Protect Your Rights After A Job Termination: Call An Attorney

Losing a job is often stressful and sometimes humiliating, but you should know that you always have certain rights regardless of the reason for termination. If you believe your rights have been violated in any way following the loss of a job, you may want to explore your legal options. Get started today by reaching out to an employment law attorney near you.

Thank you for subscribing!

When Coverage Expires And How To Replace It

You gave your boss a resignation letter. You completed an exit interview with human resources. Your co-workers threw you a going-away party. Youre all set to leave your job and move on to your next adventure.

Thats when it hits you: You have no idea when your employer-sponsored health insurance ends, let alone how to get coverage on your own.

Figuring out health insurance after leaving a job can be frustrating and confusing. Learn how to figure out when your health coverage ends and what options you have once it expires. You can make the transition from your old coverage as smooth as possible by being prepared before you leave your job.

Employee Rights After A Job Termination: Final Paycheck

Many states have laws that dictate when the employer must give an employee their final paycheck. In general, the employee’s rights to receive a final paycheck depend on whether the employee quit or whether the employer fired the employee. In Connecticut, for instance, the employer must issue a final paycheck by the next business day after firing the employee and by the next payday if the employee quit.

Other states have stricter laws. For example, in California, the law requires the employer to pay the employee immediately if the employee was fired or if the employee quit after giving at least 72 hours notice. If the employee failed to give notice, the employer has 72 hours to issue a final paycheck. These laws may be inapplicable if a contractual agreement between an employer and an employee states otherwise.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Duration Of Cobra Benefits

For an employee, COBRA coverage lasts for up to 18 months. A spouse or dependent child who becomes eligible for any reason other than the employee’s qualifying event can continue COBRA coverage for up to 36 months. For example, if the employee dies, the spouse can continue coverage for 36 months.

Different rules apply in some circumstances. For example, if a spouse is receiving COBRA coverage because the employee was laid off, both the employee and spouse would be entitled to receive benefits for 18 months. However, if the employee dies during this 18-month period, the spouse’s eligibility would be extended to 36 months. COBRA coverage can also be extended if the person receiving benefits has a disability and meets other requirements.

Employee Rights After A Job Termination

Created by FindLaw’s team of legal writers and editors

Employees terminated by an employer have certain rights. An employee has the right to receive a final paycheck and the option of continuing health insurance coverage, and may even be eligible for severance pay and unemployment compensation benefits. There are a number of steps you can take to help protect yourself after losing your job, but it’s also important to understand your rights after a job termination.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

When Does Health Insurance Expire After Leaving A Job

Although there are no set requirements, most employer-sponsored health insurance ends on the day you stop working or at the end of the month in which you work your last day. Employers set the guidelines for when health coverage ends after an employee resigns or is terminated.

To figure out your employers policies, talk with your human resources department. You might also be able to find details on health insurance expiration in your benefits documentation.

You might find answers to your health insurance expiration questions in an employee handbook, intranet, or web-based employee portal.

For example, say you plan to leave your job on August 1. You talk with your human resources representative and they explain that your company terminates health insurance at the end of the month of the employees last day. This means your last day of coverage will be August 31, and you will no longer be covered on September 1.

