How Does It Work

Supplementary health and dental insurance policies are contracts between you and an insurance company. You agree to pay a yearly or monthly fee called a premium, and the company agrees to pay the benefits which are covered under your policy. Your policy will outline what is included and what is not.

Here are some common features of supplementary health and dental insurance:

- Most policies do not cover 100 per cent of your medical expenses. You may have to pay some of the medical expenses you and your dependants incur. This is known as the deductible. Each policy is structured differently and you might have family deductibles or per service deductibles .

- Some plans have a co-insurance feature in addition to the deductible. That means you have to pay a percentage, or co-insure, the medical expenses on top of your deductible. It could be 10 per cent of the eligible medical expense, or higher, and it may depend on the type of medical service required.

- You may also have dollar or percentage limits, or maximums placed on the amount of benefits that you can receive. Maximums can apply to specific health benefits like eyeglasses or massage therapy sessions in a specified period typically a year, or during your lifetime.

Health Insurance Costs Rising

All the noise pointed people away from the real meat of the Fraser studies. That was how much health costs had increased and how fast they were increasing.

For that average family, the cost of health insurance rose 1.4 times faster than their incomes did between 2006 and 2016. Incomes were up 26% in that time, but health insurance was up 37%.

To put it in perspective, the cost of shelter rose 36% during that time and the cost of food rose 30% during that time. Insurance costs rose 1.3 times as fast as these basic costs.

