Health Insurance Marketplace And Tax Credit Status

The health care law has been the target of ongoing challenges in Washington, D.C., in various states, and in courts across the country, which could affect the tax credit and other aspects of the marketplaces.17 However, news reports suggest that there wont be major changes in 2021.18 Meanwhile, in one poll from 2019, only one in five people were even aware of the tax credit.19

Health Insurance Marketplace Subsidies

There are two types of subsidies available to marketplace enrollees. The first type, called the premium tax credit, works to reduce enrollees monthly payments for insurance coverage. The second type of financial assistance, the cost sharing subsidy, is designed to minimize enrollees out-of-pocket costs when they go to the doctor or have a hospital stay. In order to receive either type of financial assistance, qualifying individuals and families must enroll in a plan offered through a health insurance .

Premium tax credit

The premium tax credit reduces enrollees monthly payments for insurance plans purchased through the Marketplace. Marketplace plans are offered in four metal levels of coverage: bronze, silver, gold, and platinum. Bronze plans tend to have the lowest premiums but have the highest deductibles and other cost sharing, leaving the enrollee to pay more out-of-pocket when they receive covered health care services, while platinum plans have the highest premiums but very low out-of-pocket costs. The premium tax credit can be applied to plans in any of these metal levels. Also offered on the Marketplace are Catastrophic health plans with even lower premiums and higher cost sharing compared to bronze plans. Catastrophic plans are generally only available to individuals younger than 30, and premium tax credits cannot be applied to these plans.

Who is eligible for the premium tax credit?

What amount of premium tax credit is available to people?

How Does The Health Care Tax Credit Work

When you apply for health insurance, the marketplace will estimate the tax credit using information you provide about your family, projected household income, and other factors such as whether anyone you are enrolling is eligible for other types of coverage. For example, you will need to provide your modified adjusted gross income plus that of every other member of your family.

Most people use all or some of their tax credits in advance to lower their monthly premium. In other words, the marketplace factors the tax credit into their monthly insurance bill when they apply for a policy.

Even though the credit is not usually a lump sum that you apply for at tax time every year, you still have to file a tax return that includes Form 8962: Premium Tax Credit. If not, you may not qualify for a tax credit in future years. By mid-February, you should receive an annual form 1095-A in the mail, with the necessary information about your insurance policy, premiums, and advanced payment of tax credits.

The health care tax credit is refundable, meaning if the amount of the credit is more than the amount of taxes you owe, you can receive the difference as a refund.

Also Check: Can You Put Boyfriend On Health Insurance

Example For A Single Adult In Arkansas Earning $52000/year

Lets take a look at an example so you can see how it all works.

Here we have a health insurance premium and tax credit estimate for a single adult living in Arkansas, earning $52,000/year.

This example shows what a difference the American Rescue Plan made in lowering health insurance premiums for Americans who were on the edge of the subsidy cliff.

Before, a single adult in Arkansas making $52,000 would have just barely missed the cutoff for receiving a premium tax credit by less than $1,000, forcing them to pay the full premium of $836/month .

Now, a single adult making $52,000 would qualify to receive a premium tax credit of $468/month and pay only $368/month for a silver plan.

How Do You Qualify For A Premium Tax Credit

Up until the American Rescue Plan was put into place, you were considered eligible for a premium tax credit if your household income fell between 100% and 400% of the federal poverty line and if you didnt have affordable coverage through an employer or government programthat includes Medicare and Medicaid.

Your tax credit would cap the cost of health insurance between 2% and 9.5% of your annual household income, depending on how much money you made relative to the FPL.

Fast forward to today, and now all Americans who purchase health insurance under the federal exchanges or state-run markets will pay no more than 8.5% of their household income through the end of 2022.

