Average Monthly Obamacare Premiums Per State

While $612 was the national average monthly premium for ACA plans, its important to understand that the majority of people enrolled get subsidies in the form of advance premium tax credits .

The table below shows the state-by-state average premium for Obamacare plans in 2019, the most recent year for which data is available. It also gives the average monthly premium after the average advance premium tax credit is applied, as well as the average monthly premium after APTC for consumers who received an APTC.

| Obamacare Average Premiums for 2019 |

|---|

| Location |

| $62 |

Finding Your Best Health Insurance Coverage In North Carolina

The best health insurance plan for you will depend on your income level, as well as your expected expenses.

North Carolina hasn’t expanded Medicaid under the Affordable Care Act. This means Medicaid eligibility is currently limited to those whose income falls below the federal poverty level.

If your income is greater than this limit, your best health insurance options will be on the North Carolina health insurance marketplace. The marketplace also offers reduced rates on health insurance for those with low or moderate incomes who qualify for tax subsidies.

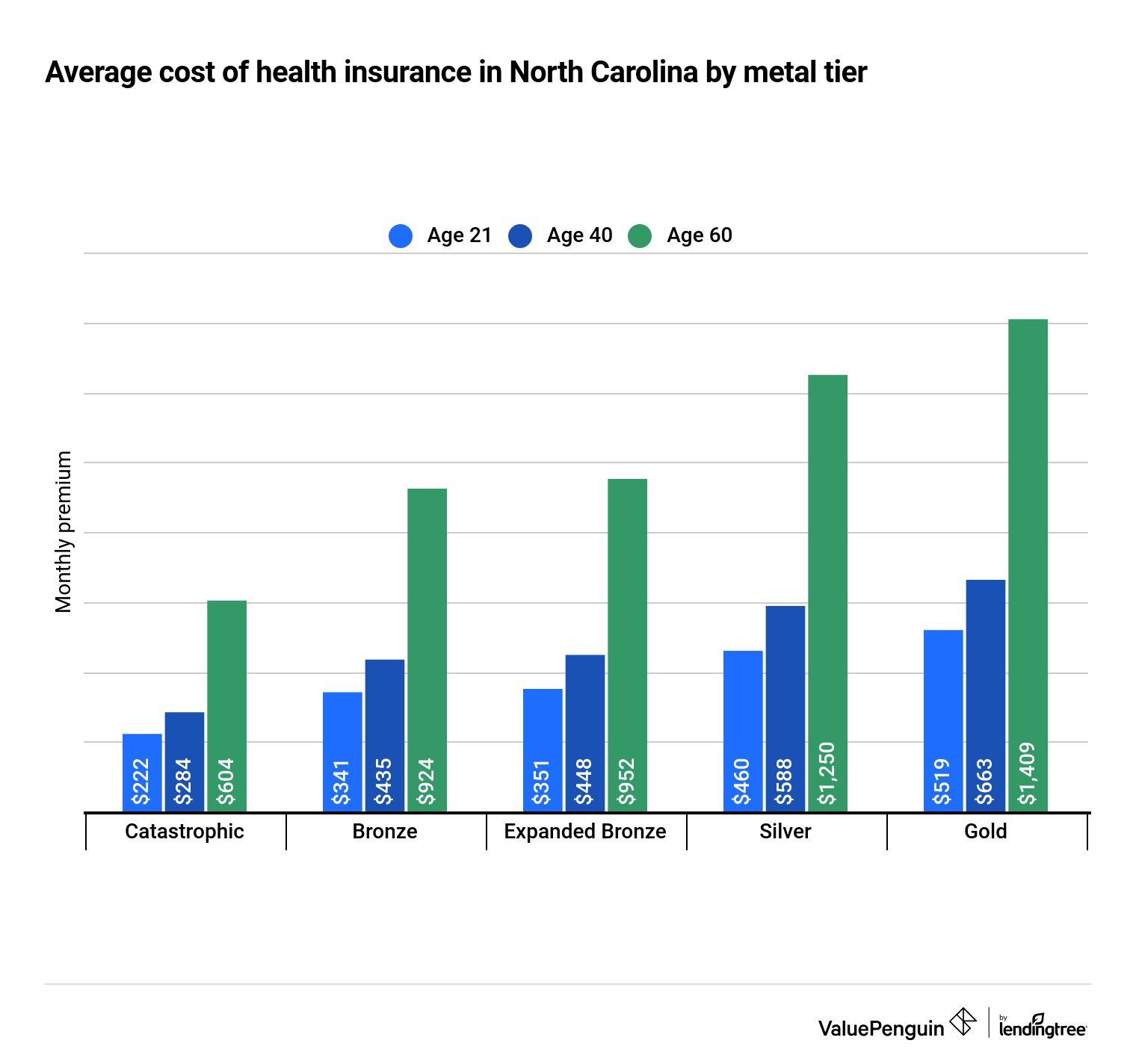

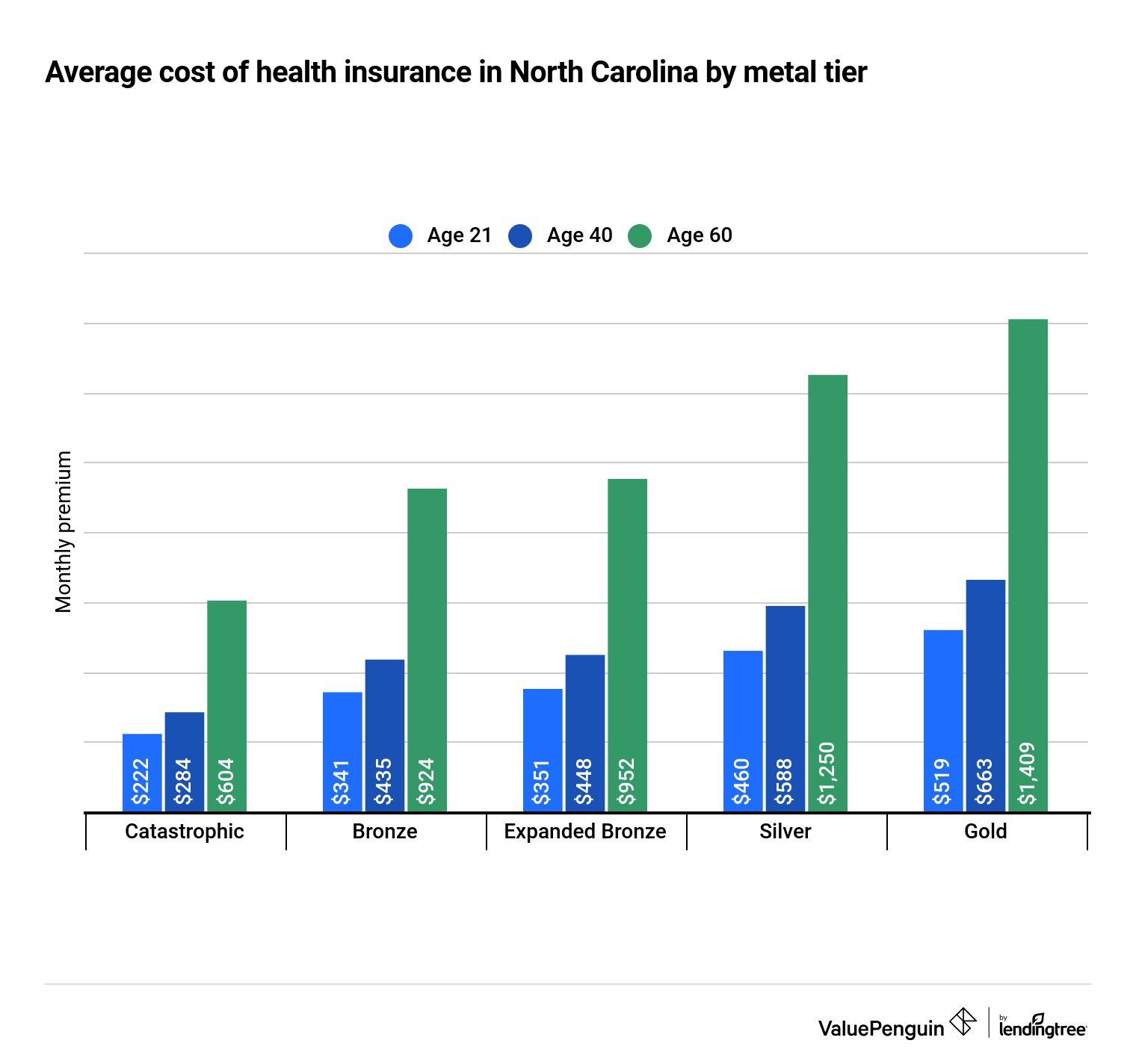

North Carolina health insurance plans are broken into tiers that represent different levels of premiums and out-of-pocket expenses.

