Find Cheap Health Insurance Quotes In Your Area

A health insurance tax credit can reduce your monthly health insurance cost. It’s only available for those who purchase insurance through the marketplace, and you must meet income criteria to qualify.

You can sign up for a health insurance tax credit during open enrollment or when you have a qualifying life event, such as getting married, having a baby or moving. If you own a small business with fewer than 25 employees, you may also qualify for government subsidies, which can help pay for your employees’ health insurance.

Should I Take My Aca Premium Subsidy During The Plan Year Or Claim It At Tax Time

The Affordable Care Acts premium subsidies are tax credits that can be taken in advance and paid to your health insurer throughout the year, but you also have the option to claim the entire amount on your tax return.

- Health insurance & health reform authority

Reviewed by our health policy panel.

Q. Ive heard that I can just claim my health insurance premium subsidy on my tax return instead of getting a subsidy throughout the year based on my estimated income. How does this work?

A. Yes, you can do that. Most people dont wait, but it can be a good choice for people who have the money to cover full price premiums throughout the year, especially if they arent sure whether or not their income will actually be subsidy-eligible when all is said and done.

The Affordable Care Acts premium subsidies are tax credits. Unlike most tax credits, the premium subsidy can be taken in advance and paid to your health insurer throughout the year. But as with other tax credits, theres also an option to claim the entire amount on your tax return.

Most people choose to take at least some of their premium subsidy throughout the year. That makes sense, given how expensive full-price health insurance can be. Paying full price each month and having to wait until the following tax season to recoup the tax credit would be unrealistic for most subsidy-eligible enrollees.

You May Be Eligible To Elect The Hctc Only If You Are One Of The Following:

- An eligible trade adjustment assistance recipient PDF, alternative TAA recipient, or reemployment TAA recipient

- An eligible Pension Benefit Guaranty Corporation payee or

- The family member of an eligible TAA, ATAA, or RTAA recipient, or PBGC payee who is deceased or who finalized a divorce with you.

You May Like: How To Change Health Insurance From One State To Another

What Are Qualified Health Plans

- COBRA: You must pay more than 50% of COBRA premiums. If COBRA eligibility ends, HCTC eligibility also ends until you enroll in another qualified health plan.

- Spouseâs Employer Health Plan: You may enroll in group coverage through spouseâs employer. Your spouse must pay more than 50% of the insurance premium. However, the monthly payment option is not available under this type of plan.

- Non-Group / Individual Health Plan

The following health plans do not qualify for HCTC:

- Health Insurance Marketplace health plans

- Medicare

- U.S. military health system

- Childrenâs Health Insurance Program

- Federal Employees Health Benefits Program

Health Insurance And Taxes: How To Take Advantage Of Financial Help And Avoid Penalties

Make sure youâre not leaving money on the table by better understanding the financial help available to Californians.

When the government wants to persuade you to do something thatâs good for you â like buying energy-efficient appliances, continuing your education or, in this case, purchasing health insurance, they often sweeten the deal by offering a tax credit. Credits are like tax exemptions and reductions, but better â instead of just reducing your total taxable income, credits actually lower the amount of tax dollars you owe.1 In other words, if you owe $2,000 in taxes and you have a tax credit of $1,500, you only have to shell out $500. Whatâs more, health insurance tax credits are considered refundable, which means if you owe $2,000 in taxes and have an unused tax credit of $2,500, youâll get a check for $500.2

How Health Insurance Financial Help Works With Your Taxes

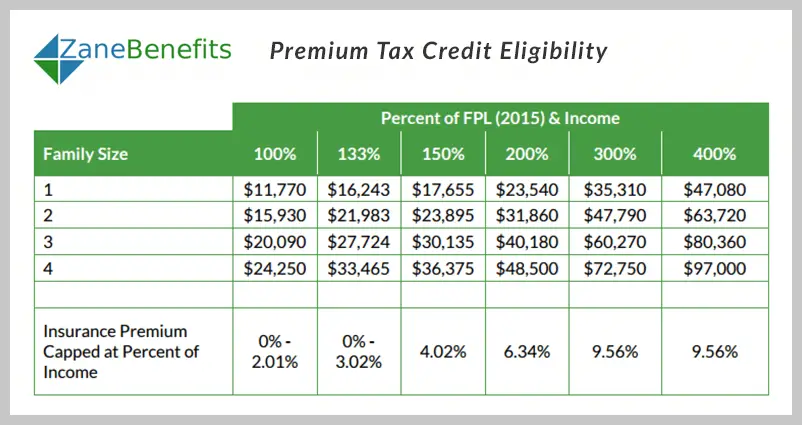

Health insurance tax credits are financial help that comes from the federal government, which help to lower the cost of your monthly health insurance premium. Thatâs why they are specifically referred to as premium tax credits. To be eligible for a premium tax credit, you need to have a household income thatâs below 400 percent of the federal poverty level .

Thatâs up to $51,040 a year as an individual or $104,800 for families of four. Even if you make more than this, you may still qualify for financial help. You wonât pay more than 8.5% of your income for a benchmark Silver plan.

