What Network Should You Pick

Everyone is looking for something slightly different out of their health insurance, so this is really a question you have to answer for yourself. But there are a few pointers you can keep in mind:

- Before you start looking, make note of your need to haves and want to haves in terms of your provider network and benefits. Also, list any doctors or hospitals you want access to. Keep that information at hand while you shop.

- Check the networks youre considering for doctors, hospitals and pharmacies near to you before making any decisions, especially if easy access to care is important.

- If your doctors already in-network, or youre flexible about where you get care and can easily stay in-network, then choosing an HMO or EPO may mean a lower cost for you each month.

- If you need the freedom to go outside a narrow network and still get some benefits from your coverage, then look at PPOs or a more flexible POS plan.

Epo: A Larger Network Makes Life Easier

An Exclusive Provider Organization is a lesser-known plan type. Like HMOs, EPOs cover only in-network care, but networks are generally larger than for HMOs. They may or may not require referrals from a primary care physician. Premiums are higher than HMOs, but lower than PPOs.

Karen, 35, manages a chain of restaurants with locations across the country. She has asthma, and usually sees her specialist a couple of times a year. Because she travels a lot on business, Karen chose an EPO with a large national network: If she ever needs care away from home, she knows shell be able to find an in-network specialist. Her EPO also doesnt require referrals, a convenience shes willing to pay a bit more for.

What Is The Difference Between Hmo Ppo Hdhp Pos And Epo

Its open enrollment season at your job and your employer offers you a choice between the three biggest plan types: HMO, PPO and HDHP. Which is best? It really depends on your financial and medical situation and preferences.

For instance, would you rather the flexibility of not having to go to a smaller group of providers in an HMO and dont mind paying more upfront for your care via premiums? Then, a PPO might be right for you.

Do you not care about having a large network of providers, but want to make sure you pay as little as possible for health care? Then, an HMO could be perfect.

Do you not use medical services often and you want a plan that protects you, but not cost much in terms of upfront premiums? Then, a HDHP could be the direction to go.

Choosing the right health insurance plan is a personal decision and depends on your situation and preferences. Whether you ultimately choose a PPO, HMO, HDHP, POS or EPO, take costs, flexibility, coverage and convenience into account when making that decision.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

What Is The Difference Between An Hmo And Health Insurance

Inclusion under an HMO is normally quite restrictive and comes at a lower cost to insured parties. Conventional health insurance, on the other hand, has higher premiums costs, higher deductibles, and higher co-pays. However, health insurance plans are much more flexible. Individuals with health insurance do not need to have a primary care physician to outline treatment. Health insurance also covers some of the expenses for out-of-network providers.

California Health Insurance Plan Options: Hmo Ppo Or Epo

Posted: December 28, 2017

Everyone has to have health insurance now that the Affordable Care Act is in place, but that doesnt mean healthcare has gotten any less confusing. We tend to go with what we know, or what weve always had when it comes to insurance coverage, but the reality is that you have options.

In California, health insurance plan options primarily include Health Maintenance Organization and Preferred Provider Organization . There is also a third option, Exclusive Provider Organization , which is growing in popularity in California.

While all of these plans can provide the coverage that you need, its important to understand each of them individually and then compare them to one another. Failing to grasp the differences between HMO, PPO and EPO plans could lead to significant unexpected costs and disappointment in having to switch doctors due to a change in insurance coverage. These plans provide coverage, but there are substantial differences in how they work and how much they cost.

Whether youre without insurance coverage and looking to purchase a plan shortly or are just exploring the options you have as a Californian, weve provided some insight to HMOs, PPOs, EPOs and Kaiser Permanente.

Also Check: Starbucks Healthcare Benefits

Hmo Ppo Pos: What Do All These Acronyms Mean

Who is this for?

If you’re new to Medicare, this information will help you understand some common terms.

If you’ve been shopping for Medicare Advantage plans, you’ve probably noticed a lot of acronyms. HMO, POS, PPO all of these signify different plan types.

Well spell it out for you.

- HMO stands for health maintenance organization.

- POS stands for point of service.

- PPO stands for preferred provider organization.

All these plans use a network of doctors and hospitals. The difference is how big those networks are and how you use them.

What Does Pffs Mean In Insurance

4.6/5private fee for service

Furthermore, what is a PFFS insurance plan?

A Medicare PFFS Plan is a type of Medicare Advantage Plan offered by a private insurance company. PFFS plans aren’t the same as Original Medicare or Medigap. The plan determines how much it will pay doctors, other health care providers, and hospitals, and how much you must pay when you get care.

Also, do PFFS plans have coverage? Not all PFFS plans include prescription drug coverage. If a PFFS plan does not offer coverage for your medications, you have the option to enroll in a stand-alone Medicare Prescription Drug plan .

Also to know is, what is the difference between a PPO and an Pffs?

HMO plans may have lower costs compared to a Medicare Advantage PPO or a PFFS plan. With a Medicare Advantage Preferred Provider Organization plan: Unlike an HMO, you don’t have a primary care physician, and you don’t need a referral to see a specialist.

Is HMO a fee for service?

A fee-for-service plan reimburses you or your provider according to a plan-allowable cost. You may pay a deductible and coinsurance or copayment for some care. An HMO plan provides care through a network of physicians, hospitals and other providers in a particular geographic area.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Hsa Vs Ppo Eligible Expenses

You can use your HSA to pay for any medical expenses, including over-the-counter medication costs. Before 2020, that didnt include over-the-counter drugs without a prescription. For example, your doctor recommends omeprazole, which used to be by prescription only but now is available over the counter. If you have them write a prescription, you can use your HSA to pay for it.

A PPO should cover any reasonable service charge from an in-network and out-of-network provider. But you must meet your deductible before the insurance provider pays for the expenses.

Although the whole cost of the appointment and any accompanying services count towards the deductible for out-of-network expenses, you most likely wont get a lower price with these providers. The PPO negotiates lower rates with all in-network providers, and even when youre still paying your deductible, you get the discounted price. However, as mentioned, you can have a PPO and an HSA if you have an HDHP. So, you can pay for the appointment with an HSA and save a little money.

What Are The Benefits Of A Ppo Plan

Do not have to select a Primary Care Physician. Can choose any doctor you choose but offers discounts to those within their preferred network. No referral required to see a specialist. More flexibility than other plan options. Greater control over your choices as long as you dont mind paying for them.

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

Why Do Hmos Have A Bad Reputation

There are a few limitations for those covered under HMOs, which is the reason why these plans have a bad reputation. For example, HMOs only permit insured parties to see people in their own network, which implies that they are answerable for the full amount of a visit to any specialist or doctor outside this group. The plan may likewise expect people to live in a specific region. This implies that somebody who gets clinical benefits out of the HMOs network should pay for it themselves. The plans additionally expect people to pick a primary doctor who decides the type of treatment patients need.

How Much Does A Ppo Plan Cost

This is an important question if you are considering signing up for one. If you dont know the answer, this article will help walk you through what to expect and what factors can affect your monthly cost.The average person pays $250 per month for their health insurance, but that price will vary depending on which company they choose and where they live. A PPO plan costs anywhere from $50-$300 per month with most people paying around $150-$200 per month for it. Some of the main factors that influence the cost of a PPO plan include: your age, whether or not you smoke, where in the country you live.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Hmo Vs Ppo: What Do Those Letters Mean

Updated on Wednesday, May 26 2021| by Judy Hucka

Learn the difference between HMO and PPO health plans and which one could be the right choice for you and your family

For many people, the most important question they have when looking for a health insurance plan is Can I keep my current doctor or Which doctors can I see under this plan?

To answer that question, you need to know about the plans provider network the list of the doctors, hospitals, pharmacies and other health care providers the plan has signed up to provide medical care to its members.

The two most common types of provider networks are HMOs and PPOs . When you shop for a health insurance plans, you will see these terms used to describe the type of plan being offered.

Unitedhealthcare Connected For Mycare Ohio

UnitedHealthcare Connected® for MyCare Ohio is a health plan that contracts with both Medicare and Ohio Medicaid to provide benefits of both programs to enrollees. If you have any problem reading or understanding this or any other UnitedHealthcare Connected® for MyCare Ohio information, please contact our Member Services at from 7 a.m. to 8 p.m. Monday through Friday for help at no cost to you.

Si tiene problemas para leer o comprender esta o cualquier otra documentación de UnitedHealthcare Connected® de MyCare Ohio , comuníquese con nuestro Departamento de Servicio al Cliente para obtener información adicional sin costo para usted al de lunes a viernes de 7 a.m. a 8 p.m. .

Don’t Miss: What Insurance Does Starbucks Offer

What Does Hmo And Ppo Mean

Health Maintenance Organizations , and Preferred Provider Organizations have distinct and separate characteristics. Deciding which health insurance plan works best for you is dependent entirely on your and your familys situation.

Lets detail the ins and out of each plan. What are the differences and similarities? How can each plan benefit you and your family?

Check out the breakdown HMO vs PPO health insurance plans below.

