Determining How Many Full

The regulations allow various calculation methods for determining full-time equivalent status. Because these calculations can be complex, employers should consult with their legal counsel.

- Full-timeemployees work an average of 30 hours per week or 130 hours per calendar month, including vacation and paid leaves of absence.

- Part-timeemployees’ hours are used to determine the number of full-time equivalent employees for purposes of determining whether the employer mandate applies.

- FTEemployees are determined by taking the number of hours worked in a month by part-time employees, or those working fewer than 30 hours per week, and dividing by 120.

What Else Should Small Businesses Consider

- You can offer employees an HRA. Even if a business doesnt include health coverage as a benefit, it can offer employees a Health Reimbursement Arrangement, or HRA. In this arrangement, the employer reimburses workers for healthcare costs such as premiums or other expenses, up to whatever the employer can afford. Smaller employers with fewer than 50 employees can use a Qualified Small Employer Health Reimbursement Arrangement . This allows businesses to contribute something toward their employees healthcare without providing full benefits.

- You can offer voluntary benefits. While there are strict rules about health insurance coverage, other benefits are optional, including dental, vision, life and disability insurance, pet insurance, critical illness coverage, hospital indemnity, and student loan assistance. In many cases, employers can offer these at little to no cost, facilitating a group plan for employees who benefit from group rates.

- You can charge a fee for spouses who can get coverage elsewhere. In 2019, 38% of companies charged an additional fee for spousal coverage when the spouse had the option of getting health insurance through their own employer. The average annual spousal surcharge was $1,200.

- You have the option to cover domestic partners. Although employers arent required to include domestic partners in employee benefit plans, they can choose to do so.

How Much Does Health Insurance Cost For Employers

The Affordable Care Act requires that all health plans provide coverage for essential benefits including things like routine preventive doctor visits, pregnancy and childbirth, and hospital care, among other services. Some additional important factors to consider when evaluating insurance plans include:

- monthly premium and your contribution

- deductible

- emergency coverage

But coverage doesnt come without a cost. In 2016, the average annual premiums for employer-sponsored health insurance were $6,435 for single coverage and $18,142 for a family according to the Kaiser/HRET Survey of Employer-Sponsored Health Benefits. And the costs can vary dramatically from state to state. So its important to do your homework and to weigh the expense of insurance for all of your employees and speak with experts who can help you find the right plan options.

The Affordable Care Act also requires that group health plan premiums be affordable for your staffers, which means it should cost no more than 9.78% of an employees household income for single coverage. As an example, an employer would be on the hook for $2523 annually for an employee who earns $40,000 a year and whose plan had the average premium.

Don’t Miss: Does My Health Insurance Cover Lasik

Whats The Small Business Health Care Tax Credit

Smaller businesses that provide SHOP health insurance to their employees may be able to get a tax credit worth up to 50% of what they pay for their workers premiums. Nonprofits could receive a tax credit that covers up to 35%.

To qualify, your business must meet these conditions:

- You must have fewer than 25 full-time employees.

- Your average employee pay is about $50,000 per year or less.

- You pay at least 50% of your full-time employees premium costs.

- You offer SHOP coverage to all full-time workers.

The smaller your business, the larger your tax credit will be. Companies with fewer than 10 employees who are paid an average of $25,000 or less qualify for the highest credit.

Employer Health Insurance Continuation Laws

If your employer does offer group health insurance, you have the right to continue it after you leave employment. The federal Consolidated Omnibus Budget Reconciliation Act requires employers with 20 or more employees to allow their employees to continue health care coverage at their own expense.

If you quit, are laid off, or are fired for reasons other than gross misconduct, you can continue to receive your group health coverage, as long as you pay the full amount of the premium.

Also Check: What Is The Best Hmo Health Insurance

Get The Best Health Insurance Coverage For Your Employees

Whether to offer health benefits to your employees or not can be a challenging decision, especially for small enterprises. However, looking at the bigger picture, providing health insurance will offer tremendous benefits to you and the workers.

AtDesign Health, we can tailor health insurance coverage for your employees to help you realize the multiple benefits it brings to small organizations.Contact us today to learn more about our unbeatable employee benefits packages.

Reporting Information On Health Coverage By Employers And Insurance Companies

The health care law requires the following organizations and some other parties to report that they provide health coverage to their employees:

- Certain employers, generally those with 50 or more full-time and full-time equivalent employees

- Health insurance companies

Learn more about these reporting requirements from the IRS.

