Health Savings Accounts Health Reimbursement Arrangements And More

If you have enrolled, or plan to enroll, in a high-deductible health plan such as a catastrophic plan, you may be able to set up a Health Savings Account . You dont have to pay federal income taxes on the contributions you make to the HSA if the money is used to pay for qualified medical expenses. If you use it for anything else, you will be required to pay the tax and a penalty.

An HSA is different from a Flexible Spending Account . For instance, you can have an FSA even if you dont have a high-deductible health plan. FSA funds can be set up to be used for medical or dependent care expenses. You will need to use up the entire amount by the end of the year . HSA money however, is yours until you take it out. For more information about setting up an HSA contact your employer, bank, or credit union.

There is also an employer-based Health Reimbursement Arrangement, or HRA, Its a special benefit that pays for medical expenses that the health plan doesnt cover, such as deductibles and co-insurance. But the employer puts in the money and decides which expenses to pay. The employer also decides whether any leftover money in the HRA can be rolled over to the next year. And, you dont get to keep the money if you leave the company.

Health System Specialist Responsibilities:

- Assessing health services, determining needs, and developing healthcare management plans and programs.

- Evaluating healthcare programs and advising stakeholders on standards of care, policies, and proposals.

- Collaborating with healthcare professionals, government departments, and communities on health system development and implementation.

- Integrating research findings and data analysis in the development of health system programs and initiatives.

- Evaluating the quality of healthcare services and delivery methods, and facilitating interventions when required.

- Developing and implementing health education and preventative care programs.

- Promoting best practices in health system management and ensuring regulatory compliance.

- Documenting processes, maintaining records, and reporting progress.

- Keeping informed of advancements in the field of health systems.

Where Does A Health Insurance Specialist Work

Health Insurance Specialists fulfill a wide array of positions in healthcare. Most often, Health Insurance Specialists work as medical coders, insurance billers, and claims examiners.

Entry-level Health Insurance Specialists are usually employed in jobs that create, manage, and organize data.A couple of these jobs are listed below:

- Medical Coders

- Medical Examiners

Senior Health Insurance Specialists interpret and analyze data at a more advanced level. They work in finances and health economics. Top Health Insurance Specialists can obtain government positions and are employed to analyze policies and trends. Some work in IT and design systems for data research and to improve internal operations.Some areas Senior Health Insurance Specialists work in include the following:

- Government

What Degree Do You Need to Become A Health Insurance Specialist? What Do They Study?

Health Insurance Specialists are required to complete a Health Insurance Specialist program. Some Health Insurance Specialists acquire optional certification as a Certified Professional Coder .

The primary requirement for a Health Insurance Specialist is a high school diploma combined with several years of experience in a healthcare field. There are educational programs for Health Insurance Specialists, and most employers prefer additional education. Many community colleges and technical schools offer medicalbilling and coding programs.

- Data

Certifications Recommended for Health Insurance Specialists

You May Like: Minnesotacare Premium Estimator Table

A Description Of Common Insurance Industry Positions

Insurance is a broad category that includes several types of coverage, including life, health, auto, property, and casualty insurance. The industry provides many job opportunities for those with the right qualifications and skills.

If youre interested in an insurance career, research different positions within the field to determine a job that best suits your interests and skills. Among the most common positions are actuary, claims adjuster, sales agent, and underwriter.

Insurance Job And Education Requirements

Most of the insurance industry requires employees that have a bachelors degree, with a background in math and statistics.

The most challenging jobs in insurance, such as an actuary, may even require candidates to understand database management and SQL coding language. Like most jobs, each requires specific training, vocational certification, or licensing.

Other jobs, such as clerks, customer service representatives, and sales agents need only to have a high school diploma or GED. However, obtaining a college degree might make a job candidate more attractive. Here are job title lists and their categories for insurance positions.

Recommended Reading: Uber Driver Health Insurance

Health Insurance Terms You Should Know

Open enrollment begins soon and many Americans will have a chance to make adjustments to their healthcare plans. But lets face it it could be tough to choose the best coverage if you dont understand the difference between a premium and a deductible. Thats where our guide comes in. We define 10 common healthcare terms that youll want to know before picking another plan.

