Is It True That Plan B Is Only Effective For Women Under A Certain Weight

Theres some conflicting information out there about whether Plan B is effective as an emergency contraceptive for heavier women. In 2013, the European manufacturer of emergency contraceptive Norlevo issued a warning that the drug is completely ineffective for women who weigh more than 176 pounds, and that it loses effectiveness when taken by women who weigh more than 165 pounds. The manufacturer based its warning on a 2011 study however, in 2014, the European Medicines Association found that these emergency contraceptives can continue to be used in women of all weights, noting that the benefits are considered to outweigh the risks.

What we know is that the heavier you are, the more likely it is that the pill will be metabolized and absorbed into your bloodstream, and it might not be as effective, Shirazian told the Cut. So, if your BMI is 30 or higher which doctors classify as obese Shirazian says that rather than taking Plan B,she recommends that women who need an emergency contraceptive get a non-hormonal ParaGard IUD. I know a lot of people dont use IUDs in that context, but it can bea form of emergency contraception, Shirazian says. According to Planned Parenthoods website, for a copper IUD to be an effective emergency contraceptive, you must have it inserted within five days of having unprotected sex. So, if you decide to take this route, call your doctor or local family-planning clinic soon as possible.

What Should I Do If I Am Moving To Another Province Or Territory

Residents moving from one province/territory to another continue to be covered by their “home” province/territory during any minimum waiting period, not to exceed three months, imposed by the new province/territory of residence. After the waiting period, the new province/territory of residence assumes your health care coverage.

It is your responsibility to inform your provincial/territorial plan that you are leaving and where you are moving, and to register with the health insurance plan of your new province or territory.

If You Work For A Non

Some non-profit religious organizations like non-profit religious hospitals and institutions of higher education that certify they have religious objections to contraceptive coverage dont have to contract, arrange, pay, or refer for contraceptive coverage.

- If your health plan is sponsored or arranged by this type of organization, an insurer or third party administrator will make separate payments for contraceptive services that you use.

- Youll have access to contraceptive services without a copayment, coinsurance, or deductible when they are provided by an in-network provider.

Contact your employer or health plan to learn more.

Recommended Reading: Can I Cancel My Health Insurance

Side Effects Of Emergency Contraception Pills

The most common side effect is nausea, with or without vomiting. There are ways to decrease this if you become nauseous easily. Take the pill with food. You may elect to take prescription or over-the-counter anti-nausea medications about 30 minutes prior to the first dose of an emergency contraception pill.

Insurance And Cpap Accessories

As you adjust to CPAP treatment, you may desire additional accessories for more comfortable sleep and easier travel. There are a number of optional accessories you can purchase for your CPAP machine. These include:

- CPAP pillows, which are cut to accommodate the machine and tubing and allow you to move during the night.

- CPAP cleaners, which may help disinfect your machine and extend its longevity.

- Mask liners that can wick away moisture and ensure a tighter seal to keep the mask in place.

- Hose holders to help the CPAP machine feel softer against the body and look less medical in appearance.

- CPAP batteries, which are convenient for travel when you dont have access to a power outlet.

- Travel bags, so you can pack your CPAP equipment when youre on the go.

Insurance does not typically cover any products that are considered optional. Costs for these products can vary depending on the quality. More expensive accessories often come with warranties of 1 to 3 years.