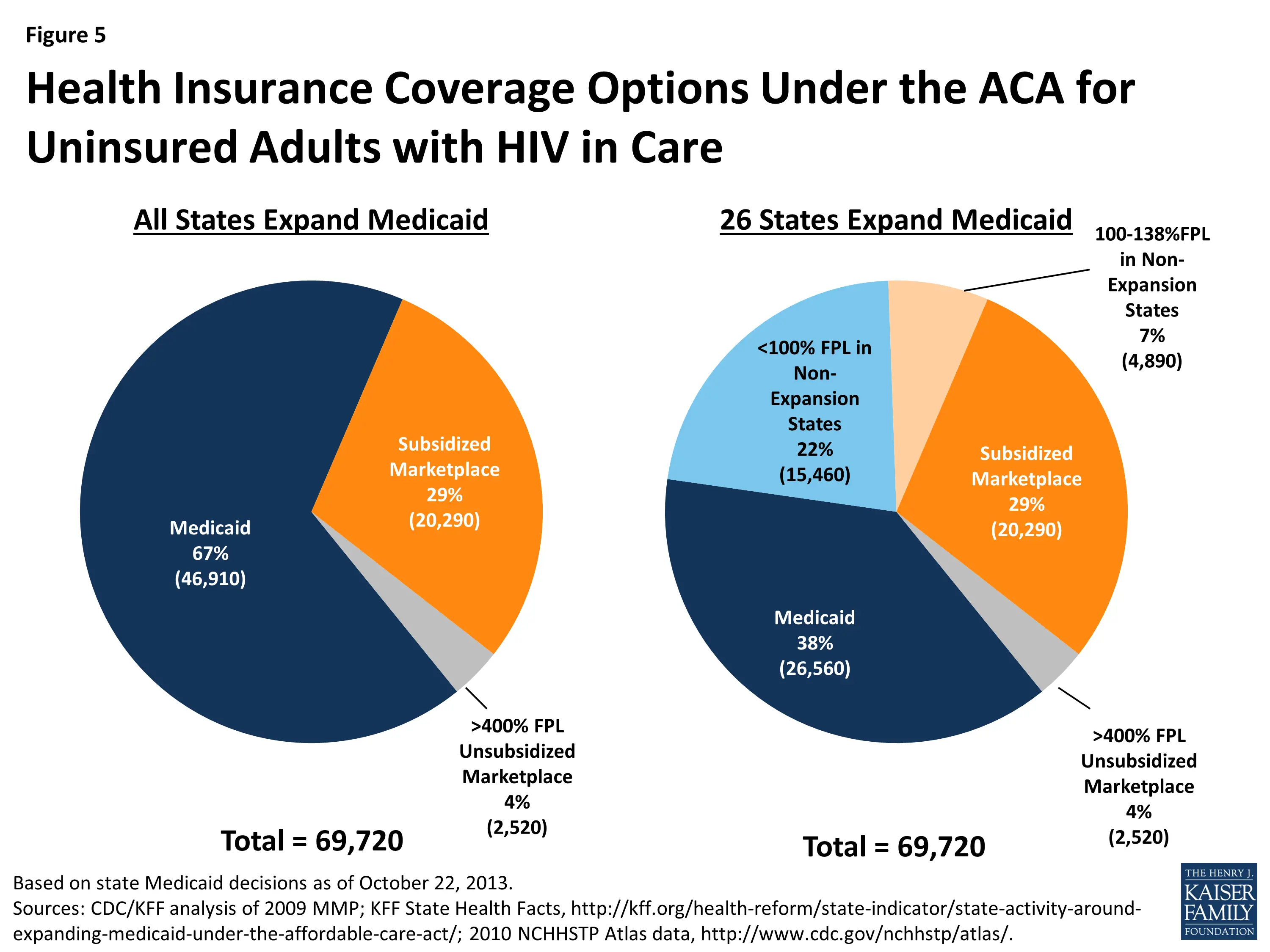

Medicaid And The Childrens Health Insurance Program

Medicaid is a federal and state health insurance program for low-income families and individuals. Medicaid has eligibility requirements that are set on a state-by-state basis, but it is primarily designed for those with low incomes and low liquid assets. It is also designed to help families and caretakers of small children in need. You can typically check if you qualify for Medicaid through healthcare.gov or your state exchange.

The Children’s Health Insurance Program is a federal and state program that is similar to Medicaid, but specifically designed to cover children below the age of 18. The program is primarily aimed at children in families who have incomes too high to qualify for Medicaid but too low to afford private health insurance. Like Medicaid, you can typically see if you qualify and apply on Healthcare.gov or your state’s exchange.

Read Also: Does Starbucks Offer Health Insurance

For Visitors To Canada

If you are an international traveler visiting Canada for a short trip or a stay of less than one year, a less comprehensive and more affordable travel insurance plan may be the best option. These travel medical insurance plans cover the costs of medical treatment for emergencies and illnesses that occur while traveling. They also offer additional benefits such as coverage for adventure sports, trip interruption, medical evacuation and transportation, and more.

If you also want to cover the cost of your trip, consider a trip cancellation plan.

Basic Health Insurance Terms

If youre just learning the ins and outs of health insurance, I feel your pain. Health insurance is complicated stufflike rocket-science complicated. You might not even know where to start.

Before we look at how much health insurance costs, lets break down some terms into plain English.

First, there are only two main kinds of health insuranceprivate and public.

Private coverage is health insurance through your employer, union or even the armed forces. You can also get it on your own through the governments marketplaceHealthcare.gov.

Public insurance is provided by the government. It includes Medicare , Medicaid or care from the Department of Veterans Affairs.

Your premium is the amount you pay monthly for your coverage.

The deductible is the amount you have to fork over before your insurance company starts chipping in.

Your maximum out-of-pocket costs are the limit to what you will pay in a year. For example, if your plans maximum out-of-pocket costs are $8,000, once you pay that amount, your insurance company will cover everything above that through the rest of the year. It acts as a financial safety net so you dont totally break the bank from medical costs.

Also Check: How To Enroll In Starbucks Health Insurance

What Does Covered Mean Anyway

If a service is covered, it means your health plan will pay for some or all of the cost. In most cases, your doctor also needs to be on the list of doctors that take your insurance, called a network. How much your health plan pays for depends on what type of care you use and where you get it.

For example:

- Some covered services are completely free to you, like going to the doctor for your annual exam. Your plan pays everything.

- For others like seeing the doctor for a lingering sinus infection or filling a prescription for covered antibiotics youll pay a fee. The amount you pay will be different depending on the type of plan you have and whether or not youve taken care of the amount you have to pay before your plan starts helping you .

To get the biggest bang for your buck, use services your health plan covers whenever possible.

