Average Cost Of Health Insurance For A Single Male

The average cost of health insurance for men in 2020 was $438 per month without a subsidy, per eHealth data. Note that this research focuses on those who buy insurance through the marketplace.

The premium you pay for health insurance will also depend on the type of plan you select. Consider options like HMO vs. PPO when you make your choice.

Health Insurance Deductibles: What Can You Expect

On top of premiums, everyone who carries health insurance also pays a deductible. This means you pay 100% of your health expenses out of pocket until you have paid a predetermined amount. At that point, insurance coverage kicks in and you pay a percentage of your bills, with the insurer picking up the rest. Most workers are covered by a general annual deductible, which means it applies to most or all healthcare services. Here’s how general deductibles varied in 2020:

- $1,644: average general annual deductible for a single worker, employer plan

- $2,295: average annual deductible if that single worker was employed by a small firm

- $1,418: average annual deductible if that single worker was employed by a large firm

| Median Individual Deductible, Qualifying Health Plan Without Subsidies from HealthCare.gov., Plan Year 2020 |

|---|

| Bronze |

| $95 |

Individuals who are eligible for cost-sharing reductions are responsible for deductibles as low as $115 for those with household incomes closest to the federal poverty level.

Does Insurance Cover Root Canals

Most dental insurance plans will cover at least some part of your root canal. The extent of coverage depends on your specific insurance plan.

Many health insurance policies offer full coverage for routine procedures but only cover a percentage of more invasive procedures. Its common for insurance providers to cover 30 to 50 percent of root canal costs.

However, insurance plans often have limits, co-pays, deductibles, and waiting periods, which can wind up costing you a lot of money and keep you in pain if you have a toothache.

Also Check: What Does My Health Insurance Cover

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you need to do in order to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

Find Cheap Health Insurance Quotes In Your Area

Health insurance premiums have risen dramatically over the past decade. In previous years, insurers would price your health insurance based on a multitude of factors. However, the number of variables have decreased significantly with the Affordable Care Act.

In 2022, the average cost of individual health insurance for a 40-year-old on a silver plan is $541. This represents an increase of nearly 1% from the 2021 plan year.

Read Also: Is It Illegal To Go Without Health Insurance

Current Upmc Monthly Rates

25-Year-Old With $33,000 Household Income

$32 Advantage Bronze $6,700/$0

$76 Advantage Gold HSA $3,100/$0

$105 VirtualCare Silver $4,500/$0

40-Year-Old Married Couple With $54,000 Household Income

$67 Advantage Bronze $6,700/$0

$181 Advantage Gold HSA $3,100/$0

$254 VirtualCare Silver $4,500/$0

55-Year-Old Married Couple With $68,000 Household Income

$93 Advantage Bronze $6,700/$0

$291 Advantage Gold HSA $3,100/$0

$420 VirtualCare Silver $4,500/$0

35-Year-Old With $36,000 Household Income

$58 Advantage Bronze $6,700/$0

$115 Advantage Gold HSA $3,100/$0

$149 VirtualCare Silver $4,500/$0

48-Year-Old Married Couple With $56,000 Household Income

$45 Advantage Bronze $6,700/$0

$199 Advantage Gold HSA $3,100/$0

$289 VirtualCare Silver $4,500/$0

50-Year-Old Married Couple And Two Children With $90,000 Household Income

$119 Advantage Bronze $6,700/$0

$359 Advantage Gold HSA $3,100/$0

$499 VirtualCare Silver $4,500/$0

30-Year-Old With $33,000 Household Income

$149 Advantage Bronze $6,700/$0

$323 Advantage Gold HSA $3,100/$0

$409 Advantage Silver $3,500/$40

30-Year-Old Married Couple With $40,000 Household Income

$170 Advantage Bronze $6,700/$0

$517 Advantage Gold HSA $3,100/$0

$197 VirtualCare Silver $4,500/$0

60-Year-Old Married Couple With $67,000 Household Income

$2 Advantage Bronze $6,700/$0

$49 Advantage Gold HSA $3,100/$0

$451 Advantage Silver $3,500/$25

45-Year-Old Married Couple And One Child With $70,000 Household Income

Cheapest Plan In Pennsylvania With An Hsa

If you are relatively healthy and youre less likely to require medical attention, you can opt for a health savings account . HSA plans cost less and will allow you to give pre-tax contributions to build savings for medical expenses. The significant benefit of having an HSA is that you can also use it for non-medical expenses, but note that it loses its tax-free perk if you do so.

