What Is A Copay In Health Insurance

A copay is a small portion of the cost you’re responsible to pay for each medical treatment. Copays can range from $25 to $100 depending on the coverage you buy. The smaller the copay, the more expensive the premiums will be. The larger the copay, the less expensive the premiums will be.

The cost for coverage can range depending on where you live, your age, tobacco use, and the type of coverage you purchase.

Does Health Insurance Cover Dental

Health insurance will not cover bridges, cleanings, crowns, exams, fillings, and non-urgent X-rays. There are some dental procedures that medical insurance may pay for, including oral infections, cysts, oral inflammation, sleep apnea appliances, headache treatment, accidents affecting the teeth, mucositis and stomatitis from chemotherapy or other medical treatments, dental implants and bone grafts, wisdom teeth extraction, biopsies, botox injections for jaw pain and more.

Can I Still Enroll Through The Health Insurance Marketplace Even When Were Not In An Open Enrollment Period

Individuals with a qualifying life event can enroll in health coverage or change their coverage outside of the open enrollment period and have it be effective for that coverage year. This is called the Special Enrollment period. Qualifying life events include having a baby or getting married. Visit www.healthcare.gov/coverage-outside-open-enrollment to learn more about these qualifying life events and other circumstances for special enrollment.

Don’t Miss: Which State Has The Cheapest Health Insurance

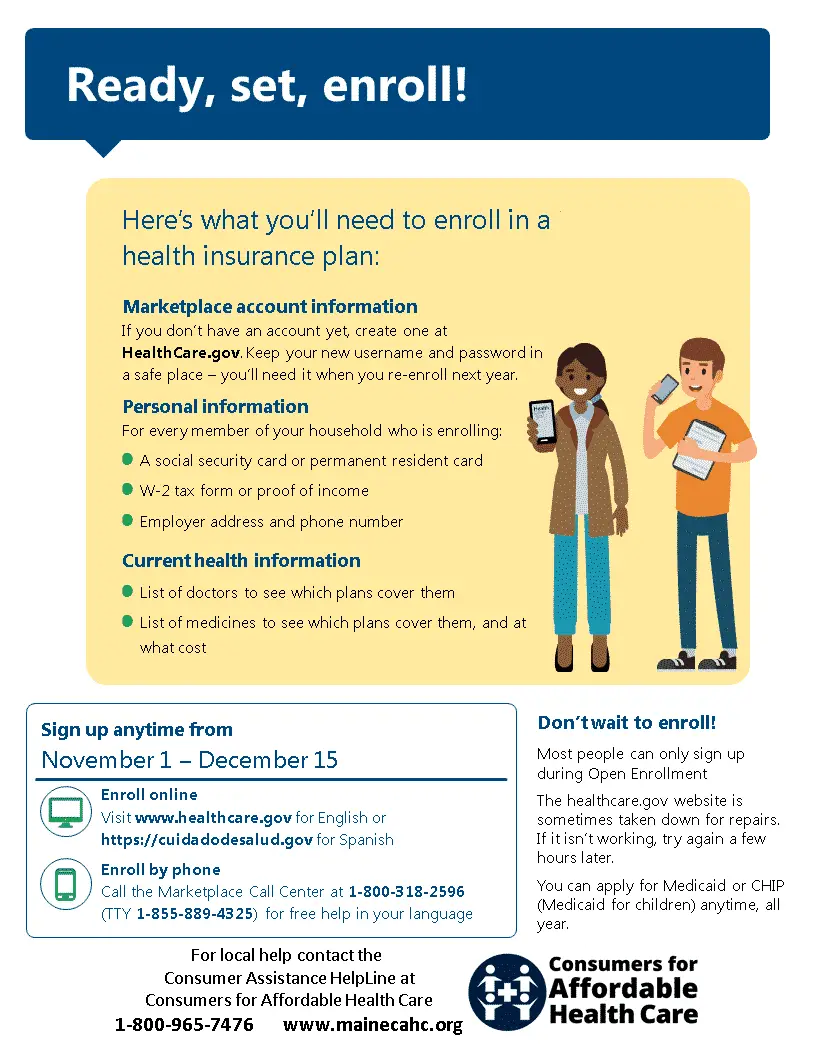

When Can I Buy An Individual Health Plan

Important: The 2022 individual and family health plan open enrollment period occurs Nov. 1, 2021 through Jan. 15, 2022. For health coverage to start Jan. 1, 2022, you must buy a plan Nov. 1 through Dec. 15. For coverage to start Feb. 1, 2022, you must buy a plan from Dec. 16, 2021 through Jan. 15, 2022. If you miss the annual open enrollment period, you can still enroll if you qualify for Apple Health or a special enrollment period.

