Your Gender And Marital Status

Under the Affordable Care Act, insurance companies are no longer able to charge consumers more based on their gender.8 But other factors do make a difference. For instance, if youre married and have kids, you can expect to pay more to cover your familys needs. Note that if your familys income falls below a certain level, a tax credit could save you money.9

But marital status arent the only things that determine how much you could be shelling out. Here are some other things insurance companies look for.

American Health Insurance Vs International Cover: Whats The Cost Difference

International health insurance is a product designed to offer cross-border coverage. Many Americans are surprised by how affordable health coverage can be when they spend time overseas so how does this product compare to domestic cover?

At William Russell, our most comprehensive international health plans provide standard coverage in every country except the USA. Weve published a full guide on how we calculate premiums for health insurance. By comparing our typical premiums to U.S. averages, its possible to get an idea of the cost difference between health insurance in the USA and other nations.

| Typical US health insurance costs in 2020 | The average William Russell international health insurance premium in 2020* |

|---|---|

| Individual cover | |

| $8,419.90 |

*Based on William Russell premiums in Thailand and Vietnam

We have a full guide on how much expat health insurance can cost in different countries, together with a list of most expensive and cheapest countries for health insurance.

Picking The Right Option For You

If youve found yourself without health insurance, you should investigate all of your options.

You may find you only have one option to get the coverage you need. In this case, you have to decide whether that option is worth the cost.

In other cases, you may find you have several options that meet your needs. If youre lucky enough to be in this situation, make sure you fully understand each option first.

Then, compare your options.

In particular, you should look at:

- What is covered

You May Like: Does Starbucks Offer Health Insurance

How Much Is Family Health Insurance Per Month

The average premium for a family of 4 in 2020 is was $1,437, according to customer data gathered by one health insurance agency. This does not include families who received government subsides. Like individual insurance, your family cost will depend on ages, location, plan category, tobacco use, and number of plan members.

What Is A Health Insurance Premium

A health insurance premium is a pre-determined sum of money that a policyholder is required to pay to their respective health insurance company in order to avail coverage and benefits offered under a health insurance plan. A policyholder is required to mention necessary information in order to use the health insurance premium calculator and to let it calculate the amount of premium that is required to be paid. The information includes sum insured, age, pre-existing illness , number of members that need to be covered under the plan, etc. This information provided by the policyholder acts as a parameter depending upon which the amount of premium would get calculated. All the benefits and coverage listed in the insurance plan will be paid by the respective insurance company if there arises any unforeseen healthcare emergency or upon the diagnosis of a specific illness, according to the terms and conditions mentioned under your health plan.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

Health Insurance Deductibles: What Can You Expect

On top of premiums, everyone who carries health insurance also pays a deductible. This means you pay 100% of your health expenses out of pocket until you have paid a predetermined amount. At that point, insurance coverage kicks in and you pay a percentage of your bills, with the insurer picking up the rest. Most workers are covered by a general annual deductible, which means it applies to most or all healthcare services. Here’s how general deductibles varied in 2019:

- $1,655: Average general annual deductible for a single worker, employer plan

- $2,271: Average annual deductible if that single worker was employed by a small firm

- $1,412: Average annual deductible if that single worker was employed by a large firm

| Median Individual Deductible, Qualifying Health Plan Without Subsidies from Healthcare.gov., Plan Year 2020 |

|---|

| Bronze |

| $1,430 |

Individuals who are eligible for cost-sharing reductions are responsible for deductibles as low as $115 for those with household incomes closest to the federal poverty level.

Costs Of Health Insurance In Germany

Healthcare insurance is mandatory by law in Germany, which means its essential that you calculate how much it is going to cost you when youre budgeting for a move to the country. The majority of people, even international students, will need to register for public healthcare insurance, however, some individuals are eligible to choose a private insurance plan.

The cost of healthcare coverage can range from 80 to 1,500 euros per month, depending on your circumstances and insurance premium. Let’s take a look at the costs in more detail.

Recommended Reading: Starbucks Benefits For Part Time Employees

Total Costs & Metal Categories

When you compare plans in the Marketplace, the plans appear in 4 metal categories: Bronze, Silver, Gold, and Platinum. The categories are based on how you and the health plan share the total costs of your care.

Generally speaking, categories with higher premiums pay more of your total costs of health care. Categories with lower premiums pay less of your total costs.

So how do you find a category that works for you?

- If you dont expect to use regular medical services and dont take regular prescriptions: You may want a Bronze plan. These plans can have very low monthly premiums, but have high deductibles and pay less of your costs when you need care.

- If you qualify for “cost-sharing reductions” : Silver plans may offer good value. If you qualify, your deductible will be lower and youll pay less each time you get care. But you get these extra savings only if you enroll in Silver. If you dont qualify for CSRs, compare premiums and out-of-pocket costs of Silver and Gold prices to find your right plan. See if your income estimate falls in the range for cost-sharing reductions.

