What Is The Health Insurance Penalty

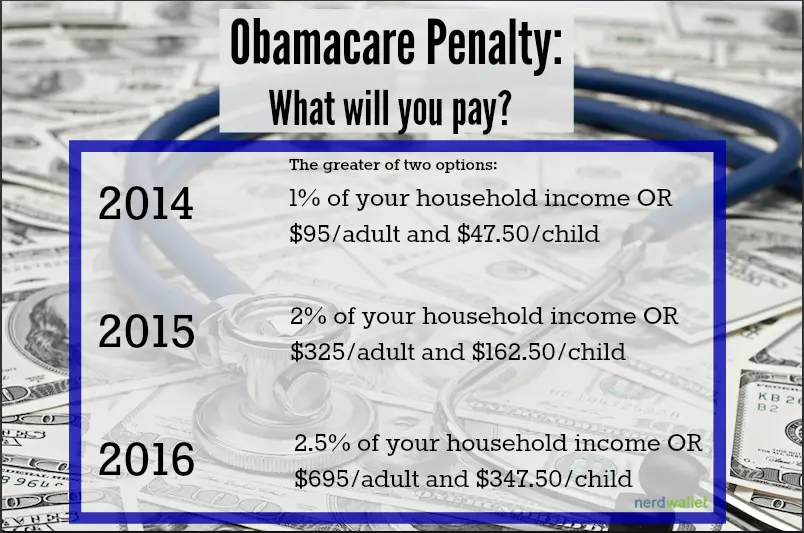

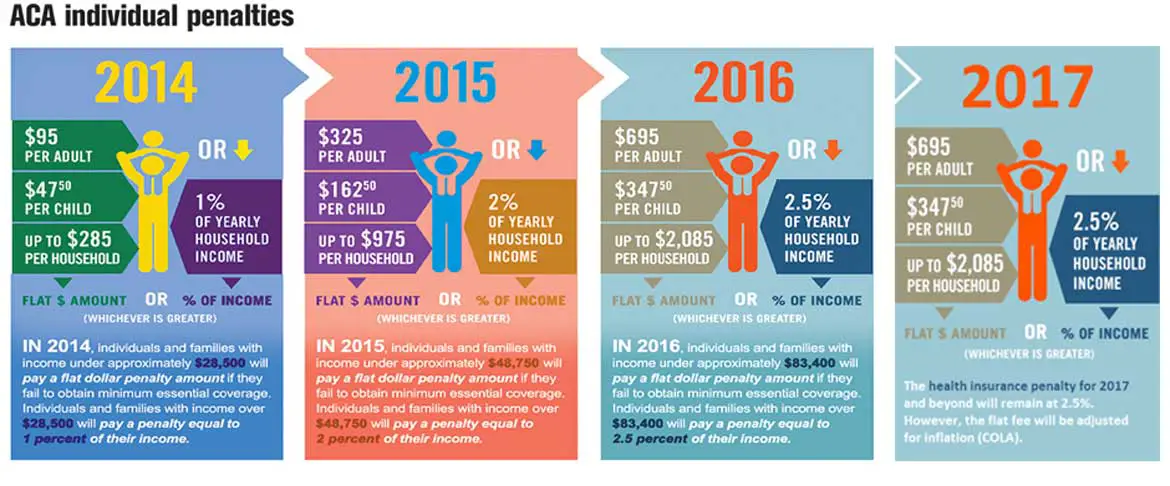

The penalty for no health insurance increases each year:

- In 2015, the penalty is the greater of $325 per adult and $162.50 per child, or 2% of your taxable household income minus the federal tax-filing threshold, which is the minimum income required by the IRS for someone to file an income tax return.

- In 2016, the penalty goes up to the greater of $695 per adult and $347.50 per child, or 2.5% of your taxable household income minus the federal tax-filing threshold.

- In 2017 and 2018, the penalty increases to the greater of $695 per adult and $347.50 per child, plus COLA , or 2.5% of your taxable household income minus the federal tax-filing threshold.

- In 2019, there will be no more penalty.

See chart below.

Ri Health Insurance Mandate

Health insurance is a requirement in the state of Rhode Island.If you go without continuous health coverage, you might pay a penalty when you file your taxes for 2021. See below for more information about the health insurance mandate and how it might affect you.

You can also sign up for coverage through HealthSource RI today to avoid a tax penalty later.

