What Needs To Change

Lofton, of NYU Langone Health, said insurance coverage of anti-obesity drugs may not improve until more people in the medical field change how they view obesity. Its not something that diet, exercise or sheer willpower can fix instead, its a dysregulation of fat cells in the body, she said.

Bias and stigma about obesity run rampant throughout the medical community.

Its evident across all health professionals, including physicians, nurses, dietitians and others, said Lisa Howley, an educational psychologist and the Association of American Medical Colleges’ senior director of strategic initiatives and partnerships.

A review published last year in the research journal Obesity found that health care professionals hold implicit and/or explicit weight-biased attitudes toward people with obesity.

But shifting the opinion of the medical community and with it, insurance companies is extremely difficult. Requiring anti-obesity drugs to be covered by insurance may require legislative action, Stanford said.

In 2021, lawmakers in the House of Representatives introduced The Treat and Reduce Obesity Act, which would have allowed the federal government to expand Medicare Part D coverage to include anti-obesity medications. The legislation had 154 bipartisan co-sponsors, according to Congress.gov, but did not receive a vote on the House floor before the term ended.

Butsch, of the Cleveland Clinic, said he is hopeful insurance companies will cover tirzepatide.

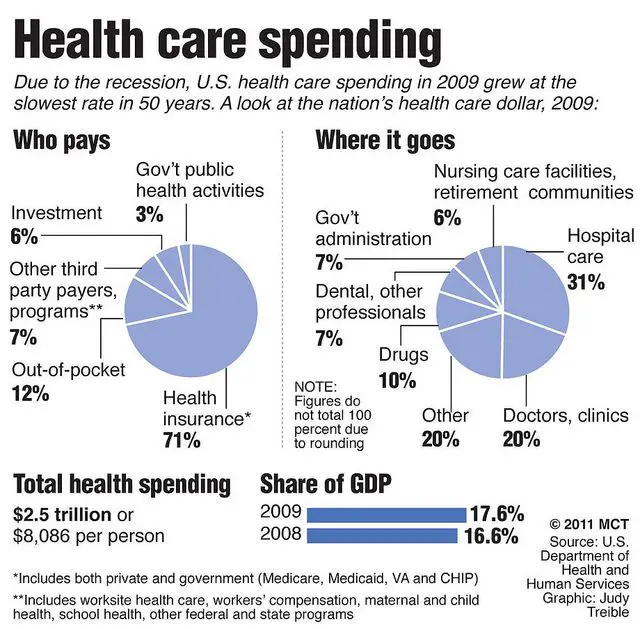

The Cost Of Medical Care In America With Insurance

If you never go to the doctor, you won’t experience these high costs. Some people feel comfortable taking that risk. But for the majority, the risks are too high.

For an expat or visitor in the USA, the best way to offset that risk is to purchase an international health insurance plan. Although a plan requires you to pay a fixed amount even if you never go to the doctor, it will cover your costs for the services detailed in the policy. A high-quality health insurance plan will cover all your costs, minus a deductible, excess, and/or co-pay . Plans with higher deductibles and co-pays tend to have lower monthly fees, and vice-versa.

Depending on the plan you choose, all your costs could be covered without limit. But there are certain plans that will put a cap on how much they will pay for your medical expenses. This is called a medical maximum.

Choosing a health insurance plan in the USA with a lower medical maximum will lower your monthly premiums but you will take on additional risks in exchange. If your medical bills exceed the maximum, any additional costs will be your responsibility.

- The flexibility to tailor a plan to suit your individual needs

- Access to Cigna Globals trusted network of hospitals and doctors

- The convenience and confidence of 24/7/365 customer service

Cost Of Term Life Insurance In Your 40s

If you haven’t already done so, your forties are a good time to begin periodically reviewing your life insurance policy to ensure you have enough coverage for your beneficiaries. If the unthinkable happened, would your dependents be able to survive without your income? As a rule of thumb, aim for a policy worth 10 times your annual income plus the cost of college for any children you have.

In 46 of 50 states, a 40-year-old female in good health would pay around $14.99 each month for a 20-year term life policy worth $250,000 and $40.82 for a $1 million policy. A 40-year-old healthy male would pay $17.33 monthly for the $250,000 policy and $49.15 for $1 million coverage. As you can see, premiums are higher in your forties than in your thirties, a trend you can expect to continue into your fifties and sixties.

You May Like: How Much Does Health Insurance Cost In Pa

What Factors Impact How Much Health Insurance In The Usa Costs

There are many different factors that can affect how much you pay for healthcare insurance in the USA. These include:

- Age how old an individual is will affect their health insurance costs. Children up to 14 years old will typically cost a flat rate, but rates will usually increase every year after that.