- If you expect a lot of doctor visits or need regular prescriptions: You may want a Gold plan or Platinum plan. These plans generally have higher monthly premiums but pay more of your costs when you need care.

Healthcare Is One Of The Biggest Expenses You’ll Face In Retirement So It Pays To Pick The Right Insurance

When you’re preparing for retirement, healthcare expenses are probably one of the last things on your mind. But retirees can end up spending tens of thousands of dollars on healthcare alone during their golden years, making it one of the most crucial costs to prepare for.

The average retiree spends around $4,300 per year on out-of-pocket healthcare costs, according to a study from the Center for Retirement Research at Boston College, and that doesn’t include long-term care. Medicare will help cover some costs, but coverage is far from free, and you’ll still face some out-of-pocket expenses.

Health insurance in retirement is widely misunderstood, which can be an expensive problem. Seventy-two percent of adults over the age of 50 admit they don’t fully understand how Medicare works, a survey from the Nationwide Retirement Institute found, and more than half believe that coverage is free. In order to avoid any pricey surprises, it’s important to understand which costs you’re responsible for, what your insurance will cover, and how much coverage will cost.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

What Is A Deductible

A deductible is how much you have to pay toward your health insurance costs before your health plan will begin to pay for covered services in a given year. For example, if your deductible is $2,000 for the year, you have to pay for the first $2,000 in medical services. Some plans will pay for certain costs, like preventive services, before you’ve met your deductible.

An Alternative Way To Pay For Health Care Costs

If youre struggling to pay for prescriptions, dental care, home care or any other medical expenses, and its not worth getting private health insurance , what options do you have?

For homeowners aged 55-plus, the CHIP Reverse Mortgage® from HomeEquity Bank could provide the money you need to pay all of your medical costs, without having any impact on your retirement income.

You can receive the money in a lump sum or in monthly payments, to coincide with your monthly health care costs. And, because you dont have to pay what you owe , until you decide to sell your home, it wont stretch your finances.

If health insurance for retirees in Canada is out of reach for you, but you have considerable health care expenses, call us now at 1-866-522-2447. Well work out how much cash you can access and help you start the process.

Recommended Reading: Starbucks Health Insurance Plan

Employer Mandate Penalty Amounts And Processes

Examples of employer penalties

|

1,200 full-time employees Employer offers coverage, but coverage is not affordable and/or doesnt provide minimum value |

The penalty is triggered if one employee purchases coverage on the Marketplace and receives a federal premium subsidy 250 employees purchase coverage on the Marketplace and are eligible for a subsidy |

Lesser of $2,570 per full-time employee, minus the first 30 employees, or $3,860 per full-time employee receiving a federal premium subsidy 1,170 x $2,570 = $3,006,900 penalty 250 x $3,860 = $965,000 penalty |

Here is a snapshot of the penalty assessment process:

|

Employer offers health coverage compliant with the employer mandate

|

|

Employer reports coverage offer and respective data during the applicable tax season |

|

IRS sends Letter 226J, with an Employer Shared Responsibility Payment assessment based on the data they have processed

|

|

IRS sends Notice 220J, confirming the final penalty amounts owed, which could state no amount is owed after final audit review. |

Read more about employers options on the IRS web page, Employer Shared Responsibility Payment Q& As, questions 55-58.

- I want to

How To Reduce Health Insurance Premium

Health insurance premiums may sometimes be an obstacle for people having higher health insurance coverage. So, for those who find it difficult to pay high health insurance premiums, here are a few tips:

1. Purchase Health Insurance At an Early Age: One of the proven ways to save on health insurance premiums is to buy the insurance policy at an early age. This is because as you age, you are more vulnerable to illnesses and are hence required to pay a higher premium then. So, you must choose to timely purchase health insurance coverage.

2. Go For a Policy With Lower Sum Insured: Health insurance plans with a lower sum insured come at lower health insurance premiums. So, to save on premiums, you can opt for a policy with a lower sum insured.

3. Opt For Copay and Deductibles: Copayment is when the insured has to bear a fixed portion of their treatment expenses whereas the insurance company covers the rest at the time of claim settlement. Whereas deductible is the fixed payment that you will have to make for the treatment expenses before the insurance policy kicks in. So, another way to make your health insurance policy more affordable is to opt for cost-sharing health insurance plans that offer copay and deductible options.

5. Opt for Top-Up Plans: To avail of high coverage at a low premiums, choosing top-up plans is the best option. The plan comes to your rescue when your medical insurance claim crosses the threshold limit.