Also Check: Can You Get Health Insurance

Understanding The Acas Premium Tax Credit Health Insurance Subsidy

The Affordable Care Act includes government subsidies to help people pay their health insurance costs. One of these health insurance subsidies is the premium tax credit which helps pay your monthly health insurance premiums.

Despite significant debate in Congress over the last few years, premium subsidies continue to be available in the health insurance marketplace/exchange in every state. And the American Rescue Plan has made the subsidies larger and more widely available for 2021 and 2022.

The premium tax credit/subsidy is complicated. In order to get the financial aid and use it correctly, you have to understand how the health insurance subsidy works. Heres what you need to know to get the help you qualify for and use that help wisely.

Arpa American Rescue Plan Act Update

With the recent passage of the ARPA, there is now NO INCOME LIMIT for ACA tax credits! Those with incomes over the set 400% FPL income limit may now qualify for lower premiums, based on their location, age and income. Tax credits are based on the Second-Lowest Price Silver Plan in your zip code NOT exceeding 8.50% of your Modified AGI for tax year 2021. The tax credits can be applied to any metal level: Bronze, Silver, Gold or Platinum plans.

You May Like: How To Find Personal Health Insurance

Also Check: How Much Is Health Insurance A Month In Texas

The American Rescue Plan And Subsidies

The American Rescue Plan Act , signed into law byPresident Biden in 2021, expanded eligibility for subsidies to make healthinsurance affordable for even more Americans. People that are already enrolledin health plans through the marketplace may find they qualify for moresubsidies to bring down the cost of their monthly premiums. Those that couldnot afford to enroll in a plan due to the subsidy cliff may now have theopportunity to sign up for coverage.

The new law allows people with incomes below 150% of the poverty level to enroll in silver plans with a zero premium. Deductibles for these plans will also be dramatically reduced allowing individuals and families with lower incomes the ability to have affordable health benefits. The ARPA also reduces the amount people must pay if they have income between 100% and 400% of the federal poverty level.

The ARPA also provides subsidies for some people with income between 400% and 600% of the poverty line, those considered on the subsidy cliff in the past. This may allow individuals and families within these income levels to find more affordable, ACA-compliant plans, which could positively impact more than 2 million people. Check out our guide to the American Rescue Plan Act to find out more about how it may affect your ability to qualify for subsidies.

Other Magi Factors To Keep In Mind

MAGI is based on household income, but there are different rules for how a child’s income is counted towards a family’s household MAGI depending on whether the eligibility determination is for Medicaid/CHIP or for premium subsidies.

If a married couple wants to apply for premium subsidies in the exchange , they have to file a joint tax return. But if a married couple that lives together applies for Medicaid, their total household income is counted together regardless of how they file their taxes.

Premium subsidies are a tax credit, but they differ from other tax credits in that you canand most people dotake them up-front instead of having to wait to claim them on your tax return . That also means when you’re enrolling in a health plan during open enrollment , you’ll be using a projected MAGI, based on what you estimate your income to be in the coming year.

If your income is steady from one year to the next, you can reasonably estimate your MAGI for the coming year based on your past year’s tax return. But many people who purchase their own health insurance are self-employed and their income varies from one year to anotherwhich can make it challenging to accurately project the coming year’s MAGI.

Once the year is underway, if you start to notice that your actual income is diverging significantly from what you projected, you can report your updated income to the exchange and they can adjust your premium subsidy amount in real-time .

Don’t Miss: Can You Get Health Insurance After Open Enrollment Ends

Tips For Managing Your Financial Help

You might want to only take as much financial help as you need each month.

When you apply, you can decide to use some or all the financial help you qualify for in advance, or wait to get a credit on your tax return.

Why would you want to do this? So you can avoid having to pay any money back.

Heres more on why: The financial help available to youa tax credit made available through the government and only available when you apply and buy through Connect for Health Coloradowill be based on what you estimate your annual income and family size will be that year.

When you file your federal income taxes, the I.R.S will double-check to make sure you got the correct amount of tax credit, based on what your actual income and family size was for that year. And they will make it right through your taxessome families may get more money, while others may have to pay money back if their estimates were not correct.

If you think your income may increase or you plan to move throughout the year, its best to take only some of the financial help each month or wait and take it all as a lump sum as a tax credit on your tax return, so you can avoid having to pay any money back.

Log-in to report changes in your income during the year after you sign up.

Reporting the changes to Connect for Health Colorado during the year lowers your risk of having to repay some or all the financial help you received because we can help make any necessary adjustments throughout the year.

How Does The Health Insurance Tax Credit Work

You can get the health care tax credits in two ways:

- Advance premium tax credit uses estimates to reduce how much you spend on health insurance each month.

- Federal tax refund allows you to receive your health insurance subsidy all at once at the end of the year or to reconcile any differences with your monthly tax credits.

The two methods would qualify you for the same number of credits, but they differ in when you would receive the subsidy and eligibility requirements. Here’s how advance premium tax credits can reduce your monthly bills.

