Is There A Penalty If An Employer Or If An Individual Does Not Have Health Insurance

A policy known as the individual mandate under the Affordable Care Act required most people to obtain health insurance or pay a tax penalty. The individual mandate was eliminated in late 2017, and healthcare consumers will no longer face penalties for not acquiring health insurance. Without health coverage, consumers may face the challenges of paying out-of-pocket for the high costs of healthcare services.

Do I Have To Offer Health Insurance To Employees

Whether you have to offer health insurance to your workers depends on the size of your business.

- Small Employers: If you have less than 50 full-time equivalent employees, youre not required to offer health insurance.

- Large Employers: If you have 50 or more employees, you technically dont have to provide health insurance however, if you dont, the Affordable Care Act requires you to pay a tax penalty. In 2020, the penalty amount is $2,750 for each full-time employee if you fail to offer coverage to 95% of full-time workers and their dependents and any worker who receives coverage from an ACA marketplace.

There may be other situations that may require you to offer health insurance. For example, if an employees employment contract or union agreement guarantees it.

However, even if youre not required to provide health coverage, you may want to offer it on a voluntary basis for a number of reasons:

Can I Offer Health Insurance To Certain Employees

Health insurance comes with many responsibilities for small business owners. Regardless of whether youre trying to cut health insurance costs or reward specific employees, you may wonder exactly how those responsibilities affect who you offer health insurance coverage. Can you pick and choose who can be a part of your health plan, or are there federal regulations involved? As you may expect, there are some rules you need to follow.

Also Check: Starbucks Health Insurance Part Time

Are Part Time Employees Eligible For Health Insurance

The short answer is yes. The long answer is more complicated. While employers are not required to provide health insurance for part time employees, they do have the option to and it can be a great way to retain employees. After all, many businesses rely on having a mix of full-time and part-time employees, and for many industries hiring has been a struggle lately.

Part time employment is defined by the Affordable Care Act as working an average of less than 30 hours per week or less than 130 hours per month for 120 days or more in a row. You absolutely can offer these types of employees health insurance if you choose to, but it does introduce a few more things to think about, which well dive into below.

Q: Aren’t Us Employers Required By Law To Provide Health Insurance To Part

A: Unfortunately, no, they aren’t. No federal regulations force American companies to offer health plans to part-time workers. The Affordable Care Act also doesnt require this.

In fact, U.S. employers don’t have to provide health insurance to any of their employees–whether they work full or part time. Most do, though, to attract and retain quality staffers.

One exception to the above: companies in Hawaii. State law requires employers there to offer coverage to eligible employees who work 20 or more hours per week.

Read Also: How To Get Insurance Between Jobs

Time Doesnt Mean Less Than 40 Hours A Week

The Affordable Care Act requires that private sector employers with more than fifty Full-Time Equivalent employees must offer health insurance to those workers or pay a tax penalty. They must offer this coverage to workers who put in at least thirty hours a week on the clock. Its not just those who work forty or more hours. Part-time workers who work less than 30 hours/week are not included. So, there is no tax penalty at this time for excluding them from a workplace health benefits plan. That said, there are still steps an employer can take to attract and retain good quality part-time talent by making it easier to get health coverage.

Employer Health Insurance Requirements

As a small business employer, you may be wondering what your health insurance requirements are. What are the criteria your small business needs to fulfill in order to offer health insurance, and what are your insurance obligations toward your employees?

Continue reading to learn about small business employer health insurance contribution and participation requirements.

Don’t Miss: Does Insurance Cover Chiropractic

How The Aca Defines Part

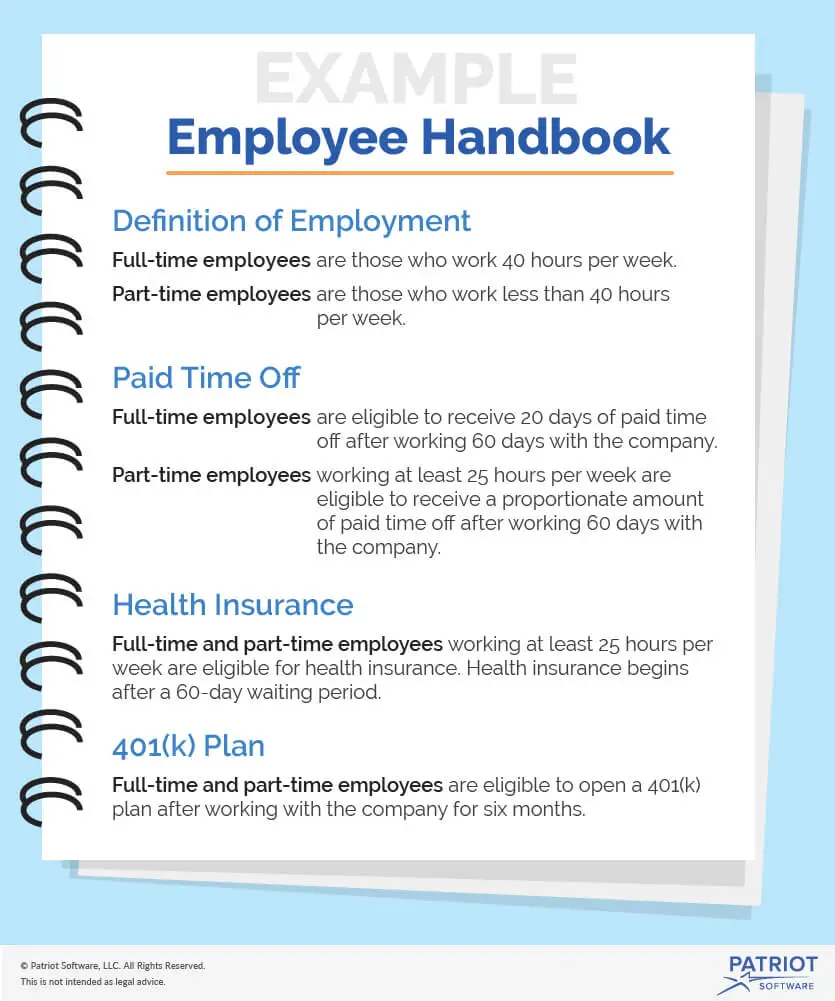

Businesses typically view a full-time employee as someone who works 40 or more hours per week. Anyone who works less than that is considered a part-time worker.

The ACA has a different definition. The law uses a threshold of 30 hours a week, so you may be required to treat an employee who averages 35 hours a week as full-time staff.

This is an important distinction as you examine your duties under the ACA.

What Are The Advantages Of Employee Healthcare Insurance Policies

Employee healthcare insurance offers a wide range of aids. Apart from making healthcare affordable and accessible for employees and their families, it includes several advantages for employers.

Healthier employees allow companies to bolster overall productivity and fetch higher results. In addition to this, extending healthcare insurance enables employers to stay compliant with government mandates and compliance requirements.

They can also avail of income tax benefits on the premium paid. Since the premium amount is counted as a business expense, companies can save a substantial amount in taxes by extending group insurance to employees.

Dive in-depth into what are the advantages of group health insurance policy? So you can give your employees the care they deserve!

You May Like: Starbucks Benefits Part Time

Can I Start A Plan At Any Time During The Year

If you decide to begin offering health insurance to your employees, you can implement a plan at any time of year. Since health Insurance plans renew annually, many employers like to align their plans with the calendar or fiscal year, but its not required. In fact, it can be advantageous to have the plan start on an off-peak month to avoid the rush of renewals at peak times of the year and can make the process easier.

No matter when you start a plan, employees may have a waiting period between when they enroll in the plan and when coverage actually starts. For example, workers coverage may begin the first day of the next month.

Can I Join My Spouses Plan If I Am A Part

Yes. If your spouse has a health insurance plan either as an individual or through their employer, you would be able to join their health insurance plan. If you are recently married, marriage is a qualifying life event for enrolling in a health insurance plan. If you wait more than 60 days after your marriage license agreement, you will have to wait until the Open Enrollment Period.

