Finding Your Best Health Insurance Coverage In New Jersey

Your cheapest options for health care coverage will depend on your income level. The state of New Jersey has expanded its Medicaid coverage as part of the Affordable Care Act , which means people whose income is under 138% of the federal poverty level may qualify for subsidized coverage at reduced or no cost.

If you dont qualify for Medicaid, then your best options for cheap health insurance coverage will be a Bronze or Silver plan through the New Jersey health insurance marketplace. These plans have lower rates, and those with low or moderate incomes can qualify for tax subsidies to reduce monthly costs.

When it comes to the cost of health care, you should take both premiums and out-of-pocket costs into account. Getting the best health plan for your situation is about finding the right balance between the two.

Plans with lower premiums will generally have higher deductibles, copays and coinsurance, which means you will be responsible for a larger portion of costs before the plans benefits kick in.

For those people with higher expected medical costs, the best health insurance plan would usually have a lower deductible and a higher monthly premium. Those who are healthier and rarely use medical care should look for the opposite type of plan: low monthly costs with a higher deductible.

Silver plans: Best if you have standard medical expenses

Healthier and younger consumers should consider cheap Bronze plans

You May Like: Starbucks Dental Coverage

New Jersey Dental And Vision Plans

Dental and vision insurance plans, underwritten by Golden Rule Insurance Company, have no age limit restrictions.1 They offer coverage for the dental and vision services many medical insurance plans dont include.

From Newark to Paterson, Jersey City to Trenton, explore these New Jersey health insurance options and more that may be available now.

Also Check: Starbucks Employee Health Insurance

Ryan White And The Aids Drug Assistance Program

Ryan White Part B Resources

Website: state.nj.us/health/hivstdtb/hiv-aids/medications.shtmlHelpline: 1-877-613-4533

The Ryan White HIV/AIDS Program is a federal program specifically for people living with HIV. It covers outpatient HIV care and treatment for those without health insurance and helps fill coverage gaps for those with insurance. The program may also be able to help with the cost of things like insurance premiums, cost-sharing, and the cost of medication.

The AIDS Drug Assistance Program is part of Ryan White. It helps covers the cost of HIV-related prescription medications for low- to moderate- income people who have limited or no prescription drug coverage. Many states also use ADAP funds to help clients pay for the cost of health insurance. Each state operates its own ADAP, including determining eligibility criteria and other program elements, such as formularies, resulting in significant variation across the country.

With the passage of the Affordable Care Act , there are now more options for individuals with HIV, and other pre-existing conditions, to obtain affordable health insurance than before, including buying coverage in the marketplace and through expanded Medicaid programs. Some services previously covered under Ryan White / ADAP may be replaced by insurance, which would also provide for broader health care.

Recommended Reading: What Is The Best Supplemental Health Insurance

The Premium Instruction Package Includes:

Available in Print and PDF*

This comprehensive textbook guides you through a deep-dive of key testable insurance terms and concepts that you will need to know for your state licensing exam. The text is broken down into easily digestible units, including Cram Sheets, making it easy to learn and retain the information. Kaplans team of experts develops the content with a focus on the most recent rules and regulations in the insurance industry along with the important insurance topics. Units contain the key testable terms and concepts, multiple graphics, exercises, quizzes, and discussion questions to help you learn faster and retain the information for your state licensing exam.

*State Exceptions:

FL: The LEM can only be provided in PDF format.

Available Online and Downloadable

Practice your test-taking skills, drill into specific topics, and test your knowledge with exam-focused questions. This interactive QBank is updated on a regular basis and allows you to build personalized exams based on length and topic of your choice. It features unlimited exam attempts that are randomly generated. The QBank also gives you the ability to:

Available in Print and PDF*

This state-specific reference contains all the relevant testable state laws and regulations needed to pass the licensing exam. Use this book in conjunction with the License Exam Manual to prepare for all aspects of the state exam.

*State Exceptions:

Health Plans Are Listed As Bronze Silver Gold Platinum Or Catastrophic What Does This Mean

Plans in the Marketplace are in metal categories: Bronze, Silver, Gold, and Platinum. Metal categories are based on how you and your plan split the costs of your health care. There are also Catastrophic health plans. Right now, there are no Platinum plans offered in the Marketplace.