How To Keep Health Insurance After A Job Layoff Or Furlough

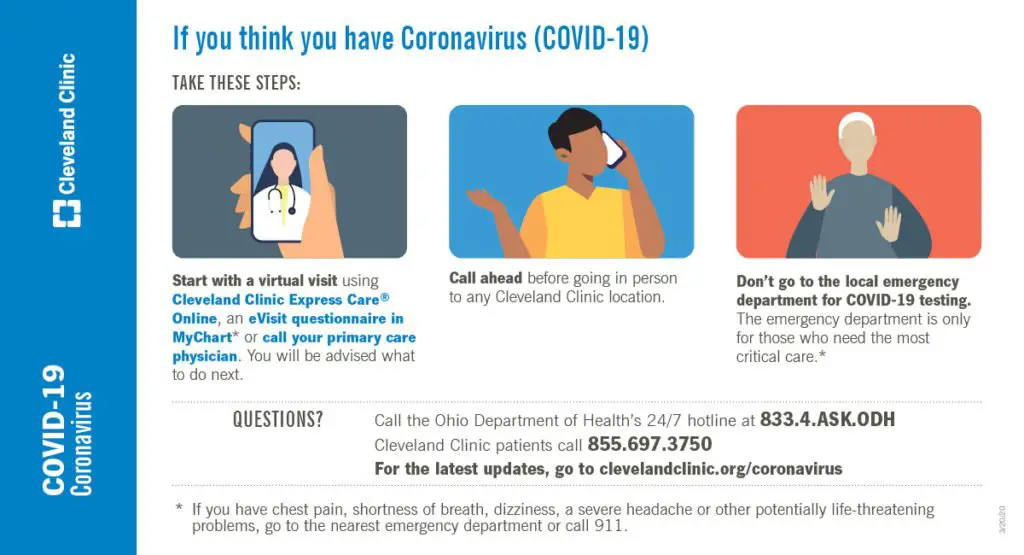

If youve been laid off or furloughed from your job, you have a lot on your mind right now. And during the COVID-19 outbreak, health care is surely near the top of the list. Now more than ever, comprehensive health insurance can help protect your health and your financial well-being and make you feel safer.

According to Healthcare Bluebook, a cost transparency website, a fair price for a 30-minute doctor visit is over $200.1 A broken leg can cost $7,500, while a three-day hospital stay might run $30,000.2 Without adequate coverage, those costs come out of your pocket.

Whether youre a displaced employee or a business owner looking out for your furloughed employees, you have options for continuing health coverage. Keep reading to learn the best solution for your needs.

Recommended Reading: How Much Is The Er Without Insurance

How Do You Know If Your Insurance Is Still Active

In order to tell if your health insurance is still active, you should contact your health insurance provider. You can typically find the customer service phone number for your health insurance provider on the back of your insurance card, on your periodic billing statement or on your policy paperwork.

Laid Off You Have 62 Days To Get Health Coverage So Here’s What To Do

A layoff doesnt have to be the end of health-care coverage.

Nearly two million American jobs have been lost in the past year, and hundred of thousands of people will likely be laid off or have their hours scaled back in 2009. If you think you might be one of them, know this: You’re almost certain to lose your employer-sponsored benefits with your full-time job. That’s why you need an action plan, stat. Make sure you know your health-insurance rights and options, because once you get that pink slip you have no time to lose. Here’s what you need to do within…

One hourYoure stressed and scared, and not in any mental state to make decisions. Take a few minutes to collect yourself and relax as much as possible. Take slow, deep breaths. In the coming days and weeks youll have to make a slew of decisions regarding your health care and personal finances, and youll need to stay calm.

One dayWhether security is waiting to walk you out the door or you have time to clean out your desk, grab the paperwork related to your employer-issued benefits. Carefully read over the fine print on your contract and the terms of your health-insurance plan. Then ask someone from human resources:

- Am I entitled to a severance package?

- When exactly will my health benefits expire?

- Is there any room for negotiation?

- Do you have any advice for me?

Also Check: Starbucks Employee Insurance

Can I Sign Up For Cobra If My Employer Stops Offering Health Insurance

No. COBRA is a law that lets you keep your company’s health insurance if you lose your job. If your company stops offering health insurance, there is no company-sponsored health plan available for you to continue. In this case, COBRA does not apply. You would need to find a new policy, which you can do through the Marketplaces offered under the Affordable Care Act.

How To Keep Your Insurance Benefits When You Quit Or Get Fired From Your Job

Losing or leaving your job doesn’t mean you have to lose your insurance coverage right away.If you leave your employerwhether voluntarily or involuntarilyyoull need to take steps to stay covered by your insurer. When you have a chronic condition such as diabetes, heart disease, or cancer, it is crucial that you avoid any breaks in coverage that could trigger a preexisting-condition exclusion. This could make all the difference in your ability to continue using the same doctors, especially if you are in the middle of receiving important treatment. “In the flurry of excitement around changing jobsespecially if youre being laid offyour mind may be on other things besides health insurance,” says Helen Dumski, vice president and chief operating officer of the Diabetes Association of Greater Cleveland, who counsels patients on health insurance issues. “Many people dont pay enough attention to the preexisting-condition exclusions. Its very important to be on the lookout for that.”