- Location health insurance companies will assess the cost of your cover based on where you live. Cities are often cheaper than remote, rural locations. State laws can also affect how much health insurance costs, by encouraging or discouraging competition between providers, or setting maximum increase rates.

- Smoking people who smoke will often pay a lot more for their health insurance, sometimes up to 50% higher than non-smokers. However, some states dont allow rates to differ by tobacco use.

- Number of people on the plan some providers allow multiple people to be covered by one plan, for example, a plan could cover two adults and two children in a family. The more people that are on the plan, the higher the monthly costs will be.

- Plan type there are a few different types of health insurance plans in the USA, including PPO , EPOs and Point of Service . HMOs are usually the cheapest option of these.

- Plan Tier Most health insurance plans are divided into tiers, with more or less healthcare covered by the plan depending on which tier the individual is in. The top tiers will be the most expensive but will provide the most comprehensive coverage.

Which Country Has The Most Expensive Healthcare

The United States: the world’s highest medical expenses The United States has the most expensive healthcare system of any country. A medical consultation with a general practitioner costs, on average, $190 or around 170. A stay in hospital can result in bills amounting to tens or even hundreds of thousands of dollars.

You May Like: How Much For Health Insurance For One Person

You Have Children Who Are Dependent On You

There are a few situations in which you might still have children who are dependent on you in your 60s. One case would be if you had your children late in life, and they are still in high-school or university. Another would be if you are raising your grandchildren because their parents are not around.

If your children are grown up, but they suffer from a mental or physical disability, you might also want to keep your life insurance. This way, you would be able to help ensure that they get the support they need if you pass away.

The Venue Of Your Surgical Procedure

As previously mentioned, lap band surgery is less complex than most types of bariatric surgery. That means that a gastric banding procedure can be performed in either a hospital or at your doctor’s private surgery center. If you’re having your procedure in the U.S., ask if your surgery will be performed at surgical center that has been certified for safety by the American Association for Accreditation of Ambulatory Surgery Facilities .

Hospital fees and related medical expenses can cost more than what you’d pay in a private surgery center, but it may be worth the extra expense to have your surgery in a hospital if you’re a high-risk patient, due to issues like heart disease or diabetes. In the unlikely event of a complication during surgery, emergency help will be close at hand.

You May Like: Does Short Term Health Insurance Cover Pregnancy

Health Spending Average By Gender

During time period of age 18 to 44, healthspending for females is 84% higher than men for years. Yes, much of this is dueto the expense of childbirth, but from age 44 to 64 spending for women is 24%higher than for men and even at age 65+ spending for women is 8% higher.

According to this data, women will need to budget more than men for health care expenses each year. Not only that but women tend to live two more years than men in the United States which requires additional savings. The MEPS data also reveals tremendous inequality in healthcare spending by race and demographic. The following chart shows average spending by demographic group for adults in America:

Recommended Reading: Is Umr Insurance Good

Average Monthly Cost For Individual Health Insurance

The average individual in America pays $452 per month for marketplace health insurance.1 But costs for health insurance coverage vary widely based on many factors.

Maybe you just turned 26 and are off your parents plan . Or maybe youre facing a job loss and need to replace your former employers coverage. Or youre just looking for other options besides your employers plan. No matter your situation, youre wondering: How much does health insurance cost?

Everyone knows health insurance is expensive. It can pretty quickly suck the life out of your monthly budget. But just how expensive is it? And why is it so costly? Are there ways you can pay less?

Well, youre in the right place! Ill walk you through everything you need to know about health insurance costs, what all those terms mean and what factors make up that hefty price tag.

Read Also: How Much Does Health Insurance Cost For Small Business Owners

Why Is Us Healthcare So Expensive Compared To Other Countries

Hospitals, doctors, and nurses all charge more in the U.S. than in other countries, with hospital costs increasing much faster than professional salaries. In other countries, prices for drugs and healthcare are at least partially controlled by the government. In the U.S. prices depend on market forces.

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you need to do in order to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

Also Check: Can You Pay Your Health Insurance Deductible Upfront

Best Rates Health Insurance Before 65

When you go to purchase family member health insurance for elderly over 61 protection, youll definitely want to take the time to evaluate and contrast the rates and deductibles that different organizations offer. Nowadays youll realize that there are many different health insurance age 62 to 65 plan organizations and they offer a variety of programs. With so many competitive programs.

Youll want to evaluate and contrast what the health insurance before 65 programs offer and the prices that youll pay. While it may take a bit of time, it will definitely be worth your time when you are able to get the best possible deal. When comparing programs, make sure you are comparing apples to apples, since the protection limits and deductibles are almost always different in various programs.

