Form : Proof Of Health Insurance

The 1095 form provides documentation of your individual health insurance information. This form is sent to you annually by your insurance provider. Individuals can use the information on the 1095 to complete the “Health Care: Individual Responsibility” line on Form 1040. For more information, see www.HealthCare.gov.

This form will be postmarked by February 28. If you do not receive a 1095 form by March 15, contact your insurance provider to request a duplicate. It is not necessary to have a 1095 in hand to file your income tax return if you know you had health coverage throughout the year. If you misplaced your copy or find incorrect information, contact your insurance provider as soon as possible.

If you were enrolled in Medicare:

- For the entire year, your insurance provider will not send a 1095 form. Retirees that are age 65 and older, and who are on Medicare, may receive instructions from Medicare about how to report their health insurance coverage.

- For part of the year, you may receive a 1095 from your insurance provider reporting the coverage you had while you were not enrolled in Medicare. For example, if you were enrolled in the IYC Access Plan and your Medicare Part A and Part B became effective on May 1st, your insurance provider will send you a 1095 form reporting your coverage from January through April.

Do I Need To Prove I Have Health Insurance For My Tax Returns

Starting with the 2019 tax year, you no longer need to prove you have health insurance on your tax returns. But you may still receive tax forms with insurance information, and those with marketplace insurance will need those details to complete their returns.

Anyone who has health insurance should receive one of three tax forms for the 2021 tax year: Form 1095-A, Form 1095-B or Form 1095-C.

The form you receive is based on how you obtained your health insurance: through a health insurance marketplace or exchange, the government or your employer. Form 1095-A is sent to people with marketplace insurance. It provides coverage dates, total premiums paid and information necessary to reconcile or request premium tax credits. If you received advance premium tax credits or want to submit the tax credits on your return, you will need the 1095-A information to file your taxes. You won’t need any information from the 1095-B or 1095-C to file, and none of the three forms need to be attached to your tax return.

The forms are important, as they provide information needed for your tax return, such as total premiums paid and the time frame you were covered. You also can use this information if you plan to itemize health care expenses, including premiums, on your taxes. If you don’t use the information on your tax form, you’ll still want to keep the documents for your records.

I Am A Recently Discharged Combat Veteran Must I Pay Va Copayments

Veterans who qualify under this special eligibility are not subject to copays for conditions potentially related to their combat service however, unless otherwise excused, combat Veterans may be subject to appropriate copay rates for care or services VA determines are unrelated to their military service.

You May Like: How To Enroll In Starbucks Health Insurance

Don’t Miss: Can I Get Health Insurance Through My Llc

How To Find Or Request Your Form 1095

Form 1095-B will still be produced for all UnitedHealthcare fully insured members and will continue to be made available on member websites, no later than the annual deadline set by the IRS. Members can view and/or download and print a copy of the form at their convenience, if desired.

Additionally, a request for a paper form can be made in one of the following ways:

- Complete the 1095B Paper Request Form and email it to your health plan at the email address listed on the form

A Form 1095-B will be mailed to the address provided within 30 days of the date the request is received. If you have any questions about your Form 1095-B, contact UnitedHealthcare by calling the number on your ID card or other member materials.

If you have had an address change in 2019 or 2020, please call customer care to request a printed copy of the 1095B. A phone call is necessary in this situation because of the private and confidential nature of the 1095B form.

Proof Of Insurance For Tax Purposes

The Affordable Care Act, or ACA, required you to provide proof of health insurance coverage when filing your taxes. Recent changes to the law mean that you are no longer required to provide proof of coverage forms when filing your taxes. However, should you want one of these forms, they are still available to you through SelectHealth.

Recommended Reading: How To Understand Health Insurance Plans

What Should I Do If I Get This Notice

- Keep your Form 1095-B with your other important tax information, like your W-2 form and other tax records.

- You dont need to:

- Take any immediate action.

- Send this form to the IRS when you file your taxes.

- Send this form back to Medicare.

