Where Can I Buy Private Health Insurance

A good place to start looking for coverage is the Health Insurance Marketplace created in 2014 by the Affordable Care Act . On the marketplace for your state, you can look through the details of private health insurance plans, and compare the cost and benefits of each. If your state does not have its own marketplace, use Healthcare.gov.

What Do I Do If My Address Changes Or If I Lose My Health Card

The provinces and territories, rather than the federal government, are responsible for the administration of their health insurance plans, which includes issuing, cancelling or renewing health cards. You should call or email your provincial/territorial Ministry of Health- the phone numbers and websites are located inside the back cover of the current Canada Health Act Annual Report.

How Do I Find Out If I Have A Health Care Card

Carefully review these, and look through your plans provider directory to see where you can get care. Youll use the card when you get health care services, so keep it in a safe place. If you didnt receive a card, call your insurer to see if you should have received one already and to make sure your coverage is effective.

Don’t Miss: Starbucks Open Enrollment 2018

Tip #: Learn What A Few Of Those Wonky Health Insurance Terms Mean

How much can you afford to pay for health insurance every month? In order to compare the true overall cost of health plans and figure out which one might work best within your budget, you need to get familiar with several important insurance terms words like premium, cost-sharing, deductible and copay.

Luckily, we made a handy health insurance glossary just for you.

Insurance companies use these different types of charges the premium vs. the deductible, for example sort of like dials to keep their own costs manageable. A basic plan they sell might dial down the monthly premium on a particular plan, so it looks inexpensive. But that same plan might have a high, “dialed up” deductible of, say, $6,000 meaning you’ll have to spend $6,000 out of your own pocket on health services each year before your insurance begins to pay its portion of the cost. If you picked that plan, you’d be betting you won’t have to use a lot of health services, and so would only have to worry about your hopefully affordable premiums, and the costs of a few appointments.

Q Are Open Work Permit Holders And/or Participants In Citizenship And Immigration Canada’s Post

Open work permit holders may be eligible for Ontario health insurance coverage provided they are employed full-time for an employer in Ontario for a minimum of six months, have a valid work permit during this time, and they:

- maintain their primary place of residence in Ontario and are

- physically present in Ontario for at least 153 days in any 12-month period and are

- physically present in Ontario for 153 of the first 183 days immediately after establishing residency in the province.

Further information on the changes concerning Temporary Foreign Workers can be found on a fact sheet entitled .

You May Like: Part Time Starbucks Benefits

Q Am I Eligible For Ontario Health Insurance

You may be eligible for the Ontario Health Insurance Plan if you are included under one of the following categories:

AND, generally speaking

- you make your primary place of residence in Ontario

- you are in Ontario for at least 153 days of the first 183 days immediately following the date you establish residence in Ontario

- you are in Ontario for at least 153 days in any 12-month period.

Tourists, transients or visitors are not eligible for OHIP coverage.

Your ongoing eligibility for Ontario health insurance coverage is based solely on you having an OHIP-eligible citizenship or immigration statuses, and on you:

- making your primary place of residence in Ontario, and

- meeting the requirement of being physically present in Ontario for at least 153 days in any 12-month period.

The above is only a summary of the OHIP eligibility provisions of Regulation 552 for your reference. You should consult the actual regulation for the specific requirements applicable to you. The provisions in Regulation 552 prevail over this summary.

Everyone, including babies and children, must have their own health cards. Always carry your health card with you. You should be ready to show it every time you need medical services.

If you have questions about when your OHIP coverage will begin, please contact ServiceOntario INFOline at 1-866-532-3161 or visit your local ServiceOntario Centre.

Meet The Terms Of Your Policy

It is your responsibility to know and understand the terms of your insurance policy. Read the fine print carefully and ask for help, if you need it.

The information you provide must be accurate and complete. If you have any questions, contact the insurance company. Ask them to clarify the issue in writing.

Get approval from your insurer before you undergo medical treatment. Travel health insurance rarely covers routine health checkups, non-emergency care and cosmetic surgery. It may not cover mental health disorders, drug- or alcohol-related incidents, or extreme sports such as bungee jumping and rock climbing.