Where Can You Get Affordable Health Insurance

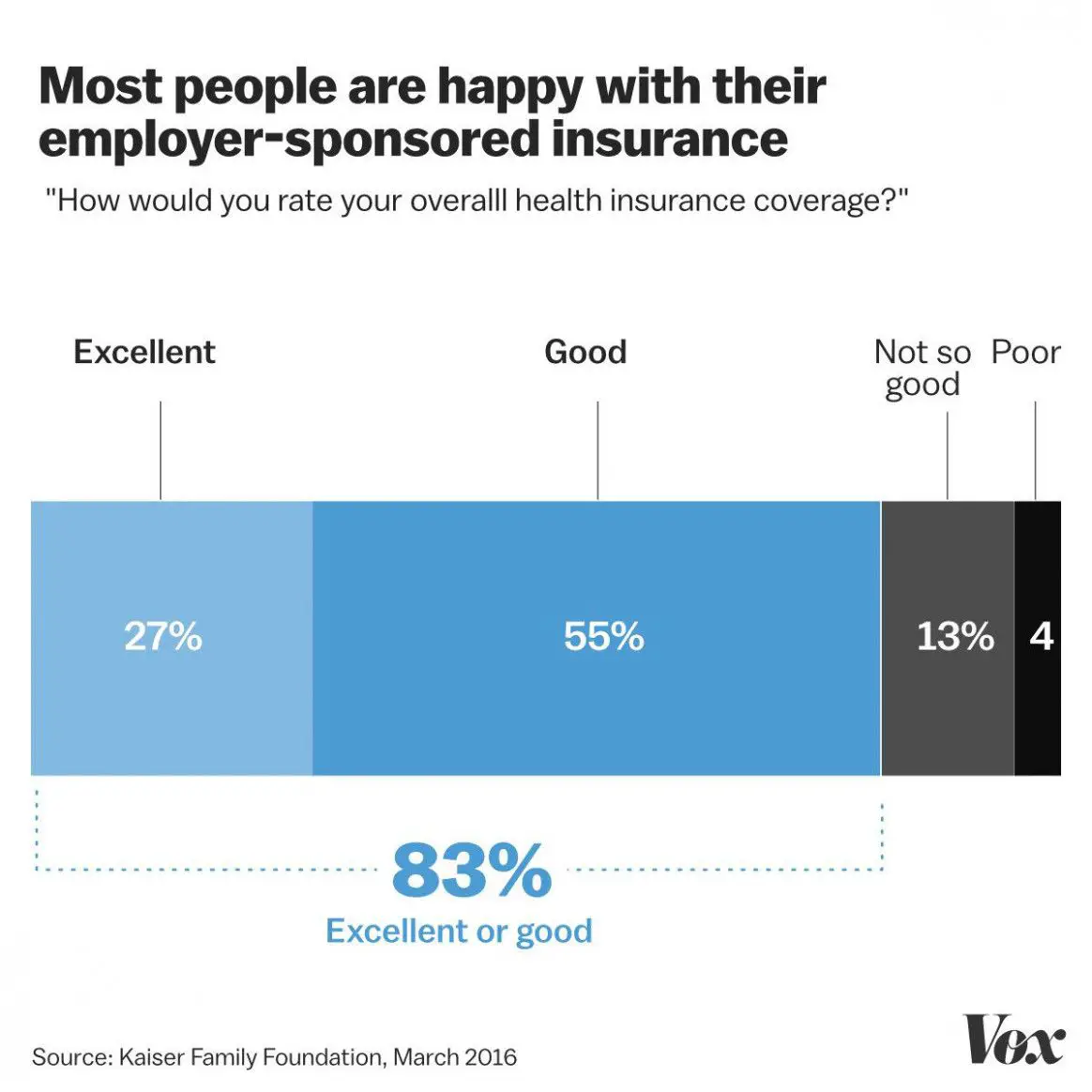

The latest analysis by the national health non-profit Kaiser Family Foundation pegged the average monthly cost of health insurance premiums at $456. The amount a person pays, however, can be lower or significantly higher, depending on where one lives.

New Hampshire residents, for instance, pay about $323 per person monthly for health insurance the cheapest based on KFFs latest benchmark premium. The amount is more than twice lower than Vermonts average at $841, which is the most expensive monthly premium among all states.

But even if employer-sponsored coverage is not an option, there are several ways for many Americans to avail of affordable health insurance plans. Here are some of them:

Also Check: What Are The Different Types Of Health Insurance Coverage

Average Monthly Obamacare Premiums Per State

While $594 was the national average monthly premium for ACA plans, its important to understand that the majority of people enrolled get subsidies in the form of advance premium tax credits .

The table below shows the state-by-state average premium for Obamacare plans in 2022. It also gives the average monthly premium after the average advance premium tax credit is applied, as well as the average monthly premium after APTC for consumers who received an APTC.

| Obamacare Average Premiums for 2022 | |

|---|---|

| Location | Average Premium After APTC Among Consumers Receiving APTC |

| United States | |

| $52 |

How Much Does Average Health Insurance Cost In The Usa

Health insurance means different things to people across the world the USAs system is known for several distinguishing features, including a high relative cost to the individual and a lack of universal coverage.

