Option : Use The Governments Health Insurance Marketplace

The Health Insurance Marketplace is often referred to as the health insurance exchange. Depending on your income and your eligibility for other health insurance coverage, you may qualify for subsidiesalso called premium tax creditswhen you buy health insurance through the marketplace.

You can buy a marketplace policy even if you are eligible for insurance through your employer, and it doesnt hurt to see if you can find a better plan for your situation. You probably wont be eligible for subsidies if you have access to job-based coverage, though.

Open enrollment for 2022 coverage began Nov. 1, 2021. You had to enroll by Dec. 15 for coverage that began Jan. 1, 2022. In 2021, amid the ongoing COVID-19 pandemic, the open enrollment period was extended from Feb. 15 to May 15.

State exchanges may have slightly different enrollment dates. Its important to buy a policy during this annual enrollment period because you wont be able to buy a policy for the rest of the year unless you have a qualifying life event like moving, getting married, or having a child.

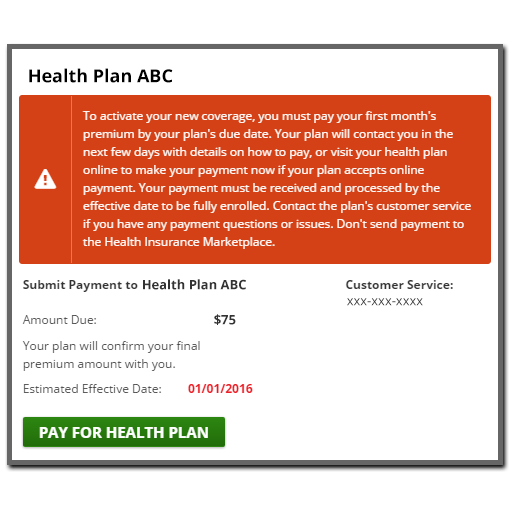

You can apply online, by phone, or in person. If you need help applying, you can work with a marketplace navigator in some states, a certified application counselor, or in-person assistance personnel. You must be a U.S. citizen or lawfully present in the country to buy a marketplace plan.

How To Apply For Individual Health Insurance

Written by: Gabrielle SmithJuly 8, 2021 at 8:35 AM

More and more employers today are adopting reimbursement models for their employees healthcare, empowering employees to choose their own individual health insurance plan and get reimbursed, tax-free, for their premium.

While this freedom is great for your healthcare, it can be daunting to shop for your own insurance plan if youve never done it before. While there are several ways to go about shopping for health insurance, the most common way is through the Health Insurance Marketplaces.

In this article, well walk you through the five-step process so you can choose the right plan for you and your family.

Big Savings Now At More Income Levels Find A Health Plan Now

New Jersey and the federal government are offering even more help to lower the cost of health insurance. You can enroll through the COVID-19 Special Enrollment Period now. If you are an existing customer, review your account to see if you qualify for extra savings.

Big savings â now at more income levels. Find a health plan now.

New Jersey and the federal government are offering even more help to lower the cost of health insurance. You can enroll through the COVID-19 Special Enrollment Period now. If you are an existing customer, review your account to see if you qualify for extra savings.

New Savings Due to COVID-19 Relief

Learn more about additional financial help available now through Get Covered New Jersey as a result of Federal and State COVID-19 Relief.

New Customers

Learn how you can shop for a health plan through Get Covered New Jersey.

More people now qualify for financial help. If you did not qualify for financial help before based on income, you may qualify now with new state and federal savings.

Compare plans and prices

Before you shop for health coverage, find if you qualify for financial help to lower your costs. Find which plans have your doctors, and compare plans and prices. You can browse health plans now.

Existing Marketplace Customers

Where can I get help?

Get free local help applying for health coverage from a certified assister or agent.

When can I buy insurance?

Recommended Reading: How To Get The Health Insurance

Confirming Your Incarceration Status

One of following documents can be used as proof that you are not currently incarcerated.

| Proof of Incarceration Status |

|

Is Annual Renewal Of Health Insurance Necessary

You probably believe you need to enroll in a new health insurance plan each year. But that might not always be the case at the time. There are some instances in which you may be able to continue your current insurance policy for longer than a year. In that case, the looming question here is how can you determine when you need to make changes to your plans? Does it make any difference if plans are changed? Perhaps even more importantly, should we change them at all?

For better understanding, lets take a closer look at the benefits and possible pitfalls of keeping your existing health insurance plan rather than switching to a new one.

For anyone wishing to enroll in an insurance offering or update their policy, thehealthcare.gov website is a valuable resource. However, it is not always simple to determine how much coverage would cost and what kind of benefits are offered at each employer, based on offerings from previous years. Please keep in mind that price levels could fluctuate. This will significantly impact the cost of monthly premiums. To get the most out of your experience with this website, updating applications every 12 months is necessary.

Recommended Reading: Who Is The Largest Health Insurance Company

Confirming Your Insurance Status

Any of the following documents that apply should be used when explaining proof of insurance.

One of the following documents can be used as proof that your employer does not provide minimal essential coverage.

| Proof that Employer Doesnt Provide Minimum Essential Coverage |

|

Do I Need These Documents To Apply For A Plan

If you arent sure what documentation you will need, dont worry. You will be asked for the type of proof at the end of your application process. You can still shop and apply for a plan without these documents. However, your enrollment in a plan wont be complete until you provide any required documents.

This is not an exhaustive list of documents that can be provided during the health insurance enrollment process.

Don’t Miss: Which State Has The Cheapest Health Insurance

What Is Aca Open Enrollment

Open enrollment underway now is the annual window during which individuals and families may sign up for ACA-compliant individual and family health insurance or make changes to their existing coverage.

Its the only time during the year other than a special enrollment period that Americans can sign up for a plan or switch to a different health plan.

What Kind Of Information Will I Need For My Application

Youll need to be able to provide some form of proof that youre a legal citizen of the United States of America. Some of the documents that youll need to have on hand include:

- A Social Security Number, if applicable

- Some form of Taxpayer Identification number

- Your green card

Even if you do have a Social Security number, you cannot be forced to show it if you do not choose to do so. If you do not have a Social Security number, but some other form of ID, your application cannot legally be halted or denied.

You May Like: Do Illegal Aliens Get Health Insurance

Missed The Apple Health Renewal Deadline

If you’ve missed the deadline to renew, but you would like to continue coverage, please contact us as soon as possible. If we find you eligible within 90 days after the date you lost coverage, we will cover you for the period you were without coverage.

The fastest way to renew your lost coverage is to go online. You may also call 1-855-923-4633.

Why Enrolling In A New Plan Is Beneficial

Admittedly, it can be troublesome to sign up for a new health insurance plan every year, but you still need to do it anyway because it has important advantages. One benefit is that this gives you the opportunity to compare rates and coverage options. In addition, it allows you to stay on top of any new health insurance regulations. This way you can be assured that you are absolutely compliant with all the requirements of the ACA.

When you sign up for a new insurance plan each year, you can reassess your coverage requirements. Your healthcare requirements will evolve in tandem with your changing life situations. Thus, it is crucial to plan accordingly. When you evaluate your health insurance policy on a regular basis, you can be confident that youre receiving the greatest available coverage for your current life situation and the present condition of your overall health.

But there are possible pitfalls also when you acquire a new health insurance.

A new health insurance plan each year has its downsides, of course. Potential interest rate hikes are one of the biggest drawbacks. As the year draws to a close, you may find yourself paying much more for health insurance than you did the year before. Furthermore, obtaining coverage at a reasonable price may be difficult if you have a pre-existing medical condition.

Also Check: Can I Upgrade My Health Insurance At Any Time

When Might You Need Private Health Insurance

There are certain occasions when you may need to have private health insurance coverage. The loss of your COBRA coverage, either through the exhaustion of benefits or if your employers stop paying the premiums, is one reason you may need individual health insurance. Getting married or gaining a dependent will also spark the need for a private policy. You may also need private health insurance coverage if youre over the age of 26 and therefore too old to remain on your parents group policy. Being self-employed or unemployed will also require that you purchase your own coverage. If youre between jobs, you may only need a short-term health insurance policy.

Confirming Eligible Medical Expenses

To receive a determination for eligible medical expenses from the past 3 months, all the following documents should be provided.

| Proof for Determination of Eligible Medical Expenses |

|

Don’t Miss: Is Platinum Health Insurance Worth It

How Do I Enroll In Medicare When I Turn 65

Medicare enrollment is managed by the Social Security Administration, and you can apply for Medicare during an initial period of seven months around your 65 birthday — the three months before your birthday month, your birthday month and the three months after.

After the initial enrollment period, you can enroll in Part A during the General Enrollment Period — Jan. 1 to March 31 — with no penalty if you qualify for premium-free coverage. If you need to pay a premium for Part A, you’ll pay a penalty for enrolling late .

If you don’t enroll in Part B during the initial period, you’ll also have to wait until that January to March General Enrollment Period, and you’ll pay a penalty that will last as long as you’re enrolled in Part B. Enrolling in Medicare during the General Enrollment Period also means that your coverage won’t start until July 1.

Americans who start receiving benefits from Social Security or the Railroad Retirement Board at least four months before turning 65 will automatically be enrolled in both Medicare Part A and Part B on the first day of the month they turn 65. If you want to delay Part B, you’ll need to contact Social Security before your coverage starts.

Is Supplemental Insurance Right For You Learn More And Get A Complimentary Quote

I would like coverage for:

MYSELF

Accident – In Idaho, Policy A37000ID. In Oklahoma, Policy A37000OK. In Virginia, Policies A371AAVA & A371BAVA.

Cancer – In Idaho, Policies B70100ID, B70200ID, B70300ID, B7010EPID, B7020EPID. In Oklahoma, Policies B70100OK, B70200OK, B70300OK, B7010EPOK, B7020EPOK. In Virginia, Policies A75100VA – A75300VA. Critical Illness – In Idaho, Policies A73100ID & A7310HID. In Oklahoma, Policies B71100OK & B7110HOK. In Virginia, Policy A73100VA. Life – In Idaho, Oklahoma, & Virginia, Policies: ICC18B60C10, ICC18B60100, ICC18B60200, ICC18B60300, & ICC18B60400. Short-Term Disability – In Idaho, Policy A57600IDR. In Oklahoma, Policies A57600OK & A57600LBOK. In Virginia, Policies A57600VA & A57600LBVA. Dental – In Idaho, Policies A82100RIDA82400RID. In Oklahoma, Policies A82100ROKA82400ROK. In Virginia, Policies A82100RVAA82400RVA.

Accident – In Idaho, Policy A37000ID. In Oklahoma, Policy A37000OK. In Virginia, Policies A371AAVA & A371BAVA.

Cancer – In Idaho, Policies B70100ID, B70200ID, B70300ID, B7010EPID, B7020EPID. In Oklahoma, Policies B70100OK, B70200OK, B70300OK, B7010EPOK, B7020EPOK. In Virginia, Policies A75100VA – A75300VA.\

Critical Illness – In Idaho, Policies A73100ID & A7310HID. In Oklahoma, Policies B71100OK & B7110HOK. In Virginia, Policy A73100VA.

Life – In Idaho, Oklahoma, & Virginia, Policies: ICC18B60C10, ICC18B60100, ICC18B60200, ICC18B60300, & ICC18B60400.

Don’t Miss: Do You Have To Have Health Insurance In Florida

How Do I Get Health Insurance If I Am Retired

If you are retired but still under the age of 65 and no longer have employment health insurance due to job loss, you can apply for coverage through the healthcare Marketplace. Losing coverage will qualify you for a special enrollment period. Based on household size and income, you may qualify for a premium tax credit and lower out-of-pocket costs.

Retirees who are 65 and older will qualify for Medicare and Medicare Advantage. You can also switch to a Marketplace plan if you have retiree health coverage but wont be eligible for the tax credits and lower out-of-pocket benefits or the special enrollment period. If you turn 65 in the middle of the year, you can apply for a Marketplace plan to cover you until Medicare begins.

If you are 65 but do not qualify for premium-free Medicare, you can buy insurance through the Marketplace and receive lower costs with tax credits.

Is A Social Security Number Required For Medical Insurance

Just the Essentials…

- A Social Security number is not required to obtain health insurance as long as certain criteria are met.

- If you do have a valid Social Security number, you will be required to show it while applying for health insurance.

- Your health insurance application cannot legally be slowed down or denied because you do not have a Social Security number.

- If you are Undocumented, you will not be able to purchase health insurance coverage through the ACA Marketplace or through state insurance exchanges.

Also Check: Is Dental And Health Insurance The Same Thing

When Is 2022 Open Enrollment For Health Insurance

Open enrollment for plans through the Affordable Care Act starts on and goes through . To get coverage starting on , you’ll need to select a plan by .

Some states have longer open enrollment periods, though this can change, so you should confirm dates with your states website. Currently, these states have longer enrollment periods, and you may notice that Rhode Islands open enrollment period is extremely long:

- California: Nov. 1 to Jan. 31

- District of Columbia: Nov. 1 to Jan. 31

- Idaho: Nov. 1 to Dec. 15

- : Nov. 1 to Dec. 15

- Massachusetts: Nov. 1 to Jan. 23

- New Jersey: Nov. 1 to Jan. 31

- New York: Nov. 1 to Jan. 31

- Rhode Island: Oct. 15 to Dec. 31, 2023

- Washington, D.C.: Nov. 1 to Jan. 31

Open enrollment for health insurance in Rhode Island runs from October 15 throughout all of 2023. Thats the longest of any state.

For other states, open enrollment starts on November 1, 2022.

A few states have shorter enrollment periods, and while things can change, youll want to be watching the calendar if you live in these two states:

- Idaho: Nov. 1 to Dec. 31, 2022

- Minnesota: Nov. 1 to Dec. 22, 2022

If A Nonworking Spouse Is Older Than You And They Meet The 40 Quarters Requirement

If your spouse is older than you, theyll qualify for Medicare benefits at age 65.

You may be able to receive Medicare benefits slightly earlier if youre at least 62 years old, married to someone who is age 65, and also worked for 40 quarters and you paid Medicare taxes.

If you dont meet these requirements, you may be able to qualify for Medicare Part A, but youll have to pay the Part A premium until youre age 62.

If you didnt work or meet the 40 quarters requirement, you may have to wait until age 65 to receive coverage under your spouses benefits.

Recommended Reading: Does Starbucks Offer Health Insurance

Do You Need Medicare If You Have Va Benefits

Are you a veteran with medical coverage through the U.S. Department of Veterans Affairs who is eligible, or nearing eligibility for Medicare coverage? If you already have medical coverage through the VA health program, you may be wondering if you also need to enroll in Medicare. The answer is that you could probably benefit from having both VA benefits and Medicare. The VA encourages you to consider enrolling in Medicare as soon as youre eligible because Medicare and VA benefits dont work together and you may have to pay a penalty if you end up enrolling in Medicare later.

VA health care benefits typically only cover services received at a VA facility, and for Medicare to cover your care, you must visit a non-VA facility that accepts your Medicare coverage. Having coverage through both the VA health program and Medicare gives you wider coverage and more choices of where you can be treated. Therefore, Medicare coverage may be particularly important if, say, you dont live near a VA facility or your local facility has long wait times. With Medicare, youre not limited to being treated at VA facilities you can visit one of the many doctors, hospitals, and facilities that accept Medicare. Follow along to learn more about Medicare and VA benefits.