- Bronze: The Together Blue EPO Bronze 6900 HSA by Highmark Blue Cross Blue Shield, costing an average of $255 per month for a 40-year-old.

- Silver: The Together Blue EPO Silver 3450 HSA by Highmark Blue Cross Blue Shield, costing an average of $343 per month for a 40-year-old.

Note that HSA plans have high deductibles. This means that you may have to pay out of your own savings if you have major medical costs.

Recommended Reading: What Is 0 Deductible Health Insurance

Average Number Of Days Pa Residents Spent In The Hospital

The number of days in the hospital are counted starting with the day the patient is admitted. The last day is not counted, unless the first and last day are the same day.

Pennsylvania residents insured with group coverage and Medicare Advantage coverage spent more days in the hospital than the national average. People with individual insurance had non-physician visits with a frequency slightly below the national average. Medicaid managed care patients used this type of health care approximately 45% less than the national average.

About Upmc Health Plan

Company headquarters are in Pittsburgh, and the parent company is the University of Pittsburgh Medical Center. Products and services are offered to more than 3 million persons, and provided by 140 hospitals and more than 20,000 physicians in four states.

Recent awards to the parent company have been received from the Human Rights Campaign Foundation, National Business Group on Health, Stevie Awards, US News And World Report, International Customer Management Institute, and National Committee For Quality Assurance.

You May Like: Are Abortions Covered By Health Insurance

The Cheapest Health Insurance In Pennsylvania By Age And Metal Tier

Age can significantly affect your premiums. Seniors may notice that their premiums may increase as they age this is because insurers view them as more likely to need medical services. For instance, a 26-year-old will only have to pay an average of $408 per month for a Silver plan, while a 60-year-old will have to pay an average of $1,076 per month. This is a difference of $668, showing the difference created by a 34-year gap in health insurance premiums.

Health Insurance Costs in Pennsylvania by Age and Metal Tier

Low-income individuals may be eligible for cost-sharing reductions , which can make Silver plans a better, more affordable option. This is because CSRs can lower your deductible.

Rates collected are based on a sample profile of a 40-year-old male for all types of plans available HMO, EPO and PPO with an HMO plan being the most common type in Pennsylvania.

Cheapest Health Insurance in Pennsylvania by Age And Metal Tier

Sort by Metal Tier:

What Types Of Alternative Health Insurance Plans Are Available In Pennsylvania

The most popular form of cost-sharing plans are faith-based plans. In a faith-based plan, members share health care costs with other members. You dont need to be a member of a particular denomination , to participate in a plan. While these plans can be relatively low-cost, most faith-based plans dont conform to ACA standards and dont cover pre-existing conditions, mental health care, or pregnancy.

Read Also: Are Daca Recipients Eligible For Health Insurance

What You Need To Do

You must provide MassHealth with information about any private employer-sponsored insurance that you or a family member already has or may have access to at application, at annual renewal, and any time there is a change in your ESI or access to ESI .

We will use this information to decide:

- Whether the services covered under your ESI meet MassHealths standards

- Whether you are eligible for the Premium Assistance program

- What we may pay toward the cost of your ESI premium

- Whether you may be required to enroll in ESI as a condition of remaining eligible for MassHealth

We may ask you or your employer for more information about your access to health insurance from a job. We may also ask for proof you or your family members have enrolled in health insurance. You must give us the information we ask for. If you do not, your MassHealth benefits may end.

Monthly Cost Estimate By Age

The cost of health insurance may also vary based on your age. Per the eHealth data, the average cost by age is:

$278 for the 18 through 24 age group

$329 for the 25 through 34 age group

$411 for the 35 through 44 age group

$551 for the 45 through 54 age group

$784 for the 55 through 64 age group

These numbers are for both men and women, but they give a sense of how your costs may vary.

Don’t Miss: How Much Is Aetna Student Health Insurance

Factors That Impact Health Insurance Rates

For a particular health insurance plan, the cost of coverage is determined by certain factors that have been set by law. States can limit the degree to which these factors impact your rates: For instance, some states like California and New York don’t allow the cost of health insurance to differ based on tobacco use.

- Age: The health care cost per person covered by a policy will be set according to their age, with rates increasing as the individual gets older. Children up to the age of 14 will cost a flat rate to add to a health plan, but premiums typically increase annually beginning at age 15.

- Where you live: Health insurance companies determine the set of policies offered and the cost of coverage based on the state and county you live in. So a resident of Miami-Dade County in southern Florida, for instance, may pay lower rates for the same policy than a resident of Jackson County, in the Florida Panhandle.

