What Are The Standard Medical Benefits

The VA offers all enrolled veterans a standard medical benefits package that includes inpatient care, outpatient care, and prescription drugs.

The VA’s standard medical benefits package includes a broad spectrum of inpatient, outpatient, and preventive medical services, such as the following:

- medical, surgical, and mental health care, including care for substance abuse

- prescription drugs, including over-the-counter drugs, and medical and surgical supplies available under the VA national formulary system

- durable medical equipment and prosthetic and orthotic devices, including hearing aids and eyeglasses 27

- home health services, hospice care, palliative care, and institutional respite care

- noninstitutional adult day health care and noninstitutional respite care

- periodic medical exams, among other services 28 and

- complementary and alternative medicine therapies.29

The medical benefits package does not include the following:

Does My Current Health Insurance Status Affect Whether I Can Get Va Health Care Benefits

No. Whether or not you have health insurance coverage doesnt affect the VA health care benefits you can get.

Note: Its always a good idea to let your VA doctor know if youre receiving care outside VA. This helps your provider coordinate your care to help keep you safe and make sure youre getting care thats proven to work and that meets your specific needs.

How To Establish Eligibility For Va Medical Benefits

VA health care eligibility is based upon active duty military service in the Air Force, Army, Marines, Navy, Coast Guard, or Merchant Marines .

Members of the National Guard and Reserves may be eligible for VA health care benefits if they were called to active duty on a Federal Executive Order . Other groups of servicemembers may also be eligible for VA medical care.

Misconceptions about VA health care eligibility: It is not a requirement to have served in combat or in a war zone. You do not need a service-connected disability rating. You did not need to be injured or wounded while in the service.

VA health care eligibility factors: VA health care eligibility is based on many issues, including active duty military service, type of military discharge, service-connected disabilities, medical conditions incurred while in the service, location of service, and more. You can be eligible based on your service dates, deployments you served on, or other criteria.

Don’t Miss: Starbucks Insurance Part Time

Options For Veterans Who Are Ineligible For Va Health Care Coverage

Veterans who are not eligible for VA health care should look into other health insurance options, such as an employer-sponsored health care plan, health insurance through a spouse, joining a trade organization that offers health insurance, or purchasing an individual health care plan from the Affordable Care Act Exchanges. This article covers health insurance options after leaving the military.

Ssa Expedited Processing For Veterans

Don’t Miss: Starbucks Part Time Insurance

How To File Irs Form 1095

Instructions for the IRS Form 1095 are include on the back of the form. Here are the basic instructions:

If you have Form 1095-B or 1095-C and you are covered for the entire year , then all you need to do is check the box on your Tax Form 1040, 1040EZ, or 1040A. Thats it. You are not actually required to include your Form 1095 when you file your taxes. Reporting Tricare on your taxes will only require Forms 1095-B, and 1095-C.

If you have IRS Form 1095-A, which is for insurance purchased on one of the exchanges, then you will need to enter the information from that form on IRS Form 8962. It is important to be accurate with this form, as some individuals may be eligible for a tax credit for their health care coverage, depending on whether or not a portion of their premium was paid by the federal government, their income, and other factors.

How To Get Your Va Award Letter

If youre a disabled veteran, you may be aware of the many benefits that you qualify for through the Department of Veterans Affairs. However, many veterans are unaware of the fact that they may qualify for reduced, VA-backed loans and property taxes because of their disability.

By presenting your benefits letter with the rest of your VA loan documentation, youll also be exempt from paying the VA funding fee on your VA purchase or loan refinance. Even better, your compensation benefits can also count toward your qualifying income during the mortgage process.

But in order to qualify for these benefits, you need to show your VA Benefit Summary Letter, also referred to as an award letter or VA disability letter. This is a letter that comes from the Department of Veterans Affairs and shows your level of disability and the amount of your monthly benefits. However, many veterans either misplace the letter or need another copy and dont know how to get another.

If you or another veteran are receiving disability and want to qualify for a reduced VA loan, you will need to provide your Home Loan Expert with your award letter. In this article, well walk through how to find your Benefits Summary Letter and why the letter matters.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

What Does Statutory Bar Mean

A statutory bar is something a veteran cannot usually overcome to qualify for health benefits with the VA. It is an act the veteran engaged in while in the military which probably resulted in the discharge of the veteran. Some examples of statutory bars are:

- If the veteran was a conscientious objector refused to serve, wear the uniform, or comply with lawful orders from a competent military authority

- Discharged by a sentence of a general court-martial

- Officer resigned for the good of the service

- Desertion

Please see M21-1MR, Part III, Subpart v, Chapt. 1, Section B and 38 C.F.R. 3.12 for the list of other statutory bars.

