What Happens If I Don’t Have Health Insurance

The Affordable Care Act was set up to make it easier for people who couldn’t afford health insurance to get it. It was an attempt to make health care more affordable for everyone by reducing the number of people who can’t pay their medical bills, which drives costs up for everyone else.

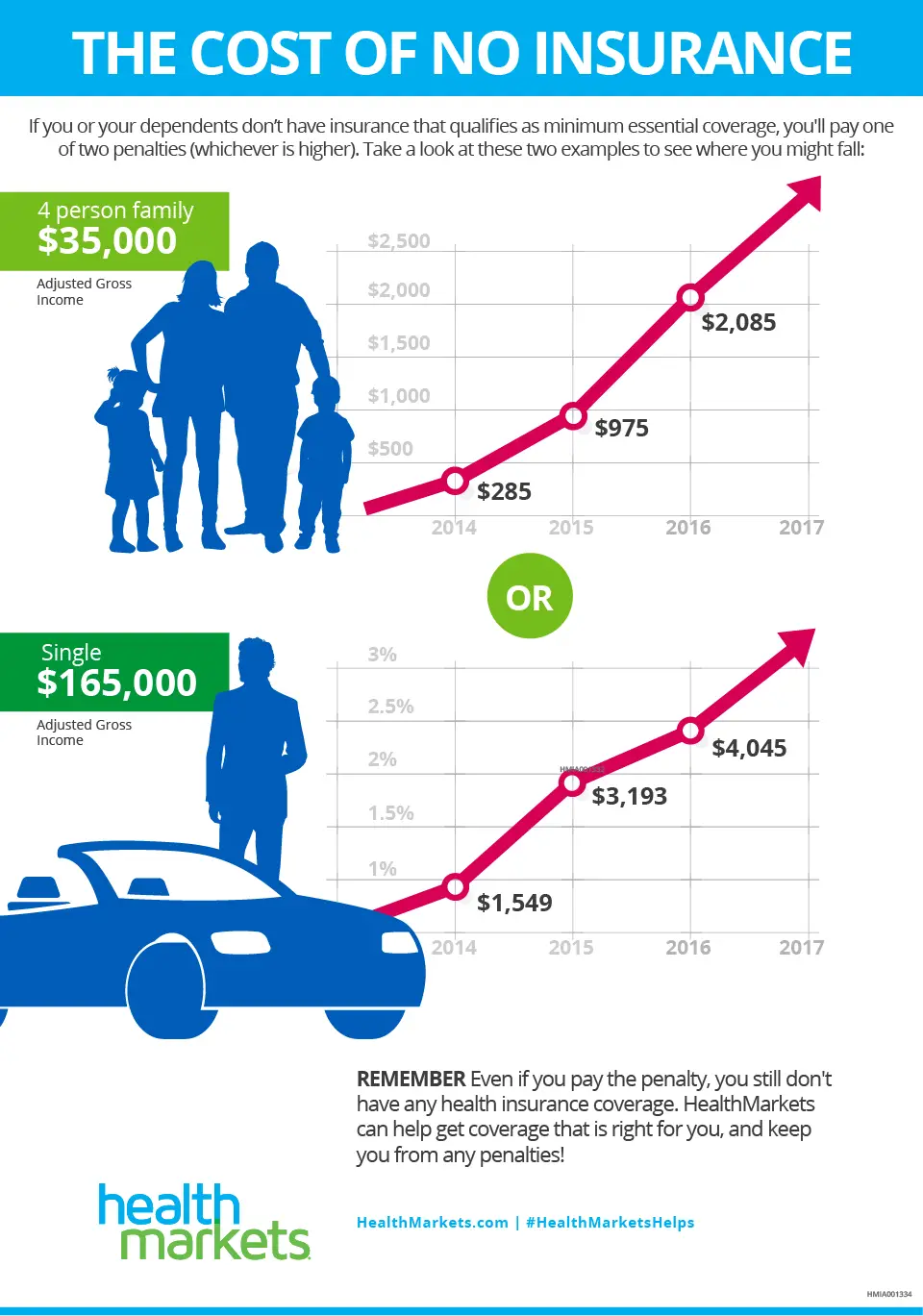

The ACA set up penalties for not having health insurance, in order to try to keep people from not being able to pay their medical bills. This portion of the ACA was repealed in 2019, with the authority to enforce health care transferred to the states. Depending on the state where you live, you may be required to pay a fee when you file your state taxes if you do not have health insurance. Check your state health care regulations to be sure.

If you are fined by your state for not having insurance, it could be a significant amount, so if you decide to take the chance of not having health insurance, you should be ready to pay this amount and factor it into your budget.

