Who Qualifies For The Health Care Tax Credit

Until recently, you could only qualify for a health care tax credit if you buy insurance on a federal or state marketplace also known as an exchange and have a low to lower-middle income. About 11.4 million Americans were enrolled in public health insurance marketplaces in 2020.2 But recent U.S. Census Bureau statistics show that private insurance continues to be prevalent. It was 68% of the insured population in 2019, either directly or through employers insurance programs.3

Now, commercial insurers and private exchanges, including those offering ACA coverage under a new government program called enhanced direct enrollment,4 may be able to sign you up directly for tax credits. Its a good idea to check if youre considering these options, since insurers capabilities vary.5

The majority of those enrolled in health insurance marketplaces receive the tax credit.6 The specific household income range to qualify is 100% to 400% of the federal poverty limit, which would amount to $12,880 to $51,520 if youre single and $26,500 to $106,000 for a family of four.7 About 8% of all Americans, or 26.1 million people, had no health insurance in 2019, according to U.S. Census Bureau data.

The IRS lists additional requirements that must be met, such as ineligibility for employer-sponsored programs, Medicaid, or Medicare.8 Online tools are available, for example, at Healthcare.gov, to determine whether you might qualify.9

If My Income Qualifies Me For Medicaid But My State’s Not Expanding It Can I Get A Tax Credit Or Cost

Some states have expanded Medicaid to include people with higher incomes . If you have a low income, but your state did not expand Medicaid, you will be eligible for a tax credit to buy a health plan through your stateââ¬â¢s Marketplace, but only if your income meets the minimum threshold . It seems counterintuitive, but if your income is too low, you do not qualify for a tax credit to buy insurance. This is because the law assumed all states would expand Medicaid and the tax credits to help pay premiums would pick up where Medicaid left off. But the Supreme Court made the Medicaid expansion optional. As of 2020, 12à states have not expanded it, so in those statesà you do not qualify for assistance if your income is too low. To find out whether your state has expanded Medicaid, go to the Healthcare.govââ¬â¢s Medicaid expansion page. Ã

The amounts for people who live in Alaska and Hawaii will vary.

When Your Coverage Starts

For existing Medicare enrollees, from October 15 to December 7 of each year, you can join, switch, or drop a plan.

For the current open enrollment, your coverage will begin on January 1, 2022.

There are separate enrollment periods each year for initial enrollment and Medicare Advantage enrollment.

To sign up, go on the Medicare.gov website.

If you are on Medicare now, here’s more information on the open enrollment period going on until Tuesday, December 7.

Plus, we outline the advantages and disadvantages of Medicare.

Recommended Reading: Starbucks Benefits For Part Time

Get A Notice Telling You To File And Reconcile 2019 Taxes

If you were enrolled in a 2020 Marketplace plan but didnt file and “reconcile” your 2019 taxes, youll get a notice saying you may lose the financial help youre getting for your 2021 plan. You may also get Letter 0012C from the IRS.

- If you havent filed your 2019 tax return or filed a return but didnt “reconcile” the premium tax credit for all household members you must do so immediately.

Your notice will provide details. If you confirm that you filed your 2019 tax return, you wont need to do anything else.

Taxes And Health Care

What are premium tax credits?

The Affordable Care Act provides families with refundable, advanceable tax credits to purchase health insurance through exchanges. Premium credits cap contributions as a share of income for families with incomes between 100 and 400 percent of the federal poverty level.

ACA tax credits for health insurance

The Affordable Care Act provides families with refundable tax credits to purchase health insurance through both state and federal Marketplaces. Tax filers can claim premium credits if they have incomes between 100 and 400 percent of the federal poverty level , are ineligible for adequate and affordable health insurance from other sources, and are legal residents of the United States. Tax filers with incomes between 100 and 138 percent of the FPL are generally ineligible for premium credits if they reside in states that take advantage of the ACAs Medicaid-eligibility expansion.

Calculation of premium credits

Premium credits effectively cap family contributions as a share of income for those purchasing midrange benchmark plans. In 2020, maximum family contributions ranged from 2.06 percent of income for families at the poverty threshold to 9.78 percent for families between 300 and 400 percent of FPL . Premium credits equal the difference between gross premiums and maximum family contributions.

advance premium credits and reconciliation

IRS . 2019. Premium Tax Credit. Publication 974. Washington, DC: Internal Revenue Service.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

How To Maximize Your Health Insurance Tax Benefits

If your employer offers a health insurance plan, youll likely get the most savings there between taxes and monthly premiums. Additionally, check to see if your employer plan comes with a Health Savings Account or Flexible Spending Account to further maximize your tax benefits.

Health Savings Account

An HSA account allows you to set aside pre-tax money to use for qualified healthcare expenses, but you can only contribute to an HSA if you have a high-deductible health plan .

As of 2017, your health insurance plan qualifies as a high-deductible health plan if your deductible is at least $1,300 for an individual and $2,600 for a family. Additionally, the plans total out-of-pocket expenses cant be more than $6,500 for an individual and $13,100 for a family for in-network services.

