About Private Insurance Tax Credit

Advance Payment of Premium Tax Credit was created under the Affordable Care Act to assist taxpayers with insurance premiums, and provides financial assistance to ensure individuals have access to health coverage. Consumers may shop for a qualified health plan using their tax credit. The APTC or tax credit is paid monthly to their health insurance provider to assist with monthly premium costs.

APTC can only be used with qualifying health insurance plans purchased through Your Health Idaho , Idaho’s Health Insurance Exchange. The amount of the tax credit is based on the individuals estimated modified adjusted gross income for the year. When tax filers file their income taxes, a reconciliation takes place based on the actual income that is reported for their household. Visit the apply page for eligibility requirements.

Your Health Idaho is the only place where Idahoans can receive a tax credit to help offset the monthly cost of health insurance coverage. Some Idahoans may also qualify for cost-sharing reductions, which lower out-of-pocket costs for things like co-payments and prescriptions.

If you need help along the way, certified agents, brokers, and enrollment counselors are available to help you free of charge. Find free help in your area.

To provide you with the best service, your determination and management of benefits will depend on which benefits you receive.

Eligibility Requirements For The Premium Tax Credit

You must meet all of the following criteria to qualify for the premium tax credit:

- You must get your health care coverage through the Marketplace

- You can’t be eligible for health care coverage through alternative options such as your employer or the government

