Can I Make Changes Outside Of The Open Enrollment Period What Is A Qualifying Life Event

Typically, once youve made your benefit elections, you have to wait to make changes until the next open enrollment period. Not always, though. You may have heard the term, qualifying life events. These are life events that let you make changes to your benefits outside of the open enrollment period.

Can You Get A Full Health Insurance Refund If You Cancel

In most cases a full refund is unlikely, especially after your first month of coverage, but individual health insurance companies will have different policies and individual states have different regulations.

For example, California requires a 10-day âfree lookâ period during which you can cancel your policy for a full refund within 10 days of receiving your plan information in the mail . Florida has the same regulation.

Make sure to check with your insurance company prior to enrolling in their plan.

Is There An Open Enrollment Period For Medicaid

Medicaid, a federal program, was designed to help people with limited income get access to health coverage. There is no open enrollment period for Medicaid programs, including the Childrens Health Insurance Program .

In some states, Medicaid covers all low-income adults below a certain income level. In all states, Medicaid provides health coverage to:

- Low-income families and children

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

If You Become Eligible For Another Form Of Minimum Essential Coverage

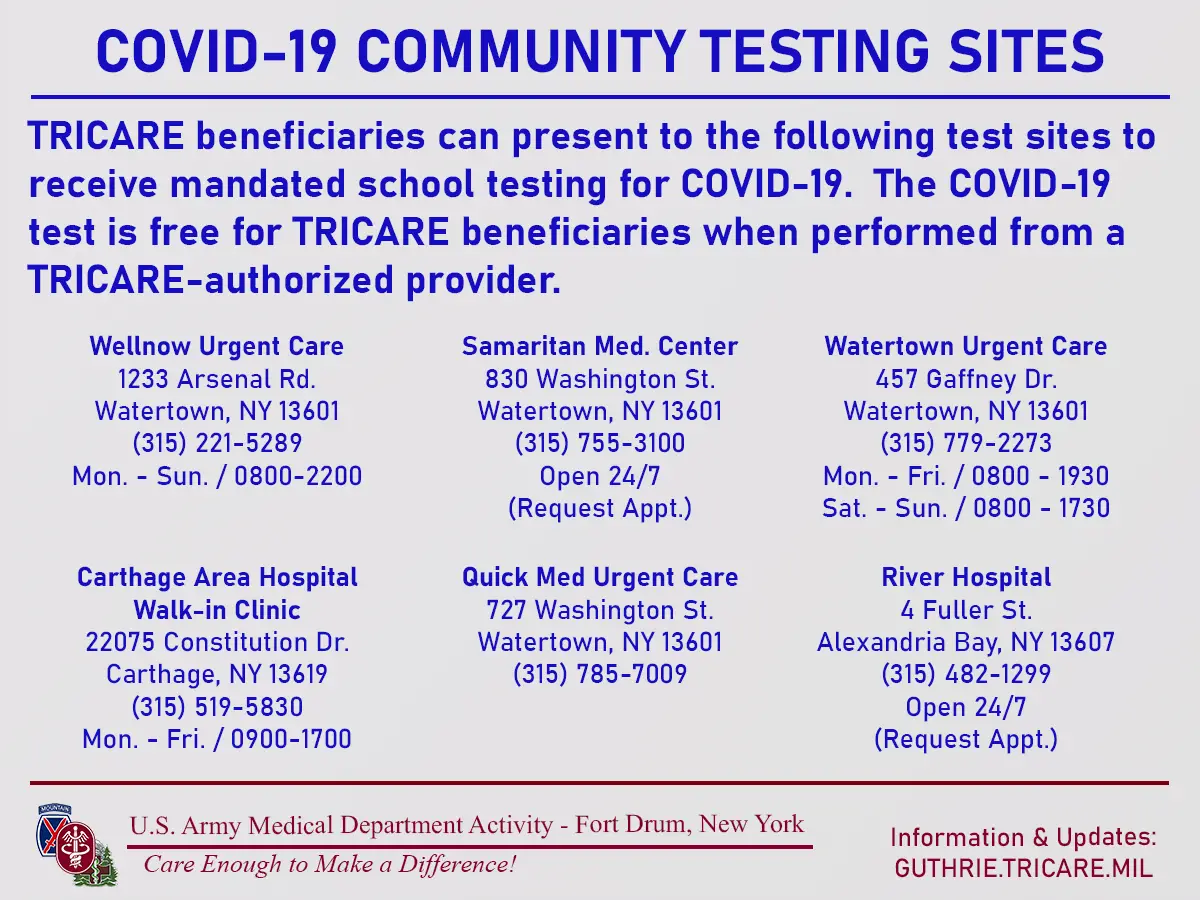

If itââ¬â¢s no longer open enrollment and you donââ¬â¢t qualify for a special enrollment period, you canââ¬â¢t switch to a different ACA plan. However, you can see if you are eligible for another form of minimum essential coverage such as Medicaid or TRICARE. You can enroll in many of these programs year-round if you qualify.

Still unsure? Find out if you can get health insurance now.

Special Enrollment Periods For Health Insurance

Health Services > COVID” alt=”Guthrie Ambulatory Care Center > Health Services > COVID”>

Health Services > COVID” alt=”Guthrie Ambulatory Care Center > Health Services > COVID”> Special enrollment periods are so named because thats exactly what they are: special. During a special enrollment period, only you and your family have the chance to decide on new coverage options.

Special enrollment periods are triggered by specific events, including:

- Getting married, divorced or legally separated

- Giving birth or adopting

- Starting, ending or losing a job

- Losing other health insurance coverage

- A death in the family

- Moving to a new ZIP code or county

- Certain other qualifying events

If one of these events applies to you, youll usually have 60 days to switch to a new plan or make changes to your existing one.

Just like with open enrollment, you can shop around and compare plans by talking to your existing health insurance provider, your broker or visiting your states health insurance marketplace. In some cases, youll need to provide evidence of your qualifying life event before enrollment is complete.

Also Check: How To Keep Insurance Between Jobs

Which Insurance Is Best For Health

Best Health Insurance Plans in India Health Insurance Companies Health Insurance Plans Maximum Sum Insured Amount HDFC Ergo General Insurance My Health Suraksha Rs. 75 Lakh Care Health Insurance Care Policy Rs. 6 Crore Care Health Insurance Care Freedom Policy Rs. 5 Lakh Bajaj Allianz General Insurance Health Guard Policy Rs. 50 Lakh.

If You Cancel But Then Change Your Mind Can You Reinstate

There may be a grace period after cancellation during which you can be reinstated and resume coverage un-interrupted .

You will be expected to pay your premium amount in full for that period of time during which your coverage was canceled and it may take a couple of weeks for the policy to be reinstated, but you will have retroactive coverage for that time and you wonât have to undergo a new waiting period.

Read Also: Do Substitute Teachers Get Health Insurance

Health Insurance Open Enrollment: If You Need Health Insurance Coverage In Michigan Help Is Here

This site contains everything you need to know about health insurance, how to get covered, and how to use your coverage to keep yourself and your family healthy.

Open Enrollment for 2022 health insurance ran between November 1, 2021 and January 15, 2022.

Consumers who missed the January 15 deadline for 2022 coverage may still qualify for a Special Enrollment Period if they experience a qualifying life event, such as a birth, job loss, or divorce. In addition, Michiganders who qualify for the state’s Medicaid or MIChild programs can apply at any time. For help getting started, and to figure out for which programs they qualify, consumers should visit Healthcare.gov/lower-costs.

Your local agent or assister can help with the application or answer your questions. Find Marketplace help near you by visiting LocalHelp.HealthCare.gov.

Review And Update Your Beneficiary

It is important to periodically review and update your beneficiary designations for your life insurance and your retirement savings plans. Your named beneficiary is a person or an entity , who will receive death benefits when you pass away.

It is especially important to review your beneficiary designations and make updates as necessary whenever your circumstances change. For example, when you experience a life event that changes your eligible dependents, for example a marriage or divorce, or the birth or adoption of a child.

Consult with all your advisors your lawyer, your financial advisor and your insurance specialist to make sure that your named beneficiaries are consistent with your financial wishes and estate planning documents.

You May Like: Evolve Medical Insurance

When Is Open Enrollment For Aca Plans

For ACA plans, some state-based markets may have open enrollment periods that differ from federal-based marketplaces, as well as special enrollment periods. For UnitedHealthcare Individual and Family Marketplace plans , open enrollment for most states is November 1 through January 15.

What If You Cant Afford Your Aca Plan Anymore

What happens if you simply canââ¬â¢t afford your health insurance premium at some point in the coming year? If an ACA special enrollment period and other minimum essential coverage are not available options, you may want to consider non-ACA-compliant short term health insurance, but only if it fits both your financial situation and healthcare needs.

If you find yourself in a position where your current health insurance is unaffordable you donââ¬â¢t have to make these decisions alone and guess the best course of action.

Call to speak with a licensed agent to help you understand your health insurance options both on and away from the state-based and federally facilitated health insurance exchanges.

Don’t Miss: How Long After Quitting Job Health Insurance

Enrollment Options And Procedures

Once you have your health plan in place, youll need to manage all the details of signing up and dropping employees. Below, we explain how to do this and the rules you need to understand.

Adding and Dropping Employees

You can add employees to the medical plan when they are hired, usually on the first of the month following date of hire, or the first of the month after completing a waiting/probationary period. Once the employee chooses a plan, it stays in effect until one of two things happens:

- Open enrollment. See below for more information.

- Qualifying status change. Go to Making Enrollment Changes below for more information.

You can drop employees from the plan at any time during the year due to:

- Termination. Layoff, firing, retirement or quitting.

- Change in hours or classification. Employees who reduce their hours so that they are no longer eligible for insurance, or who move into a classification that is not offered insurance . Employees who lose coverage must be offered the opportunity to continue their medical coverage at their own expense.

Laws such as COBRA govern how employers may extend medical benefits to employees after termination in the tool box see Laws Related to Health Insurance for more information.

Open Enrollment

Making Enrollment Changes

Employees generally can make changes to their benefit elections during the year only if they have a qualifying status change. Events that qualify as a status change include:

Waiver of Coverage

Can You Just Cancel Your Aca Plan

Letââ¬â¢s say you want to switch health insurance plans halfway through the year and donââ¬â¢t qualify for special enrollment, but youââ¬â¢d still like to cancel your current major medical coverage. Is that an option?

Yes, itââ¬â¢s possible. However, itââ¬â¢s important to remember that going without comprehensive major medical coverage could leave you vulnerable to unexpected medical bills should you become sick or injured.

Instead of canceling your ACA plan and going without coverage, you may want to consider either keeping your comprehensive plan and adding supplemental coverage or enrolling in a non-ACA-qualifying short term medical policy as an alternative to going uninsured if you qualify.

Letââ¬â¢s look more closely at these options, both of which are available year-round in most states.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Cancel Your Health Plan: Any Time

You can cancel your Marketplace coverage any time. You may need to do this if you get other health coverage, or for another reason.

You can end coverage for:

- Everyone on the application after your coverage has started. Your termination can take effect as soon as the day you cancel, or you can set the Marketplace coverage end date to a day in the future like if you know your new coverage will start on the first day of the following month.

- Just some people on the application. In most cases, their coverage will end immediately.

When Is Medicare Enrollment

Turning 65 or retiring in the near future? It could be time to choose your Medicare coverage. There are a number of different Medicare enrollment periods. One key Medicare enrollment period for changing your coverage is called the Annual Enrollment Period . This happens from October 15 to December 7 every year. During AEP, you can join, switch or drop a plan. If you dont make any changes during AEP, your current plan will automatically renew the next year.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Main Considerations When Switching Health Insurance

Benefit limits

Check the benefit limits for specific services. They’re usually a fixed amount. Benefit limits are usually listed as a dollar amount, but occasionally you may see a benefit limit listed as a percentage on the PHIS. This means the fund will give you that percentage of the actual cost of the service . However, if you see a benefit listed as a percentage in a fund’s marketing material it may mean something else, so always go by the PHIS.

Lifetime limits

Beware of lifetime limits and combined annual limits for a range of services, such as $400 for physiotherapy, natural therapies and chiropractic. This means that once you’ve claimed $400 for physiotherapy , you won’t receive anything for the other therapies during that 12-month period.

Extras

For extras cover, consider the services you use most, such as dental, and check the annual limit per person and per family. Sometimes the family limit is only twice the per-person limit, while with other policies it’s four times the per-person limit.

Discounts

Check for a discount some funds provide an up to four percent discount for paying by direct debit or by prepaying your annual premium.

Waiting periods

Before changing policies, check any waiting periods. For extras cover, they’re usually two months for most services, 12 months for major dental and 36 months for hearing aids. Funds often waive the shorter waiting periods and may even waive all waiting periods if you’re switching from another fund.

Loyalty bonuses

Special Enrollment Under Hipaa

Under the Health Insurance Portability and Accountability Act of 1996 , a special enrollment period for health coverage may be available if you lose coverage under certain conditions or when you acquire new dependents by marriage, birth, or adoption.

If you decline enrollment for yourself or your dependents because of other health coverage, you may be able to enroll yourself or your dependents in U-M health coverage in the future. To request enrollment, complete the Group Health Insurance Application for Special Enrollment form and the Benefits/Enrollment Change Form and send the forms to SSC Benefits Transactions within 30 days after your other coverage ends. In addition, if you have a new dependent as a result of marriage, birth, adoption, or placement for adoption, you may be able to enroll yourself and your dependents, provided that you request enrollment within 30 days after the marriage, birth, adoption, or placement for adoption.

Also Check: Does Insurance Cover Chiropractic

Should You Downgrade Your Hospital Cover

Do you have hospital insurance to protect your Lifetime Health Cover status so that you don’t need to pay a surcharge if you take it up later in life, or perhaps to avoid paying the Medicare levy surcharge ?

If you’re relatively healthy and your only reason for having hospital insurance relates to the LHC or MLS, you could opt for a cheap hospital cover policy and upgrade later, when you need it. Depending on your situation, our experts have crunched the numbers and worked out how you can pay the LHC loading and save money.

Is Hmo Or Ppo Better

The biggest advantage that PPO plans offer over HMO plans is flexibility. PPOs offer participants much more choice for choosing when and where they seek health care. The most significant disadvantage for a PPO plan, compared to an HMO, is the price. PPO plans generally come with a higher monthly premium than HMOs.

You May Like: Is Umr Good Insurance

Rulemaking Was More Complex Than Other Years

These rules are usually finalized in the spring and then take effect the following January. The process was longer for 2022, however, because there was an administration change at the start of 2021.

So although some aspects of the 2022 rules had been finalized in early 2021 , there were various changes made after the Biden administration took office.

Under the Trump administration, HHS published the proposed 2022 NBPP in November 2021. They then finalized some parts of that proposal in January 2021. But that was only a few weeks after the public comment period had closed, and there wasnt time to finalize some aspects of the proposed rules before the Trump administration left office.

So the final NBPP that was published in January 2021 was only a partial rule, and HHS/Treasury made that clear at the time. In April 2021, they finalized the rest of the originally proposed NBPP for 2022, but noted that as a result of a change in administration priorities, they would soon be issuing an additional proposed NBPP.

This process had to be followed because procedural rules prevent an administration from simply announcing new rules. Instead, the applicable agencies have to publish proposed rules, open a public comment period, and then issue finalized rules that incorporate the agencies responses to the public comments they received.

So in June 2021, HHS and the Treasury Department published another proposed 2022 NBPP. And in September 2021, they issued the final NBPP for 2022.

Question: Can I Change Health Insurance Plans Anytime

Changing health insurance after open enrollment: Can I switch anytime? In most cases, you can only sign up for or update your health insurance during the annual Open Enrollment Period. However, if you experience certain qualifying life events, you may also become eligible for a Special Enrollment Period.

You May Like: Why Do Doctors Hate Chiropractors

Question: Can I Upgrade My Florida Blue Health Plan

You can buy or change your health plan all year long if you have changes in your life, like a new baby, marriage, a job change, if you move to a new county or had other major life events.. We can help you find out if you qualify for financial assistance and enroll you in the plan that best meets your needs.

What To Know Before You Cancel Your Health Insurance

Canceling health insurance is easy most of the time. But getting a new health insurance plan isnt always so simple. Thats why you should never terminate your coverage until you know exactly when a new health insurance policy will take effect.

Federal law allows administrators of group health plans to impose up to a 90-day waiting period. So if you land a new job that offers health insurance, you may have to wait nearly three months before your health insurance takes effect.

Young adults can remain on their parents group health insurance policy until age 26, even older in some states. While getting your own policy might seem like a step toward independence, staying on your familys health insurance plan might prove more economical. If youre younger than 26, you can stay on a parents health insurance policy even if you get married, go off to college, or move out of your folks house.

Canceling your health insurance coverage may also create more risks if you dont get a new plan. Uninsured children are less likely to receive preventive care, vaccinations, and treatment for serious conditions such as asthma, according to the Office of Disease Prevention and Health Promotion. Uninsured adults often dont receive care for deadly conditions such as cancer, cardiovascular disease, and diabetes, and often dont seek medical attention for injuries.

Read Also: Does Costco Offer Health Insurance For Members

Update Your Health Plan: Report Changes Keep Plan Up

If you experience a change to your income or household like a pay raise, a new household member, or a dependent getting other coverage you must update your Marketplace application.

- Some changes will qualify you for a Special Enrollment Period, allowing you to change your plan.

- Some changes, like an increase or decrease in income, may affect your savings or coverage eligibility. If you dont update, you may miss out on additional savings or pay money back when you file your taxes.