Read Also: How To Put Someone On Your Health Insurance

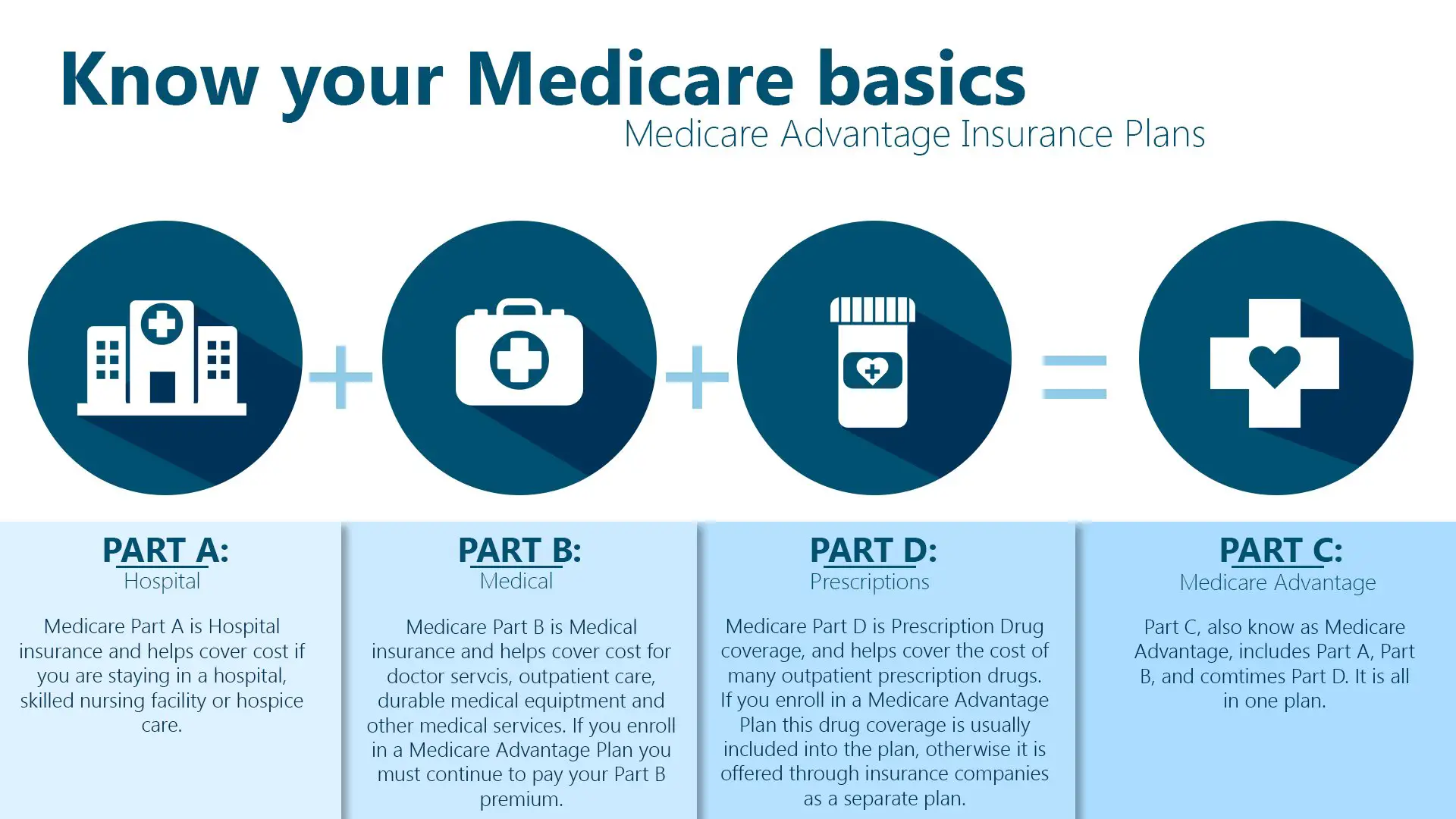

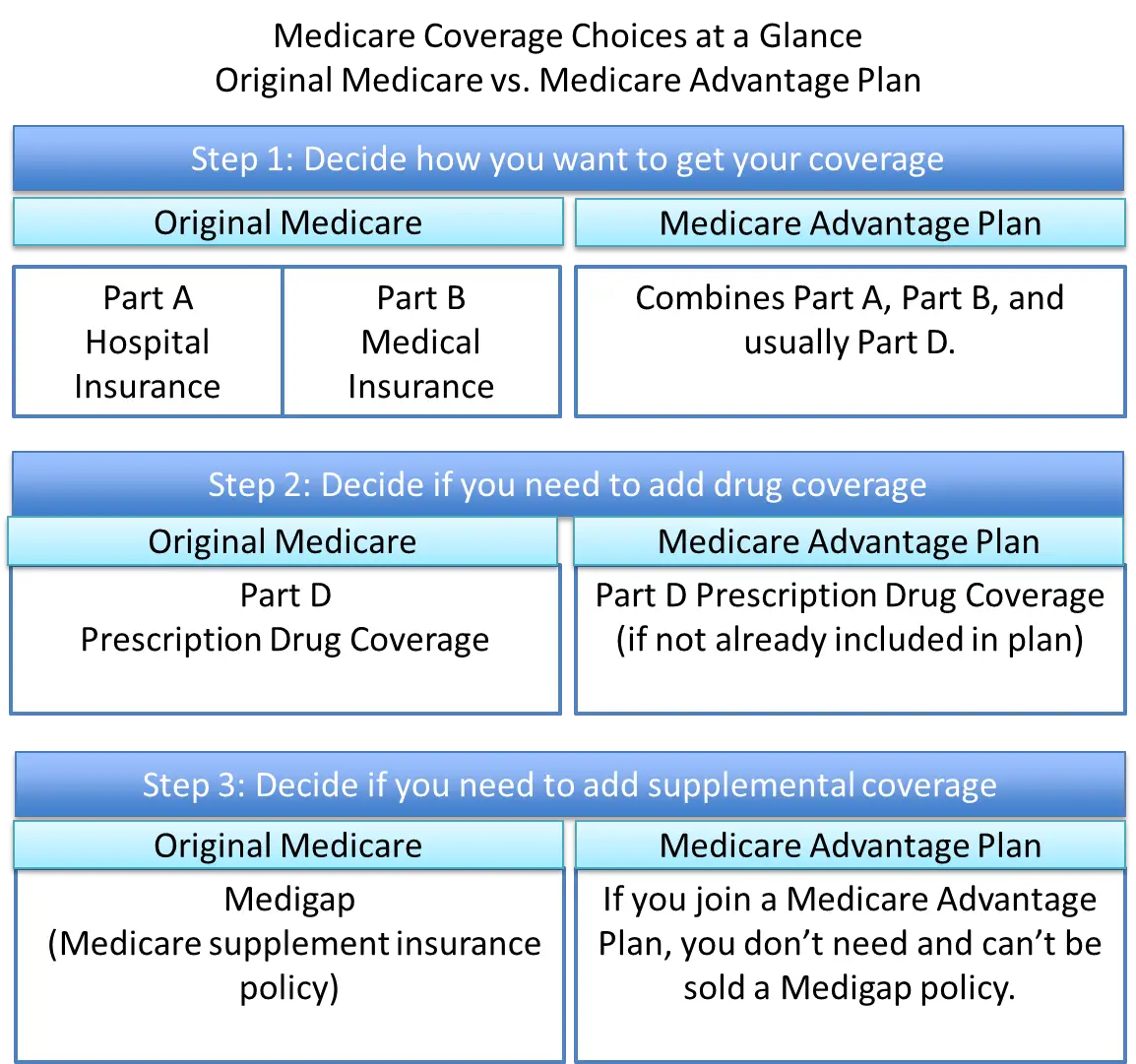

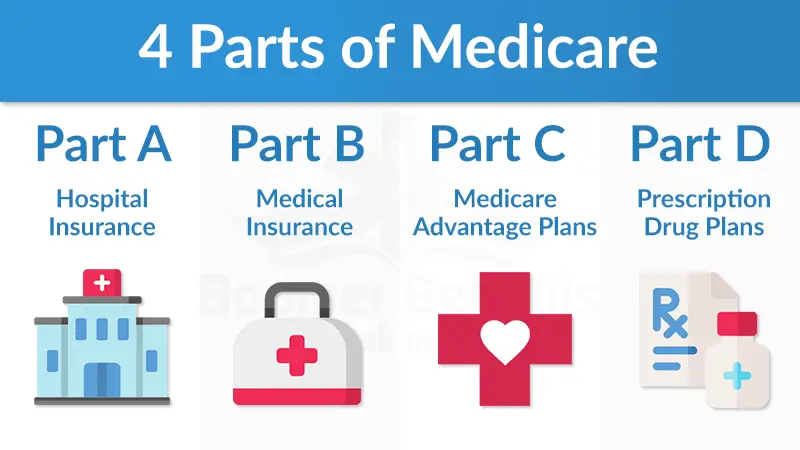

Enrollment Period For Medicare Part B

Youre eligible to enroll in Medicare Part B during the seven-month period around your 65th birthdaybeginning three months before the month of your 65th birthday, including your birthday month, and lasting up to three months after. This is called your Initial Enrollment Period . Enrollment in Part B is automatic if you are receiving Social Security or Railroad Retirement Board benefits.

Evaluate Your Needs And Requirements

Once you have chosen your ideal company, evaluate your family’s health needs thoroughly, and decide the type of plan you want to buy. For example, if you have a nuclear family , a family floater plan with Rs.5-10 Lakhs coverage will be enough . However, if you want to cover your parents under health insurance, senior citizen plans will be a good option.

Step 3

Don’t Miss: How To Get Gap Health Insurance

Does Medicare Part B Cover Any Dental Expenses

Yes, but Medicare Part B only covers dental expenses that are a medically necessary part of another covered service. It does not cover routine dental services, such as cleanings, or other standard procedures like dentures, crowns, or fillings.

In fact, approximately 37 million Americans on Medicare do not have dental insurance that covers these services. These services would need to be covered through independent senior dental plans or through a Medicare Advantage plan that includes dental coverage.

Insurance And Cpap Machines

The terms of your CPAP machine, insurance coverage depends on your provider. Some providers reimburse you for the cost of purchasing the machine outright, while others require a rent-to-own plan under which you must use the machine for a set amount of time before it becomes your property.

Costs for purchasing a machine outright can range anywhere from $250 to $1,000 or more, depending on where you live and the type of machine you need. Most CPAP machines cost between $500 and $800. BiPAP machines, which provide a different level of air pressure for exhalation and inhalation, frequently run in the thousands of dollars.

If you are on a rent-to-own structure, your monthly fee typically equals the cost of the CPAP machine divided by the number of rental months. Your insurance provider usually splits this cost with you, and the exact amount you pay depends on your policy. Bear in mind that if you are required to rent for longer than a year, you may need to pay a second deductible.

If your insurance company determines you are not using the machine frequently enough as per your policy, they may stop covering their portion of the machine rental. You must decide if you prefer to pay the full cost of the monthly rental, purchase the machine outright, or stop CPAP treatment altogether.

Recommended Reading: Can Grandparents Add Grandchildren To Health Insurance

Q What If My Baby Wasn’t Born In Hospital Or Attended At Home By A Registered Midwife

You will need to visit a ServiceOntario centre to register your child for Ontario health coverage.

If you visit a ServiceOntario centre within 90 days of the birth of your child you need to bring :

- confirmation of the baby’s birth, through either a letter from the hospital or attending physician, or a Certified Statement of Live Birth from a provincial office of the Registrar-General

- your residency document

- your identity document

If you visit a ServiceOntario centre more than 90 days after the birth of your child you need to bring :

- your child’s citizenship document

Refer to the question “What documents should I bring when I register?” or to the Ontario Health Coverage Document List for a complete listing of approved documents.

Q My Baby Was Born In An Ontario Hospital But We Are Only Visiting Ontario For A Short Period Can We Use The Ontario Health Coverage Infant Registration Form To Register Our Baby For Ontario Health Coverage While We Are Here

No. Tourists, transients or visitors are not eligible for OHIP coverage. For a child born in Ontario to be eligible for Ontario health insurance coverage they must make their primary place of residence in Ontario, and be physically present in Ontario for at least 153 days in any 12-month period to retain OHIP coverage.

If you are visiting Ontario from another province or territory in Canada, contact your home province/territory regarding health insurance coverage for your baby and any insured services received while visiting Ontario.

Also Check: What Does Health Insurance Cost In Retirement

Manulife Health Insurance Plans

SBIS works with Manulife Financial to offer flexible coverage under the Flexcare®, FollowMe and Association programs. Some Manulife plans offer the ability to add specific coverages, providing you with a customizable solution to meet your unique requirements for a New Brunswick Health Insurance policy.

All of our New Brunswick Health Insurance plans cover services over and above those covered by your provincial plan . Some plans offer guaranteed acceptance regardless of your medical history if you are coming off a company group plan.

What Does Part B Of Medicare Cover

Medicare Part B helps cover medically-necessary services like doctors services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.

The basic medically-necessary services covered include:

- Abdominal Aortic Aneurysm Screening

- Bone Mass Measurement

- Cardiac Rehabilitation

- Durable Medical Equipment

- EKG Screening

- Foot Exams and Treatment

- Glaucoma Tests

- Kidney Dialysis Services and Supplies

- Kidney Disease Education Services

- Outpatient Medical and Surgical Services and Supplies

- Pap Tests and Pelvic Exams

- Physical Exams

- Smoking Cessation

- Speech-Language Pathology Services

- Tests

- Transplants and Immunosuppressive Drugs

To find out if Medicare covers a service not on this list, visit www.medicare.gov/coverage, or call 1-800-MEDICARE . TTY users should call 1-877-486-2048.

Also Check: What Jobs Give Health Insurance

Where Can I Get The Plan B Morning

You can buy levonorgestrel morning-after pills over the counter without a prescription at drugstores and pharmacies. It doesnt matter how old you are and it doesnt matter what your gender is. Sometimes the morning-after pill is locked up or kept behind the counter, so you may have to ask the pharmacist or store clerk for help getting it but you dont have to have a prescription or show your ID.

You can also get the morning-after pill at many family planning or health department clinics, and Planned Parenthood health centers.

Q Am I Eligible For Ontario Health Insurance

You may be eligible for the Ontario Health Insurance Plan if you are included under one of the following categories:

AND, generally speaking

- you make your primary place of residence in Ontario

- you are in Ontario for at least 153 days of the first 183 days immediately following the date you establish residence in Ontario

- you are in Ontario for at least 153 days in any 12-month period.

Tourists, transients or visitors are not eligible for OHIP coverage.

Your ongoing eligibility for Ontario health insurance coverage is based solely on you having an OHIP-eligible citizenship or immigration statuses, and on you:

- making your primary place of residence in Ontario, and

- meeting the requirement of being physically present in Ontario for at least 153 days in any 12-month period.

The above is only a summary of the OHIP eligibility provisions of Regulation 552 for your reference. You should consult the actual regulation for the specific requirements applicable to you. The provisions in Regulation 552 prevail over this summary.

Everyone, including babies and children, must have their own health cards. Always carry your health card with you. You should be ready to show it every time you need medical services.

If you have questions about when your OHIP coverage will begin, please contact ServiceOntario INFOline at 1-866-532-3161 or visit your local ServiceOntario Centre.

Don’t Miss: Can You Terminate Health Insurance At Any Time

Q Am I Still Eligible For Ohip If I Temporarily Leave Ontario

You may be out of the province for up to 212 days in any 12-month period and still maintain your Ontario health insurance coverage provided that you continue to make Ontario your primary place of residence.

To maintain eligibility for OHIP coverage you must be an eligible resident of Ontario. This means that you must :

- have an OHIP-eligible citizenship/immigration status and

- be physically present in Ontario for 153 days in any 12-month period and

- be physically present in Ontario for at least 153 days of the first 183 days immediately after establishing residency in the province and

- make your primary place of residence in Ontario.

If you will be out of the province for more than 212 days in any 12-month period, please refer to the Longer Absences from Ontario fact sheet.

Top Health Insurance Plans In India

On the basis of lowest premiums for a coverage of Rs. 5 Lakhs, we have mentioned a few of the top plans available in India. You can check the complete list of best health insurance plans, and then choose accordingly.

| Plan Name |

|

Read Also: Do Employers Pay For Health Insurance

What Health Care Services Are Insured By The Provinces And Territories

Provincial and territorial health insurance plans are required to provide insured persons with coverage of insured health services, which are: hospital services provided to in-patients or out-patients, if the services are medically necessary for the purpose of maintaining health, preventing disease or diagnosing or treating an injury, illness, or disability and medically required physician services rendered by medical practitioners.

What Are The Types Of Emergency Contraception

There are two main types of emergency contraception: pills and the copper intrauterine device . Most women choose pills because they work well, don’t cost a lot, and are usually easy to get. The IUD works very well, but it has to be inserted by a doctor.

- Emergency contraception pills: Pills used for emergency contraception are sometimes called “morning-after pills.” They can be used up to 5 days after unprotected sex.

- The most common option contains a progestin hormone called levonorgestrel. Progestin is a synthetic version of the hormone progesterone.

- Another option is a medicine called ulipristal acetate that affects the progesterone in your body.

- Some birth control pills are also used. These often contain a combination of the hormones estrogen and progestin. If you already take birth control pills, you may be able to use the pills you have as emergency contraception. Talk to your doctor or check the websites listed below for the correct doses.

You May Like: Does Insurance Pay For Home Health Aides

How Do I Know Which Services Are Covered

If you already have an insurance plan and want to keep it, review your benefits to see which services are covered. Your plan may not cover the same services that another plan covers. You should also compare your plan with those offered through the Health Insurance Marketplace. The Health Insurance Marketplace is a service that helps you shop for and compare health insurance plans. It is operated by the federal government.

Why Choose Policyxcom

PolicyX.com is a one-stop-shop for all your insurance-related needs. It is the Insurance Regulatory and Development Authority of India certified web insurance aggregator company .

You can compare health insurance plans from top insurance companies with us, and buy the best plan as per your needs. Our systems and teams are well-equipped to help you with the buying procedure . Let us look at the following key highlights about PolicyX.com:

- PolicyX.com offers a free comparison service with unbiased quotes.

- Allows a person to compare health insurance plans from over 15 companies within 30 seconds. You can buy the best medical insurance policy according to your needs in 5 minutes.

- Most health plans are available online and you can get your policy instantly by making an online payment.

- We help you with your documentation, medical tests if required, policy issuance and claim assistance. Our customer service executives are available 24×7 to help clarify your doubts and most importantly help you at the time of claim.

- You pay the same premium as if you were to directly buy from insurance company. In other words, we don’t charge from our customers for our services.

Also Check: Can I Use My Health Insurance In A Different State

What Is Plan B

Plan B is emergency contraception that can help keep you from getting pregnant after unprotected sex or if your birth control method failed. This form of contraception does not require a prescription and can be found at your local pharmacy. Plan B One-Step has many other generic versions you may find over-the-counter such as AfterPill, My Way, Next Choice One Dose, and Take Action.

Q My Photo Health Card Has Expired How Do I Renew My Health Card

Your photo health card has an expiry date that is linked to your date of birth. The first time you apply for a photo health card, the expiry date can be anywhere from two to seven years in the future. When your photo health card is renewed, the renewal date will always be five years in the future and linked to your date of birth.

Renewal notices for photo health cards are mailed approximately two months prior to the expiry date shown on the front of the photo health card however, if it is more convenient, you can renew up to six months prior to the date of expiry.

To learn more about renewing your Ontario photo health card, refer to the fact sheet Renewing Your Photo Health Card.

Recommended Reading: How To Apply For Kaiser Health Insurance