Youre Covered Under A Group Health Plan

If you, your spouse and your children are covered under your workplace health plan, your whole family can get in on the COBRA action. But if you were the only person covered, then no one else in your family would qualify for COBRAjust you.

Your spouse or children covered under your old jobs plan will also be eligible for COBRA if:

- You pass away. Even though you obviously wont need health insurance anymore, your family can still stay covered under COBRA.

- You get divorced. If you and your spouse split up and theyre on your health plan, they can keep that same coverage with COBRA. The same thing applies if youre on their health plan.

- You move to Medicare. When you make the switch to Medicare, your family can extend their coverage under COBRA.

- Your kid grows up. Once your kid turns 26, theyre on their ownat least when it comes to health insurance! But while they hunt for their own insurance plan, COBRA can prevent a gap in coverage, if it comes to that.

How Does Cobra Health Insurance Work

COBRA allows you to keep your health insurance if you lose your job. Apply for coverage within 60 days of job loss to qualify for coverage.

Under COBRA, individuals can extend the coverage they had from their employer for up to 18 months . However, the plan is no longer sponsored by your employer, so you are responsible for paying the entire monthly premium for the duration of your extended coverage.

COBRA benefits also apply to your spouse or dependents that were covered by your employer-sponsored plan.

Understand The Differences Between Plans

Things can get confusing really quickly while you try to figure out all the health insurance plans out there. You need to understand what youre getting and the differences as you look at each option.

For example, your doctor might have been in network through the preferred provider organization plan you had at work, but they might not be in the health maintenance organization plan network youre looking at from the marketplace. That means its going to cost you more to see your doctor if you go with the HMO. In that case, you need to do some soul-searching and ask yourself how much you really like your doctor!

These are the kind of details you should think about as you decide whether or not to choose COBRA. Different plans have different coverage options, so make sure you know what youre signing up for!

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

How To Estimate Cost Of Cobra

Your employer will notify you in writing. If you want to try to estimate before you receive something in writing you can look at your last W2 form.

Employers are asked to report the total cost of health insurance on the W2 form. Box 12a will show the total cost of health insurance.

It includes what you paid plus what your employer paid. Most people are shocked by the number.

Who Qualifies For Cobra Coverage

An employee may qualify for COBRA insurance coverage if they were covered by a group health plan on the day before a qualifying event .

Qualifying individuals can be employees or their:

- Dependents

- Spouses

- Former spouses

In the event that your business files for bankruptcy, retired employees or their spouses, former spouses, and dependents may be eligible for COBRA coverage, too.

Any children qualified individuals have or adopt while using COBRA coverage are automatically covered.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

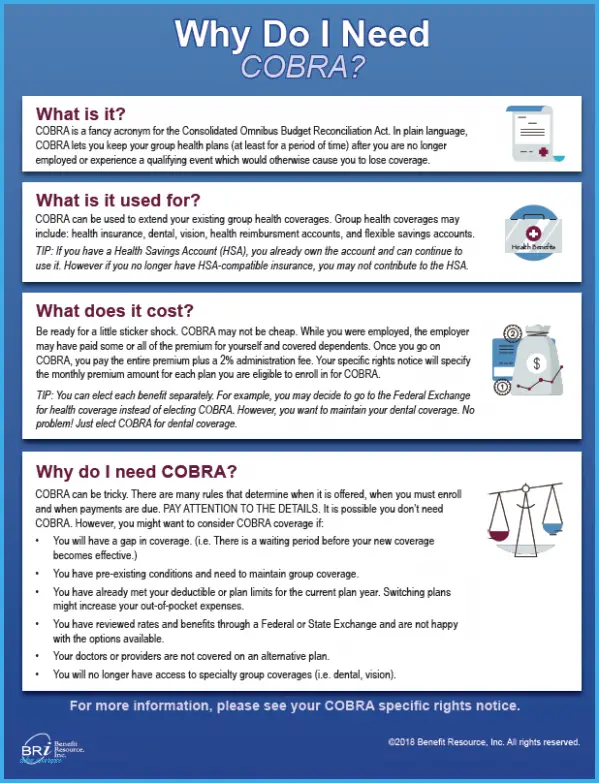

What Is Cobra Health Insurance

The Consolidated Omnibus Budget Reconciliation Act is a federal law that requires employers to extend health insurance to employees who become ineligible for the business-provided health plan. You must also offer COBRA health coverage to eligible employees dependents and covered spouses.

COBRA regulates:

- When and how you must provide continued coverage

- When an employee is eligible for COBRA coverage

- How long an employee has coverage

Keep in mind that COBRA coverage is only for health plans and does not cover life or disability insurance plans.

How Much Is Cobra

Because COBRA is the same work health insurance you previously had, you pay the entire premium, including the employers portion they were paying.

The Good And The Bad

If you have pre-existing conditions or require many visits to the doctor, continuing your former health plan may be the best option. Though, the cost of paying the insurance company premiums out of pocket while youre in a job transition may cause financial hardships.

You May Like: Does Starbucks Have Health Insurance

What If You Change Your Mind And Decide You Want Cobra

If you are entitled to elect COBRA coverage, you must be given an election period of at least 60 days. If you decline COBRA coverage during the normal 60-day decision period, you must be allowed to rescind your coverage waiver. However, you must reverse your decision during that period, and your final decision will become permanent after the 60-day window closes.

How Do You Qualify For Cobra Continuation Coverage

You generally qualify for COBRA coverage if you were covered as an employee or dependent on an employer-sponsored policy, and your coverage is ending due to job loss, resignation, loss of hours, divorce, death of the employee, etc. But there are some circumstances where you wont qualify for COBRA. For example, youre not eligible for COBRA coverage if your company changes to a different health care plan and you want to continue under your existing plan, because you are instead eligible for coverage through the new plan. COBRA also does not have to be made available if you lose your job for gross misconduct.

Also Check: Is Starbucks Health Insurance Good

I Was Laid Off And My Job

Yes. Under the American Rescue Plan, you can enroll in COBRA if you are still within your federal COBRA 18-month coverage periodeven if you did not enroll at first. Starting April 1, 2021, you can enroll in COBRA even if you didnt enroll during your first 60-day COBRA election period when you were laid off. You can also reenroll if you dropped COBRA. The American Rescue Plan does not extend your 18 months of COBRA.

How Much Will You Pay For Cobra

Cost is a major drawback of COBRA coverage because in almost all cases your employer will no longer be chipping in anything for your premium. Under COBRA you must pay the full premium costs plus a possible 2% administrative fee. That can be a significant increase, considering that the average employer pays about 80% of annual premiums for plan members.

According to the Kaiser Family Foundation, the average annual premiums for family-based, employer-sponsored health insurance was more than $21,000 in 2020. 4

While employed, you would be paying only 20% of that, or $4,200 per year. With COBRA, youll pay the full $21,000 plus the administrative fee.

That said, you cant be charged more than 102% of the cost of the plan. You make payments directly to the health insurance company or COBRA plan administrator.

In some cases, your former employer may choose to pay some or all of your COBRA premiums. This may happen if your employer is undergoing a merger or acquisition, has furloughed you, or is offering severance. In these cases, you may find you pay the full cost of insurance and get a reimbursement from your former employer afterwards. Or, the employer may pay the health plan directly.5

Changes for 2021

The American Rescue Plan added a subsidy that will pay 100% of COBRA premiums until September 30, 2021. This applies for certain groups whose work hours shrank or who lost their jobs.

Don’t Miss: Starbucks Health Insurance Plan

What If You Are Retiring

If you are retiring before you reach eligibility age for Medicare , that is considered a qualifying event, and you and your dependents will be eligible for COBRA.

Before you sign up, be sure to check if your employer offers retiree healthcare benefits and if early retirees are eligible to receive them. Retirement health coverage from your employer will last as long as the company offers it, and it will likely be more affordable than COBRA.

What Do I Need To Know About Paying For Cobra

Your COBRA administrator should tell you within 14 days about the COBRA4 continuation coverage thats available to you.

If you qualify for ARPA there is a 100% subsidy, which means COBRA premiums are covered including the 2% administrative fee that health plans are permitted to charge for COBRA. This subsidy is available April 1, 2021 through September 30, 2021.

Under regular COBRA youd have to pay the full premium for your health care coverage, plus an administrative fee. When you were employed, your employer generally paid for some of the cost of your health insurance premium, and now you will responsible for the full amount. That means you may pay more for COBRA coverage.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

How Long Does Cobra Health Insurance Last

Consider the following when deciding between COBRA health coverage or an individual health insurance plan.

COBRA coverage typically lasts 18 months, but can be longer

You have 60 days from the day you lose coverage to apply for COBRA

COBRA is month-to-month, so you can cancel any time

COBRA lets you stay on your same insurance plan

eHealth is an authorized federal government partner.

Coverages Of Cobra Health Insurance

One of the benefits of COBRA is that it provides the exact same coverage your company currently offers its employees. Often times it is identical insurance you had before you lost benefits. While disability and life insurance are not included, plans that covered dental, vision, and prescription drugs are considered health care benefits and will remain intact. Employer provided health care is often more robust than health care found on current health care markets, so you may wish to keep it.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Is Cobra Coverage Expensive

COBRA can be significantly more expensive than what you paid under your employers plan. Why? Under COBRA you pay 100% of the costs for the health plan. This includes any costs your employer previously helped pay. This extra cost can make this coverage more expensive for you, even though its the same health plan.

Cobra Continuation Coverage Questions And Answers

Q1: What is COBRA continuation coverage?

The Consolidated Omnibus Budget Reconciliation Act of 1986 amended the Public Health Service Act, the Internal Revenue Code and the Employee Retirement Income Security Act to require employers with 20 or more employees to provide temporary continuation of group health coverage in certain situations where it would otherwise be terminated.

Q2: What is public sector COBRA?

Title XXII of the Public Health Service Act, 42 U.S.C. §§ 300bb-1 through 300bb-8, applies COBRA requirements to group health plans that are sponsored by state or local government employers. It is sometimes referred to as public sector COBRA to distinguish it from the ERISA and Internal Revenue Code requirements that apply to private employers.

Q3: Who has jurisdiction with respect to public sector COBRA?

The U.S. Department of Health and Human Services, through the Centers for Medicare & Medicaid Services has jurisdiction with respect to the COBRA continuation coverage requirements of the PHS Act that apply to state and local government employers, including counties, municipalities and public school districts, and the group health plans that they sponsor.

Q4: What is a qualified beneficiary?

Q5: What is a qualifying event?

Q6: What are some examples of qualifying events?

Q7: How long does COBRA last?

Q8: How is COBRA affected if I am disabled?

Q10: What notification requirements apply when there is a qualifying event?

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

What Are Cobra Coverage Limits

COBRA coverage is only a short-term solution, so its a good idea to explore other options. Besides the general time limit of 18 to 36 months, there are a couple of other reasons your COBRA coverage can end.

- You dont pay your premiums on time.

- Your former employer stops offering any group health plans.

- You get comparable coverage through a new job.

- You become eligible for Medicare.

Know Your Medical Needs

Everyone is different. You and your familys medical needs probably wont be the same as the Joneses next door, so its important to know what you want and find a health insurance plan that makes sense for you.

For example, if you have any prescriptions, you should check whether or not they will be covered under COBRA or a marketplace insurance plan. Take a look at the overall coverage and provider network as well.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

If You Qualify For Cobra Premium Assistance

If you qualify for COBRA continuation coverage because you or a household member had a reduction in work hours or involuntarily lost a job, you may qualify for help paying for your COBRA premiums .

COBRA premium assistance is available April 1, 2021 through September 30, 2021 under the American Rescue Plan Act of 2021, based on when your COBRA coverage starts and how long it can last.

If you qualify:

When your COBRA premium assistance ends, you can enroll in a Marketplace plan with a Special Enrollment Period. If you know your COBRA premium assistance is ending September 30, 2021, you can report a “loss of coverage” to qualify for a Special Enrollment Period starting August 1, 2021.

- When you apply for Marketplace coverage, tell us youre losing qualifying health coverage, and provide the last day that youll have COBRA coverage with premium assistance.

- For most people, premium assistance will end September 30, 2021, but you may also qualify for a Special Enrollment Period if your COBRA coverage ends sooner.

To learn more about eligibility for COBRA premium assistance, including more on your eligibility for COBRA continuation coverage or COBRA premium assistance, visit the U.S. Department of Labor at DOL.gov.

Coverage Can Be Expensive

- Employees who select COBRA must pay the entire premium including the portion previously paid by their employer, plus a 2% administrative fee.

- Instead of COBRA, see if you qualify to buy a health plan through the Washington Healthplanfinder and receive a subsidy to help pay your insurance premiums.

- If you enroll in COBRA and later on decide to switch to a health plan through the Washington Healthplanfinder, you may have to wait until the next open enrollment period.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

How Does Cobra Coverage Work

COBRA is a short-term health care insurance thats usually available for up to 18 months after the termination date of your job .

You can get COBRA coverage if you worked for a business that employs 20 people or more. There are exceptions to this, so please call your COBRA administrator to get more information.

With COBRA, you can continue the same health care coverage through the plan you had when you were employed. That may include medical, dental and vision plans. If you choose to sign up for COBRA health care coverage, you wont be able to choose a new plan or change the coverage you had under that plan until the next open enrollment, if your employer offers an open enrollment to active participants. You will be asked to choose and pay for the same health care coverage you had with the plan you were under when you were employed. For example, if you had a medical plan and a dental plan, you can keep one or both of them. But you wouldnt be able to add a vision plan or change certain benefits within your medical plan if it wasnt part of your plan before COBRA.

What Type Of Coverage Is It

COBRA is a continuation of your State Group benefits that you were enrolled in, prior to benefits ending. For example: Prior to ending State employment you were enrolled in the State Health Plan PPO. When you choose to enroll in COBRA and elect health, it is a direct continuation of your same State Health Plan PPO the same is true for dental and vision plans. Health, dental, and vision are all available for continuation, and you may also be eligible for life insurance continuation if you are on a leave of absence or layoff from State service.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

How Long Can I Keep Cobra

As mentioned above, COBRA coverage starts on the day of whatever event causes you to lose coverage and is offered for up to 18 or 36 months, depending on your circumstances.

Qualified beneficiaries are entitled to 18 months of COBRA coverage when the qualifying event is the covered employees termination or their hours have been reduced. This includes leaving their job voluntarily.

Highlights

COBRAs 18-month duration limit can be extended under two circumstances.

The 18-month limit can be extended under two circumstances: First, if a beneficiary is disabled, all qualified beneficiaries under that plan may receive an 11-month extension, for a total of 29 months of coverage. The 18-month period can also be extended to 36 months if a second qualifying event occurs, which could be any of the events mentioned above.

Keep in mind, though, that the second event is only considered such if the event would have caused the person to lose coverage under the plan even if there were no first event. For example, if you were let go from your job , elected COBRA, and then decided to divorce , your spouse would have the right to purchase COBRA coverage and continue it for a total of up to 36 months. Thats because the second event would have also led to the loss of your spouses healthcare coverage.

Coverage for spouses and/or dependent children can also last for 36 months if the qualifying event is the death of the covered employee.