How Do You Get Health Insurance In Florida

Florida residents can purchase plans from private providers or the federal exchange during open enrollment. Outside of open enrollment, you may qualify for a special enrollment period due to a qualifying life event, like getting married or losing coverage. Floridians can also enroll in short term plans without a qualifying life event for quick coverage outside of open enrollment.

You May Like: Where To Go If You Have No Health Insurance

Florida Health Insurance Overview

If youre looking for individual or family health insurance in Florida under the Affordable Care Act also known as Obamacare, youll probably have a good chance of getting government subsidies to lower your costs. You can also get low-cost or free Florida health insurance through public programs like Medicaid and the Childrens Health Insurance Program .

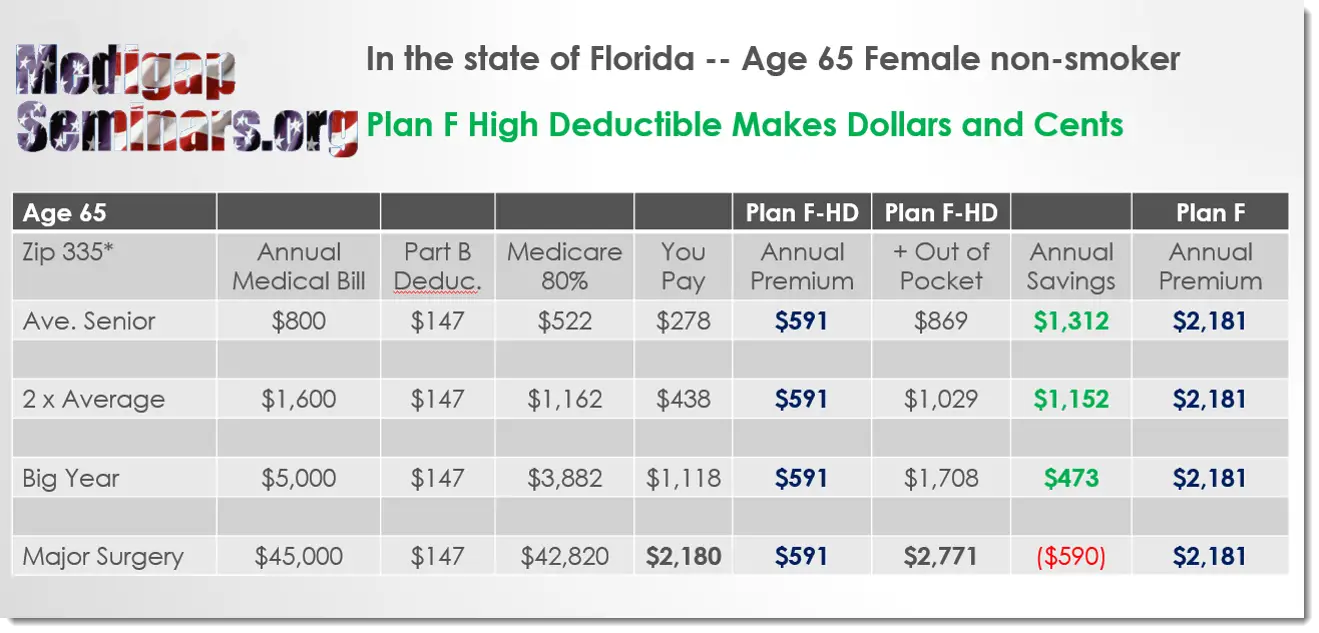

Health insurance through Medicare is also a big deal in Florida. So if youre at least 65 years old , Medicare may be a cheaper option for you.

You can review the sections below to learn different aspects of buying health insurance in Florida, such as how to enroll, average health insurance costs, and income requirements to qualify for subsidies.

Health Insurance Coverage For Multiple Years

TriTerm Medical Insurance,2 underwritten by Golden Rule Insurance Company, is short term health insurance that offers coverage for preventive care, doctor office visits, and prescriptions.

- Apply once for insurance coverage terms that equal one day less than 3 years.

- $2 million lifetime maximum benefit per covered person on most plans.

- Eligible expenses for preexisting conditions are covered after 12 months on the plan.

You May Like: Starbucks Dental Insurance

Florida Health Insurance Enrollment In The Marketplace

Florida uses the federal exchange at Healthcare.gov for Obamacare open enrollment that takes place from .

Despite opposition to the federal healthcare law by state legislators, Florida has had the highest number of sign-ups for individual Obamacare plans since 2015.

Florida saw enrollments climb from about 1.7 million in 2018 to almost 1.8 million in 2019 to more than 1.9 million in the 2020 plan year.3

The vast majority of Floridians who enroll in Marketplace coverage are under age 65, which shouldnt be a surprise given that the 65-and- older age group are better suited for Florida Medicare plans. As of 2020, total ACA enrollment for the under-65 market in Florida is nearly 1.9 million compared to nearly 36,000 for those 65 and older.4

Why Should You Think About Including Medical Payments Coverage

Medical Payments, sometimes known as MedPay, is a sort of insurance similar to PIP but without the financial benefits. Because the limitations are so low in Florida, it might be worth adding to your insurance. For our 30-year-old driver, MedPay can provide an additional $5,000 in coverage for roughly $100 per year.

Additionally, if your health insurance doesnt cover it, MedPay can assist pay for the 20% of your costs that PIP wont cover. MedPay can also help you pay down your PIP deductible.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

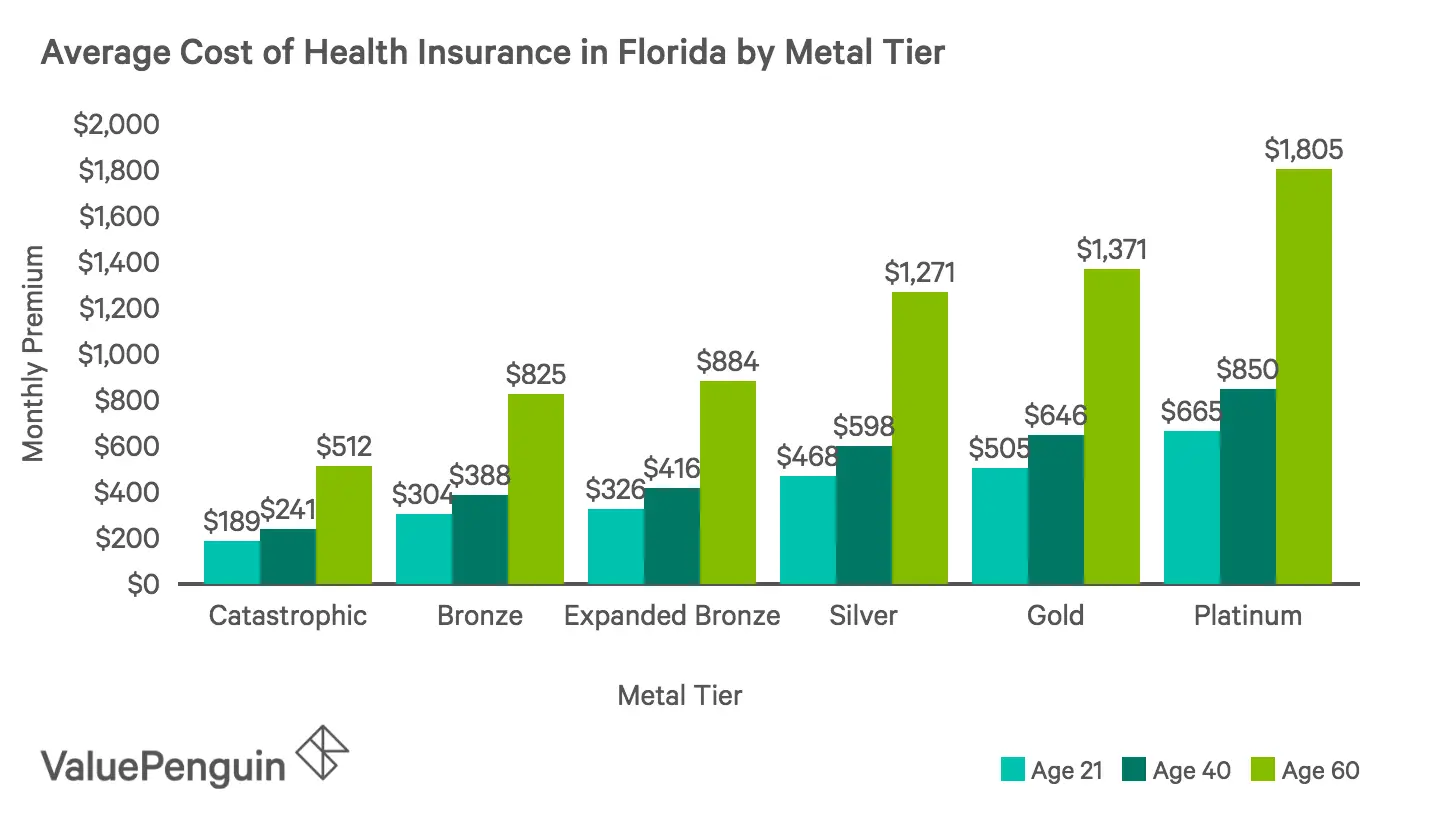

Average Health Insurance Premiums By Metal Tier

Health insurance plans are separated into different metal tiers based on the proportion of health care costs the insurance plan is expected to cover.

Catastrophic and Bronze plans cover the smallest proportion, having the highest deductibles, copays and coinsurance. On the other end of the spectrum, Platinum plans offer the greatest amount of coverage. They are expected to cover 90% of all costs.

The average rates paid for health insurance plans are inversely related to the amount of coverage they provide, with Platinum plans being the most expensive and Bronze and Catastrophic plans being the cheapest. The following table shows the average rates a 40-year-old would pay for individual health insurance based on plans in the different tiers. Older consumers would see their rates increase according to the age scale set by the federal guidelines.

| Metal tier |

|---|

Policy premiums are for a 40-year-old applicant.

Is It Cheaper To Get Health Insurance Through Employer

Workplace health insurance is usually cheaper than an individual health plan. Employer-sponsored plan premiums have increased 3% annually for single coverage plans and about 5% for family plans. Those increases are much more modest than what youll find for individual health plans most years.15 oct. 2020

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

How Do I Buy Private Health Insurance In Florida

You can purchase individual health insurance through the Health Insurance Marketplace. These are plans that meet government requirements per the Affordable Care Act. Learn more about ACA insurance options in Florida . Call 1-844-711-0168.

Health Insurance Companies In Florida

You have access to 2021 individual and family health insurance from nine companies that sell plans both on and off the exchange. You can also buy these plans if youre a self- employed entrepreneur with no employees.

Cigna left the Florida Health Insurance Marketplace to sell plans off the exchange starting in the 2016 open enrollment period 9but has returned to the Florida exchange for the 2020 plan year. Bright Health Insurance Company joins Cigna for the 2020 OEP.

Below are Florida health insurance companies offering 2021 ACA plans in the individual market:

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Which Factors Determine The Cost Of Your Snowbird Travel Insurance

The main factors that affect how much your snowbird travel insurance premiums will be are:

Additional factors that affect your snowbird travel insurance premiums include:

- Deductible Amount Generally, the higher your deductible is, the lower your premiums will be. However, be sure to exercise caution when increasing your deductible, as a small savings on your premiums can mean a big out of pocket expense if you ever need to make a claim. Keep in mind that some policies have deductibles in $USD, which can effect how much you will have to pay out of pocket when the Canadian dollar is weak.

- Policy Type The type of policy you purchase, specifically a single trip policy vs. multi-trip policy, will affect how much your premiums are. Which option ends up being less expensive will depend on your travel plans and trip duration, and we suggest comparing quotes for both options.

- Policy Features Some policies offer unique features such as reduced stability periods for pre-existing medical conditions that are not stable during the standard stability period and supplemental riders for additional benefits. You will likely pay a higher premium for these features, so only choose a policy that offers them if you feel you absolutely need them.

Average Health Insurance Cost By Age And State

Healthcare has been one of the biggest talking points in politics over the past several decades. Health costs and the ability of the average person to afford them have been at the forefront of many presidential and Congressional debates — from arguments for and against the Affordable Care Act to the rise in insurance premiums to growing support for Medicare for All plan.

Many factors determine health insurance rates and premiums and what’s offered. Individuals seeking healthcare may have options provided by an employer or may get health insurance through the ACA. Depending on a person’s income and health, he may have several options to choose from or may only be able to qualify for certain plans.

With this in mind, what does the average health insurance cost?

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

How Much Money Does It Take To Fill Up A Yacht

Annual fuel costs for a 71-meter yacht using 500 liters an hour could come in at around $400,000. The longest superyacht in the world is the Azzam, which was constructed by the German shipbuilding company Lürssen. The Azzam has an overall length of 180.65 meters and a fuel tank capacity of 1 million liters.7 nov. 2020

How To Get The Best Health Insurance

If youre looking to purchase health insurance on your own, you can just go to the websites of major health insurance companies in your area and see what plans they provide. You can compare plans on your own, although quotes will vary pretty widely.

But lets face it. This is a ton of work. Choosing the right health insurance plan for you or your family is a daunting task. And you probably have better things to do with your time than sifting through endless health insurance quotes.

Thats why I recommend using our trusted and independent insurance agents for your health insurance needs. Theyll look at your situation and compare the best rates so you can get the coverage you need. Theyll help you understand the marketplace or even what your employer is offering. And the best thing? Theyre free!

Connect with one of our insurance agents today.

About the author

George Kamel

George Kamel is a personal finance expert and host of The Fine Print Podcast. Since 2013, George has served at Ramsey Solutions where he teaches on how to spend less money, save more, and avoid consumer traps. He is also the host of The EntreLeadership Podcast.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Retiring At 62 Or Before 9 Ways To Cover Your Health Costs For An Early Retirement

There are a lot of hurdles to overcome when figuring out how to retire early before 65. However, early retirement health care is one of the most fiscally challenging. Medical care is going to be expensive no matter when you retire, but the picture is more serious for those who retire early, by choice or otherwise.

Medicare isnt available until age 65 and self-insurance in your 40s, 50s, and 60s can be prohibitively expensive. Never mind that you typically face more health challenges as you age and are therefore more likely to use health care.

Use the NewRetirement Retirement Planner to find out now if you can afford an early retirement and explore the following 9 possibilities for how to cover early retirement health care costs:

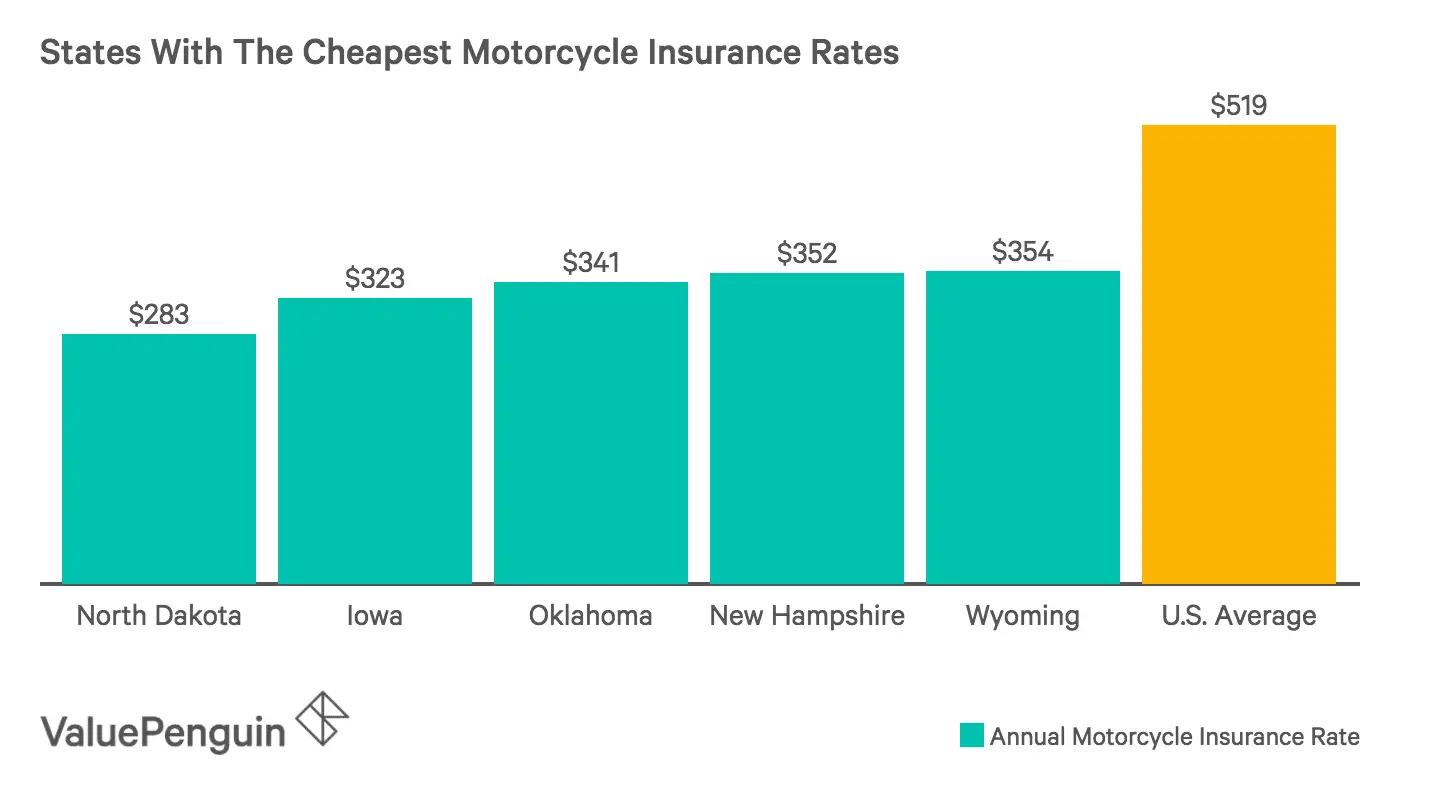

Average Health Insurance Cost By State

Residents of different states can see some pretty stark differences in the average cost of health insurance. Which states have the highest premiums, and which ones have the lowest?

Using ValuePenguin data on certain states, the state with the highest monthly rates is Alaska at $426 for a 21-year-old. Multiplying for someone who is 30, that becomes $483.51. It becomes $544.43. for a 40-year-old, and a whopping $1,156.16 for a 60-year-old. The second-highest rate is in Wyoming at $366. Doing that math again, for those who are 30, 40 and 60 that figure turns into $415.41, $467.75 and $993.32, respectively.

These are particularly extreme examples, but even states that aren’t quite as high compared to the average rates can have monthly premiums not everyone can afford. The average health insurance premium for a 21-year-old in Florida is $285 not as large as Alaska or Wyoming, but still a lot, especially as a person gets older .

Still, there are states where premiums aren’t as expensive as these. Utah, for example, has an average cost of $180. While $180 can still be quite a lot of money per month for someone working in Utah at 21 , it is still a lesser figure than other states. In Montana, the average health care premium for someone at 21 is $210 per month. Check your state for more details, because the range of premiums can vary even more wildly than you may expect. ValuePenguin’s list did not include every state, such as Massachusetts.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Plus Cigna Makes It Simple To Get The Care You Need

Access Your Benefits Anytime, Anywhere

The myCigna® website and mobile app let you easily search in-network providers, estimate out-of-pocket costs, view prescriptions, and more.4

Proactive, Personalized Support

Cigna One Guide® delivers personalized recommendations through one-on-one support and digital technology. Connect by phone, online, or via the app for guidance about your plan.

Save on Diabetes-related costs

Pay no more than $25 out-of-pocket for a 30-day supply of covered, eligible insulin. Plus, our new Diabetes Care plans offer many additional benefits with $0 out-of-pocket cost.5

Estimate Your Costs

Find out your estimated out-of-pocket costs for doctor visits, lab tests, medical treatment, and more using our online directory.

Floridas Other Exchange: 712 Customers By 2016 No Longer State

Florida Health Choices is the states own version of an online marketplace, but it does not offer any premium subsidies. While Florida Health Choices was established by 2008 legislation sponsored by Marco Rubio, who was the Florida House Speaker at that point, it faced many delays and did not go live until March 2014. The states pseudo-exchange was engaged in a legal battle with HHS over efforts to trademark Healthchoices, The Health Insurance Marketplace.

Florida Health Choices initially offered discount-only plans for some health services, such as dental services and prescription drugs. These plans were not true health insurance, and consumers largely ignored the state-sponsored exchange. Just 49 people purchased plans through Florida Health Choice during 2014 .

In early January 2015, Florida Health Choices began offering health plans that were compliant with the ACA and covered the ACA s ten essential health benefits. Policies from four insurers were available in 2015: Assurant, Cigna, Humana, and UnitedHealthCare.

For 2016, Assurant exited the health insurance market nationwide, but Cigna, Humana, and UnitedHeathcare continued to offer plans through Florida Health Choices .

The Florida Health Choices board of directors approved an $852,000 budget for 2015. Heading into the year, Naff was quoted in the Miami Herald saying, Id be tickled pink if we got 1,000 people.

Recommended Reading: Part Time Starbucks Benefits

Florida Health Insurance Exchange Links

Assists consumers who have purchased insurance on the individual market or who have insurance through an employer who only does business in Florida. / Out of State: 413-3089

Serves residents enrolled in managed care helps resolve grievance between managed care entities and their subscribers. 1-888-419-3456

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

About our health insurance quote forms and phone lines

We do not sell insurance products, but this form will connect you with partners of healthinsurance.org who do sell insurance products. You may submit your information through this form, or call to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

The mission of healthinsurance.org and its editorial team is to provide information and resources that help American consumers make informed choices about buying and keeping health coverage. We are nationally recognized experts on the Affordable Care Act and state health insurance exchanges/marketplaces. Learn more about us.

If you have questions or comments on this service, please contact us.

Economic Benefits Of Personal Injury Protection In Florida

If you are handicapped as a result of an accident, Florida PIP will cover 60% of your lost wages up to a $10,000 limit. This payout also covers services you would ordinarily supply but are unable to do so due to the accident.

This payout also covers services you would ordinarily supply but are unable to do so due to the accident. Daily duties such as laundry, house cleaning, pet care, and so on are included in these services.

Read Also: Starbucks Part Time Insurance

Average Cost Of Health Insurance In Florida For One Person

With so many different variables affecting how much medical insurance will cost an individual on a monthly or yearly basis, we are better off breaking things down instead of giving one general number.

So, what are some of the biggest factors in determining how health insurance costs can differ? Definitely, the type of health insurance plan someone has and the plans tier has to go a long way. Medical history not to mention whether the individual is a smoker can play a role in whether insurers give a higher rate. Someone in need of a family health insurance will have a higher premium than someone seeking an individual plan.

Two factors that can also play a significant role in healthcare rates and premiums are how old someone is and where they live.

Average Should Start By Browsing Silver Plans

Unless you are extremely healthy or know you will have medical expenses, we advise that you begin your buying process by looking at the Silver metal tiered health insurance policies. These are the plans that the exchange offerings are typically benchmarked off of, and they occupy a good middle ground between premiums you are guaranteed to pay and cost-sharing obligations that you will incur if you have any medical costs.

In such a case, these plans can essentially provide more benefits than higher-priced Gold and Platinum plans but at a much lower premium.

You May Like: Does Starbucks Give Health Insurance

Finding Your Best Health Insurance Coverages In Florida

Note that premiums are not the only cost component when it comes to your health care. Out-of-pocket costs in the form of deductibles, copays, and coinsurance are just as significant to compare when you shop.

The best affordable health insurance plan for you and your family will depend on your income level and expected healthcare requirements.

Families with higher expected medical costs should opt for health insurance plans with higher cost-sharing benefits, while those who expect to be relatively healthy or to require little to no routine care should look toward affordable plans.