The Average Cost Of Health Insurance By Plan Types And Metal Tier

The type of health plan and the level of coverage you choose impact how much youll pay for health insurance.

For example, you might be willing to pay more for easier access to a broader range of providers, such as through a Preferred Provider Organization or Point of Service plan. Or, you may opt for less flexibility with a Health Maintenance Organization or Exclusive Provider Organization plan but score lower-than-average premiums.

Another thing to consider is how much of the cost of care your insurance covers. Different metallic tiers dictate how much of your health care expenses your plan will cover compared to what youll pay in premiums. As youd expect, the more a plan covers, the higher your premiums will typically be.

How Much In Monthly Premiums Can You Expect To Pay With Obamacare

What you pay each month also depends on the plan you select. A Kaiser Family Foundation national analysis of marketplace plans for a 40-year-old person found that the average premium for a benchmark silver plan in 2022 is $438. The price ranges from $309 in New Hampshire to $762 in Wyoming.

Thanks to the American Rescue Plan Act of 2021, there is new financial assistance for ACA premiums in 2022. These savings will make ACA healthcare plans more affordable than ever. Generous subsidies mean that 4 out of 5 people will be able to find a plan that costs $10 or less per month.

The KFF analysis applied nationwide to all metal tiers, except platinum, found:

Average 2022 marketplace premium for a 40-year-old without subsidies

| Plan Category | |

|---|---|

| Average lowest-cost gold premium | $462 |

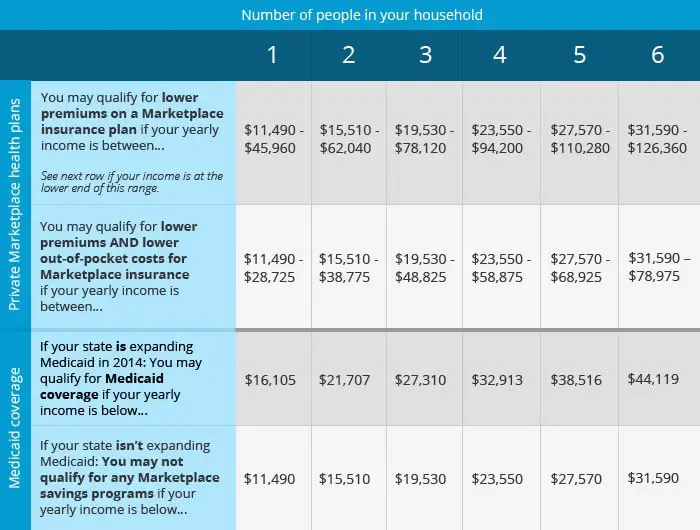

Families earning 100% to 400% of the federal poverty level and sometimes more will qualify for savings on monthly premiums.

According to KFF, the 2022 subsidies fully cover the cost of a benchmark silver plan for consumers with incomes up to 150% of the federal poverty level. These consumers also receive extra savings that greatly reduce deductibles and copays to costs similar to platinum plans.

A subsidy also known as premium tax credit is based on your estimated income in a coverage year. If your actual income is higher or lower, your premium tax credit could be adjusted.

You can estimate your costs using this ACA Health Insurance Marketplace Calculator.

Insurance For Individuals In Pennsylvania

Your personal health history is important because it can help you decide whether you want to choose a plan based on cost or extent of coverage. If you have a chronic disease, you may want to prioritize plans that will allow you to keep seeing the same specialists or filling the same specialty prescriptions. A low-cost plan may take priority if you dont have chronic health conditions. You also need to think about your familys medical history. If a close relative had cancer or heart disease, for example, it might make more sense to choose a plan with a higher monthly premium and a lower out-of-pocket maximum.

The type of plan you choose is also an important consideration.

- Health Maintenance Organization plans typically cost less than other health coverage types and have some restrictions that can affect your ability to access care. For example, you may have to ask for a referral if you want to see a specialist and your network is local.