- Bronze: The health plan pays 60% of total health care costs. You pay about 40%. Bronze plans have the lowest premiums and the highest levels of cost-sharing .

- Silver: The health plan pays 70% of total health care costs. You pay about 30%. People who qualify for premium tax credits may also qualify for more savings through cost-sharing reductions. These can only be applied to Silver plans.

- Gold: The health plan pays 80% of total health care costs. You pay about 20%. Gold plans have higher premiums and lower cost-sharing levels.

- Platinum: The health plan pays 90% of total health care costs. You pay about 10%. Platinum plans have the highest premiums and the lowest levels of cost-sharing.

- Catastrophic: Available to individuals under the age of 30 and those who qualify for a hardship exemption. This plan has a low monthly premium, but a very high deductible. This may be an affordable way to protect yourself from costs of a serious illness or injury. But you pay most routine medical expenses yourself.

Also Check: Can I Upgrade My Health Insurance At Any Time

Are There Any Ongoing Special Enrollment Periods

If you have a yearly income up to 200% of the Federal Poverty Level , or $25,760 for an individual and $53,000 for a family of 4, you can apply for coverage any time during the year and may qualify for plans with a zero dollar or low cost monthly premium under the Expanded Access Special Enrollment Period.

What If I Already Have Health Insurance

If you or your spouse have job-based insurance, the only way you will qualify for financial help on GetCoveredNJ is if your insurance does not meet minimum standards for affordability and coverage. A job-based health plan is considered “affordable” if your share of the monthly premiums for the lowest-cost self-only coverage is less than 9.12 percent of your household income. Note that there are certain rules for minimum coverage and affordability that employer plans must meet. If you already have a GetCovered NJ plan but want to adjust your coverage, youll need to wait until the next open enrollment period to do so, unless you experience a qualifying life event or qualify for the state’s Expanded Access Special Enrollment Period. If you lose your COBRA coverage, you may be able to sign up for a GetCovered NJ plan during your 60-day special enrollment window. Try to apply and select your plan through GetCovered NJ before your COBRA coverage ends to make sure there’s no gap in coverage. If you’re insured under a NJ FamilyCare plan including Medicaid, Medicare, and Tricare you’re not impacted by the expanded federal tax credits or the states NJHPS subsidy.