Keep in mind that there are other financial risks associated with forgoing health insurance, such as not being able to pay for health care. This can turn into large amounts of debt should you need more than minor care. Some 17.8% of Americans with credit reports have medical debts in collections. This is why you should consider health insurance a necessity instead of a nice-to-have.

Helping You Get Insured Affordably

The risks of being an uninsured person are high. Without an insurance plan, both your health and your bank account are put in jeopardy. But by protecting yourself, you can make sure that an unexpected accident wont derail your life.

If youre self-employed and wondering about the costs associated with health insurance, check out this article: How much is health insurance for the self-employed?

KFF. Key Facts about the Uninsured Population.

Healthcare.gov. Read the Affordable Care Act.

Congress.gov. Tax Cuts and Jobs Act.

HealthCareInsider. 5 States Are Restoring the Individual Mandate to Buy Health Insurance.

KHN. The Cost Of Unwarranted ER Visits: $32 Billion A Year.

Bankrate. Survey: Fewer than 4 in 10 Americans could pay a surprise $1,000 bill from savings.

NCBI. Health Consequences of Uninsurance among Adults in the United States: Recent Evidence and Implications.

Visit An Urgent Care Center

If youre not experiencing a true emergency, you may want to visit a nearby urgent care center. Urgent care professionals, who may be nurse practitioners rather than physicians, can treat minor illnesses or injuries. They will also advise you if they believe you need more medical care or if you should go to the ER.

Urgent care often costs roughly half as much as a trip to the ER. For example, a visit to an urgent care center will cost you the office visit and any prescription drug or lab fee costs you may need.

Don’t Miss: Can I Buy Health Insurance Outside The Marketplace

How Do You Pay For Medical Bills

Most people turn to health insurance to cover larger medical bills. And many people rely on insurance provided by their employers.

This insurance is less expensive than individual policies that people buy for themselves. Thats because employers can spread the cost of health insurance out over a large pool of employees. Most employees will pay for insurance coverage with money deducted out of their paychecks. But not all employees will need insurance to cover large medical bills. This allows employers to offer this type of medical coverage at lower costs.

Individual policies, though, are far more costly, something that is a problem if your employer doesnt offer health insurance or if you are unemployed. According to eHealth, the average monthly cost of an individual health insurance policy one not provided by an employer was $440 in 2018. The average cost for an individual health insurance plan for a family was even higher, coming in at $1,168 a month.

Getting A Personal Loan Has Never Been Easier.

What If You Go Without Health Insurance

The federal tax penalty may no longer be a factor, but you may still want to obtain some level of coverage, such as a short term medical policy, to help pay for covered medical expenses should you experience an unexpected illness or injury.

Why? Well, evidence suggests that uninsured people are less likely to receive healthcare than their insured friends and family, and when they do, they pay more for it.

Specifically, Kaiser Family Foundation research found that:

- 24% of nonelderly adults without insurance postponed medical care due to cost compared to only 6% of those with private coverage and 9% of those on Medicaid or another public plan

- 20% of nonelderly adults without insurance went without needed care due to cost, compared with 3% of those with private coverage and 8% of those with public coverage

- Nonelderly adults without insurance for an entire year pay for 1/4 of their care out of pocket and hospitals frequently charge uninsured patients much higher rates compared to those paid by private health insurers and public programs

Find short term health insurance plans in your area to compare coverage options and costs.

Don’t Miss: How To Get Health Insurance In France

What Are The Different Health Insurance Policies

The Dutch government obliges the residents to take out at least the basic healthcare insurance. The basic health insurance covers costs such as hospital care, medication, rehabilitation and certain therapists and mental health care.

There exist more than 50 different health care policies in the Netherlands. These policies come with different conditions. The ones with a lower monthly premium do not cover 100% of the costs at all hospitals. The insurance companies made arrangements with certain hospitals. If you go to a non-contracted hospital you have to pay a percentage of the bill. This percentage differs per insurance company. You usually get between 65% and 80% refunded by the insurer. These policies are called Natura policies or budget policies. Be sure to read these conditions thoroughly before taking out Dutch basic health insurance.

The restitution policies come with a higher monthly premium. However, they give you freedom of choice of health care provider. Most of the times you pay the bill yourself after visiting a hospital or health care provider. Afterwards, you can submit the bill to your insurance company for reimbursement.