Find out now: How much life insurance do I need?

What Is Prior Authorization

Prior authorization means getting approval before you can get access to medication or services. With prior authorization, your health plan agrees to help pay for the service and its important to know that ahead of time. Review our list of common terms to get more help with understanding health insurance terms.

Don’t Miss: When Does Health Insurance Stop After Quitting Job

Hospital Indemnity Policies Cancer Insurance And Other Supplemental Or Health

Hospital indemnity policies, sometimes called supplemental medical policies, pay a fixed amount for each day you are in the hospital. There may be a limit on the total number of days it will pay for in a calendar year, or a cap on the total number of days it will ever pay. The money you get from this type of policy can be used in any way the insured person wishes. Its often used for medical costs not paid by the health insurance plan, or the other expenses that families face when one member is ill.

These supplemental plans dont offer the kind of coverage needed for a disease such as cancer. So, if this is your only form of coverage, youll also be paying large out-of-pocket costs if you have a serious illness.

Critical-illness and cancer insurance policies

There are other types of policies that offer extra money in case of certain kinds of health problems such as cancer, stroke, or an accident. They typically cover some part of the expenses that your regular health insurance doesnt, like deductibles and co-insurance. Others just give you a fixed amount of money if you are diagnosed. You cant buy these critical-illness policies after you are diagnosed, and there are often limitations and waiting periods. Its important to understand exactly what the plan will cover, and not rely on this type of policy for your health coverage. These policies DO NOTcover most of the healthcare services a patient needs.

Long-term care insurance

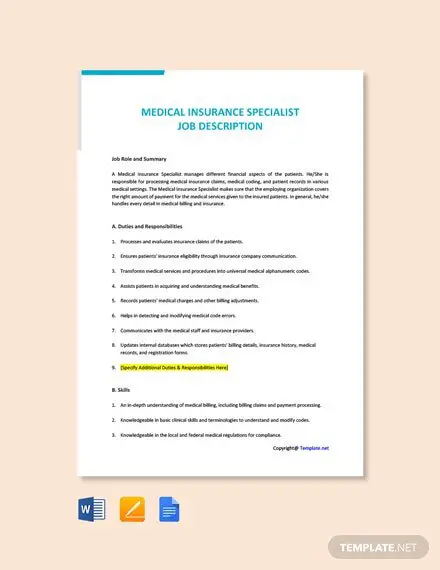

What Is A Health Insurance Specialist Responsible For

In general, Health Insurance Specialists Jobs are responsible for maintaining patient records in different healthcare settings. Health Insurance Specialists process medical claims, perform medical coding, and keep patient records up to date. Health Insurance Specialists often manage financial considerations for patients and create, control, and organize health information. They maintain the integrity, quality, and security of health information data.

Recommended Reading: Starbucks Health Insurance Plan

How Do I Set Up A Virtual Visit

Virtual visits are a way to connect with a health care provider from home or at work. With virtual visits, you use digital technologies, like your smartphone, tablet or computer, to talk with a provider. You may get treatment options and may even get prescriptions for medications, if needed.

We offer members options for telehealth visits with local providers or by using UnitedHealthcare preferred national providers. to learn about telehealth options available with your benefits.

Ppos Epos Bypass Referrals

Referrals are not necessary for a preferred provider organization or an exclusive provider organization . A PPO is a health plan that has contracts with a wide network of “preferred” providers. You are able to choose your care or service out of the network as well. An EPO also has a network of providers, but it generally will not cover any out-of-network care unless it’s an emergency.

Unlike a health maintenance organization, in a PPO or EPO, you do not need to select a primary care physician and you do not need referrals to see other providers in the network. Because of this flexibility, PPO plans tend to be more expensive than HMO plans with otherwise comparable benefits.

In fact, although PPOs are still the most common type of employer-sponsored plan, they aren’t as common in the individual market as they once were because insurers have found them more expensive to offer.

Read Also: Starbucks Insurance Enrollment

Who Are Healthcare Providers

The healthcare provider youre probably the most familiar with is your primary care physician , who gives you primary care services like screenings, vaccinations, and routine exams. There are also specialists that you see when you need certain specific medical care.

