Factors That Affect The Cost Of Offering Employees Health Insurance

As mentioned above, there are several factors that can impact the cost of offering health insurance to your employees. Some of the main factors that can cause the price to fluctuate include your employee demographics, your location, the size of your group, other healthcare inflation factors, and the type of plan you decide to purchase for your company.

Yes Its That Same Managed Individual Model That I Mentioned Earlier

When you consider in this hiring climate that the most competitive feature you can offer your team is health benefits, it should indicate how you budget your dollars. Even more importantly, maybe its already in your budget, but you can just reallocate and spend those dollars smarter? Based on the numbers, and based on what is being seen in the industry trends, if you dont decide to improve your efforts on retaining and recruiting top talent, then it will likely be made for you.

What if it is more accessible than ever before? What if I told you that in the past 3 years, Remodel Health has been able to see employers put $65 Million back into their organizational budgets while improving their teams coverages. Were talking about real money, and real budgets, for real people and real companies that got smarter and more competitive with their employer health insurance costs.

Is There A Waiting Period For Coverage

Waiting periods for coverage today typically range from zero to 90 days, says Eric Gulko, president of Innovo Benefits Group, a benefits-management firm. If there is a waiting period before your new coverage kicks in, youll want to make sure you have coverage in place until the period is upeither by extending coverage from your prior employer through COBRA, coverage under your parents plan , or through an individual plan, says Buckey. As part of your offer negotiation, you can ask if the company would be willing to partially fund your COBRA benefits for that period of time.

Recommended Reading: Do Teachers Get Health Insurance When They Retire

How Much Do Companies Pay For Employer Health Insurance

A number of small business owners fear that offering employer health insurance will hurt their bottom line. For instance, they worry that paying a share of premiums will hurt profits or even force them to reduce the number of workers they must cover. On the other hand, an eHealth survey found that many employers believed a small business health plan benefited their business by reducing turnover and keeping employees healthy.

Before any small business owners can weigh the pros and cons of providing group medical benefits, they should understand all of the costs and benefits of their choice to provide employer health insurance or not. Also, some employers may pay higher taxes or miss tax credits if they fail to offer qualified group health plans.

Employers Are Paying Too Little For Health Insurance

My second answer for how much do employers pay for health insurance is too little! Thats right! You might be thinking I am talking out of both sides of my mouth right now, but so are small businesses!

You see, out of all the complaining that is out there about health insurance, did you know that only 31% of companies that have less than 50 employees even offer any sort of health benefit to their teams? That means that 7 out of 10 small businesses are not doing anything to help their employees with healthcare. I dont blame them. I mean, when you look at the data above, it can feel like an insurmountable task to provide anything substantial, right?

It depends on your budget. Most organizations have something they can give. Its just that they dont realize there is a stair-step approach they can take to finally get into benefits maybe again, or maybe even for the first time. You can easily throttle in a brand new benefit to the team in a more flexible and accessible way than has ever been possible before.

Read Also: What Is Wellcare Health Insurance

Waiting Periods To Become Eligible For Coverage

Employers may not impose enrollment waiting periods that exceed 90 days for all plans beginning on or after January 1, 2014. Shorter waiting periods are allowed. Coverage must begin no later than the 91st day after the hire date. All calendar days, including weekends and holidays, are counted in determining the 90-day period.

How Do Employers And Employees Share Costs

When an employer purchases a group plan for their company, theyre agreeing to cover a portion of the employees costs associated with their plans. That means the number you pay in premiums every month is greatly reduced because your employer is paying for a percentage of it. According to a 2014 study, employers pay an average of 69% of insurance premiums.

Insurance costs are re-negotiated every year between employers and insurance providers. That means its never the same for very long, but you can assume its somewhere in this ballpark. The employers are responsible for setting this percentage. Because of this, many employers offer to cover a larger percentage in order to attract and retain top talent. At the same time, other employers experiencing financial hardship might choose to lower their own costs to help offset their own troubles.

Under the Affordable Care Act, employers are required to cover at least 60% of costs under whats known as the essential coverage requirements. This essential coverage requirement sets the bar for what insurance providers and employers are required to cover, though it doesnt include things like supplemental plans.

You May Like: What Is My Health Insurance Plan

When Must An Employer Offer Health Insurance

Technically, an employer is never required to offer PPO or HMO health insurance, and employees are not granted the explicit legal right to demand insurance from employers. However, the fines that the Affordable Care Act imposes on certain employers who dont offer health insurance are so severe that employers tend to provide health insurance to avoid these monetary consequences.

