Use A Professional Employer Organization

Professional employer organizations are similar to purchasing alliances in that they also group multiple businesses together to bring down the cost of each businesss health insurance offerings. The difference is that PEOs often assist with more than health insurance. They often handle other administrative tasks as well, such as managing payroll, recruiting, and filing taxes.

As with health alliances, PEOs pool together the purchasing power of multiple small businesses, so youre likely to get a better rate compared to going directly to a broker or health insurance company.

You May Like: Do Part Time Starbucks Employees Get Benefits

Choosing The Right Health Plan

Getting small business health insurance as an LLC owner can be a bit confusing, but it’s worth taking the time to research your options and find the plan that’s right for you.

If you filed as a non-member employee, you might have to consider getting individual health insurance.

If you filed as self-employed, you might have to consider getting group health insurance plans directly from an insurance company or brokers.

If you filed as a partnership and you and the other partners wish to get group health insurance , I would suggest talking with an accountant or tax advisor to see if that’s possible for your company.

If you filed as a corporation, your options would be generally limited, and coverage costs will generally be substantially higher than LLCs and other unincorporated entities.

Most small business owners are now opting for an alternative option, which is a health reimbursement arrangement. An HRA is an agreement between you and your insurance company to be reimbursed tax-free for medical expenses.

You set money aside each month to cover anticipated healthcare costs.

The nice thing about an HRA is that you can use it with individual or group health plans. You can also use it to cover expenses that your regular health plan doesn’t cover, such as dental or vision care.

How Does Health Insurance For Small Business Owners Work

A different set of tax incentives apply to certain small businesses. Small business owners must have at least one full-time employee who is not a spouse or family member to purchase group health insurance.

Additionally, employers who offer health insurance must offer it to all full-time employees . Health insurance cannot be limited to certain individuals, such as managers or highly skilled workers.

In order to offer employer-provided health insurance, 70% of your uninsured, full-time employees must opt-in to the plan youre offering. However, this 70% rule does not apply between November 15th and December 15th of any given year.

Small business owners can easily compare health insurance plans through the Small Business Health Options Program , a government-run marketplace created as part of the Affordable Care Act. They can also research costs and coverage by contacting individual companies or health insurance brokerages.

Also Check: How Long Can My Child Be On My Health Insurance

Review Tax Credits For Your Business

If you qualify for the Small Business Health Care Tax Credit, you may get a break on the costs you pay for group health insurance. You may be eligible for a tax credit if:

As A Small Business Owner Are You In Need Of Health Insurance

As a small business, its important to assess your needs for health insurance plans for employees. Many times, providing access to coverage is a big benefit to employees and one they appreciate. If your company has 50 or more employees, finding affordable health insurance options is essential, especially if you plan to cover some or all of the costs for employees. Even companies with fewer than 50 employees benefit from health insurance coverage, especially if employees want it.

Don’t Miss: How Many Employees Before Health Insurance Is Required

Why Offer Health Insurance To Employees

Before enrolling in small group health insurance, employers want to know: Will the benefits outweigh the costs? Here are four reasons to offer coverage through beWellnm for Small Business:

Here’s Everything You Need To Know About Offering Small Business Health Insurance To Your Employees

- Small business owners should focus on coverage, the number of employees, employee premiums and shopping when looking for an insurance provider.

- Offering health insurance to employees can help to attract and retain top talent and provide tax benefits for your business.

- There are several ways to find insurance, including contacting providers directly and using a broker.

- This article is for small business owners who want to learn more about small business health insurance and how to get it for their own business.

Navigating small business health insurance can be one of the hardest parts of running your small business, as there are many options and rules to figure out, and if your small business doesnt have a full human resources department, youre left to work it out on your own. Use this guide to help you learn about how small business health insurance works, why you should offer it and what types of health insurance are available for small businesses.

You May Like: Does Health Insurance Cover Everything

Average Cost Of Health Insurance For Small Businesses

Because the costs of health insurance vary widely depending on your specific business, it can be difficult to estimate how much health insurance will cost. According to 2018 research from the Kaiser Family Foundation, the average employer premium for small business health insurance was $6,896 per full-time employee. Employers covered roughly 80% of the premium, with employees covering the remaining 20%.

Key takeaway: Costs vary widely the average employer premium for health insurance in 2018 was $6,896 per full-time employee.

How Many Employees Do You Need To Qualify For Group Health Insurance

Group health insurance is a cost-effective way for small businesses to offer health insurance, as its cheaper than buying individual plans.

A company has to have fewer than 50 employees to qualify for group health insurance. You also have to have an office of some sort in the state where youre applying for coverage, and you need to enroll at least 70% of your uninsured employees.

If youre a family-run business, you need to check your eligibility for group health insurance, as you need to have workers who are not related to or the spouse of the owner of the company. If you only employ family members, youll need to apply for a family health insurance plan instead. Sole proprietors also cannot apply for group health insurance.

Part-time employees and seasonal workers do not count as part of the group, but you can still choose to offer them group health insurance. You can also provide individual health insurance to specific workers alongside your group plan.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Don’t Miss: How Long Can A Dependent Stay On Health Insurance

How Much Does Health Insurance For Small Business Cost

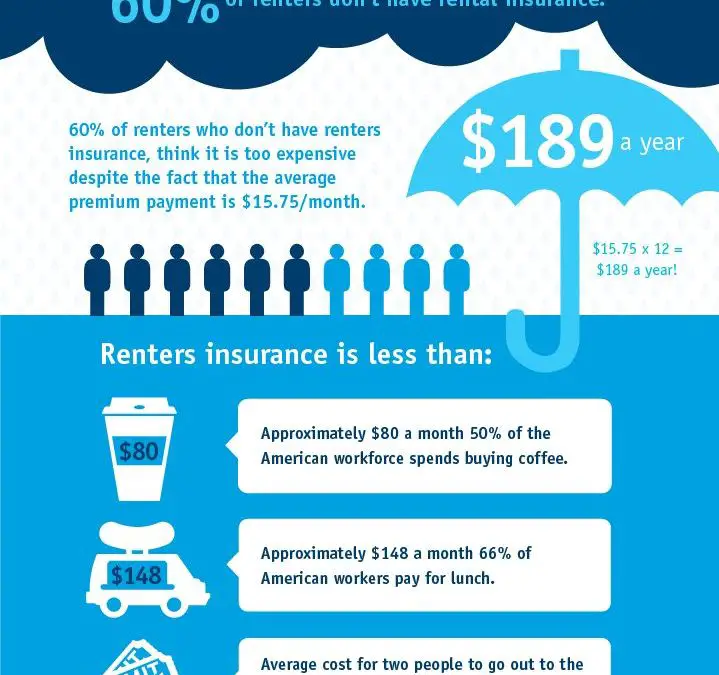

The cost of health insurance for small business should be measured in both dollars and in time.

If youre going with a group plan, youll want to consider the percentage of premiums you are willing to cover, whether or not you are covering employees or their families as well, whether you use third-party services to find insurance for you, since they have a fee as well. But it also takes time to search and compare plans that meet the needs of your business, to educate your team on their plan options, and the administrative burden of setting up and maintaining the plan. And did we mention paperwork? So much paperwork.

More specifically, according to the 2019 Employee Benefits Survey by Kaiser Family Foundation, annual premiums for employer sponsored family health coverage reached $20,576 in 2019, up 5% from the previous year, with workers on average paying $6,015 toward the cost of their coverage. The Wall Street Journal reports that employers shouldered 71% of that cost, while employees paid for the rest. The average deductible among covered workers in a plan with a general annual deductible is $1,655 for single coverage.

Pro tip: The best way to budget for health benefits is either a percentage of your payroll or a monthly per-employee amount.

Does Amerihealth New Jersey Offer Affordable Health Insurance Options For Self

AmeriHealth New Jersey has a range of insurance plans to suit your needs and budget. But depending on your estimated yearly income and the size of your family, you may also qualify for a government subsidy to help you afford your monthly health insurance premiums.