Also Check: Why Is Teacher Health Insurance So Expensive

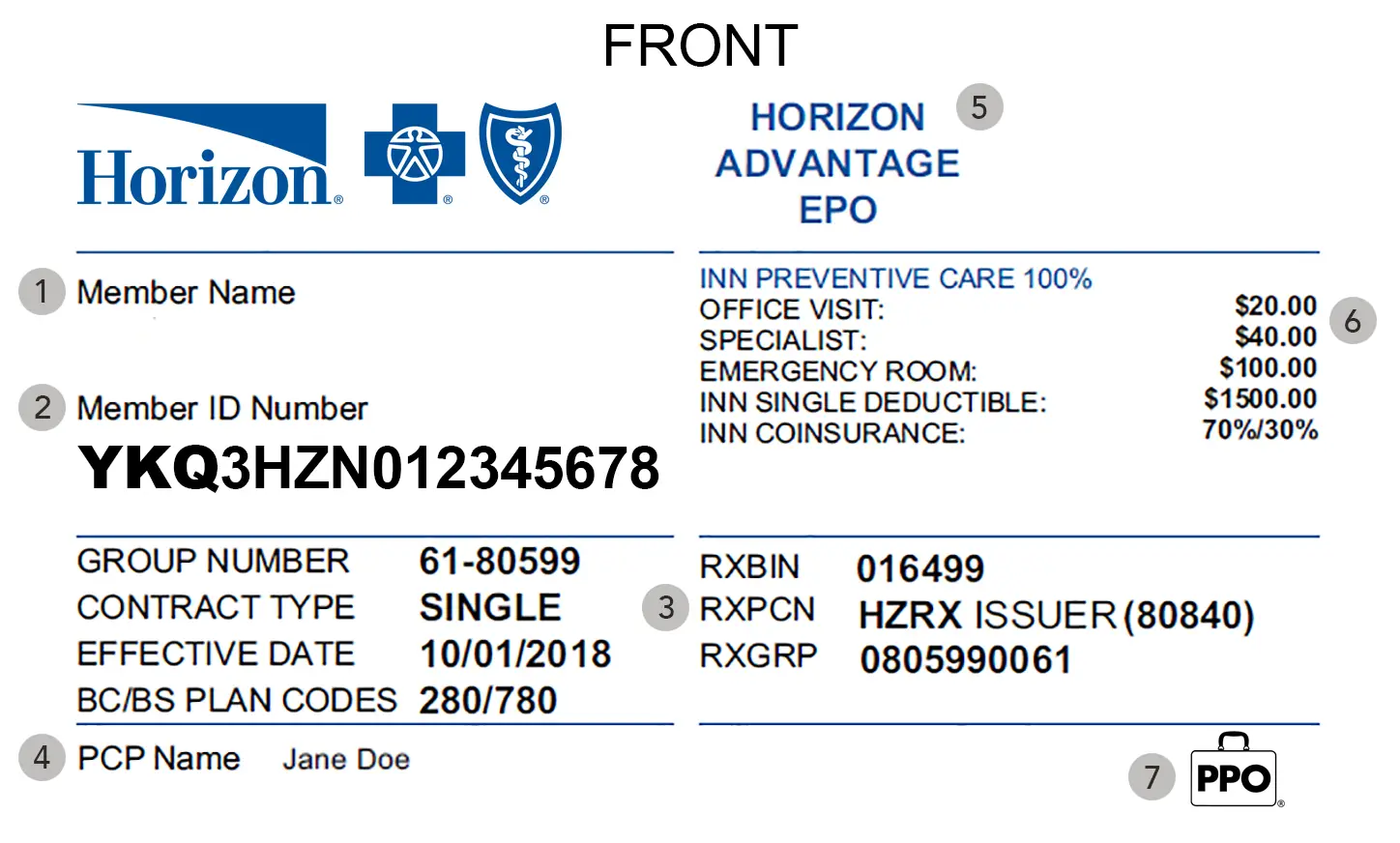

Horizon Blue Cross Blue Shield

- More Detailssecurely through Blue Cross Blue Shield Health Insurance’s websiteMore Details

Horizon Blue Cross Blue Shield is New Jerseys most popular choice for independent health insurance plans. Horizon now offers paperless online account management for all plan holders giving you easier and safer access to your sensitive medical data.

Horizon Blue Cross Blue Shield offers health insurance plans to individuals in New Jersey and has a vast network of doctors, hospitals and specialists in its provider network. Horizon Blue Cross Blue Shield is an independent licensee of the Blue Cross Blue Shield Association. Horizon Blue Cross Blue Shield offers insurance policies on the healthcare exchange.

First-time health insurance buyers will find the FAQs page very helpful. It is loaded with information on the benefits available and how to find medical providers in your network. In addition, the company offers a wide range of plans suitable for almost any type of budget and healthcare needs.

Its comprehensive FAQ page is also packed with information on finding doctors in your network and using your benefits, which can be particularly useful for first time shoppers. Finally, Horizon offers a wide range of plan types and tiers suitable for nearly any budget.

I Currently Have Medicaid However I Would Like To See Other Doctors Who Do Not Take Medicaid Can I Buy A Getcoverednj Plan To See The Doctors

If you qualify for Medicaid coverage, you are not eligible to receive GetCoveredNJ financial help. Your income and household size are what makes you eligible for Medicaid, CHIP, or GetCoveredNJ financial help. You are not able to choose between programs. If you are willing to pay a full premium for a health plan, you can buy a plan through Get Covered New Jersey. Generally, disenrolling from Medicaid will not make you eligible for GetCoveredNJ financial help. You may apply for GetCoveredNJ coverage if you become ineligible for Medicaid or CHIP.

Read Also: What Is The Best Hmo Health Insurance

Why Have I Lost Coverage

If a member of your household has been identified as deceased as part of the automatic check that Get Covered New Jersey does periodically with the Social Security Administration, Get Covered New Jersey is required by the federal government to terminate coverage for the deceased member. If this information is accurate, you should update your account by contacting Get Covered New Jersey to report the passing of the household member. If you or a family member have been incorrectly identified as deceased, please complete the following steps within 30 days of this notice:

- Call the consumer assistance center at about this notice or

- Upload a letter or statement attesting that you or a family member have been incorrectly identified as deceased, and you will contact the Social Security Administration to correct this information.