Don’t Miss: Starbucks Partner Health Insurance

What Percent Of Health Insurance Is Paid By Employers

Written by: Elizabeth WalkerSeptember 24, 2021 at 9:37 AM

When youre considering a new health insurance program, your organization’s contribution strategy is an important decision. In simple terms, how much will employees pitch in for coverage, and what percentage will be paid by the employer?

With traditional group health insurance plans, the organization must contribute a minimum percentage, leaving the employees to pay the remaining amount, usually through a payroll deduction. So just what percent do employers typically pay in the United States?

Across the country, a Kaiser Family Foundation survey found that the average percent of health insurance paid by employers is 83% for single coverage and 73% for family coverage. Lets dive into these stats a little deeper.

How Much Does Health Insurance Cost

10 Minute Read | October 14, 2021

The average individual in America pays $452 per month for marketplace health insurance.1 But costs for health insurance coverage vary widely based on many factors.

Maybe you just turned 26 and are off your parents plan . Or maybe youre facing a job loss and need to replace your former employers coverage. Or youre just looking for other options besides your employers plan. No matter your situation, youre wondering: How much does health insurance cost?

Everyone knows health insurance is expensive. It can pretty quickly suck the life out of your monthly budget. But just how expensive is it? And why is it so costly? Are there ways you can pay less?

Well, youre in the right place! Ill walk you through everything you need to know about health insurance costs, what all those terms mean and what factors make up that hefty price tag.

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Employee Health Insurance Premiums

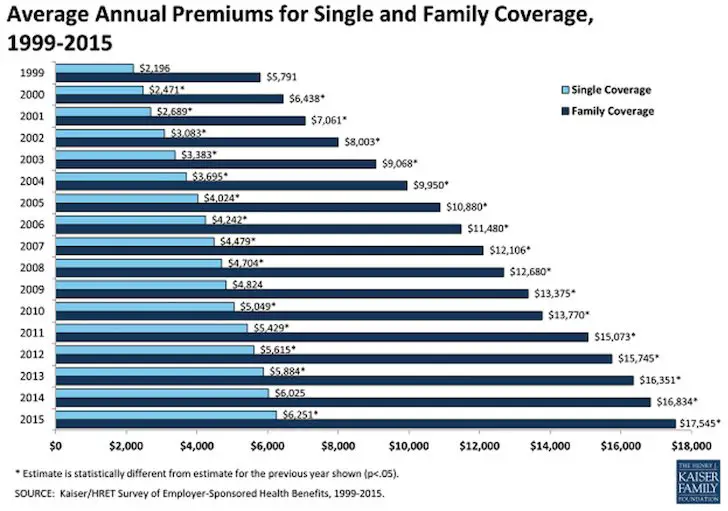

If you work for a large employer, health insurance might cost as much as a new car, according to the 2019 Employer Health Benefits Survey from the Kaiser Family Foundation. Kaiser found that average annual premiums for family coverage were $20,576 in 2019, which was nearly identical to the base price of a Honda Civic.

Families contributed an average of $6,015 toward the cost, which means employers picked up 71% of the premium bill. For a single worker in 2019, the average premium was $7,188. Of that, workers paid $1,242 or 17.2%.

Kaiser included health maintenance organizations , Preferred Provider Organizations , point-of-service plans , and high deductible health plans with a savings option in arriving at the average premium figures. It found that PPOs were the most common plan type, insuring 44% of covered workers. While high deductible health plans with a savings option covered 30% of insured workers.

| Average Employee Premiums in 2019 |

|---|

| Employee Share |

| $103.50 |

Of course, whatever employers spend on their workers’ health insurance leaves less money for wages and salaries. So workers are actually shouldering more of their premiums than these numbers show. In fact, one reason wages may not have risen much over the last two decades is because health costs have risen so much.

Which type of plan employees choose affects their premiums, deductibles, choice of healthcare providers and hospitals, and whether they can have a health savings account , among many choices.

What Would Medicare For All Cost To Run

Estimated administrative costs as a share of all spending

| friedman | |

|---|---|

| 6% | 5% |

The complexity of the American system means that administrative costs can often be high. Insurance companies spend on negotiations, claims review, marketing and sometimes shareholder returns. One key possible advantage of a Medicare for all system would be to strip away some of those overhead costs.

But estimating possible savings in management and administration is not easy. Medicare currently has a much lower administrative cost share than other forms of insurance, but it also covers sicker people, distorting such comparisons. Certain administrative functions, like fraud detection, can have a substantial return on investment.

The economists all said administrative costs would be lower under Medicare for all, but they differed on how much. Those differences amount to percentage points on top of the differing estimates of medical spending. On this question, there was rough agreement among our estimators that administrative costs would be no higher than 6 percent of medical costs, a number similar to the administrative costs that large employers spend on their health plans. Mr. Blahous said a 6 percent estimate would probably apply to populations currently covered under private insurance, but did not calculate an overall rate.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.