Don’t Miss: What Is The Most Affordable Health Insurance

Once I Am Receiving Benefits Can My Employer Terminate Them

Yes. An employer may at any time amend the terms of an existing plan, including termination of the plan. Additionally, an employer may reduce or terminate health benefits of retired former employees who become eligible for Medicare Benefits without violating the Age Discrimination in Employment Act.

Exception: An employer may not terminate, suspend, discipline, discriminate, or take any adverse action against the employee for exercising his or her rights under a plan or ERISA, or for giving information or testimony in an investigation or proceeding relating to ERISA.

Is The Magic Number

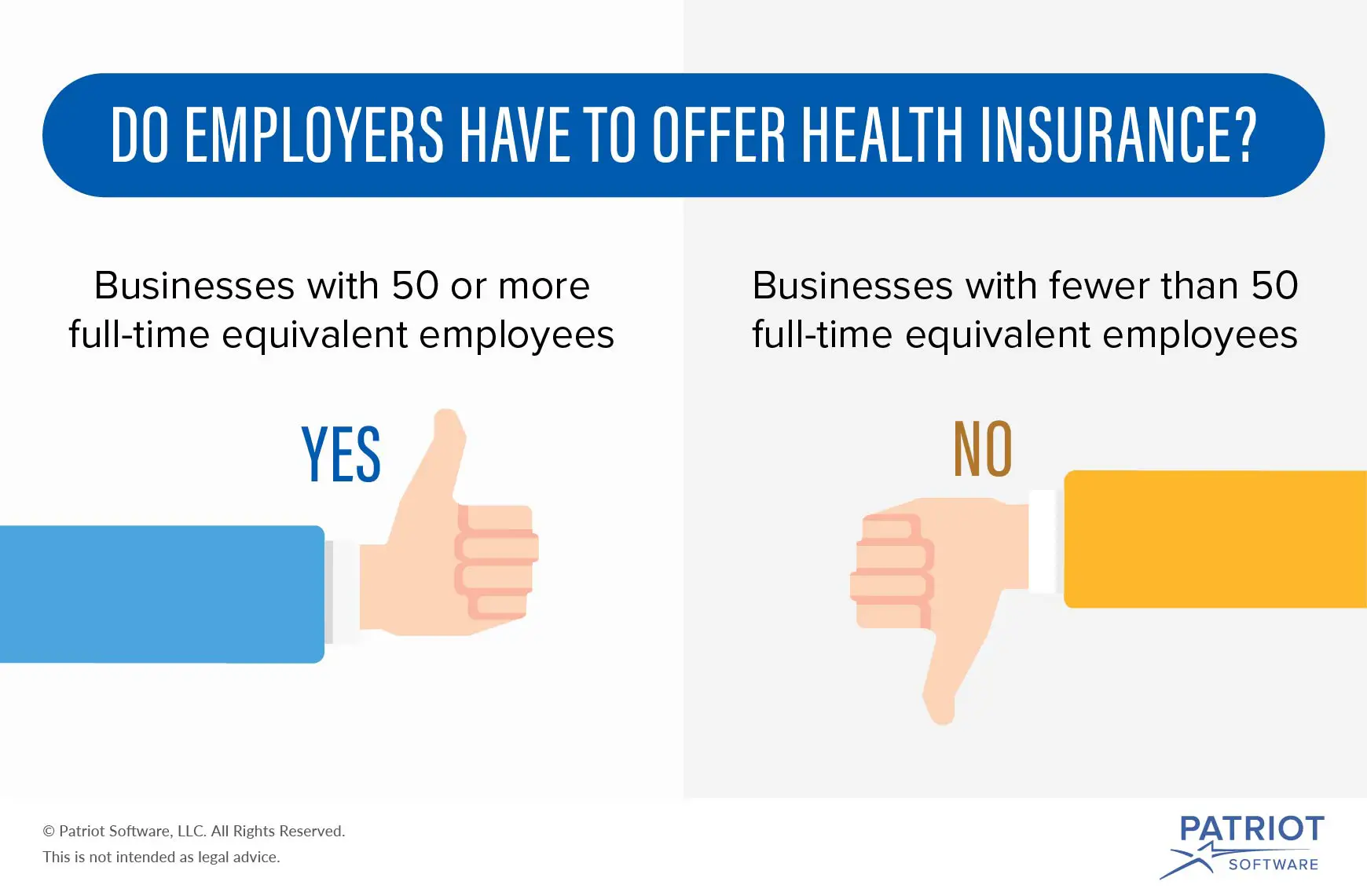

The fundamental issue that determines whether your company must offer employee health insurance is the number of employees on your payroll. If your business has less than 50 full-time employees or less than 50 full-time equivalent employees, it has no obligation under the Affordable Care Act or any other state or federal law to offer or provide employee health insurance.