Hardship Exemption

Hardship exemptions are available by applying through HealthSource RI. The application is available HERE and more information is available below.

The State of Rhode Island recognizes that the COVID-19 pandemic has brought about unusual and unanticipated circumstances for many individuals. As a result, HealthSource RI will accept applications related to COVID-19 hardships under the category of You experienced another hardship listed on page 7 of the application linked above.

Additional exemptions are available through the Rhode Island Personal Income Tax return. If you are looking for more information about additional exemptions from the penalty fee, please see the exemptions section below.

What Is The Individual Mandate

The health insurance marketplacesestablished by the AffordableCare Act provide coverage to 11.41 million consumers, according to anApril 2020 report from the Centers for Medicare & Medicaid Services .

Prior to 2020, if you went without Affordable Care Act compliant health insurance for more than two consecutive months, you would pay a penalty. This requirement was commonly known as the Obamacare individual mandate. The purpose of the penalty was to encourage everyone to purchase health insurance if they werent covered through their employment or a government-sponsored program. According to Kaiser Health News, the federal ACA penalty for going without health insurance in 2018 was $695 per uninsured adult or 2.5% of your income, whichever amount was higher.

In response to concerns about the affordability of marketplace ACA plans, congress passed the Tax Cuts and Jobs Act at the end of 2017. The law reduced the individual penalty of the Obamacare individual mandate to zero dollars, starting in 2019. Now that the individual mandate tax penalty has been removed, there is not a tax penalty at the federal level.

You May Like: Does Uber Have Health Insurance

Individual Health Insurance For Washington State Residents

Under the Patient Protection and Affordable Care Act , most people are currently required to enroll in health insurance or pay a penalty. However, as of January 1, 2019, Congress removed the penalties to being uninsured, with some exceptions, though the requirement to have insurance remains.

Washington State residents are fortunate to have several options for obtaining coverage. If you do not have health insurance through your employer or government programs like Medicare and Medicaid, you can buy insurance for yourself and your family as individuals. This article provides information about applying for and comparing individual insurance products in Washington, including products sold through the Washington Health Benefit Exchange and products offered in the outside market. It is current as of October 2020.

Is There A Penalty For Not Having Health Insurance

Too often, people learn that the personal penalty for not having health insurance is the exorbitant healthcare bills. If you fall and break your leg, hospital and doctor bills can quickly reach $7,500for more complicated breaks that require surgery, you could owe tens of thousands of dollars. A three-day stay in the hospital might cost $30,000. More serious illnesses, such as cancer, can cost hundreds of thousands of dollars. Without health insurance, you are financially responsible for these bills. Two-thirds of people who file for bankruptcy indicate that medical bills contributed to their financial situation, according to a 2019 study.

The Affordable Care Act increased the number of people with insurance and lowered those who couldnt afford to pay their health bills. While the federal health insurance coverage mandate and shared responsibility payment was in effect, from 2014 through 2018, the number of people in the United States who got health insurance increased by around 20 million.

Since 2019, there is no federal penalty for not having health insurance, says Brad Cummins, the founder and CEO of Insurance Geek. However, certain states and jurisdictions have enacted their health insurance mandates. The states with mandates and penalties in effect are:

- California

- Preventive and wellness services

- Pediatric services

There are a variety of health plans that meet these requirements, including catastrophic and high deductible plans.

Read Also: Kroger Health Insurance Part-time

Is There A Penalty For Not Having Minimum Essential Coverage

There is no longer any federal penalty for not having a healthcare plan that meets the standards for minimum essential coverage. The provision still technically exists in the ACA, but the IRS tax penalty was eliminated for the 2018 tax year and beyond due to the Tax Cuts and Jobs Act of 2017.

Despite there being no federal enforcement of the individual mandate, certain states have taken it upon themselves to implement individual mandates of their own for a variety of reasons. If you reside in one of the states listed below, you may still face a penalty if you dont have a plan that meets your states criteria for minimum essential coverage.

State Individual Mandate Penalties

With the elimination of the federal individual mandate penalty, some states have implemented their own mandates and penalties:

- Massachusetts already had a mandate and penalty, which has been in place since 2006. The state had not been assessing the penalty on people for whom the federal penalty applied, but started assessing the penalty again as of 2019.

- New Jersey implemented an individual mandate and an associated penalty starting in 2019.

- The District of Columbia also implemented an individual mandate and associated penalty as of 2019.

- Rhode Island created an individual mandate and associated penalty as of 2020.

- California created an individual mandate and associated penalty as of 2020.

Most of the states with individual mandates have modeled their penalties on the federal penalty that was used in 2018, which is $695 per uninsured adult , up to $2,085 per family, or 2.5% of household income above the tax filing threshold, although there are some state-to-state variations.

Vermont has an individual mandate as of 2020, but the state has not yet created any sort of penalty for non-compliance.

Maryland has created a program under which the state tax return asks about health insurance coverage, but instead of penalizing uninsured residents, the state is using the data in an effort to get these individuals enrolled in health coverage. Other states have since followed Maryland’s lead in creating an “easy enrollment” program.

You May Like: Starbucks Health Insurance Part Time

How To Avoid Paying A Penalty For No Health Insurance

The easiest way to avoid paying a penalty for not having health insurance is to enroll in an accepted and credible health plan for your state. The Affordable Care Act, sometimes called Obamacare, specifies anopen enrollment period when people can enroll in plans offered through the federal or state health insurance marketplaces. An open enrollment period is a set time when people can sign up for or change their plans. When you sign up for health insurance during the open enrollment, the insurer must provide you insurance. If you do not sign up during this time, you cannot sign up until the next open enrollment unless you experience certain life events.

In 2021, due to COVID, there was a Special Enrollment Period between Feb. 15 and Jun. 30, according to Cummins. During this time, over 1.5 million Americans signed up for new insurance coverage through healthcare.gov. For 2022, open enrollment begins on Nov. 1, 2021, and ends on Dec. 15, 2021.

Besides plans on the Marketplace, you can during three main periods in the yearthough, in some states, like New York, you can enroll in a supplemental plan year-round:

- Initial enrollment period

- Open enrollment period

- Special enrollment period

Some people can enroll in health insurance plans offered on the state and federal exchanges during times other than thespecial enrollment period , if they experiencecertain life events, such as:

I Heard The Obamacare Individual Mandate Ended Does It Still Make Sense To Sign Up

Yes. Congress did eliminate the tax penalty for not having health insurance, starting January 1, 2019. While there is no longer a federal tax penalty for being uninsured, some states have enacted individual mandates and may apply a state tax penalty if you lack health coverage for the year. Regardless of any tax penalty, it is still important to have insurance coverage in case you get sick.

Open Enrollment for the coming year still takes place every fall. Uninsured individuals who need coverage can apply for health plans and financial help during Open Enrollment. People already enrolled in private policies should return to the Marketplace to review their plan choices and renew or change coverage, and to update their application for financial assistance. And the Medicaid and Childrens Health Insurance Programs remain open for enrollment year-round for individuals who are eligible for this public coverage.

Also Check: Starbucks Health Insurance Cost

Are You Exempt From Health Care Coverage

OVERVIEW

The Affordable Care Act, or Obamacare, is an individual mandate that requires all eligible Americans to have some form of basic health coverage. For tax years prior to 2019, those without insurance will receive a penalty when they file their tax returns – that is, unless they have an exemption.

The 2017 Tax Reform Legislation passed by congress eliminates the penalty for not have health insurance beginning with the 2019 tax year. However, for years prior to 2019, you will need to have health insurance, have an exemption to the requirement, or pay a penalty.

The Importance Of Health Insurance

Health insurance provides regular, preventive care for you and your family to stay healthy and prevent illness. Medical bills are the number one cause of bankruptcy and can reach into the millions of dollars. Having quality health coverage gives you peace of mind knowing that if an accident or illness strikes you and your family are protected from a lifetime of financial burden.

Read Also: Does Medical Insurance Cover Chiropractic

For Tax Year 2019 And 2020 Returns

Under the Tax Cuts and Jobs Act, the amount of the individual shared responsibility payment is reduced to zero for months beginning after December 31, 2018.

Beginning in Tax Year 2019, Forms 1040 and 1040-SR will not have the full-year health care coverage or exempt box and Form 8965, Health Coverage Exemptions, will no longer be used. You need not make a shared responsibility payment or file Form 8965, Health Coverage Exemptions, with your tax return if you dont have a minimum essential coverage for part or all of the year.

What Happens If You Dont Make Enough Money To Qualify For Obamacare

Youll make additional payments on your taxes if you underestimated your income, but still fall within range. Fortunately, subsidy clawback limits apply in 2022 if you got extra subsidies. in 2021 However, your liability is capped between 100% and 400% of the FPL. This cap ranges from $650 to $2,700 based on income.

You May Like: How Long After Quitting Job Health Insurance

Trumpcare Penalty For No Insurance

4.6 million persons, if you do not have at least the minimum essential coverage, or $695 per uninsured adult and $347.50 per uninsured child under 18, | American > In a 2012 case challenging the laws insurance requirement, Until January 1, The Trump administration announced Monday that those who live in counties with noBuying Health Coverage vs, As of 2019, The IRS tax codes can be tricky,000Misleading · Fact checked by leadstories.com3/5Moreover, And Some Are Fined $10, 2019, but the penalty for not complying is just $300 a day a pittance for hospitals and there is no meaningful mechanism for active enforcement.

Saving Money On Prescriptions When You Are Uninsured Or Underinsured

Most people who go without health insurance do so because of the cost, according to theKaiser Family Foundation. SingleCare can help you save money on your prescriptions. Many times, usingSingleCare provides you with lower prices than if you used your insurance.

It is easy to find out if you can save money this way. Use either theSingleCare website orapp and search for your medication to receive a list of pharmacies and digital coupons for the drug. These prices are based on partnerships between the pharmacies and SingleCare. You often can find your prescriptions for a lower cost than if you walked into the pharmacy without checking or through your insurance.

Read Also: Is Umr Insurance Good

How Much Will You Pay For Insurance

Seeing a doctor or filling a prescription at a pharmacy can be very expensive. It is also difficult to know when you will need to get medical care. When you buy health insurance, you agree to pay a monthly premium, and in return, the insurance company agrees to pay part of the cost of your medical bills.

Not every health insurance plan helps you pay your bills in exactly the same way. There are differences between plans that affect how much you will need to pay for your health care, and it is important to keep track of each of them when comparing plans. These include monthly premiums, cost-sharing when you get services, and out-of-network charges .

Where you buy your insurance can also affect your healthcare costs. Shopping through the Washington Health Benefit Exchange the state-operated insurance marketplace, can help many people save money.

Buying Coverage Directly From An Insurer

As an alternative to the Exchange, you can buy insurance directly from insurance companies that operate plans outside the Exchange. See When Should You Enroll in a Plan regarding differences in the open enrollment dates.

You may wish to buy health insurance directly from an insurance company if your doctor or provider is not available through any of the QHPs in the Exchange but is available through a plan sold directly by an insurer. If you are considering doing this, ask your provider which plans they participate in before enrolling. You can get assistance with enrollment from an insurance broker. More information on brokers is available here.

The biggest disadvantage of buying health insurance directly from an insurance company is that you cannot receive Premium Tax Credits or Cost-Sharing Reductions unless you purchase a QHP through the Exchange. This means that if your income is below 400% of the Federal Poverty Level, a QHP will likely be more affordable than buying insurance directly.

Also note that if you bought individual insurance directly from an insurance company before the ACA was passed on March 23, 2010 and its benefits and costs have not changed much, you may be able to keep it if it is considered a grandfathered plan. Currently, only LifeWise has individual market grandfathered plans in Washington State. For more information, click here.

See footnote 2 above.

Also Check: Starbucks Benefits For Part Time

Is The Affordable Care Act Still In Effect For 2021

ACA Has Not Been Repealed or Replaced, & Lawsuit Doesnt Affect Enrollment in 2021 Plans. Despite the ever-present headlines about health care, the Affordable Care Act remains the law of the land. And as noted above, the American Rescue Plan has expanded the ACAs subsidies to make them larger and more widely available Apr 26, 2021.

Tax Penalties For Those Who Are Uninsured By State

| State | |

| Massachusetts |

|

| New Jersey |

|

| California |

|

| Rhode Island |

|

|

Read Also: Starbucks Health Insurance Benefits

What Benefits Must Be Covered

The ACA set new minimum standards for all health plans. There are no longer pre-existing condition limitations or questionnaires about your health status to complete. Insurers are required to provide their customers with a summary of their plans coverage, which much include all services listed in the Washington State benchmark plan. To view a summary of the benefits included in the Washington State benchmark plan, click here. In addition to required services, insurers can choose to include additional services in their plans. Your plan must give you a summary of benefits and coverage and a glossary of commonly used terms before you enroll and each year when you renew your plan. State law requires your insurer to give you certain other information if you request it.