How Much Will A Loan Affect Your Finances If You Take It To Deal With A Health Emergency

The cost of treatment varies based on the disease you have, the equipment/machine required during the operation, etc. So, if you require open-heart surgery, it would cost you around INR 3-5 lakh currently. In case you dont have a health insurance plan and take a 5-year loan of INR 4 lakh for the same, how much will it cost you if it comes at an interest rate of 15% per annum? You will need to pay an Equated Monthly Installment of INR 9,516, which will lead to interest payments worth INR 1,70,958 over five years. So, the overall payment will be INR 5,70,958. That is quite an amount to pay and not good to do so as a health insurance plan can cover that cost adequately. All you need to do is choose a high sum assured while also keeping an eye on the premium payable.

Don’t Miss: Does Health Insurance Cover Ivf

How Much Will I Owe If I Didnt Have Health Insurance

Up through December 31, 2018, lets say you could afford health insurance by chose not to buy it. If thats the case, you may pay a penalty fee on your federal taxes. This might come up in three different scenarios:

Starting with the 2019 plan year, the Shared Responsibility Payment no longer applies. This is important to note when you file your taxes. However, this does not apply to the states that have their own individual health insurance mandate.

Its best to check with your state to find out whether you might be subject to any penalty fees. Another option can be to check with your accountant. California, the District of Columbia, Massachusetts, New Jersey, Rhode Island, and Vermont have their own individual mandates.

Children’s Health Insurance Program

People under 18 years of age may qualify for coverage under their state’s Children’s Health Insurance Program . CHIP provides health coverage to nearly eight million children in families with incomes too high to qualify for Medicaid but too low to afford private coverage.

Eligibility is determined by each state and is based on income and disability. Each state’s CHIP program may have a different name. It is important to note that your child may qualify for CHIP coverage even if denied Medicaid.

Children may also be eligible for some disability benefits from Supplemental Security Income.

Additionally, under the Affordable Care Act, young adults are able to remain on their parents’ health insurance plan until age 26.

Recommended Reading: How Long Can I Go Without Health Insurance

What Symptoms Will Get You Admitted To The Hospital

When to Go to the Hospital

- Difficulty breathing, shortness of breath.

- Chest or upper abdominal pain or pressure.

- Fainting, sudden dizziness or weakness.

- Changes in vision.

- Confusion or changes in mental status.

- Any sudden or severe pain.

- Uncontrolled bleeding.

- Severe or persistent vomiting or diarrhea.

Not Addressing Care Issues

Similarly, many Americans postpone receiving healthcare or avoid seeing their doctor because they dont want to pay for the visit.

According to the Kaiser Family Foundation, almost 24% of uninsured people hesitate to seek needed healthcare due to the high cost of uninsured care. One study on trauma care and mortality among insured and uninsured adults who had suffered unexpected health shocks concluded that:

Uninsured crash victims received 20% less care, particularly costly procedures and services, than did privately insured patients, and had a substantially higher mortality rate: 1.5 percentage points above the mean rate of 3.8%.

Instead of addressing a health concern, you run the significant risk of it becoming worse over time. Like preventative care, taking steps to strengthen your health early on saves you in the long run. Thats why healthcare coverage is an absolute necessity for all individuals.

Also Check: What Is A Marketplace Health Insurance Plan

Options For The Uninsured

The best option if youre uninsured is to find some type of coverage. There are many options available today, at various prices, through the Health Insurance Marketplace. Depending on your income, you may be eligible for financial help to pay for insurance. The Marketplace will let you know if you qualify for tax credits to help pay for your premium. You can find out if you will get assistance with out-of-pocket costs as well. Applying through the Marketplace can also tell you if you qualify for Medicaid.

Can I Get Insured After Losing Coverage Through Employer Family Member Or Medicaid

If you lose coverage through a spouse or parent, or becomeineligible for Medicaid, you can still get insurance coverage. These coveragelosses are examples of qualifying life events that may give you eligibility ina special enrollment period. A special enrollment period allows you to enrollin major medical health insurance plans outside of the open enrollment period.

If you qualify for a special enrollment period whichtypically last 60 days you will have to prove that you experienced aqualifying life event in order to purchase a health insurance plan off thefederal or state marketplace, or through a licensed broker.

If you lose coverage through an employer or family memberand you believe that you may qualify for federal assistance, you can applyanytime throughout the year for Medicaid and CHIP two government programsseeking to provide low-cost or free health insurance to low-income individualsand families.

Even if you do not think that you will qualify for Medicaidor CHIP based on income alone, it is a good idea to apply anyway, especially ifyou are disabled, have children or are pregnant.

Don’t Miss: What To Do If You Lost Your Health Insurance

What If I Dont Enroll In Health Insurance At All

As of 2019, theres no more individual mandate. This means you dont have to enroll in health insurance to avoid paying a penalty fee, in most states.