Heres what to considerbefore you leave your jobto make the best choices for you and your family.

Get Your Insurance Company to Pay for a Denied Claim

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Do I Need Health Insurance Between Jobs

Having health coverage when youre in between jobs can help protect you should you need care. If you need medical care, a health insurance plan can provide coverage for eligible services. That means once you meet your deductible, you and your plan share the costs for your care. And under most plans your preventive care is covered at 100%. Without health insurance, you may have to pay out-of-pocket for any care you receive.

How Long Does Insurance Last After Turning 26

Thats not the case when you turn 26. Turning 26 triggers a special enrollment period that lasts for 120 days. Young adults who will age out of their parents healthcare plans can enroll in their own plans within the 60-day window before they turn 26 or the 60-day window after their birthday.18 2018 .

You May Like: Starbucks Health Insurance Cost

Confirm Your Current Doctor Takes Your New Insurance

You pay more or all the costs when you go to a doctor who doesnt take your insurance. If you want a new plan to help pay for visits to a doctor you like, ask the doctors office if they accept it. Be sure to give them the full name of the plan.

You can also look on our website to find doctors and see what plans they take.

When To Stop Contributing To Group Health Plan

If you are eligible for premium-free Part A, your coverage starts retroactively 6 months back, so its important to stop contributing to an HSA 6 months before applying for Medicare or Social Security benefits. Group Health Coverage Contact your employer and ask if you have group health plan coverage, then check which applies to you:

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

If I Lose My Job Or My Workplace Drops My Insurance Can I Get Health Coverage Through My State’s Marketplace

Most likely yes. You can shop for insurance online through the Marketplace. If you lost your job or your employer dropped your insurance, you will qualify for a special enrollment period. You may also qualify for a subsidy to help you purchase insurance, depending on your income.

You can shop and enroll online at healthcare.gov or if you need assistance, you can call a toll-free number to get your questions answered. You can also ask for face-to-face help in your area. To find a location near you, go to localhelp.healthcare.gov.

Pension And Retirement Plans

You may entitled to pension and retirement fund benefits after you terminate employment. If you are enrolled in a 401, profit sharing or another type of defined contribution plan, your plan may provide for a lump sum distribution of your retirement money when you leave the company. If you are a participant in a defined benefit plan, your benefits will begin at retirement age.

Recommended Reading: Starbucks Insurance Plan

Is There Lost Job Health Insurance

While theres no specific lost job health insurance, two main coverage options are available for you if youre unemployed:

- A COBRA plan allows you to extend the health care plan from your previous employer for up to 18 months after you leave a job. The disadvantage to this is COBRA is expensive and you have to pay for it yourself.

- You can buy a plan yourself through the Health Insurance Marketplace. For up to 60 days after you lose coverage through your job, you qualify for the Special Enrollment Period. During this time you can buy and enroll in a new plan. When applying, youll also find out if you qualify for federal financial assistance, such as tax premium credits or cost sharing reductions.

What Is The Law On Employers Providing Health Insurance

The Employer Mandate for Large Employers

Employers can require that employees contribute toward their insurance coverage, but they cant require them to pay more than 9.86% of their household income toward it. Large employers who fail to comply with the coverage mandate must pay a no-coverage penalty to the IRS.

Also Check: Starbucks Health Care Benefits

Can You Leave Health Insurance At Any Time

While you can cancel your private health insurance at any time, you wont be able to select a new health plan outside of the open enrollment period unless you meet certain qualifying reasons. If you miss this 30-day window youll have to wait until your companys open enrollment period comes around again.

What Happens To My Health Insurance When I Lose My Job

Who is this for?

Blue Cross Blue Shield of Michigan and Blue Care Network members under age 65.

When you get your Blue Cross plan through an employer, your payments are taken out of your paycheck so you can use your coverage when you need it.

But if you lose the insurance coverage you had from your job, or need to buy your own for other reasons, you might not know what to do.