How The Veteran Health Id Card Works

The first thing to consider is what the VHIC is NOT it is not an insurance card it cannot be used to pay for health care services and does not function as an insurance ID card. It also does NOT authorize care at non-VA or out-of-network facilities.

These are very important distinctions to make, especially when time is of the essence and the right ID is needed to obtain medical services and determine who pays for them.

The Veteran Health ID Card includes the following features as listed on the Department of Veterans Affairs official site. These features may be subject to change depending on mission needs, federal legislation, changes in VA policy, etc.

At the time of this writing, only those enrolled in VA health care will receive these cards, which include:

- Privacy protection. No personally identifiable information is contained on the magnetic stripe or barcode of your VHIC according to the VA.

- A DoD-created personal identifier code that helps the VA access your health records at the VA facility you where you are being treated.

- Accessibility for the visually impaired the card features Braille that can help users quickly locate and use the VHIC.

- Anti-counterfeiting measures built-in to further secure your card.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Who Is Eligible For Va Health Care And The Vhic

Those who serve as active duty military members who retire or separate and do not have a discharge characterized as Dishonorable. You may also qualify as a current or former National Guard or Reserve member called to active duty by a federal order.

The requirements in this area include having served the full period ordered to active duty. Those activated only for training purposes do not qualify.

What Is The Difference Between Discharge Upgrade Vs Vas Character Of Discharge Determination

Very simply put, if a person is dissatisfied with their discharge characterization from the military, they have the option to apply for a discharge upgrade with their Discharge Review Board or with their Board for Corrections of Military/Naval Records . If these applications fail to result in an upgrade that can provide VA health benefits, the applicant may have another way to get VA Health benefits through a Department of Veteran Affairs character of discharge determination.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

What If I Do Not Receive This Form

Since 2015, VA has annually sent IRS Form 1095-B to Veterans who were enrolled in the VA health care system at any time the previous calendar year. If you did not receive a Form 1095-B from VA explaining your health care coverage for each year you are or have been enrolled, call 1-877-222-VETS Monday through Friday from 8 a.m. until 8 p.m. ET. This form is for your records only and should not be sent to the IRS or returned to VA.

What Happens If At The End Of The Process My Income Is Verified To Be Higher Than The Income Limits

Your copay status will be changed from copay exempt to copay required, which may result in disenrollment due to enrollment restrictions for Veterans whose income exceeds the income limits. VA facilities involved in your care will be notified of your change in status and to initiate billing for services provided during that income year. Your enrollment priority status may be changed if your financial status is adjusted by the income verification process. If your enrollment status is changed, you will be notified by mail.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Don’t Forget Your Guarantee Exam

ExamFX is so confident in the quality of its material that we offer our customers a first-time pass guarantee. If you dont pass the first time around, we will refund your money. To qualify for this offer, you must pass our Guarantee Exam with a score of 80% to determine maximum exam readiness. While completing this portion of your online course is not required, we highly recommend taking this extra step.

I Am A Recently Discharged Combat Veteran Must I Pay Va Copayments

Veterans who qualify under this special eligibility are not subject to copays for conditions potentially related to their combat service however, unless otherwise excused, combat Veterans may be subject to appropriate copay rates for care or services VA determines are unrelated to their military service.

You May Like: How To Enroll In Starbucks Health Insurance

Can The Va Bill Private Health Insurance

The VA has the authority to bill most health care insurers for nonservice-connected care provided to veterans enrolled in the VA health care system.

The Consolidated Omnibus Budget Reconciliation Act of 1985 ” rel=”nofollow”> P.L. 99-272), enacted into law in 1986, gave the VHA the authority to bill some veterans and most health care insurers for nonservice-connected care provided to veterans enrolled in the VA health care system to help defray the cost of delivering medical services to veterans.56 This law also established means testing for veterans seeking care for nonservice-connected conditions.

Congress authorized the VHA to collect reasonable charges for medical care or services from a third party to the extent that the veteran or the provider of the care or services would be eligible to receive payment from the third party for a nonservice-connected disability for which the veteran is entitled to care under a health plan contract 57 a nonservice-connected disability incurred as a result of the veteran’s employment and covered under a worker’s compensation law or plan that provides reimbursement or indemnification for such care and services 58 or a nonservice-connected disability incurred as a result of a motor vehicle accident in a state that requires automobile accident reparations insurance.59 Similarly, the VHA can receive payments from Medicare supplemental coverage plans for nonservice-connected conditions for which the veterans receives care at VHA facilities.

