If I Dont Qualify For An Exemption How Do I Avoid The Penalty For No Health Insurance 2020

The best way to avoid the health insurance penalty is to obtain coverage as soon as possible during the open enrollment period, which began on October 15, 2019 and will continue through January 15, 2020.

If you already have a plan, the open enrollment period is still a good time to review your current policy and compare coverage options in case you discover an option that better suits your needs.

No Longer A Question On Federal Tax Return About Health Coverage

From 2014 through 2018, the federal Form 1040 included a line where filers had to indicate whether they had health insurance for the full year .

But since 2019, Form 1040 has no longer included that question, as theres no longer a penalty for being without coverage.

But state tax returns for DC, Massachusetts, New Jersey, California, and Rhode Island do include a question about health coverage. , in order to try to connect uninsured residents with affordable coverage. Colorados tax return will have a similar feature as of early 2022 .

In addition, nothing has changed about premium subsidy reconciliation on the federal tax return. People who receive a premium subsidy will continue to use Form 8962 to reconcile their subsidy. Exchanges, insurers, and employers will continue to use Forms 1095-A, B, and C to report coverage details to enrollees and the IRS.

What Is The Penalty For No Health Insurance

Question: What is the penalty for not having any health insurance?

Answer: In 2016, the penalty is $695 per adult and $347 per child up to a family cap of $2,500 or 2.5% of household income, whichever is greater. In 2015, it was $325 for adults, with a $975 maximum or 2% of household income. Kaiser Family Foundation predicts that in 2016, average penalties will increase, on average, from $1,177 to $1,450 per household. According to Peter Lee of Covered California, The bigger penalty could be showing up in the emergency room and walking out with a bill in the tens of thousands of dollars,.

Categories:

Read Also: Can I Go To The Er Without Health Insurance

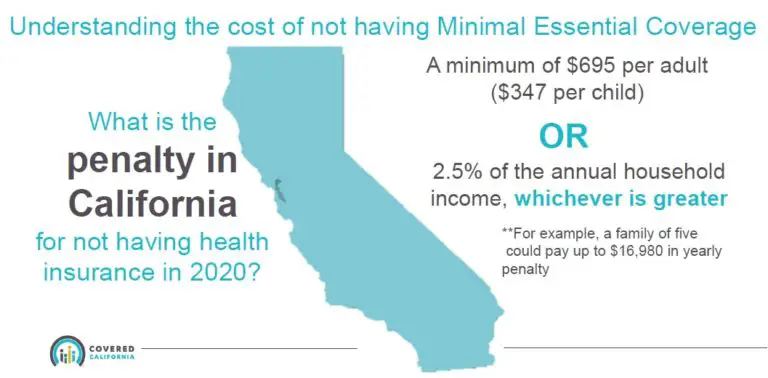

Tax Penalty For No Health Insurance 2020

What is the penalty for not having health insurance? A taxpayer who fails to get health insurance that meets the states minimum requirements will be subject to a penalty of $695 per adult, or 2.5% of annual household income, whichever is higher when they file their 2020 state income tax return in 2021. The penalty for a dependent child is half of what it would be for an adult. According to Covered California, a family of four that has no insurance for the entire year could face a penalty of at least $2,000.

Is There A Penalty For Being Uninsured

No, there is no longer a federal mandate but some states and jurisdictions have enacted their health insurance mandates.