The best health insurance plan for you will balance the monthly cost of the plan with the out-of-pocket costs you may need to pay for medical care. Higher-tier plans typically cost more, but have lower deductibles, copays and coinsurance. This means you’ll be responsible for a smaller proportion of medical costs. With a lower-tier plan, you’ll pay less each month, but you’ll pay more for your medical care.

Gold plans: best for people with high expected medical costs

Silver plans: best for people with average medical costs or low incomes

For low-income households, a Silver health insurance plan may be the cheapest option because these policies are eligible for additional cost-sharing reductions . These are extra savings that can further reduce what you pay for medical care.

Bluecross Blueshield Of North Carolina

BlueCross BlueShield of North Carolina offers individual and family plans for NC residents. Plans include benefits like health and wellness programs, fully covered preventive care, fitness discounts, a 24/7 nurse line, and more. Plans levels are organized into metal tiers. The metal tiers include bronze, silver, and gold. Bronze covers 60 percent of medical costs, silver covers 70 percent of costs, and gold covers 80 percent. You may also qualify for a catastrophic health plan If you are under 30 or qualify for a hardship.

Blue Cross NC was founded in 1933. The company has more than 4,700 employees and serves more than 3.89 million members.

Read Also: What Is The Best Health Insurance

What Are Average Health Insurance Costs

