Whether You Have Different Deductibles

Some plans have separate deductibles for in-network care versus out-of-network care. This could cost you more money unnecessarily if youve met one deductible and then see a doctor that counts towards the other. So, find out the rules and always check whether providers are in-network before you go .

- What if you have a family health plan?

If you have a family policy, check if there are separate or combined deductibles for each member that is covered. The rules can vary on this one, too.

Things To Know About Deductibles In The Health Insurance Marketplace

IMPORTANT: This page is out-of-dateGet the latest information here.

Deductibles, premiums, copayments, and coinsurance, are important for you to consider when choosing a health insurance plan. You can compare health plans and see if you qualify for lower costs before you apply. Most people who apply will be eligible for help paying for health coverage.

Here are 6 important things to know about deductibles:

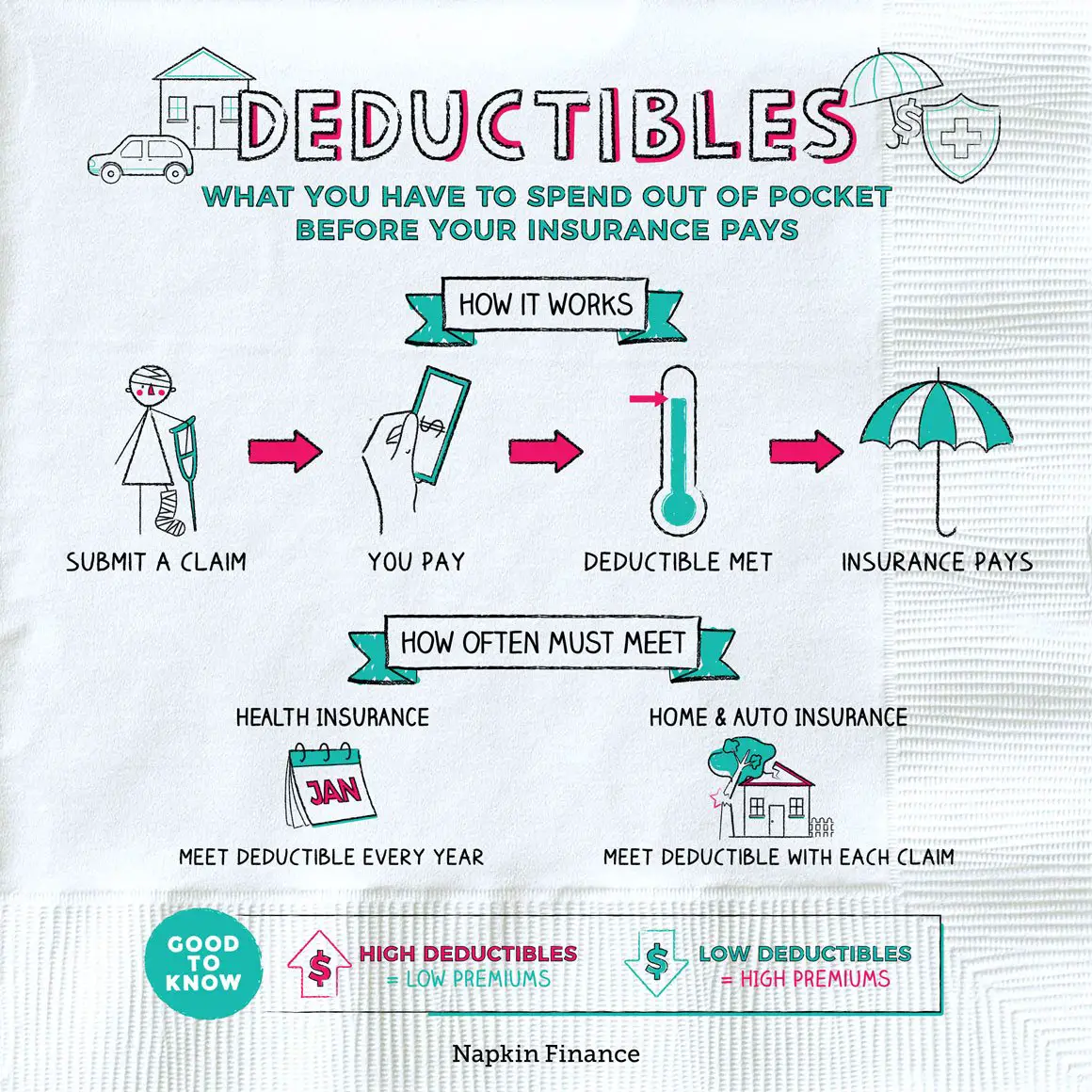

How Health Insurance Deductibles Work

Understanding what a deductible is, how it works, and when you have to pay it is part of using health insurance wisely.