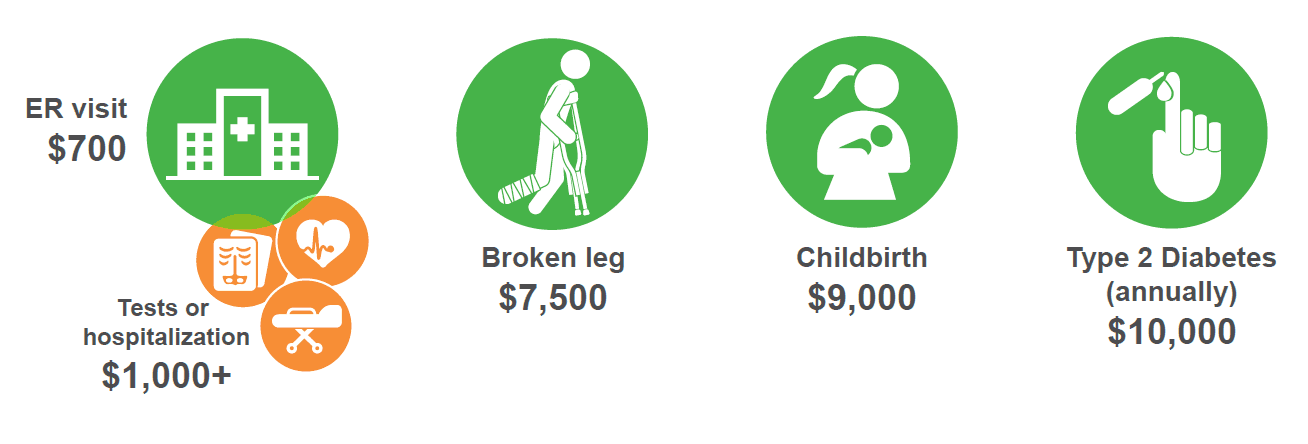

However too often than not, people learn that the personal penalty for not having health insurance is the exorbitant healthcare bills.

For instance, if you get a broken leg from a trip and fall, hospital and doctor bills can quickly reach $7,500 and for more complicated breaks that require surgery, you could owe tens of thousands of dollars.

A three-day stay in the hospital might cost you about $30,000.

If you take a look at more critical illnesses including cancers and strokes, your bill might be running into the hundreds of thousands of dollars. So without a health insurance, you are financially responsible for these bills. Two-thirds of people who file for bankruptcy indicate that medical bills contributed to their financial situation, according to a 2019 study.

So essentially, the Affordable Care Act increased the number of people with insurance and lowered those who couldnt afford to pay their health bills.

Below are the states that have mandates and penalties in effect for persons without a health insurance cover

- California

There are a variety of health plans that meet these requirements as well.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Do You Get Penalized For Not Having Health Insurance In California

California health insurancepenaltynothealth insurancepenalty

. Considering this, what is the penalty for not having health insurance in California?

About the PenaltyGenerally speaking, the penalty will be $695 or more when you file your 2020 state income tax return in 2021. The penalty for a dependent child is half of what it would be for an adult. A typical family of four that goes uninsured for the whole year would face a penalty of at least $2,000.

One may also ask, is it mandatory to have health insurance in California? California’s health care mandate1, 2020, will require Californians to have health insurance throughout the year. Californians who don’t have health coverage in 2020 and who don’t qualify for exemptions would have to pay a penalty in 2021 when they file their 2020 state income tax return.

Just so, is health insurance required in 2019 in California?

A new state law requires Californians to have health insurance in 2020 or face a penalty on their state taxes. This follows the repeal of the individual mandate at the federal level, which took effect in 2019. Covered California’s enrollment period for health coverage in 2020 starts Tuesday and runs through Jan. 31.

Is there penalty for no health insurance in 2020?

States Where There Is Still A Penalty

In 2020, theres a penalty for being uninsured if youre in California, DC, Massachusetts, New Jersey, or Rhode Island. The penalty was assessed on 2019 tax returns in DC, Massachusetts, and New Jersey it will start to be assessed on 2020 tax returns in California and Rhode Island. Massachusetts has had an individual mandate penalty since 2006, although they didnt double penalize people who were uninsured between 2014 and 2018 and subject to the federal penalty. But they started assessing penalties again as of 2019, since there is no longer a federal penalty.

Vermont implemented an individual mandate as of 2020, requiring state residents to maintain coverage. But lawmakers designed the program so that there is currently no penalty for non-compliance with the mandate. Instead, the information people report on their state tax return will be used for the state to conduct targeted outreach to help people obtain coverage and understand what financial assistance might be available to offset the cost.

Recommended Reading: Do Starbucks Employees Get Health Insurance

Uninsured Tax Filers Were More Likely To Get An Exemption Than A Penalty

Although there were still 33 million uninsured people in the US in 2014, the IRS reported that just 7.9 million tax filers were subject to the penalty in 2014 . According to IRS data, 12 million filers qualified for an exemption.

The number of filers subject to the ACAs penalty was lower for 2015 , as overall enrollment in health insurance plans had continued to grow. The IRS reported in January 2017 that 6.5 million 2015 tax returns had included individual shared responsibility payments. But far more people12.7 million tax filersclaimed an exemption for the 2015 tax year. For 2016, the IRS reported that 10.7 tax filers had claimed exemptions by April 27, 2017, and that only 4 million 2016 tax returns had included a penalty at that point.

A full list of exemptions and how to claim them is available here, including a summary of how the Trump administration made it easier for people to claim hardship exemptions .