What Does It Mean To Be Underinsured

As the name suggests, underinsurance is the lack of enough protection provided by your policy. You can be underinsured in two ways:

Not enough sum insured: In this case, while you have the right insurance, you go for a lower sum insured, either due to the wrong estimation of future needs or just to lower the premium. The biggest problem with a low sum insured is that you just dont have access to enough funds when there is a pressing need. Lets illustrate this with a real-life scenario.

Picture a situation where you buy a health insurance cover with a sum insured of Rs 5 lakhs. Under the present circumstances, you feel that this amount is more than enough to cover all your health-related needs, however, one aspect that you have not considered here is inflation. A few years down the line, Rs 5 lakhs wont hold the same value that it does today. Consequently, when the need arises, this amount might not be able to ease your financial burden and you might have to dip into your savings, defeating the purpose of buying insurance.

Not enough coverage: In this case, your insurance either doesnt provide enough coverage or doesnt provide coverage against the ailments or treatments you might need in the future. Lets elucidate with the same example:

Don’t Miss: Can I Go To The Er Without Health Insurance

How Much Does Individual Health Insurance Cost

BY Anna Porretta Updated on November 24, 2020

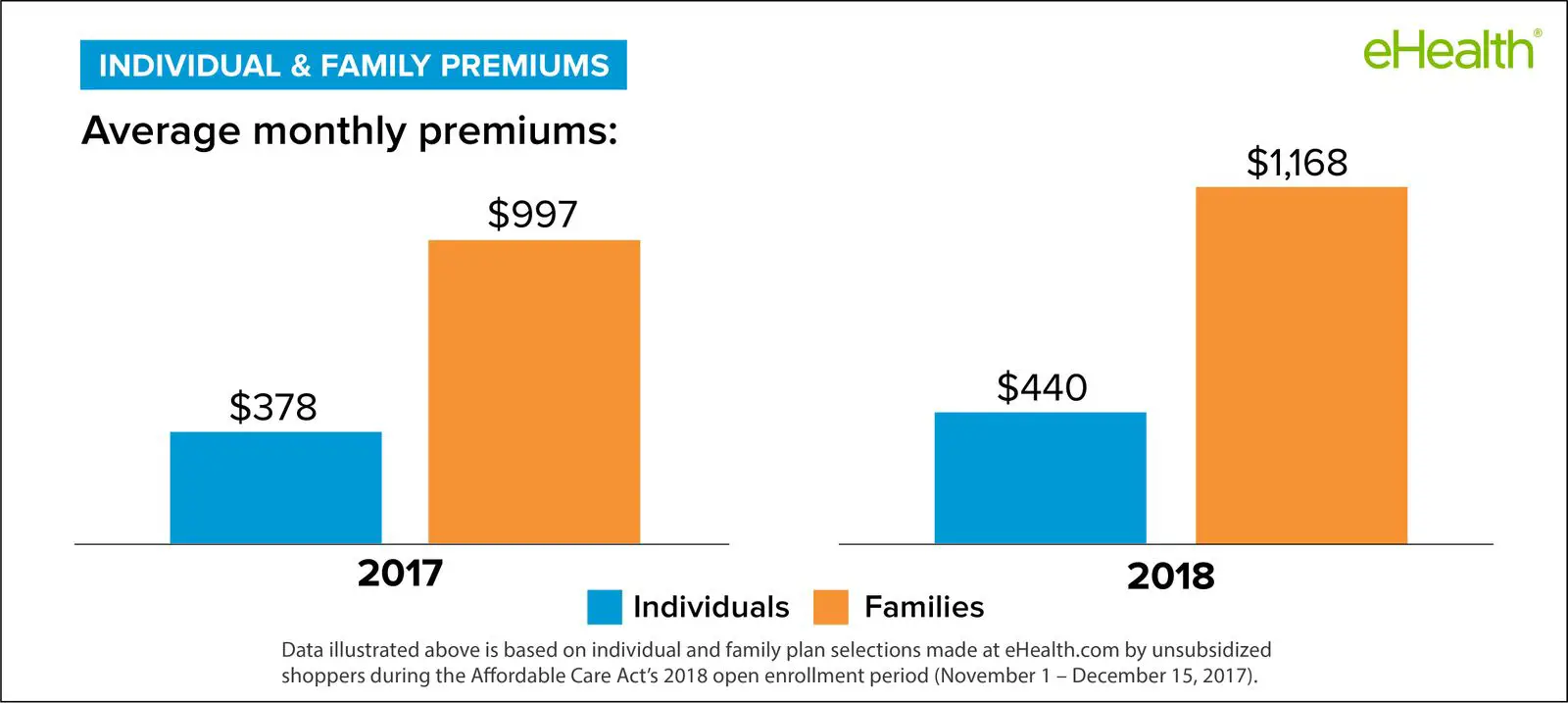

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans. Understanding the relationship between health coverage and cost can help you choose the right health insurance for you.

