Health Insurance In The United States

Health insurance in the United States is any program that helps pay for medical expenses, whether through privately purchased insurance, social insurance, or a social welfare program funded by the government. Synonyms for this usage include “health coverage”, “health care coverage”, and “health benefits”.In a more technical sense, the term “health insurance” is used to describe any form of insurance providing protection against the costs of medical services. This usage includes both private insurance programs and social insurance programs such as Medicare, which pools resources and spreads the financial risk associated with major medical expenses across the entire population to protect everyone, as well as social welfare programs like Medicaid and the Children’s Health Insurance Program, which both provide assistance to people who cannot afford health coverage.

In addition to medical expense insurance, “health insurance” may also refer to insurance covering disability or long-term nursing or custodial care needs. Different health insurance provides different levels of financial protection and the scope of coverage can vary widely, with more than 40% of insured individuals reporting that their plans do not adequately meet their needs as of 2007.

Average Costs For The Us Health Insurance

The following table shows the monthly average of how much you might pay for health insurance in the US. Note that the price usually depends on your age, how healthy you are, what is included in your plan, and which state you live in.

Monthly Premiums

Single male, healthy, in his 30sCouple in their 30s, healthy, expecting a childFamily of 4 , healthyBronze250â400550â8001,000â1,500Silver400â550650â1,0001,300â2,000Gold500â600900â1,2001,800â2,400

Most insurance plans can have added bonuses to them. The most common of those are dental and vision care and can cost you an additional 50 USD per person each month. You can also take out additional bonuses from insurers if your employer does not cover you and your family adequately enough.

