Health Insurance Tax Benefits

?As a self-employed individual, you can claim a 100% health insurance deduction, including dental and vision. W4 employees arent so lucky. They can only deduct health insurance expenses that exceed 10% of their adjusted gross income if theyre under age 65. For example, if your AGI for the year is $100,000, you can only deduct medical expenses that exceed $10,000. If you spent $10,100 in combined insurance and medical expenses, you could only claim a $100 health insurance deduction under those rules. Conversely, a self-employed worker can claim the entire $10,100 deduction.

You can claim the health insurance deduction on page 1 of Form 1040. The insurance can cover you, your spouse, your dependents, and any of your children who are under 27 years old. Your adult children can qualify even if theyre not listed as dependents. You can put your policy under your name or the business. Any premiums you pay directly reduce your AGI and lower your tax bill.

Health Insurance Premiums That Aren’t Tax

Not all health insurance premiums are tax-deductible. You can’t deduct the portion of your premiums that your employer pays, for example, or any premiums that come out of your paycheck pretax.

If you are enrolled in Medicare under Social Security, your Medicare A premiums are paid by Social Security and aren’t tax-deductible.

Does a tax subsidy cover part of your premiums for health insurance through a state or federal insurance marketplace? If so, you can’t deduct that portion of your premiumsjust the amount you pay out of pocket.

What Counts As Medical Insurance

The IRS specifies that three types of insurance count for this deduction. You can take into account the premiums that you pay for medical insurance, dental insurance and long-term care insurance. In other words, you can use this benefit with more than just major medical policies.

When describing medical insurance policies, the IRS explains that they may cover hospitalization, surgical services, X-rays. These are the types of services that are covered by most short term health insurance plans, which means that temporary health plans should qualify as a tax-deductible expense for self-employed people.

If your short term health plan provides more limited coverage for example, it doesnt cover X-ray services that doesnt necessarily rule out your premiums as a deductible expense. The IRS doesnt insist that a plan must cover all of the outlined services in order to qualify as medical insurance for tax purposes. These services are simply provided as examples to help taxpayers understand what medical insurance is.

Although the IRS rules dont specifically exclude short term health insurance as a deductible expense, neither do they expressly include short term health plans. If you have questions about whether your health coverage counts as a deductible expense, consult a tax professional who specializes in matters related to self-employment.

You May Like: Can I Use My Health Insurance In A Different State

How Do I File Health Insurance Costs Paid For Myself And My Family

Once you confirm you are eligible to file, you’ll need to know where to deduct health insurance premiums for self-employed tax purposes.

The most direct way to claim your health insurance premium costs is to apply them as a deduction to your total gross income. When you take these deductions, the result is called your adjusted gross income, or AGI. Basically, your AGI is your gross income minus allowable adjustments, such as student loan interest or health savings account contributions. In summary:

Gross income – adjustments = AGI

Applying your premiums as an income adjustment provides two benefits:

- Your total tax liability is based on your AGI. If you use the insurance premiums to lower your AGI, you may have a lower tax debt.

- You can claim 100% of your eligible health insurance premiums as an income deduction.

If you don’t submit all your paid premiums as an income deduction, you can include the remaining costs with your other itemized medical expenses. You would have to do this, for example, if your health insurance premiums exceeded your business income. Keep in mind that if you combine premiums with your other itemized medical costs, you can use only 10% of your total eligible health-related expenses including premiums beginning with the 2021 tax year.

Do Aca Tax Credits Make Health Insurance More Affordable For The Self

Thanks to the ACA, federal tax credits obtained via the exchanges are helping many families subsidize the purchase of individual health insurance. The tax credits are great for the self-employed, who had to foot the entire bill for their health insurance prior to 2014. Employees who get employer-sponsored health insurance typically enjoy a substantial subsidy in the form of pre-tax premiums and employer contributions to the premium. The ACA makes similar subsidies available for many self-employed people.

The tax credits are available to households with incomes of at least 100% of the federal poverty level but not more than 400 percent of FPL, as long as the enrollees do not have access to Medicaid or employer-sponsored health insurance that is considered affordable . For coverage effective in 2021, the 2019 poverty level is used, and the upper annual income threshold for subsidy eligibility is $51,040 for a single individual and $122,720 for a family of five .

