Is Health Insurance Getting More Expensive

It certainly feels like it. And its true that over the last decade, health care costs have risen significantly. The average family is paying 55% more in their premium in 2020 versus 2010 according to the Kaiser Family Foundation.5 And that number is up 22% since 2015.6 But premiums have only risen 4% when comparing 2020 against 2019.7

Health care costs also change based on where you live. In some states theyre up, in other places theyre lower.

If you feel like youre drowning in sky-high health insurance costs, there are some ways to save money on health insurance. Dont give up hope. You always have options, even if it just helps your budget a little. There are also some ways to save on health care costs your insurance doesnt cover.

And if youre trying to cut costs while paying off debt, or youre just starting to budget and barely making ends meet, you might want to choose a high-deductible and lower-premium plan that will kick in if you have serious medical issues or an accident. This allows you to focus on your necessities before you tackle an expensive health care plan.

Average Cost Of Health Insurance In Georgia

The average cost for a Bronze plan is $354, $460 for a Silver plan and $538 for a Gold plan in 2019.

Georgia residents spent an average of $6,587 per year on health care expenditures in 2014, which is less than the national average, according to a Kaiser Family Foundation report. This was the latest data available.

Georgia Individual Health Insurance 2022 Options For Atlanta Ichras

Amy

Looking for the best individual health insurance options in Atlanta to use with an ICHRA? You’re in the right place – and there’s good news! The individual coverage HRA is taking off where you live, thanks to a vibrant local individual health insurance market. That means more ACA-compliant, high quality health insurance choices for employees.

| We’ve put together this guide to help employees orient themselves to the local individual health insurance market in Atlanta to use with their Individual Coverage HRA. Health insurance can be confusing, and many employees offered an ICHRA will be buying their own health insurance for the first time. We’ve got you covered! |

Who this guide is for:

- Employees shopping for health insurance to use with their ICHRA

- Employers wanting to help their employees make educated decisions about their health plans to use with their ICHRA

- Employers of any size considering implementing an ICHRA

What this guides covers:

Also Check: How To Switch Your Health Insurance

The Cost Of Health Insurance In Georgia

The average cost of health insurance in the state of Georgia is $5,424 per person based on the most recently published data. For a family of four, this translates to $21,697. This is $1,557 per person below the national average for health insurance coverage. However, health insurance costs vary significantly based on the cost of care and the population insured. The chart below shows the four major insurance types available in Georgia. The dollar amounts shown on the chart are the average cost in Georgia to insure people for each type of insurance.

Group Coverage Vs Individual Health Insurance Cost

Written by: Elizabeth WalkerOctober 25, 2021 at 9:23 AM

Many people assume that individual health insurance is more expensive than group health insurance, but is that really true? How exactly do individual health insurance premiums compare to group health insurance premiums?

In this article, well compare the cost of group health insurance and individual health insurance, as well as discuss another budget-friendly health insurance option to make your insurance even more affordable.

Read Also: What Are Some Good Health Insurance Plans

What To Know About Health Insurance In Georgia

- You can purchase a plan through the Health Insurance Marketplace if you dont have employer health coverage or your employers plan is inadequate for your needs. All ACA-compliant plans are guaranteed issue, which means the plans provide coverage for preexisting conditions and mental health care.

- Alternative enrollment: You also have the option to buy a health care policy off the exchange through a broker, an insurance agent, or a private company. Alternatively, you can purchase a short-term health care policy that provides insurance for a limited period.

- Open Enrollment: Open Enrollment in Georgia starts no earlier than October 1 and ends no later than November 15. If you want to enroll outside of this timeframe, you will need to qualify for a special enrollment with a life event. Qualifying events include getting married, having a baby, losing your job, or moving.

- Open Enrollment extension:This year, Georgia extended Open Enrollment to , due to the COVID-19 pandemic. You dont need a qualifying life event to enroll in a marketplace plan during the extended Open Enrollment.

- Coverage types: About half of Georgia residents get healthcare through an employer , followed by Medicare , then Medicaid . Nongroup insurance such as marketplace plans or short-term insurance accounts for 5.6%, while the military provides health coverage for 2.2%. About 13.4% are uninsured.

