quality candidates, here are six other advantages to investing in healthcare insurance for your employees:

- Employee retention : Research from the Society of Human Resource Management found that employees are more likely to stay with an employer if they like their healthcare plan.

- Lower premiums: Group plans typically cost less than individual plans, even within the ACA framework.

- Pretax benefit for employees: In many cases, small business-provided health insurance can reduce employees’ tax burden, which provides your workers with more take-home income.

- Healthier and productive employees: When employees have access to healthcare, they, and their dependents, can more easily address health issues early on. This results in healthier employees, which reduces the number of days employees take off because of illness.

- Creating an employee-focused company culture: Few things boost company culture more than offering benefits that employees truly value. Having a solid benefit offering shows employees that the company cares about them. Health care insurance is one of those key benefits that a business can offer its workers that powerfully delivers this message.

- Possible employer tax credit eligibility: Although it is not required for small businesses to offer group health insurance, some employers may benefit from a tax credit through the ACA’s Small Business Health Options Program .

Do Small Businesses Have To Offer Health Insurance A Guide To Employee Health Benefits

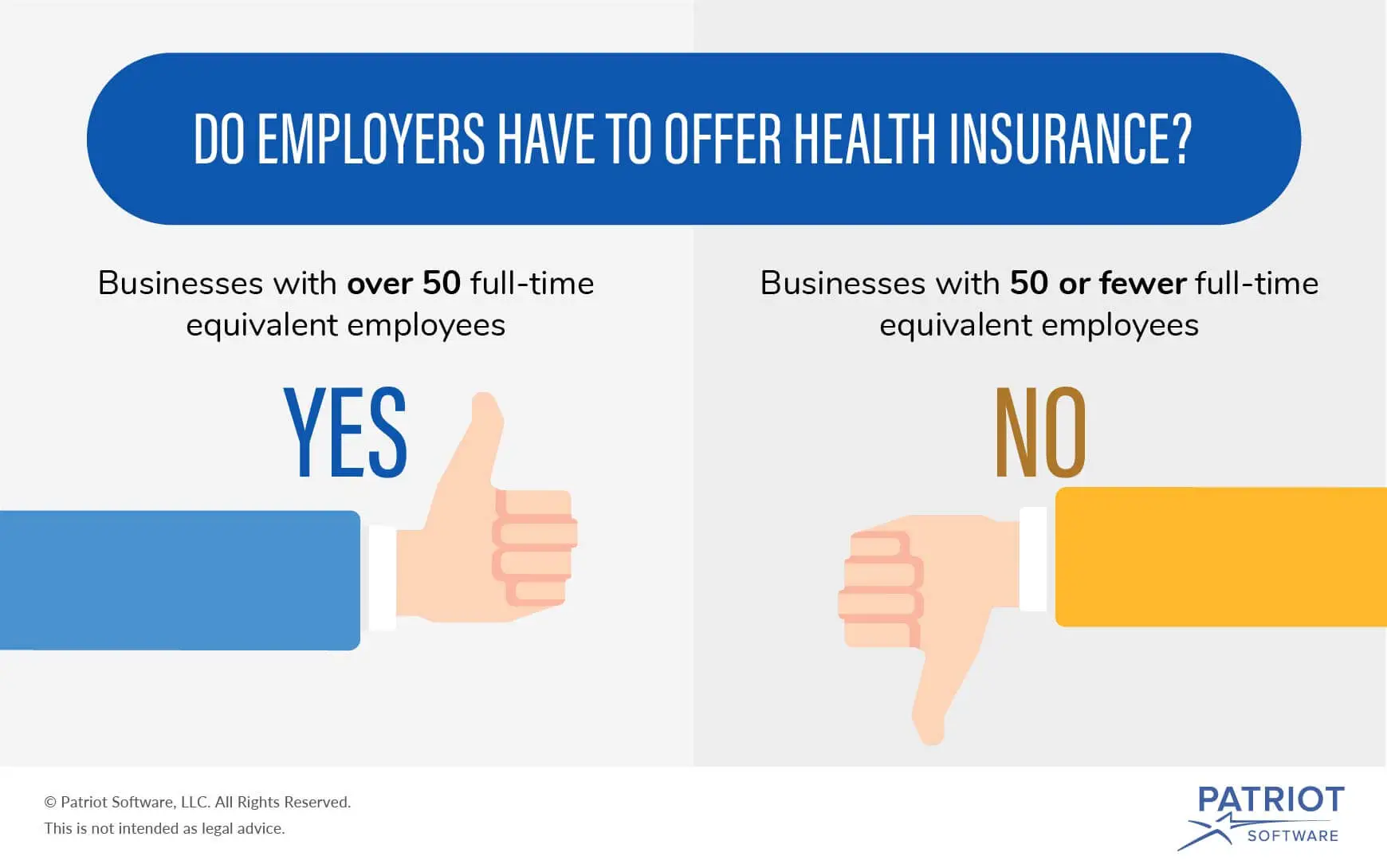

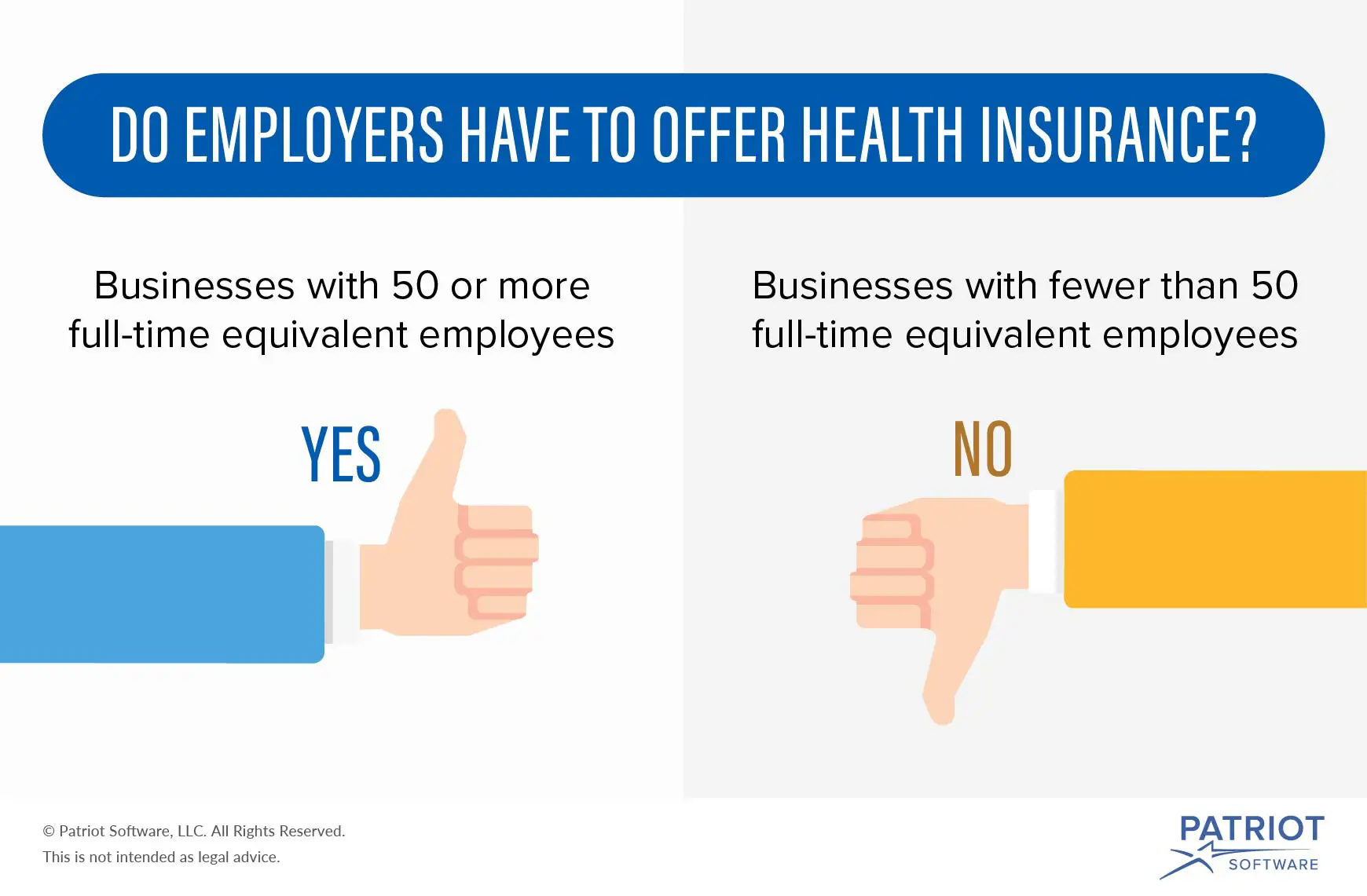

The health insurance mandates of the Affordable Care Act have changed since President Donald Trump took office. Many small business owners are confused and have questions about whether or not they have to offer health insurance to their employees. In 2018, small businesses with fewer than fifty full-time equivalent employees are not required by law to provide health insurance to their workers.