The relatively high income limits mean that premium tax credits are widely available: of the more than 10.5 million people who had effectuated coverage with private health plans through the exchanges as of 2020, about 86 percent qualified for premium tax credits. Nationwide, the average premium subsidy in 2020 was $491 per month .

You May Like: Does Health Insurance Pay For Abortions

Deducting Cobra Insurance Costs On Tax Returns

Going without medical coverage is never a good idea. But if the high cost of COBRA is tempting you to forgo coverage altogether, keep in mind there may be a way to keep your coverage and defray the costs.

You can deduct your COBRA costs if you itemize deductions on your federal income tax return and if your total qualifying medical and dental expenses including the COBRA premiums you paid in the tax year amount to at least 7.5% of your adjusted gross income for the year.

Qualifying medical expenses include COBRA premiums as well as money paid for diagnosis, cure, mitigation, treatment, disease prevention, medical supplies and equipment, and other medical services. However, you can only deduct the premiums you paid for yourself and qualifying dependents, such as your spouse and children. If your employer subsidizes any portion of the COBRA premiums, you typically cant deduct the subsidized amount.

What Is The Medical Expense Tax Credit

The Medical Expense Tax Credit can give you some financial assistance if you have paid for medical services out of pocket. Premiums paid for private health insurance plans are often eligible for deduction by the Canada Revenue Agency, but does that also apply to the self-employed?

Premiums paid to private health plans can be deducted from your business income, but you must be the sole proprietor of your business, and it must be your primary source of income.

To figure out which expenses count for deduction, visit the Tax Planning Guide website, which lists them along with what you cannot claim. Canada Revenue Agencys website gives an even more detailed list.

You May Like: Can You Buy Health Insurance For A Child Only

You Cant Be Eligible For An Employer

The second requirement is that you cant be eligible to participate in an employer-sponsored health insurance plan. If youre eligible to participate in a program sponsored by your spouses employer even if you choose not to participate in that plan you cant claim the self-employed health insurance deduction.

That requirement is determined on a month-by-month basis, so if you were eligible to participate in an employer-sponsored plan for five months out of the year and not eligible for the remaining seven months, you could deduct seven months of premiums.

More Answers To Your Tax Questions

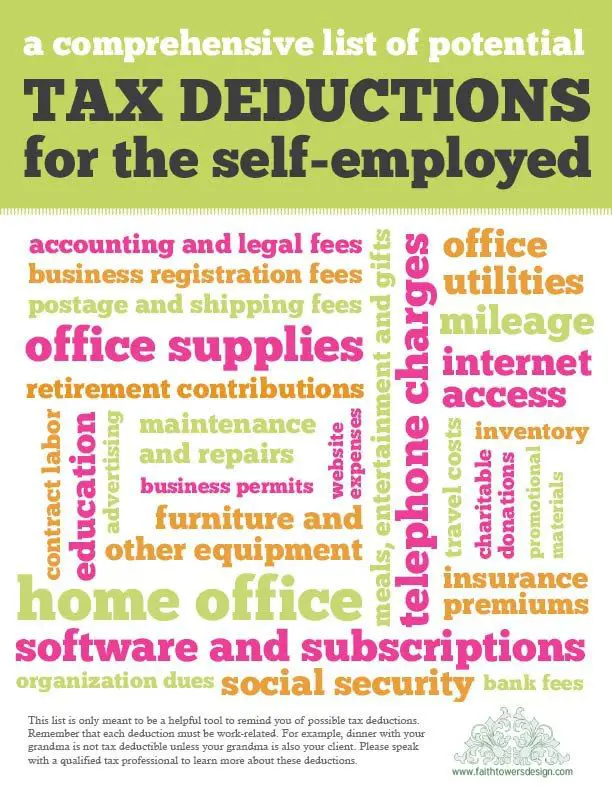

Planning for healthcare expenses can help you save tons of money on taxes, but it can get really complicated if youre unfamiliar with tax concepts. If you really want to maximize your tax savings, you should talk to a professional tax advisor. Shared Economy Tax has been closely serving the self-employed business community for years, so we understand the tax challenges your business is facing. We can help you develop a cohesive plan to minimize your tax bill and keep more of whats yours. Get started today with a one-on-one consultation with one of our certified tax professionals and well show you exactly how we can help. You can also signup for our complimentary newsletter using the form below for more small business tax tips.

Read Also: Can I Stop My Health Insurance Anytime

Health Insurance For The Self

When youre self-employed, you have a range of options when it comes to types of cover for health insurance, depending on the policy you take out. Our health insurance covers the cost of private healthcare for conditions that develop after your policy has begun. Our health insurance is adaptable to suit your individual health and wellbeing needs, and your budget. From fast access to doctors through our Digital GP service, to our mental health support, there are many benefits to our health insurance.

Get a quote today to find out the cost of your self-employed health insurance cover

Other Things To Keep In Mind When Determining Whether Youre Eligible For The Health Insurance Deduction For The Self

There are a few additional things youâll want to keep in mind when determining eligibility for the insurance deduction for the self-employed, including:

- Tax credits. Under the ACA, households below a certain income threshold may qualify for the Premium Tax Credit, which can make health insurance more affordableâincluding for self-employed people. But keep in mind that if you use the tax credit to subsidize a portion of your premium costs, youâll only be able to claim your out-of-pocket costs on your tax returnânot the portion of your premium costs that were covered by the tax credit.

- Policyholder requirements. In order to qualify for the tax deduction, the insurance policy must be under either the self-employed taxpayerâs name or the businessâ name if itâs under someone elseâs name , the premiums wonât qualify for the deduction.

- 2 percent shareholder requirements. If youâre a 2 percent shareholder in an S corp, in order to qualify for the self-employed health insurance deduction, youâll need to either pay your premiums through your business or have your business reimburse you for the premium costs if you just pay for your policy out of your personal account, it wonât be eligible for the deduction. Youâll also need to include your premium costs as shareholder wages on your W2.

Don’t Miss: Is It Legal To Marry For Health Insurance

Computer And Other Equipment Leasing Costs

You may lease:

- fax machines

- other similar equipment

If so, you can deduct the percentage of the lease costs that reasonably relates to earning your business income. You can also deduct the percentage of airtime expenses for a cellular telephone that reasonably relates to earning your self-employment income.

If you buy a computer, cellular telephone, fax machine, or other such equipment, you cannot deduct the cost. You can deduct capital cost allowance and interest you paid on money you borrowed to buy this equipment that reasonably relates to earning your business income.

Travelling Abroad For Treatment

You can claim tax relief on the cost of medical treatment you get outsidethe State. You can claim for treatment abroad that is also available in theState but you cannot claim travelling expenses for this care .

The practitioner who provides your care must beentitled to practice in the country where the care is provided.

You can only claim for the cost of maintenance or treatment in a hospital,nursing home or clinic abroad if the hospital, nursing home or clinic providesaccess to 24-hour nursing on-site.

If the qualifying health care is only available outside Ireland, you canalso claim reasonable travel and accommodation expenses. In such cases theexpenses of one person accompanying the patient may also be allowed if thecondition of the patient requires it. If the patient is a child, the expensesof one parent are usually allowed and, exceptionally, of both parents where itis clear that both need to be with the child.

Also Check: Does Any Health Insurance Cover Cosmetic Surgery

Child Oncology Patients And Children With Permanent Disabilities

In the case of children receiving treatment for cancer and children with permanent disabilities, you can claim taxrelief on the following as health expenses:

Telephone: Where a child oncology patient or a child with apermanent disability is being treated at home, you can claim a flat ratepayment to cover telephone rental and calls where those expenses are incurredfor purposes directly connected with the treatment of the child.

Overnight accommodation: Tax relief is also allowable forparents or guardians of child oncology patients and children with permanentdisabilities where the child needs to stay overnight in a hospital as part oftheir treatment and the parent or guardian is required to stay nearby. Reliefis allowable on payments made to the hospital and/or hotel or bed-and-breakfastnear the hospital for accommodation.

Travel: The cost incurred in travelling to and from any hospital for:

- The patient and accompanying parents or guardians and

- Parents or guardians of the patient

Where such trips are shown to be essential to the treatment of the child.There is a mileage allowance if you use a private car.

Hygiene products and special clothing: Tax relief is alsoallowed for parents/guardians of child oncology patients and children withpermanent disabilities for the cost of hygiene products and special clothing.This is subject to a maximum of â¬500 per year.