In the U.S., 55% of people receive health insurance through their employer, and 20% receive insurance coverage through government assistanceeither through Medicaid or Medicare according to the U.S. Census Bureau. Some peoplesuch as those who are self-employedchoose to purchase insurance privately, says Peter Kongstvedt, M.D., a health care expert and author based in Virginia. There are also 8% of people in the U.S. with no health insurance coverage at all.

The average health insurance cost for a single person who received health insurance through their employer in 2020 was $7,040 a year, according to data compiled by the Kaiser Family Foundation. The average cost of health insurance for a family in 2020 was $21,342 a year. These numbers represent what someone pays for a health care premium. A premium is the amount you pay each month to the health insurance provider, Dr. Kongstvedt says.

A premium is different from a deductible. A premium is what you pay up front , regardless of if you get health care or not. A deductible is something you pay in plans if you actually receive health care, Dr. Handel explains. For example, if the deductible for your health insurance plan is $1,000 a year, youll need to cover the other medical bills beyond that amount, he adds.

What To Know About Health Insurance In North Carolina

The rates used in MoneyGeekâs analysis are based on plan data from North Carolina marketplaces. When you apply for a plan, you may find that you can get even cheaper options. For older and limited-income North Carolina residents, state programs like Medicare and Medicaid are the most affordable options.