Well help you understand what steps you can take, such as getting COBRA coverage, and address some common concerns.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Does Cobra Apply To Dental Coverage

You can usually hang on to your insurance for 18 months after losing your job, as long as you weren’t fired for serious misconduct. If you’re covered by the Consolidated Omnibus Budget Reconciliation Act — or COBRA — you stay insured by paying both the employee and employer share of the premiums. Your employer can offer you a longer coverage period in your severance package if he chooses.

How Long Do You Get Health Insurance After Getting Fired

If you have employer-sponsored healthinsurance, you can still maintain the coverage you have prior to getting fired.You can do this through COBRA.

The Consolidated Omnibus BudgetReconciliation Act allows health insurance coverage to continue even after youare involuntarily terminated or if your working hours are reduced. Mind you,this will not be applicable if you are fired due to gross misconduct. Also,COBRA is only applicable to employers who have at least 20 employees.

With COBRA, you get to keep the exactcoverage or group health plan that you had during your employment. In order foryou to continue your COBRA coverage, you should notify COBRA that you haveopted to continue the insurance not later than 60 days after your termination.

Make sure that your former employer send inthe election form. Also, you should continue to pay the premiums, including thepremiums that your employer used to pay, as well as the administration fee. The first premium payment should be maderetro-active to the last day you are employed and covered with youremployer-sponsored health insurance.

Now, if you opt to find other alternatives tohealth insurance instead of COBRA, you can consider buying health insurancefrom the individual market, or else look into the possibility of coverage givenby your employee union. You can also consider whether your state can provideyou with coverage. This depends on whether your state provides continuationcoverage.

| Not a bit |

Don’t Miss: Do Starbucks Employees Get Health Insurance

Terminating An Employee Cutting Off Insurance Benefits Can Come Back To Haunt You

This article was published more than 4 years ago. Some information may no longer be current.

Terminating an employee is always difficult, but when it comes to employee benefits, both employees and employers need to do their due diligence to avoid issues in the future.

Employers typically think about issues such as showing due cause or the length of severance packages, and employee benefits aren’t at the top of the list of considerations. But benefits can often come back to haunt you after employees leave, as they can sue their former employers for big bucks if the proper procedures weren’t followed. Here are a few tips on making sure you’ve covered your bases during the termination process.

Make sure you know how long an employee is covered after they leave

It’s important to factor benefits coverage into the severance package. This is where you outline the employee’s notice period the length of time after termination that the employee will remain eligible for benefits which is something many employees, and indeed employers, may not realize.

If your benefits package includes long-term disability coverage, your insurance provider likely won’t extend those benefits for a terminated employee, so you’ll need to set up separate LTD coverage.

Take common-law notice into account: it’s not always a simple calculation

Protect yourself by having employees sign a waiver

Make sure you accurately describe benefits packages to employees and their dependents

Are There Other Government Plans I May Qualify For

Yes. Government programs include:

Medicaid. You can get insurance through Medicaid if you have a low income, you’re pregnant or you’re disabled. The rules vary by state.

To find out if you qualify and how to apply for Medicaid in your state, visit the insurance and coverage finder on the federal government’s web site, HealthCare.gov. You can also visit the Medicaid web site at Medicaid.gov.

CHIP. CHIP stands for Children’s Health Insurance Program. Your kids can get insurance through CHIP if your income qualifies. It’s meant for families that can’t afford private health insurance but make too much money to get Medicaid. Whether you’re eligible and how much you pay depends on the state you live in.

To find out about children’s coverage programs in your state, visit the insurance and coverage finder on HealthCare.gov. You can also get more information on the federal government web site called InsureKidsNow.gov.

Medicare. If you’re age 65 or older or are disabled, you may be eligible for coverage from Medicare, the government health program for seniors and people with disabilities.

To find out if you qualify for Medicare, visit Medicare.gov. You can also use the government’s Medicare Plan Finder to get cost estimates and coverage information and get information on private Medicare plans, called Medicare Advantage plans.

Robert Wood Johnson Foundation: “State-Level Trends in Employer-Sponsored Health Insurance: A State-by-State Analysis.”

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees