Common Reasons For Prepaid Expenses

The two most common uses of prepaid expenses are rent and insurance.

1. Prepaid rent is rent paid in advance of the rental period. The journal entries for prepaid rent are as follows:

Initial journal entry for prepaid rent:

Adjusting journal entry as the prepaid rent expires:

2. Prepaid insurance is insurance paid in advance and that has not yet expired on the date of the balance sheetBalance SheetThe balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting..

Initial journal entry for prepaid insurance:

Adjusting journal entry as the prepaid insurance expires:

We will look at two examples of prepaid expenses:

Example #1

Company A signs a one-year lease on a warehouse for $10,000 a month. The landlord requires that Company A pays the annual amount upfront at the beginning of the year.

The initial journal entryJournal Entries GuideJournal Entries are the building blocks of accounting, from reporting to auditing journal entries for Company A would be as follows:

At the end of one month, Company A wouldve used up one month of its lease agreement. Therefore, prepaid rent must be adjusted:

Note: One month corresponds to $10,000 in rent.

The adjusting journal entry is done each month, and at the end of the year, when the lease agreement has no future economic benefits, the prepaid rent balance would be 0.

Example #2

The initial journal entry for Company A would be as follows:

Its All About You We Want To Help You Make The Right Coverage Choices

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships dont influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

- You have to pay car insurance upfront

- There are many car insurance payment options for insurance policies

- An extra car insurance deposit may be required to start your policy

- If you pay for car insurance a year in advance, you may save $50 to $100 a year

- In the event of a policy cancellation, you will receive a refund

Is car insurance prepaid? How often do you pay car insurance premiums? In order to start a car insurance policy, a car insurance company must collect a premium. This is to ensure that your policy is up to date.

It is also so that in the event of a car insurance claim, the insurance company has some reserve from your payments to help with sharing the cost of the claim.

Q2 Is There An Open Season For Advance Monthly Payments Of The Health Coverage Tax Credit Program Enrollment

A2. No. While there is no open season for AMP HCTC program enrollment and registration with the IRS you must be enrolled in qualified health insurance coverage to receive the benefit of an AMP. In addition, your Health Plan Administrator must be registered and follow certain requirements to receive the monthly payments. Contact your provider directly for more information.

Also Check: Can You Get Supplemental Health Insurance Anytime

Q16 What Else Should I Know About Form 13973 Health Coverage Tax Credit Blank Payment Coupon Pdf

A16. Please download, complete, and print the HCTC payment coupon and include the bottom portion of the HCTC payment coupon with your payment when you make your HCTC payment. Failure to provide all required information could delay processing of your payment or the return of your payment if after research, the IRS cannot verify payment posting.

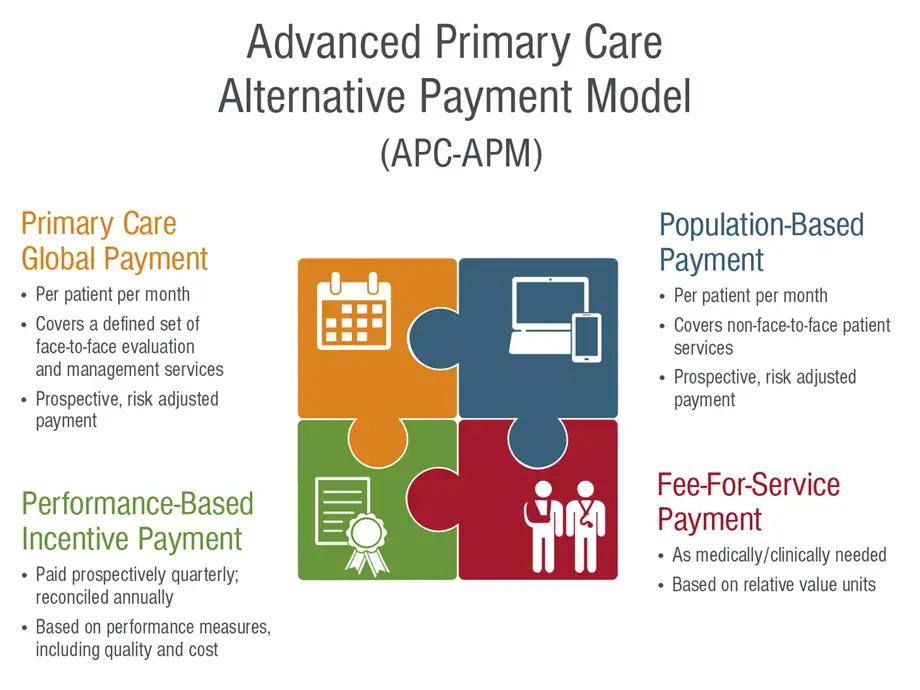

What Is The Small Business Health Care Tax Credit

If you own a small business, then you may qualify for a tax credit that subsidizes the health insurance premiums you pay for your employees.

Usually, small business owners are not required to offer health insurance if they have fewer than 50 full-time employees. Therefore, the small business health care tax credit, which was created under the ACA, encouraged small business owners to offer health insurance to their employees.

You and your business would be eligible for the credit if you:

- Purchased insurance through the Small Business Health Options Program marketplace.

- Have fewer than 25 full-time employees.

- Pay average wages of less than $50,000 per year.

- Pay at least half of all employees’ health insurance premiums.

If you qualify, the federal government would give you a subsidy to help pay for your portion of employee premiums. The size of your business and number of employees that you have would determine the amount of the credit you can receive. For example, if your business had fewer than 10 full-time employees, you can receive the maximum credit possible. A larger business with 25 employees would qualify for a lower tax credit.

You May Like: How To Stop Health Insurance

How To Calculate The Advance Premium Tax Credit

The amount of the credit is typically equal to the premium for the second-lowest-cost silver plan available through the health insurance marketplace minus a certain percentage of your household income.

“It’s the difference between the second-lowest silver plan and the highest amount that your state has reasoned to be affordable as a monthly health insurance premium,” notes Adam Garcia, a personal finance and investing expert and founder of TheStorkDork.com. “This is also known as the premium cap.”

Here’s an example:

- Let’s say a person makes $25,000 a year.

- He expects to pay 10% of his income to health insurance premiums.

- His benchmark plan is $5,000.

- In this case, the person would be eligible for a $2,500 credit, which you get by subtracting the benchmark plan with the percentage of income expected to get paid on health insurance premiums.

Be aware that the advance premium tax credit cant be more than the cost of the premium for the marketplace plan.

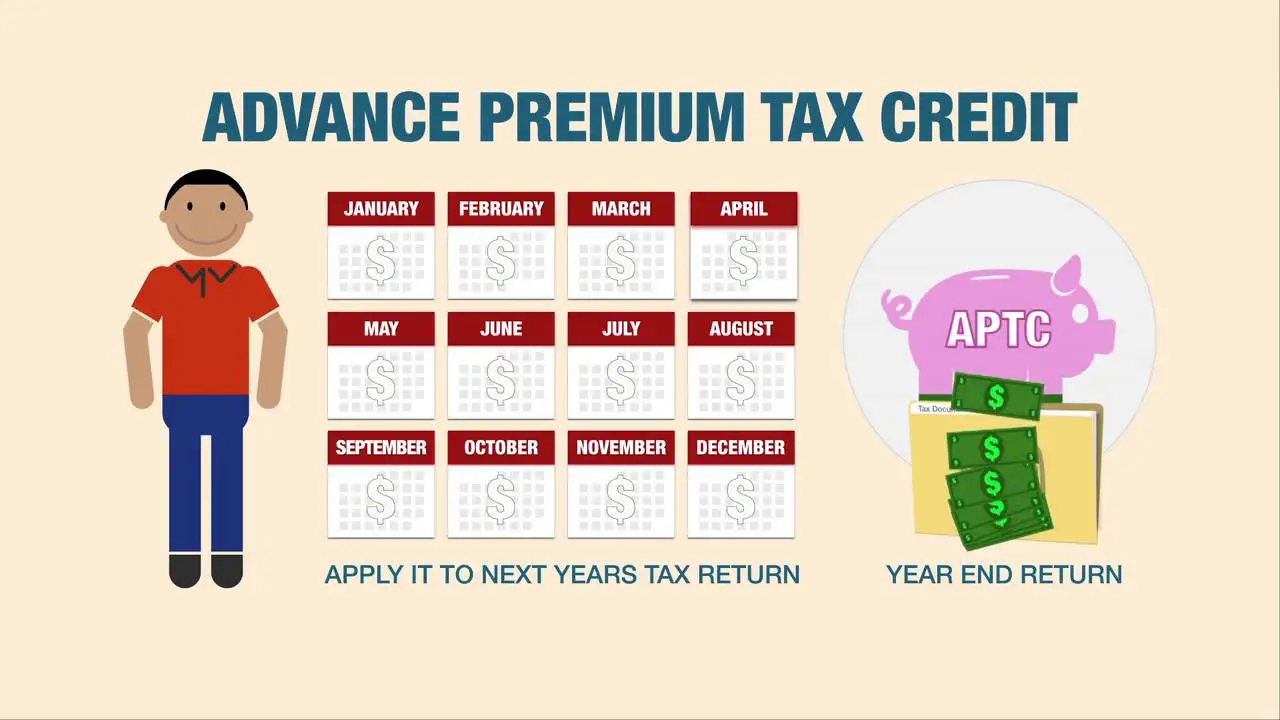

About Private Insurance Tax Credit

Advance Payment of Premium Tax Credit was created under the Affordable Care Act to assist taxpayers with insurance premiums, and provides financial assistance to ensure individuals have access to health coverage. Consumers may shop for a qualified health plan using their tax credit. The APTC or tax credit is paid monthly to their health insurance provider to assist with monthly premium costs.

APTC can only be used with qualifying health insurance plans purchased through Your Health Idaho , Idaho’s Health Insurance Exchange. The amount of the tax credit is based on the individuals estimated modified adjusted gross income for the year. When tax filers file their income taxes, a reconciliation takes place based on the actual income that is reported for their household. Visit the apply page for eligibility requirements.

Your Health Idaho is the only place where Idahoans can receive a tax credit to help offset the monthly cost of health insurance coverage. Some Idahoans may also qualify for cost-sharing reductions, which lower out-of-pocket costs for things like co-payments and prescriptions.

If you need help along the way, certified agents, brokers, and enrollment counselors are available to help you free of charge. Find free help in your area.

To provide you with the best service, your determination and management of benefits will depend on which benefits you receive.

Also Check: How Much Does Usps Health Insurance Cost

Decide If You Need Health Insurance

Have a think about whether you actually need either hospital insurance or extras.

Hospital cover

You may decide you want private hospital insurance because it could save you money at tax time.

Take our Do I Need Health Insurance? quiz to find out if hospital insurance will save you money at tax time, and how the lifetime health cover loading affects you.

If you don’t need health insurance for tax reasons you might still want it for peace of mind. Here is what you should consider:

- Are you happy to rely on Medicare and public hospitals that provide excellent care, especially for life-threatening illnesses and emergencies?

- Do you want to use a potentially more comfortable private hospital?

- Is it important for you to choose your own doctor? For example, you might want to choose a plastic rather than a general surgeon for reconstructive surgery after cancer or a burn.

Do you pay too much for extras cover? Should you consider downgrading or dropping it altogether?

According to , the average annual extras premium per person is about $500 but the average annual benefit is $390, so many people spend more on extras than they get back. In 2020, benefits were lower than usual because of restrictions on services due to COVID-19, making it more important than ever to check whether you’re getting value from your extras cover.

A lot of people spend more on extras than they get back from their health fund

What If You Received Excess Advance Payments

You must pay the excess amount back as an additional tax if your advance payments are more than your Premium Tax Credit, but the amount might be limited. Your repayment is based on your household income above a certain threshold that correlates with the percentage of the federal poverty line that your family income falls within.

Your household income as a percentage of the federal poverty line is calculated and entered on Line 5 of Form 8962, and yes, it comes with instructions.

Also Check: Can I Have Dental Insurance Without Health Insurance

What If You Dont File A Tax Return

You need to file a tax return to claim the advance premium tax credit. Even if you otherwise wouldnât have to file a return, you need to file one every year for the APTC. If you ever claim the credit but donât file a tax return, you will be ineligible to receive the APTC in the future. That means youâll have to pay full price for premiums in the future.

Federal Health Insurance Credits

Any Excess Advance Premium Tax Credit repayment from the 2018 federal form 1040, Schedule 2, line 46 will be entered on line 18 of the IA 1040 in the year paid. Any repayment calculated on your 2018 federal return cannot be included on line 18 of the 2018 IA 1040, but will be entered on line 18 of the 2019 IA 1040.

The Net Premium Tax Credit from the 2018 federal form 1040, Schedule 5, line 70, and the Health Coverage Tax Credit from the 2018 federal form 1040, Schedule 5, line 74c will be reported as Other Income on line 14 of the 2019 IA 1040. The federal Net Premium Tax Credit and the federal Health Coverage Tax Credit are reportable income to the extent these credits were a reimbursement for health insurance premiums deducted from Iowa income in a prior year.

The Iowa 1040 departs from the federal 1040 in the treatment of health insurance premiums by allowing taxpayers to elect to deduct qualifying health insurance premiums as an adjustment to Iowa gross income. The Iowa return allows a deduction for certain health insurance premiums on line 18 of the IA 1040, rather than reporting those same premiums as a medical expense deduction on the IA 1040 Schedule A for Iowa Itemized Deductions.

If the deduction is taken on the IA 1040 Schedule A, then the federal tax guidance should be followed when addressing the complications due to the impact of the Federal Excess Advance Premium Tax Credit repayment, the Net Premium Tax Credit, and the Health Coverage Tax Credit.

Recommended Reading: How To Cancel Oscar Health Insurance

Keep Your Budget In Mind While Purchasing A Health Insurance Plan:

When you buy a medical insurance plan, the first thing to assess is your familys health insurance requirements and then checking a policy that meets those requirements and is a clear policy with the least capping and sub-limits. However, it also merits attention to check the amount of premium you will need to pay year after year. If youre considering a policy with all its bells and whistles, and costs you upwards of Rs. 25,000, and the fact that you get an intuition at the time of purchase itself that you might not be able to afford the regular annual premiums, it does not make sense to enter into such a commitment at all.

Instead, you can explore options like a basic and straightforward policy with bare minimum features, have some deductible also that can further reduce the premium. There are also options like buying only a super-top up cover if you already are covered under a group policy by employer etc. Later on, when your income levels rise, and youre able to afford the higher premium, you can buy more exotic policies or increase sum insured in existing policies to take care of higher sum insured requirement. The Underlying point is that when you purchase a policy, you should be comfortable in paying the premium every year and it should not become an unnecessary burden on you.

Q6 How Do I Enroll In The Advance Monthly Payment Program

A6. Enroll using Form 13441-A, HCTC Monthly Registration and Update. You must complete and mail Form 13441-A, HCTC Monthly Registration and Update PDF, with all required supporting health plan documents to the IRS to enroll. An incomplete form or missing documents will delay the processing of your registration. Keep a copy of the completed HCTC Monthly Registration and Update form and all required documents for your records.

Also Check: Will My Health Insurance Pay For An Auto Accident

What Is A Health Insurance Tax Credit

A health insurance tax credit, also known as the premium tax credit, lowers the cost of your health insurance. This discount can be applied every month, or you can receive the credit as a refund on your federal income taxes.

The credit, implemented under the Affordable Care Act , is designed to help eligible families or individuals with low to moderate incomes pay for health insurance. Premium tax credits are only available if you enroll in a qualifying insurance plan through the federal marketplace or a state marketplace. A key exclusion is that those who sign up for Catastrophic coverage do not qualify for health insurance tax credits.

Tax credit amounts do not vary by state. For example, you would receive the same tax credits in New York as you would in Arizona.

Q7 What Else Do I Need To Send To The Irs With My Form 13441

A7. You must provide required supporting health plan documents with your registration. You must include a copy of your health insurance bill dated within the last 60 days that includes:

- Your name

- Health Plan Administrator name and phone number

- Health plan identification numbers

- Address for mailing your payments

Read Also: How To Apply For Health Insurance In Texas

Q15 What Methods Of Payments Are Accepted

A15. The AMP HCTC Program accepts the following payment methods by mail: personal check, business check, certified check, cashier’s check, and money order. Make your payment payable to US Treasury HCTC. Write your HCTC Participant Identification Number on your payment and on your Form 13973, Health Coverage Tax Credit Blank Payment Coupon PDF.

Advance Payments Of The Premium Tax Credit

The Health Insurance Marketplace estimates your Premium Tax Credit when you enroll in a health insurance plan based on estimates of your household income for the year. The actual amount of your credit cant be calculated until you actually submit your income information on your tax return, along with the amount of health insurance premiums you received as they’re reported to you and the IRS on Form 1095-A.

Recommended Reading: How To Be A Health Insurance Agent

Filing A Federal Tax Return To Claim And Reconcile The Credit For Tax Years Other Than 2020

For tax years other than 2020, if you or someone in your family received advance payments of the premium tax credit through the Health Insurance Marketplace, you must complete Form 8962, Premium Tax Credit PDF and attach it to your return. You will receive Form 1095-A, Health Insurance Marketplace Statement, which provides you with information about your health care coverage. Use the information from Form 1095-A to complete Form 8962 to reconcile advance payments of the premium tax credit on your tax return. Filing your return without reconciling your advance payments will delay your refund. You must file an income tax return for this purpose even if you are not otherwise required to do so.

If you choose not to get advance credit payments, you can claim the full amount of the premium tax credit that you are allowed when you file your tax return. This will increase your refund or lower the amount of tax you owe.

For tax years other than 2020, you must file if:

- You are claiming the premium tax credit.

- Advance credit payments were paid to your health insurer for you or someone else in your tax family. For purposes of the premium tax credit, your tax family is every individual you claim on your tax return yourself, your spouse if filing jointly, and your dependents.

- You told the Marketplace that you would claim an exemption for someone on your tax return who was benefitting from advance credit payments, however, no one ended up claiming that individual.

Is Prepaid Insurance A Current Asset

In most cases, prepaid insurance is listed as an asset on the insurance companys balance sheet. The amount that is recorded will then drop by a certain amount each month until the asset has expired. Then another payment must be made in order to keep the coverage in force. This process will repeat itself over and over for as long as the insured maintains coverage with the insurer.

Recommended Reading: How Do You Get A Tax Credit For Health Insurance