How Can I Save Money With A Deductible

Even though you pay more of the claim when you have a higher deductible, most people do not have claims each year. So, each year you do not have a claim, you could raise itsaving you money.

You can change your deductible on your policy to fit your needs. If you can afford a higher one in one year but then feel that you would like to reduce it later, it is not usually a problem. Be aware that your payments will also change. If you have a high claims rate, your payments may also rise.

How Does An Embedded Deductible Work

In an embedded deductible health plan, the policy will have two deductibles: the individual deductible for each family member covered and a family deductible. Due to the two deductibles, the coverage provided by the insurer for embedded policies can be accessed sooner.

When one family member accrues enough medical expenses to the point that they meet their individual deductible, after-deductible health insurance benefits, like copays, coinsurance and cost sharing, will be provided by the insurer. However, these will be provided solely for that family member. Other members of the family would not yet be eligible for the same benefits.

Once multiple family members’ medical expenses add up and surpass the family deductible, the insurer would begin to pay covered medical expenses for all members of the family. This applies even if a member did not meet their individual deductible.

Typically, embedded deductibles are exactly half of the entire family deductible. For example, a marketplace family health insurance plan with embedded deductibles could have a family deductible of $10,000 and individual deductibles of $5,000 for every covered member of the family.

How Do Premiums Deductibles Cost

Generally,the more benefits your plan pays, the more you pay in premium. But your medicalexpenses for care are lower.

Toillustrate how these costs may influence your choice of plans, consider the ACAplans.

Inaddition to the metallic plan categories, some people are eligible to purchasea plan with catastrophic coverage. Catastrophic plans have very low premiums andvery high annual deductibles . However, they pay for preventivecare regardless of the deductible. These plans may be a suitable insuranceoption for young, healthy people. To qualify for a Catastrophic plan, you mustbe under age 30 or be of any age with a hardship exemption or affordabilityexemption . Learnmore about Catastrophic coverage.

You May Like: How Much Is Health Insurance For Seniors

Don’t Miss: How To Set Up Small Business Health Insurance

Do All Medical Expenses Count Towards My Deductible

Not all medical bills are covered by your insurance, and therefore, not all medical expenses count towards your deductible. Many health insurance plans do not cover services such as acupuncture, fertility treatment, or weight loss surgery. So its important to check what your plan covers before making the appointment. Otherwise, you could be on the hook for the whole bill without even making a dent in your deductible. Every plan is different, so always remember to check ahead of time.

What Deductible Plan May Be Right For Me

If you dont anticipate needing many medical expenses for the upcoming plan year, a high deductible health plan may be the most economical one for you. If you do anticipate upcoming medical expenses, a low deductible plan might help you get the most mileage out of your plan.

| High deductible health plans may appeal to those who: | Low deductible health plans may appeal to those who: |

|---|---|

| Are young and generally healthy | Are 65 or over |

You May Like: Does Progressive Do Health Insurance

What Is A Copay

A copay is a fixed amount you pay for a health care service, usually when you receive the service. The amount can vary by the type of service.

How it works: Your plan determines what your copay is for different types of services, and when you have one. You may have a copay before youve finished paying toward your deductible. You may also have a copay after you pay your deductible, and when you owe coinsurance.

Your Blue Cross ID card may list copays for some visits. You can also log in to your account, or register for one, on our website or using the mobile app to see your plans copays.

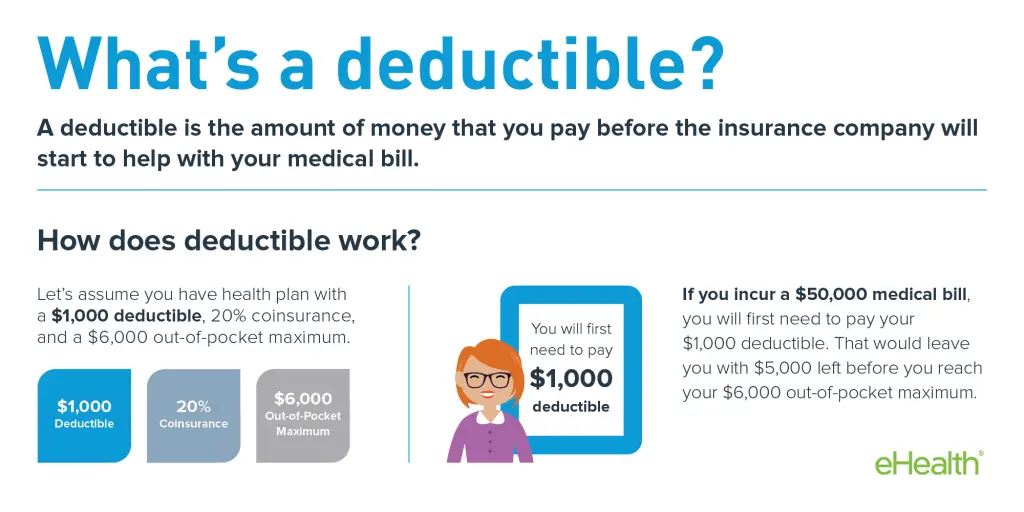

How A Deductible In Health Insurance Works

When you purchase health insurance, you seek protection against the unexpected expenses appearing in the form of medical bills.

Lets understand it this way.

Most consumers agree to pay the smaller part before getting the big financial help from the insurer. Depending upon your health insurance plan and coverage, the insurer will calculate and tell you the deductible amount you are entitled to pay before making a claim.

Also Check: Can I Have Dental Insurance Without Health Insurance

Should I Have A High Or Low Deductible

As mentioned, the health insurance deductible may vary from plan to plan. Its important to take your time to compare plans side by side, since higher plan deductible may be offset by lower cost sharing or premiums, and vice versa. Some plans may not have a deductible at all. These plans are referred to as zero-deductible plans. Zero-deductible plans typically come with higher premiums while high-deductible plans typically come with lower premiums.

If you frequently visit doctors or take multiple medications, a zero-deductible plan may suit your budget and coverage needs. If, on the other hand, youre generally healthy and dont use medical services often, you may find youre unlikely to reach your plans deductible every year. In that case, it may make more sense to find a plan with a higher deductible if its offset by lower monthly premiums. You may find you end up paying less overall this way.

eHealth offers a wide range of individual and family health insurance plans for a variety of budgets and needs. Our plan finder tool makes it easy to browse and compare plan options. Remember, health insurance costs are regulated, so youll never pay more at eHealth than you would elsewhere.

What Does No Charge After Deductible Mean

This means that once you have paid your deductible for the year, your insurance benefits will kick in, and the plan pays 100% of covered medical costs for the rest of the year. After youve reached this limit, you will not have copayments, coinsurance, or other out-of-pocket costs.

In most health insurance plans, the health insurance carrier usually only pays 100% of covered medical costs once youve reached your out-of-pocket maximum. This threshold is a similar idea to your deductible, except usually higher meaning you have to spend more money on covered medical costs before reaching it.

Recommended Reading: Can I Cancel My Health Insurance

Examples Of How They Work

Say you backed your car into one of the light posts in the mall parking lot and caused $1,000 worth of damage to your car. If your deductible is $1,500, the insurance will not pay to repair the damage. If you had a $500 deductible, you’d pay $500, and they would pay $500.

Often, there are discrete types of coverage under the same policy, each with its own deductible. You may also have one deductible for your home and its contents.

Another example of different deductibles on one policy is an endorsement or rider. The rider may have no deductible, even though the rest of your policy does. One reason many people buy a rider is to avoid a deductible on high-value items.

What Are Deductibles In Health Insurance In India

Team AckoNov 15, 2021

Understanding different terms associated with health insurance might seem like a difficult task. However, these terms are important components of health insurance which influence the percentage of the claim the insurance company will pay. In health insurance, you and your insurance provider need to share the medical cost arising out of hospitalization. Deductibles in health insurance are the amount that you need to pay before the insurance company is liable to pay the claim amount. To understand more about deductibles in health plans, read on to learn about deductibles in health insurance in India and how it is helpful in determining a robust health plan for you and your family.

You May Like: Does Health Insurance Cover Transplants

Example #: Maximum Limiits

Your health plan sets a maximum limit for certain tests, procedures and medical services. This means that it will cover up to a certain amount for these services. These limits help lower costs for all members by keeping rates fair and reasonable.

Let’s say your doctor charges more for the above hand X-ray.

- Your health plan covers a maximum of $200 for an X-ray.

- Your doctor charges $250.

- You may have to pay the $50 difference.

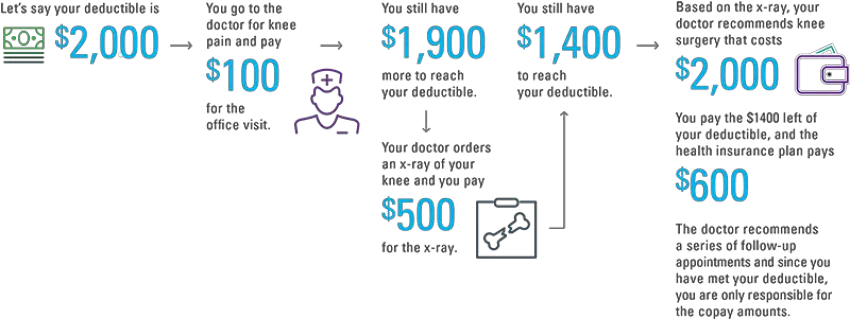

A Concrete Example Of How A Deductible Works

Deductible is something really easy to understand. Let us pretend that your insurance plans yearly deductible is 1.000. This means that you will pay all medical expenses until you reach 1.000. Above that amount, the insurance will start reimbursing expenses related to the invoices it received.

Be aware that some deductibles can be non-comprehensive, meaning that they do not apply on all medical treatments. For example, dental or vision treatments can be excluded for deductibles. Make sure to have all the necessary information before contracting with an insurance company. There could easily be limitations within some group benefits for example.

Read Also: Do I Need Pet Health Insurance

What Is Deductible In Top

Top-up in health insurance is an increase in the sum insured to cover the policyholders and their nominees in case of prolonged sickness or unexpected medical emergencies. This is beneficial, especially when you do not want to compromise on the base sum insured in the primary health insurance policy.

However, deductibles in top-up health insurance are slightly different. It is the amount over which the top-up health insurance plan gets triggered. But, any claim amount less than the deductible amount will be paid under the top-up policy. Insurers offer different types of top-up health insurance with specific terms and conditions for deductibles. Ensure you read them carefully before you buy the plan.

Example: Let us say that the sum insured in the primary health insurance policy is Rs. 5 lakh and the top-up policy is another Rs. 3 lakh with Rs. 1 lakh as the deductible amount. If the hospitalization bill amounts to Rs. 6 lakh, the insurer will pay Rs. 5 lakh from the primary policy and the balance Rs. 1 lakh will be paid from the top-up policy. In case of subsequent hospitalization and the medical bills total Rs. 2 lakh, the policyholder must pay Rs. 1 lakh as deductible amount and the rest Rs. 1 lakh will be borne by the insurance company.

What Is A Deductible In Health Insurance

The fact that health insurance is of utmost importance is indisputable. Buying a health insurance plan can Offer You Comprehensive Financial Protection Against Medical Expenses And Help You Safeguard Your Savings For Other Goals In Life.

However, before you buy a health insurance plan, you must understand what the plan entails. Certain insurance jargon can be confusing and misleading. Understanding their meaning and utility can help you pick the right policy. One such term that you are bound to come across when purchasing a health policy is the insurance deductible.

Lets find out how does health insurance deductibles work and why you should know about them.

Read Also: How To Find The Best Private Health Insurance

What Is An Insurance Deductible

Insurance deductibles have been part of insurance contracts for years. When you sign up for a plan, you agree to pay a certain amount before the provider pays. It’s the amount of money that you pay when you make a claim. Often, it is stated as a dollar amount.

It could also be listed as a percent of the costs. This is more common for earthquake, windstorm, hail damage, or on higher risks assets.

You’ll have to come up with your part of the bill before a claim is paid. Once you pay it, the insurance pays the rest of the claim. They’ll pay up to the policy limits and send the money to you or the people that are owed.

Choosing The Right Deductible Amount

The best health insurance coverage for you depends on your budget and your health history. When buying an insurance policy, youâll be able to choose your deductible amount. Many people only look at the insurance premiums when comparing health plans. But this monthly price only represents one of the expenses that contributes to how much you’ll spend on health care in a given month.