There are many different types of healthcare providers. Any type of healthcare service that you might need is provided by one of them.

Not all healthcare providers are physicians or doctors. Here are some non-physician examples of healthcare providers:

- The physical therapist that helps you to recover from your knee injury

- The home healthcare company that provides your visiting nurse

- The durable medical equipment company that provides your home oxygen or wheelchair

Do I Need To Change My Login Information Or Re

If you get your health plan through work, you may have a change in your group number at times. However, you will not need to re-register with your new group number or create a new username or password.

- Your registration stays the same even if you switch employers or if your employer changes group numbers

- When you sign in to your health plan account, you can choose which account you want to see: the old group number account or the new group number account

Recommended Reading: Kroger Health Insurance Benefits

How Can I Find A Network Doctor Clinic Or Hospital

With almost every plan, you may pay less for health care when you choose providers in your network.

- If you’re already a member and have your member ID card, or use the UnitedHealthcare app to view network doctors, clinics and providers for your health plan.

- If you dont have your member ID card yet or if you’re shopping for a health plan, you can still use the provider search tool to learn which doctors, clinics and providers are in network.

Healthcare Enrollment Specialistsample Job Descriptions Salaries And Interview Questions

Health care enrollment specialists determine the type of care for which patients in a clinic or hospital are eligible. They also verify patients eligibility with their insurance carrier, collect health records, and manage medical care forms. Health insurance companies also employ enrollment specialists. In that setting, they assist customers with enrolling in health care programs, answer questions about benefits, and maintain current customers.

Health care enrollment specialists need to possess administrative and organization skills and communication and customer service skills. Candidates should also be well-versed in all aspects of the programs for which they enroll customers and patients so that they can pass along accurate information.

Recommended Reading: Does Starbucks Provide Health Insurance

What If I Dont Need My Temporary Insurance Coverage For As Long As I Had Planned

Short term health insurance plans can be cancelled at any time without penalty.

If you need coverage for longer, you may be able to apply for another short term insurance plan.2 However, for any subsequent plan, whatever you received treatment for under a preceding plan will be considered a preexisting condition.

Insurance And Healthcare Provider Networks

Most health plans have provider networks. These networks are groups of healthcare providers that have agreed to provide services to the health plans members at a discounted rate and that have met the quality standards required by your insurer.

Your health plan prefers that you use its in-network providers rather than using out-of-network providers. In fact, health maintenance organizations and exclusive provider organizations generally wont pay for services you get from a healthcare provider thats out-of-network except in emergency situations.

Preferred provider organizations , and to a lesser extent, point of service health plans, will usually pay for the care provided by out-of-network providers. However, they incentivize you to get your care from their in-network providers by imposing a higher deductible, copayment and/or coinsurance, and out-of-pocket maximum when you use an out-of-network provider.

If you choose to use an out-of-network provider, the provider can balance bill you for the portion of their costs that are above the reasonable and customary amount your insurer is willing to pay.

Also Check: Does Medicare Pay For Maintenance Chiropractic Care

Find Answers To Common Questions About Health Plans And Coverage

Whether you’re new to your health plan or have been a member for years, from time to time, it’s natural that questions may pop up. We’ve gathered common health plan and coverage questions below to help you get started with finding the answers you may be looking for.

If you’re looking for answers about your specific health plan benefits and coverage, the first step is to There, you can find details that are specific to you and your health plan.

What Does A Health Insurance Specialist Do

A health insurance specialist works in an office environment, often in a hospital. However, they may conduct their duties from a separate office or even from home, depending on the rules governing the facility. On a day-to-day basis, a health insurance specialist oversees a caseload of patients who are receiving treatment for a variety of illnesses. Some insurance specialists work with certain types of patients based on the department or facility they work for. This helps them gain an intimate familiarity with the medical terminology and procedures. For instance, some may specialize in patients on the maternity ward, the oncology ward, or the mental health ward.

A health insurance specialist is responsible for ensuring that patients receive the care they need while makings sure that the insurance company will cover the payments. They also manage any co-pays that patients must provide as a condition of receiving care. Essentially, a health insurance specialist is an expert at reading insurance policies and filing medical insurance claims for payment. They are well-versed in medical coding and insurance protocols and can thus file medical insurance claims in an efficient and timely manner. Their expediency helps give patients and providers the green light for surgeries, therapies, and other forms of care.