Patient Protection And Affordable Care Act

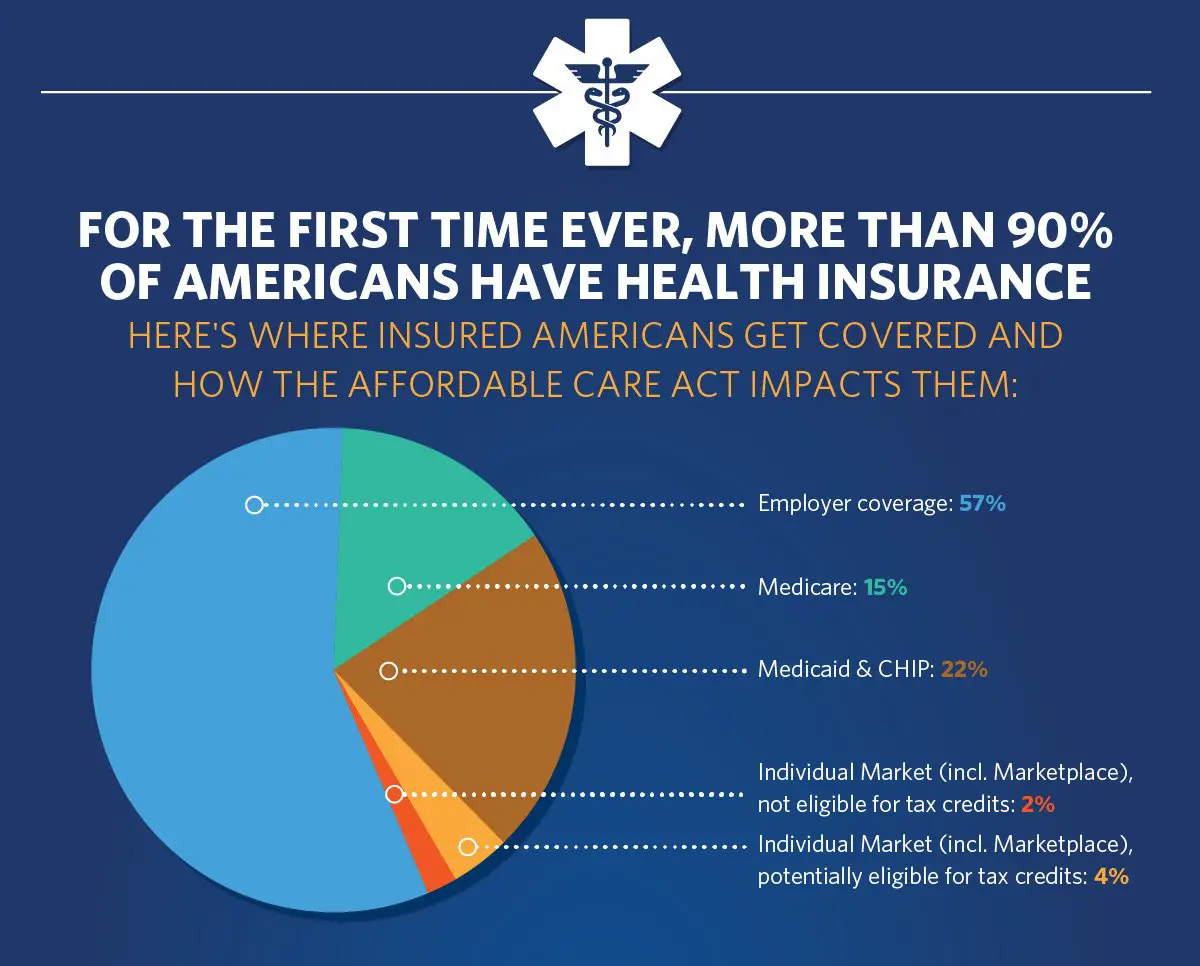

The first open enrollment period of the Affordable Care Act began in October 2013. Prior to this period, access to healthcare and insurance coverage trends were worsening on a national level. A large, national survey of American adults found that after the act’s first two enrollment periods, self-reported coverage, health, and access to care improved significantly. Furthermore, insurance coverage for low-income adults were significantly greater in states that expanded Medicaid in comparison with states that did not expand Medicaid. However, discrepancies do exist between those covered by Medicaid versus those covered by private insurance. Those insured by Medicaid tend to report fair or poor health, as opposed to excellent or very good health.

Read Also: Does Any Health Insurance Cover Cosmetic Surgery

Health Insurance Options For Legal Immigrants

Immigrants that are lawfully present in the United States are eligible to get private health insurance in the US. In addition, lawful immigrants may also eligible for lower costs on monthly premiums and lower out-of-pocket costs based on your income, as follows:

- Those with annual income 400% of the federal poverty level or below may be eligible for premium tax credits and other savings on Marketplace insurance.

- Whereas those with annual household income is below 100% federal poverty level that are not otherwise eligible for Medicaid are eligible for premium tax credits and other savings on Marketplace insurance, given that they meet all other eligibility requirements.

Most of the time, qualified non-citizens are eligible for coverage through Medicaid and Childrens Health Insurance Program , given that they meet the income and residency rules of the state where they are based.

Qualified non-citizens are considered the following:

- Lawful permanent residents

- Asylees, refugees, battered non-citizens & spouses, children, or parents, victims of trafficking and his or her spouse, child, sibling, or parent or individuals with a pending application for a victim of trafficking visa

- Cuban/Haitian entrants,

- Those paroled into the US for at least one year

- Conditional entrant granted before 1980

- those granted withholding of deportation and members of a federally recognized Indian Tribe or American Indian born in Canada.

What Is Being Done To Promote Delivery System Integration And Care Coordination

The ACA introduced several levers to improve the coordination of care among medical/clinical providers in the largely specialist-driven health care system. For example, the law supported adoption of the patient-centered medical home model, which emphasizes care continuity and coordination via primary care, as well as evidence-based care, expanded access, and prevention and chronic care management.

The ACA also expanded the Centers for Medicare and Medicaid Services ability to test alternative payment models that reward quality, reduce costs, and aim to improve care coordination. This trend has since been continued by public and private payers.

One of these alternative payment models is bundled payments, whereby a single payment is made for all the services delivered by multiple providers for a single episode of care. Another trend is the proliferation of accountable care organizations . These networks of providers assume contractual responsibility for providing a defined population with care that meets quality targets. Providers in ACOs share in the savings that constitute the difference between forecasted and actual health care spending.

Read Also: How Does Health Insurance Work

Why You Need Health Insurance

Health insurance is necessary for Americans to pay for the high cost of healthcare. You generally need it unless you can afford to pay for healthcare on your own or receive government assistance. The very wealthy can afford the cost of even extraordinary emergency or chronic medical care. Those over age 65 usually qualify for Medicare. Lower-income individuals and families may qualify for Medicaid.

Everyone else must either purchase health insurance or risk medical bankruptcy. Since it is so common, many people have lost sight of its underlying purpose. It’s just like insurance for your car, home, or apartment. It’s supposed to protect your life savings from the devastating costs of a major accident, medical emergency, or chronic disease.

Unlike other insurance, health insurance makes it possible for you to get healthcare when you need it. If you don’t have car insurance, you can take the bus until you can afford to get your car fixed. If you break your leg, you cant splint it yourself until you save up enough to go to the doctor.

Government Health Insurance Programs

Medi-Cal:

- Description: Medi-Cal is California’s Medicaid program. The state and the federal government jointly fund it. It provides free or low-cost care to children and adults with limited incomes.