These topics will show you how to determine if you need to provide health insurance and walk you through your health benefits options:

Recommended Reading: How To Get Appointed To Sell Health Insurance

How To Know If You Qualify For The Shop Marketplace

-

SHOP insurance is available to employers with 1-50 full-time equivalent employees in most states . Use our FTE Employee Calculator to find out if you qualify to use SHOP.

-

You must offer SHOP coverage to all of your full-time employees generally those working 30 or more hours per week on average.

-

In many states, at least 70% of employees offered coverage must accept the offer, or be covered by another form of coverage, for the employer to participate. For help calculating the SHOP minimum participation rate in your state, visit the MPR Calculator.

-

You must have an office or employee work site within the state whose Small Business Health Options Program you want to use.

Get more details on SHOP eligibility rules.

Summary Of Benefits And Coverage Disclosure Rules

Employers must provide employees with a standard “Summary of Benefits and Coverage” form explaining what their health plan covers and what it costs. The purpose of the SBC is to help employees understand their health insurance options. You could face a penalty for non-compliance. Learn more about SBCs and see a sample completed form.

Don’t Miss: How To Qualify For Government Health Insurance

Where To Go For Information

The Small Business Administration has information on its website about what small businesses need to provide in terms of health insurance, along with links to their SHOP program and information on tax credits. You can also find out about webinars and in-person training sessions run through small business development centers, SCORE chapters or Womens Business Centers. The website is constantly being updated, said the SBAs Natalia Olson. Healthcare.gov is another good resource for ACA health insurance information.

