How The Small Business Health Insurance Tax Credit Works

The health insurance tax credit is available to small businesses that pay at least half the cost of single coverage for their employees. If your business and your plan meet the qualifications, you can get a credit of up to 50% of the health insurance premiums you paid for employees, but not for yourself as the business owner.

To be eligible for the small business health insurance tax credit, you must:

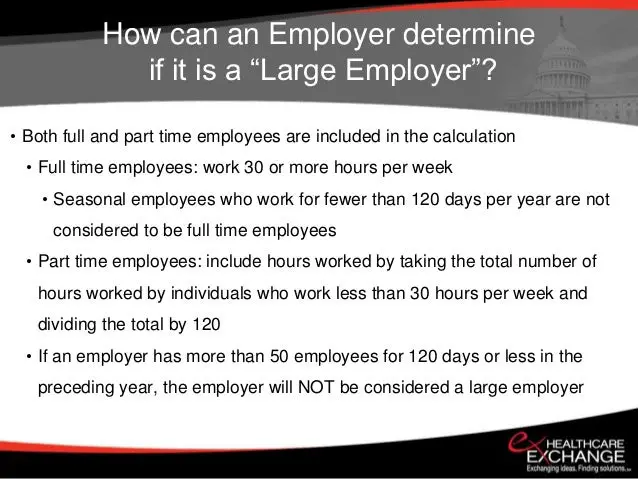

- Have fewer than 25 full-time equivalent employees

- Have average wages that are lower than $56,00

- Pay these premiums using an IRS-qualified arrangement generally an arrangement that requires you to pay a uniform percentage of the premium cost for each enrolled employees health insurance coverage

If you are self-employed and your business was profitable during the year, you can get a tax deduction for yourself, your spouse, and your dependents. A tax deduction differs from a tax credit in that a deduction reduces your taxable income thus, the value of the deduction depends on the taxpayers marginal tax rate, which rises with income. A self-employed health insurance deduction is available for the costs of medical insurance, dental insurance, and long-term care policies. You can deduct these costs up to the total of your self-employment gross income.

What Happens If I Dont Use My Premium Tax Credit

If you didnt receive all of the premium tax credit youre entitled to during the year, you can claim the difference when you file your tax return. If youre uncertain about your income for the coming year, remember that you can modify the amount of premium tax credit during the year if your income changes.

Buying Health Insurance Affects Your Taxes So Does Not Buying It

Whether you get your health insurance through an employer or the Health Insurance Marketplace, its important to understand how health insurance affects taxes so that youre better prepared to file your tax return.

When the Affordable Care Act was enacted in 2010 , the law made health insurance more widely available for some people. But it also made things a little more complicated for some during tax season.

You May Like: Starbucks Insurance Plan

Health Insurance Marketplace Subsidies

There are two types of subsidies available to marketplace enrollees. The first type, called the premium tax credit, works to reduce enrollees monthly payments for insurance coverage. The second type of financial assistance, the cost sharing subsidy, is designed to minimize enrollees out-of-pocket costs when they go to the doctor or have a hospital stay. In order to receive either type of financial assistance, qualifying individuals and families must enroll in a plan offered through a health insurance .

Premium tax credit

The premium tax credit reduces enrollees monthly payments for insurance plans purchased through the Marketplace. Marketplace plans are offered in four metal levels of coverage: bronze, silver, gold, and platinum. Bronze plans tend to have the lowest premiums but have the highest deductibles and other cost sharing, leaving the enrollee to pay more out-of-pocket when they receive covered health care services, while platinum plans have the highest premiums but very low out-of-pocket costs. The premium tax credit can be applied to plans in any of these metal levels. Also offered on the Marketplace are Catastrophic health plans with even lower premiums and higher cost sharing compared to bronze plans. Catastrophic plans are generally only available to individuals younger than 30, and premium tax credits cannot be applied to these plans.

Who is eligible for the premium tax credit?

