Health Insurance Coverage For Dental And Visionin Delaware Ohio

Dental and vision coverage is important. If ignored, it’s something that is likely going to end up costing you more than monthly premiums would have.

Dental and vision insurance plans can help to offset the cost of dental work, eye exams, glasses, and contact lenses among other things. While the health plan you are considering may have everything you want from affordability to service availability, health plans don’t always come with dental and vision coverage.

There are two main ways to go about getting dental and vision coverage. They are as follows:

- Purchase a health plan that includes vision or dental coverage: You may be able to combine both vision and dental plans as a part of your health plan package. Of course, premiums will increase based on the additional benefits of the plan.

- You can also buy a vision or dental plan as a stand-alone product: . It’s important to note that some plans on the Marketplace may require that you also purchase a health plan. As a stand-alone service, you will have to pay two separate premiums – one for your health plan and another for your dental or vision plan.

As with health plans that we discussed earlier, dental and vision plans on the marketplace fall into two categories, low and high:

How Do I Find Affordable Health Insurance

Group plans are generally cheaper than individual plans. So if you are eligible for onethrough your employer, your union, or some other associationthat’s your best bet, in terms of coverage for the money. If that’s not an option, the public health marketplaces established by the Affordable Care Act offer affordable health insurance for individuals. In most of the U.S., you can sign up for a plan offered through the federal government via the HealthCare.gov site. However, 12 states run their own marketplaces, and residents sign up via their sites.

Medicare For Delaware Seniors And Younger Adults With Disabilities

Medicare is a federal health insurance program generally for people aged 65 and older. But younger adults qualify if they have disabilities or certain chronic illnesses, such as End-Stage Renal Disease .

More than 210,000 Delawareans get coverage through the federal governments Original Medicare program.15 Its divided into two parts: Part A covers inpatient care at hospitals, hospice, and skilled nursing facilities. Part B covers medical benefits, such as doctor visits, same-day surgeries, ambulance, and limited drug coverage.

Another 39,000 Delaware beneficiaries choose an alternative program called Medicare Advantage.16 This is a private health plan that includes Part A, Part B, and extra benefits, such as Part D prescription drug coverage. Private insurers also sell individual Part D drug plans. People with Original Medicare typically buy these plans to get comprehensive drug benefits. Nearly 128,000 Delawareans have a standalone Part D plan.17

Another option for Original Medicare enrollees is Medicare Supplement, also called Medigap. Delaware, like most states, offers 10 standard plan options. Policies pay some to all of your covered out-of-pocket expenses, including copays, coinsurance, and deductibles.

Read Also: Starbucks Partner Health Insurance

Will I Be Penalized If I Don’t Have Health Insurance

You won’t be fined by the IRS for not having health coverage in 2022but there are several disadvantages to being uninsured. The tax penalty under Obamacare vanished in 2019, so if you don’t have health insurance, you won’t be penalized.

However, some states have passed their own health insurance requirements, resulting in a state-level tax fine if you go without coverage.

Massachusetts, New Jersey, Vermont, California, Rhode Island, and Washington D.C are among the states that have enacted their own health insurance rules.

Taking Good Care In Delaware

The First State puts first priority on the health and well-being of its residents. This commitment is illustrated by the range of readily accessible, high-quality healthcare systems and wellness resources throughout Delaware, as well as an overarching philosophy that the key to happiness is maintaining a healthy work-life balance.

According to a recent survey of Delawareans, the top three activities in the state are dining out, going to the beach and walking/hiking. Between the thriving culinary scene, over 20 miles of award-winning beaches to suit every type of beach-goer, and endless nature trails and state parks, its so easy to relax and enjoy life here.

And knowing that you have excellent, always-available healthcare options in a state that values and promotes the industry certainly brings peace of mind.

Delawareans outpace residents nationwide when it comes to health insurance. About 92% of Delawares population ages 19 to 64 had healthcare coverage in 2018, compared to an 87% national average.

See also:

Hospitals throughout the state rank nationally each year as some of the best in the country.