Note that you can also qualify for an HSA if you get your health insurance through the Health Insurance Marketplace .

The interest that you earn in an HSA is tax free, and so are the disbursements. Additionally, funds roll over from year to year, so you dont have to worry about them expiring.

Flexible Spending Account

Similar to an HSA, an FSA allows you to set aside money from your paycheck pre-tax to pay qualified medical expenses. There are, however, a few differences:

The Aca’s Premium Tax Credit

Most people who are eligible for the premium tax credit subsidy choose to have it paid in advance directly to their health insurance company each month. This lowers the amount they have to pay for premiums each month. When enrollees choose this option, the subsidy is referred to as an advance premium tax credit, or APTC.

But enrollees also have the option to pay full price for a plan purchased through the health insurance exchange, and then receive the full amount of their premium tax credit from the IRS when they file their tax return. When tax filers take this option, the subsidy is simply called a premium tax credit, or PTC.

APTC and PTC both refer to the same thinga premium subsidy to offset the cost of health insurance obtained in the exchange. And either way, it’s a refundable tax credit, which means you get it even if it exceeds the amount you owe in federal taxes.

And regardless of whether you receive APTC or PTC, you have to complete Form 8962 with your tax return. This is how you reconcile the amount that was paid on your behalf during the year or claim the credit in full after the year is over.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Your Deductible In Action

To explain how a deductible works, let’s say you have a $50 deductible on the dental portion of your policy. Your dentist bill is $475. When you submit the claim to the insurance company, they only reimburse you for $425, because you are responsible for the first $50 of the cost via the deductible.

The good news is that once the deductible is paid, it will not apply again until the new term, which is most often a full year. If a month later you have a second visit with the dentist, you will not have to pay the deductible again, as you’ve already paid it for that term with the former bill.

Deductibles do not apply to all coverages in the same way and may vary between types of service on the same plan, For example, a person may have a $10 deductible on vision, but a $50 deductible on dental, and none at all for medication.

You will most often see the deductible stated as a per year amount. This means whey your plan renews, the deductible would be in effect again. You may be able to receive some services, such as standard doctor visits, without meeting the deductible first. If your health plan covers you as well as your family, you may have a separate deductibles for each member.

Waiving Medical Coverage: Is It A Good Idea

There are many reasons you may decide that you want to waive your health insurance coverage, but before you do, it is always a good idea to look into the advantages of dual coverage or coordination of benefits. Sometimes it is more beneficial to take advantage of multiple plans if you have a lot of medical costs or specific needs. Always explore all your options. Let’s look at some examples of when you might want to request a waiver:

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

When Is A Health Insurance Waiver An Advantage

Some companies, usually local government employers, offer medical waivers as part of an employee benefits package. If an employee chooses a medical waiver they could receive an extra yearly payment that would be a percentage of what the company pays for the employee’s insurance coverage. Some of these medical waiver benefits are as high as $7,000 per year.

What Is A Tax Credit

Tax credits are taken in the final step of the process of calculating your tax liability.

Suppose your gross income for the tax year is $100,000. The next step is to claim above-the-line deductions, also known as adjustments to income part of your self-employment tax or your traditional IRA contribution deduction, for example.

Your gross income minus your above-the-line deductions equals your adjusted gross income . From there, subtract either your standard deduction or your itemized deductions from your AGI and you’re left with your taxable income. Your taxable income is used to calculate your tax liability it’s the amount of money you’ll be taxed on at your marginal tax rate.

Finally, any applicable tax credits are subtracted from your total tax bill. Say your total tax bill is $4,000 and you claim a credit worth $2,000, you will only be responsible for paying $2,000 in taxes. Some tax credits are refundable, meaning if you don’t have a tax bill large enough to use the full credit, you will get the money as a refund.

Below are a few of the most common tax credits.

Also Check: Starbucks Insurance Benefits

How Coordination Of Benefits Works

To explain how the process works, say you have a health plan that pays up to a limit of $1000 per year for a certain service. Suppose you are also covered under a second plan that belongs to your partner, which pays up to $500 per year for that same service. You are said to be covered by a dual plan. Once you have used all the funds in your main plan and have hit your limit per year, you may still be able to cover costs under your partner’s plan. The health provider would coordinate benefits to make sure each plan pays a portion of the service.

If your main health plan has an 80/20 coinsurance clause on a given type of service and you have dual coverage, it will pay 80% of the cost and you will then get the 20% from your second health plan. Because you are covered under the dual pan, thanks to the coordination of benefits between the two plans, you end up paying nothing out of pocket.

On the other hand, if both your main plan and your second plan have 80/20 coinsurance, the process does not apply. After your main plan pays the 80%, the second plan does not kick in to pay any of the balance, as they would have only paid 80% as well.

Let’s say your main plan had a 50/50 coinsurance and your second plan had 80/20 coinsurance. In this case, then the coordination of benefits would result in a 50% payment from the main plan, and the 30% left from the second plan. The total you would get always ends up as 80%, and there is no chance to double up on benefits.