What amount of premium tax credit is available to people?

If My Income Qualifies Me For Medicaid But My State’s Not Expanding It Can I Get A Tax Credit Or Cost

Some states have expanded Medicaid to include people with higher incomes . If you have a low income, but your state did not expand Medicaid, you will be eligible for a tax credit to buy a health plan through your stateââ¬â¢s Marketplace, but only if your income meets the minimum threshold . It seems counterintuitive, but if your income is too low, you do not qualify for a tax credit to buy insurance. This is because the law assumed all states would expand Medicaid and the tax credits to help pay premiums would pick up where Medicaid left off. But the Supreme Court made the Medicaid expansion optional. As of 2020, 12à states have not expanded it, so in those statesà you do not qualify for assistance if your income is too low. To find out whether your state has expanded Medicaid, go to the Healthcare.govââ¬â¢s Medicaid expansion page. Ã

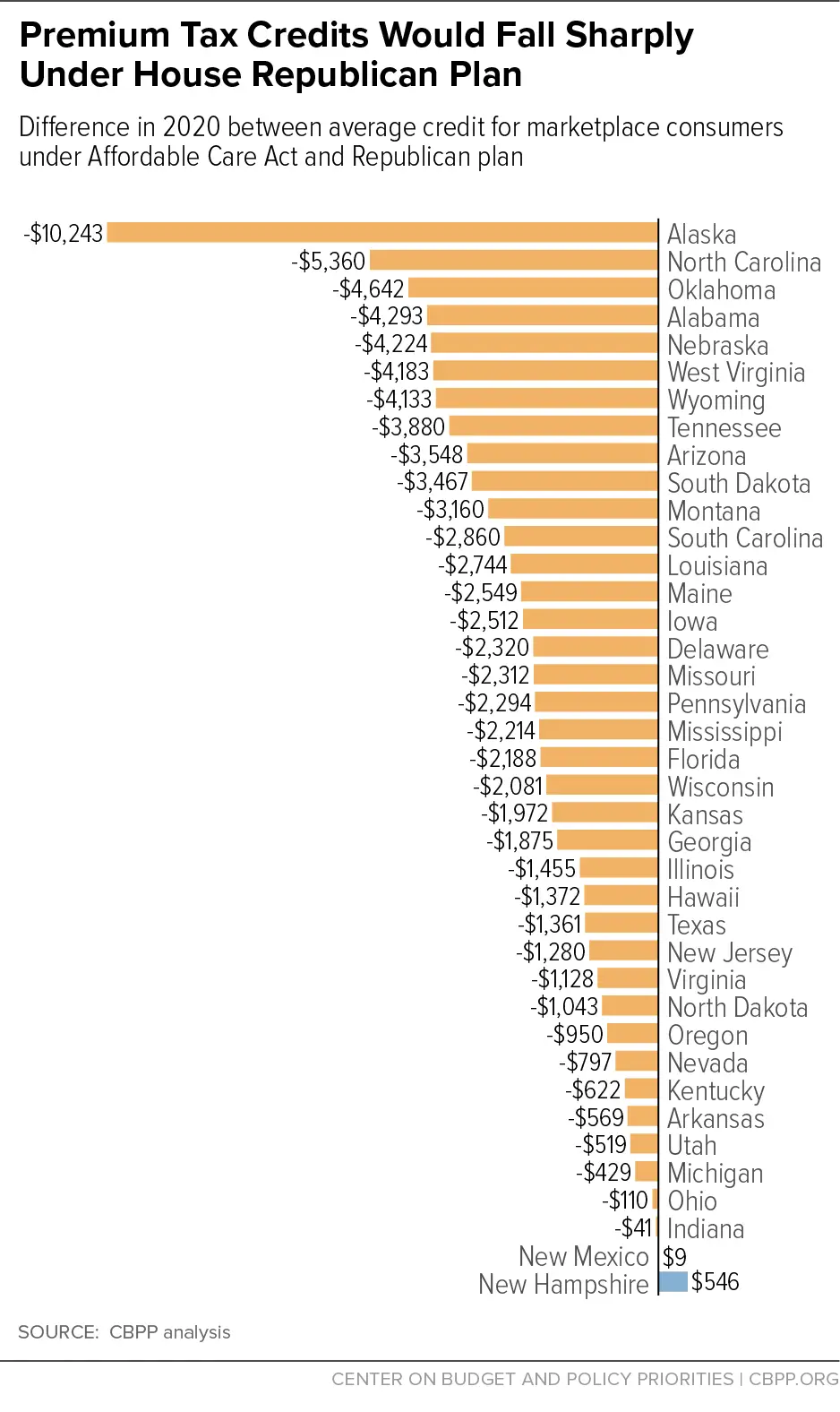

The amounts for people who live in Alaska and Hawaii will vary.

Recommended Reading: Starbucks Insurance Enrollment

What If I Dont Qualify For A Premium Tax Credit Or Csr

The IRS allows you to deduct certain medical expenses exceeding 7.5% of your adjusted gross income .

Deductible medical expenses may include but arent limited to the following:

- Payments to doctors, dentists, chiropractors, psychologists, etc.

- Payments for inpatient hospital care.

- Payments for insulin and for drugs that require a prescription.

- Payments for false teeth, prescription glasses, contact lenses, hearing aids, crutches, wheelchairs, etc.

- Payments for transportation primarily for and essential to medical care that qualify as medical expenses.

For a full list of deductible medical expenses, visit the IRS website.

Review: Your Deductible Vs Out

To understand how a catastrophic plan works, itâs important to review a couple of key health insurance concepts: your deductible vs your out-of-pocket maximum.

Just about every health insurance plan has a deductible. Thatâs the amount of money you need to spend on your health expenses before your insurance starts paying for anything. A higher deductible means you will have more out-of-pocket expenses before insurance starts sharing costs with you.

Recession-proof your money. Get the free ebook.

Get the all-new ebook from Easy Money by Policygenius: 50 money moves to make in a recession.

Get your copy

The out-of-pocket maximum, also called the out-of-pocket limit, is the most you will ever have to pay, in a given year, on health services that your insurance covers. Once you spend enough to hit that limit, your insurance will cover 100% of the rest of your health expenses for the year. The highest possible out-of-pocket limit for 2020 is $8,150.

Catastrophic health insurance plans have a deductible that is the same as your out-of-pocket limit. The tradeoff is catastrophic plans have lower monthly premiums â the amount you pay each month in order to keep your insurance policy active â compared to most health insurance plans since you could be on the hook to pay some health costs yourself.

Read Also: Burger King Health Insurance

What Happens If My Family Size Or Income Changes During The Year

Life-changing events can impact your tax credit eligibility by either increasing or decreasing the amount that you are allowed to claim. Events that can affect your premium tax credits may include:

- Change in your household income

- Adoption

- Gaining or losing health insurance coverage

Since the marketplace determines your tax credit, it is important to report changes immediately so your health plan eligibility can be updated. And if you’re currently using the advance premium tax credit, then it is particularly important to report any life changes to the marketplace as soon as possible.

If you wait to report such changes, there may be discrepancies between what you paid and what you should pay. In this case, if you used more advance premium tax credits than you are allowed, you may have to pay back money when filing your federal income tax return. On the other hand, if you used less than allowed, you may get an added refund. This is known as “reconciling” your advance premium tax credits.

Heres How Aca Subsidies Work In A Nutshell

If you think you qualify for subsidies, apply for insurance through the government-sponsored marketplace . Subsidies are only available through the exchange.

Estimate how much income you think youll have for the year and youll receive a subsidy based on your income level and other factors. This subsidy is actually an estimated amount that the government pays to the insurance company on your behalf.

Next year when you file your taxes, you may have to pay back some or all of the subsidy if it turns out you made more income than you estimated or otherwise dont qualify.

You May Like: How To Stop Health Insurance

Recommended Reading: 8448679890

How To Claim The Tax Credit

To claim the ACA tax credit, attach Form 8941, Credit for Small Employer Health Insurance Premiums, to your annual business tax return . Form 8941 helps you calculate the amount of the tax credit you can receive.

The premium tax credit is only available for two consecutive years. If your tax credit is more than the amount of taxes you owe, you can carry the unused amount back to previous tax years or forward to the next year.

Nonprofit organizations can receive a refundable tax credit. This means that nonprofit, tax-exempt organizations can receive cash for unused credit.

What Factors Affect How Much Premium Tax Credit You Can Claim

The premium tax credit makes health insurance more accessible and affordable. However, every individual will not receive the same premium tax credit. The amount of your credit may also vary from year to year. Several factors influence your credit amount, including:

-

Estimated income

-

Household size

-

Place of residence

A higher premium tax credit can lead to more savings as long as you keep up with income reporting requirements. When you apply for ACA marketplace coverage, you will have a chance to forecast your income. The information you report will determine your premium tax credit.

Don’t Miss: Does Kroger Give Employee Discounts

Is A Tax Credit A Refund

Refundable tax credits are called refundable because if you qualify for a refundable credit and the amount of the credit is larger than the tax you owe, you will receive a refund for the difference. For example, if you owe $800 in taxes and qualify for a $1,000 refundable credit, you would receive a $200 refund.

The Aca’s Premium Tax Credit

Most people who are eligible for the premium tax credit subsidy choose to have it paid in advance directly to their health insurance company each month. This lowers the amount they have to pay for premiums each month. When enrollees choose this option, the subsidy is referred to as an advance premium tax credit, or APTC.

But enrollees also have the option to pay full price for a plan purchased through the health insurance exchange, and then receive the full amount of their premium tax credit from the IRS when they file their tax return. When tax filers take this option, the subsidy is simply called a premium tax credit, or PTC.

APTC and PTC both refer to the same thinga premium subsidy to offset the cost of health insurance obtained in the exchange. And either way, it’s a refundable tax credit, which means you get it even if it exceeds the amount you owe in federal taxes.

And regardless of whether you receive APTC or PTC, you have to complete Form 8962 with your tax return. This is how you reconcile the amount that was paid on your behalf during the year or claim the credit in full after the year is over.

Read Also: Does Insurance Cover Chiropractic

How Does Health Insurance Affect Taxes

Where you get your health insurance from can make a big difference in its effect on your tax return.

Employer-sponsored health insurance

If your employer offers health insurance as a benefit and you pay a portion of the plans premium, your part of the bill is paid with pre-tax dollars . This means the amount isnt subject to withholdings for federal or state income tax, or Social Security and Medicare taxes .

The amount of federal and state income taxes withheld can depend on your income and how many allowances you claim on your W-4 form. As of 2017, the total Social Security and Medicare tax rate is 15.3 percent. Your employer must pay half of that, so youll see 7.65 percent automatically withheld from each paycheck.

The health insurance exchange

If your employer doesnt offer a health insurance plan or youre self-employed, you can get a health insurance policy through HealthCare.gov.

Depending on your income level, you may qualify for the premium tax credit to help offset the cost of your monthly premiums. The amount of the credit is on a sliding scale , and you may be eligible if your household income for the year is at least 100 percent but no more than 400 percent of the federal poverty line for your family size.

If youre self-employed, you may also be able to deduct the amount your paid for health insurance for you, your spouse and your children.

Why is employer-sponsored health insurance typically cheaper than a marketplace plan?

Overview Of The Premium Tax Credit

Shereen Lehman, MS, is a healthcare journalist and fact checker. She has co-authored two books for the popular Dummies Series .

The health insurance premium tax credit is part of the Affordable Care Act . It’s often referred to as a premium subsidy, and it’s designed to help make health insurance premiums more affordable for middle and low-income people.

But the terms “low-income” and “middle class” are subjective. To clarify, premium tax credits are normally available for people with household incomes as high as 400% of the poverty levelthat amounted to $103,000 for a family of four in the Continental U.S. in 2020. But for 2021 and 2022, the American Rescue Plan has removed the upper income cap for subsidy eligibility, meaning that some households with income well above 400% of the poverty level can qualify for premium subsidies.

Most people who buy their coverage through the ACA’s health insurance exchanges are receiving premium subsidies. And for enrollees who receive subsidies, the subsidies cover the majority of the monthly premiums.

The premium subsidy is often referred to as “the ACA subsidy,” but there’s another ACA subsidy that applies to cost-sharing and shouldn’t be confused with the premium tax credit.

Don’t Miss: Shoprite Employee Benefits

How Do I Access The Premium Tax Credits

You may be wondering, does the premium tax credit work with any type of insurance? No to receive your premium tax credit, you must purchase health insurance through the federal marketplace, healthcare.gov, or your state’s marketplace.

You can purchase a qualified health plan during your states open enrollment period. Otherwise, you can only get health coverage during a special enrollment period .

Most states have a website where you can view and compare policies, enroll in a plan, and receive the premium tax credit. A licensed health insurance broker is a great resource for help selecting a health plan. Look up your state marketplace here.

Expert Advice About Tax Credits

Youre probably wondering who qualifies for a tax credit. The government figures out who will qualify based on household income, household size, and age of household members. About 26 million Americans will qualify for health insurance tax credits. Generally, you are not eligible if your employer provides you affordable health insurance that includes a certain amount of coverage. Affordable is a key word theres actually a specific measurement for it under the Affordable Care Act . Be sure to ask your employer for more details. One more thing: If youre eligible for Medicare or Medicaid, youll probably get your health coverage through those programs. People covered under Medicare or Medicaid typically dont qualify for tax credits.

If you do qualify, how do you find out how much youll get? To predict your tax credit, go to an online estimator, like the one here on GetInsured. Youll be asked to provide your estimate of household income. Youll also be asked how many people are in your household, and how old they are. It takes only a minute or two to find out whether youre likely to be eligible for tax credits or any other government assistance.

How the tax credit works

Health insurance tax credits help people pay their monthly health insurance premiums. Credits are paid in one of three ways:

1. The government can pay the tax credit directly to your insurance company up front.

This means youll pay less of your monthly premium.

Recommended Reading: Do Starbucks Employees Get Health Insurance

How To Apply For The Advance Premium Tax Credit

When you buy health insurance at Healthcare.gov or your state marketplace, you estimate your income for the year, which is used to calculate your subsidy.

When you apply for coverage, you can choose how much of the premium tax credit to apply to your premiums now. You can receive the remainder of the tax credit when you file your income-tax return for the year.

Policy Options For Improving Financial Assistance

Several legislative proposals introduced in the previous Congress would significantly improve the ACAs subsidies, reducing both premiums and out-of-pocket costs for subsidized consumers. H.R. 5155, introduced by Representatives Frank Pallone, Richard Neal, and Bobby Scott , would significantly increase both premium tax credits and cost sharing assistance, lowering net premiums for subsidized ACA consumers to closer to Massachusetts levels. The bill would also extend subsidies to people above 400 percent of the poverty line.

Legislation introduced by Senator Elizabeth Warren would make similar changes. Other proposals would make more limited but targeted improvements, for example lowering premiums for young adults . All of these proposals would advance the goals of expanding coverage and making premiums and out-of-pocket costs more affordable for those who are already insured.

| Appendix Table: Non-Elderly Uninsured, by Income, 2017 |

|---|

| State |

Also Check: Starbucks Part Time Insurance