Read Also: Insurance Lapse Between Jobs

Four Types Of Delaware Small Business Health Insurance Plans

Whether youre looking at individual health insurance or group health insurance, there are several different types of health plans available. The four you should absolutely know are:

PPO Health Insurance Plans,

HSA-Qualified Health Insurance Plans, and

Indemnity Health Insurance Plans.

The plan type that is best for you and your employees depends on what you and your employees want, and how much you are willing to spend. Heres a brief review of the four popular types of health insurance plans:

Average Cost Of Health Insurance In Delaware

The average resident of Delaware pays about $475 per month for their health insurance plan. However, you may qualify for a subsidy through the Marketplace exchange. Begin by creating a profile at Healthcare.gov and entering your income and personal information. About 8 out of 10 Delaware residents who qualify for a Marketplace plan also qualify for a subsidy so youre likely to get some form of assistance.

Recommended Reading: Starbucks Health Insurance Eligibility

Average Health Insurance Costs

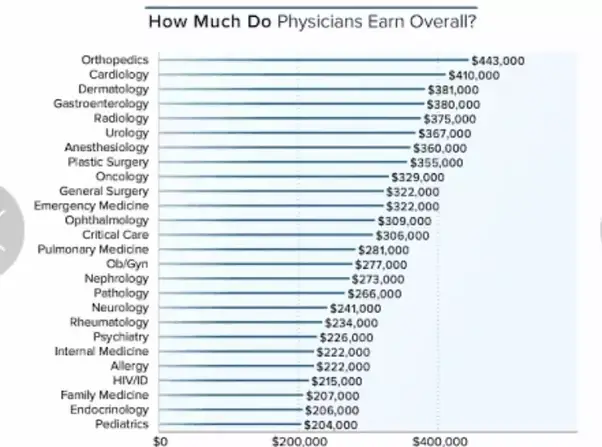

With so many different variables impacting how much health insurance will cost a person on a monthly or yearly basis, we’re better off breaking things down instead of giving one general number.

So what are some of the biggest factors in determining how health insurance costs can vary? Certainly, the type of plan someone has and the tier of the plan she has to go a long way. Medical history — not to mention whether the person is a smoker — can play a role in whether insurers give a higher rate. Someone in need of insurance for a family is going to have a higher premium than someone seeking an individual plan.

Two factors that can also play a large role in healthcare rates and premiums is how old someone is and where he lives.

Compare Top Health Insurance Plansin Delaware

Having a health insurance policy can give you peace of mind knowing that you and your loved ones have financial backing for common or unforeseen medical circumstances. However, choosing a health plan amidst the sea of options can be daunting.

The more you know about the health insurance plans, the better you’ll be able to make an informed decision, saving you money. To make your decision easier, American Health Insurance will help connect you with top insurance providers who can unravel the key differences between various options.

You May Like: Kroger Employee Discount Card

How Do I Enroll In Medicare Part D In Delaware

You are eligible for Medicare Part D in Delaware if you:

- Have Medicare Part A and/or Part B and

- Live in the service area of a Medicare plan that covers prescription drugs

Like other parts of Medicare, youâre only allowed to enroll in or make changes to your Medicare prescription drug coverage during specific times. These periods include:

Health Insurance Plan Type

How does health insurance cost in DE? These are the monthly premiums for each plan type for a middle-aged resident in 2020:

2020 Delaware Health Insurance Martketplace Plan Rates| Bronze |

|---|

| Kaiser Family Foundation, Change in Average Marketplace Premiums by Metal Tier |

A gold plan costs about 43 percent more than a bronze plan. Thats not a big surprise considering gold plans cover 80 percent of medical costs, whereas bronze plans cover 60 percent of costs.

You may also qualify for a catastrophic plan, the lowest level of marketplace coverage available. Catastrophic plans come with low monthly premiums but a high yearly deductible of $8,150. The plan is designed to prevent medical bankruptcy, but it doesnt offer much for preventative care. Because of that high deductible, you may save money by investing in a bronze or silver plan if you need health care.