Try our Subsidy Calculator to see if you might be eligible. If you don’t qualify for a subsidy, stay on our site to browse and enroll in an affordable health insurance plan directly with AmeriHealth New Jersey.

Also Check: Can You Put A Girlfriend On Your Health Insurance

How Much Does Small Business Health Insurance Cost

Your total cost will depend on several factors, including the location of your business and the type of network you choose. In 2021, businesses with fewer than 200 employees spent an average of $6,569 per employee on annual health insurance premiums for single coverage and $14,094 for family coverage. Experts generally recommend keeping group health insurance costs between 10% and 20% of your annual revenue.

What Is A Self

A self-insured health plan is a type of group health insurance in which the employer collects premiums and is responsible for paying claims when employees need care. These plans can be self-administered, or the business may work with an insurance provider to get stop-loss coverage and administrative support.

There are several benefits to self-funded plans. Employers can keep surplus premiums , plans can be customized to a greater degree, and certain ACA provisions that lead to high costs can be avoided. Increasingly, small businesses are opting for self-funded coverage. But self-insured plans arent right for every business.

Don’t Miss: How Much Family Health Insurance Cost

How Much Does A Small Business Cost

Estimate your costs. According to the U.S. Small Business Administration, most microbusinesses cost around $3,000 to start, while most home-based franchises cost $2,000 to $5,000. While every type of business has its own financing needs, experts have some tips to help you figure out how much cash youll require.

Making Health Insurance Affordable For As Many People As Possible

Under the Affordable Care Act , the government is required to help pay for your health insurance if you cant afford it on your own. There are a few ways you can get help paying for a health plan.

- If you qualify for the Advance Premium Tax Credit, the federal government will pay a part of your premium each month or you could opt to receive a tax refund at the end of the year.

- If you qualify for lower out-of-pocket costs, youll pay less for things like prescriptions, emergency care, and copays.

- New financial help is available to lower your monthly premiums through Get Covered New Jersey. The state of New Jersey is offering a state subsidy, called New Jersey Health Plan Savings, that will help lower your premium. To learn more, visit GetCovered.NJ.gov.

You May Like: What Is Marketplace For Health Insurance

How Much Do Small Business Owners Pay For Health Insurance

The cost of obtaining healthcare insurance for yourself and any employees depends on the age, location, and size of the workforce. It also depends on what, if any, premium cost-sharing arrangement you made with your employees to reduce your costs.

But according to PeopleKeep, small businesses with fewer than 200 employees annually paid roughly $6,480 per employee for single coverage premiums and $17,616 per employee for family coverage premiums in 2017. They spent another $13,000 annually in plan administrative costs.

You’ll also have to factor in the cost of hiring a part- or full-time benefits administrator, if you choose to hire one, to handle plan selection, price negotiation, plan enrollment and compliance. If you decide to oversee the plan yourself, factor in how much time it would take you to manage the plan throughout the year and translate that into opportunity cost.

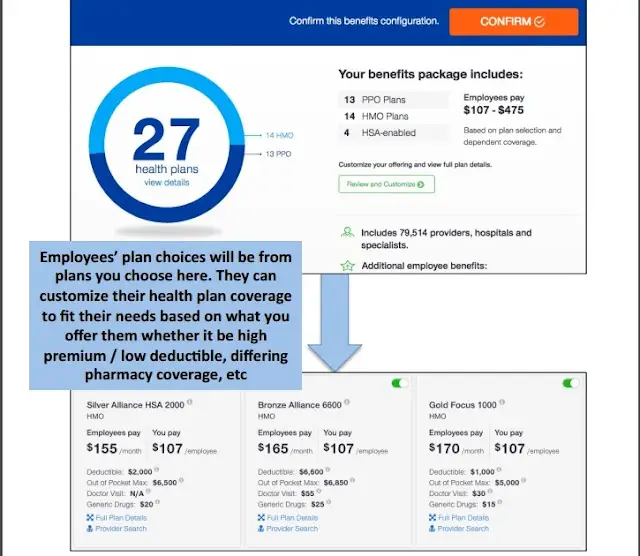

The Employer Chooses The Plan Provider

As the owner or manager, its up to you to select the plan that is best aligned with your goals. This means weighing your employees financial and medical needs against the brass-tacks numbers of what you can actually afford. This is where a professional group insurance advisor comes in handy.