What If You Fail To Provide Proof Of Insurance

Most states require motorists to provide proof of insurance to a law enforcement officer during a traffic stop or at the scene of an accident. You may be cited and fined for not carrying proof of insurance.

Depending on the state, these penalties might be reduced or waived if you subsequently prove that you were insured at the time.

If youve financed your vehicle, failure to show proof of insurance to your lender in a timely manner can turn into a costly hassle. As an additional interest on your insurance policy, your lender will be notified if the policy is canceled or lapses.

If you dont have a new policy in place, the lender will acquire force-placed coverage and require you to pay the premiums. Force-placed insurance is almost always more expensive than coverage you shop for yourself.

QuoteWizard.com LLC has made every effort to ensure that the information on this site is correct, but we cannot guarantee that it is free of inaccuracies, errors, or omissions.All content and services provided on or through this site are provided as is and as available for use.QuoteWizard.com LLC makes no representations or warranties of any kind, express or implied, as to the operation of this site or to the information, content, materials, or products included on this site.You expressly agree that your use of this site is at your sole risk.

Get an insurance quote on the phone. Call: | Agents available 24/7

Don’t Miss: How Much Is Health Insurance Under Obamacare

Do I Need Proof Of Insurance For A Home Apartment Or Condo

You may need to provide proof of insurance to your landlord, home lender, or condo association, but you usually won’t need an insurance card for property insurance policies. Your insurance policy’s declarations page will have that information and can be sent wherever you’d like. Learn more about homeowners insurance, renters insurance and condo insurance.

States With Individual Insurance Mandates Such As Nj Dc

Members living in states with laws that require reporting of health coverage will continue to receive a paper copy of the Form 1095-B for state filing tax purposes. Subscribers filing taxes in one of these states are encouraged to retain a copy of their 1095B for their state tax records. If you are filing taxes for an individual mandate state and do not have a copy of your 1095B, you may download one immediately from your member website or request one by calling the number on your ID card or other member materials. By retaining a copy of the 1095B form, you will be prepared for any questions about your state return. If you are unsure whether your state has an individual mandate, check with your state revenue department or a tax professional.

You May Like: Can I Buy Health Insurance For Myself

Do I Still Have To Pay A Penalty If I Dont Have Health Insurance

You dont have to pay a penalty if you dont have health insurance in 2019 or any year after that.

Through the end of 2018, the ACA required all U.S. taxpayers to have health coverage that met a minimum standard unless they qualified for an exemption due to certain life events, financial status, or other factors. This meant that if you had affordable health coverage options, but chose not to buy health insurance, you would have to pay a fee when filing your taxes. This fee was known as an individual shared responsibility payment. It was also sometimes called the penalty,fine, or individual mandate.

Congress changed this part of the law for plans starting in 2019 and after. The individual shared responsibility payment no longer applies starting in plan year 2019.

Note: If you didnt have coverage or an exemption in 2018, you may still have had to pay a fee when you filed your 2018 taxes in 2019.

Understanding Your Irs 1095 Forms

Important information: Kaiser Permanente is scheduled to start mailing Form 1095-B to primary account owners on . These forms will be sent out through the rest of the month, to subscribers in all regions, until weve finished. Please allow some time for them to arrive.

CA Individual Mandate

California Senate Bill 78 was signed by Governor Gavin Newsom on June 27, 2019. The bill’s passage institutes an individual mandate to have qualifying health coverage throughout the year beginning January 1, 2020. Under the new mandate, those who fail to maintain qualifying health coverage could face a financial penalty unless they qualify for an exemption.

To avoid a penalty, California residents need to have qualifying health coverage for themselves, their spouse or domestic partner, and their dependents for each month beginning on January 1, 2020. If they don’t have coverage, California residents will be subject to a penalty of $695 or more when they file their 2020 state income tax return next year in 2021. The penalty for a dependent child is half of what it would be for an adult. This law does not change Kaiser Permanente’s Large Group special open enrollment guidelines.

DC Individual Mandate

A DC law began in 2019 that requires residents to have qualifying health coverage, get an exemption, or pay a penalty on their DC taxes. The penalty is based on the number of months an individual or family goes without health coverage.

Please allow some time for them to arrive.

You May Like: How To Get Health Insurance Reinstated

Q Will I Receive Any Health Care Tax Forms To Help Me Complete My Tax Return

Early in the year, you may receive one or more forms providing information about the health care coverage that you had or were offered during the previous year. Much like Form W-2 and Form 1099, which include information about the income you received, these health care forms provide information that you may need when you file your individual income tax return. Like Forms W-2 and 1099, these forms will be provided to the IRS by the entity that provides the form to you.

The forms are:

The IRS has posted a set of questions and answers about the Forms 1095-A, 1095-B and 1095-C. The questions and answers explain who should expect to receive the forms, how they can be used, and how to file with or without the forms.

How To Use Form 1095

IMPORTANT: You must have your 1095-A before you file.Donât file your taxes

- Your 1095-A includes information about Marketplace plans anyone in your household had in 2021.

- It comes from the Marketplace, not the IRS.

- Keep your 1095-As with your important tax information, like W-2 forms and other records.

Don’t Miss: How To Buy Health Insurance Online

Your Proof Of Health Coverage Form Will Arrive Soon

Health Net will mail Form 1095-B to our members starting January 31, 2023. This form is not required when you file your federal or state 2022 tax return. But, we do suggest that you keep this form with your tax information. This is in case you are asked to provide proof of your health care coverage.

How To File Irs Form 1095

Instructions for the IRS Form 1095 are include on the back of the form. Here are the basic instructions:

If you have Form 1095-B or 1095-C and you are covered for the entire year , then all you need to do is check the box on your Tax Form 1040, 1040EZ, or 1040A. Thats it. You are not actually required to include your Form 1095 when you file your taxes. Reporting Tricare on your taxes will only require Forms 1095-B, and 1095-C.

If you have IRS Form 1095-A, which is for insurance purchased on one of the exchanges, then you will need to enter the information from that form on IRS Form 8962. It is important to be accurate with this form, as some individuals may be eligible for a tax credit for their health care coverage, depending on whether or not a portion of their premium was paid by the federal government, their income, and other factors.

You May Like: How Much Is Health Insurance A Month In Texas

Options For Veterans Who Are Ineligible For Va Health Care Coverage

Veterans who are not eligible for VA health care should look into other health insurance options, such as an employer-sponsored health care plan, health insurance through a spouse, joining a trade organization that offers health insurance, or purchasing an individual health care plan from the Affordable Care Act Exchanges. This article covers health insurance options after leaving the military.