Read Also: Starbucks Insurance Part Time

Unitedhealthcare Senior Care Options Plan

UnitedHealthcare SCO is a Coordinated Care plan with a Medicare contract and a contract with the Commonwealth of Massachusetts Medicaid program. Enrollment in the plan depends on the plans contract renewal with Medicare. This plan is a voluntary program that is available to anyone 65 and older who qualifies for MassHealth Standard and Original Medicare. If you have MassHealth Standard, but you do not qualify for Original Medicare, you may still be eligible to enroll in our MassHealth Senior Care Option plan and receive all of your MassHealth benefits through our SCO program.

How Much Does Health Insurance Cost

In 2022, the average cost of health insurance is $541 a month for a silver plan. However, costs will vary by location. Insurance is expensive in West Virginia and South Dakota, averaging more than $800 a month. States with cheaper health insurance include Georgia, New Hampshire and Maryland, averaging less than $375 a month.

Don’t Miss: Starbucks Health Insurance Part Time

The Cost Of Health Insurance In Delaware

The average cost of health insurance in the state of Delaware is $7,499 per person based on the most recently published data). For a family of four, this translates to $29,996. This is $518 per person above the national average for health insurance coverage. However, health insurance costs vary significantly based on the cost of care and the population insured. The chart below shows the four major insurance types available in Delaware. The dollar amounts shown on the chart are the average cost in Delaware to insure people for each type of insurance.

Health Insurance Costs In Delaware

have fluctuated from 2020 to 2021. Below are the average monthly rates for bronze, silver, and gold plans.

- Average lowest-cost bronze premium: $372 in 2020 | $400 in 2021

- Average lowest-cost silver premium: $521 in 2020 | $522 in 2021

- Average lowest-cost gold premium: $531 in 2020 | $517 in 2021

Highmark Blue Cross Blue Shield has requested a 4% premium rate increase. 7

You May Like: Kroger Part Time Health Insurance

Buying Health Insurance Outside Open Enrollmentin Delaware Ohio

Don’t worry, Open Enrollment is not the only time that you can buy insurance. If you do not qualify for a Special Enrollment Period and have missed the Open Enrollment Period, or your situation and needs suits it, then you can purchase non-Marketplace insurance such as short-term insurance.

American Health Insurance can connect you with top insurance providers who will help you to find a health plan outside of Open Enrollment in the following ways:

- Through a Delaware, Ohio insurance broker or agent: Insurance agents and brokers can help you to find an ideal health plan that falls outside of the Marketplace. What you pay tends to be unaffected by the use of an agent or broker since they are paid by the insurance company.

- Direct from an insurance company: Alternatively, you can go directly to an insurance provider and browse the insurance products that they have.

Whether through the Marketplace or outside of the Open Enrollment Period, we can help get you and your family a health plan that covers your important medical needs.

Shop for insurance the easy way, speak to a live agent.

What Does Health Insurance Not Cover

Even the best health insurance plan wont cover every treatment and service. Lets take a look at a few of the most common exclusions youll see when you shop for coverage.

- Cosmetic surgery: No insurance plan will cover elective, non-necessary procedures.

- Travel vaccines: Insurance plans must cover routine vaccinations on the standard schedule set by the CDC. Vaccines that fall outside of the standard schedule usually arent covered.

- Adult dental and vision services: Insurance providers must cover dental and vision services for children on your plan. And theres no requirement that they extend these services to adults. You can buy an independent dental or vision plan if youd like coverage for adults on your plan.

- Male birth control: ACA plans only need to cover female methods of birth control. Male methods typically arent covered.

This isnt a comprehensive list of services excluded from insurance. So long as a treatment isnt considered an essential benefit, your insurance provider is free to limit or deny coverage. If you arent sure if a plan covers a specific treatment, contact a representative from your insurance company.

You May Like: Sidecar Health Dental

Delaware Health Insurance: Find Affordable Plans

See how you can get cheap health insurance in DE, including marketplace plans, Medicare, and Medicaid.

- IX.

As a Delaware resident, you have access to a wide range of affordable health insurance options. Although group coverage is the most common, you can also sign up for an Affordable Care Act plan, use your military health benefits, or enroll in Medicare or Medicaid.

This guide explains your Delaware health insurance options in detail.