No Longer A Federal Penalty But Some States Impose A Penalty On Residents Who Are Uninsured

Although there is no longer an individual mandate penalty or Obamacare penalty at the federal level, some states have implemented their own individual mandates and associated penalties:

Vermont enacted legislation to create an individual mandate as of 2020, but lawmakers failed to agree on a penalty for non-compliance, so although the mandate took effect in 2020, it has thus far been essentially toothless . Vermont could impose a penalty during a future legislative session, but the most recent legislation the state has enacted calls for the state to use the individual mandate information that tax filers report on their tax returns to identify uninsured residents and provide targeted outreach to help them obtain affordable health coverage.

Also Check: Starbucks Part Time Insurance

Make Sure You Have Health Coverage

The mandate, which takes effect on January 1, 2020, requires Californians to have qualifying health insurance coverage throughout the year.

Many people already have qualifying health insurance coverage, including employer-sponsored plans, coverage purchased through Covered California or directly from insurers, Medicare, and most Medicaid plans.

Under the new mandate, those who fail to maintain qualifying health insurance coverage could face a financial penalty unless they qualify for an exemption.

Generally speaking, a taxpayer who fails to secure coverage will be subject to a penalty of $695 when they file their 2020 state income tax return in 2021. The penalty for a dependent child is half of what it would be for an adult.

The penalty is based on your state income and the number of people in your household.

Summary of possible penalties

| $140,200 | $2,085 |

To avoid a penalty, California residents need to have qualifying health insurance for themselves, their spouse or domestic partner, and their dependents for each month beginning on January 1, 2020.

The open enrollment period to sign up for health care coverage through Covered California is scheduled for October 15, 2019 through January 31, 2020.

What Are The Effects Of Repealing The Individual Mandate

Since its implementation, the individual mandate was controversial amongst the public and its repeal was equally debated. Much of the debate surrounding the individual mandate repeal was based on its effects on healthcare premiums. With less people obtaining health insurance, the premiums were expected to become higher for those who needed healthcare and had preexisting conditions. Not only was this controversial financially, but this brought up concerns over the state of health for the U.S. population. The worries about the inflation of premiums were brought to light when premiums for bronze plans increased from 3 percent to 13 percent once the tax penalty was removed. Additionally, enrollment fell from 2.8 million uninsured individuals to 13 million. For these reasons, certain states have chosen to enact their own mandates on health insurance requirements.

Recommended Reading: What Insurance Does Starbucks Offer

Californians Without Health Insurance Will Pay A Penalty Or Not December 12 2019

What you need to know about Californias Individual Healthcare Mandate, including potential financial penalties, available exemptions and possible financial assistance.

The HEAL Team

Californians, be warned: A new state law could make you liable for a hefty tax penalty if you do not have health insurance next year and beyond.

But some of you need not worry: The law contains several exemptions that will allow certain people to avoid the penalty, among them prisoners, low-income residents and those living abroad.

It will be really important that people get clear guidance and instruction to make sure they dont inadvertently pay a penalty when they are eligible for an exemption, says Laurel Lucia, director of the Health Care Program at the University of California-Berkeleys Center for Labor Research and Education.

The Golden State will join Massachusetts, New Jersey, Rhode Island, Vermont and Washington, D.C., in requiring their residents to have health coverage and dinging those without it.

Most types of insurance, including Medi-Cal, Medicare and employer-sponsored coverage, will satisfy Californias coverage requirement. People who purchase insurance for themselves and their families, either through Covered California, the states health insurance exchange, or the open market, will have until Jan. 31 to buy a health plan for 2020.

How you claim an exemption depends on the type you are seeking.

Exemptions From Health Insurance Requirement

There are a number of exemption provisions under which you may avoid the requirement to have health insurance. These provisions include:

- Unaffordable careif minimum coverage would cost more than 8 percent of your household income, you may qualify for an exemption.

- No tax filing requirementhaving an income below the Internal Revenue Service’s filing threshold exempts you from the coverage requirement.

- Hardshipif you experience a hardship that prevents you from getting coverage, the Health Insurance Marketplace may certify your exemption. Situations include those whose pre-existing health coverage was canceled due to the ACA.

- Short coverage gapsif your coverage lapses for less than three consecutive months, you will not be charged a fee for the uninsured time.

- Membership in an exempt groupNative American tribes, prisoners, undocumented immigrants, members of health care sharing ministries and those whose religious beliefs prevent them from having insurance are exempt from the requirement to be insured.

Not sure if you are exempt from the tax penalty or from the requirement to purchase health insurance? See “Are You Exempt From Health Care Coverage?” to help determine whether you might be eligible to waive the tax penalty entirely and apply for a health care exemption.