Read Also: Starbucks Part Time Insurance

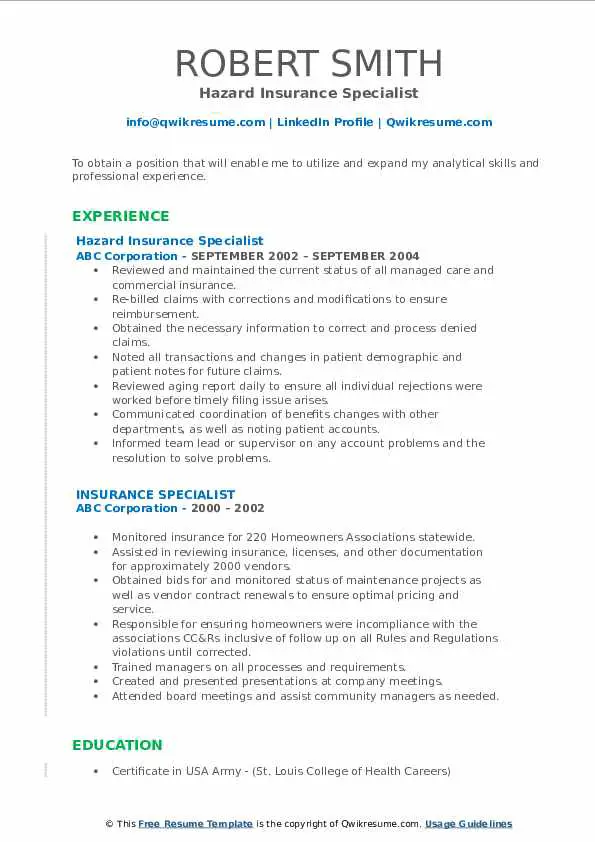

Tips For Writing A Health Insurance Industry Resume

How else can you make your resume stand out? Try following these strategies:

Consider including a summary statement. The resume example following this section includes a resume summary statement as well as sections on education, employment, and skills. A key component is the overview summary at the top of the resume. A summary overview is a concise paragraph that highlights what makes you an ideal candidate for a position. Ultimately, it sets you apart from the competition.

Emphasize skills, as well as certification or training. If you have HIPAA training or certification, or other relevant training or certification, do mention it on your resume. These may be qualifications that employers in the industry seek out. As well, be sure to highlight any relevant skills. For instance, if you’re applying to be a claims processor, attention to detail is a must. If you will be explaining benefits to consumers, strong communication skills and customer service abilities are important.

Make sure your resume is easy to read. Resumes can be chronological, functional, or a mix of the two. Learn more about the different resume types. Whatever option you choose, make sure to make it consistent and easily readable. That means using white space so people can scan the page and a professional font. Make sure to carefully check for typos or grammatical errors, too.

Review our top 10 tips for writing a professional, effective resume.

Types Of Health Insurance Plans

There are many types of health insurance plans:

- Managed Care Plans: health maintenance organizations , point-of-service plans , preferred provider plans

- Hospital indemnity policies

- Cancer insurance and other supplemental insurance

They all require you to pay a monthly fee, called a premium. Most of them also require you to pay either a flat fee for doctors office visits and other services , or a percentage of the cost . Some services require you to pay both a co-pay and co-insurance. Each year, most people also have to pay a certain dollar amount of their medical costs, known as the deductible, before insurance will start to pay at all. After you have met your deductible, your insurance will pay a set percentage of your bills for medical care for the rest of the year. In addition, all insurance plans must set an out-of-packet maximum that an individual or family are required to pay before the health insurance plan covers 100% of covered benefits.

If your doctor accepts your insurance, their office will often bill the insurance company for you, and then send you a bill for the amount your insurance didnt cover. If not, you might have to pay your medical bills yourself and then fill out forms and send them to your insurer to get paid back.

It’s important to know that some health insurance plans might not cover all your healthcare needs. Here are some helpful things to consider when selecting a plan:

Read Also: Starbucks Health Plan