Get a detailed report and invoice from your doctor or hospital before leaving the country where you received medical treatment. Trying to get the proper paperwork from thousands of kilometres away can be frustrating. Always submit the original receipts for medical services or prescriptions you received abroad. Keep a copy of the documents for your files.

Carry your insurance information with you while you are travelling. Leave a copy of the information with a friend or relative at home.

You May Like: Starbucks Employee Insurance

Tip #: Know Your Deadlines

Usually you only get a few weeks in the fall to sign up. This year, the sign up period for the HealthCare.gov marketplace plans that go into effect in January 2022 starts Nov. 1, 2021 and runs until Jan.15, 2022. If you’re signing up for an employer-sponsored plan or Medicare, the deadlines will be different, but probably also in the fall. For Medicaid, you can enroll at any time of the year.

DeLaO, the health navigator, says even if you’re already enrolled in a plan that seems fine and it’s tempting to just let it automatically renew, it’s always a good idea to annually check what else is available.

“Are you eligible for additional subsidies to lower the cost of your monthly premium?” he says. “Is there a plan that with those increased subsidies you can now get a silver plan as opposed to a bronze plan, which lowers your deductible your copayments?”

Figuring out the right plan for you doesn’t have to require a huge time commitment, he says. His team aims to get people in and out enrolled in a plan in an hour and a half. And those appointments don’t have to be in person customers can get help by phone and can often do everything they need to do to get signed up virtually.

Though signing up for health insurance can be confusing at first, it’s also very important for your wallet and your health. Hang in there and know there are people out there eager to help you make sure you get covered.

What Is A Medicaid Divorce

When planning for retirement, many couples realize they may make too much each month to qualify for nursing home assistance.

To get around this, some couples resort to what is known as a Medicaid divorce. This is a planning tool that helps reduce the overall amount of assets a couple has in their name. It helps each spouse qualify for Medicaid without losing a substantial amount of their assets.

Currently, Medicare does not cover the costs of long-term care. Medicaid assistance is necessary for many families who cannot afford the staggering costs of a nursing home.

Medicaid eligibility requires that a family spend down their assets to the point of poverty before Medicaid assistance may become available.

To get around this, in a Medicaid divorce, one spouse will offer nearly all of the couples assets to the other in a divorce settlement. A spouse can then apply for Medicaid benefits without having to report assets on a Medicaid application.

There are several possible implications in doing this that can have impacts on other benefits.

It is best to consult an elder law attorney before considering a possible Medicaid divorce.

Read Also: What Health Insurance Does Starbucks Offer

The Benefits Of Short Term Health Insurance

Short term health insurance offers you just the kind of flexible, fast coverage you need for those dynamic times of change in your life. With short term medical plans1 you can:

- Get covered fast, as soon as the day after application

- Pick your deductible amount from several options

- Pick your length of coverage, 1 to nearly 12 months in some states2

- Drop coverage with no penalty if a more permanent health insurance option comes along

- You may be able to apply for another short term health insurance plan when the first one finishes, if needed3

- Access an extensive network of health care professionals, with 1.4 million physicians and other health care professionals and approximately 6,500 hospitals and other facilities4

- Get generally lower premiums than with ACA health insurance plans

Are There Different Types Of Health Plans

Most health insurance plans fall into one of three categories. In order to choose the best plan for you and your family, you should understand the difference between these major types.

Traditional Health Benefit Plans

Traditional health plans pay some of the cost of medical treatment. They may differ in the services covered and the providers offered in the network.

Medical/Indemnity Plans

These plans cover services with any licensed health provider. This may be a good plan if you have family members outside the HMO’s or PPP’s service area, or if your providers are not in the network. These plans usually cover hospital and medical expenses for an accident or illness. They may also cover preventive care. These plans may only cover a fixed percentage of any covered cost. For example, the policy may say that the plan pays 80% of a service and you must pay the other 20%. With these plans, you are covered for any licensed health providers.

Health Maintenance Organizations-HMO

Preferred Provider Plans-PPP

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

How To Check If My Medicaid Was Approved

Medicaid provides medical care to over 73 million citizens of the United States. It is considered the program with the most coverage in the country. The US government launched Medicaid in 1965 along with two other programs CHIP and BHP . The aim of the programs was to provide quality healthcare to disabled people, parents, seniors, pregnant women, and low-income families.