Also Check: Can I Join A Group Health Insurance Plan

The Cheapest Health Insurance In North Carolina With Low Out

For people with high medical expenses, a policy with high premiums and a low out-of-pocket max is often the best option. High-premium plans have low out-of-pocket costs, which is an important feature for people who incur medical costs frequently and need sufficient coverage for their expenses.

The cheapest health insurance in North Carolina with low out-of-pocket maximums is Ambetter Balanced Care 25 HSA, offered by Ambetter of North Carolina. This plan costs $562 monthly for the average 40-year-old.

The out-of-pocket maximum for this Ambetter of North Carolina Silver plan is $4,800. This out-of-pocket max is higher than the threshold of $4,250 that MoneyGeek uses to define a plan with a low out-of-pocket maximum. However, the Ambetter Balanced Care 25 HSA plan has the lowest out-of-pocket max in the state.

Ambetter of North Carolina

This plan is a Silver plan with a low out-of-pocket maximum but may have higher premiums than low-cost options in the state.

Can You Get Cheap Health Insurance In North Carolina

Medicaid and the North Carolina Health Choice Health Insurance Program for Children provide affordable health insurance coverage for low-income North Carolina residents. If youre 65 or older or younger and disabled and meet the income and asset requirements, you might qualify for Medicaid.

The North Carolina Health Choice Health Insurance Program for Children is a comprehensive health plan for low-income children. In many other states, the program is called Child Health Insurance Program .

Don’t Miss: Do I Get Fined For Not Having Health Insurance

What Types Of Alternative Health Insurance Plans Like Cost

Health care sharing and faith-based health plans are usually based on religious beliefs, but you dont need to be associated with any religious group to purchase a plan. Since theyre not considered insurance, the North Carolina Department of Insurance doesnt regulate them. You should carefully check the plan before you purchase one. Under the Affordable Care Ac, some benefits are mandated, and faith-based plans may not offer the critical coverage you need.

Looking For Plans Through Your Employer

This page features plans you can buy for yourself and your family. If you are looking for plans you might get through your employer, we can help get you there.

Find plans through your employer

Plans are insured by Cigna Health and Life Insurance Company or its affiliates: For Arizona residents, health plans are offered by Cigna HealthCare of Arizona, Inc. For Georgia residents, health plans are offered by Cigna HealthCare of Georgia, Inc. For Illinois residents, health plans are offered by Cigna HealthCare of Illinois, Inc. For North Carolina residents, health plans are offered by Cigna HealthCare of North Carolina, Inc.

1 Includes eligible in-network preventive care services. Some preventive care services may not be covered, including most immunizations for travel. Reference plan documents for a list of covered and non-covered preventive care service.

3 Refer to plan documents for a complete description and list of equipment, supplies, and tests that are covered at $0 through the condition specific plans.

4 2021 Special Enrollment Period for Marketplace Coverage Starts on HealthCare.gov Monday, February 15, Centers for Medicare & Medicaid Services, March 12, 2021, https://www.cms.gov/newsroom/press-releases/2021-special-enrollment-period-marketplace-coverage-starts-healthcaregov-monday-february-15

We were unable to load the ifp footnotes app, please try again later.

Recommended Reading: How Do I Know Which Health Insurance I Have

Frequently Asked Questions About North Carolina’s Aca Marketplace

North Carolina uses the federally run exchange , and has not yet expanded Medicaid under the ACA.

North Carolinas path towards ACA implementation was a complicated one that covered all bases. The state took official actions toward each one of the options for a health insurance marketplace: state-run, partnership, and federally operated. In June 2011, North Carolina passed a law stating an intention to develop a state-run health insurance exchange.

The House at one point authorized a state-run exchange, but the Senate did not. Outgoing Gov. Bev Perdue announced in November 2012 that the state would partner with the federal government to run the marketplace. Finally, new Gov. Pat McCrory announced in February 2013 that North Carolina would default to the federal marketplace.