According to the ACA, any employer with 50 or more full-time employees , or an equivalent number of part-time employees, must offer health insurance to 95% of their full-time employees. Should an employer fail to meet this stipulation, they must pay a fee per employee per year to the IRS. Additionally, an employer of 50 or more full-time employees who provides health insurance to one employee is legally obligated to do so for all similarly situated employees meaning employees with similar titles, salaries and job duties.

For employers with 50 or more full-time employees to comply with the ACA, they must offer health insurance that meets ACA-established minimum coverage and affordability requirements. Employer-sponsored health coverage must also be available to the employees dependents. Biological and adopted children under the age of 26 qualify as dependents, but spouses, stepchildren and foster children generally do not.

What Happens If An Employee Receives Subsidized Coverage

Each year, public Marketplaces should send notices to employers that may owe a penalty for not complying with the employer mandate. These notices will alert employers if any of their employees received a subsidy through the Marketplace.

Employers that receive these notices will have 90 days to file an appeal if they believe the eligibility determination was made in error. It’s important that employers maintain documentation and records to provide proof of compliance with the employer mandate.

Read more about thefrom the Centers for Medicare and Medicaid Services.

Read Also: How Much Does Health Insurance Cost In Idaho

How To Choose An Employer Health Insurance Provider

When you are trying to choose a health insurance provider, there are a few things you need to take into account.

- Firstly, you need to decide what type of policy you want and what features are most important to you.

- Once you have done this, you can start to compare prices and benefits.

- It is also worth reading online reviews so that you can get an idea of the level of customer service offered by each provider.

Type Of Plan You Purchase

The type of plan that you as an employer decide to purchase for your employees may also impact the overall cost of providing health insurance to your employees. Some types of plans include:

- Health Maintenance Organization : HMOs tend to cut the total cost of monthly premiums by 20% and are more cost-contained. With these lower costs of premiums also comes lower monthly premiums that employers have to pay.

- Preferred Provider Organization : PPOs may offer more flexible plan options however, they can cost more than HMOs because there is no cost containment.

- Mira: Mira is an affordable healthcare alternative that enables employers and employees to receive access to urgent care visits, lab testings, and a discount on prescriptions for just $45 per month. Find out more about the prices to purchase Mira for your company.

