How Are Subsidies Calculated

The government determines subsidies based on your adjusted gross income , family size and directly.8 Your AGI is your gross income minus specific deductions, such as the student loan interest tax deduction and deductions for IRA contributions you may have made over the year.9

For example, if you live in Pennsylvania, are married, have no children, and have a household income of $30,000 per year, you earn 177% of the FPL. At that level, you would be eligible for subsidies. You could get up to $344 in financial assistance per month as a premium tax credit, which would cover 72% of your cost.10

By Hal LevyHealthcare Writer

How do you get help paying for health insurance and health coverage? It depends on how much you earn. In 2022, youre eligible for Obamacare subsidies if the cost of the benchmark plan costs more than a given percent of your income, up to a maximum of 8.5%. The cut-off threshold increases on a sliding scale depending on your income. The discount on your monthly health insurance payment is also known as a Premium Tax Credit , also known as an Advance Premium Tax Credit .

2022 health plans are measured against your projected income for 2022 and the benchmark plan cost. You qualify for subsidies if you pay more than 8.5% of your household income toward health insurance.

The Health Insurance Marketplace

If you don’t have health insurance through a job, Medicare, Medicaid, the Childrens Health Insurance Program , or another source, you can buy a plan on the Health Insurance Marketplace.

To be eligible to enroll in health coverage through the Marketplace, you:

- Must live in the United States

- Must be a U.S. citizen or national

- Must not be incarcerated

If you have Medicare coverage, youre not eligible to use the Marketplace to buy a health or dental plan.

The Marketplace was created as part of the Affordable Care Act of 2010, colloquially known as Obamacare. Most people can use the federal government’s marketplace to apply for and to enroll in health insurance, but 17 states, plus Washington D.C., have set up their own exchanges.

You’ll use a state health marketplace to enroll if you live in:

- California

- Obesity screening

Whos Eligible For Medicaid For The Aged Blind And Disabled In Connecticut

Medicare provides coverage for physician visits, hospital care, skilled nursing care, and more. However, enrollees can face large out-of-pocket expenses , and dont receive coverage for vision or dental care. Some beneficiaries those whose incomes make them eligible for Medicaid can receive coverage for cost sharing and services Medicare doesnt pay for if theyre enrolled in Medicaid benefits for the aged, blind and disabled .

In Connecticut, Medicaid covers up to $1,000 in dental care each year for enrollees who are 21 or older. Medicaid also pays for eye exams from ophthalmologists, optometrists, or opticians, and will cover one pair of eyeglasses every two years.

Medicaid is called HUSKY Health in Connecticut.

Income eligibility: The income limits vary by region.

- Southwestern Connecticut the income limit is $984.49 a month if single and $1,507.09 a month if married.

- Northern, Eastern, and Western Connecticut the income limit is $874.38 a month if single and $1398.41 a month if married.

These income limits are adjusted to reflect that Connecticut doesnt count an individuals first $351 each month in unearned income .

Asset limits: The asset limit is $1,600 if single and $2,400 if married.

This website contains more information about Medicaid benefits in Connecticut.

Medicaid spend-down for regular Medicaid for the aged, blind and disabled and LTSS in Connecticut

Enrollees must satisfy the same asset test as other Medicaid ABD enrollees.

Read Also: What Is Forward Health Insurance

Who Pays For Coverage

When you have employer-sponsored health insurance, your employer usually pays part of the monthly premiums and you pay part of the monthly premiums.

In most cases, your employer will pay most of the cost, though it varies. Your share of the premiums gets taken out of your paycheck automatically. That means you dont have to remember to pay the bill each month.

The payroll deduction is usually made before your income taxes are calculated. That means youre don’t have to pay income taxes on the money that you spent on health insurance premiums.

With job-based health insurance, your employer usually doesn’t help you pay cost-sharing expenses like deductibles, copays, and coinsurance.

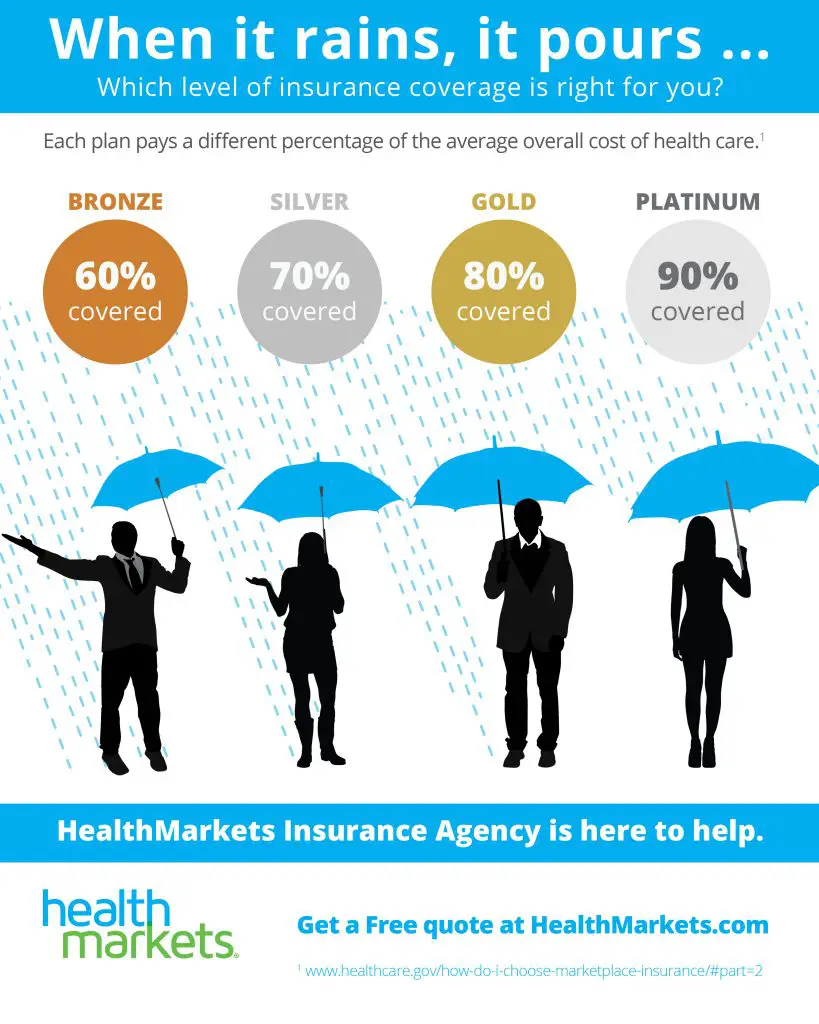

A Review Of The Metal Tiers

As a quick review, health care plans available through a health insurance marketplace are categorized into four levels, each of which is named after a metal: Bronze, Silver, Gold, Platinum. Bronze plans usually have the lowest premiums, followed by Silver plans.

The level of the plan is unrelated to the quality of the plans coverage. The difference is in how the insurance company splits the costs with you. So if you have a Bronze plan, the insurance provider will generally cover 60% of your insurance costs, which mostly applies after you hit your deductible.

Which type of subsidy you are trying to get will determine which of the metal tiers you can use. The advance premium tax credit is available for any metal tier, but cost-sharing reductions require you to use a Silver plan, as we will discuss in the next sections.

You May Like: When Does Health Insurance Renew

Choosing A Health Care Plan: How To Calculate The Cost Of Health Insurance

To get started youll want to figure out what your budget is for health care this year. Affordable health insurance is defined as 8% of your income . Take your income for last year and find out if you can afford to pay 8%, if not find a number that you feel you can pay. Now that you have an idea of what you can afford, its time to take a look at the cost calculator from the Kaiser Family Foundation to get an idea of what you will pay on the Connecticut health insurance exchange. This will give you an estimate of what you and your family will pay. Keep in mind that health, age and other factors can increase or decrease the cost of your insurance.

Are There More Options For Free Health Insurance

Aside from affordable health insurance on the ACA marketplace and through Medicaid, you can save money on health insurance if you or a spouse has a job-based plan through an employer who shares the premium cost with you. If youre a young adult, you can use your parents health insurance coverage until age 26, even if married or not living at home. If youre 65 or have a qualifying disability, you can get health care coverage through Medicare.

Before you discount whether you can find low-cost health insurance, Jones advises: It costs nothing to verify where you stand. Know your options, and dont be afraid to ask an insurance agent.

You May Like: How Much Does Health Insurance Cost In Ct

Why It Changes Each Year

Your states Health Insurance Marketplace selects a new benchmark plan each year. This plan is always the second-lowest cost silver plan available where you live. How much youll pay your health plan every month will change every year, and so will your tax credit. Changes to your income and household size may also affect your tax credit.

How Do I Apply For The Premium Tax Credit Health Insurance Subsidy

Apply for the premium tax credit through your states health insurance exchange. If you get your health insurance anywhere else, you cant get the premium tax credit.

If you’re uncomfortable applying on your own for health insurance through your state’s exchange, you can get help from a licensed health insurance broker who is certified by the exchange, or from an enrollment assister/navigator. These folks can help you enroll in a plan and complete the financial eligibility verification process to determine whether you’re eligible for a subsidy.

If you’re in a state that uses HealthCare.gov as its exchange , you can use this tool to find an exchange-certified broker who can help you pick a health plan. If you already know what plan you want and just need someone to help you with the enrollment process, there are also navigators and enrollment counselors who can assist you, and you can use the same tool to find them. If you’re in a state that runs its own exchange, the exchange website will have a tool that will help you find enrollment assisters in your area .

You May Like: How To Apply For Free Health Insurance

You Might Need To Switch Plans To Get The Full Benefit

You can get the additional premium subsidies applied to any metal-level plan, although your subsidy can never be more than the cost of your plan. So if youre enrolled in a plan thats less expensive than the benchmark plan, you might find that youre able to upgrade to a better plan without paying any additional premium.

But you can only get the enhanced cost-sharing reductions if youre enrolled in a Silver plan. So if you currently have a Bronze or Gold plan, you might choose to switch to a Silver plan to get the full benefits available under the ARP.

Although switching to a new plan mid-year usually means starting over with a new deductible and out-of-pocket maximum, many states and insurers are allowing enrollees to keep their accumulated out-of-pocket costs, as long as they switch to a new plan from the same insurer.

Health Insurance Subsidy: Financial Aid For Health Care

Find out more about tax credits and cost-sharing reductions.

Getting federal financial assistance, also known as federal aid, depends on your household size and income. If you qualify, you may be able to get a health plan at a lower cost. These are qualified health plans that come with financial help from the federal government. Here are some key things to know about federal aid:

Also Check: How Much Does It Cost For Health Insurance Per Month

How To Get Your Tax Credit

If you qualify, you have two ways to get money back:

- Add the tax credit to your monthly premium Use some or all of this tax credit to pay your monthly premium. The Marketplace will send it directly to your insurance company, so youll only pay what is left.

- Claim the credit when you file your tax return You can wait to claim your tax credit until you file your tax return. If you only applied part of the credit to help pay your monthly health insurance plan than you can claim the rest when you file, too.

Keep in mind, if you take more money in advance than youre due, youll have to pay the extra money back when you file your taxes. If youve taken less money than you qualify for, youll get that money back in a tax return.

What Does Health Care Reform Like The Aca And Arp Mean For You

Sometimes little things happen sometimes big things do. Sometimes theyre expected, sometimes theyre not. No matter what, a health plan can offer you the comfort of feeling like youre ready for any circumstance. And you may qualify for financial help paying for it thanks to the Affordable Care Act and the American Rescue Act.

Depending on your income, your monthly cost may be as low as $0 per month, if you qualify,* and you may pay less when you see a doctor. All without sacrificing quality of care.

Our agents can see if you qualify for financial help through the Health Insurance Marketplace to help pay your monthly premium.

Don’t Miss: How To Transfer Health Insurance From One State To Another

Helpful Information To Bring To Your Appointment:

- Please bring 2 forms of ID, for example:

- Drivers License, Passport, State ID, Social Security Card

What Does The American Rescue Plan Mean For You

-

If you currently have an ACA plan and qualify for additional financial assistance, you may have a lower monthly cost no later than Sept. 1, 2021. You may also be eligible for health plans with more benefits at a lower cost.

-

If you currently have an ACA plan and qualify for additional financial assistance, you may have a lower monthly cost no later than Sept. 1, 2021. You may also be eligible for health plans with more benefits at a lower cost.

Also Check: How To Change Health Insurance From One State To Another

Health Insurance For Low Income

Everyone needs health care, but not everyone can afford health insurance. Learn about your options for coverage with low income.

- VII.

Health insurance premiums are too expensive for some individuals and families. But going without health insurance is risky. If you were to face an unexpected illness or injury, the medical bills could be overwhelming, especially if you need ongoing care.

How Much Does Health Coverage Cost

The average employer-sponsored health insurance plan cost $645/month for a single employee in 2020 and $1,852/month for a family. Most employers pay the majority of this cost, leaving employees with a more manageable portionbut that’s not always the case when you’re adding family members to your plan.

For people who buy their own health insurance, the average full-price cost of a plan purchased in the health insurance exchanges was $575/month per enrollee in 2021. But most people who buy coverage in the exchange qualify for premium subsidies that covered an average of $486/monththe majority of the full premium cost.

Although the American Rescue Plan has increased the number of people who are eligible for subsidies in the marketplace , there are still a small minority of exchange enrollees nationwide who do not qualify for premium subsidies and have to pay full price for their coverage. In addition, everyone who enrolls off-exchange is paying full price, as there are no premium subsidies available outside the exchange.

You May Like: Is Ivf Covered By Health Insurance

Can I Save Money By Buying A Cheaper Plan Or Must I Buy The Benchmark Plan

Just because the benchmark plan is used to calculate your subsidy doesnt mean you have to buy the benchmark plan. You may buy any bronze, silver, gold, or platinum plan listed on your health insurance exchange. You may not use your subsidy to buy a catastrophic plan, though, and premium subsidies are never available if you shop outside the exchange .

If you choose a plan that costs more than the benchmark plan, youll pay the difference between the cost of the benchmark plan and the cost of your more expensive planin addition to your expected contribution.

If you choose a plan thats cheaper than the benchmark plan, youll pay less since the subsidy money will cover a larger portion of the monthly premium.

If you choose a plan so cheap that it costs less than your subsidy, you wont have to pay anything for health insurance. However, you wont get the excess subsidy back. Note that for the last few years, people in many areas have had access to bronze or even gold plans with no premiumsafter the application of their premium tax creditsdue to the way the cost of cost-sharing reductions has been added to silver plan premiums starting in 2018. And as a result of the American Rescue Plan, far more people are eligible for premium-free plans at the bronze, gold, and even silver levels.

Understanding The Acas Premium Tax Credit Health Insurance Subsidy

The Affordable Care Act includes government subsidies to help people pay their health insurance costs. One of these health insurance subsidies is the premium tax credit which helps pay your monthly health insurance premiums.

Despite significant debate in Congress over the last few years, premium subsidies continue to be available in the health insurance marketplace/exchange in every state. And the American Rescue Plan has made the subsidies larger and more widely available for 2021 and 2022.

The premium tax credit/subsidy is complicated. In order to get the financial aid and use it correctly, you have to understand how the health insurance subsidy works. Heres what you need to know to get the help you qualify for and use that help wisely.

Also Check: Do You Need Health Insurance To Use Goodrx

Ira Contributions Might Help

It’s also important to understand that “income” means Modified Adjusted Gross Income and the calculation for that is specific to the ACAit’s not the same as general MAGI calculations that are used for other tax purposes.

So if it’s looking like your income is going to be higher than you anticipated, know that a contribution to a traditional IRA will reduce your MAGI and help you limit how much of your premium subsidy has to be repaid to the IRS.

The Subsidies Apply To Both Premiums And Out

The unemployment-based subsidies are two-fold:

- They provide full premium subsidies, which means they fully cover the cost of the benchmark plan in your area.

- They provide the most robust level of cost-sharing reductions, which means theyll boost the benefits of any Silver-level plan so that its better than a Platinum plan.

You May Like: How Many Employees Require Health Insurance