What Is Covered By Short

The services covered by short-term insurance can vary greatly depending upon the insurance company that is offering the plan. There are some services that are generally covered by these plans, though. A few of these services are hospitalization, mammograms, regular doctor visits, lab work, x-rays, and more.

Short-term insurance does not cover prescription drugs or preventative care, however. It is not a substitute for permanent coverage by any means.

You May Like: Do You Get Fine For Not Having Health Insurance

Types Of Individual Health Plans

Individual health insurance plans dont differ in terms of benefits. However, plans vary on costs, how theyre structured, which doctors accept them and which prescription drugs they cover.

Health plans in the ACA marketplace are divided into four metal tiers to make comparing them easier. The tiers are based on the percentage of medical costs the plans pay and the portion you pay out of pocket. Out-of-pocket costs include deductibles, copayments and coinsurance. Find out more about copays and coinsurance.

The percentages are estimates based on the amount of medical care an average person would use in a year.

- Bronze — Plan pays 60% of your health care costs. You’re responsible for 40%.

- Silver — Plan pays 70% of your health care costs. You responsible for 30%.

- Gold — Plan pays 80% of your health care costs. You responsible for 20%.

- Platinum — Plan pays 90% of your health care costs. You responsible for 10%.

Additional Ways To Save Without Health Insurance

While not a health insurance plan, SingleCare is a prescription savings service that offers a free discount card to reduce the price of prescription medications for those with or without insurance. If you are without insurance or are paying the cash price for your medication, you could see up to 80% savings with our card. We have partnered with more than 35,000 pharmacies nationwide , so start by searching for your medication today at singlecare.com.

You May Like: Can You Use Health Insurance For Dermatologist

Can You Buy Your Own Health Insurance

BY Anna Porretta Updated on January 21, 2022

If you or your spouse work, you may have the opportunity to get your health insurance through an employer-sponsored group health plan, but thats not your only option. You can buy your own health insurance. Perhaps your circumstances are such that buying your own health insurance is the most reasonable, financially viable course of action. This may be true if you are self-employed, the owner of a small business, or an employee of a business that either does not offer health insurance as an employee benefit, or offers group health insurance but does not share substantively in the premium cost.

According to Medical Mutual, due to changing economic conditions, some employers have chosen or been forced to cut group insurance as an employer-sponsored benefit. This has led to a growing number of people looking elsewhere to get health coverage. If you are interested in comparing individual and family health insurance plans, eHealth can help you navigate your health insurance options and find an affordable that meets your needs.

Can I Buy Or Change Private Health Plan Coverage Outside Of Open Enrollment

In general, you can have a special enrollment opportunity to sign up for private, non-group coverage during the year, other than during Open Enrollment period, if you have a qualifying life event. During the COVID-19 emergency period, you can also have an extended amount of time to sign up. Events that trigger a special enrollment period are:

- Loss of eligibility for other coverage Note that loss of eligibility for other coverage because you didnt pay premiums does not trigger a special enrollment opportunity

- Gaining a dependent . Note that pregnancy does NOT trigger a special enrollment opportunity in most states

- Loss of coverage due to loss of dependent status

- A permanent move to another state or within a state if you move outside of your health plan service area

- Exhaustion of COBRA coverage

- Cessation of employer contributions to COBRA premiums

- Losing eligibility for Medicaid or the Childrens Health Insurance Program

- Income increases or decreases enough to change your eligibility for Marketplace subsidies

- Change in immigration status

- Enrollment or eligibility error made by the Marketplace or another government agency or somebody, such as an assister, acting on their behalf.

Note that some triggering events will only qualify you for a SEP in the health insurance Marketplace they do not apply in the outside market. For example, if you gain citizenship or lawfully present status, the Marketplace must provide you with a special enrollment opportunity.

Recommended Reading: Can I Have Dental Insurance Without Health Insurance

Medicaid And The Childrens Health Insurance Program

In all states, Medicaid provides coverage for some low-income people, families and children, pregnant women, the elderly, and people with disabilities. Likewise, CHIP provides low-cost health coverage to children in families that earn too much to qualify for Medicaid. CHIP also covers pregnant women in some states, and some states have expanded their Medicaid programs to cover anyone who falls below certain income levels.

If your state has expanded Medicaid, income is the only requirement. In states without expanded Medicaid, qualifications vary and may consider income, household size, disability, age, and more. Qualifications for CHIP vary from state to state. To find out if you qualify and apply for Medicaid or CHIP, go to the Health Insurance Marketplace or your states Medicaid agency.