The following is an example of expenses with an annual deductible that’s $1,000:

In January, you get bronchitis. You see the healthcare provider and get a prescription.

- Total bill after your insurer’s network discount = $200.

- You pay $200.

- Your health insurance pays $0.

- $200 is credited toward your deductible.

- $800 is remaining before the deductible is met.

In April, you find a lump in your breast. The lump turns out to be non cancerous youre healthy.

- Total bill for doctors, tests, and biopsy = $4,000.

- You pay $800.

- You pay any copayments or coinsurance your health plan requires.

- Your health insurance pays the rest of the bill.

Also Check: Does Kroger Give Employee Discounts

Finding The Right Health Insurance Plan With Fearnow

If you need affordable medical insurance, our agents can help you. We can answer your questions and compare plans to help you find one that is right for your budget and medical needs. Well also take the time to explain the full costs of your policy, including the monthly premiums, coinsurance, copays and deductibles. Once youve found the right policy for your needs, we can take your first payment and activate your policy so that you can have peace of mind when it comes to getting the health care that you need.

To learn more about our group health insurance plans, please give us a call at 813-689-8878.

How To Choose A Deductible Level

The two primary considerations when selecting a deductible are your ability to withstand risk and the amount you expect to spend annually on health care coverage. For example, if you have recurring medical expenses each month, such as prescription drugs, then you may want to select a lower deductible plan that allows you to quickly reach that deductible.

On the other hand, if you are relatively young and do not get sick often, selecting a plan with higher deductibles may make the most sense. As a result, higher-deductible plans generally have lower premiums. Until these deductibles are met, you are effectively not receiving any of the cost-sharing benefits of having coverage.

For those people with low expected health care expenses, a more affordable health insurance plan with a higher deductible may make more sense. This lowers your guaranteed out-of-pocket costs by reducing the premiums you pay on a monthly basis. The only thing to consider when selecting a plan is whether or not you have the financial means to cover the required deductible should an incident occur.

Understanding this tradeoff is vital in how you choose a plan and find the best health insurance for your needs. The deductible structure of a health insurance plan is important in deciding which plan you choose since it dictates when the carrier actually begins to pay.

You May Like: Shoprite Employee Benefits

After The Deductible Its A Free Ride

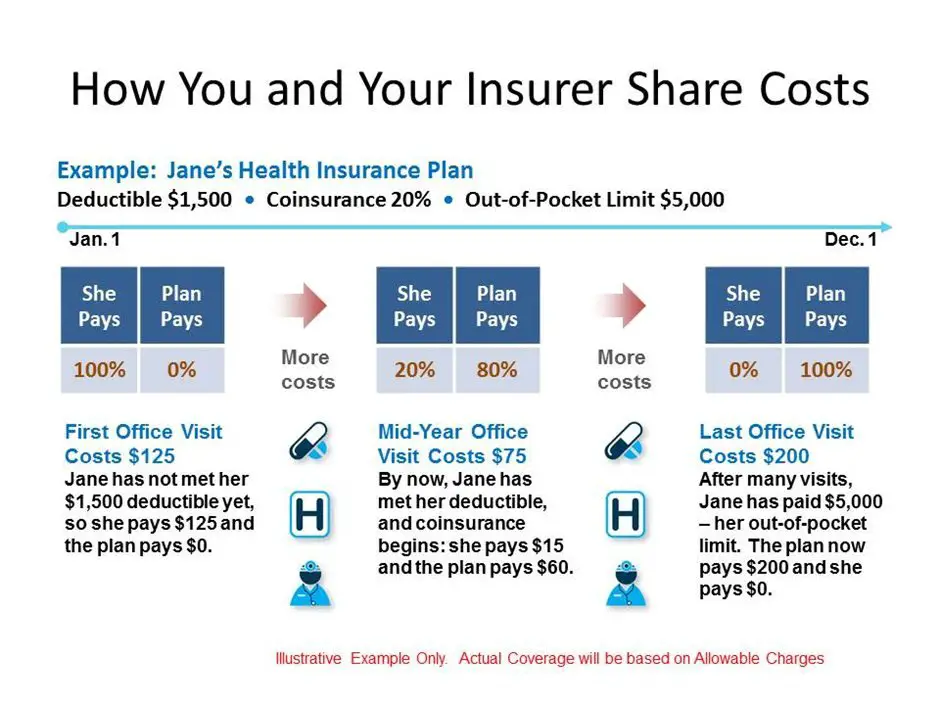

In the American system, only a percentage of medical expenses are covered after the deductible is met. The insured is responsible for the rest. This is the idea of coinsurance. The normal percentage that you will be left to pay after the insurance is applied ranges from 10 to 30%, depending on your exact plan. At this point, it might help to look at a quick example of how the deductible and coinsurance work together in this beautiful mess of a healthcare system.