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Irs Suspends Requirement To Repay Excess Advance Payments Of The 2020 Premium Tax Credit

If you have excess advance payments of the premium tax credit for 2020, you are not required to report the excess APTC on your 2020 tax return or file Form 8962, Premium Tax Credit.

If you claim a net Premium Tax Credit for 2020, you must file Form 8962.

If you already filed a 2020 return and reported excess APTC or made an excess APTC repayment, you dont need to file an amended return or take any other action.

For details see: Fact Sheet | News Release

Under the Tax Cuts and Jobs Act, passed December 22, 2017, the amount of the individual shared responsibility payment is reduced to zero for months beginning after December 31, 2018.

Beginning in tax year 2019, Forms 1040 and 1040-SR will not have the full-year health care coverage or exempt box and Form 8965, Health Coverage Exemptions, will no longer be used. You need not make a shared responsibility payment or file Form 8965, Health Coverage Exemptions, with your tax return if you dont have minimum essential coverage for part or all of the year.

You may receive multiple information forms that you can use to complete your tax return and will keep with your tax records.

The information forms are:

Other Rules For Qualifying For Va Health Care And A Veteran Health Id Card

Those who enlisted after September 7, 1980 or entered active duty after October 16, 1981 are required to have served 24 continuous months or the full period for which you were called to active duty, unless any of the following apply:

- The service member was discharged for a disability caused or aggravated by active-duty service.

- The service member was given an early out or hardship discharge.

- The service member was on duty before September 7, 1980.

Military members with punitive discharges such as Bad Conduct, Other Than Honorable, or Dishonorable discharges may be eligible for VA health care and the Veteran Health ID Card if they successfully navigate the discharge review process and have a Discharge Review Board upgrade the nature of the discharge to a non-punitive one.

If you must sign up for VA health care using a power of attorney, the VA advises for best results, include a copy of that POA along with your application documents.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Can The Va Bill Medicare

The VA is statutorily prohibited from billing Medicare61 in most situations. Additionally, veterans are responsible for paying all Medicare premiums, deductibles, and co-insurance. The VA has no authority to reimburse Medicare beneficiaries for expenses they incur to obtain medical care under Medicare.62

In general, Medicare is prohibited from reimbursing for any services provided by a federal health care provider unless

- the provider is determined by the Secretary of Health and Human Services to be providing services to the public as a community institution or agency

- the provider is providing services through facilities operated by the Indian Health Service 63 or

- the services were provided in an emergency .

Medicare is also prohibited from making payments to any federal health care provider who is obligated by law or contract to render services at public expense.64 Therefore, the VHA is statutorily prohibited from receiving Medicare payments for services provided to Medicare-covered veterans.65 Although the legislative history does not indicate congressional intent for this decision, “a safe assumption to be drawn from the exclusion of Medicare is that Congress wanted to avoid the unnecessary transfer of federal funds from Medicare to the VA when the money is all coming out of the same coffer.”66

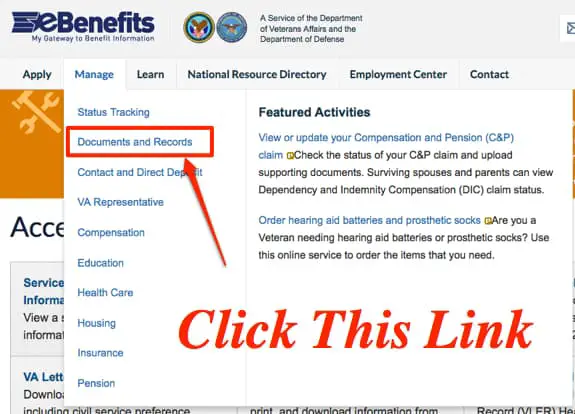

Submitting A Claim For A Va Benefits Letter

If you have not yet applied for disability, and are looking to use your VA loan benefits, youll need to have an approval from the VA before you can receive your benefit.

A friend and team member just went through the process of applying for the information with his dad and said it was incredibly easy.

He created an eBenefits account and printed off the actual award letter application. They filled out the application and gathered the following information:

- 2 most recent bank statements

- 3 years of tax returns

- 2 most recent pay stubs

- 2 most recent Social Security awards letters

Most of this information is readily available online and can be printed at home. Based on your eligibility, you may even be able to complete your entire application for disability benefits electronically.

After returning the application along with the above documents to the local regional office, it took about a month for them to review this application because they had all the documents upfront.

If you have already been receiving benefits and need a copy of the awards letter, remember, go to eBenefits and you can download all of your documents and approvals there. Or if you prefer to talk it over with a person, call your local regional VA office and they can help you.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees