When Can My Health Insurance Coverage Be Terminated

Your coverage can only be terminated because:

- Premiums are not paid by the due date. Coverage is also waived when the employee portion of the premium is not deducted for 12 consecutive months.

- Coverage is voluntarily canceled.

- Death of the .

- Fraud is committed in obtaining benefits or there is an inability to establish a physician/patient relationship. Termination of coverage for this reason requires Group Insurance Board approval.

State and Grad only: Your coverage can be terminated because your eligibility for coverage ceases .

Retirees only: Your coverage can be terminated because you:

- Became ineligible for coverage as an annuitant because of becoming an active Wisconsin Retirement System employee.

- IYC Medicare Advantage enrollees only: Dropped Medicare Part B. Your coverage will change to IYC Medicare Plus. You may also change health plans.

The Medicare enrollment requirement is deferred while you or your spouse are employed and covered under a group health insurance plan from that employment. Active employees should contact their benefits/payroll/personnel office for the date coverage will end.

In Most Cases Knowing How To Cancel Your Health Insurance Policy Is As Simple As Contacting Your Insurance Company

Can you cancel your employer health insurance at any time. However for any subsequent plan whatever you received treatment for under a preceding plan will be considered a preexisting condition. Health insurance can be canceled retroactively but your employer and the insurance provider would have to have a pretty solid case of fraud or misrepresentation against you. If you need coverage for longer you may be able to apply for another short term insurance plan.

If they are they are de facto enrolled in a Section 125 Plan and cannot change that election until Open Enrollment or a Qualifying Life Event. Rescission of coverage thats what retroactive cancellation is called in the Affordable Care Act is strictly prohibited. Private insurance polices may be canceled at any time according to your insurance.

Ad Get Your Quote in 2 Minutes for Affordable Health Insurance. It is possible that your plan may offer exceptions that allow you to terminate coverage. Get an Expat Quote Today.

An employee can voluntarily cancel coverage at any time only if the company is not having employee premium contributions deducted pre-tax. As stated above the ACA requires employers of a certain size to provide access to ACA-compliant health insurance or face a tax penalty. Your type of insurance coverage determines whether you may cancel your insurance policy.

You could call the carrier or if applicable healthcaregov if you prefer. To answer the question in the title. Group plans are different.

An Income Increase That Moves You Out Of The Coverage Gap

There are 13 states where there is still a Medicaid coverage gap, and an estimated 2.3 million people are unable to access affordable health coverage as a result. .

For people in the coverage gap, enrollment in full-price coverage is generally an unrealistic option. HHS recognized that, and allows a special enrollment period for these individuals if their income increases during the year to a level that makes them eligible for premium subsidies .

As mentioned above, the new market stabilization rules only allow a special enrollment period triggered by marriage if at least one partner already had minimum essential coverage before getting married. However, if two people in the coverage gap get married, their combined income may put their household above the poverty level, making them eligible for premium subsidies. In that case, they would have access to a special enrollment period despite the fact that neither of them had coverage prior to getting married.

You May Like: How Much Does Starbucks Health Insurance Cost

Can You Cancel Health Insurance When It Is Not Open Enrollment

Health insurance can be expensive. Consumers who find a better deal may be tempted to cancel existing coverage in favor of saving money in the long run. Your type of insurance coverage determines whether you may cancel your insurance policy. Employer-sponsored plans require you wait until open enrollment unless you have a qualifying event. Private insurance polices may be canceled at any time according to your insurance documentation.

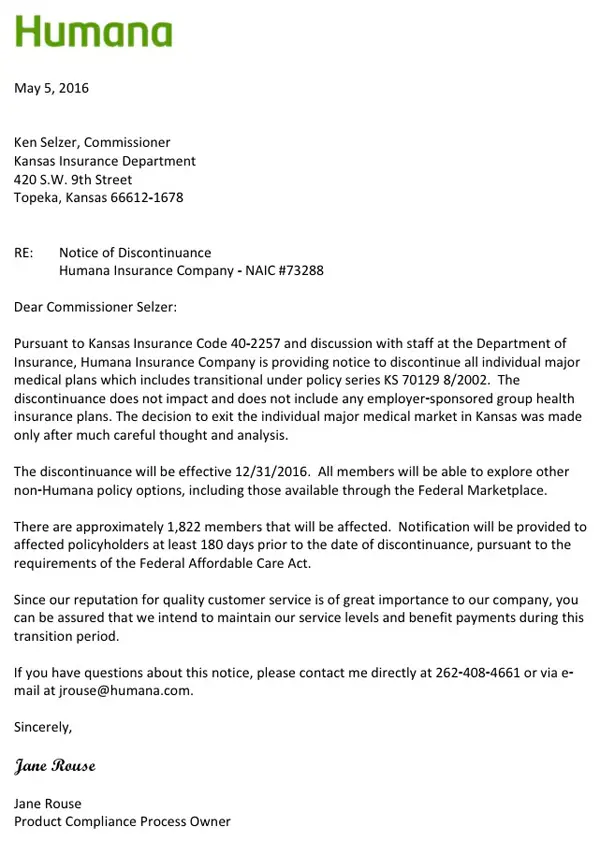

Health Insurance Cancellation Laws

To protect individuals and groups from having their insurance cancelled by the company, health insurance cancellation laws are in place. State laws keep in check when insurance may or may not be cancelled. Generally, the protections apply to all plans, including those that were in place before 2010, when the Affordable Care Act was introduced.

Insurers typically can not cancel their clients insurance plan even if they made a mistake on their form. This excludes intentionally missing out information that is key to the insurance provider, like the medical history of the client, their income, and other important personal information. Insurers have up to two years after a client purchases their plan to do a check and ensure the information is correct. If they find something that was kept hidden they may move to ask for an explanation for the misinformation or cancel the plan altogether if they so wish.

If the insurance company decides to cancel the plan altogether, they have to give a 30-day notice period to the client. This notice period may vary depending on the plan that the individual has. For instance, if you received a subsidy on your plan through the ACA, you may receive a 90-day notice. Similarly, state laws vary for individuals who do not qualify for a subsidy, and hence, your notice period may vary as well. This grace period ensures that clients are able to secure either another insurance or go for an appeal.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

How To Cancel Your Health Insurance Plan

If youre unhappy with your health coverage, dont worry, there is something you can do about it. Learn how you can cancel your health insurance plan without facing any harsh penalties or repercussions.

Find Affordable Health Insurance In Your Area!

For most people, health insurance is a necessity and a burden that must be born. If you find yourself in the situation where you need to cancel health insurance, you may find it difficult to navigate the various regulations and policies that surround the healthcare market. You may change jobs, turn 65, or simply cannot afford your premiums. Whatever the reason, there are a number of factors to consider as you begin the process.

Qualifying Events That Trigger Special Enrollment

Outside of open enrollment, you can still enroll in a new plan if you have a qualifying event that triggers your own special open enrollment window.

The Supreme Court just upheld the ACA. Should marketplace insurance buyers breathe a sigh of relief?

People with employer-sponsored health insurance are used to both open enrollment windows and qualifying events. In the employer group market, plans have annual open enrollment times when members can make changes to their plans and eligible employees can enroll. Outside of that time frame, however, a qualifying event is required in order to enroll or change coverage.

In the individual market, this was never part of the equation prior to 2014 people could apply for coverage anytime they wanted. But policies were not guaranteed issue, so pre-existing conditions meant that some people couldnt get coverage or had to pay more for their policies.

All of that changed thanks to the ACA. Individual coverage is now quite similar to group coverage. As a result, the individual market now utilizes annual open enrollment windows and allows for special enrollment windows triggered by qualifying events.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

I Was Already Enrolled In A Marketplace Plan When I Got A New Job Do I Need To Cancel It

If youre currently enrolled in a Marketplace-based health insurance plan and then get hired and your employer offers insurance, there are a few things to know. First is that now youre probably no longer eligible for any savings or subsidies on your Marketplace plan. And this is true even if you dont accept the employer-sponsored insurance and opt to continue on your Marketplace plan. If youre offered job-based insurance that meets the federal minimum standards, then you lose your eligibility for cost savings on the Marketplace. So, some people may want to cancel their Marketplace plans to enroll in job-based insurance. For many, this will best allow you to stay covered and keep your costs down.

If you want to cancel your Marketplace plan, you can log into your Marketplace account to do so.

Question: Do You Need A Qualifying Event To Cancel Health Insurance

You can cancel your individual health insurance plan without a qualifying life event at any time.

On the other hand, you cannot cancel an employer-sponsored health policy at any time.

If you want to cancel an employer plan outside of the companys open enrollment, it would require a qualifying life event.

You May Like: Is Starbucks Health Insurance Good

Can You Get Insurance Through The Marketplace If Your Employer Offers Coverage

You can purchase a plan from the health insurance marketplace, but this will forfeit any employer contribution you may receive with a group plan. You may also not be able to receive any premium tax credits or other incentives because an employer-provided policy is available.

If you cancel coverage and dont replace it, you could face a penalty, in addition to the health risks.

Helpful Tips When Cancelling Private Plans

- Get Carded: Youll commonly find the insurers customer care phone number for your policy, printed on your health insurance card and on your monthly premium bill.

- Watch Out for Waiting Periods: If youre covered through a new employer, remember that many workplaces require a 30- or 90-day waiting period before your coverage starts. To avoid an unexpected lapse in coverage, double check with your HR department to confirm exactly when your coverage begins.

- Write Down Confirmation Numbers: When you speak with an insurance representative, record the date in your notes, plus the representatives full name, the callback number, and your cancellation confirmation number. With that information at hand, it will be much easier to resolve any future issues that may arise.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Can Employers Cancel Benefits Due To Financial Burden

Another worry that some employees have is that their employer will cancel their insurance if their health issues have become a financial burden. However, an employer cant cancel an employees benefits simply because their medical care is expensive.

The same goes if youve become disabled. The Affordable Care Act prohibits an employers insurance provider from canceling a persons health insurance just because theyve developed a disability.

Can You Drop Your Employer

Most people are thrilled at the prospect of acquiring employment that offers health benefits. It means that you have insurance coverage, and in the United States, health insurance is an absolute necessity. But not everyone is happy with the health insurance plan that their employer provides. You may not be satisfied with the type of coverage that the plan offers, for example or, you may have recently gotten married and are now covered by your spouses employer-sponsored health insurance plan perhaps you are interested in acquiring a private health insurance plan.

Whatever the case may be, if you are covered by an employer-sponsored health insurance plan, you might be wondering if you are actually allowed to drop it.

You May Like: Starbucks Dental Benefits

How To Cancel Employer Health Insurance

- Contact HR: If you want to cancel your health insurance at work, speak to the colleague who handles employee benefits.

- Scheduling Matters: Make sure that the cancellation date for your existing coverage is on or after the date when your new coverage begins.

- Exceptions for Cafeteria Plans: Employees can decide to cancel their employer-sponsored health insurance at any time, provided the worker is not deducting his or her premium payments from salaries pre-tax. When employees can make their premium payments with pre-tax dollars, they are enrolled in whats called a Section 125 Plan, and therefore by law they can only alter or cancel their plan in an OEP or SEP.

Helpful Tips about Employer Health Insurance

- COBRA: Employees who lose group coverage at work must be offered the opportunity to continue their medical coverage but at their own expense.

The Consolidated Omnibus Budget Reconciliation Act allows employees and their families who lose their health benefits to continue participating in their group health plan for limited periods 18 months for the worker, up to three years for dependents. You qualify for COBRA in cases of voluntary or involuntary job loss, reduction in work hours, divorce, and death. But COBRA is expensive because employers stop contributing the entire health costs fall on you, plus a 2% administrative fee.

Health Insurance Cancellation Laws You Need To Know

The two primary health insurance cancellation laws that may affect you are the penalty for going without coverage, and the laws governing Open Enrollment Periods for employer insurance. Under the law that created the Affordable Care Act, if you spend over 3 months of any year without health insurance you will face a financial penalty at tax time. This amount varies based on individual incomes.

The second law that may affect your ability to cancel health insurance has to do with employer plans. Most employers who provide their employees with insurance, do so on a pre-tax basis. For these companies, employees can only change plans during Open Enrollment, usually each year in the fall, or after a qualifying life event. The health insurance cancellation laws governing Medicaid and Medicare do vary based on the state and situation.

If you are seeking more guidance on the issue, the best place to start is by contacting your health insurance provider. Their representatives will know the specifics of your coverage and any policies regulating that coverage. FirstQuote Health makes it easy to get in touch with a health insurance agent who can help you cancel or switch your policy. Start by filling out your zip code to get started.

Popular Articles

Don’t Miss: Starbucks Employee Insurance

What You Need To Know

Canceling a health insurance policy can be as easy as calling up your insurance company and asking them to cancel the coverage. But canceling a health insurance policy without having a new health insurance policy in place could leave you open to a fine. If you’re outside of Open Enrollment, you can only purchase health insurance if you qualify for a Special Enrollment Period. It’s smart to line up your next health insurance policy before you cancel your existing policy. That way, you never have a gap in coverage.

Ready to shop health insurance?

If you’re canceling a plan that you purchased on a health insurance marketplace, such as healthcare.gov or a state marketplace, you can cancel the policy by logging into your marketplace account, selecting “My Plans & Programs,” and hitting “End All Coverage.” Set your coverage end date and follow the final instructions to cancel your policy. You can also if you need help or are switching to a government-run health program.

Recession-proof your money. Get the free ebook.

Get the all-new ebook from Easy Money by Policygenius: 50 money moves to make in a recession.

Get your copy

If you’re cancelling a privately purchased plan, you can call your health insurance company directly. Your insurer’s phone number should be printed on your policy, health insurance card, and your premium bills. Your insurer may allow you to cancel over phone. They may also require that you fax or mail them a confirmation letter.

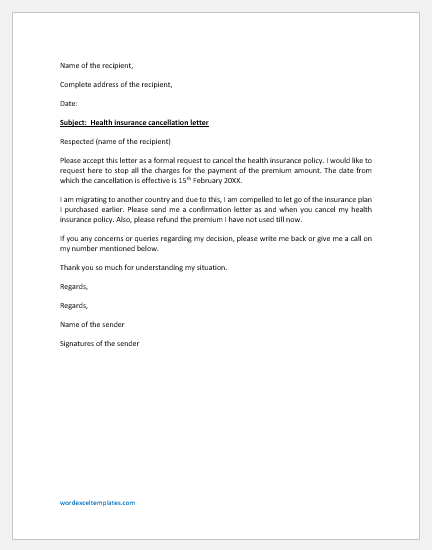

Writing A Cancellation Letter For Health Insurance

Individuals who wish to cancel an insurance policy will need to do so in writing. The letter will then be mailed to the insurance company via the postal service. This is the best method to contact health insurance companies and effectively communicate intentions.

A letter also prevents policy holders from having to talk directly to the representative of a company. Writing a health insurance cancellation letter can easily be done by following a set of steps.

Also Check: Starbucks Medical Insurance

An Income Or Circumstance Change That Makes You Newly Eligible For Subsidies Or Csr

If your income or circumstances change such that you become newly eligible or newly ineligible for premium tax credits or newly-eligible for cost-sharing subsidies, youll have an opportunity to switch plans. This rule already existed for people who were already enrolled in a plan through the exchange .

But in the 2020 Benefit and Payment Parameters, HHS finalized a proposal to expand this special enrollment period to include people who are enrolled in off-exchange coverage , and who experience an income change that makes them newly-eligible for premium subsidies or cost-sharing subsidies.

As of 2022, there will also be a special enrollment period for exchange enrollees with silver plans who have cost-sharing reductions and then experience a change in income or circumstances that make them newly ineligible for cost-sharing subsidies. This will allow people in this situation to switch to a plan at a different metal level, as the current rules limit them to picking only from among the other available silver plans.

If I Stick With My Employer

In most cases, sticking with your employer-sponsored coverage for your health insurance will be your cheapest option. Most employers contribute towards your monthly premium costs, meaning you might not be able to beat that price. Especially since some employers might even contribute up to 100% of your monthly costs for your health insurance premiums.

Unless your employer offers health insurance that does not meet the minimum standards outlined in the ACA, you wont be able to qualify for any subsidies for your monthly premiums on the Marketplace. So while an Obamacare plan may seem cheaper on the surface, a quality employer-provided plan might be more affordable when you look at the big picture.

Recommended Reading: Does Starbucks Give Health Insurance