Other expenses, including your health insurance plan’s deductible and the copay and coinsurance costs, directly contribute to how much you’ll be spending overall on health insurance, as weâve seen in the example above.

Generally, individually purchased plans with a lower monthly premium will have a higher deductible, copay, and coinsurance percentage, which increases the amount you’ll spend out of pocket for medical expenses.

When choosing a health insurance company and plan, make sure to look closely at these costs. If you think you will utilize your health insurance plan frequently â because you’re managing a chronic condition or otherwise â the plan with the lowest monthly premium may not actually be the cheapest in the long run because of the high deductible.

Health insurance and life insurance work together to offer financial protection.

Health insurance can pay your medical expenses. Life insurance keeps your loved ones whole after you die.

You May Like: How Do I Get Health Insurance If I Retire Early

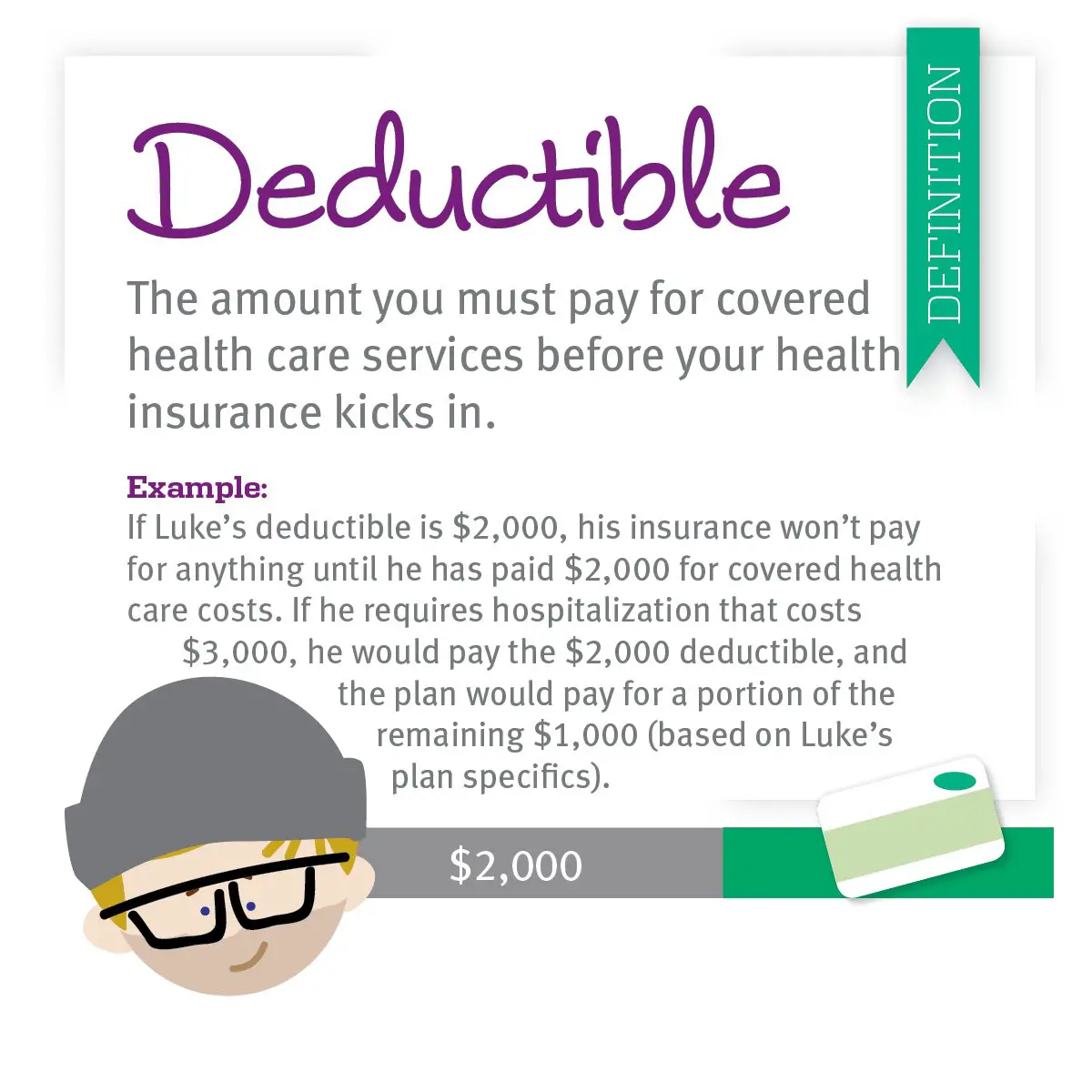

Understanding What Is Deductible In Health Insurance With Example

Heres an example to understand an insurance deductible and how it works:Consider a scenario where you have to undergo surgery that costs 1,20,000. In this case, you will be admitted to the hospital and will eventually raise a claim to cover the expenses of your treatment. However, your insurance policy has a deductible of 20,000. So, you will have to pay 20,000 out of your own pocket, and the insurance company will pay the remaining value of 1,00,000.

Now in another scenario, you have a minor procedure in the hospital that costs 15,000 only. Since this amount is less than the deductible amount of 20,000, you will have to bear the entire expenses, i.e., 15,000, on your own. You will not be able to raise a claim at all because the value of the claim is less than the deductible.

Now that you know what does deductible means, lets find out why deductibles are important and how they can benefit you.

Which Plan To Choose

Is a lower deductible better? Before we go on and decide which out of a low vs high deductible is right for us, we need to better understand the full picture. The minimum premium plan should not be the sole reason behind choosing a high deductible health plan, because in case we end up needing medical care, there could be a surprise when its time to pay the deductible.

If your employer is offering health insurance benefits, you can expect the first question to be Do you want a higher or lower deductible? and whether you want a Health Savings Account to go along in case you chose the HDHP Plan. An HSA is an account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses. The money can be later paid for deductibles, copayments, coinsurance, and other qualified expenses, including some dental, drug, and vision expenses so you can lower your overall health care costs and monthly premiums. Here we will talk about what are the pros and cons of each and how distinct groups of people can benefit from each plan?