Olson recommends also talking to your lawyer and accountant, as they should be up on how the latest government changes affect small businesses. A health insurance broker is a key person for finding small business health insurance plans. It can be challenging to find an effective and knowledgeable broker, given that brokers arent highly compensated for small group plans, says Farris. Through networking, you can find a broker to help you.

With government regulations constantly changing, its tough to stay abreast of the requirements. Continue networking with other small businesses, which may have helpful information as well.

As Affordable Care Act Enrollment Starts This Week These Are Four Things Small Businesses Should Consider

Its a once-a-year opportunity for hundreds of thousands of people in Pennsylvania, New Jersey, and Delaware to enroll, cancel, waive coverage, change plans, or drop and add coverage.

Beginning this week, the health-care exchanges open up for an enrollment period that will end in January. Its a once-a-year opportunity for hundreds of thousands of people in Pennsylvania, New Jersey, and Delaware to enroll, cancel, waive coverage, change plans, or drop and add coverage for themselves and family members.

But what about small employers? The Affordable Care Act excludes businesses with fewer than 50 employees from the requirement of providing health insurance for their employees. But although the health-care exchanges are focused on providing coverage for individuals, the open enrollment period presents a good opportunity to consider what options are available for small-business owners and their employees.

Also Check: What Does Pcp Mean In Health Insurance

What Are Small Business Health Insurance Requirements Related To Tax Reporting In 2021

If you decide to offer group health coverage to your employees, be mindful of certain tax reporting requirements for small businesses in 2021.

- You must report the value of the insurance provided to each employee. This information goes on the employees Form W-2 using the code DD, as per IRS requirements.

- IRS requires your business to withhold and report an additional 0.9 percent on employee compensation that is greater than $200,000, as per the ACA.

- Your small business also must pay a fee toward funding the Patient-Centered Outcomes Research Trust Fund. You are required to report this fee through Form 720.

Option : Reimburse For Health Insurance With An Hra

What is an HRA?

A health reimbursement arrangement is an affordable, tax-advantaged alternative to traditional insurance where employers reimburse their employees for individual insurance premiums and medical expenses on a pre-tax basis.

Unlike Health Savings Accounts and Flexible Spending Accounts that are accounts, HRA stands for Health Reimbursement Arrangement, meaning that the model operates on reimbursements. Employees will pay the insurance company or doctors office directly and then submit a claim to get reimbursed for their expenses tax-free.

The use of new reimbursement models of HRAs put the employer’s reimbursements on nearly the same tax playing field as traditional small group plans, but without all the hassles and requirements. Before, a big advantage for group plans was that they were deductible expenses for employers and were taken out of employee paychecks on a pre-tax basis. With an HRA, employers can make reimbursements without having to pay payroll taxes and employees dont have to recognize income tax. In addition, reimbursements made by the company count as a tax deduction.

How an HRA works

HRAs that work best for health insurance for small business

There are a few different kinds of HRAs that are worth noting.

QSEHRA: To cut quickly through the insurance jargon , a QSEHRA allows small employers to set aside a fixed amount of money each month that employees can use to purchase individual health insurance or use on medical expenses, tax-free.

Recommended Reading: What Is New Health Insurance Marketplace Coverage

Do Small Businesses Have To Offer Health Insurance

The short, simple answer is, no. But as always with health insurance, the short, simple answer is not quite the right one. For one thing, it depends on what we mean by small.

Under the Affordable Care Act , businesses with the equivalent of 50 or more full-time employees have to offer health care to their employees or pay a penalty. The choice is up to their management.

Other Changes To Know In 2016

The definition of âsmall employerâ is expanding. Due to changes in state law, starting in 2016, the definition of âsmall employerâ is expanded to include businesses with 50 to 100 FTE employees. This means that Covered California for Small Business is available to small businesses with up to 100 FTE employees, whereas it had not been before. Through Covered California for Small Business, small employers can shop for coverage for their employees among multiple carriers across multiple levels of coverage. Covered California also relieves employers of administrative burden by handling much of the payment distribution to health plans across carriers and coverage levels. And, federal tax credits are available to those businesses that qualify.

New coverage requirements for large businesses. Starting in 2016, insurance carriers offering products in the large group market are prohibited from marketing, offering, amending or renewing a large group plan contract or policy that provides a minimum value of less than 60%. Large businesses purchasing a health coverage plan for their employees should confirm that the plan provides no less than 60% minimum value.

Recommended Reading: How Do I Pay My Health Insurance Deductible

Does Small Business Have To Provide Health Insurance

Given the ongoing decline in employer-sponsored health coverage and soaring healthcare costs, many cash-strapped small business owners ask, “Do small businesses have to provide health insurance?”

Read on to learn whether or not you’re legally required to provide healthcare coverage for your employees. Plus, why you might want to offer it if you have the budget.

Is It Illegal Not To Offer Health Insurance

In general, employers are not legally required to offer health insurance to employees. However, under the Affordable Care Act , employers with 50 or more employees or 50 full-time equivalent employees who dont offer health coverage to at least 95% of full-time employees must pay a penalty called the employer shared responsibility provisions.

Employers covered by the Fair Labor Standards Act are required to provide employees with a notice about the health insurance marketplace and whether they offer employer-sponsored health coverage.

You May Like: How Much Do I Have To Pay For Health Insurance

Know The Rules About Offering Health Insurance

When it comes to healthcare benefits for employees, the rules for small businesses are actually pretty straight forward. Youre required to offer your employees health insurance if you have 50 or more FTEs . Additionally, the health insurance you offer must be considered affordable for your employees. In nuts and bolts, that means that the health insurance benefits must not cost employees more than 9.86% of their annual income. In general, thats not a hard bar to clear.

