Are Employers Required To Provide Healthcare

As a business owner, offering health benefits for the first time is an important milestone that will inevitably help you recruit and retain top talent. After all, health benefits consistently rank as the top most requested benefit by employees in the U.S.

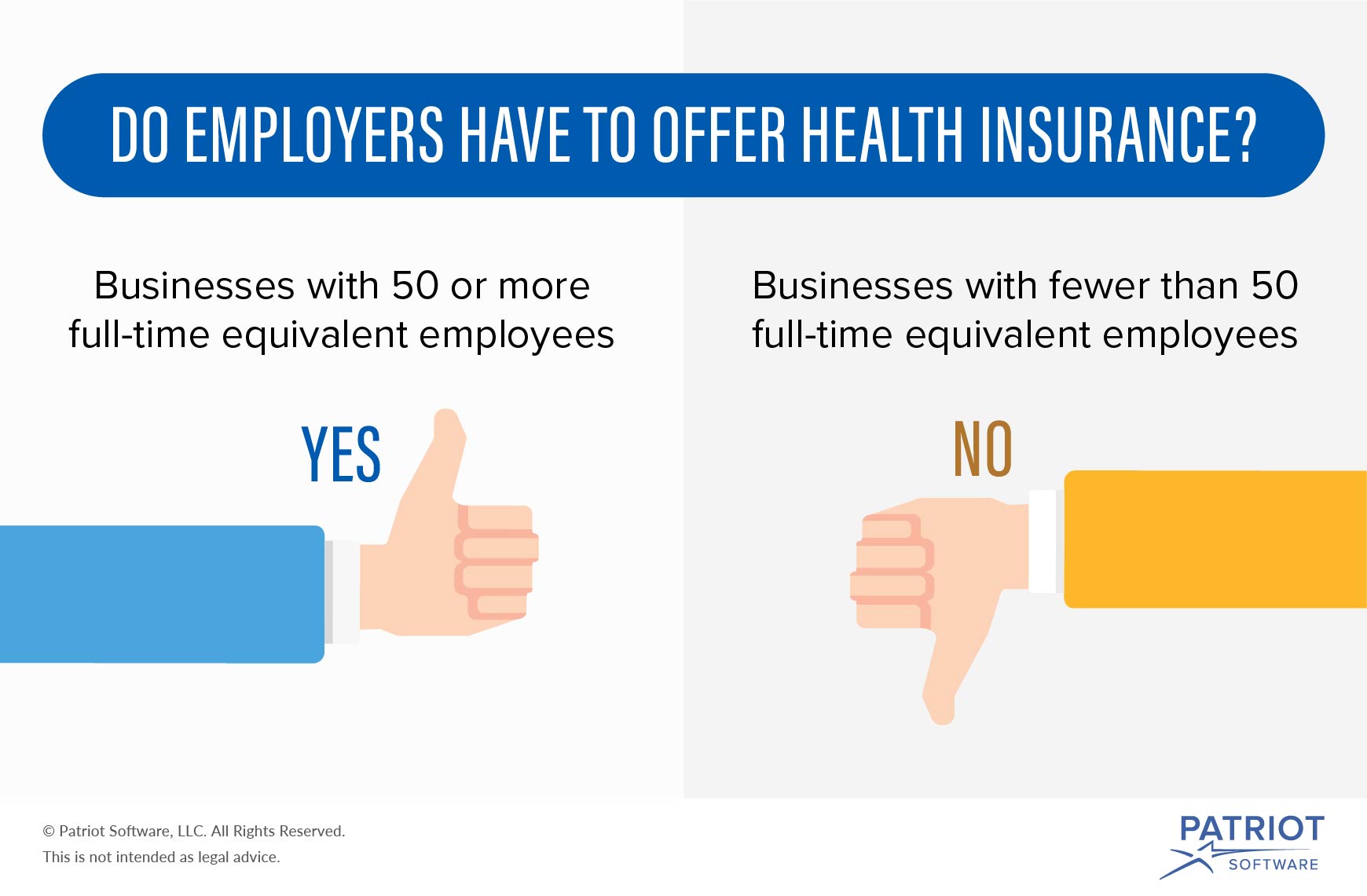

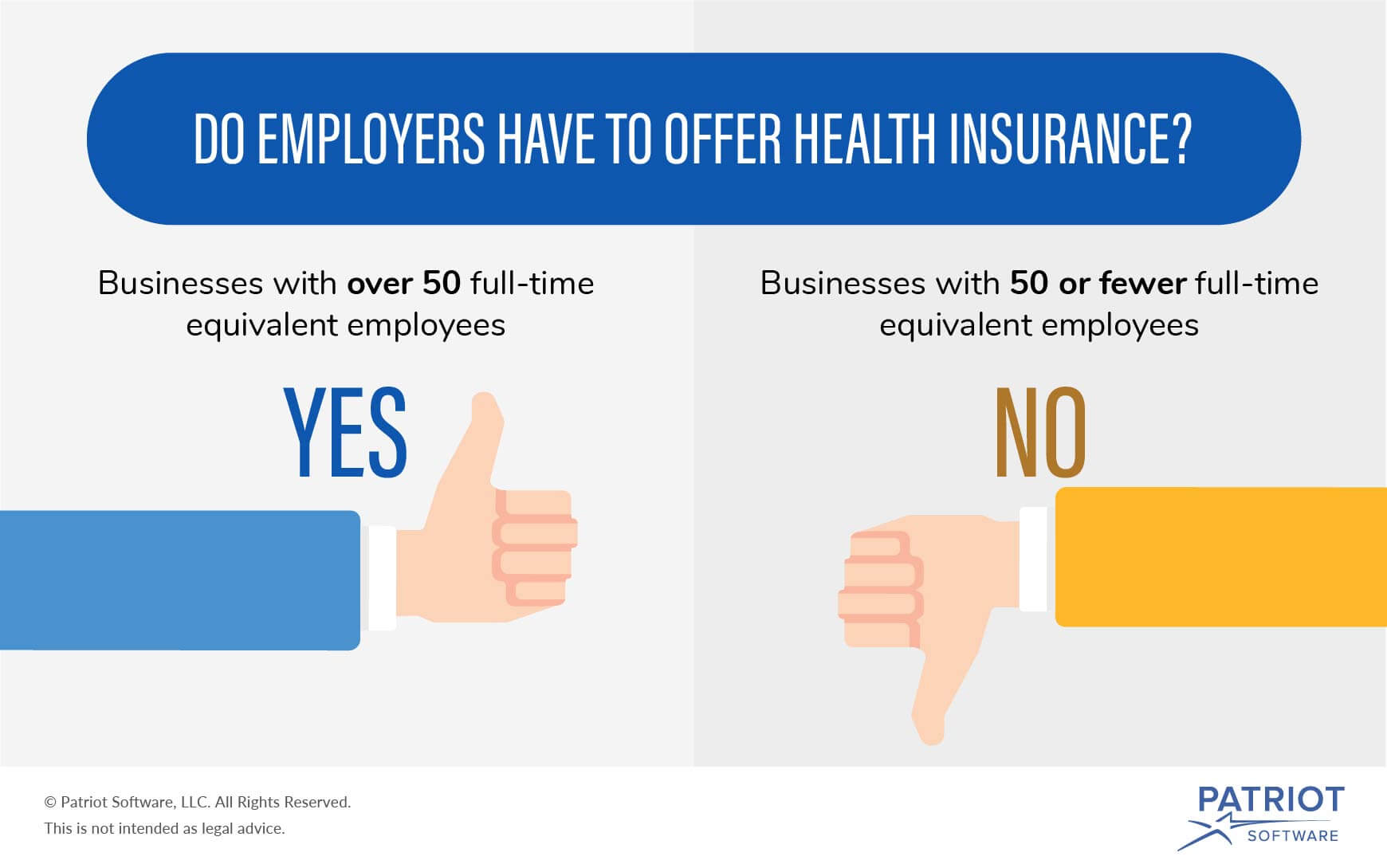

While health benefits are important for organizations of all sizes, the Affordable Care Act only legally requires a select few to offer itor suffer potential consequences if they choose not to. So how do you know if the ACA regulation applies to your organization, and what happens if you dont follow it?

In this article, well cover:

Worker Quality And Turnover

Do firms offering health benefits recruit and retain higher-quality workers than do firms that do not provide health coverage to workers? Are firms offering health insurance more likely to attract workers interested in a long-term employment relationship? Many studies suggest that workers in jobs with health insurance coverage change jobs less frequently than do workers in jobs without health benefits . Evidence for this relationship remains somewhat mixed, however, with other studies suggesting that offering health insurance has very little or no effect on job turnover . Moreover, even if researchers could agree on whether and how much health coverage affects turnover, they would still disagree about the productivity implications of the turnover effect.

Organizational Performance And Profitability

Perhaps the most important impact of health insurance is its effect on firms productivity and profitability, although these effects were not directly tested. Similarly, no studies compared the quality or ability of workers employed by firms providing health insurance with workers at firms that did not offer insurance. However, the evidence that firms offering health insurance paid their workers higher wages than did those not offering health benefits suggests that insured workers may be more productive than uninsured workers. A complementary explanation is that workers with health insurance also received a wage premium, or an efficiency wage.

Some analysts make a similar argument with regard to pensions and productivity: The strength and durability of the wage/pension relationship across different data sets and empirical procedures support the view that pensions enhance productivity . More remains to be learned about how health insurance fits into a compensation structure that enhances work effort. However, the fact that firms making a wide range of investments in workers typically start with health insurance suggests that health coverage comes to mind first when employers consider making human capital investments in their workforce.

Recommended Reading: What Is The Best Health Insurance Policy

If You Have More Than 50 Full

If your business has 50 or more full-time or FTE employees as defined by the ACA, the state defines it as an applicable large employer . That designation means that your company must offer at least 95 percent of its full-time employees the opportunity to enroll in an employer-sponsored ACA-compliant group health insurance plan.

Even though almost all employee health insurance plans purchased through private insurers or the health insurance marketplace meet these requirements, it is important to confirm that the coverage you are considering complies with the ACA. Meeting with an experienced California small business health insurance broker provides the best way to ensure that your business complies with all of its obligations under the ACA.

What Happens If An Employee Receives Subsidized Coverage

Each year, public Marketplaces should send notices to employers that may owe a penalty for not complying with the employer mandate. These notices will alert employers if any of their employees received a subsidy through the Marketplace.

Employers that receive these notices will have 90 days to file an appeal if they believe the eligibility determination was made in error. It’s important that employers maintain documentation and records to provide proof of compliance with the employer mandate.

Read more about thefrom the Centers for Medicare and Medicaid Services.

Don’t Miss: Do I Need Pet Health Insurance

Do Employers Have To Offer Health Insurance A Beginners Guide

Many Americans depend on receiving affordable health care coverage through their employer. If you are a small business owner with employees, you might be wondering if you are obligated to provide a group health plan of some sort.

Even if you arent obligated, you might wonder if there are benefits to you, as an employer, in providing group health insurance coverage to employees as part of a benefits package. In this guide, we will cover the ins and outs of employer health insurance obligations for businesses of all sizes.

Myth : Employers Must Pay At Least 70 Percent Of Employees Health Insurance Premium Costs

Busted. Although the Affordable Care Act does not specify a set amount that employers are required to contribute, some insurance carriers or states require employers to cover at least 50 percent of the premium for employee-only coverage. Employers can choose to cover more as a strategy to attract and retain quality employees, and many do. In 2017, the average employer contribution was 82 percent for employee-only coverage.2

Read Also: How Do I Know If I Have Private Health Insurance

Should Small Employers Offer Health Insurance

Even though they are not required to offer health insurance, there is a strong argument to make that small business should offer health insurance to their employees, if possible, since it is such a strong added value for employees over the long run.

Since so many companies do offer health insurance, not doing so can put your business at a disadvantage when trying to attract highly skilled talent to your organization.

If An Employer Voluntarily Provides Health Insurance Benefits Are There Any Laws That Cover Those Benefits

The Employee Retirement Income Security Act of 1974 governs employer-provided health benefits if an employer voluntarily provides insurance to employees. Under ERISA, employers must provide a Summary Plan Description to employees who participate in the plan. The SPD is usually a small pamphlet or other document that explains what the plan provides and how it operates. It provides information on when an employee can begin to participate in the plan, how service and benefits are calculated, when benefits become vested , when and in what form benefits are paid, and how to file a claim for benefits. The employer must provide the SPD to the employee free of charge within 90 days after an employee becomes a plan participant or within 120 days after the plan is established. If the plan changes, the employer must inform the employee through a revised SPD or in a separate document called a Summary of Material Modifications that must be provided to the employee free of charge.

Health and welfare benefits provided by employers are exempt from ERISAs minimum participation, vesting, benefit-accrual and minimum funding requirements that apply to employer-provided pension benefits.

You May Like: Do I Need Health Insurance In Massachusetts

Health Insurance Coverage As A Voluntary Benefit

Many smaller companies offer health insurance as a benefit, even if they aren’t required to by law. In fact, the majority of Americans have health insurance coverage through an employer. A study by the Urban Institute reported that 83.1% of all workers were offered health insurance through an employer in the first quarter of 2016.