- Preferred Provider Organizations dont require referrals and usually offer nationwide coverage but tend to cost more than HMO plans. Most PPOs also have out-of-network benefits.

- Point-of-Service plans combine the features of an HMO with the features of a PPO. You have to ask for a referral to see a specialist, but you can get care from out-of-network providers if youre willing to pay a larger percentage of the cost.

Don’t Miss: Can You Lose Health Insurance While On Fmla

Do You Qualify For A Subsidy Under The American Rescue Plan Act

President Biden signed the American Rescue Plan Act into law on March 11, 2021. The act is designed to provide governmentassistance to people struggling under the impact of COVID-19, including helpwith health insurance coverage. ARPA changed the way subsidies were calculatedso that more Americans qualified for federal assistance with their healthcare plans.

Before the ARPA, people who made more than 400% of thefederal poverty level were automatically disqualified from any subsidies.This became known as the subsidy cliff. In addition to eliminating thesubsidy cliff, the ARPA increased subsidies for those making between 100% and400% of the FPL. These changes increased the number of Americans who qualifiedfor subsidies by 20%, or millions of people.

Now, people who make more than 400% of the FPL cannot pay more than 8.5% of their income for health insurance premiums for a silver premium plan. People who fall between 100% and 150% of the FPL now qualify for a zero-premium silver plan. Premiums are also lower for those that fall between 150% and 400% of the poverty line.

If you are one of the millions that now qualifies for a subsidy or can receive more assistance under the ARPA, eHealth is ready to help you find a plan that meets your needs and budget. Our licensed brokers are ready to work with you to purchase insurance in any state, with 24/7 support and the ability to sign up for a plan online, through our chat, or by phone.

Pros And Cons Of Self

One change enacted by the Affordable Care Act is that monthly premiums can now be a deductible line item on a tax return for someone that is self-employed. Self-employed insurance also is beneficial because it gives you the flexibility to adjust your income level throughout the year, which may qualify you for subsidies to help with the cost of coverage. This is very helpful in the event that your insurance dips lower than you had originally expected. This can, however, have some disadvantages if you dont update your income on your application as you will risk paying a higher amount in monthly premiums if you dont update any increases in your income.

Don’t Miss: How Long Can You Go Without Health Insurance In Massachusetts

The Importance Of Subsidies

The good news is that many who purchase marketplace plans will pay lower premiums through what the government calls advanced premium tax credits, otherwise known as subsidies. In 2019, 88% of people who enrolled at HealthCare.gov were eligible for advanced premium tax credits.

What are these subsidies? They are credits the government applies to your health insurance premiums each month to make them affordable. Essentially, the government pays part of your premium directly to your health insurance company, and you’re responsible for the rest.

As part of the American Rescue Plan Act passed in March 2021, subsidies have increased for lower-income Americans and extended to those with higher incomes. The ARPA expanded marketplace subsidies above 400% of the poverty level and increased subsidies for those making between 100% and 400% of the poverty level.

You can take your advance premium tax credit in one of three ways: equal amounts each month more in some months and less in others, which is helpful if your income is irregular or as a credit against your income tax liability when you file your annual tax return, which could mean you owe less tax or get a bigger refund. The tax credit is designed to make premiums affordable based on your household size and income.

What Is The Least Expensive Health Insurance

As you can see from the factors listed above, theres a lot that goes into determining the price of insurance. There isnt a single healthcare plan thats right for everyone. But finding the right plan for your needs can be easy with HealthMarkets. You can shop online, compare healthcare plans, and apply in minutes. You can also call 986-2752 to speak with a licensed insurance agent.

46698-HM-0222

You May Like: What Is Husky Health Insurance

Informed Choices Confident Decisions

Choosing the right health insurance for you and your family is an important decision. We understand, and we want you to feel confident in your choice. Let us help you find the insurance plan thats right for you.

Were Here to Help

Sometimes talking over the phone is easier. Were here to listen to your questions and help you get answers. Call us at 888.630.2583.

You May Like: Does Medical Insurance Cover Chiropractic

The Average Cost Of Health Insurance By Plan Types

There are four types of health plans you can choose on the Marketplace, with varying degrees of flexibility and cost:

- Health Maintenance Organization : HMOs tend to have lower premiums but require you to use a specific set of providers and get referrals to specialists for covered services, except in emergencies. Silver HMOs average $473 per month.

- Exclusive Provider Organization : Somewhere between an HMO and a PPO, EPOs typically require that you use the health plans in-network providers, but you dont always need referrals to see specialists. EPO Silver plans average $508 per month.

- Preferred Provider Organization : PPOs tend to be more expensive than HMOs but typically offer a broader range of providers. You usually dont need to get a referral to see specialists for covered services. On the Marketplace, Silver PPO plans have an average premium of $517.

- Point of Service : POS plans tend to be the most flexible at an increased financial cost. You can usually get care outside of the health plans provider network, though youll likely pay more for those services. POS Silver plans have an average monthly premium of $534.

Average Health Insurance Premiums by Plan Type – Silver Plans

Scroll for more

Recommended Reading: Can I Get Free Health Insurance

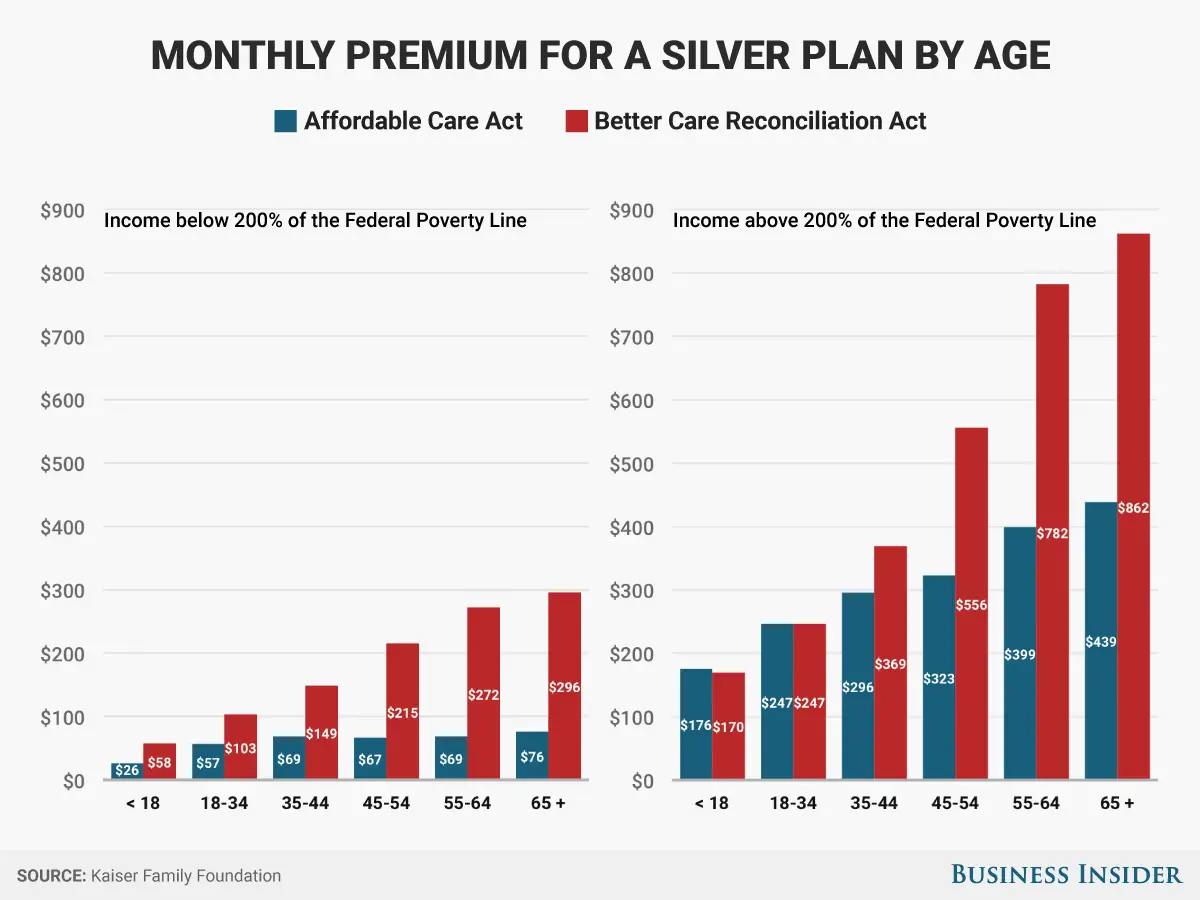

What Is The Difference Between Obamacare And Trumpcare

Trumpcare refers to the American Health Care Act passed in 2017 by President Trump. Overall, there are not that many differences between the two bills. With Trumpcare, there is no tax penalty for not having a health insurance plan, and states are not required to offer preventative care in their marketplace plans. Trumpcare also ensured that state authority was responsible for managing Medicaid and implemented the Federal Invisible Risk Sharing Program.

Find Cheap Health Insurance Quotes In Pennsylvania

The cheapest health insurance in Pennsylvania for most people is from Ambetter Balanced Care 30, which is the most affordable Silver plan in 28% of the states counties. The cheapest Silver plan in the state is UPMC VirtualCare Silver . However, this plan is only available in Allegheny and Erie counties.

For a 40-year-old, the average cost of health insurance in Pennsylvania is $498 per month for a Silver plan.

Affordable health insurance plans in Pennsylvania are available through the state exchange, though some shoppers can qualify for Medicaid depending on their household income. In 2022, the average cost of health insurance in the state is $441 per month, remaining flat since 2021.