Recommended Reading: Starbucks Health Insurance

California Has Its Own Affordable Care Act Tax Penalty

- Not all states have expanded Medicaid coverage under the Affordable Care Act. Learn where California stands.

- The Affordable Care Act tax penalty has been set to zero, but some states have enacted their own health insurance requirements.

- If you miss the Affordable Care Act deadline in California, you may still be able to get covered.

- Three ways California residents can reduce the costs of health care coverage under the Affordable Care Act .

- Four ways students who need health insurance can get covered under the Affordable Care Act .

- When you have homes in two different states, it may be tricky to decide if you need one health plan or two.

Supplemental Job Displacement Benefit

The Supplemental Job Displacement Benefit is a nontransferable voucher for education-related retraining and/or skill enhancement that is payable to a state-approved or accredited school if the date of injury is on or after 01/01/04 and before 01/01/13. The voucher can be used to pay for tuition, fees books, or other expenses required by the school for retraining or skill enhancement. Up to 10 percent of the voucher may be used to pay for a vocational or return-to-work counselor. In order for the injured worker to qualify for this benefit, the injured employee must have sustained permanent disability, the injured employee must not have been able to return to work within 60 days, and the employer must have failed to timely offer modified or alternative work. There is a maximum voucher amount set by law and the amount varies based upon the extent of permanent disability.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

How Much Will I Owe If I Didnt Have Health Insurance

Up through December 31, 2018, lets say you could afford health insurance by chose not to buy it. If thats the case, you may pay a penalty fee on your federal taxes. This might come up in three different scenarios:

Starting with the 2019 plan year, the Shared Responsibility Payment no longer applies. This is important to note when you file your taxes. However, this does not apply to the states that have their own individual health insurance mandate.

Its best to check with your state to find out whether you might be subject to any penalty fees. Another option can be to check with your accountant. California, the District of Columbia, Massachusetts, New Jersey, Rhode Island, and Vermont have their own individual mandates.

The Evolution Of Workers Compensation

The concept that workers should be protected from and compensated for injury or illness occurring in the workplace came about with the rise of the trade union movement at the beginning of the 20th century. Workers compensation insurance is a direct result of public awareness and outrage at the poor and often dangerous working conditions people were forced to labor under in order to make a living, and the financially devastating effects of worker injury or illness on the worker and the workers dependents.

Workers compensation insurance is the oldest social insurance program in the United States in fact, it is older than both social security and unemployment compensation.

California adopted workers compensation laws in the 1910s along with most other states. Workers compensation is based on a no-fault system, which means that an injured employee does not need to prove that the injury or illness was someone elses fault in order to receive workers compensation benefits for an on-the-job injury or illness.

Since almost every working Californian is protected by the workers compensation system, it is important that employers and employees alike have an understanding of workers compensation insurance and how it works.

Recommended Reading: How To Enroll In Starbucks Health Insurance

Why Is There A Penalty

The penalty was included in the California budget as a way to provide for new state insurance subsidies. The help includes state aid for people who qualify for federal help and first-time subsidies for middle-income families.

The latter subsidies are available to many families who earn between 400% and 600% of the federal poverty level about $50,000 to $75,000 a year for an individual. Eligibility is also affected by factors including the cost of health care in an area.

Covered California officials say the the middle-income families eligible for the subsidies could receive an average of $460 a month.

Frequently Asked Workers Compensation Questions

Q: What is a loss reserve?

A: Insurance companies use loss reserves to evaluate the monetary worth of each claim. A loss reserve is an estimated amount of money that the insurance company sets aside, or earmarks, to pay for a claim. It is usually up to a claims adjuster to set the loss reserve, utilizing judgment and experience from prior claims that are similar. Adequate loss reserves help determine how much money an insurance company must have in surplus to meet current, emerging, and future claims obligations. Insurance companies must report workers’ compensation loss reserves, along with other claim reporting information, to the WCIRB, as this information is used by the WCIRB to calculate experience modifications. Poor loss reserve practices can put an insurance company in financial jeopardy, as both overestimating and underestimating loss reserves can lead to a misallocation of funds required to pay out claims, and creates an inaccurate picture of an insurer’s financial obligations. When there are not enough funds reserved to meet future obligations, an insurer’s solvency will be negatively impacted.

Conversely, if too many funds are reserved, the experience modification may become inflated, leading to the need to unfairly raise the insureds premiums. Since maintaining insurer solvency is of high importance, loss reserves must be as accurate as possible and revised regularly based on the most current claims information available.

Q: What is a minimum premium?

Read Also: Starbucks Healthcare Benefits