Heres how the old rules compare to whats been put in place by the American Rescue Plan:

Also Check: How To Become A Health Insurance Broker In California

If My Income Qualifies Me For Medicaid But My State’s Not Expanding It Can I Get A Tax Credit Or Cost

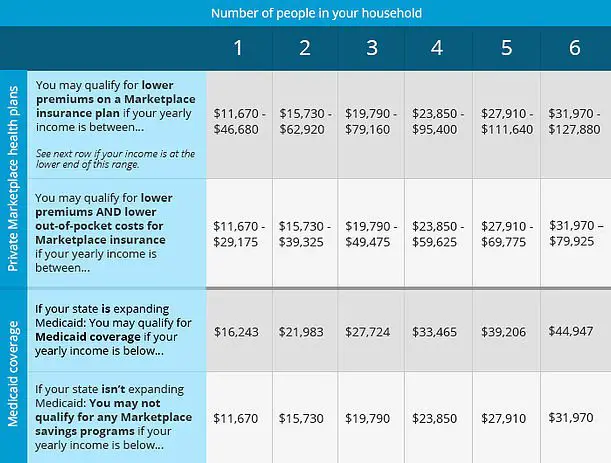

Some states have expanded Medicaid to include people with higher incomes . If you have a low income, but your state did not expand Medicaid, you will be eligible for a tax credit to buy a health plan through your stateââ¬â¢s Marketplace, but only if your income meets the minimum threshold . It seems counterintuitive, but if your income is too low, you do not qualify for a tax credit to buy insurance. This is because the law assumed all states would expand Medicaid and the tax credits to help pay premiums would pick up where Medicaid left off. But the Supreme Court made the Medicaid expansion optional. As of 2020, 12à states have not expanded it, so in those statesà you do not qualify for assistance if your income is too low. To find out whether your state has expanded Medicaid, go to the Healthcare.govââ¬â¢s Medicaid expansion page. Ã

The amounts for people who live in Alaska and Hawaii will vary.

How To Maximize Your Health Insurance Tax Benefits

If your employer offers a health insurance plan, youll likely get the most savings there between taxes and monthly premiums. Additionally, check to see if your employer plan comes with a Health Savings Account or Flexible Spending Account to further maximize your tax benefits.

Health Savings Account

An HSA account allows you to set aside pre-tax money to use for qualified healthcare expenses, but you can only contribute to an HSA if you have a high-deductible health plan .

As of 2017, your health insurance plan qualifies as a high-deductible health plan if your deductible is at least $1,300 for an individual and $2,600 for a family. Additionally, the plans total out-of-pocket expenses cant be more than $6,500 for an individual and $13,100 for a family for in-network services.

Note that you can also qualify for an HSA if you get your health insurance through the Health Insurance Marketplace .

The interest that you earn in an HSA is tax free, and so are the disbursements. Additionally, funds roll over from year to year, so you dont have to worry about them expiring.

Flexible Spending Account

Similar to an HSA, an FSA allows you to set aside money from your paycheck pre-tax to pay qualified medical expenses. There are, however, a few differences:

Read Also: How To Be A Health Insurance Agent

What Is The Health Coverage Tax Credit

The Health Coverage Tax Credit is a refundable tax credit that pays 72.5% of qualified health insurance premiums for eligible individuals and their families. If you qualify for HCTC, its claimed on Form 8885.

To qualify for this credit, you must have received one of the following types of assistance:

- Eligible for the Trade Adjustment Assistance program and received a Trade Readjustment Allowance or was entitled to receive TRA except you hadnt exhausted your unemployment insurance

- Benefits under the Alternative Trade Adjustment Assistance program

- Benefits from the Reemployment Trade Adjustment Assistance program

- Pension benefit payments from the Pension Benefit Guarantee Corporation and be between 55 and 64 years old

You are not eligible for the HCTC if you:

- Can be claimed as a dependent on another persons federal income tax return

- Are enrolled in Medicare, Medicaid, the Childrens Health Insurance Program, or the Federal Employees Health Benefits Program or are eligible to receive benefits under the U.S. military health system

Related Information:

$150 Billion To Expand Affordable Home Care

The plan provides funding for a Medicaid program that supports in-home health care, helping to reduce a backlog of people waiting to receive subsidized home care and improve wages for providers. Thousands of seniors and disabled Americans have been unable to receive care they need, including more than 800,000 on state Medicaid waiting lists, the White House says. Many home care issues have been exacerbated by the COVID-19 pandemic.