For 2022, the following insurers offer plans in the marketplace in North Carolina, with localized coverage areas:

- Blue Cross Blue Shield of North Carolina

- Cigna

- Celtic/WellCare

- AmeriHealth Caritas

Four of those insurers are new for 2022, continuing a trend of growing insurer participation in the marketplace over the last few years:

- Aetna CVS Health .

- Friday Health Plans

- AmeriHealth Caritas

- Celtic/WellCare

For 2021, UnitedHealthcare rejoined North Carolinas exchange, and Oscar also joined the exchange, offering plans in the Asheville area.

Why Is Health Insurance So Expensive

The price of medical care is the single biggest factor behind U.S. healthcare costs, accounting for 90% of spending. These expenditures reflect the cost of caring for those with chronic or long-term medical conditions, an aging population and the increased cost of new medicines, procedures and technologies.

Don’t Miss: Can You Have Two Types Of Health Insurance

North Carolina Dental And Vision Plans

Dental and vision insurance plans, underwritten by Golden Rule Insurance Company, have no age limit restrictions.6 They offer coverage for the dental and vision services many medical insurance plans dont include.

From Charlotte to Raleigh, Asheville to Wilmington, explore these North Carolina health insurance options and more that may be available now.

North Carolina Health Insurance Overview

North Carolina has one of the highest enrollments for private health insurance under the Affordable Care Act , also called Obamacare. Most of the states ACA enrollees qualify for financial assistance. Many uninsured, childless adults choose Obamacare because North Carolina has not expanded Medicaid to this demographic.

The Obamacare open enrollment for North Carolina health insurance is open from November 1, 2021, to January 15, 2022. But if you experience a qualifying life event, such as getting married or having a child, you could still get coverage. If you qualify for Medicaid based on income, you can enroll at any time.

Don’t Miss: When Is The Health Insurance Enrollment Period

Do I Need Health Insurance If I Have An Fsa/hsa

Flexible spending accounts and health savings accounts are good ideas, but they dont replace health insurance coverage. While these accounts allow you to save money on your health care costs or put money aside to deal with medical expenses, its unlikely an FSA or HSA will provide enough money to cover all your out-of-pocket expenses.

The Effect Of Insurance Deductibles On The Cost Of Health Care

NC residents insured through group, individual and medicare health plans generally have a deductible. Deductibles define the amount of the medical expenses the insured person must pay before the insurers coverage begins to pay the medical bills. The deductible amount depends on the insurance plan. Generally speaking, individual insurance has larger deductibles than other plans. Deductibles have the effect of increasing the cost of the insurance for people that file insurance claims. For example, a person on an individual plan paying the average price of $5,318 with a relatively common $6,000 deductible has an effective price of nearly $11,000, if they use their insurance.

You May Like: How Much For Health Insurance For One Person

Enrollment Is Now Open Through August 15 2021

Starting , consumers enrolling in Marketplace coverage will be able to take advantage of lower premiums and access to financial assistance during the American Rescue Plan Act of 2021 announced by the Biden administration. If youre looking for health insurance marketplace plans, UnitedHealthcare Exchange plans offer affordable, reliable coverage options from UnitedHealthcare of Wisconsin, Inc, in North Carolina.

Call / TTY 711 to talk to a representative.

When Can I Purchase Cheap Health Coverage

Health insurance coverage can be purchased by anyone during the annual open enrollment period . During this period, you can access your state or federal health insurance marketplace and shop around for coverage from a variety of providers. If you need coverage outside of this time, then you may qualify for a special enrollment period , which allows you to still buy coverage. However, qualification usually only occurs if you have lost a job, had a child or recently gotten married.

Read Also: How To Find Personal Health Insurance

Free And Discounted Services

Do you lack health insurance? There are several free and discounted services that you may qualify for. These include free urgent care clinics and help with paying for your medications or health insurance. To find resources in North Carolina that offer free services or financial assistance for medical cost, see below.

To learn about health insurance in general, check out our Health Insurance page. To find a free and low-cost clinic nearby, check out the free Clinic Locator app.