If youre 30 or older and want to enroll in a Catastrophic plan, you must claim a hardship exemption to qualify. Catastrophic health plans offer more affordable coverage. And they can protect you from high medical costs if youre seriously hurt or injured. If youre under 30, you can enroll in a Catastrophic plan without any kind of exemption, though. For people over 30, youll need to qualify for a hardship or affordability exemption. Some examples of hardship exemptions are homelessness, domestic violence, the death of a family, or experiencing a fire or other natural disaster. Once granted an exemption, you can see every Catastrophic plan available based on where you live on the Marketplace.

Common Experiences Of People With No Health Insurance

There are many myths and misconceptions surrounding the topic of health insurance in this country. You may be wondering:

- Is it mandatory?

- Am I fined if I dont have it?

- What if I cant afford it?

- What happens in an emergency if I dont have insurance?

With these questions circling in your head , you may be like millions of other Americans with no health insurance and lots of stress.

You May Like: How To Meet A Deductible With Health Insurance

Was Health Insurance Mandatory For The Entire Year

For all years after the ACA went into effect until Jan. 1, 2019, health insurance was mandatory for the entire year. Youll only pay a penalty, though, for any months of the year before 2019 that you were uninsured. So, if you did have coverage for some of the year, the penalty fee will only apply to the non-covered months. Technically, you dont have to have health insurance all 365 days a year to avoid the tax penalty. If you have coverage for even just one day of a month, the IRS considers this as having minimum essential coverage for the entire month.

In addition, you could also qualify for a short coverage gap exemption. You will qualify for this exemption if your lack of health insurance coverage was for a period of less than three months. However, this coverage only applies to the first gap each year, so if you lack health insurance more than once during a calendar year, the exemption will only cover the first gap. For example, if you do not have insurance in May and then again in September, you will only be exempt for May and have to pay the penalty for your second gap.

Covering Your Visit With Health Insurance

Unfortunately, in recent years, the percentage of uninsured and under-insured has increased. Currently, about 28 million Americans are uninsured and an estimated 30 million are underinsured.

One reason the number of uninsured is rising is that the federal government is no longer requiring people to maintain health insurance, though five states do require it: California, Massachusetts, New Jersey, Rhode Island, and Vermont, plus the District of Columbia.

The individual mandate requiring virtually everyone to have health coverage or pay a tax penalty was passed in 2010 as a part of the Affordable Care Act . That financial incentive led many to get insurance, often carefully comparing and choosing a health plan that best suited their needs and budget. But now with this section of the ACA no longer being enforced by the federal government, many people have dropped their insurance.

Signing up for health insurance during the Open Enrollment Period helps you avoid shouldering the entire cost for large medical bills stemming from serious injury or illness. Most people declare bankruptcy due to medical costs, rather than for any other reason. Undoubtedly, having health insurance can play an indispensable role in helping people maintain their financial security.

Read Also: Do You Have To Have Health Insurance In 2020

Other Benefits That Youll Miss Out On

Other benefits, such as ambulance cover, home care treatment, bonus on not claiming in a financial year, reinstatement of sum insured upon its utilization, make health insurance plans a must-have.

So go online, choose a suitable health insurance plan and secure yourself & your family financially against health hazards.

Why Have Health Insurance If Youre Young And Healthy

One of the main reasons why health insurance is important is that you want to stay healthy, right? One of the best ways to help you do that is to make sure you see your doctor for your annual check-up, get your flu shot, and other preventive care. Its covered 100% by most health insurance plans when you stay in-network.*

Without health insurance, you may have to pay the full cost of any medical care you receive, including preventive care.

Health insurance is important for other reasons, as well: if you do get sick or suddenly need emergency care, health insurance plans help cover some of those costs.2 Otherwise you may be on your own paying the high cost for care.

Don’t Miss: How To Get A Replacement Health Insurance Card

Types Of Health Insurance

If you dont enroll in health insurance, there are a few things that can happen. Some people may not have any health insurance, while others may have only a limited selection of options. If you dont have health insurance, you could end up paying high premiums or being unable to get coverage if you need it.

There are a few different types of health insurance. You may be covered by an employer-sponsored plan, a government program like Medicare or Medicaid, or a private plan. Each type of coverage has its own benefits and drawbacks.

If you only have limited options, the best option might be a government program like Medicare or Medicaid. These programs are free for most people, and they provide comprehensive coverage for medical expenses. However, these programs have very strict eligibility requirements, so you might not be able to get coverage if youre not eligible.

If youre covered by an employer-sponsored plan, the best option might be to switch to a plan thats more affordable or offers better coverage. Employers offer a variety of plans, so its important to compare them carefully before making a decision.