Don’t Miss: Does Health Insurance Cover Tooth Extraction

What Forms Should You Use On Your 2021 Taxes

There are different forms that you will use to report your health insurance on your 2021 taxes. It is important to note that these forms will vary, based on:

Form 1095-A, Health Insurance Marketplace Statement. This form is used if you have purchased health insurance from a government-sponsored or private marketplace. The form will include the information that you need to complete Form 8962, which is used to receive a premium tax credit. Additionally, you will need to complete Form 1095-A for each insurance policy that you had for 2021. Our staff can help you with questions you may have about the Form 1095-A when you work with eHealth to purchase your health insurance.

Form 1095-B, Health Coverage. Your health insurer will typically send you this form to show that you and your family had health coverage throughout all or part of 2021.The form is not typically included in your tax return however, it does contain vital information that will help you to fill out your taxes properly.

Form 8941, Credit for Small Employer Health Insurance Premiums To calculate the credit. For detailed information on filling out this form, see the Instructions PDF for Form 8941.

Can I Get A Tax Credit If I Get Insurance From An Employer

In general, people who get insurance through an employer probably won’t use a state Marketplace. And the Marketplace is the only place where this kind of financial aid is available.

Some people, though, may want to buy a health plan through a Marketplace even though an employer offers affordable insurance. In that case, the employee will not be eligible for tax credits or subsidies, even if the family’s income falls within the ranges listed above.

In some cases, an employer’s plan may not be affordable enough. If either of the statements below is true for you, you may enroll in a health plan in a state Marketplace:

- None of the health plans available from your employer covers at least 60% of your average health care costs.

- The cost of enrolling in a plan from your employer would cost more than 9.6% of your annual income.

If one of these statements is true and you do enroll, you may be eligible for a tax credit if your household income falls within the eligibility ranges listed above.

Read Also: Where To Get Health Insurance When Unemployed

Review: Your Deductible Vs Out

To understand how a catastrophic plan works, itâs important to review a couple of key health insurance concepts: your deductible vs your out-of-pocket maximum.

Just about every health insurance plan has a deductible. Thatâs the amount of money you need to spend on your health expenses before your insurance starts paying for anything. A higher deductible means you will have more out-of-pocket expenses before insurance starts sharing costs with you.

Recession-proof your money. Get the free ebook.

Get the all-new ebook from Easy Money by Policygenius: 50 money moves to make in a recession.

Get your copy

The out-of-pocket maximum, also called the out-of-pocket limit, is the most you will ever have to pay, in a given year, on health services that your insurance covers. Once you spend enough to hit that limit, your insurance will cover 100% of the rest of your health expenses for the year. The highest possible out-of-pocket limit for 2020 is $8,150.

Catastrophic health insurance plans have a deductible that is the same as your out-of-pocket limit. The tradeoff is catastrophic plans have lower monthly premiums â the amount you pay each month in order to keep your insurance policy active â compared to most health insurance plans since you could be on the hook to pay some health costs yourself.

How Does The Health Insurance Tax Credit Work

You can get the health care tax credits in two ways:

- Advance premium tax credit uses estimates to reduce how much you spend on health insurance each month.

- Federal tax refund allows you to receive your health insurance subsidy all at once at the end of the year or to reconcile any differences with your monthly tax credits.

The two methods would qualify you for the same number of credits, but they differ in when you would receive the subsidy and eligibility requirements. Here’s how advance premium tax credits can reduce your monthly bills.

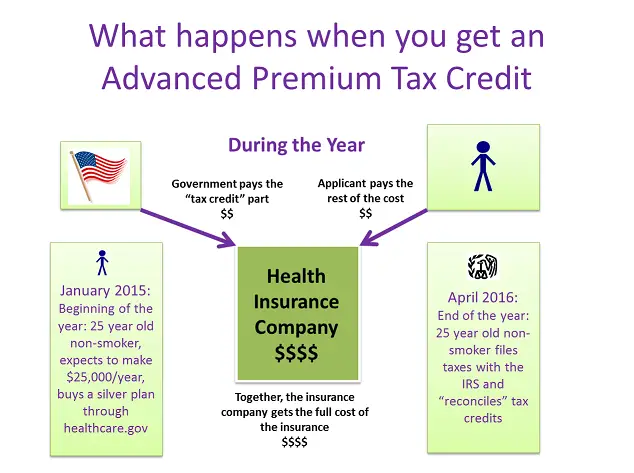

You can apply for advance premium tax credits when you apply for health insurance through the marketplace. With this program, the government sends advance payments directly to the health insurance company every month. The insurer would then credit that money toward the cost of your health insurance premiums, decreasing your out-of-pocket costs each month.

Therefore, if you expect to have low disposable income, taking the advance premium tax credit could be more beneficial if you qualify.

Don’t Miss: How Do I Pay My Health Insurance Deductible

What Does Tax Credit Mean On Covered California

Tax CreditTaxCovered California

How does covered california tax credit work?

The IRS pays your premium tax credit directly to your health insurance plan. Your monthly premium costs are lower as a result. The only way to get premium tax credits is to buy from Covered California. If you bought from Covered California, it will send you a tax form, called the Form 1095A, by January 31, 2016.

What does a tax credit mean?tax credittaxtax

Contents

$400 Billion For Universal Pre

The bill directs money to providing free universal preschool for all three and four year olds, which the White House has dubbed the largest expansion in education programs since the creation of public high school.

Under the universal preschool plan, parents will be able to send their children to a public school or childcare program of their choice. The effort is part of Bidens larger plan to ease the financial burdens facing millions of American families, particularly low-income parents with children. Families that earn less than $300,000 annually, for instance, will pay no more than 7% of their income on child care for kids under age six, according to the bill.

Also Check: Can I Add A Friend To My Health Insurance

Eligibility Requirements For The Premium Tax Credit

You must meet all of the following criteria to qualify for the premium tax credit:

- You must get your health care coverage through the Marketplace

- You can’t be eligible for health care coverage through alternative options such as your employer or the government

- Your income needs to fall within a certain range

- Another person can’t claim you as a dependent on their return

- You must file a joint return if you’re married

Changes in income and family size may affect your eligibility, so report these to the Marketplace to ensure you receive the appropriate tax credit. The premium tax credit program uses the federal poverty line to determine the income ranges that qualify you for the credit.

The U.S. Department of Health and Human Services reports the annual federal poverty levels, which vary depending on whether you live in the contiguous 48 states and the District of Columbia, Hawaii, or Alaska.

The range is 100% to 400% of the federal poverty line amount for the size of your family for the current tax year.

For example, an individual earning between $12,880 and $51,520 in 2021 meets the income criteria to qualify, while a family of four qualifies with household earnings between $26,500 and $106,000.

Even if your income makes you eligible, you must meet the other qualification criteria as well. You’ll use Form 8962 to determine your full eligibility to claim the premium tax credit.

How Do I Know If I Qualify For A Tax Credit

Your eligibility for tax credits is calculated based on your income and household size during your health insurance application on either the federal exchange or your state marketplace.

Health care tax credits are available if your household family income falls between 100% and 400% of the federal poverty level .

If your income is less than this, then you would be eligible to enroll in Medicaid. Most states have now expanded Medicaid eligibility to 138% of the FPL, providing more health insurance choices for those with low incomes.

If you earn more than 400% of the FPL, then you may still qualify for health insurance discounts. The so-called “subsidy clif” of 400% FPL was eliminated for 2021 and 2022 as part of the American Rescue Plan Act of 2021. For those who qualify, health insurance rates are capped at 8.5% of income, with applicable tax credits offsetting the cost.

You can preview your tax credit eligibility by using our Affordable Care Act Subsidy calculator. If you qualify, the monthly premium cap shows how much you would spend for the second-cheapest Silver plan on the marketplace.

You May Like: How Much Subsidy For Health Insurance