How Much Does Private Health Insurance Cost In Ontario

Our experts were quoted $168.26 per month with Blue Cross for a 41-year old with no pre-existing conditions for full comprehensive hospital, dental and prescription drug coverage. Cost varies depending on the level of coverage you choose.

Other factors that may affect premiums would include:

- Age

Donât Miss: What Is Evolve Health Insurance

How Much Does Dental/vision Care Visit Cost With Health Insurance

Dental insurance is separate from traditional health insurance and comes with its own premium. The average is between $15 and $50 per month and this typically covers two annual cleanings and exams and one set of X-rays without a copay.

Should you need a filling or work done, a portion of the treatment is covered by insurance and you will have to pay the remaining costs. Insurance typically covers 50% to 70% of the costs. Cavity fillings can cost between $150 to $2,600 so you could pay $75 to $1,300 out of pocket.

Cosmetic work is not covered with dental insurance so any teeth whitening, veneers, and the like will be out of pocket and can climb into the thousands.

For vision care, an eye exam may be included once a year in your coverage plan with discounted pricing on glasses and contacts. You may find glasses covered with out-of-pocket ranges from $50 to $120. Contacts can range from $150 to $1,500 annually, with or without insurance. The good news is vision premiums are extremely low. Youll only pay $5 to $15 per month.

Can You Ask For More Money If You Dont Need Insurance

You can always ask for more, but the company usually is plan-obligated to allow you adjustments should you lose coverage or have a major life event down the road. In that case, the company would see this as they shouldnt have A small company will definitely agree to giving you a raise instead of paying a benefit.

Also Check: How Much Does Private Health Insurance Cost In California

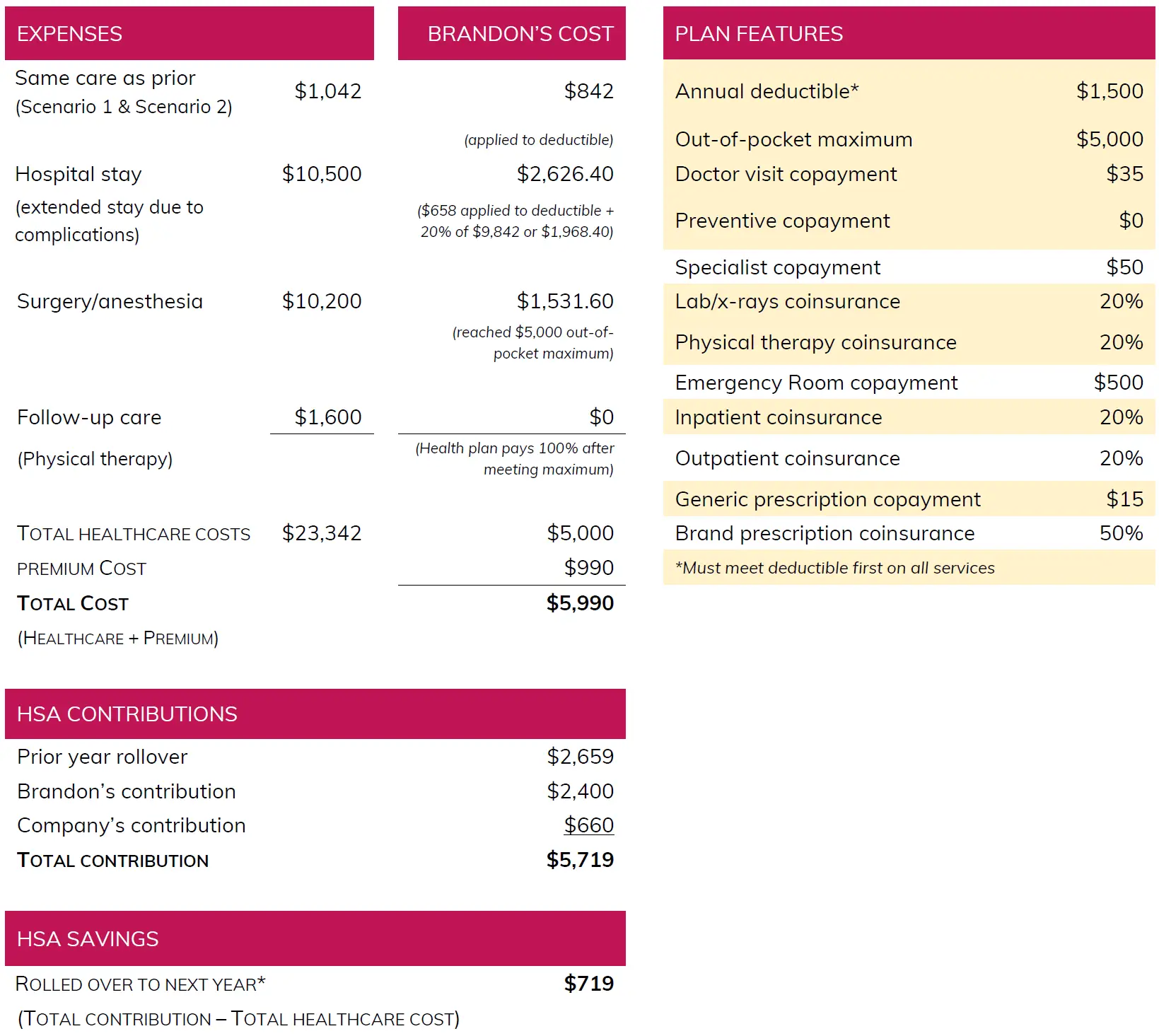

Deductibles Copays And Coinsurance

Premiums are set fees that must be paid monthly. If your premiums are up to date, you are insured. The fact that you are insured, however, does not necessarily mean that all your healthcare expenses are paid for by your insurance plan.

Deductibles, co-payments, and coinsurance are applied toward a patients annual out-of-pocket maximum. The yearly out-of-pocket maximum is the highest total amount a health insurance company requires a patient to pay themselves towards the overall cost of their health care .

Once a patients deductibles, copayments, and coinsurance paid for a particular year add up to the out-of-pocket maximum, the patients cost-sharing requirements are then finished for that particular year. Following the fulfillment of the out-of-pocket maximum, the health plan then picks up all of the cost of covered in-network care for the remainder of the year .

So if your health plan has 80/20 coinsurance , that doesn’t mean that you pay 20% of the total charges you incur. It means you pay 20% until you hit your out-of-pocket maximum, and then your insurance will start to pay 100% of covered charges. However, premiums must continue to be paid, every month, in order to maintain coverage.

Ask A Health Insurance Broker

B-Protected is an independent insurance broker in Berlin. Daniel will answer your questions within one business day. This is a free service.

Thank you! We sent your request to B-Protected.

A broker from B-Protected will contact you soon. They will ask you more questions about your situation, and help you choose the best health insurance.

They will also help you get the documents you need for your employer, or for your visa application.

Use Tarifcheck to compare private health insurance prices. Tarifcheck does not help you pick the best insurance. It only shows you the prices. It’s always better to talk to a broker.

Ottonova is popular option with expats, because they offer support in English, but they are not perfect.

Feather also offers private health insurance. They helped me get private health insurance, and I trust them. They are a health insurance broker, not a health insurer. This means that they sell insurance from different companies. They speak English. Their insurance works for residence permit applications.

Useful links:

- Private health insurance comparator – Tarifcheck

You May Like: Does Health Insurance Cover Hair Transplant

How Much Does Managing Chronic Illnesses Cost With Health Insurance

The Centers for Disease Control foundchronic and mental health conditions take up 90% of healthcare spending. For example, the American Diabetes Association finds the medical costs for a person with diabetes is $16,752 2.3 times higher than the expenses of a person without diabetes.

Having insurance doesnt mean cut-and-dry coverage, however. Insurance companies vary greatly in how much they will cover for a chronic illness and while you may only need to pay a copay for doctors visits, different lab work, testing, medications, and more means shelling out more dough financially.

Chronic conditions may be subject to government insurance under Medicare, with premiums up to $458 per month for Part A, which doesnt cover medications. For drugs, you will also need Medicare Part D, which averages $30 per month.

Millions Still Cant Afford Healthcare

Fast forward to today. Millions of people are still uninsured, even though there are subsidies provided by those who make more. . Whats going on? Healthcare affordability is an important issue for all Americans.

Nearly 65 percent of uninsured adults who were aware of Obamacare marketplaces said they had not visited one to seek coverage because they didnt think they would be able to afford it according to The Commonwealth Fund, a private organization aimed to promote a high performing healthcare system.

Further, 85 percent of uninsured adults who actually shopped for coverage said they didnt enroll in the end because they couldnt find an affordable plan.

Check out this chart explaining why there are still ~25+ million uninsured people in America.

Nobody really believed that all 47 million uninsured people would suddenly get health insurance under Obamacare, despite the subsidies and penalties. But the fact that five years has gone by and 60% of those who were uninsured are still uninsured seems like another example of incredible government inefficiency.

Yes, 20 million more people now have health insurance is progress. But what has been the cost?

Recommended Reading: Can I Have Two Health Insurance

Sample Premium For Critical Illness Insurance

A 30-year-old male can expect to pay about $20 to $80 per month for a stand-alone standard critical illness plan, offering a single payout of $200,000 upon late-stage diagnosis.

But this can vary greatly depending on the type of plan and coverage, so dont forget to compare among a few insurers before you commit.

How Much Does Private Health Insurance Cost

It depends on the coverage you choose, and your age and health when you join. If you are healthy, and you make a lot of money, private insurance can be much cheaper than public insurance, because it’s not a percentage of your income. If you choose a higher deductible , or worse coverage, it gets even cheaper1.

Your employer pays half of your health insurance. If you are self-employed, you pay the full price yourself1. This is why health insurance is so expensive for freelancers.

With private health insurance, there is no nursing care insurance surcharge. It’s included in the price of your insurance.

Useful links:

- Price comparison tool – Tarifcheck

Recommended Reading: Can You Add Your Mom To Your Health Insurance

Is $200 A Month A Good Estimate For My Car Insurance

Is $200 a month a good estimate for my car insurance?

I own a hyundai accent, paying 90 for liability only. I am going to add my new mazda rx-8 to my insurance, but w/ full coverage. I am 19/female. Im thinking itll be about $200 a month total for both cars. Sound about right?

Answer : I would recommend you to try this site where one can compare from different companies: .

Related :

I own a hyundai accent, paying 90 for liability only. I am going to add my new mazda rx-8 to my insurance, but w/ full coverage. I am 19/female. Im thinking itll be about $200 a month total for both cars. Sound about right?

I own a hyundai accent, paying 90 for liability only. I am going to add my new mazda rx-8 to my insurance, but w/ full coverage. I am 19/female. Im thinking itll be about $200 a month total for both cars. Sound about right?

I own a hyundai accent, paying 90 for liability only. I am going to add my new mazda rx-8 to my insurance, but w/ full coverage. I am 19/female. Im thinking itll be about $200 a month total for both cars. Sound about right?

I own a hyundai accent, paying 90 for liability only. I am going to add my new mazda rx-8 to my insurance, but w/ full coverage. I am 19/female. Im thinking itll be about $200 a month total for both cars. Sound about right?

What Happens If I Meet My Out

Even if you reach your out-of-pocket maximum, youll still have to continue paying the monthly cost of your health plan to continue receiving coverage. Services received from out-of-network providers also dont count toward the out-of-pocket maximum, nor do some non-covered treatments and medications.

You May Like: What Is The Fee For Not Having Health Insurance

How Much Does Health Insurance Cost In The Us

The annual cost of health insurance for the average American is $3,414 per year, according to Bureau of Labor Statistics data from 2017. This equates to around $285 per month.

However, healthcare costs can vary quite significantly between states.

In a 2019 survey by the Kaiser Family Foundation , which analysed insurers across the country using a benchmark plan, they found that some Americans pay a lot more than others for ultimately the same thing.

That may still be better than being surprised by a hefty hospital bill though, especially considering that 12% of health expenditure in the US is paid out of pocket, according to Statista.

How Much Does Dental/vision Care Visit Cost Without Health Insurance

40% of the population does not have dental coverage. This means they pay $50 to $350 for an office visit, with cleanings ranging from $70 to $200, X-rays between $20 and $250 and the dental exam costing $50 to $150.

If something goes wrong, such as a cavity must be filled, you need a root canal, or your wisdom teeth need to be extracted, the costs are high. To fill a cavity can cost up to $450 while a crown could take the price all the way to $3,000. If your wisdom teeth are impacted and you require surgery the cost is also as high as $3,000.

Without vision care, seeing anophthalmologist can cost between $50 and $100 for an eye exam. Glasses including frames and lenses average $351 without insurance. Contacts can range from $150 to $1,500 annually, with or without insurance.

Read more: Is Dental Insurance Worth It?

Also Check: How To Get Gap Health Insurance

How To Estimate Your Yearly Total Costs Of Care

In order to pick a plan based on your total costs of care, youll need to estimate the medical services youll use for the year ahead. Of course its impossible to predict the exact amount. So think about how much care you usually use, or are likely to use.

- Before you compare plans when youre logged in to HealthCare.gov or preview plans and prices before you log in, you can choose each family members expected medical use as low, medium, or high.

- When you view plans, youll see an estimate of your total costs including monthly premiums and all out-of-pocket costs based on your households expected use of care.

- Your actual expenses will vary, but the estimate is useful for comparing plans total impact on your household budget.

International Health Insurance For Us Citizens Living Abroad Whats Covered

How much youll pay for health insurance isnt a number you can guess. Its affected by many factors, few of which you control.

With William Russell, international health insurance can cover US citizens for:

- Doctor visits, consultations, hospital care and mental health treatment in multiple overseas territories .

- Up to $100,000 for unexpected elective medical care and $250,000 in emergency treatment costs during short visits back to US soil, for reassurance when you visit family or head home for the holidays .

Also Check: When Do I Have To Offer Health Insurance

Compared To Public And Private Health Insurance

- It’s not accepted when you renew a residence permitExpat insurance is rarely accepted when you renew a residence permit, or when you apply for a different residence permit1. You must have real public or private health insurance.

- It can expire after 5 yearsSome expat insurances are only valid for 5 years1. Many freelancers stay on expat insurance for too long. When they need to switch to public or private insurance, no insurer wants to cover them. They can’t get health insurance, or the only options are very expensive1. If you settle in Germany, switch to real health insurance as soon as possible.

- It’s very expensive when you are oldHealth insurance gets more expensive every year. Compared to public or private health insurance, the cost of expat insurance rises really quickly1. If your expat insurance does not expire, it can become really expensive when you are old.

- The coverage is not as goodYou usually pay a deductible for basic treatments. Simple check-ups and dentist visits are rarely covered. Long term treatments are 100% covered, without any deductible.

Useful links:

- Feather expat insurance – from 72 per month, valid for residence permit applications1

- Ottonova expat insurance – from 155 per month, valid for residence permit applications

What Doesnt Impact Your Life Insurance Premium

These factors have no effect on the rate youre offered:

-

Your ethnicity, race and sexual orientation. While insurers assess your age and gender, they cant discriminate based on these elements of diversity.

-

Your credit score. Although your credit score wont affect your life insurance premium, you can expect your insurer to look at your credit history going back seven years. If you have a bankruptcy on your record, you might be deemed to have a higher risk of mortality, which may affect premiums.

-

Your marital status. Unlike many auto insurance companies, life insurers dont have different rates for married applicants.

-

The number of life insurance policies you have. Just know that you need to justify purchasing large amounts of coverage across multiple policies.

-

The number of beneficiaries you name. Whether you have one life insurance beneficiary or five, this wont impact your rate.

Also Check: Do I Need Health Insurance To See A Doctor

How Much Does Health Insurance Cost Average Health Insurance Costs By Us State

Health insurance costs vary a lot between states. According to a 2019 report by the Commonwealth Fund:

- Hawaii has the cheapest individual health insurance contributions of any US state, at $755 annually.

- Texas, Tennessee, South Carolina and Michigan all see personal health insurance costs close to the US national average $1,427.

- Massachusetts was the most expensive state for health insurance. Here, individual contributions stood at $1,903.

How Do Copayments And Coinsurance Work

After youve met your deductible depending on the type of plan you have you may pay a coinsurance for some services. Your coinsurance is a percentage you pay after meeting your deductible. Some of the most common percentage breakdowns are 80/20 and 90/10.

Your copayment, or copay, is different. Its a fixed amount you pay for a covered service. Its common to have separate copay rates for different types of care. For example, a visit to your primary care doctor may have a different copay than a visit to a specialist, like a dermatologist. You may also pay a copay for prescriptions. Youll often pay your copay during the time of service.

Also Check: Does Amazon Offer Health Insurance

Understanding Health Insurance Monthly Premiums

- https://www.verywellhealth.com/health-insurance-premiums-1738769

- After much research, you eventually end up selecting a particular plan that costs $400 per month. That $400 monthly fee is your health insurance premium. In order for all of your healthcare benefits to remain active, the health insurance premium must be paid in full every month. If you are paying your premium on your own, your monthly bill will …

Understanding Health Insurance Premium Increases

- https://www.verywellhealth.com/health-insurance-premium-increase-2615099

- Health insurance premiums go up with inflation, but they also regularly increase out of proportion to inflation. This is due to a number of factors. New, sophisticated, and costly technology helps in the diagnosis and treatment of health conditions, while specialized medications can prolong lives from diseases like cancer.

Also Check: When Do You Pay Deductible For Health Insurance

Can You Buy Health Insurance Without A Job

The good news is you can get health insurance without a job. While group health insurance is not an option for those without an employer, you can still qualify for individual or family plans. Individual health insurance offers all the same coverage options as you may find from employer-sponsored plans.

How To Lower Term Insurance Premiums

The best way to keep costs down is to buy term life insurance as early as possible. Since the premiums are calculated based on age, buying early means you can lock down a cheap rate for the entire term.

Dont forget to comparison-shop if you dont have an insurance policy already! You can get free term insurance quotes and comparison across multiple insurers on MoneySmart.

To keep your long-term costs down, try to avoid signing up for a term thats too short for your needs. That can save you from higher premiums come renewal time.

If you are just looking for basic life insurance coverage, consider buying direct purchase life insurance, which is cheaper and can be purchased without having to first speak to an agent. You can learn more about direct purchase insurance here.

Read Also: Where To Find Individual Health Insurance