Here are some questions to ask yourself about group health insurance:

- How much can the company afford to contribute to health care benefits?

- What coverage options are important to my current employees?

- What coverage options are valuable to new, top talent in my companys field?

When you have the answers to these questions, your benefits manager will be able to point you to the plan youre looking for.

Recommended Reading: How Much Will Health Insurance Cost Me In Retirement

The Best Health Insurance Providers For Small Businesses

There are a lot of different health insurance providers out there, and it can be tough to figure out which one is the best for your small business. Here are a few things to keep in mind when youre looking for the right provider:1. Make sure the provider offers a good selection of plans. You should be able to find a plan that fits your budget and your employees needs.2. Look for a provider with a good reputation. This will give you peace of mind that youre getting quality coverage.3. Find out if the provider offers any discounts for small businesses. This can help you save money on your premiums.4. Get quotes from several different providers before making a decision. This will help you ensure that youre getting the best rate possible.

You Protect Your Financial Health

For those of you who think you can just pay out-of-pocket because you normally dont have medical issues, consider

- When you are insured, insurance companies negotiate rates with health care providers. You wont get those discounted rates paying out-of-pocket.

- Tax penalties are still in effect. If you maintain medical coverage, you will not face tax penalties put in place under Obamacare.

Other posts you may enjoy:

Also Check: What Does Family Health Insurance Cost

Group Coverage May Cost Less And Cover More

Whereas an individual plan offers coverage for only you or your family, group health insurance is insurance that businesses purchase and offer to eligible employees and their dependents. Group insurance offers certain advantages over individual health insurance, including generally being more affordable and offering more extensive coverage.

You May Qualify For A Tax Credit

The purchase of health insurance for yourself and your employees can help you qualify for tax credits if you purchase a plan through the Small Business Health Options Program Exchange, an insurance portal created by the ACA. You must meet the following requirements:

- Have fewer than 25 full-time employees

- Offer health insurance to all full-time employees

- Pay salaries of less than $50,000 per full-time employee, on average, each year

- Front at least 50% of the premium cost

As a small employer, you can receive up to 50% of your contributions toward employee premiums, which can significantly reduce the costs of providing health benefits to your employees.

Recommended Reading: How Long Can My Son Stay On My Health Insurance

How Does Insurance Through An Employer Work

Employer-sponsored health insurance is a health policy selected and purchased by your employer and offered to eligible employees and their dependents. These are also called group plans. Your employer will typically share the cost of your premium with you. Your employer often splits the cost of premiums with you.

Employee Health Care Is Managed Through The Plan Provider

Once your employees are enrolled, their coverage begins immediately. Group plans work just like individual plans Your employees will likely have copays and deductibles that need to be covered out-of-pocket.

Administrating a small business insurance plan is not as much work as people think. Still, many growing businesses choose to work with a healthcare administrator or HR company to manage their coverage.

Read Also: What Are The Different Types Of Health Insurance Plans

Q: How Much Is Health Insurance For A Small Business

Group insurance premiums can vary in price based on your location, the number of employees you are enrolling, and the total amount that you want to contribute.

In general, you can expect a group coverage plan to average between $400 and $500 per month per employee. Other variables include where your business is located, the age of the employee, and family size .

Estimating the cost of small business insurance is also an easy process that only takes a few minutes.

The Type Of Industry In Which Your Business Operates

The construction industry, for instance, is fairly expensive to insure due to the high risk to its workers and third parties on site. Thereâs also the expensive equipment they use, which must also be insured. A private piano teacher, on the other hand, who teaches out of their home, wonât face the same potential hazards and will ultimately have to pay less for their insurance.

Don’t Miss: Can You Buy Health Insurance For A Child Only