Read Also: Eligibility For Aarp

What Is Considered Part

Business owners typically consider full-time employment as someone who works 40 or more hours each week. Part-time employees usually work an average of 30 or fewer hours per week, or less than 130 hours per month for more than 120 days in a row.

Other than that basic criteria, the Fair Labor Standards Act and other employment laws dont outline specific requirements. Generally, individual businesses determine what they consider to be part-time hours.

Employers should also consider any state and local laws that may stipulate what is considered part-time work. It’s the employer’s responsibility to choose the maximum hours for a part-time worker and communicate that to their employees in writing during the hiring process.

Are Companies Required To Provide Health Insurance Coverage To Part

Clearly, most private and public-sector employers choose not to offer health insurance coverage to part-timers. Under federal law, no employer regardless of size is required to offer benefits like employer-sponsored health insurance to part-time employees, which the law defines as those working fewer than 30 hours per week for the same employer.

This is a problem for workers who earn too much to qualify for Medicaid and dont meet age or health eligibility criteria for Medicare.

Many part-time workers do receive subsidies under the Affordable Care Act, making it more affordable to purchase individual health care plans from private insurers through state-run or federal exchanges. But some workers earn too much to qualify for subsidies under the ACA, putting exchange-based individual or family insurance policies out of reach.

Affordable health care options do exist for people without health insurance: brokers likeeHealth, private high-deductible health plans paired with health savings accounts , and health insurance alternatives like a health care sharing ministry. None are perfect, however.

And while workers with suitable credit profiles can take out unsecured personal loans to cover unexpected health care costs, no one should have to choose between their health and credit utilization rate.

To make matters worse, some companies have scaled back or eliminated benefits packages for part-time workers in recent years.

Read Also: Evolve Health Insurance Company

Is It Mandatory To Have Employee Healthcare Insurance

Yes, employee healthcare insurance has to be provided by employers compulsorily. Post the Covid-19 lockdown, the Government of India in April 2020 also introduced a mandate to implement the change.

As per the Industrial Regulatory and Development Authority on India circular in this regard, comprehensive health insurance policies for employees must be provided by all companies.

Read all about the mandate in this article – is medical insurance mandatory for employees in India?

To stay compliant with the law, companies can explore a range of insurance plans as suitable to them. At Loop, we offer customized group insurance policies that you can enhance as per your requirements.

Do I Have To Offer Health Insurance To All Employees

If you offer an employer-sponsored group health plan, generally, all of your full-time employees must be given the opportunity to enroll. Thats because, under the ACA, if you offer health insurance to full-time employees, you must offer it to all similarly situated full-time workers.

However, you can exclude part-time those who work on average less than 30 hours a week and seasonal employees from participation. You can still offer health insurance to part-time and seasonal workers if you want to and, if you do, you can create your own requirements for participation. For example, you may decide that employees only qualify for coverage if they work at least 10 hours a week. At Starbucks, hourly employees are eligible for benefits, including health insurance, once they work 240 hours during a consecutive 3-month period.

Also Check: Starbucks Healthcare Benefits

Do Employers Have To Offer Health Insurance To Their Part

The Affordable Care Acts employer mandate requires applicable large employers with 50+ full-time equivalent employees to offer affordable health insurance to their workers or be subject to a tax penalty. The ACA defines full-time employees as those who work at least 30 hours per week.

If you have less than 50 FTEs, you arent required to offer health insurance to any of your employees. If you are an ALE with part-time employees who work less than 30 hours per week, you dont have to provide health insurance to them-even if youre providing insurance to your full-time workers.

Even if not legally required, employers may offer their part-time employees health insurance if they wish. Offering health insurance benefits to those with part-time positions can help improve employee retention, boost workplace morale, and increase job satisfaction.

How Do I Purchase Group Health Insurance For My Small Business

There are various means by which a small business employer can shop for group health coverage. Some of those include:

- Agent/Broker: There are two types of agents/brokers – those that can only sell for one carrier and those that can sell for multiple carriers . A captive agent can only provide quotes for plans sold by the carrier they represent. Independent agents can provide multiple quotes from multiple carriers. Various factors can determine which agent would be best for your group.

- SHOP: The Small Business Health Options Program was created in conjunction with the Affordable Care Act and provides an online medium for small business owners to search for and purchase group health insurance. You can visit for further information on the SHOP and/or to search for and purchase group health coverage.

- Carrier: Insurance carriers maintain websites through which, typically, you can search for and purchase their health insurance products. Some carriers will allow you to conduct the quoting and enrollment process online however, some may require you to call the carrier directly. An enrollment/eligibility specialist will then assist you through the process of purchasing a health insurance product.

Before purchasing, interview several licensed insurance agents who specialize in serving the health insurance needs of small businesses.

Also Check: Starbucks Part Time Health Insurance

Disability Insurance For Part

Disability insurance covers a portion of a workers wages if they are unable to work. The policy covers missed wages for non-work related injuries that render an employee unable to work for a period of time. Workers comp is responsible for wages only if it is a work-related injury.

If youre in California, Hawaii, New Jersey, New York or Rhode Island, youre required to offer disability insurance and cover the premium for employees.

Disability insurance also can be offered as a voluntary benefit, whether the cost is covered in full by the employer or in part. Some larger employers might allow employees to purchase it through the company, which allows workers to get coverage for a lower group rate.

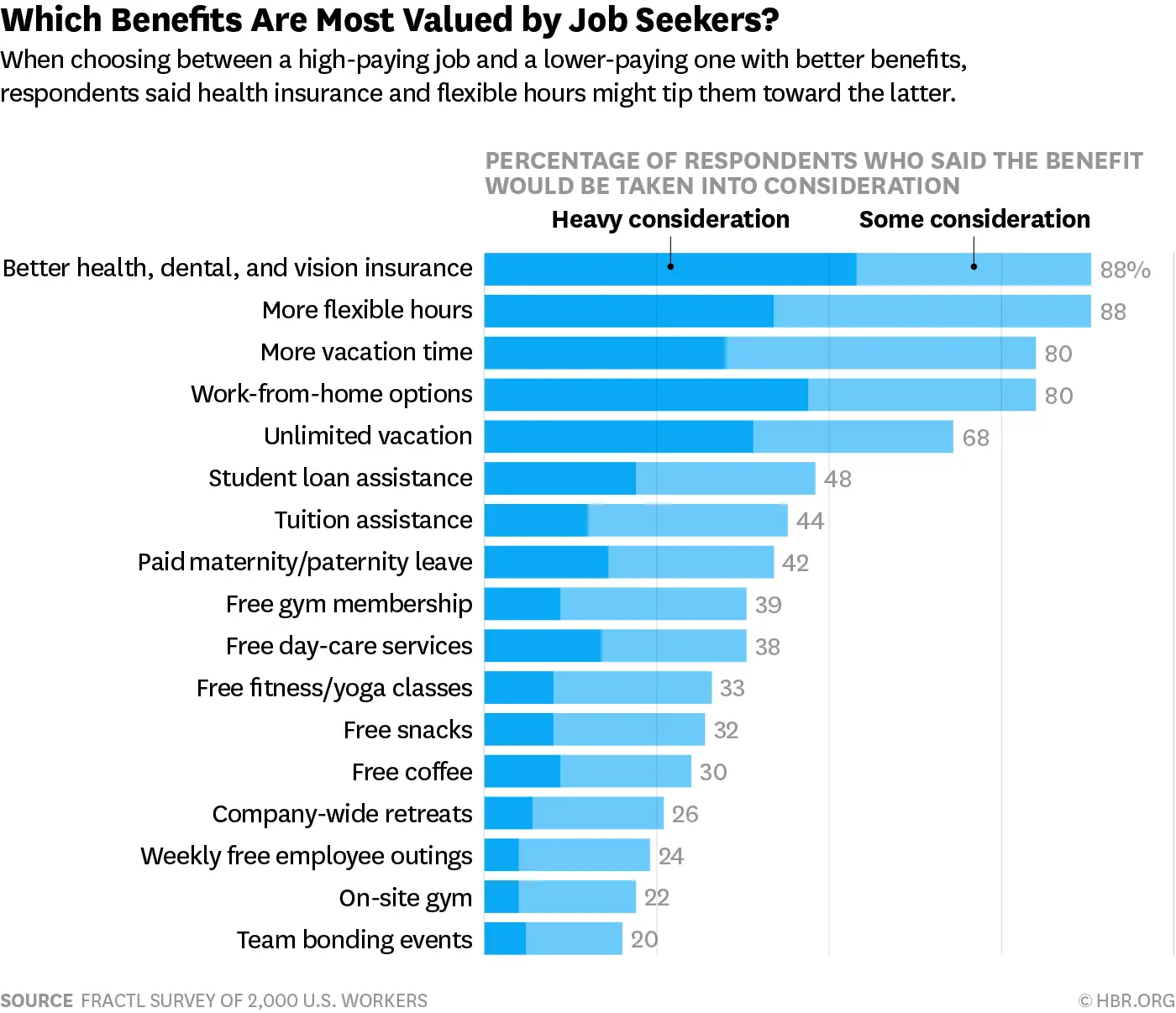

Should You Offer Benefits

If you are considering offering some amount of benefits to your part-time employees, it is important to understand what benefits you should be offering. As an employer, you should think through the following questions and select benefits that fit the criteria.

Considering the type of benefits that will most assist and interest your employees is crucial to employee and employer satisfaction. Offering something just to make yourself feel better wonât help the business if the employees donât care for what you offer. Make sure it aligns with their needs.

Read Also: Starbucks Benefits For Part Time

Small Businesses: Employer Healthcare And The Affordable Care Act

Do employers have to offer health insurance for small businesses? As discussed earlier, small businesses with fewer employees arent obligated to provide health insurance.

Ninety-nine percent of U.S. companies are considered small businesses, which means that a vast majority of employers dont have to offer health coverage.

However, even larger employers with over 50 full-time employees have concluded that even with the penalties levied, its still cheaper to either not to offer full healthcare coverage or to invest in alternative health coverage options, such as a Health Reimbursement Arrangement .

While offering employer-provided health insurance is considered best practice, the fact is the majority of businesses arent required to offer this benefit.

What Can Employers Do Instead

The health insurance marketplace is notoriously difficult for the average person to navigate. Many families simply give up and go without coverage. Or, they end up with a plan that doesnt fit their needs because they simply cant figure out how to make an informed decision.

Fortunately, independent insurance brokers are available across most of the United States. They are happy to provide free group educational meetings and one-on-one consultations with a companys employees. This service is often available even if the company is not providing a group health insurance plan or excludes part-time workers from the plan. Such brokers can help workers understand their options. Plus they help them choose an appropriate plan and figure out if they qualify for subsidies or state-funded care .

Hosting this type of learning session and connecting part-time workers with valuable resources is a low cost or no cost way for employers to help part-time employees gain coverage. The brokers make their commissions from signing up families and individuals for health insurance plans. Experienced brokers or consultants may also be able to review a company health plan. They can offer lower-cost options for group coverage for some or all employees.

Read Also: How To Keep Insurance Between Jobs

Is Health Insurance Required For Part Time Employees

Its not required to offer health insurance to part time employees and the decision rests completely in your hands as the employer. Many employers choose not to simply because of the increased cost it entails.

However, health insurance is becoming more and more important to employees and offering it to part timers is a great way to attract and retain good employees. This can save you costs elsewhere, such as recruiting and training new employees regularly.

Health insurance also leads to healthier employees, which means less time off work sick and better performing employees.

Another great benefit of offering health insurance to part time employees is that everything you spend on health insurance premiums are tax deductible for both federal and state taxes. You may also even be eligible for further tax credits if youre a small business.