Short-term health insurance is temporary health insurance that can help fill in the gaps in health care coverage. It can be a solution if youre between jobs, have started a new job and are waiting for new coverage to begin, are waiting to become eligible for Medicare, or dont have health insurance because you missed open enrollment. Its not right for everyone, however, and benefits can be quite limited. Consider these pros and cons.

Medicare Special Enrollment Periods

There are for people with Medicare.

- Initial enrollment period: Sign up for Medicare Part A and/or Part B within seven months of the time you first become eligible for Medicare through age or disability.

- Fall open enrollment period: Reevaluate and make changes to your Medicare or Medicare Advantage coverage, or your Part D coverage, from Oct. 15 to Dec. 7.

- General enrollment period: The time period between Jan. 1 and Mar. 31 of every year is when you can enroll in Medicare Part B for the first time. You may be eligible to enroll in a Medicare Advantage or a prescription drug plan in Apr. 1 to Jun. 30 of the same year with coverage starting on Jul. 1.

Similar to Marketplace plans, Medicare also has Special Enrollment Periods. You may qualify for a Medicare Special Enrollment Period if you meet any of these eligibility requirements, which includes losing coverage through no fault of your own, moving to or from institutional facilities, and experiencing changes in your eligibility for certain programs.

Don’t Miss: Is Cigna Health Insurance Any Good

Do Ancillary Products For Groups Or Supplemental Plans For Individuals Have An Open Enrollment Period

No. Employers can shop for group ancillary plans* anytime during the year and set their own enrollment periods for their employees. They can also add extra benefits at any time.

Our supplemental plans for individuals and families can also be purchased at any time throughout the year and don’t have an enrollment period.

*Group plans are plans that are offered through an employer.

When Can I Buy An Individual And Family Plan

Everyone under the age of 65 has the opportunity to purchase health insurance during the Open Enrollment Period.

Open Enrollment is from every year for coverage starting on January 1.

You can purchase a plan outside of Open Enrollment if you have a qualifying life event. There are many things that can be considered a qualifying life event, like:

- Loss of health coverage

- Turning 65 and needing to purchase a Medicare plan

- Changes to your household

- Changes to your physical location

- Becoming a U.S. Citizen

- Changes to your income that may affect a subsidy you qualify for

Don’t Miss: How Much Is Health Insurance Usually

Why Does Open Enrollment Exist

Before the Affordable Care Act, insurance companies could raise insurance premiums or refuse coverage to an individual based on their medical history. The Affordable Care Act made it illegal for insurance companies to deny coverage due to someones medical history or any type of pre-existing condition. To avoid a situation where people only get health insurance the month they know they need medical care, the Affordable Care Act established an Open Enrollment Period so that everyone can get health insurance once a year.

So now when someone pays their monthly insurance premium, it essentially goes into a large pot . And this gives insurance companies the ability to put that money towards medical care whenever a consumer needs it.

How Much Does Private Health Insurance Cost

While many people are scared by the prospect of purchasing their own insurance versus enrolling in an employer-sponsored plan, some studies have shown that it can end up being more affordable than employer-sponsored plans.

A study from the Kaiser Family Foundation found that the average monthly premium for an employer-sponsored insurance plan for individual coverage in 2021 was around $645 and $1,850 for family coverage. If you were to purchase your own insurance outside of an employer-sponsored plan, the average cost of individual health insurance was $438. For families, the average monthly premium was $1,168.

In addition, if you end up purchasing coverage through the Health Insurance Marketplace, you may qualify for a Cost-Sharing Reduction subsidy and Advanced Premium Tax Credits. These can lower your premium payment amounts, your deductible, and any co-payments and co-insurance for which you are responsible.

Don’t Miss: What Is The Health Insurance Portability And Accountability Act

Buying Health Insurance For 202: New Rules And Ways To Afford Coverage

New and expanded consumer protections, additional financial help, and more flexible enrollment are here.

Buying health insurance for 2022? Itâs a good idea to get up to speed on the new rules, regulations, and ways to get coverage. Many Californians will receive additional financial help to pay for monthly premiums and make health insurance coverage more affordable than ever for you and your family. For low-income Californians, expanded special enrollment means the opportunity to enroll in health insurance will last all year long. Learn more about what else has changed and what may impact your health insurance and medical care in 2022.

Expanded Health Insurance Subsidies Continue

Californians will continue to receive more help paying for health insurance. In 2021, the American Rescue Plan went into effect, helping millions of Californians and people all around the country lower the cost of health insurance premiums by expanding financial help for health insurance . These expanded subsidies continue through 2022, saving many California households hundreds to thousands of dollars on their premiums.

Increase in Tax Penalties for No Health Insurance

No More Surprise Medical Bills

Out-of-Pocket Maximums Changed for 2022

New Monthly Statements Show How Much You Spent on Care

Low-Income Families Can Enroll Any Time of Year

New Mental Health Coverage Provisions

A Pandemic Relief Exception Expired

Public Charge Rule Reversed

Donât Wait to Enroll

I Am Losing My Current Health Insurance Do I Have To Wait Until Open Enrollment To Enroll In A New Health Insurance

Typically, losing health insurance is considered a qualifying life event. This includes losing health insurance through a job, becoming ineligible for MassHealth or ConnectorCare, or aging out of your parents plan when turning 26.You have 60 days from the date when you lose your health insurance to enroll in new health insurance.

Recommended Reading: Does Health Insurance Cover Labor And Delivery

What Are The Advantages Of Employer

There are advantages to getting insurances through your employer. Typically, your employer will choose a coverage option for you and you can decide to accept the benefits if you are an eligible employee.

Several advantages of purchasing employer-sponsored healthinsurance include:

- Your employer selects your plan options and may engage benefits consultants or insurance brokers to identify the most suitable plan.

- Your employer will typically split the cost of your premiums with you, thereby reducing your out-of-pocket costs

- The premium contributions your employer makes are not taxed and your contributions can be made on a pre-tax basis. This will lower your taxable income.

If you are the owner of a small business with more than 1 unrelated employee, you may want to look at small business health insurance options before making a decision. eHealth can help you explore your options and select the right plan for your business and personal needs. eHealth works with highly rated insurance companies that specialize in individual and small group health plans. By using eHealths online tools, you can evaluate small group plans with ease.

Whats The Cheapest Health Insurance

The cheapest premiums in the individual market are Bronze plans. Bronze and Silver typically have similar premiums.

Its a good idea to get health insurance quotes for both Bronze and Silver plans to see the difference. Silver level plans are also eligible for cost-saving subsidies that reduce health insurance costs, which can make a Silver plan even cheaper than a Bronze plan, depending on your income.

If you want the most affordable health insurance premiums, make sure to get quotes for both types of plans.

That said, individual health insurance is often more expensive than employer-sponsored health insurance. Employers usually pay more than half of job-based plan costs, so those plans are often more affordable than an individual health insurance plan.

Read Also: How Much Do Employees Pay For Health Insurance

What Is The Affordable Care Act

The Affordable Care Act provides individuals and families greater access to affordable health insurance options including medical, dental, vision, and other types of health insurance that may not otherwise be available. Under the ACA:

-

You may be able to purchase health care coverage through a state or federal marketplace that offers a choice of plans.

-

Insurers can’t refuse coverage based on gender or a pre-existing condition.

-

There are no lifetime or annual limits on coverage.

-

Young adults can stay on their familys insurance plan until age 26.

-

Seniors who hit the Medicare Prescription Drug Plan coverage gap or “donut hole” can get a discount on medications.

Read the full text of the ACA and learn more about its provisions and relationship to patients, insurers, businesses, and families.

How Does The Company Handle Disputes Over Claims

Make sure you understand how your insurance company handles disputes filed over claims. Typically, there will be two avenues to appeal a denied claim. You can either file an internal appeal wherein your insurance company does a thorough review of their decision and your situation, or file for an external review wherein a third party looks into the matter.

About the Author

Derek has over 10 years of experience writing web content for a variety of online publications. His pieces range from finances and entertainment to religion and philosophy. For the past three years, Derek has focused on writing financial literacy articles for credit unions throughout the country. He prides himself on being able to take complex topics and make them accessible to the general public.

Read Also: Is Umr Health Insurance Good

Your Options If Youre Not Eligible Through Your Employer

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

If your employer doesnt offer you health insurance as part of an employee benefits program, you may be looking at purchasing your own health insurance through a private health insurance company.

A premium is the amount of money that an individual or business pays to an insurance company for coverage. Health insurance premiums are typically paid monthly. Employers that offer an employer-sponsored health insurance plan typically cover part of the insurance premiums. If you need to insure yourself, youll be paying the full cost of the premiums.

It is common to be concerned about how much it will cost to purchase health insurance for yourself. However, there are various options and prices available to you based on the level of coverage that you need.

When purchasing your own insurance, the process is more complicated than simply selecting a company plan and having the premium payments come straight out of your paycheck every month. Here are some tips to help guide you through the process of purchasing your own health insurance.