Read Also: How Do I Get Health Insurance In Maryland

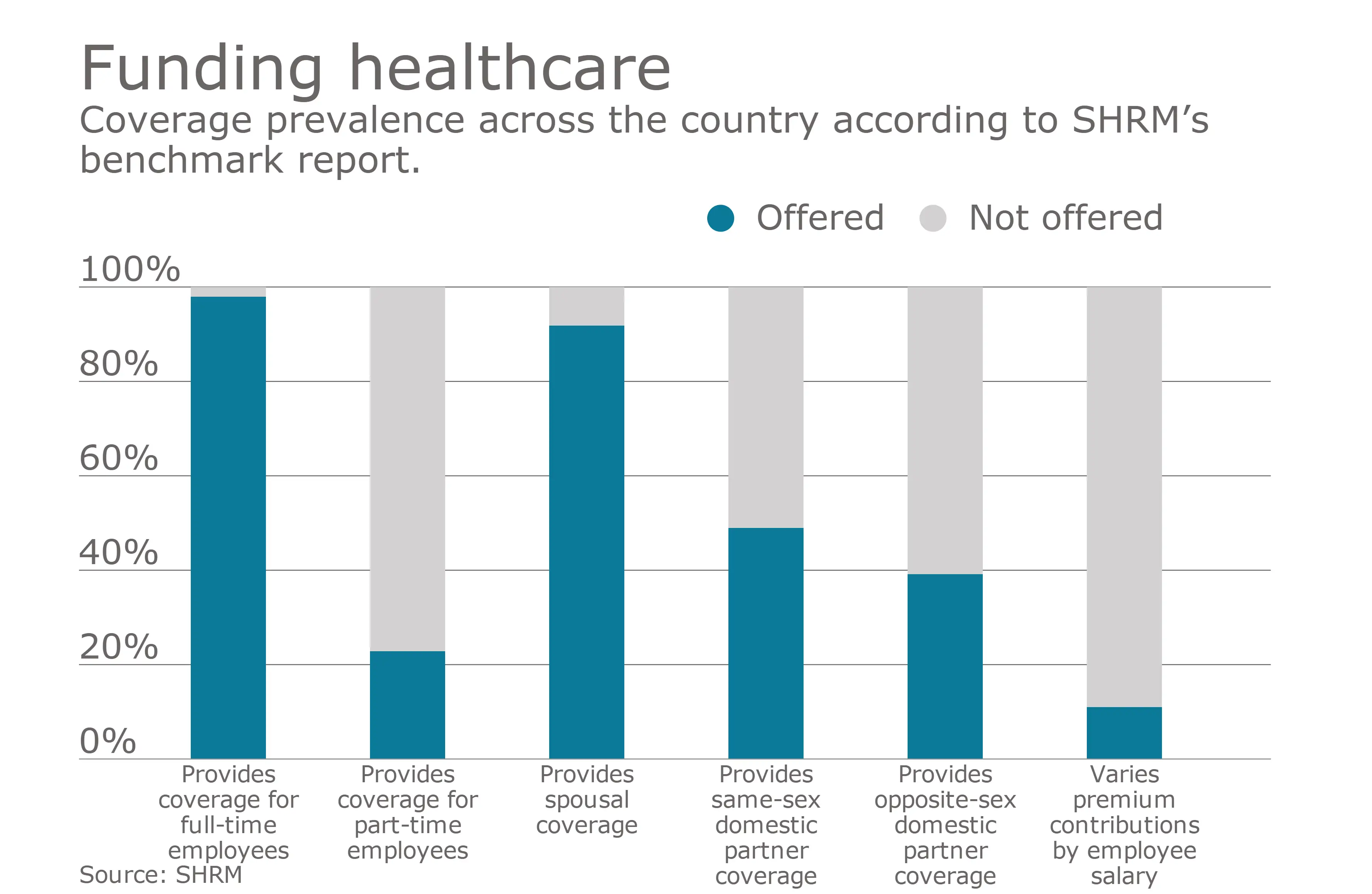

Percentage Of Firms Offering Health Benefits

Not only do small employers have tighter budgets to begin with, the rising cost of health insurance makes it even harder to offer a benefit.

The average premium for family coverage has increased 22% over the last five years and 55% over the last ten years, significantly more than either workers wages or inflation. This steady increase in costs can make it difficult for small employers with tight budgets to continue to offer employees with a health benefit that will provide enough value.

How You Can Control Group Health Insurance Costs

Although healthcare is considered one of the most expensive benefits you can offer at your organization, its undoubtedly an important investment in your companys future.

The cost of providing health insurance to employees depends on the following factors:

- The insurance carrier

- The type of plan you choose, such as a preferred provider organization or health maintenance organization

- The network of providers in a plan

- Plan features such as deductibles, copays, out-of-pocket maximums

- Your location

- Your contribution amount

- The demographics of your employees or your plan rates for the risk pool at your company

- For example, older workforces tend to have higher healthcare costs, which might increase your rates

Recommended Reading: How Much Is Health Insurance For A Child

Can An Employee Opt Out Of An Employers Health Insurance

In almost all situations, an employee can opt out of an employers health insurance. The exceptions to this rule are if the employer entirely covers employees health insurance premiums or if an employment or union agreement requires an employee to use the employers insurance.

An employee can opt out of their employers health insurance during the companys open enrollment period. Should an employee choose to forgo their employers health insurance, theyll need to sign up for a healthcare marketplace plan during the national open enrollment period . They can also purchase insurance plans directly from certain non-marketplace insurers.

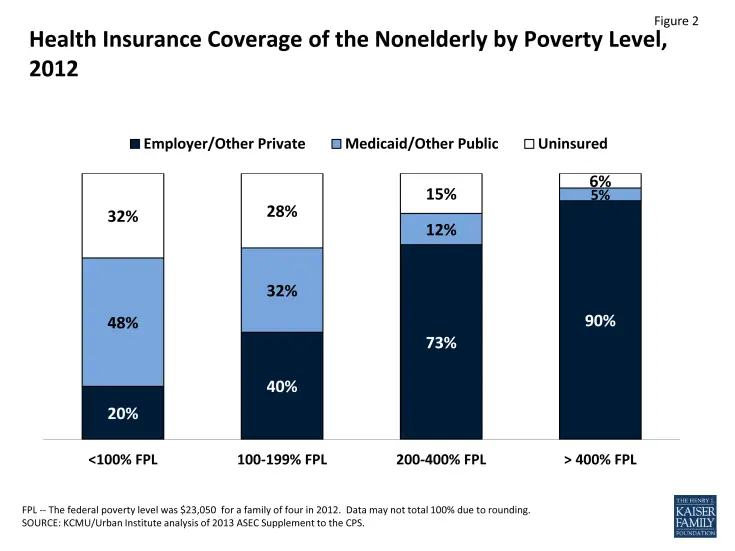

Two common reasons why workers opt out of an employers health insurance offering are that the plans have a high deductible or there is a limited range of medical services covered. For workers who decline employer-sponsored insurance in favor of marketplace insurance, the premiums and plan options are determined in part by the individuals income.