A full-time employee for purposes of the ACAs coverage requirements is one who works 30 hours or more each week or 130 hours each calendar month, including vacation and paid leave time.

Companies with less than 50 full-time employees may still need to provide coverage if they have 50 or more full-time equivalent employees. The ACA defines FTE as a combination of employees, each of whom individually is not a full-time employee, but who, in combination, are equivalent to a full-time employee.

That may sound confusing, but the law provides guidance on how to calculate your number of full-time-equivalent employees:

The IRS has some helpful guidance that explains in greater detail how to figure out whether your company falls above or below the 50 employee threshold and whether your business, therefore, must provide employee health insurance coverage.

Recommended Reading: How To Get Health Insurance After Being Laid Off

Aca Requirements For Employers

The ACA requires that applicable large employers offer affordable coverage to their full-time employees and their dependents up to age 26. However, the law makes no requirement for spousal coverage, nor does it mandate that employers pay for any portion of the premium for dependents.

So in short employers are not required to offer family health insurance. That being said, many employers choose to offer coverage for spouses and families, regardless of whether dependents are older or younger than 26 years of age. In addition, most choose to subsidize a portion of the premium as well.

One trend picking up steam in the past decade is to only offer spousal coverage if the spouse isnt able to obtain health insurance through his or her own employer .

Another common practice is for an employer to levy an additional surcharge for spouses who can obtain insurance through their own employers, but prefer to be on their spouses insurance instead. The reasons for doing so are often wide and varied. Nevertheless, the surcharge is often relatively minimal perhaps around $100.

Are Employers Required To Offer Health Insurance

The provisions of the Affordable Care Act determine whether an employer is required to offer health insurance or not. In most states, small businesses with fewer than 50 full-time or full-time equivalent employees have no legal requirement to offer health insurance. But many small business owners do to attract and retain good workers. As a small business owner if you decide to offer medical coverage, youll have to meet the following health insurance requirements.

- The health insurance coverage must be offered to all full-time employees. Typically, full-time employees are defined as those who work 30 or more hours per week on average.

- A small business has no obligation to offer health insurance to part-time employees .

- However, if an employer offers insurance to at least one part-time employee, then the small business must offer group coverage to all part-time employees.

Also Check: How Long Do You Have Health Insurance After Being Fired

Other Changes To Know In 2016

The definition of âsmall employerâ is expanding. Due to changes in state law, starting in 2016, the definition of âsmall employerâ is expanded to include businesses with 50 to 100 FTE employees. This means that Covered California for Small Business is available to small businesses with up to 100 FTE employees, whereas it had not been before. Through Covered California for Small Business, small employers can shop for coverage for their employees among multiple carriers across multiple levels of coverage. Covered California also relieves employers of administrative burden by handling much of the payment distribution to health plans across carriers and coverage levels. And, federal tax credits are available to those businesses that qualify.

New coverage requirements for large businesses. Starting in 2016, insurance carriers offering products in the large group market are prohibited from marketing, offering, amending or renewing a large group plan contract or policy that provides a minimum value of less than 60%. Large businesses purchasing a health coverage plan for their employees should confirm that the plan provides no less than 60% minimum value.

Employers Required To Offer Health Insurance

Beginning Jan. 1, 2014, employers with 50 employees or more will be required to provide health insurance coverage to full-time employees or face paying a penalty. The requirement does not apply to employers with fewer than 50 employees. The annual penalty for not offering coverage is $2,000 for every full-time employee beyond the first 30.

Employers that offer coverage to employees may also be subject to penalties if any of their employees choose to buy coverage through the local health insurance exchange instead of participating in the employerâs plan. These employers will be required to pay a $3,000 penalty annually for each of their employees who opt for coverage through the health insurance exchange and receive a premium tax credit for doing so. However, employers will not be subject to penalties if the coverage they offer pays for at least 60% of covered health care expenses for a typical population and employees do not have to pay more than 9.5% of their household income for the coverage. For more information about who can purchase insurance through an exchange and who qualifies for a premium credit, click here. Employers will not be penalized for any employee insured through a spouses employer, Medicaid, or Medicare.

Read Also: Does Starbucks Provide Health Insurance For Part Time Employees

Read Also: How Do You Get Free Health Insurance

Employer Mandate Penalty Amounts And Processes

Examples of employer penalties

The employer does not offer coverage to full-time employeesThe penalty is $2,570 per full-time employee, excluding the first 30 employees. This example shows how the penalty would be calculated.

Error loading table data.