No Matter How You Buy It Health Insurance Isnt Cheap

Generally, workers on employer-sponsored plans share health insurance premium costs with their employers. But if youre self-employed and not eligible to get insurance through a spouses employer, youll typically be responsible for covering the entire cost of health insurance.

Still, theres some good news. Employees generally cant deduct their share of monthly premiums from employer-sponsored plans if they pay their share with pre-tax dollars . But if you work for yourself as a freelancer or independent contractor, for example you may be able to take the self-employed health insurance deduction.

If you meet the criteria for taking it, the deduction could allow you to trim 100% of your health insurance premiums off your federally taxable income. And reducing your taxable income can ultimately help lower your tax obligation.

Lets look at the self-employed health insurance deduction and how it works.

Don’t Miss: How Does Health Insurance Work Through Employer

Note For Business And Professional

If you cannot apply the rebate, grant, or assistance you received to reduce a particular expense, or to reduce an asset’s capital cost, include the total in Part 3C at line 8230, “Other income,” on Form T2125. For more information, go to Grants, subsidies, and rebates.

The following may be considered when determining operating expenses:

The Medical Expense Deduction

Health insurance costs are included among expenses that are eligible for the medical expense deduction. You must itemize to claim this deduction, and its limited to the total amount of your overall costs that exceed 7.5% of your adjusted gross income in the 2020 tax year, the return filed in 2021.

This threshold was historically 7.5% until 2013 when it increased to 10%, although it remained at 7.5% for taxpayers who were age 65 or older, at least for a little while. Then, as of December 31, 2016, all taxpayers were supposed to meet the 10% threshold to be able to claim this deduction, regardless of their age.

The Tax Cuts and Jobs Act restored the threshold to 7.5% retroactively for 2017 and going forward through 2018. It was slated to hike back up to 10% in 2019, then the Further Consolidated Appropriations Act extended the 7.5% threshold indefinitely.

Recommended Reading: What Is The Best Affordable Health Insurance

Can I Expense My Health Insurance

You can deduct your health insurance premiumsand other healthcare costsif your expenses exceed 7.5% of your adjusted gross income . Self-employed individuals who meet certain criteria may be able to deduct their health insurance premiums, even if their expenses do not exceed the 7.5% threshold.

Contents

Where Can I Buy Private Health Insurance

A good place to start looking for coverage is the Health Insurance Marketplace created in 2014 by the Affordable Care Act . On the marketplace for your state, you can look through the details of private health insurance plans, and compare the cost and benefits of each. If your state does not have its own marketplace, use Healthcare.gov.

You May Like: Does Burger King Offer Health Insurance

How Do Small Business Health Insurance Tax Deductions Work

How do small business health insurance tax deductions work?

Small businesses that provide health insurance plans for their employees can see some tax relief for their investment. Owners of these companies can deduct some of their health insurance-related expenses from their federal business taxes. If you are a small business owner, you will want to know the type of tax benefits you can expect when you provide health insurance coverage to you, your family, and your staff.

Leaving Or Losing A Job Typically Means Losing The Employer

When that happens, you could buy a medical plan from a private insurer or from the federal or state marketplaces established by the Affordable Care Act of 2010. But the premiums could be higher, especially if your employer covered a portion of the monthly premium costs as many do. And the benefits might not match what you had through your employers plan.

Another option is to continue on your employers plan and shoulder the total costs yourself. The Consolidated Omnibus Budget Reconciliation Act of 1985, or COBRA, allows you to temporarily extend your coverage at your own expense under your employers group health plan for you and your family. Although this can be a less stressful and less time-consuming alternative to finding your own health coverage, it can be a costly option.

Typically, youll have to pay 100% of the premium costs the portion you paid before losing your job and the portion your employer paid plus an additional 2% for administrative costs. And if you receive an 11-month extension of coverage for a disability, your expense may be as much as 150% of the total cost of coverage.

Still, if you need to maintain the same level of benefits as you had while employed, COBRA can help you do that at least temporarily. And you may be able to defray some of the expense by deducting qualified COBRA premiums on your federal income tax return.

Lets look at how COBRA works, and how you might be able to deduct your COBRA premiums.

Recommended Reading: Can You Have Double Health Insurance