Delaware And The Affordable Care Act

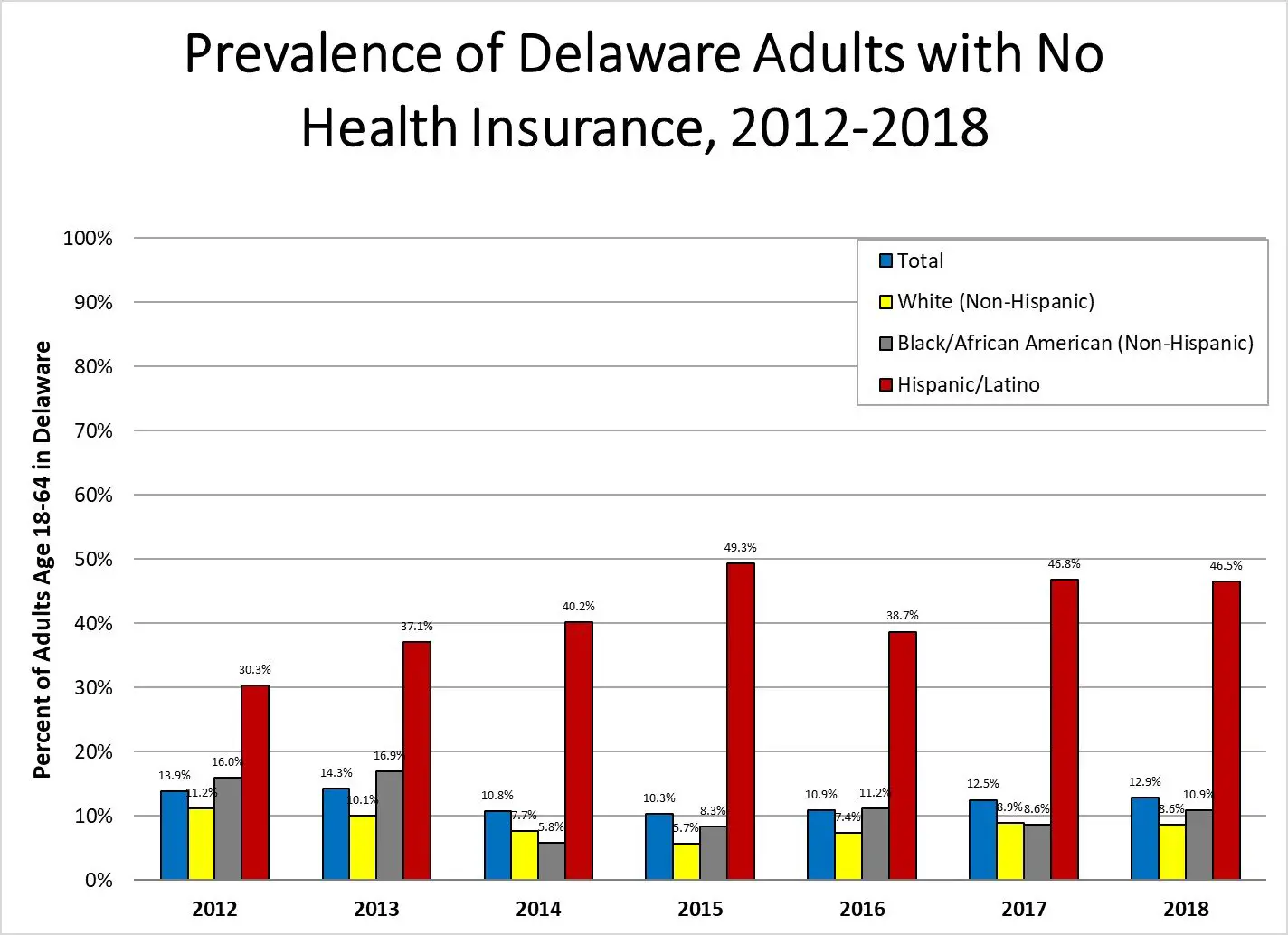

About 7% of Delaware residents dont have health insurance. This number amounts to 58,000 uninsured out of roughly 975,000 residents.