- Your income needs to fall within a certain range

- Another person can’t claim you as a dependent on their return

- You must file a joint return if you’re married

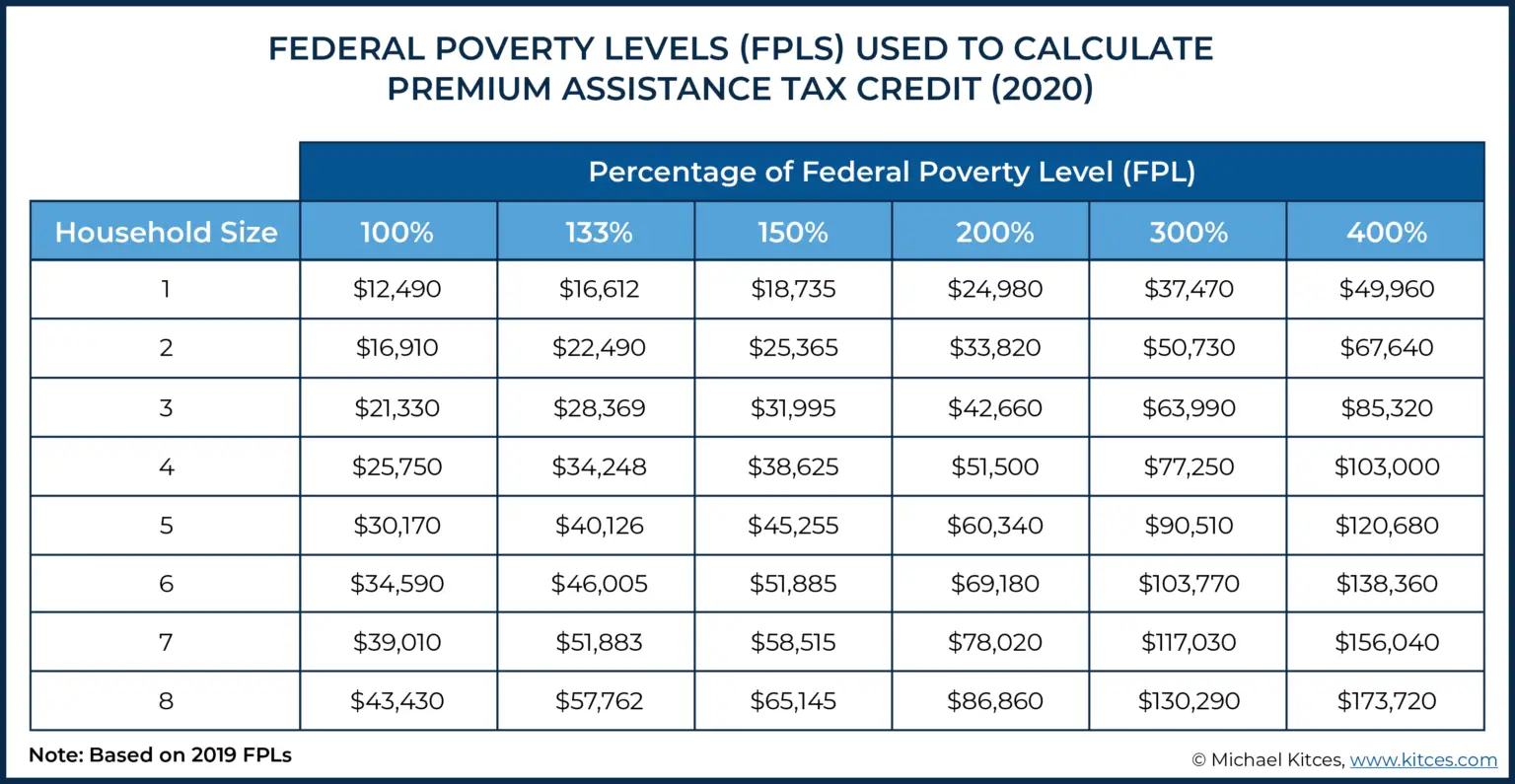

Changes in income and family size may affect your eligibility, so report these to the Marketplace to ensure you receive the appropriate tax credit. The premium tax credit program uses the federal poverty line to determine the income ranges that qualify you for the credit.

The U.S. Department of Health and Human Services reports the annual federal poverty levels, which vary depending on whether you live in the contiguous 48 states and the District of Columbia, Hawaii, or Alaska.

The range is 100% to 400% of the federal poverty line amount for the size of your family for the current tax year.

For example, an individual earning between $12,880 and $51,520 in 2021 meets the income criteria to qualify, while a family of four qualifies with household earnings between $26,500 and $106,000.

Even if your income makes you eligible, you must meet the other qualification criteria as well. You’ll use Form 8962 to determine your full eligibility to claim the premium tax credit.

How Do I Use My Tax Credit

When you first apply for health insurance in the Marketplace, you will learn if you qualify for a tax credit based on your stated income and household size. Next, you can elect to apply the estimated credit to your premium to lower your monthly premiums. You can choose to apply all, some, or none of the estimated credit upon enrollment. Using the credit early is referred to as an advanced payment of the premium tax credit . Depending on the amount you choose to apply, you will need to reconcile at the end of the year when filing taxes, and this will determine how much is owed or refunded.

Note: if your year-end income or household size is different than from when you first applied for insurance, this affects what you owe or are refunded when filing taxes. More on this in the next section.

Also Check: Starbucks Part Time Health Insurance

Using Your Premium Tax Credit Wisely

You can take advanced payments each month or use them as a credit on your tax return to increase your refund. Look to either use all, some or none of your premium tax credit in advance to lower your monthly premium. If you use more advance payments of the tax credit than you are eligible for that is based on your final yearly income, you will end up repaying the difference when you file your federal income tax return. If your income turned out to be lower than you anticipated, you would receive the additional tax credits with your tax refund.

Save your money: You could put the extra money in short-term Certificates of Deposit or a high yield savings account receiving between 0.90% and up towards 1.5% of interest each year.

Invest in stocks and crypto: Investing in cryptocurrencies is similar to buying stocks. Prices are determined by supply and demand, and transactions can be completed online. Investments can build wealth or lose it. Both of these options could serve as short-term investment opportunities for using your additional premium tax credit.

Other Health Care Tax Credits

The premium tax credit isnt the only credit available to help you save money on your health insurance. The health coverage tax credit is another federal tax credit that helps reduce the cost of insurance for people aged 55 through 64 who receive benefits from the Pension Benefit Guaranty Corp or people eligible for Trade Adjustment Assistance allowances due to a qualifying job loss.

If you own a small business, you may also qualify for the small business tax credit. To claim this credit, you must enroll in a Small Business Health Options Program plan. There are additional eligibility requirements based on the size of your business and the number of employees you have.

You May Like: Kroger Health Insurance Part-time

Who Can File Irs Form 8: Premium Tax Credit

You only need to complete IRS Form 8962 if you purchased health insurance through the Affordable Care Acts Health Insurance Marketplace. If youre covered by a health insurance plan at work or you purchased health insurance directly from an insurance company outside of the exchange, you dont need this form to complete your tax filing.

If you received a Form 1095-B from your insurance company or a Form 1095-C from your employer, you dont file Form 8962.

Customarily, you must fill out and file Form 8962 if:

- You paid your health insurance premiums out of pocket, and now want to claim the premium tax credit, or

- Advance premium tax credits were paid for you or a family member covered by your plan

However, for the tax year 2020, the IRS has decreed you are not required to file Form 8962 if it turns out you have excess advance premium tax credits.