Group Coverage Also Known As Employer

Companies that provide health insurance to employees as a benefit provide an insurance type known as group insurance. The cost of this type of health plan is based on total premiums paid to the insurance company. Premiums include payments from both employers and employees. Premiums do not include payments for services such as deductibles, co-pays or other out-of-pocket costs. Group coverage includes: Health Maintenance Organizations , Preferred Provider Organizations , Point-of-Service Plans and High-Deductible Health Plans.

Recommended Reading: How To Get Mental Health Care Without Insurance

How Do I Buy Health Insurance

For some, buying health insurance can be a confusing and overwhelming process. First, you have to find a health insurance plan within your budget. Then you have to contact the company or an insurance agent in order to get a quote. Once you have all of that information, you can evaluate your options. It is a very personal and complicated process, but there are ways to simplify it.

Now that the Affordable Care Act is in place, it is much easier to find a health insurance plan based on your income and personal health needs. In most states, you may even qualify for financial subsidies. You can quickly and easily apply for coverage through the new Healthcare Marketplace.

Before you settle on a plan, you should first get a quote, find a price, and discover any out-of-pocket expenses your plan will expect you to pay . Once you have all of this information together, it will be easier to find coverage which fits your needs.

Health Care Market Competitive Dynamics

Most states have laws requiring new health care facilities to be approved by special boards. These boards are known as certificate of need boards. The purpose of these boards is to certify there is need for new facilities. CON boards have the effect of reducing the level of competition, which results in higher prices for the services provided.

To quantify the effect of legislation that minimizes competition, ValChoice has calculated the difference in health care cost between states with and without CON boards. Using a simple average calculation, states with CON requirements have an average cost for health care that is $664 more per person insured than states without CON requirements.

States included in the calculations as having CON requirements include the following: Alabama, Alaska, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Illinois, Iowa, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire*, New Jersey, New York, North Carolina, Oklahoma, Ohio, Oregon, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, Washington, West Virginia and Wisconsin*. Other states do not have CON board certification requirements.

*New Hampshire and Wisconsin are included as having CON requirements for the reason the recent modifications in CON laws have not yet had a material impact on the cost of health care in the state.

Also Check: Do We Need Health Insurance

Health Insurance Coverage For Multiple Years

TriTerm Medical Insurance,4 underwritten by Golden Rule Insurance Company, is short term health insurance that offers coverage for preventive care, doctor office visits, and prescriptions.

- Apply once for insurance coverage terms that equal one day less than 3 years.

- $2 million lifetime maximum benefit per covered person on most plans.

- Eligible expenses for preexisting conditions are covered after 12 months on the plan.

Questions about Short Term or TriTerm Medical insurance? Call / TTY 711 to talk to a representative.

High Deductible Health Plan

Description

Both UNC and the enrolled employee share the monthly cost of coverage. The enrolled employee will receive a monthly bill for his/her portion of the monthly cost.

Please contact to see if you are eligible for this plan.

How Much Does it Cost?

When does Coverage Begin/End?

How to Enroll or Make Changes

Health Plan enrollment and changes are made through ConnectCarolina Self Service or call the Benefits and Eligibility Hotline at: 855-859-0966.

Also Check: How To Get Health Insurance For My Small Business

What Is A Medicare Supplement Plan

Medicare supplement plans are one health insurance option for people with Original Medicare. There are standardized Medicare supplement insurance plans available that are designed to fill the gaps left by Original Medicare . These are sold by private insurance companies as individual insurance policies and are regulated by the Department of Insurance. After age 65 and for the first six months of eligibility for Medicare Part B, beneficiaries have an Open Enrollment Period and are guaranteed the ability to buy any of these plans from any company that sells them. Companies cannot deny coverage or charge more for current or past health problems. If you fail to apply for a Medicare supplement within your Open Enrollment Period, you may lose the right to purchase a Medicare supplement policy without regard to your health.