- Smoking/tobacco use: If you smoke, you could pay up to 50% higher rates for health insurance, though the maximum increase is determined by the state.

- Number of people insured: The total cost of a health plan is set according to the number of people covered by it, as well as each person’s age and possibly their tobacco use. For example, a family of three, with two adults and a child, would pay a much higher monthly health insurance premium than an individual.

The Effect Of Insurance Deductibles On The Cost Of Health Care

PA residents insured through group, individual and medicare health plans generally have a deductible. Deductibles define the amount of the medical expenses the insured person must pay before the insurers coverage begins to pay the medical bills. The deductible amount depends on the insurance plan. Generally speaking, individual insurance has larger deductibles than other plans. Deductibles have the effect of increasing the cost of the insurance for people that file insurance claims. For example, a person on an individual plan paying the average price of $3,747 with a relatively common $6,000 deductible has an effective price of nearly $10,000, if they use their insurance.

Also Check: How To Find Personal Health Insurance

Insurance For Individuals In Pennsylvania

Your personal health history is important because it can help you decide whether you want to choose a plan based on cost or extent of coverage. If you have a chronic disease, you may want to prioritize plans that will allow you to keep seeing the same specialists or filling the same specialty prescriptions. A low-cost plan may take priority if you dont have chronic health conditions. You also need to think about your familys medical history. If a close relative had cancer or heart disease, for example, it might make more sense to choose a plan with a higher monthly premium and a lower out-of-pocket maximum.

The type of plan you choose is also an important consideration.

- Health Maintenance Organization plans typically cost less than other health coverage types and have some restrictions that can affect your ability to access care. For example, you may have to ask for a referral if you want to see a specialist and your network is local.

- Preferred Provider Organizations dont require referrals and usually offer nationwide coverage but tend to cost more than HMO plans. Most PPOs also have out-of-network benefits.

- Point-of-Service plans combine the features of an HMO with the features of a PPO. You have to ask for a referral to see a specialist, but you can get care from out-of-network providers if youre willing to pay a larger percentage of the cost.

What Is The Aca Health Insurance Marketplace

Established by the Affordable Care Act , the Health Insurance Marketplace is a platform that offers medical insurance plans to individuals, families, and small businesses. Fourteen states and the District of Columbia offer their own marketplaces, also known as exchanges, while the federal government manages a marketplace open to residents of other states. Marketplace plans are divided into four categories that range in cost and coverage. Though offered by private companies, all must meet certain criteria established by the state or federal government.

You May Like: What Is An Average Health Insurance Deductible

What Factors Influence The Cost Of Pennsylvania Individual Health Insurance

Under the new health care law, insurance companies are only allowed to consider five factors when determining rates: for Pennsylvania residents, your location, age, tobacco use, plan type, and whether the policy covers dependents.

Where You Live – Yes, health insurance premiums vary from one state to the next and even neighborhood to neighborhood. The cost of living and the typical wage are two elements that influence how much you will pay for a health plan.

Your Age – Your age will impact your premiums, just like most insurance. When you get health insurance, the younger you are, the lower your rates will be.

Tobacco Use – The use of tobacco is very likely the one thing on this list that will cause you to pay more for insurance. Regarding health insurance, premiums can rise by upwards of 60% per month.

Individual vs. Family enrollment – A health insurance plan that covers you and your spouse and any dependents may cost more than one that only covers you. So, if you’re purchasing coverage for yourself alone, it will be less expensive than buying a family policy. However, some inexpensive family health insurance plans are still available in Pennsylvania.

States can restrict how much these elements influence premiums however, the essential health benefits have to be the same in all Marketplace health plans. Insurance companies may add extra benefits, which might affect costs.