The First State has maintained one of the lowest uninsured rates since the Affordable Care Act was implemented in 2013. About 10% of the states population lacked coverage at that time compared to 15% across the country.2

Delawares expansion of Medicaid in 2014 gave more residents access to health insurance.Under the ACA, states can use federal funding to expand Medicaid to childless adults who earn up to 138% of the federal poverty level .3As of October 2019, 62,500 residents gained coverage because of Medicaid expansion.4

Recommended Reading: Starbucks Health Insurance Plan

What Types Of Alternative Health Insurance Plans Are Available In Delaware

As a Delaware resident, you have access to some health insurance alternatives that can help with your medical expenses. One of the most common is a health care sharing ministry, which uses funds contributed by members to pay for hospital fees and other health-related costs. HCSMs dont offer traditional health insurance, and theyre not regulated like regular health insurance, so theyre allowed to deny you based on pre-existing conditions or charge you more money based on your health history.

What To Know About Health Insurance In Delaware

MoneyGeek used information regarding private plans from the Delaware health insurance market in this analysis. Its possible, however, to get lower rates upon applying for a health plan. Older residents or those with low income in Delaware may qualify for government health programs such as Medicaid or Medicare, which provide more affordable coverage compared to private plans from the insurance exchange.

Also Check: How Long After Quitting Job Health Insurance

Private Health Insurance On The Delaware Marketplace

Health plans found in the Delaware insurance marketplace follow a system that divides them into metal tiers with varying levels of deductibles and out-of-pocket maximums. These do not impact the quality of care you receive but affect the share of expenses your provider covers.

Each metal tier comes with its benefits and risks. These are:

Compared to the plans from MoneyGeeks analysis, your annual income may allow you to get cheaper premiums or increased coverage. If your earnings fall between 100% and 400% of the federal poverty level, you could qualify for premium tax credits. It applies to a two-person household with an annual income between $17,420 and $69,680. You can use the healthcare.gov calculator to get an accurate calculation.

Open enrollment is the annual period when you can renew your existing health plan coverage or apply for a new one. It occurs between November and December but has currently been expanded due to COVID-19.

Cost-sharing reductions also become possible if your annual income falls between 138% and 250% of the federal poverty level and you purchase a Silver plan. Its possible to get Gold plan coverage with Silver plan costs if youre eligible to get these deductions, which allow you to lower your deductible, copayments, coinsurance and out-of-pocket maximums. A two-person home in Delaware earning $24,040$43,550 may be eligible for these reduced rates.

Election : State Health Care Snapshots

Health care is a top issue for voters in the 2020 election. Polling indicates voter concerns range from the high cost of health coverage and prescription drugs, to protections for people with pre-existing conditions, to womens health issues.

To understand the health care landscape in which the 2020 election policy debates will unfold, these state health care snapshots provide data across a variety of health policy subjects, including health care costs, health coverageMedicaid, Medicare, private insuranceand the uninsured, womens health, health status, and access to care. They also describe each states political environment.

Please note, the data included in these snapshots come from a variety of different sources and time periods, and therefore, may not be comparable.

Recommended Reading: Which Statement Is Not True Regarding Underwriting Group Health Insurance

What To Know About Insurance In Delaware

- If you live in Delaware, you can use the Health Insurance Marketplace to sign up for an ACA plan. Delaware is somewhat unusual, as it has no health insurance companies offering plans outside the health exchange.

- Open enrollment: Delawares 2022 enrollment period runs from

- Special enrollment: You cant sign up for health coverage outside of open enrollment unless you qualify for a special enrollment period. You may qualify for an SEP if you have a qualifying life event that changes your insurance eligibility. Qualifying events include job loss, divorce, and the birth or adoption of a child.

- Health Insurance Marketplace: Delaware doesnt have its own affordable health insurance exchange, so it uses the federal Health Insurance Marketplace. If you want an ACA plan, you can use the Health Insurance Marketplace to compare plans and enroll. You should know that Highmark is the only insurance company that currently offers plans on the exchange.

- Coverage types: In Delaware, 49.7% of the insured population has group health coverage through an employer. Another 37.7% of the insured population has Medicare or Medicaid, 1.8% have military coverage and 4.1% have non-group coverage. Approximately 6.6% of the Delaware population is uninsured.