Whats An Hmo Health Maintenance Organization

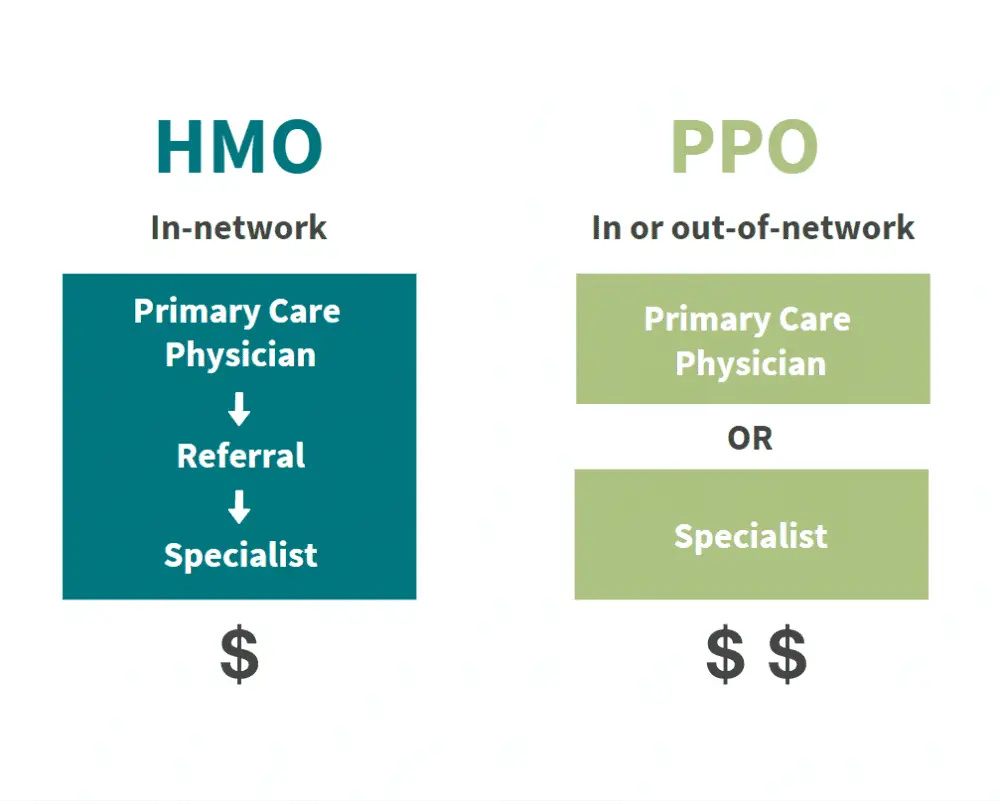

With an HMO, you are usually required to get your care from doctors and other health care providers who work for or contract with the health plan . If you want to see a doctor who is not in the HMOs provider network, you may have to pay the full cost of the care or services that you get. The plans doctors, hospitals and other providers may be concentrated in a specific geographic area, so you may need to live or work in its service area to be eligible for health insurance coverage.

The number of doctors in the HMOs network may be smaller than the number of doctors in a PPO network. If your current doctor is in the HMOs provider network, or if you dont currently have a regular doctor, an HMO may be a good choice for you. The plans customer service representatives can usually help you find a doctor in the network who is a good match for you.

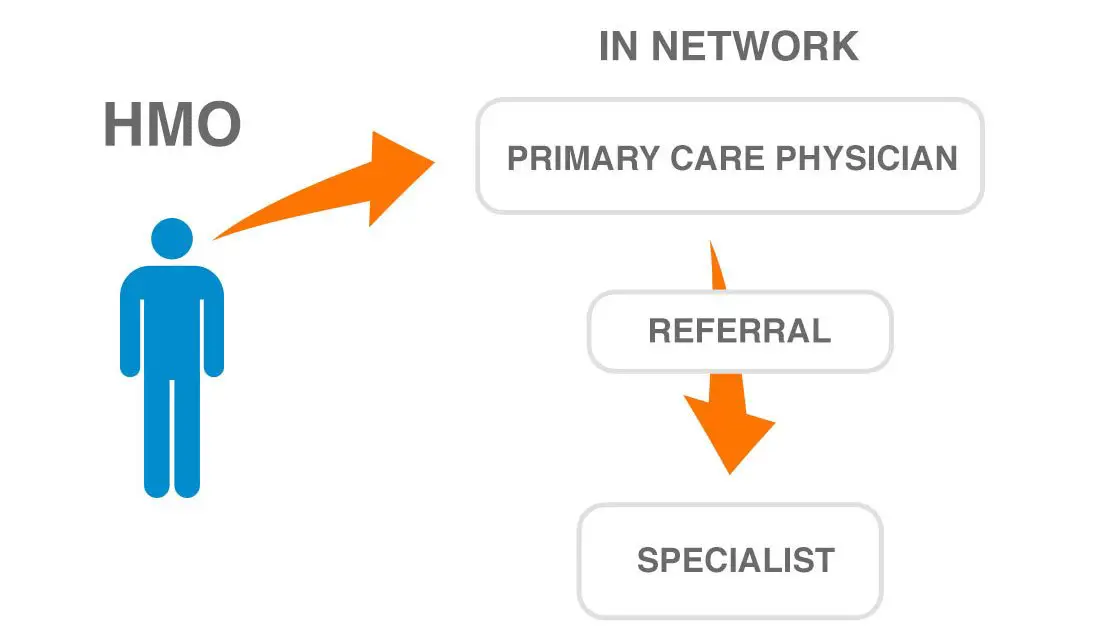

Another important thing about HMOs is that usually you must choose one doctor who is considered your primary care provider. That doctor coordinates your care with other doctors or services if needed If you want or need to see a specialist, your primary care doctor must give you a referral to see that specialist.