If your company falls into the above category, then youve got your marching orders. However, if your company is structured differently, then youll need to make other considerations. For example, if you only have 20 full-time employees, you arent required by law to supply your employees with health insurance benefits however, if you do, youre eligible for a tax credit.

Here is an overview of how a small business can qualify for a tax credit when offering employees health insurance:

- Have 25 or fewer FTEs

- Offer health insurance to all full-time employees

- Pay your FTEs an average of $50,000 a year

- Pay at least 50% of the health insurance costs

Helping Employees Get Individual Coverage

If your business doesnt offer health insurance, its a good idea to educate your employees particularly lower-income employees on the choices they have on the various state health-care marketplace exchanges. Employees in Pennsylvania and New Jersey without employer-sponsored coverage can visit Pennie or GetCoveredNJ . where they can find out more about which plans may be available to them.

Small employers can have an important role in educating and encouraging their employees without health insurance coverage to visit these marketplace websites to find and enroll in an individual and family plan, said a representative from the Department of Health and Human Services Center for Consumer Information and Insurance Oversight. For small-business employees without employer-sponsored coverage or self-employed individuals, there are major marketplace improvements for individual and family plans because of the American Rescue Plan Act of 2021.

Thanks to this legislation, people who buy their own health insurance directly through the marketplace may be eligible to receive increased tax credits to reduce their premiums.

Business owners with no employees, or self-employed individuals, can use the marketplace for individuals and families to enroll in a health plan that best fits their needs.

You May Like: Can Substitute Teachers Get Health Insurance

Can Small Businesses Offer Health Insurance

As a result of the ACA, small businesses do not have to provide health insurance to their employees. The United States does not require businesses to carry insurance, instead, under the Affordable Care Act, large businesses that fail to carry insurance cover must pay an IRS penalty for their failure to do so.

This Looks Like It Could Be A Major Headache What Should I Do

Indeed, it can. The record-keeping, calculations, correspondence, and administrative duties involved will probably consume the time of at least one full-time employee. For this reason, you may want to consider outsourcing your insurance administration or compliance handling to a company that specializes in them. Contact Health Care Insurance Company on the web or call them at 401-8383.

Also Check: How To Add Dependent To Health Insurance

How Can I Purchase A Health Insurance Plan

There is more than one way to purchase a health insurance plan. Here are the most popular for small businesses:

- Group health insurance plans: You can buy these plans through the federally run SHOP Marketplace. This was the most popular choice for small businesses in the past, but due to the high costs and lack of flexibility, this is no longer an option for many companies.

- Qualified small employer health reimbursement arrangement : Set up by Congress in December 2016, QSEHRA is becoming an increasingly popular choice for small businesses. Under this arrangement, businesses offer employees a tax-free monthly allowance, and employees then choose and pay for their own health care using that money. The advantages of QESHRA are that it gives employees the flexibility to choose their own plan and its considerably easier to manage from an administrative point of view.

- Association health plans: Small businesses can join with other small companies to buy large-group health insurance . This works in the same way as a normal group health insurance policy.

Why Health Insurance For Small Business Is Important

Health insurance can be a major financial deterrent when you’re considering going out on your own. But it doesn’t have to be.

There are tax-friendly tools on the market called health reimbursement arrangements that help new business owners like you afford benefits, either for you personally or your growing team. We’ll touch on the subject later on in this post. So keep reading!

If you are planning on growing, having a competitive benefits package is key to recruiting and maintaining the top talent in a tight job market. Your company is only as good as the team you build, and it’s just common sense to ensure that those valuable team-members remain loyal. Compensation is a big driving factor, but other things like benefits and culture are also extremely important to today’s workforce.

And remember, benefits aren’t just important to ensure that your team is happy and covered, if you fail to offer competitive benefits, it can bring some serious financial consequences, not to mention the risk of losing employees you depend on to competitors.

A study by the Society for Human Resource Management shares that on average, the cost to hire an employee is $4,129, taking around 42 days to fill a position.

And if you’re replacing an employee instead of hiring for a new position, the numbers are even worse.

Don’t Miss: How Much Aetna Health Insurance Cost