One Of These Health Insurance Subsidies Is The Premium Tax Credit Which Helps Pay Your Monthly Health Insurance Premiums

What does subsidy mean in health insurance. You dont pay it back. Subsidized health insurance is an insurance plan with reduced premiums. Put simply a health insurance subsidy helps you to pay for your health insurance.

Its not a loan. Some consumers between 200 and 400 of the FPL may also get a small amount of extra subsidy to further reduce their health insurance premiums. Your eligibility is generally determined by your household income and family size.

Ad Compare 50 Medical Insurance Plans Designed for Expatriates. A health care subsidy is financial assistance from the government that you could be eligible for to help you pay for health insurance. Get a Free Quote.

Examples of subsidized coverage include Medicaid and the Childrens Health Insurance Program CHIP. Subsidized health insurance is an insurance plan with reduced premiums with health coverage thats obtained through financial assistance from programs to help people with low and middle incomes. Subsidy often goes to people or institutions in need but the subsidy is also a way of providing an incentive.

Some subsidies also help by lowering other costs like your copays. Health coverage available at reduced or no cost for people with incomes below certain levels. The premiums are reduced because of the involvement of an outside entity that is paying or subsidizing the premium payment.

Pin On Design

Health Insurance And You Health Insurance Health Insurance Companies Affordable Health Insurance

Don’t Miss: Starbucks Medical Insurance

Signing A Health Insurance Waiver As A Strategy To Save Money Or Gain Income

The health Insurance waiver is sometimes viewed as an employee benefit because by waiving insurance, some employers have offered to compensate the employee for the financial value of the cost of insurance. Unfortunately, due to the economy many employers do not offer their employees fully paid insurance benefit packages, therefore the popularity of this type of employee benefit or perk is not as common as it once was when the economy was stronger and employers offered health insurance benefits for “free.” Signing a health insurance waiver may not provide any advantage in regard to your employee benefits in the form of a salary “increase” anymore since many employers do not pay for their employees’ health insurance benefits like they used to. The waiver may instead reduce the costs of deductions from your payroll for your insurance since you will be covered under an alternate plan and not paying into the employer plan.

Example: Jim and Tina both work. Jim chooses the health insurance waiver from his job since he is covered under Tina’s employer-sponsored health insurance plan. In return, his employer gives him an additional $3,000 per year, also known as an “opt-out buyback.”

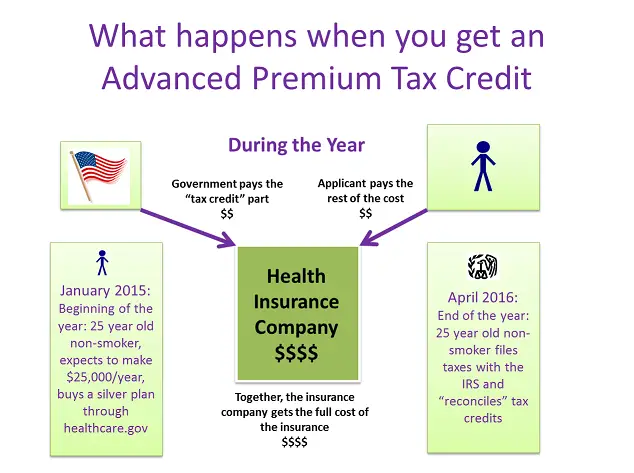

Understanding The Advanced Premium Tax Credit

The advanced premium tax credit is a credit in the Patient Protection and Affordable Care Act , also referred to colloquially as Obamacare, which was signed into law on March 23, 2010, by President Barack Obama.

The tax credits are not like regular tax credits that must be calculated and applied to the taxpayers tax liability and either refunded or used to reduce liability when taxes are filed for the previous year.

In contrast, the Advanced Premium Tax Credit is calculated and sent directly from the government to the health insurance companies that insure individuals who are eligible for the credit. The individual gets a discount on monthly premium payments in the amount of the tax credit. Anyone eligible for this tax credit receives an amount determined by income.

Those who make more will receive a smaller credit and a smaller monthly discount, while those with less income will receive larger credits and a larger discount on healthcare premiums. Because this tax credit is a direct payment, individuals who receive it do not have to pay the full amount of their monthly health insurance premium up front, but can pay the discounted amount.

Taxpayers get a discount on the monthly premium payments in the amount of the tax credit.

The American Rescue Plan Act of 2021 removes the cap on income for the advanced premium tax credit for 2021 and 2022. The act limits the premiums for these plans to 8.5% of the payers modified adjusted gross income on the top-end .

Don’t Miss: Do Starbucks Employees Get Health Insurance

Deadline To Enroll In Medicare Is Tomorrow 5 Things To Know

- 9:45 ET, Dec 6 2021

THERE’S only one day left for open enrollment for Medicare.

The deadline to review coverage and make any changes to Medicare healthcare or prescription drug plans ends tomorrow, December 7.

This deadline is for senior citizens who are already on Medicare.

Medicare is health insurance for people 65 and older.

You’re first eligible to sign up for Medicare three months before you turn 65.

Here are five tips to help you through open enrollment.