- Contact: Call or visit medi-cal.ca.gov.

Medicare:

- Description: This insurance program from the federal government covers people 65 and older, as well as some people with certain diseases or disabilities. Medicare includes Parts A and B . Part D is optional and costs extra. You may only join during certain enrollment periods.

- Contact: Call or visit medicare.gov. You may find it easier to contact an outside group for advice. For questions about your options and rights, reach the nonprofit HICAP at cahealthadvocates.org/hicap or . Learn about prescription drug options through our partner, the consultant eHealth, at medicare.com or .

Read Also: How Does Short Term Health Insurance Work

How Is The Delivery System Organized And How Are Providers Paid

Physician education and workforce: Most medical schools are public. Median tuition fees in 2019 were $39,153 in public medical schools and $62,529 in private schools. Most students graduate with medical debt averaging $200,000 , an amount that includes pre-medical education.21 Several federal debt-reduction, loan-forgiveness, and scholarship programs are offered many target trainees for placement in underserved regions. Providers practicing in designated Health Professional Shortage Areas are eligible for a Medicare physician bonus payment.

Primary care: Roughly one-third of all professionally active doctors are primary care physicians, a category that encompasses specialists in family medicine, general practice, internal medicine, pediatrics, and, according to some, geriatrics. Approximately half of primary care doctors were in physician-owned practices in 2018 more commonly, these are general internists rather than family practitioners.22

Primary care physicians are paid through a combination of methods, including negotiated fees , capitation , and administratively set fees . The majority of primary care practice revenues come from fee-for-service payments.23 Since 2012, Medicare has been experimenting with alternative payment models for primary care and specialist providers.

Providers bill insurers by coding the services rendered. There are thousands of codes, making this process time-consuming providers typically hire coding and billing staff.

How Do Health Insurance Subsidies Work In The Usa

A health insurance subsidy provides government assistance to contribute to the cost of cover in the USA, the Affordable Care Act provides a sliding scale of support to US citizens and legal residents earning four times the federal poverty level or less.

In 2021, the federal poverty level is US$12,880 for an individual, so individuals earning less than US$51,520 may be entitled to subsidised health insurance.

Applications are made through the government-run health insurance marketplaces in each state. Changes to incomes may affect eligibility, so applicants sometimes need to pay subsidies back if circumstances change.

You May Like: Does Farmers Insurance Sell Health Insurance

What Happens If You Don’t Have Medical Cover In The Us

Despite there no longer being any kind of penalty for not having health insurance, adequate medical cover is still an essential expense.

First and foremost, youll have to pay an awful lot of money for medical care that could otherwise have been covered by your insurer.

Check out the typical cost of certain medical procedures without insurance .

| Medical procedure | |

|---|---|

| A day in the hospital | $5,220 |

Health Insurance Requirements For Foreign Visitors In The Us

Though the United States Authorities have not made health insurance mandatory for short-term travelers to the country, as B-1/B-2 visa holders, it is highly recommended for every traveler to get insurance before their trip to the country.

The main reason why you should get insurance is that healthcare in the US is extremely expensive and even a check-up for a simple headache will cost you hundreds of dollars, while a broken limb will cost you thousands.

Health incidents are never foreseen, therefore it is best to be prepared for it and get insurance, so in case of need you save yourself money.