If you enrolled for health insurance through the Marketplace and received a Form 1095-A, you will use it to complete Form 8962. This form, called a Health Insurance Marketplace Statement, has information about your coverage, including:

- Premiums paid

- Premium tax credits used

- Who is covered under your plan

Form 1095-A is issued to you by the Marketplace, not the IRS. If you dont get one in the mail, you should be able to view your form by logging into your Marketplace account online.

What Is An Advance Payment Of Premium Tax Credit

The advance premium tax credit reduces health insurance payments of the premium for those with ACA marketplace plans.

When you buy health insurance on Healthcare.gov or from the 14 states that run their own insurance marketplaces, you can receive a subsidy to help reduce your premiums based on your income.

This subsidy is technically a tax credit paid in advance. The federal government can send the money directly to your health insurance company to reduce your monthly premiums rather than having people wait to receive the money when you file your income tax return.

The lower your income, the larger the tax credit and the less youll pay each month.

Key Takeaways

- The federal government offers advance premium tax credits to those with plans from the health insurance marketplace.

- People who get insurance through an employer, Medicare or any other source arent eligible for the subsidies.

- The Affordable Care Act marketplace will factor in the tax credit when estimating your health insurance premiums for the coming year.

- The health insurance tax credit is based on your household income.

- The American Rescue Plan expanded the subsidy for 2021 and 2022, so now everyone with a marketplace plan is eligible for the tax credit.

Also Check: Minnesotacare Premium Estimator

Understanding Premium Tax Credits

Watch how premium tax credits may help you save money on health insurance premiums. View the Video.

What is a subsidy? A subsidy is financial assistance provided by the federal government that helps lower what you pay for health insurance each month . The size of your family, where you live, and your income are the three things that determine your subsidy. See if you qualify: Enroll.Ambetterhealth.com

How To Fill Out Form 8962

Form 8962 is only five sections, over two pages, and most people donât even have to fill out the whole form. Hereâs a quick rundown of each part of the form.

Part I requires you to put information like how many people are in your household, what your householdâs modified adjusted gross income was for the year, and what percentage of the federal poverty line your income was.

Part II is where you âreconcileâ your APTC. You list how much you received from the APTC each month of the year , and then you compare that to how much you should have received based on your final annual income. If you received more in advance payments than you should have, you will have to pay back the excess. If you didnât receive enough, you will get money refunded to you.

Part III is where you write how much you need to pay back if you received more of a credit than you should have. You donât need to fill it out unless you got excess APTC.

Part IV isnât necessary for most people. It only applies if your credit is split between multiple taxpayers. For example, you may fill out this part if you got divorced. If you need to split your credit, Part IV is where you state what portion of the credit each taxpayer should receive.

Part V of the form only applies if you got married during the year. This section allows you to account for different household incomes before and after your marriage.

Don’t Miss: Substitute Teacher Health Insurance

How The Premium Tax Credit Works

You can only get the premium tax credit if you buy coverage through your stateâs health insurance Marketplace. . If you buy coverage outside of the Marketplace , it disqualifies you from the tax credit.

The premium tax credits are advanceable. You can use all, some, or none of your premium tax credit in advance to lower your monthly premium. The Marketplace will actually pay the insurance company your premium tax credit so that you only have to pay the difference. Letâs revisit our example from above. If you qualify for a premium tax credit of $1,000 per month and you pick a plan with a $1,250 monthly premium, you would only need to pay $250. The Marketplace would pay the insurance company the $1,000 premium tax credit on your behalf every month.

Premium tax credits get reconciled when you file taxes. Any premium tax credits you receive in advance are based on an estimated income. At tax time, the IRS reconciles your estimated income with your actual income and adjusts your premium tax credit.

- If you use more credits in advance than you qualify for, youâll repay some or all of the difference when you file your federal income tax return.

- If you use less credits in advance than you qualify for, youâll receive the difference as a refund when you file your taxes.

Note: We recently put together a guide to how the premium tax credit works.

How Does The Advance Premium Tax Credit Work

When getting a marketplace plan, you estimate your household income for the current year including yourself, your spouse, and your dependents. That income figure will determine the size of the tax credit.

The subsidy will be applied directly to your monthly premiums. You only have to pay the difference. You can request to have the entire tax credit applied to your premiums or you can receive a portion of it in premium reduction and the remainder of the credit when you file your income-tax return for the year.

When you file your tax return, you reconcile your estimated income with your actual income.

- If you end up earning less than expected, you could be eligible for a larger tax credit. In that case, you may get the extra money back as a refund.

- If you earn more than expected and dont qualify for as large a tax credit as you had received, you may need to repay excess advance payments when you file your income tax return.

Repayment of extra credits was suspended temporarily in 2020 because of the job instability from COVID. However, the regular rules are scheduled to resume for tax year 2021.

There are no plans currently in Congress to suspend the premium tax credit repayments again this year, says Mark Steber, chief tax information officer at Jackson Hewitt.

Read Also: How To Get Insurance Between Jobs

Who Is Eligible For This Credit

As mentioned above, tax credit eligibility is contingent on a few items. You must have enrolled in a health insurance plan through your states Marketplace. You can learn more about plans offered by your state here . Secondly, your total household income must fall between 100-400% of the federal poverty level according to household size.

This table, adapted from IRS.gov, outlines the Federal Poverty Line as it applies to 2017 tax returns and several average household sizes. For more ranges of different household sizes, HealthCare.gov has a variety of numbers here.

| Household Size | |

| $24,300 | $97,200 |

There are two additional requirements for determining tax credit eligibility. If married, you must file your tax return with the status Married. Individuals filing Married Filing Separately are ineligible to receive a tax credit, unless an exemption is met. Victims of domestic abuse or spousal abandonment may still qualify, and the flow chart on page 5 of Publication 974 will help confirm this eligibility.

Finally, you cannot be claimed as a dependent by another person filing taxes and still qualify as eligible.

What Happens If My Family Size Or Income Changes During The Year

Life-changing events can impact your tax credit eligibility by either increasing or decreasing the amount that you are allowed to claim. Events that can affect your premium tax credits may include:

- Change in your household income

- Adoption

- Gaining or losing health insurance coverage

Since the marketplace determines your tax credit, it is important to report changes immediately so your health plan eligibility can be updated. And if you’re currently using the advance premium tax credit, then it is particularly important to report any life changes to the marketplace as soon as possible.

If you wait to report such changes, there may be discrepancies between what you paid and what you should pay. In this case, if you used more advance premium tax credits than you are allowed, you may have to pay back money when filing your federal income tax return. On the other hand, if you used less than allowed, you may get an added refund. This is known as “reconciling” your advance premium tax credits.

You May Like: Starbucks Health Coverage

What Is Tax Form 8962

If you purchased health insurance from the Healthcare.gov site â or your state healthcare marketplace if you live in a state that maintains one â you’ll need to use Tax Form 8962. This form has two parts you’ll need to fill out:

Form 8962 is also used to reconcile the premium tax credit you might be eligible for with any advanced premium tax credit payments youâve already received.

The first part of the form determines your annual and monthly contribution amount based on your family income and tax family size. Your tax family generally includes you and your spouse if filing a joint return and your dependents. You must include all of your family’s or household’s income.

After filling in this information and determining your applicable federal poverty level, you can figure out the amount of credit you can claim. You have two choices for how to claim it:

- A credit to reduce your monthly payments on your health insurance premiums

- A credit to reduce your taxes on your return

If you choose the monthly payments, the government pays your insurer over the course of the year, which lowers your monthly premium costs.

If you can claim the premium tax credit and your insurer received advanced payments from the government, the second part of Form 8962 compares how much credit you used and your final available credit. There are three possible scenarios:

Corporate Tax Harmonization And Simplification

For taxation years ending after December 31, 2008, corporations are required to file a harmonized T2 Corporation Income Tax Return with the Canada Revenue Agency . The harmonized tax return includes the following Ontario corporation taxes:

- corporate income tax

- corporate minimum tax

- capital tax, and

- special additional tax on life insurance corporations.

However, the harmonized tax return does not include the Ontario Insurance Premium Tax . For taxation years ending in 2009 and 2010, corporations subject to Premium Tax previously filed the Insurance Premium Tax Return with the Ontario Ministry of Finance . For taxation years ending in 2011 and beyond, corporations will file the new CT – Insurance Premium Tax Return with the ministry.

Don’t Miss: Insurance Lapse Between Jobs

No Premium Tax Payable During This Reporting Period

Corporations that meet the following criteria are not required to complete the tax return if:

- the taxation year ends after December 31, 2008

- the corporation is not an insurance corporation, generally carrying on business through a permanent establishment in Ontario in the taxation year, and

- the corporation’s premium tax payable for the taxation year is nil.

If you meet these criteria, check this box and file a nil tax return.