In other words, you are likely to receive health insurance through your company, but it’s perfectly legal for employers of any size to refuse to provide it.

Determining The Companys Size

The law determines the size of your company through a simple formula. It calculates this by counting the number full-time employees and part-time employees separately. Part-time workers hours are added up, and every 30 hours worked counts as a full-time employee. This number is added to the total count of full-time workers. This means companies cant just drop employee hours to reduce their size. Employers or owners also count as employees under the law.

You May Like: Is Priority Health Good Insurance

Recommended Reading: What Is Gpa Health Insurance

Determining How Many Full

The regulations allow various calculation methods for determining full-time equivalent status. Because these calculations can be complex, employers should consult with their legal counsel.

- Full-timeemployees work an average of 30 hours per week or 130 hours per calendar month, including vacation and paid leaves of absence.

- Part-timeemployees’ hours are used to determine the number of full-time equivalent employees for purposes of determining whether the employer mandate applies.

- FTEemployees are determined by taking the number of hours worked in a month by part-time employees, or those working fewer than 30 hours per week, and dividing by 120.

Small Business Health Insurance Requirements

The Affordable Care Act stipulates that small businesses with fewer than 50 employees are not required to offer health insurance benefits to their employees or pay a tax penalty. However, that doesnt mean they shouldnt provide health insurance benefits.

Here are some advantages of offering health insurance:

- Building a healthier workforce

- Saving more money during tax season

Small group health insurance is available to organizations with fewer than 50 employees in most states. You can purchase a small group health plan directly from an insurance company or through a Small Business Health Options Program exchange. Getting a SHOP plan can qualify your organization for the small business health care tax credit.

The ACA doesnt specify which types of health insurance small businesses can offer their employees as long as its affordable and meets MEC. Therefore, in addition to group health insurance coverage and small group insurance, employers can consider non-traditional health insurance options such as a health reimbursement arrangement or health stipend.

Recommended Reading: When Can I Cancel My Health Insurance

How We Got To Now

Interested in learning more about healthcare in America and how we got to where we are today? Download our eBook, The History of Employer-Sponsored Healthcare. Here, we discuss the on-going debate regarding the impact of the ACA’s employer mandate. It also takes you through a quick look at the historical timeline of employer-sponsored healthcare, providing context for the state of American healthcare as it exists today.

Do you offer family health insurance to your workforce? How do you handle premium differentials and/or surcharges? Leave us a comment below or contact us. Wed love to help you find solutions that work for everyone!

Suggestions For Future Research

Additional research is needed to better document the value of health and health insurance coverage to employers. However, since almost all large firms offer health insurance to at least some of their employees, there is no easy way to demonstrate that not offering health coverage adversely affects firms performance. One way to proceed is to take advantage of differences in health plan offerings across large firmsdifferences in the proportion of workers made eligible for coverage, the share of premiums paid by workers, the availability of dependent coverage, the generosity of coverage, and the liketo determine how these differences affect workers take-up and firms performance.

Don’t Miss: What Is Tricare Health Insurance

Leaves Of Absence: Do Employers Need To Provide Health Insurance During These Times

Employees who take qualifying leaves of absence are provided multiple protections by way of the Family and Medical Leave Act , the Uniformed Services Employment and Reemployment Act , and many state laws.

The most well-known protection is the guarantee of the same or an equivalent job when employees return to work, but there are also other protections. For example, many of these laws stipulate employers obligations regarding health insurance during employees qualifying leaves of absence.

The following is a breakdown of FMLA, USERRA, and some general state laws with regards to employer-provided health insurance coverage.

The Health Care Reform: Whats An Employer Mandate

Under the Affordable Care Act, beginning in 2015, employers who employ 50 or more full-time workers will be required to provide health care coverage to employees. If employers do not provide coverage, they will have to pay a fine, called an employer shared responsibility payment . This provision may be referred to as an employers mandate.

Also Check: How Can I Add My Parents To My Health Insurance

What People Are Saying

You can browse plans and read articles online or call and get personalized recommendations from one of our agents. No charge, no expectations to enroll.

Varner Faddis Elite LegalRachel M.MS Glass LLCTabathaCristyPaulBrettCarlosCindyArthur UXAny Screen Inc.Elliott S.Sarika K.Ekaterina S.

eHealth has a fabulous and effective on-boarding process.