HDHP

Best for young and generally healthy people, individuals who rarely visit the doctor or buy prescription drugs, do not have dependents and can cover out-of-pocket costs in an unexpected medical situation.

Pros Lower monthly premiums and tax-free spending account in the form of a Health Savings Account.

Cons Higher deductible and higher out-of-pocket maximums and limits.

LDHP

Pros Saving on out-of-pocket costs.

Recommended Reading: When Does A Company Have To Offer Health Insurance

Benefits Of High Deductible Plans

True to its name, a high deductible health plan , has a higher deductible than a low deductible health plan, or traditional health plan. There may be other benefits to these types of plans, including:

- Members may spend less per month on their premium, or amount deducted from each paycheck. Spending less up front tends to appeal to generally healthy members who dont anticipate upcoming medical expenses. The trade-off for spending less on the monthly premium is that youre responsible for 100% of out-of-pocket costs until the deductible is met.

- As a way to offset the out-of-pocket costs, certain qualified high deductible health plans can be paired with a savings tool called a health savings account, or HSA. Employees can contribute pretax money into a special account designed for qualified medical expenses. If the funds arent spent, they roll over year to year.

Comparing Health Insurance Deductibles

As you can see, there’s a substantial difference in the monthly premiums of high deductible versus low deductible healthcare plans. However, the real out-of-pocket costs of any plan include the premium, the deductible, and any coinsurance.

The amount anyone pays in out-of-pocket expenses depends on the individual’s health profile. A young and healthy person who rarely goes to a doctor might gamble on a high deductible plan with high coinsurance costs. Someone who requires regular treatment for a chronic condition might go for a higher-level plan to minimize deductible and coinsurance costs.

Also Check: Can Aflac Replace Health Insurance

How Deductibles In Health Insurance Work

Deductibles in health insurance act as a deterrent from raising small and unnecessary claims just because there is health insurance coverage. For instance, a health insurance policy that has a higher deductible amount will deter the insured from raising small claims as the deductible amount will be paid by him/her. Also, not making any claim will help the insured keep the No Claim Bonus safe. Therefore, the insured is prompted to raise a claim only in case of high medical expenses only and not for any minor expenses. As the insured has to pay the deductible amount before the insurance provider pays the rest of the claim amount, it eliminates any unnecessary claims thereby increasing the chances of getting rightful claims.