Lets say you undergo a total knee replacement on Jan 1. You have a $1,500 deductible, are responsible for 10% through coinsurance, and the total surgical bill is $30,000. Subtract the deductible from the total and youre left with $28,500. Your insurance company is responsible for 90% of that, leaving you with an outstanding bill of $2,850.

The final thing to consider is what if your coinsurance rate was 30% rather than 10%? Ouch. That would mean your final surgical bill would be $8,550. To be honest, more people might fall into this category than the 10% example. Obviously, the insurance company is going to do their best to be responsible for as little of the total as government regulations and human decency allow. Luckily, there is an out-of-pocket maximum beyond which you pay nothing.

What’s The Difference Between A Deductible And An Out

Your insurance deductible is relevant at the beginning of your health insurance policy, and your out-of-pocket maximum is relevant after you’ve had significant health care during a policy year.

- Deductible: You pay 100% of your health care costs until your spending totals your deductible amount.

- Coinsurance/copay: You’ll pay a portion of your health care costs until your total spending reaches your out-of-pocket limit.

- Out-of-pocket limit: You’ll pay 0% for covered health services after your out-of-pocket limit.

Also Check: Kroger Employee Discount Card

How Does An Auto Insurance Deductible Exactly Work

An insurance deductible is a fixed amount you pay each time you file an auto insurance claim. This means that it doesnt matter how much your car is worth or what kind of coverage you have because every time you make a claim on your policy, the same dollar amount will be deducted from your insurance payout and applied to the repair bills.

This method of deducting money from your insurance payout is very similar to how homeowners insurance works. You pay a deductible amount each time you file a claim, and the insurance company pays out the rest of the settlement once it has paid off all of its expenses.

How Do You Reach Your Out

Your deductible is part of your out-of-pocket maximum . This is the most youll pay during a policy period for allowed amounts for covered health care services.

Other cost-sharing factors that count toward hitting your out-of-pocket maximum:

- Copayments: Fixed dollar amounts of covered health careusually when you receive the service. .) Your plan determines the price of your copay and whether its owed before or after you meet your deductible.

- Coinsurance: You likely wont pay coinsurance, calculated as a percentage of shared costs between you and your health plan, until your deductible is met. Typical coinsurance ranges from 20 to 40% for the member, with your health plan paying the rest.

Your premium and any out-of-network costs dont count toward your out-of-pocket maximum.

Once your deductible and coinsurance payments reach the amount of your out-of-pocket limit, your plan will pay 100% of allowed amounts for covered services the remainder of the plan year.

Also Check: Starbucks Health Insurance Cost

What Has Changed In Health Insurance

The ACA changed how health insurance works. Some of the changes are:

- Parents can keep their children on their health insurance plans until they turn 26 years old.

- Insurance companies cannot turn down people who already have medical conditions, sometimes called pre-existing conditions. Before, a company could decide not to insure someone because they had a medical condition like diabetes, or because they had cancer in the past. Now, everyone must be accepted.

- Insurance companies cannot cancel peoples insurance plans if they get sick.

- Insurance companies cannot set a limit on how many medical bills they will pay for someone on their insurance plan.

- Preventive care is now free. Your insurance cannot charge you for doctor visits for babies, vaccinations, annual check-ups, screenings and other care that helps you stay healthy.

- You can buy your insurance in the Health Insurance Marketplace . Before, if your job didnt give you health insurance, you had to buy it on your own and it was usually very expensive.

- Health insurance plans now have to cover a certain amount of care. Before, each company made their own decisions about what they would pay for and to what amount.

Essential Things To Know About Your Annual Deductible

Enrolling in a healthcare plan can be an overwhelming experience from unfamiliar terminology to crunching costs, theres a lot to learn before you can find the best coverage for your needs. Whether youre planning to enroll soon or just need to clear up some long-held confusion, here are some of the most important things to know about how deductibles work, and what you should know about yours.

You May Like: How Long Do I Have Insurance After I Quit

How Do I Choose A Good Health Insurance Plan

There is no such thing as a perfect health insurance plan.