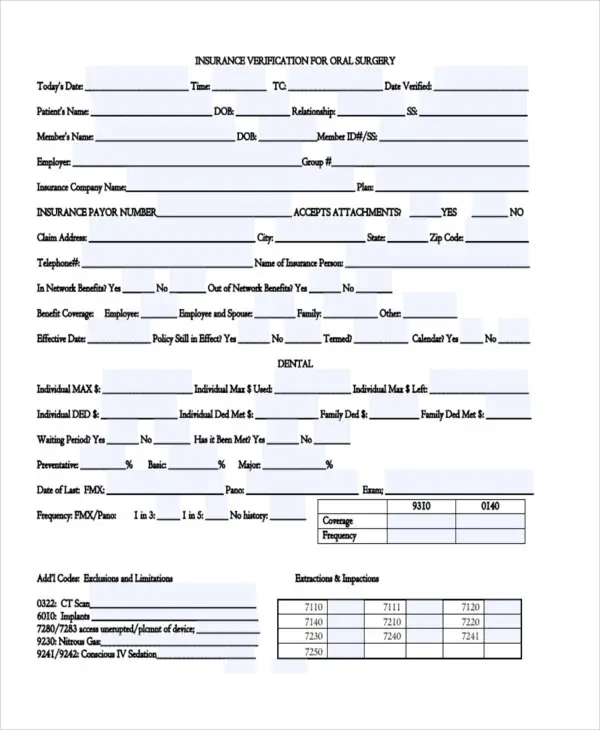

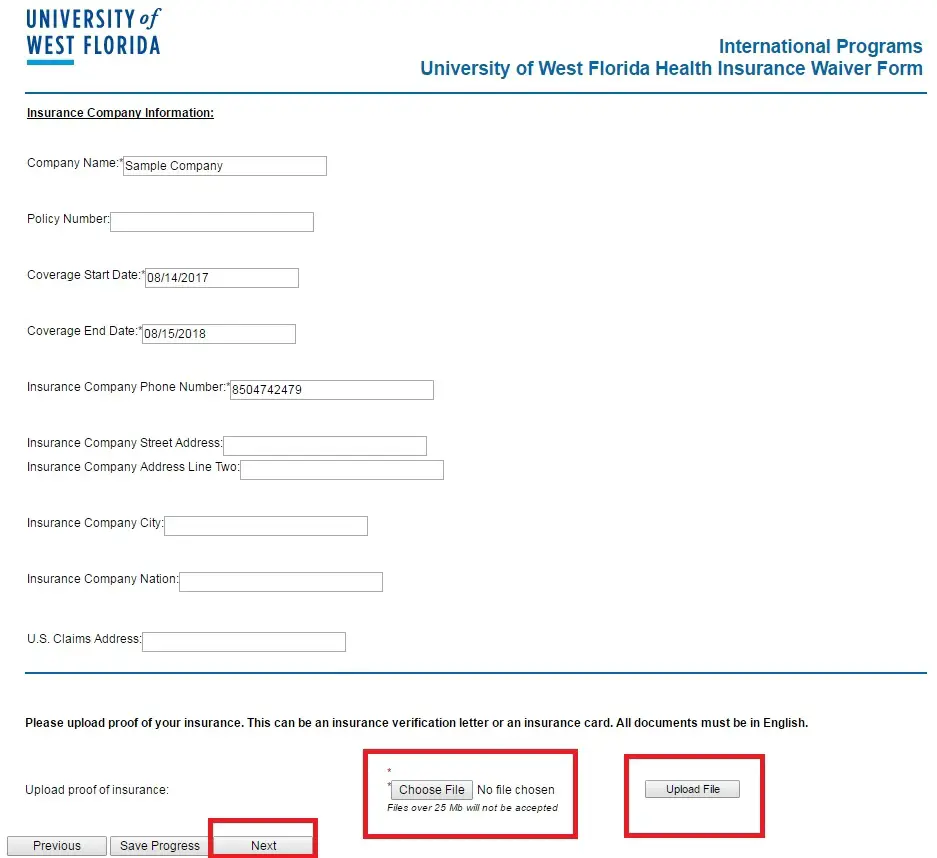

What Counts As Proof Of Insurance

Below are a few examples of proof of insurance or health coverage. Not all of these may be applicable or valid in every situation, so be sure to check with the requesting institution to make sure you have the right documentation:

- A current member ID card

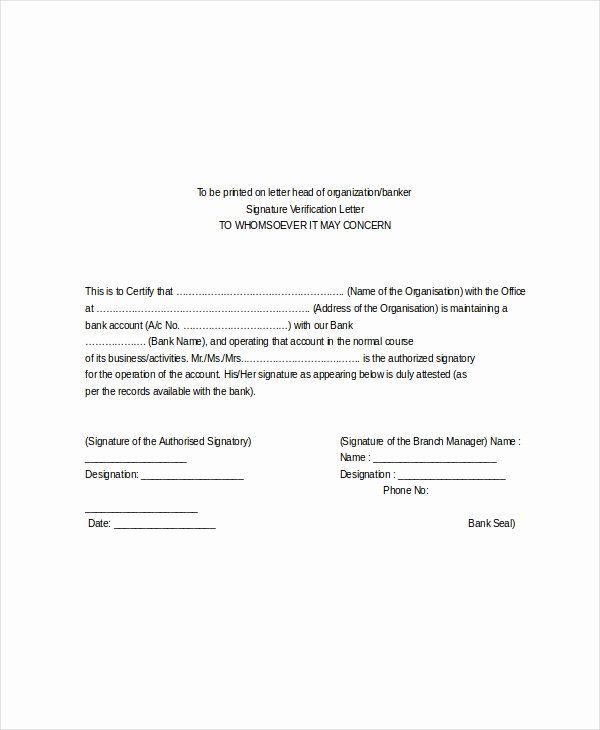

- A letter from your insurance company verifying coverage, sometimes called a certificate of coverage

- Explanation of benefits

- Form 1095-A, if you are covered by a plan purchased through the health insurance marketplace

- Form 1095-B, if you purchased coverage directly from an insurer or are employed in a small business with less than 50 full-time employees

- Form 1095-C, if you are covered by an employer-sponsored plan

Read Also: How To Buy Pet Health Insurance

Tax Year : Requirement To Repay Excess Advance Payments Of The Premium Tax Credit Is Suspended

The American Rescue Plan Act of 2021, enacted on March 11, 2021, suspended the requirement to repay excess advance payments of the premium tax credit for tax year 2020.

If you already filed a 2020 return and reported excess APTC or made an excess APTC repayment, you don’t need to file an amended return or take any other action.

If you have not filed your 2020 tax return, here’s what to do:

- If you have excess APTC for 2020, you are not required to report it on your 2020 tax return or file Form 8962, Premium Tax Credit .

- If you’re claiming a net premium tax credit for 2020, you must file Form 8962, Premium Tax Credit .

For details see Tax Year 2020 Premium Tax Credit:

Health insurance providers – for example, health insurance companies may send Form 1095-B to individuals they cover, with information about who was covered and when. Certain employers will send Form 1095-C to certain employees, with information about what coverage the employer offered.

The IRS has posted questions and answers about the Forms 1095-B and 1095-C. The questions and answers explain who should expect to receive the forms, how they can be used, and how to file with or without the forms.

You should not attach any of these forms to your tax return.

Tax Forms As Proof Of Health Insurance Coverage

Unlike previous years under the ACA, you no longer face a tax penalty if you do not have a qualifying health insurance plan. However, having a health insurance plan can be beneficial to you when tax time rolls around. Tax forms that prove that you had adequate health insurance coverage and paid premiums during the previous year can provide helpful deductions when the time comes to pay.

Only certain types of health insurance premiums are tax-deductible. Youll know whether yours is deductible or not as youll receive one of three tax forms that provide proof of your health insurance coverage and premiums paid. Those forms are the 1095-A, the 1095-B, and the 1095-C. Below, weve broken down each form for you by the type of coverage that it represents.

Also Check: How Long Can You Be On Your Parents Health Insurance

To Learn More About Your Form 1095

The form you get will depend on the type of health coverage you had. See the table below to find out which type of form to expect.

| Type of Medical Coverage Plan | Form Provider |

| 1095-B |

Kaiser Permanente mails the 1095-B form only. You may get multiple 1095-B forms if you were enrolled in 1 or more health coverage plans during the year.

If youve received a notice from Kaiser Permanente stating that we would soon send your 1095 forms, know that the mailing of these forms starts in early January and will continue through the first weeks of February .

Does The Proof Of Insurance Show What Coverage Types I Have

No, the proof of insurance shows that you met your stateâs minimum insurance requirements. It wonât show if you have optional coverages such as collision and comprehensive insurance.

Your insurance policyâs declaration page will list the coverage types you purchased. If you canât find your policy, ask your insurance agent or check to see whether your auto insurer has a mobile app. Many insurer apps offer access to policy documents online.

Recommended Reading: Can You Pay Your Health Insurance Deductible Upfront