Find Cheap Health Insurance Quotes In Pennsylvania

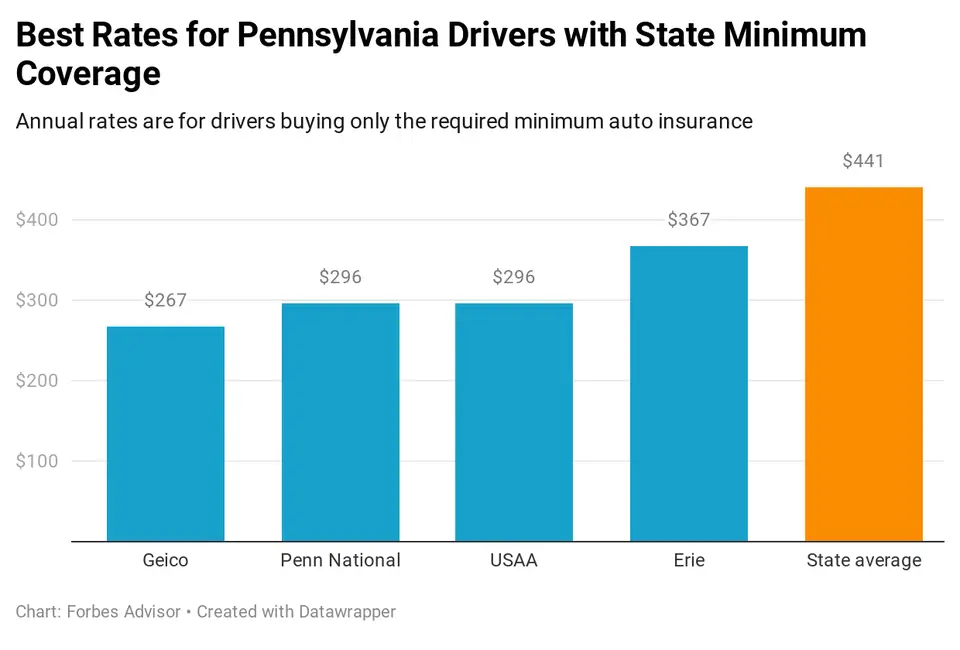

The cheapest health insurance in Pennsylvania for most people is from Ambetter Balanced Care 30, which is the most affordable Silver plan in 28% of the state’s counties. The cheapest Silver plan in the state is UPMC VirtualCare Silver . However, this plan is only available in Allegheny and Erie counties.

For a 40-year-old, the average cost of health insurance in Pennsylvania is $498 per month for a Silver plan.

Affordable health insurance plans in Pennsylvania are available through the state exchange, though some shoppers can qualify for Medicaid depending on their household income. In 2022, the average cost of health insurance in the state is $441 per month, remaining flat since 2021.

Recommended Reading: Is Health Insurance Mandatory In Ct

The Importance Of Subsidies

The good news is that many who purchase marketplace plans will pay lower premiums through what the government calls advanced premium tax credits, otherwise known as subsidies. In 2019, 88% of people who enrolled at HealthCare.gov were eligible for advanced premium tax credits.

What are these subsidies? They are credits the government applies to your health insurance premiums each month to make them affordable. Essentially, the government pays part of your premium directly to your health insurance company, and you’re responsible for the rest.

As part of the American Rescue Plan Act passed in March 2021, subsidies have increased for lower-income Americans and extended to those with higher incomes. The ARPA expanded marketplace subsidies above 400% of the poverty level and increased subsidies for those making between 100% and 400% of the poverty level.

You can take your advance premium tax credit in one of three ways: equal amounts each month more in some months and less in others, which is helpful if your income is irregular or as a credit against your income tax liability when you file your annual tax return, which could mean you owe less tax or get a bigger refund. The tax credit is designed to make premiums affordable based on your household size and income.

What To Know About Insurance In Pennsylvania

- : Pennsylvania doesnt require residents to use its health insurance exchange or shop with a broker to buy health coverage. As of 2021, you can buy one of 38 plans directly from companies authorized to sell health insurance in the state.

- Open Enrollment: In Pennsylvania, open enrollment for 2022 affordable health insurance plans runs from . You can buy a new health plan, switch plans, or drop your current coverage during open enrollment.

- Special Enrollment: Most of the time, you cant sign up outside of Open Enrollment unless you experience a qualifying event. These events usually result in a loss of coverage or a change in eligibility. Examples of qualifying events include moving to Pennsylvania, giving birth, getting married or divorced, and losing your eligibility for Medical Assistance.

- Pennie: When you use Pennie to shop for coverage, you can compare multiple plans to determine which one is right for you.

- Premium tax credit: You can purchase an off-exchange plan if you dont want assistance paying monthly premiums. Aetna, UPMC Health Coverage, and Keystone Health Plan Central are among the many insurers offering off-exchange plans in Pennsylvania.

- Coverage types: In 2019, 8% of insured Pennsylvanians had group health coverage, 20.2% were covered by Medicaid, 16.3% were covered by Medicare, 5.1% had non-group coverage, and 0.8% were covered by the military. Nearly 6% of Pennsylvanians had no health coverage in 2019.

Don’t Miss: Are 1099 Employees Eligible For Health Insurance