To see personalized quotes for coverage options available in your area, browse health insurance by state. If you already know which health insurance carrier youd like to purchase from, check out our list of health insurance companies.

Your Gender And Marital Status

Under the Affordable Care Act, insurance companies are no longer able to charge consumers more based on their gender.8 But other factors do make a difference. For instance, if youre married and have kids, you can expect to pay more to cover your familys needs. Note that if your familys income falls below a certain level, a tax credit could save you money.9

But marital status arent the only things that determine how much you could be shelling out. Here are some other things insurance companies look for.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

How Do Premiums Deductibles Cost

Generally,the more benefits your plan pays, the more you pay in premium. But your medicalexpenses for care are lower.

Toillustrate how these costs may influence your choice of plans, consider the ACAplans.

Inaddition to the metallic plan categories, some people are eligible to purchasea plan with catastrophic coverage. Catastrophic plans have very low premiums andvery high annual deductibles . However, they pay for preventivecare regardless of the deductible. These plans may be a suitable insuranceoption for young, healthy people. To qualify for a Catastrophic plan, you mustbe under age 30 or be of any age with a hardship exemption or affordabilityexemption . Learnmore about Catastrophic coverage.

How Us Health Insurance Works

Health care in the United States can be very expensive. A single doctors office visit may cost several hundred dollars and an average three-day hospital stay can run tens of thousands of dollars depending on the type of care provided. Most of us could not afford to pay such large sums if we get sick, especially since we dont know when we might become ill or injured or how much care we might need. Health insurance offers a way to reduce such costs to more reasonable amounts.

The way it typically works is that the consumer pays an up front premium to a health insurance company and that payment allows you to share “risk” with lots of other people who are making similar payments. Since most people are healthy most of the time, the premium dollars paid to the insurance company can be used to cover the expenses of the small number of enrollees who get sick or are injured. Insurance companies, as you can imagine, have studied risk extensively, and their goal is to collect enough premium to cover medical costs of the enrollees. There are many, many different types of health insurance plans in the U.S. and many different rules and arrangements regarding care.

Following are three important questions you should ask when making a decision about the health insurance that will work best for you:

Don’t Miss: Does Starbucks Provide Health Insurance

Cost Of Short Term Health Insurance In The Usa

The cost of an international health insurance plan varies greatly.

Short-term travel medical plans start at about $1.50 per day and can cost more than $10 per day for older clients or more comprehensive coverage.

Global medical plans widely vary in available options. The more affordable catastrophic coverage that only covers worst-case scenarios is good for travelers on a budget. On the other end of the spectrum, comprehensive medical plans may include physician visits, hospitalization, prescription drugs, lab services, and chronic disease management.

The most affordable global medical plan we offer ranges from $400 to $500 a year, while the most expensive but comprehensive ones can reach as high as $30,000 to $40,000 a year.

If Youre Buying For A Family

You should also be aware that your plan may have a family deductible in addition to individual deductibles for each family member. Individual deductibles are lower than the family deductible. Once an individual hits their individual deductible, their health insurance plan kicks in just for them. But once the family deductible is met, health insurance kicks in for every member of the family, regardless of whether or not an individual has reached their deductible.

You May Like: Starbucks Healthcare Benefits

How Do I Avoid The Risks Of Underinsurance

#ThinkAhead and take these steps to avoid being underinsured:

Make a diligent assessment of your needsWhen purchasing an insurance policy, you need to assess your needs systematically and only then make a purchasing decision. Remember to take factors such as inflation and plausible unforeseen expenses into account too.

Opt for an adequate sum insuredAlways ensure that your sum insured is adequate as per your needs. You might have to pay a higher premium, but its worth it. Down the road, you should not be stuck bearing the entire brunt of a costly financial emergency.