You can apply for advance premium tax credits when you apply for health insurance through the marketplace. With this program, the government sends advance payments directly to the health insurance company every month. The insurer would then credit that money toward the cost of your health insurance premiums, decreasing your out-of-pocket costs each month.

Therefore, if you expect to have low disposable income, taking the advance premium tax credit could be more beneficial if you qualify.

Don’t Miss: Who Takes Health Net Insurance

Which Amount Do You Enter On Your Tax Return

Follow these steps to find out how to calculate the amount to enter on lines 33099 and 33199 of your tax return.

- $2,397

Step 3

Subtract the lesser amount from Step 2 from the amount from Step 1. Enter the result on line 33199 of your tax return .

Step 4

Claim the corresponding provincial or territorial non-refundable tax credit on line 58729 of your provincial or territorial Form 428. If you live in Quebec visit Revenu Québec.

Tax tip

Compare the amount you can claim with the amount your spouse or common-law partner would be able to claim. It may be better for the spouse or common-law partner with the lower net income to claim the eligible medical expenses.

Richard and Pauline have two children, Jen and Rob. They have reviewed their medical expenses and decided that the 12-month period ending in 2020 they will use to calculate their claim is July 1, 2019, to June 30, 2020. They had the following expenses:

- Richard $1,500

- Jen $1,800

- Rob $1,000

Total medical expenses = $5,300

Since Jen is under 18, Richard and Pauline can combine her medical expenses with theirs, for a total of $4,300. Either Richard or Pauline can claim this amount on line 33099 of their tax return . Since Rob is over 18, his medical expenses should be claimed on line 33199.

In this case, it is better for Pauline to claim all the expenses for Richard, herself, and their daughter Jen on line 33099.

Craig From Grand Junction Co Got A Plan For $59 Per Month

Apply for savings

- your familys estimated annual income.

You can use the financial help in two different ways:

If you take the financial help in advance, the amount of the tax credit you use should be based on your estimated gross income for the year youre getting coverage, not last years income.

Also Check: How Much Does My Company Pay For My Health Insurance

Do I Have To Wait Until I File My Taxes To Get The Subsidy Since Its A Tax Credit

You dont have to wait until you file your taxes. You can get the premium tax credit in advancepaid directly to your insurance company each monthwhich is what most people do. However, if youd rather, you may choose to get your premium tax credit as a tax refund when you file your taxes instead of having it paid in advance.

This option is only available if you enrolled in a plan through the exchange. If you buy your plan directly from an insurance company, you wont be eligible for up-front premium subsidies, and you also wont be able to claim the subsidy on your tax return.

If your income is so low that you dont have to file taxes, you can still get the subsidy, although you wont be eligible for a subsidy if your income is below the poverty level .

When the subsidy is paid in advance, the amount of the subsidy is based on an estimate of your income for the coming year. If the estimate is wrong, the subsidy amount will be incorrect.

If you earn less than estimated, the advanced subsidy will be lower than it should have been. Youll get the rest as a tax refund.

Regardless of whether you take your subsidy up-front throughout the year or in a lump sum on your tax return, youll need to file Form 8962 with your tax return. Thats the form for reconciling your premium tax credit .

Dont Miss: What Is A Gap Plan Health Insurance

Eligibility Requirements For The Premium Tax Credit

You must meet all of the following criteria to qualify for the premium tax credit:

- You must get your health care coverage through the Marketplace

- You can’t be eligible for health care coverage through alternative options such as your employer or the government

- Your income needs to fall within a certain range

- Another person can’t claim you as a dependent on their return

- You must file a joint return if you’re married

Changes in income and family size may affect your eligibility, so report these to the Marketplace to ensure you receive the appropriate tax credit. The premium tax credit program uses the federal poverty line to determine the income ranges that qualify you for the credit.

The U.S. Department of Health and Human Services reports the annual federal poverty levels, which vary depending on whether you live in the contiguous 48 states and the District of Columbia, Hawaii, or Alaska.

The range is 100% to 400% of the federal poverty line amount for the size of your family for the current tax year.

For example, an individual earning between $12,880 and $51,520 in 2021 meets the income criteria to qualify, while a family of four qualifies with household earnings between $26,500 and $106,000.

Even if your income makes you eligible, you must meet the other qualification criteria as well. You’ll use Form 8962 to determine your full eligibility to claim the premium tax credit.

You May Like: What Do I Need To Know About Health Insurance

You Must File A Tax Return To Get Your Premium Tax Credit

If the amount of the credit to which youre entitled is more than the amount you owe in taxes, you will receive the difference as a refund once you file your taxes. If you do not owe any taxes, you get the full amount.

Because you had to estimate your income when you bought health insurance, you may have earned more money than you thought and took a larger subsidy than you were entitled to. In this case, you will have to pay back the amount of the subsidy that is greater than what you were eligible for.

It’s also possible that your family circumstances changed over the year. Changes to your family’s income or size could affect how much credit you will receive when you file your tax return. The changes could increase your refund or balance due or they could decrease it.

You may not need to file taxes if your income falls below the filing threshold. However, you will need to file a return to get your credit.