You may be wondering why the cost of healthcare insurance seems to be rising and how the picture compares to other nations. In a country that spends nearly US$4 trillion on healthcare yet finds coverage varies widely, theres a lot to weigh up. How much does health insurance cost? is one of the most important questions to Americans.

Across the United States, Americans pay wildly different premiums monthly for health insurance. The average annual cost of health insurance in the USA is US$7,739 for an individual and US$22,221 for a family as of 2021, according to the Kaiser Family Foundation a bill employers typically fund roughly three quarters of.

The cost to each person can vary a lot, however, based on factors such as age, geography, employer size and the type of plan theyre enrolled in. While these premiums are not determined by gender or pre-existing health conditions, thanks to the Affordable Care Act, a number of other factors impact what you pay.

Of course, not all companies offer health benefits to employees 44% of firms did not offer insurance to staff in 2020.

Insurance costs are rising globally.

Find out what’s driving up prices

Read Also: How Us Health Insurance Works

Who Administers Your Anesthesia

A lap band procedure requires general anesthesia, which can be administered by either an anesthesiologist or a nurse anesthetist . Some surgeons prefer the expertise of an MD, but if you’re concerned about keeping fees low, ask whether your anesthesia can be administered by a CRNA.

Along with the fee for your anesthesia provider , you’ll have to pay for the related supplies and anyone else who’s assisting with your anesthesia.

What Is The Cost Of Healthcare In The Us Without Medical Insurance

Below are average American healthcare prices for common procedures and services. These are estimates. The actual costs will vary depending on the healthcare facility providing the services. The infographics below will give you a good overview of the costs you may incur when visiting a doctor or hospital without insurance. These are the prices a visitor to the USA may face if they do not have a travel insurance plan or international health insurance plan.

These infographics list some of the typical, routine or unforeseen medical services that people require, along with their average costs. Much of this data comes directly from U.S. hospitals, which are required to list the cost of 300 of the most common medical procedures. As you will see, the cost of a doctors visit or the average cost of a hospital stay in the U.S. varies widely depending on the services you need.

Recommended Reading: How Much Does Insurance Pay For Home Health Care

What Is The Aca Health Insurance Marketplace

Established by the Affordable Care Act , the Health Insurance Marketplace is a platform that offers medical insurance plans to individuals, families, and small businesses. Fourteen states and the District of Columbia offer their own marketplaces, also known as exchanges, while the federal government manages a marketplace open to residents of other states. Marketplace plans are divided into four categories that range in cost and coverage. Though offered by private companies, all must meet certain criteria established by the state or federal government.

Is Lap Band Surgery Covered By Insurance

In recent years, more and more insurance providers have begun to cover weight loss surgery, including laparoscopic gastric banding.

You may be surprised to learn that Medicare also pays for lap band surgery, as long as the patient has a BMI of 35 or above. Usually, the patient will have to complete a medically supervised weight loss program before Medicare will cover the cost of lap band surgery. In some states, bariatric surgery may be covered by Medicaid.

Your insurance company will have to determine that your surgical procedure is medically necessary before they can deem it worthy of coverage. Do do this, your surgeon will have to provide a letter documenting why you need a lap band system. This letter should detail your obesity-related health conditions , a thorough history of past attempts to lose weight through other means, and a list of current medications that you take.

Bariatric surgeons and their office staff have extensive experience in working with insurance companies to obtain coverage, so they should have the process down, but it’s always a good idea to check with your insurance carrier first, to make sure you’re providing all of the right documentation.

If your coverage request is denied, you can always initiate an appeal. This needs to be done immediately.

Ask your surgeon if they can provide an estimate of related fees, and discuss payment plans or financing options.

Recommended Reading: Does My Health Insurance Cover Abortion

How Much Does Health Insurance Cost For Employees

According to HR consultancy Willis Towers Watsons Best Practices in Health Care Survey, as reported by SHRM, the average annual premium cost for an employee in 2021 for employer-sponsored health coverage was $3,331, up from $3,269 in 2020. Another survey from Mercer projected premiums will increase by 4.4% in 2022. However, the data indicates many employers arent raising their employees share of the cost its expected workers will continue to contribute 22% of their health plan premiums cost, unchanged from 2021.

At the same time, some employers are looking to decrease their employees healthcare expenses by covering treatments or expanding what they offer. These services could be considered fringe benefits:

- Health and wellness promotions within the workplace

- Access to centers of excellence

- Working spouses surcharges

Bottom Line: Even as insurance premiums rise, costs wont necessarily increase for employees in 2022 if employers take on more of the financial burden and cover more services.