People who apply for Medicaid are always anxious to know their status. If you are wondering how to check if my Medicaid was approved then continue reading this article.

You apply for Medicaid assistance once you know that you are eligible for it. Your coverage begins either from the first day of the month you applied or from the exact date you applied. Either date can be your first day of coverage. The office of the Center of Medicaid makes the decision which is based on your economic record and medical record. The office also informs you of the assigned date.

If you fulfill certain requirements, your Medicaid coverage can work retroactively for a period of three months before you apply at a particular month.

There are two ways to find the status of your Medicaid application:

What Is The Individual Mandate

The health insurance marketplacesestablished by the AffordableCare Act provide coverage to 11.41 million consumers, according to anApril 2020 report from the Centers for Medicare & Medicaid Services .

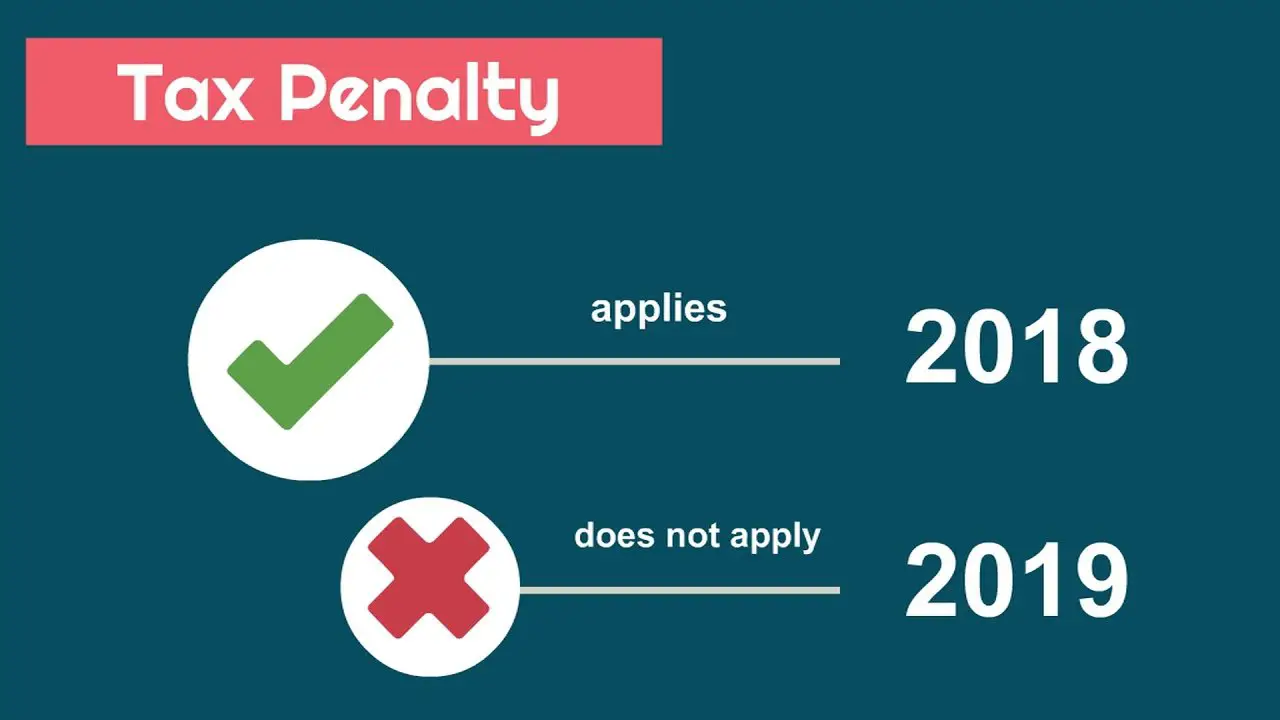

Prior to 2020, if you went without Affordable Care Act compliant health insurance for more than two consecutive months, you would pay a penalty. This requirement was commonly known as the Obamacare individual mandate. The purpose of the penalty was to encourage everyone to purchase health insurance if they werent covered through their employment or a government-sponsored program. According to Kaiser Health News, the federal ACA penalty for going without health insurance in 2018 was $695 per uninsured adult or 2.5% of your income, whichever amount was higher.