Everybody has different individualized needs and the best plan for you will depend on what your individual circumstances are.

And just as those circumstances may change over time, so will the plan that is best for you.

You should always compare different plans to figure out which one will be right for you.

Here are a few things that will help to know when comparing different plans.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Health Insurance Deductible Example

Example #1

Say you have a health insurance plan with a deductible of $1,000. During the course of the year, a medical event arises with a bill of $4,500 that is covered by your health insurance plan. Your health insurance policy will pay for this bill since it is covered, but you would first need to pay off the deductible. Here’s how that would play out:

Example #2

Now let’s say you have a health insurance plan with a deductible of $1,000 and coinsurance of 20% after the deductible has been reached. During the course of the year, you receive a medical bill for $4,500 that is covered under your health insurance policy. Here’s how that would play out:

Editorial Note: The content of this article is based on the authorâs opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Health Insurance Basics

Recommended Reading: Starbucks Dental Coverage

Family Maximum Deductibles Vs Individual Deductibles

If you have a family health insurance plan through yourself or your partner, then the term cumulative deductible could be of interest to you.

In insurance plans, deductibles can be defined as individual and family. Individual deductibles focus on the amount towards a deductible that each individual in the plan has paid. When you have a family maximum deductible, once the amount that all members of the plan have paid cumulatively towards a deductible meets the deductible, then the plan considers the deductible as being met.

It does not require each individual in the plan to meet the deductible on their own first. This can help save money because every plan memberâs contribution to the deductible will count.

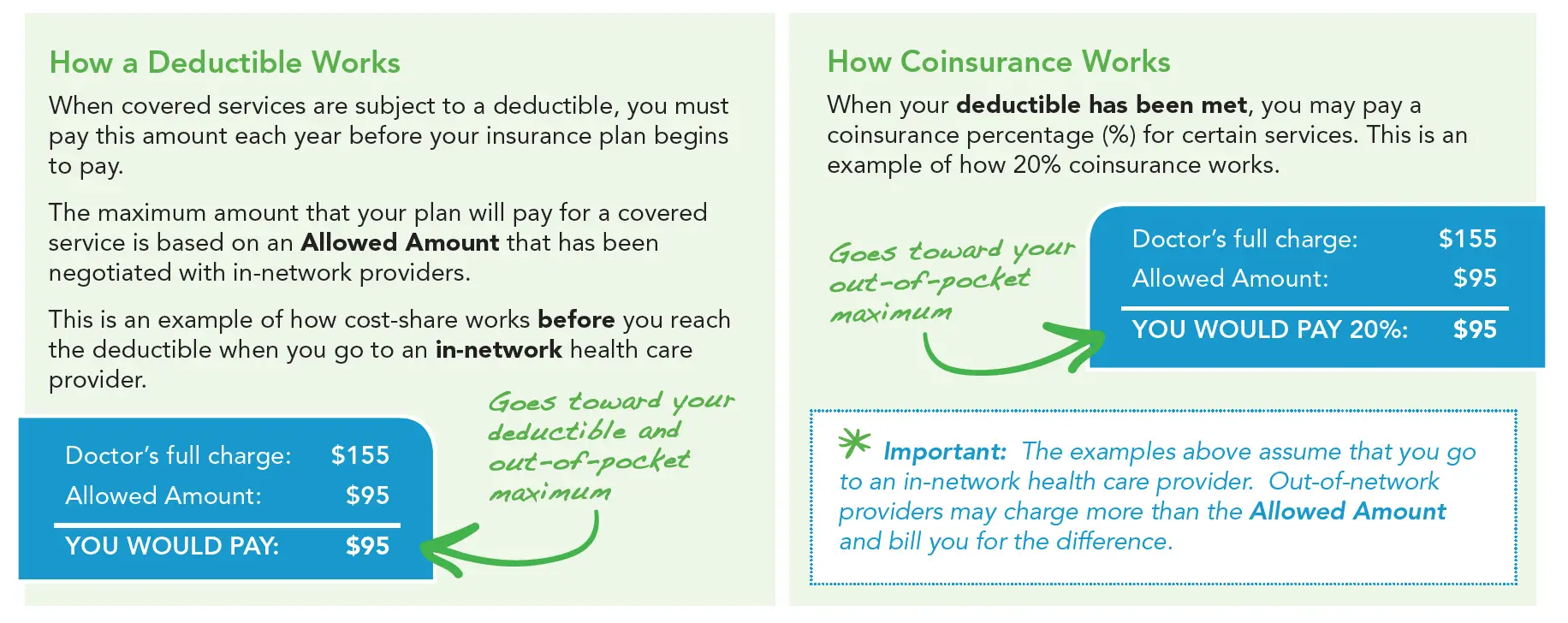

How Does A Deductible Compare With Coinsurance

Besides having to pay a copayment for services alongside your deductible, insurance plans can include something that is called a coinsurance into their payment system. What is coinsurance? Coinsurance is a varying percentage of the costs you pay after youve paid the deductible.