A great agent partner makes a huge difference!

Russell W.Varner Faddis Elite LegalRachel M.MS Glass LLCTabathaCristyPaulBrettCarlosCindyArthur UXAny Screen Inc.Elliott S.Sarika K.Ekaterina S.

eHealth has a fabulous and effective on-boarding process.

A great agent partner makes a huge difference!

Russell W.Varner Faddis Elite LegalRachel M.

Also Check: Is Dental Insurance Included In Health Insurance

Employer Health Insurance Requirements

As a small business employer, you may be wondering what your health insurance requirements are. What are the criteria your small business needs to fulfill in order to offer health insurance, and what are your insurance obligations toward your employees?

Continue reading to learn about small business employer health insurance contribution and participation requirements.

Also Check: Can I Add My Parents To My Health Insurance

It Keeps Employees Happy

Offering health insurance benefits to your employees can keep them happy and help with employee retention. It can also help attract new employees to your company. According to a recent survey by Glassdoor, health insurance coverage is the most important benefit for employee satisfaction, ahead of vacation and pension plans.

What Contribution Level Or Premium Cost

Group health insurance plans are a form of employer-sponsored coverage. This means that a business is required to share the cost of group health insurance with employees. Typically, this cost-sharing element of health insurance requirements refers to a small business splitting monthly premium costs with workers. If you opt for a group health insurance plan, in most states, employers are required to contribute or pay at least 50% of each employees health insurance premium, although this may vary, depending upon the state in which your business is located.

Also Check: How To Pass The Life And Health Insurance Exam

If My Employer Voluntarily Provides Health Insurance Benefits Is It Obligated To Provide Benefits To All Employees

Maybe, depending on the employer. Employers covered by Obamacare must provide health insurance to at least 95% of their full-time employees and dependents up to age 26. Otherwise, an employer is free to cover some, as opposed to all, of its employees. For example, salespersons can be excluded from an insurance plan while administrators are covered.

Exception: If an employee is entitled to participate in an employer-provided health benefits plan under ERISA, an employer may not wrongfully deny participation. To qualify, an individual must be classified as an employee, not a temporary worker or independent contractor and must be eligible to receive benefits according to the terms of the plan.

Are Employers Required To Provide Employee Health Insurance

Question: Do California employers have to provide health insurance to their employees?

Answer: The is currently no requirement for California employers to provide health insurance for their employees. Health care reform places no requirement on small business employers to provide employer-sponsored health insurance in 2014 and beyond.

The Affordable Care Act mandates that larger employers provide health insurance starting in 2014 or pay a penalties called the play-or-pay tax. The play-or-pay tax is one of the most significant tax consequences of health care reform. The tax will take effect in 2014, and it will have a significant impact on large employers subject to it. Both applicable large employers that offer coverage, and those who do not offer coverage to their employees will be subject to this tax. Employers will face another big decision due to this tax. Their question will be, Should we offer healthcare coverage to our employees at all, or just simply pay the applicable tax?

Categories:

Also Check: What Does Tax Credit Mean For Health Insurance

It Boosts Employee Productivity

Worrying about healthcare coverage and neglecting preventative care because of healthcare costs can lead to stress and illness, both of which lower employee productivity at work. According to the Center for Disease Control, healthier employees are more productive and are less likely to call in sick for work. Offering health care coverage to employees can reduce stress levels and encourage workers to get the care they need to maintain their health and stay productive.

Health And Worker Productivity

The existing studies found little evidence that workers with health coverage are absent less often than are workers without coverage. For example, the Rand Health Insurance Experiment found that the effect of insurance coverage on work loss days was small and insignificant . Similarly, despite years of research outside mainstream economics , there is almost no direct evidence regarding the effect of health insurance coverage on morale and worker productivity and the firmâs performance. In those fields, although the link between employment practices and productivity is widely recognized, the linkages between productive behavior and psychosocial job structure have remained unclear in the eyes of many observers . However, there is compelling research demonstrating that health insurance has a powerful influence on access to health care, the timeliness of care, the amount and quality of care received, and fundamental health . People without health insurance are less likely to seek medical care, less likely to get it, and, as a result, more likely to be in worse health and have higher death rates than are people with insurance coverage . Uninsured persons have a much greater risk of health decline and death, with several studies showing them to be 1.2 to 1.5 times more likely to die than are insured persons .

Recommended Reading: What Type Of Health Insurance Do I Need