Recommended Reading: Is Health Insurance Mandatory In Ct

Don’t Miss: How To Get Health Insurance For My Small Business

Choosing Health Insurance For Large Families

Choosing health insurance for large families can be more complex and more expensive. The specific price you pay depends heavily on how many people are in your family and what your specific health needs are. Generally, if everyone in your family is in good health, your premiums and deductibles will be lower. This makes it wise to invest in a family health insurance plan that covers preventative care, as that will help you stay healthy and achieve lower prices over the long haul.

If you are considering health insurance for large families, youre likely to pay more in total, but less per person. You are also likely to pay less if you get your family health insurance plan from your employer, since employer-sponsored health insurance often covers larger numbers of people and faces less risk per person.

Florida Health Insurance Overview

If youre looking for individual or family health insurance in Florida under the Affordable Care Act also known as Obamacare, youll probably have a good chance of getting government subsidies to lower your costs. You can also get low-cost or free Florida health insurance through public programs like Medicaid and the Childrens Health Insurance Program .

Health insurance through Medicare is also a big deal in Florida. So if youre at least 65 years old , Medicare may be a cheaper option for you.

You can review the sections below to learn different aspects of buying health insurance in Florida, such as how to enroll, average health insurance costs, and income requirements to qualify for subsidies.

Read Also: How Much Does Health Insurance Cost An Employer

What Are Average Health Insurance Costs

In the U.S., 55% of people receive health insurance through their employer, and 20% receive insurance coverage through government assistanceeither through Medicaid or Medicare according to the U.S. Census Bureau. Some peoplesuch as those who are self-employedchoose to purchase insurance privately, says Peter Kongstvedt, M.D., a health care expert and author based in Virginia. There are also 8% of people in the U.S. with no health insurance coverage at all.

The average health insurance cost for a single person who received health insurance through their employer in 2020 was $7,040 a year, according to data compiled by the Kaiser Family Foundation. The average cost of health insurance for a family in 2020 was $21,342 a year. These numbers represent what someone pays for a health care premium. A premium is the amount you pay each month to the health insurance provider, Dr. Kongstvedt says.