For A Family Of 4 The Bottom Line Is For Non

For a family of four, an ACA plan can be purchased as non-subsidized insurance. You will pay approximately $25,000 per year in premiums. This equates to an annual premium cost of $17,244 for family health insurance, and $7,767 for deductible expenses.

eHealth acknowledges that rising costs of health care are alarming for many families. Dont let this discourage you from looking for family health insurance that you can afford. We can help you find the right level of coverage that is affordable for you and your family. You can also use our subsidy calculator, which will help you determine if you are eligible for a tax rebate. eHealth:

- Our online service allows you to compare individual and family insurance options. You can also chat with an eHealth representative whenever you have a question.

- Talk to an eHealth licensed agent for insurance. They will help you find affordable coverage that suits your needs and those of your family.

Explore your individual and family health insurance options today. You dont have to pay anything to use eHealth services.

This article contains general information that may not have been updated since publication. Instead of using this article as legal advice, consult your tax, accounting or tax professional.

You May Like: Can You Add Spouse To Health Insurance

Georgia Medicare Plans For Seniors And Younger Adults With Disabilities

Most Georgia residents on Medicare qualify because theyre at least 65. Coverage is also available to adults under 65 with disabilities and chronic illnesses.

There are two main ways you can receive Medicare Part A hospital and Part B medical insurance in Georgia:

Original Medicare: Enrolls about 1 million Georgians.

Medicare Advantage: Enrolls nearly 735,000 residents

Which Insurance Licenses Do You Need

The first step to getting your insurance license is choosing which licenses you need. The most common licenses new insurance agents get are the property & casualty license , life and health insurance license .

The types of insurance products and policies youll be selling will determine which licenses you need. Here are some examples of the types of policies you can market with each license:

- Life and Health Insurance License Life Insurance, Annuities, Medicare, Health Insurance, etc

Most insurance agents and producers choose to get both P& C and L& H licenses, but if you plan on specializing in only one category then you dont need every license.

Insurance adjusters require a separate license. You can find more information on becoming an insurance adjuster here: Georgia Insurance Adjuster License

Note:

Recommended Reading: What Does Cobra Health Insurance Cover

What Is The Average Cost Of Health Insurance For A Student In Georgia

Georgia does not require that its residents carry health insurance. However, the Affordable Care Act made it possible for students to stay on their parents health insurance policy until 26. Though the state does not require residents to carry health insurance, some schools in Georgia may require students to. Many of these schools offer on-site clinics and health insurance plans through the school or university.

How Much Does Obamacare Cost

- Not all states have expanded Medicaid coverage under the Affordable Care Act. Learn where your state stands.

- The Affordable Care Act tax penalty has been set to zero, but some states have enacted their own health insurance requirements.

- If you miss the Affordable Care Act deadline in your state, you may still be able to get covered.

- Three ways your state residents can reduce the costs of health care coverage under the Affordable Care Act .

- Four ways students who need health insurance can get covered under the Affordable Care Act .

- When you have homes in two different states, it may be tricky to decide if you need one health plan or two.

State Affordable Care Act Costs

Also Check: What To Do When You Lose Health Insurance

How Much Does Health Insurance Cost In Georgia

Any plan sold on Georgias insurance marketplace or off-exchange is required to have the same cost by law. Plans sold on Healthcare.gov use the metal tier system: bronze, silver, gold, and platinum. The different metal tiers do not signal a difference in the kind of health care you will receive, but tiers indicate a difference in monthly premium and out-of-pocket costs.

| Average premium in Georgia | |

|---|---|

| $491 | $463 |

- Bronze plans are suitable for healthy people with few medical needs. The plans feature low monthly premiums but high deductibles. There is also a high coinsurance payment of 40%. The most affordable bronze Plan in Georgia has a monthly premium of $348.

- Silver plans are suitable for people with more complicated health situations. The plans offer lower deductibles, which is good if you need to make frequent doctor visits, but youll pay more in a monthly premium. The coinsurance fee also costs less at 30%. Silver plans offer CSRs for individuals who qualify financially, which results in lower deductibles. Sometimes, the bottom line cost on a silver plan is lower than a bronze plan. The lowest-priced silver plan in Georgia is $443 per month.

- A gold or platinum plan is appropriate if you have significant health issues and need regular doctor visits or have numerous prescriptions. Be prepared you will pay more for monthly premiums with these plans. You will save money on coinsurance payments . The lowest-priced gold plan in Georgia costs $463 a month.

Georgia Office Of Insurance And Safety Fire Commissioner Contact Information

Mailing Address:

2 Martin Luther King, Jr., DriveWest Tower, Suite 702Atlanta, GA 30334

Note: In Georgia, Pearson VUE is the primary contact for all inquiries about insurance agents and agency licensing as well as continuing education.

Phone: 274-8969

Two years. Learn more here: Georgia Insurance License Renewal

Read Also: What Is Aetna Health Insurance

What Determines The Cost Of Obamacare Health Insurance

What Obamacare costs will depend on your age, location, household size, and income. If you use tobacco products, your monthly premiums will cost more. The type of plan you choose from the Marketplace will also impact cost.

These are the only factors that are allowed to influence coststhe Affordable Care Act mandated that plans could not charge more based on gender.

You can learn more about what individual Marketplace premiums have looked like by metal tier and by state over the past few years here.

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you must do to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

Recommended Reading: How Much Does Usps Health Insurance Cost

Health Insurance Rate Changes In Georgia

Health plan premiums are set by individual health companies. Once an insurer has decided on rates for the upcoming year, these are sent to the Georgia health insurance exchange for approval.

In Georgia, the average cost of a Silver health plan is 25% less expensive in 2022 than it was in 2021. The cost of Gold policies decreased the least from 2021 to 2022, by 22%, or $154 per month. Catastrophic health insurance plans saw the most significant decrease in pricing â rates are 26% lower than they were in 2021, or $90 cheaper per month for the average 40-year-old.

| Metal tier |

|---|

Premiums are for a 40-year-old adult.

How To Get Health Insurance In Georgia

Individuals with a family or business looking to buy affordable health insurance coverage online to bridge the temporary gap until the next ACA healthcare exchange open enrollment period have many insurance options at their disposal.

Until Open Enrollment starts, term health insurance could be your best option because you can get a free quote and buy it online with coverage starting by the next day that is temporary, plus you can cancel it anytime!

Please review the following information to help you make the best decision as you compare online health insurance plans:

Read Also: How To Be A Health Insurance Agent

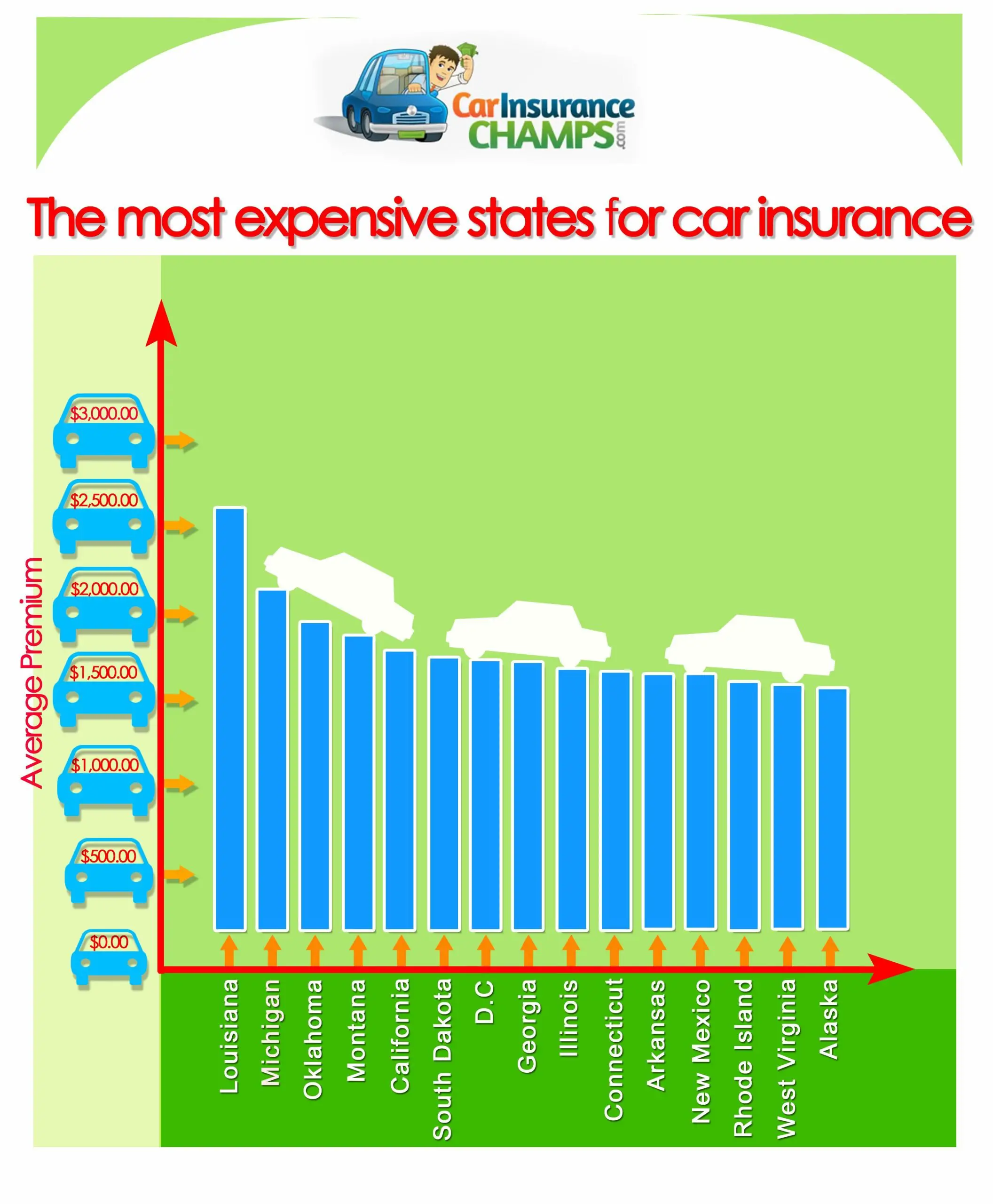

Average Cost Of Health Insurance

One of the primary factors in your individual health insurance costs is your location, as prices will vary depending on the state and county where you live. In this first table, we look at health insurance premiums for 2021 and how they differ based upon the state you reside in.

| State |

|---|

Policy premiums are for a 40-year-old applicant.

How Much Does Health Insurance Cost For A Family In Georgia

- Asked March 14, 2013 in

Contact J Scott Burke Contact J Scott Burke by filling out the form below

J Scott BurkePROPresident, Newbury Inc., Evansville, IndianaShopping for health insurance rates in any city is pretty much the same. You can look for a health insurance agent in the yellow pages or look them up on the Internet.Your premiums are going to be based on your age, health history, smoking status, gender, other family members to be covered and also how much you will accept for deductibles and co-pays.Answered on April 15, 2013+0

Also Check: What Type Of Insurance Is Health Partners

Cheapest Health Insurance Plans By County

The county you live in will determine which insurers and health plans are available to you on the Georgia marketplace, as well as your cost of coverage. For instance, the Ambetter Balanced Care 11 plan costs $373 in Lincoln County and is the most affordable Silver plan in that region. Meanwhile, the best-priced Silver plan in Carroll County costs $386 â the SoloCare Silver PPO .

To help you find the best health insurance policy, we analyzed all plans on the exchange and identified the cheapest Silver plan in each county. Below, you can see the lowest-cost plan alongside sample monthly rates for an individual, a couple and a family of three.

| County |

|---|

How Much Is Health Insurance Per Month For One Person

Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. The average national monthly health insurance cost for one person on an Affordable Care Act plan in 2019 was $612 before tax subsidies and $143 after tax subsidies are applied.

Wondering how insurance premiums are decided? The Affordable Care Act ensures that insurance companies cannot discriminate based on gender, current health status, or medical history. Here are factors that determine health insurance premiums.

Recommended Reading: How To Get Health Insurance As A Real Estate Agent

Health Insurance Plans In Georgia

Health insurance policies in Georgia include public and private options. Comparing quotes from different health insurance providers is a great way to find the best plan for you, but first its important to understand the different types of insurance available.

< qa> 1 Individual Health Insurance in Georgia For self-employed Georgians or those that arent offered adequate insurance by their employer individual health insurance may be a suitable option. Individual insurance can be purchased through the Healthcare Marketplace or through private providers.< /qa>

< qa> 2 Family Health Insurance in Georgia Family health insurance covers you, your spouse, and your children, up to age 26. As long as they meet age guidelines, your children dont have to be financially dependent on you to fall under family coverage.< /qa>

< qa> 3 Short Term Health Insurance in Georgia Short term, also called temporary health insurance, may be a good choice is you experience whats known as a qualifying life event. For instance, perhaps you are moving from one job to a new job in between, you may experience a period of time when youre not covered by your old employers plan or your new employers plan. Short term health insurance can cover you during these in-between periods.< /qa>