For example, if you woke up with severe back pain, you would first go to your primary care doctor, whod examine you. If your doctor determined you needed additional care, he or she would refer you to a spine specialist.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Is A Ppo Worth It

A lower the risk for the insurance company means lower costs for you. The main things to consider when deciding between a PPO and an HMO are providers and out-of-pocket costs. If you can afford it, the cost is worth it PPO plans are the most popular. If youre OK with staying in-network, an HMO may be the way to go.

Is Aetna Better Than Blue Cross Blue Shield

Once again, there are differences from one Blue Cross Blue Shield to another but for the most part both Aetna and Blue Cross have very strong health insurance plans for both individuals and groups. In the Blue Cross health insurance plans vs. Aetna health insurance plans section of this showdown its a tossup.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

What Is The Difference Between A Ppo And A Pos

In general, the biggest difference between PPO and POS plans is flexibility. Both plans cover you whether you use providers and facilities in or out of the network. However, a POS requires you to have a primary care physician and get referrals from them if you want to see a specialist or anyone else. PPOs don’t.

Costs are another consideration. PPOs tend to be more expensive overall than POS: Their premiums are higher, and they usually come with deductibles that must be met before your coverage begins.

Whats A Ppo Preferred Provider Organization

PPO plans generally give you a larger choice of doctors and other providers you can see. If you choose to see in-network providers — preferred providers that are part of the plans network — youll pay less. But with PPOs, you can also see out-of-network providers. Youll pay more a greater percentage of the total cost of the visit but you will not have to pay the entire cost, as you would with an HMO if you went outside the network.

So, with a PPO, you can see any doctor you want, although youll pay a greater share of the cost if the doctor is not in the plans network. If you already have a doctor that you like and want to keep, you should check to see whether that doctor is in the PPOs provider network .

Also, with a PPO, you generally dont have to select a primary care doctor and you can see a specialist without a referral. If you woke up with serious back pain, you could make an appointment with a spine specialist immediately, without first seeing a primary care doctor.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Need Health Coverage Now

Short term health insurance underwritten by Golden Rule Insurance Company may be just the fast, flexible solution you need for your temporary coverage. It provides access to large nationwide provider networks through UnitedHealthcare and coverage can be available as soon as the next day in many cases.

How To Enroll In Medical Health Plans

If youre eligible, you can enroll in a health insurance plan through your employer when you first become eligible, during open enrollment or if you qualify for a special enrollment period.

Employer-sponsored health insurance is how most pre-retirement people get health insurance.

You can also sign up for an individual or family plan through the Affordable Care Act marketplace or a similar plan directly from a health insurance company.

Other health insurance options are Medicare and Medicaid if you qualify. Eligibility for those plans is connected to your age and household income .

You May Like: Starbucks Benefits For Part Time Employees

Hsa Vs Ppo: Which Is Better

Both plans offer distinct advantages and disadvantages depending on the persons financial and health situation. Each has rules that may be less beneficial than the other. For example, people who have high-deductible health plans and want to put money aside for future medical expenses should consider an HSA. Additionally, people on a budget that have out-of-network medical care needs. However, you can have an HSA with a PPO if you have an HDHP.

How Your Healthcare Provider Gets Paid

Understanding how your healthcare provider gets paid can alert you to situations in which more services than necessary are being recommended, or situations in which you might need to push for more care than is being offered.

In an HMO, the healthcare provider is generally either an employee of the HMO or is paid by a method called capitation. Capitation means the healthcare provider is given a certain amount of money each month for each of the HMO members he is obligated to care for. The healthcare provider gets the same amount of money for each member whether that member requires services that month or not.

Although capitated payment systems discourage ordering tests and treatments that arent necessary, the problem with capitation is that theres not much incentive to order necessary ones, either. In fact, the most profitable practice would have lots of patients but not provide services to any of them.

Ultimately, the incentives for providing necessary care in an HMO are an honest desire to provide good patient care, a decrease in long-term costs by keeping HMO members healthy, public quality and customer-satisfaction rankings, and the threat of a malpractice suit.

In EPOs and PPOs, healthcare providers are typically paid each time they provide a service. The more patients they see a day, the more money they make.

Also Check: Starbucks Medical Insurance