Read Also: How Much Is Kaiser Health Insurance

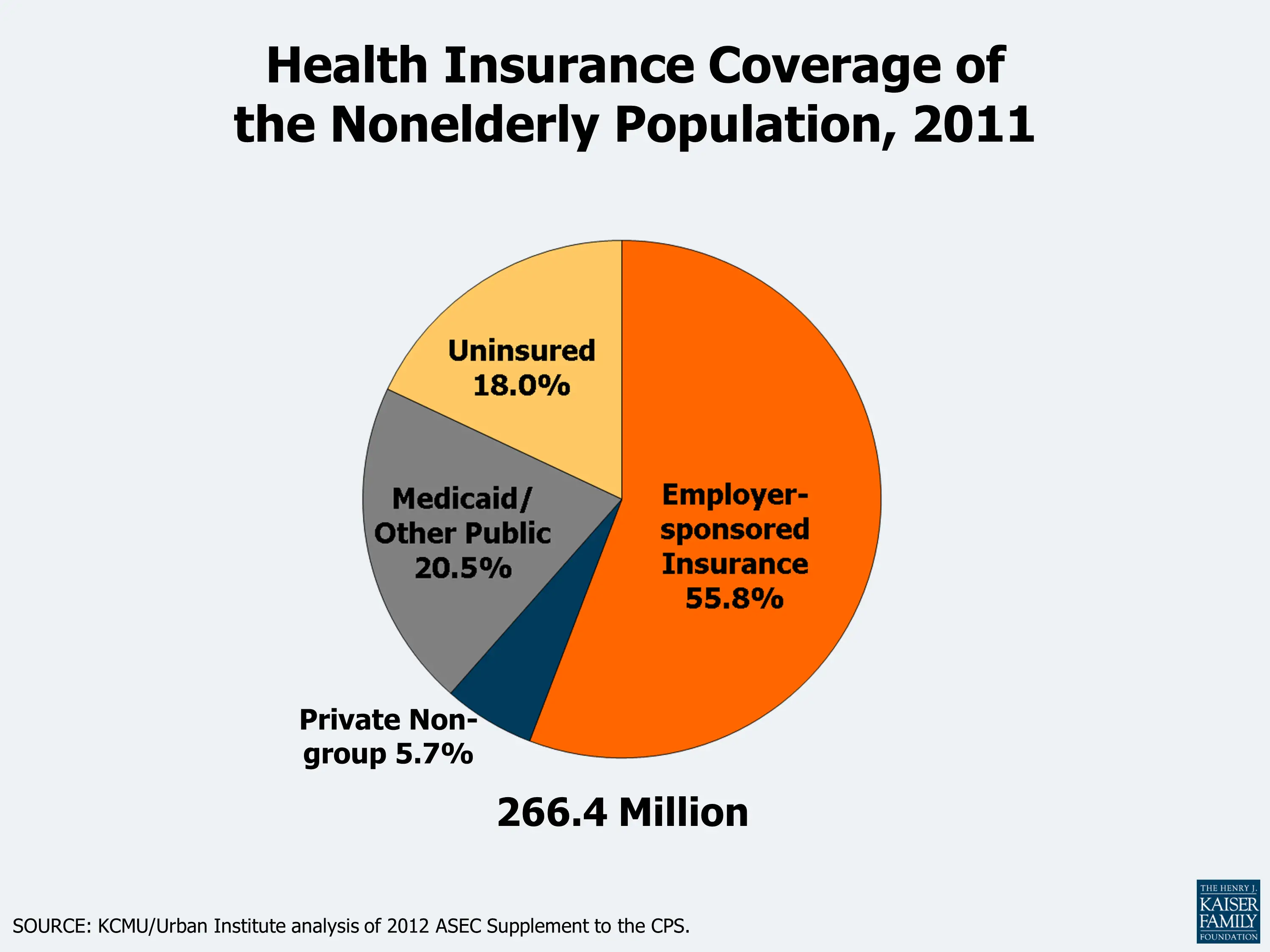

Obamacare Is Not Universal Health Care

The United States does have a very recent, very large expansion of health insurance coverage that’s the program we all call Obamacare. It’s expected to cover an additional 26 million people by 2024.

What the United States does not have, however, is universal coverage.

Obamacare doesn’t eliminate uninsurance in America instead, it cuts the number of people lacking coverage about in half. Even after Obamacare is fully implemented, budget forecasters still expect that 31 million Americans will lack insurance coverage a bigger group than the people buying coverage on the exchanges. Our uninsured rate will still be in the double digits, hovering around 11 percent.

This group includes people who are locked out of the insurance expansion and those who do have access but decide not to participate.

Among the groups left out of the health-care law are undocumented workers, who are not eligible to purchase any health-care plans from the new insurance exchanges, and people who live in states that are not expanding Medicaid. For a sense of how big a population that is, the 10 largest states not expanding Medicaid are leaving out an estimated 3.6 million low-income residents.

This will continue to set the United States apart from most other industrialized nations, in which universal coverage is the standard. And it means there will still, in decades to come, be people who can’t afford health insurance. That means there will be millions who rely on free clinics for medical care.

Types Of Health Insurance Plans In The Us

As mentioned before, when choosing your plan, you can

- opt for insurance plans that comply with government standards

- choose short-term plans offered by insurers.

If opting from the government-regulated plan, you will be able to choose between the following networks of the marketplace:

- Preferred Provider Organizations : allows the members to visit doctors inside and outside of the network. The costs for specialists outside of the network might be higher. Allows members to visit any doctor without a referral.

- Point of Service Plan : allows the members to visit doctors inside and outside of the network, with higher costs for out-of-network specialists. Members need a referral to visit providers that are outside of their network.

- Health Maintenance Organizations : covers healthcare services provided by specialists and hospitals in the network and out-of-network emergency services. The members usually have their primary doctors who refer them to specialists.

- Exclusive Provider Organizations : covers healthcare services provided by specific specialists and hospitals that are a part of the network.