To put it another way, if your coinsurance was 15% then you would be paying 15% of the total costs of your health insurance coverage. As a result, your insurance plan would cover the remaining 85% of your medical bills. It is also important to realize that the higher your copayment is, the higher the share of the cost you would be paying.

You May Like: Starbucks Healthcare Benefits

Will You Always Have A Copay

No. It will depend on your plan, and the service youre using. Some plans use them to cover shared costs, but others dont. And sometimes the service youre using will be paid for with a mix of a copay and/or your deductible and coinsurance obligation. Plus, as well discuss more below, some plans offer certain services at no cost to you, such as annual exams or other preventive care.

What Is Not Included In The Deductible

Things that arent covered by your health insurance wont count toward your deductible even though you pay them out of your own pocket.

For example, medical marijuana isnt covered by health insurance. If you pay $1,500 for medical marijuana, that $1,500 wont be credited toward your individual or family deductible since its not a covered benefit of your health plan.

If you use an out-of-network medical provider in a non-emergency situation, the costs generally won’t count toward your health plan’s regular deductible. If the plan doesn’t cover any out-of-network care , the out-of-network charges simply won’t count toward your plan’s cost-sharing at all. If your plan does cover out-of-network care , the plan will likely have a separate deductible for out-of-network services. This out-of-network deductible will generally be quite a bit higher than the plan’s regular in-network deductible.

Certain preventive care services dont require a deductible, copayment, or coinsurance thanks to the Affordable Care Act . You won’t pay for things like age-appropriate preventive mammograms and colonoscopies, flu shots, or childhood vaccineseven if you havent met your deductible.

Copays for office visits and prescriptions generally don’t count towards your deductible, but when you have a copay, it means your insurer is paying part of the billand you get that benefit even before you’ve met your deductible.

Recommended Reading: Evolve Health Insurance

What Is The Difference Between A Deductible And A Copay

Depending on your health plan, you may have a deductible and copays.

A deductible is the amount you pay for most eligible medical services or medications before your health plan begins to share in the cost of covered services. If your plan includes copays, you pay the copay flat fee at the time of service . Depending on how your plan works, what you pay in copays may count toward meeting your deductible.

Can I Get Health Insurance With No Deductible

First, we must understand that there are two types of health insurance – public and private. In this article, we are referring to private health insurance which is marketed and sold by by insurance companies. The other form of health insurance in Canada is public, which is provided by the provincial government. A private health insurance plan comes with fees like premiums, copay, and deductibles.

Back to the question of finding a private insurance plan with no deductible. Typically, an insurance carrier will increase the monthly premium when there is little to no deductible. This ensures that insurers maintain their expected profit/loss ratio. It is standard for zero or low deductible plans to be offset with higher premiums. The opposite is true for a high deductible plan. This moves us onto our second point.

You May Like: Health Insurance Starbucks

How Does A Health Spending Account Work And Why Does It Have No Deductibles Premiums Or Copay

An HSA enables a small business owner to deduct 100% of their health and dental expenses – without paying the fees typically associated with private health insurance plans. An HSA does not work in the traditional ways of paying a premium and getting coverage. It incorporates principles of both tax planning and medical insurance. To qualify for this plan, you must own or operate a small incorporated business. To sum up an HSA in one sentence, it legally writes off your personal health expenses. In other words, it turns your after-tax personal medical costs into before-tax business expenses.

In most cases, this method will save you more money in comparison to paying a monthly premium under a health insurance plan. You can claim all health-related expenses. It’s that simple.

Examples Of Copayments And Coinsurance

Here are two examples:

- A copayment of $30 may be due when you have an office visit with a doctor.

- A coinsurance share of 10% may be due if you are treated in an emergency room.

The amount you pay for your deductible, copayments, and coinsurance all count toward your annual out-of-pocket maximum, which is the total you must pay before your insurance plan begins paying 100%.

The maximum out-of-pocket annual cost, as of 2021, is $8,550 for an individual plan and $17,100 for a family plan. For 2022, those limits increase to $8,700 and $17,400, respectively.

Recommended Reading: Can You Add A Boyfriend To Your Health Insurance