If the employees income is within 400% of the federal poverty line for their family size, they may be eligible for a tax credit that reduces healthcare costs by lessening premiums. Upon filing next years tax return, if their annual income exceeds the amount they listed on their marketplace application, they will need to pay the IRS the difference between their new tax credit amount and the previous years. Conversely, if income decreases, they will get a refund.

Paycheck Deductions: How Much Do Employees Pay For Health Insurance On Average

56 percent of Americans got health insurance from their employers in 2017. If you have an employer-sponsored health insurance plan, you will have a certain amount deducted from your paycheck to cover your premiums.

Understanding how much is taken out of your paycheck to cover health insurance is essential to figuring out how to best pay for your coverage. If your employer-provided plan is too expensive, it may make sense for you to change to a private plan.

Its important to ask how much do employees pay for health insurance also because you want to make sure that youre not overpaying your employer.

Recommended Reading: What Is The Average Cost Of Self Employed Health Insurance

Do Employers Have To Cover Family Members

With a group insurance plan, employers usually offer coverage to legal spouses and dependent children.

The ACA requires you to provide dependent coverage to age 26. If you do not, you might have to pay a penalty. You can choose to cover dependents over 26 years old, but you are not required to.

Employers are not obligated to pay premiums for dependents. However, you can contribute towards premiums for dependents. Or, you can require employees to pay the full premium cost for dependents.

You are not required to cover your employees spouses. Some companies decline coverage when a spouse can receive insurance from their own employer. Or, they might charge the employee more to cover the spouse.

According to the Kaiser Family Foundation, most small businesses pay part of their employees family plans. Compared to single plans, small employers usually pay the same amount or more:

- 45% provide the same dollar contribution for single and family plans

- 45% make a higher dollar contribution for family plans than single plans

- 3% vary their approach with the class of the employee

- 7% take a different approach

On average, small businesses contribute more to single coverage but less for family coverage than large companies do. Employees of small firms pay $1,021 for single coverage vs. the large firm cost of $1,176. Small firm employees pay $6,597 for family coverage vs. the large firm cost of $4,719.

Health Insurance Costs Rising

All the noise pointed people away from the real meat of the Fraser studies. That was how much health costs had increased and how fast they were increasing.

For that average family, the cost of health insurance rose 1.4 times faster than their incomes did between 2006 and 2016. Incomes were up 26% in that time, but health insurance was up 37%.

To put it in perspective, the cost of shelter rose 36% during that time and the cost of food rose 30% during that time. Insurance costs rose 1.3 times as fast as these basic costs.

Recommended Reading: Which Health Insurance Company Is The Best For Medicaid

How Much Should You Contribute To Your Employees Health Insurance Premiums

If youre reading this, its probably because your health insurance rates are going up, you feel like youre out of options, and youre considering pushing more costs onto your employees. Dont do it. Why? For starters, lets remember why you offer benefits in the first place to attract and retain talent, right? That said, pushing additional costs onto your employees will undermine your efforts to attract and retain talent, and according Employee Benefits News, it can cost as much as 33% of an employees annual salary to replace them. Second, we need to understand why your rates are going up in the first place. Has your broker explained the underlying factors and provided you with proven risk management strategies to address them? If your rates are going up, its most likely because you dont have the right pieces in place. With the right strategies in place, there is no need push more expenses onto employees. In fact, many companies are able to reduce costs without reducing provider choice or raising deductibles or copays. Contact us if youd like learn how our high-performance health plans bend the cost curve.

Digging Deeper For Pricing Information

However, it’s not universally good news. For more details, we consulted the CMS’ 2020 Health Insurance Exchange Premium Landscape Issue Brief. It indicates that 27-year-olds buying silver plans saw their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”

In 2021, that trend continues. The 2021 edition of the CMS Brief notes that, for example, while Wyomings average benchmark plan premium decreased 10% from PY20 to PY21, the average 27-year-old PY21 benchmark plan premium is $648the highest in the U.S. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Hampshire’s benchmark plan premium for a 27-year-old is the lowest in the nation at $273.

Read Also: How Much Do You Pay For Health Insurance

What Else Do You Need To Know

A great job offer is what youre after, but remember: Salary isnt the only thing that matters. Before signing on the dotted line, there are plenty of other considerations to weigh, from commuter reimbursements to sick days to promotion prospects. Could you use some help understanding the ins and outs of job offers? Join Monster for free today. As a member, you can sign up to receive career advice, job search tips, and negotiation strategies sent directly to your inbox to help you make smart, informed choices. Think of it as insurance for your career.

This article is not intended as a substitute for legal advice. Always seek the advice of a lawyer regarding any questions you may have.