The employer offers coverage that does not meet the minimum value and affordability requirements

The penalty is the lesser of the two results, as shown in this example.

Error loading table data.

Do Small Businesses Have To Provide Health Insurance

Short answer: it depends. In 2020, small business owners with fewer than 50 employees are not generally required by the ACA to offer health insurance. Employers with more than 50 full time employees are not technically required to offer insurance, but they must pay fines of $3,860 per employee per year in 2020 if they dont offer a health plan. To avoid fines under this law, coverage must extend to an employees dependents too, up until they reach 26 years of age.

Note that the 50-employee threshold is just the ACAs limit for when for employers must begin offering insurance. Its also possible for a smaller employer to accidentally stumble into a requirement to offer employee benefits.

For example, if you include benefits as part of an employment offer, you could be held to the terms of that offer if you try to renege. Similarly, if you extend benefits to some employees but not others, a requirement to cover all your employees could arise. If you have any questions about these gray areas, its probably best to check with an employment law specialist.

Don’t Miss: What Is The Worst Health Insurance Company

What You Should Know

- The Employer Is the Policyholder

The employer is the master policyholder and the employees are certificate holders in an employer group health plan. The master policyholder:

- Negotiates the terms of the group policy with the health insurer.

- May reduce or change the plans benefits.

- May increase the employees premium contribution.

- Is permitted to switch health insurers.

- May allow the employees to choose from more than one plan.

- Can stop providing coverage entirely.

Coverage and rates may change annually. The employee contribution what you pay is determined by your employer.

Employees should be aware of the employers group health coverage enrollment policies and deadlines. Employers can require up to a 90-day waiting period before new employees are eligible to enroll in coverage.

Employers have an annual open enrollment period for employees to apply, change, or disenroll in coverage. Any benefit changes or premium adjustments in the group plan are communicated to employees during the annual open enrollment period.

Special enrollment periods are allowed when certain life events occur . Check with the employers human resources department for more information about SEPs.

Employer group health plans typically offer:

Should You Offer Health Benefits Anyway

Fifty-six percent of employees consider health insurance to be a key factor in determining whether they will stay at their job, according to the Society for Human Resource Management. Aflacs 2016 Workforces Report also showed that 60% of employees would take a job with lower pay but better benefits.

Offering health insurance can help maintain a productive, healthy, and happy workforce. The Centers for Disease Control and Prevention reports the loss of productivity related to personal and family health problems cost US employers a total of $225.8 billion annually. The CDC also notes that the hidden costs of an unhealthy workforce things like absenteeism and reduced work output can ultimately be several times higher than medical costs.

Another hidden cost to employers can come from presenteeism employees who come to work sick or injured. Beyond the fact that just one sick employee spending only a few hours at work can infect up to 60 percent of office or store common areas, according to one global study, presenteeism also results in the average worker losing almost 54 days worth of productivity every year.

Recommended Reading: Substitute Teacher Health Insurance

Also Check: How Much Family Health Insurance Cost

Why Your Company Should Consider Offering Employee Health Insurance Even If It Doesnt Have To

Even if your business falls below the 50 full-time employee limit, you should seriously consider offering employee health insurance coverage to your full-time as well as your part-time employees. There are several tangible and intangible benefits of providing group coverage, including:

- Attracting and retaining top talent

- A healthier workforce with greater productivity and lower absenteeism due to illness or injury

- Significant tax benefits and credits, such as small business healthcare tax credits of up to 50 percent of your premium expenses for any two-year period if your company qualifies.

How Does Health Insurance For Employees Work

Health insurance plans for employees are commonly referred to as group insurance plans. Group health insurance is a single plan that provides coverage for all employees. Plans are typically paid for on a monthly basis, and those monthly premiums are dependent upon your location, the number of employees covered and the ages of your covered employees.

In addition, there are different types of insurance plans. The four most common types of plans are:

- Preferred Provider Organization : PPOs are often seen as the most lenient type of plan, since referrals aren’t mandatory and the plan will at least partially pay for out-of-network services, but they also tend to carry the most expensive premiums. Also the most common group insurance plan.

- Health Maintenance Organization : HMOs tend to have lower monthly premiums, but employees will need to receive primary care physician referrals for any special services.

- Exclusive Provider Organization : EPO plans only pay for services from a select list of providers.

- Point of Service : POS plans are similar to HMOs in that you are required to get a referral for certain services, but a POS will still pay for certain out-of-network services.

Each plan will have a monthly premium, a deductible that has to be met before the plan kicks in, and copays that the covered individual might have to pay for particular services.

Recommended Reading: Can You Put A Girlfriend On Your Health Insurance