In response to concerns about the affordability of marketplace ACA plans, congress passed the Tax Cuts and Jobs Act at the end of 2017. The law reduced the individual penalty of the Obamacare individual mandate to zero dollars, starting in 2019. Now that the individual mandate tax penalty has been removed, there is not a tax penalty at the federal level.

Also Check: Starbucks Health Care Benefits

What Does Uninsured Motorist Insurance Cover

Uninsured motorist coverage is often conflated with underinsured motorist coverage. They are two separate coverages, and you may need to choose between them in some states.

Uninsured motorist bodily injury offers the following collision coverage in an accident with an uninsured or hit-and-run driver:

- Damage to passengers present in the car at the time of the accident

- Injuries sustained to a permissive driver in an accident caused by an at-fault driver

- Medical expenses

- Expenses for pain and suffering from an accident caused by an at-fault driver

- Lost wages

As well as car accidents, UMBI also covers damages to victims of accidents caused by at-fault drivers, as well as hit-and-run cases. An uninsured driver could be held legally responsible, subject to lawsuits and prosecution. If you’re facing injuries now, you may not want to wait. In this type of instance, you can pass the right to sue onto your insurance company.

Uninsured motorist property damage covers:

- Car damage in an accident caused by an at-fault driver

- Damage to property in an accident caused by an at-fault driver

In the event of an accident, you would have more protection with uninsured motorist coverage than you would have with your health insurance plan.

When Can I Buy Private Health Insurance

Most types of health insurance have an open enrollment period during which you can sign up for private health insurance. This is true whether you are buying insurance via the Affordable Care Act health insurance exchange in your state, sign up directly through the insurer, enroll in the plan your employer offers, or sign up for Medicare.

Certain life events can trigger a special enrollment period, which will allow you to change your health insurance coverage outside of the normal enrollment period. These events include getting married or divorced, having a baby, losing your job-based health insurance, or moving out of your health plans service area.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Find Cheap Health Insurance Quotes In Your Area

At the end of a plan year, you should receive documents or a letter regarding your health insurance coverage. This is known as a 1095 form which provides details about the amount along with the period of time you received coverage. A 1095 form acts as proof of your health insurance and is useful to keep for your own personal records. Although they are not necessary to file your tax return, 1095 forms can be used as documentation for any extra deductions you want to claim on your taxes. Depending on where you receive your health insurance coverage from you would be provided with one of three forms that outline your policy.

New Jersey Individual Mandate

- Effective date: January 1, 2019

- Requires individuals and their dependents have ACA-compliant health insurance

- Imposes a penalty on New Jersey residents who go without health insurance but can afford it

- Provides state subsidies to help lower income residents afford health insurance

The New Jersey penalty, otherwise known as the Shared Responsibility Payment, is based on household income as well as family size. However, the penalty is capped at the cost of the average statewide premium for bronze health insurance plans.

According to NJ.gov, the minimum tax penalty for individuals is $695 and the maximum is $3,012 for the 2020 tax year. For a family of five with a household income of $200,000 or below, the minimum tax penalty in 2020 is $2,351 and the maximum is $5,074. If you are not required to file a tax return for 2020 in New Jersey, then you are exempt from paying this fine.

New Jersey law has exemptions in certain situations. For example, if you cant afford the health plans available to you through the Marketplace or your employer, you may be eligible for an exemption. Plan premiums must be more than 8.05% of your household income for that year. There may also be exemptions for religious belief or hardship.

Read Also: Starbucks Dental Coverage

Q What Immigration Documents Must I Present To Confirm My Immigration Status As An Applicant For Permanent Residence When Applying For Ontario Health Insurance Coverage

If you are applying for Ontario health insurance coverage as an Applicant for Permanent Residence, you are required to present written confirmation from Citizenship and Immigration Canada that you are eligible to apply for permanent residence in Canada, which may be one of the following :

- CIC Confirmation Letter letter on CIC letterhead addressed to the Applicant for Permanent Residence that confirms that the applicant is eligible to apply for permanent residency in Canada

- CIC Immigration document such as a Work Permit, Visitor Record, Temporary Resident Permit or Study Permit with note in the “Remarks Section” that indicates that you have applied for permanent residence and the CIC has confirmed that you meet the eligibility requirements to apply for permanent residence in Canada.