Go through the exclusions and conditions thoroughlyTo avoid being underinsured, dont miss out on the details of your chosen plan, like its exclusions. You should be certain about what your insurance covers and what it doesnt. There should be no unpleasant surprises in the future.

Seek professional help when in doubtIt is always advisable to rely on the expert knowledge of insurance companies rather than trusting unreliable sources blindly when it comes to picking the right insurance policy.

In all effectiveness, insurance exists to ensure that you and your loved ones are well covered in case of emergencies. Tata AIG provides a range of comprehensive insurance policies with a variety of helpful add-ons to suit your needs.

Who Is Eligible For Short

Short-term health insurance provides limited coverage as a temporary bridge while you wait to qualify for an ACA-compliant plan. It can be used when you do not yet qualify for a group insurance plan or are waiting for the next open enrollment. Some people choose short-term health insurance as temporary coverage in case of an emergency if they are suddenly without coverage for various reasons. Here are some examples:

- Leaving a job that had a health insurance plan and not qualifying for COBRA plans

- Retiring early and looking for temporary insurance until qualifying for Medicare

- No longer qualifying for a group plan due to divorce

- Moving to a new state where an existing plan cannot follow and waiting until a new plan starts

- Students or young adults turning 26 who no longer qualify for their parents insurance

- People who want to have a plan with no network and find ACA plans too expensive

Anyone can apply for short-term health insurance. However, because short-term health is not ACA compliant, it uses medical underwriting and may refuse to insure you . Depending on which state you are in, coverage may only be available for a very limited time for a maximum of three years.

Also Check: Does Starbucks Give Health Insurance

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.

An Alternative Way To Pay For Health Care Costs

If youre struggling to pay for prescriptions, dental care, home care or any other medical expenses, and its not worth getting private health insurance , what options do you have?

For homeowners aged 55-plus, the CHIP Reverse Mortgage® from HomeEquity Bank could provide the money you need to pay all of your medical costs, without having any impact on your retirement income.

You can receive the money in a lump sum or in monthly payments, to coincide with your monthly health care costs. And, because you dont have to pay what you owe , until you decide to sell your home, it wont stretch your finances.

If health insurance for retirees in Canada is out of reach for you, but you have considerable health care expenses, call us now at 1-866-522-2447. Well work out how much cash you can access and help you start the process.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

The Postwar Period: National Health Systems

After the Second World War, most Western European governments massively expanded their health insurance coverage, many insuring entire populations as a right of citizenship. Not only health insurance, but the health system as a whole was the subject of reform efforts. In 1946, a Labour government introduced the British National Health Service to provide healthcare to all citizens through publicly-owned hospitals and publicly-paid doctors. In order to overcome opposition from the British Medical Associationwhich largely represented the interests of the general practitionersplans for salaried practice for outpatient care was dropped instead general practitioners would be under contract to the NHS, and paid on a capitation basis , as they had been by the Approved Insurance Societies , since the National Insurance Act of 1911. Similar ideas of universal provision of healthcare through salaried hospital doctors and national health hospital plans were discussed in other nations as well, such as France and Sweden , but failed due to medical opposition.

L.R. Snowden, in, 2001

Finding A New Family Doctor

You might not have a family physician or a nurse practitioner just like many Canadian citizens and expats living in the country. If you are one of them and you need access to healthcare services, you will have to either visit a community walk-in clinic or go straight into the emergency room for more serious concerns. This system may work just fine, especially if you are in good health. However, it can be a source of frustration, especially if you cannot find an office that is accepting new patients.

There is no standardized way to find a family physician in Canada. It often comes down to asking family, friends, or colleagues who they would recommend, and hoping they will put in a good word to connect you with the doctor.

In some provinces, there is a database where you can register your information to be matched with a family physician. In Ontario, for example, the Health Care Connect program considers preferences like language services and travel distance in matching a physician.

If you are an expat or a non-resident in Canada, the best advice is to start looking for a physician right away. Find a doctor you can contact long before you feel unwell. It may take several months before you get matched with a physician, so it is better to be proactive in searching for one.

You May Like: Starbucks Dental Coverage