A premium is different from a deductible. A premium is what you pay up front , regardless of if you get health care or not. A deductible is something you pay in plans if you actually receive health care, Dr. Handel explains. For example, if the deductible for your health insurance plan is $1,000 a year, youll need to cover the other medical bills beyond that amount, he adds.

What Factors Influence The Cost Of Pennsylvania Individual Health Insurance

Under the new health care law, insurance companies are only allowed to consider five factors when determining rates: for Pennsylvania residents, your location, age, tobacco use, plan type, and whether the policy covers dependents.

Where You Live Yes, health insurance premiums vary from one state to the next and even neighborhood to neighborhood. The cost of living and the typical wage are two elements that influence how much you will pay for a health plan.

Your Age Your age will impact your premiums, just like most insurance. When you get health insurance, the younger you are, the lower your rates will be.

Tobacco Use The use of tobacco is very likely the one thing on this list that will cause you to pay more for insurance. Regarding health insurance, premiums can rise by upwards of 60% per month.

Individual vs. Family enrollment A health insurance plan that covers you and your spouse and any dependents may cost more than one that only covers you. So, if youre purchasing coverage for yourself alone, it will be less expensive than buying a family policy. However, some inexpensive family health insurance plans are still available in Pennsylvania.

States can restrict how much these elements influence premiums however, the essential health benefits have to be the same in all Marketplace health plans. Insurance companies may add extra benefits, which might affect costs.

Recommended Reading: Can You Put Boyfriend On Health Insurance

What Are The Types Of Health Insurance Marketplaces

A states health insurance marketplace can be run by the state, by the federal government, or both. As of the 2021 plan year:

- DC and 14 states have fully state-run marketplaces, which means they oversee the marketplace and operate their own website and call center .

- Twenty-four states rely fully on the federal government for their marketplaces. They use the HealthCare.gov website and customer service call center.

- Six states havestate-based marketplaces that use the federal platform , which means they oversee their own marketplace but rely on HealthCare.gov for enrollment.

- Six states have state-federal partnership marketplaces, which are similar to the states that rely fully on the federally-run marketplace, but involve more state participation in oversight and management .

You can find more information here about the types of health insurance marketplaces, how they work, and which model each state uses. As noted above, three states that currently have an SBM-FP model are planning to launch their own fully state-run exchanges in the fall of 2021.

Who Will Pay For Your Health Care In Retirement

Who will pay for your health care expenses in retirement? This is a good question, whether retirement is just around the corner oreven if it is still far off in the future. Maybe your answer is Medicare will pay for it. And thats partly true, with emphasis on partly. Medicare, the nations federal health insurance program for people over the age of 65, pays benefits if you are eligible for Social Security. If youve noticed the term FICA on your pay stub that stands for Federal Insurance Contributions Act youve been paying into Medicare.

But heres the rub: Medicare covers some medical expenses, but not everything. And it isnt free you pay Medicare premiums in retirement,and these premiums can increase as the years go by, as can your out-of-pocket expenses. Thats why you need to be thinking about having a plan to cover your health care costs beyond Medicare.

Read Also: Can You Buy Dental Insurance Anytime

Also Check: Can Parents Be Added To Health Insurance

What Is A Health Insurance Marketplace

A health insurance marketplace, also known as a health insurance exchange, is a place where consumers in the United States can purchase private individual/family health insurance plans and receive income-based subsidies to make coverage and care more affordable. As of early 2021, there were about 11.3 million Americans enrolled in marketplace plans throughout the country.

And although marketplace enrollment generally trends downward throughout the year , that has not been the case in 2021. The American Rescue Plans additional subsidies and the COVID-related special enrollment period have resulted in much higher-than-normal enrollment outside of the open enrollment period for 2021. During the first several months of the COVID-related enrollment window, two million people signed up for coverage through the marketplaces nationwide.

Each state has just one official health insurance marketplace, operated either by the state, the federal government, or both. In most states, HealthCare.gov serves as the marketplace and runs the customer service call center. But some states run their own platforms, such as Covered California, New York State of Health, Connect for Health Colorado, MNsure, etc.