As a lot of insurers are in the marketplace, you will see the appropriate acronym of each network indicated in the description of the plans they are offering.

Most insurers in the marketplace also allow you to choose between plans categorized into metal types:

Plan typeWhat you payWhat your insurer paysBronze40%60%Silver30%70%Gold20%80%Platinum10%90%

Don’t Miss: Do You Have To Carry Health Insurance

How To Choose A Good Us Health Insurance Plan

When looking up for a good health insurance plan make sure you ask questions like:

- Does that plan grant you with the right to go to any doctor, hospital, clinic or pharmacy you choose?

- Are specialists such as eye doctors and dentists covered?

- Does the plan cover special conditions or treatments such as pregnancy, psychiatric care and physical therapy?

- Does the plan cover home care or nursing home care and medications a physician might prescribe?

- What are the deductibles? Are there any co-payments?

- What is the most you will have to pay out of my own pocket to cover expenses?

Make sure you also understand how a dispute about a bill or service is handled by your provider, as in some plans, you may be required to have a third party decide how to settle the problem. We recommend the GeoBlue Xplorer plan for foreigners in the United States

The Affordable Care Act

The Affordable Care Act was started in order to make healthcare more accessible to the public. The main changes made by the Affordable Care Act are:

- Eliminated lifetime and yearly coverage limits.

- Ability to purchase health insurance through government-regulated Health Insurance Marketplace.

- Permission for adults under 26 years old to stay under their familyâs insurance plan.

- Refusal of coverage based on gender or pre-existing conditions.

The act also introduced a yearly fine for people that do not purchase any insurance as well as the concept of ten essential healthcare benefits that must be covered by the qualifying health plans. However, the recent policy changes aim to eliminate those clauses and make other alterations in the act.

Read Also: Does Health Insurance Cover Nicotine Patches

Health Care Markets And Pricing

The US health insurance market is highly concentrated, as leading insurers have carried out over 400 mergers from the mid-1990s to the mid-2000s . In 2000, the two largest health insurers had total membership of 32 million. By 2006 the top two insurers, WellPoint ” rel=”nofollow”> Anthem) and UnitedHealth, had total membership of 67 million. The two companies together had more than 36% of the national market for commercial health insurance. The AMA has said that it “has long been concerned about the impact of consolidated markets on patient care.” A 2007 AMA study found that in 299 of the 313 markets surveyed, one health plan accounted for at least 30% of the combined health maintenance organization /preferred provider organization market. In 90% of markets, the largest insurer controls at least 30% of the market, and the largest insurer controls more than 50% of the market in 54% of metropolitan areas. The US Department of Justice has recognized this percentage of market control as conferring substantial monopsony power in the relations between insurer and physicians.

Certificates Of Need For Hospitals

In 1978, the federal government required that all states implement Certificate of Need programs for cardiac care, meaning that hospitals had to apply and receive certificates prior to implementing the program the intent was to reduce cost by reducing duplicate investments in facilities. It has been observed that these certificates could be used to increase costs through weakened competition. Many states removed the CON programs after the federal requirement expired in 1986, but some states still have these programs. Empirical research looking at the costs in areas where these programs have been discontinued have not found a clear effect on costs, and the CON programs could decrease costs because of reduced facility construction or increase costs due to reduced competition.

You May Like: How Much Is Health Insurance In Idaho

Taking Advantage Of Enhanced Premium Tax Credits

There is a COVID-related enrollment window underway in every state as of March 2021 in nearly every state, it continues through May 15, 2021.

If youre uninsured, this window is an opportunity to enroll in coverage through the marketplace and take advantage of the newly available additional premium tax credits.

In most states, this window is also an opportunity for people to switch from one plan to another or switch from off-exchange coverage to on-exchange coverage.

All of the enhanced premium tax credits described above are available retroactively to January 2021. So if youve been enrolled in a marketplace plan since the start of the year, youll be able to claim the additional premium tax credits for the first few months of 2021 when you file your 2021 tax return.

If youre enrolling in an exchange plan during the COVID-related enrollment period, be aware that the new subsidies created by the ARP wont show up on HealthCare.gov until April 1, and it could be later than that in some of the states that run their own exchanges.

If you enroll before the new subsidies are displayed, your initial subsidy amount will reflect the pre-ARP rules. But again, youll be able to claim any additional premium subsidies owed to you when you file your 2021 taxes.

The new subsidy amounts will ultimately apply for any month that you have on-exchange coverage in 2021 .

If youre already enrolled in an off-exchange plan , youre not eligible for any premium subsidies at all.