- Note: Any consumer incorrectly identified as deceased should promptly contact the Social Security Administration to report that the household member was identified as deceased by mistake. Visit socialsecurity.gov, go to your local Social Security office, or call Social Security at .

If I A Pay A Premium For Part A Medicare Coverage Can I Enroll In Marketplace Coverage

Many individuals over 65 will be eligible for full coverage under Medicare and should not enroll in GetCoveredNJ coverage. However, some individuals pay a premium for Medicare Part A or are not eligible for Medicare. Individuals in this situation may be eligible for coverage through GetCoveredNJ, but should consult a Medicare expert before applying for GetCoveredNJ. Local and national Medicare resources include:

â New Jerseys Division of Aging and Community Services, State Health Insurance Assistance Program at 1-800-792-8820

â Medicare.gov or 1-800-MEDICARE

â Your Countys Office on Aging

Recommended Reading: Do Colleges Offer Health Insurance

Reaching The Finish Line: Covering All Of New Jerseys Uninsured Children

The New Jersey Health Care Reform Act of 2008 mandates that all children have health insurance through either private insurance or public programs. New Jersey has made steady progress toward achieving this goal.

In recent years, we have seen a significant decline in the number of uninsured children and a corresponding rise in kids covered by NJ FamilyCare, which provides free or low-cost health coverage to children and low-income parents. In 2013, Governor Christie approved expanding Medicaid to more low-income parents, which should also help reduce the number of uninsured children.

Despite this strong progress, thousands of New Jersey children still lack health coverage. You can do your part by telling family members, colleagues and neighbors about NJ FamilyCare.

Nj Public Workers Face Big Increase In Health Insurance Rates In Coming Year

Hundreds of thousands of public workers, early retireesm and school employees in New Jersey are facing potential rate increases of as much as 24% for health benefits under proposals being considered by the State Health Benefits Commission.

Rate increases being considered include a 24% increase for medical and a 3.7% increase for pharmacy benefits for active public workers, as well as a 15.6% increase in medical and a 26.1% increase in pharmacy benefits for public workers who retired before the age of 65, according to an email sent to county administrators from New Jersey Association of Counties Executive Director John Donnadio.

Donnadio said in the email that the figures, which havent been made public, were shared by an insurance and benefits broker.

StateTreasury spokeswoman Jennifer Sciortino acknowledged rate increases were being considered and added that rates for active members and early retirees would likely increase between 12-20% across the various plans for the upcoming year.

A vote to approve the rate increases was scheduled for Monday, but the state health benefits board and the Division of Pension and Benefits postponed the vote after acknowledging during a public meeting on July 13 that more time would be needed to address questions and concerns, Sciortino said.

Horizon administers health care plans for state and local government employees and retirees in New Jersey.

Also Check: Who Pays First Auto Insurance Or Health Insurance

New Jersey Insurance License Exam

The next step after completing all of your pre-license coursework is to take the insurance exam. You will take one exam for each line of insurance you wish to carry. You must pass your exams within one year of completing your pre-license education course.

This is a proctored test, which means that you will be in a controlled environment with a person watching you. For people who havent tested in a situation like this should be aware of this fact, and work on taming their nerves prior to sitting for the exam. One great way to get some experience with insurance testing is taking an insurance practice exam.

The fee for each attempt of the exams is $45. When you show up you must have a photo ID and the original pre-license education certificate.

For each of the four exams, Life, Accident and Health, Property, and Casualty, you are allotted three hours and thirty minutes to complete the exam. You must answer 70% of the questions correctly to pass.

PSI Exams provides a content outline for each of the exams:

- New Jersey Casualty Insurance Exam Content Outline 91 Questions

For more information on the New Jersey Insurance exams, visit the PSI Exams New Jersey Insurance Producer License Examination Candidate Information Bulletin.

Check out our Insurance Exam Guide. Its extremely in-depth, and will hopefully help you pass the first time.

Looking for a guide to passing the insurance exam? Check out our in-depth article: How to Pass the Insurance Exam

Tip:

New Jersey Insurance License Application

Once you have completed your exams and fingerprinting, you are now ready to apply for your license. If you have more than one line of authority that you have passed the exam for, be sure to apply for all of those lines.

The fee for the initial online application is $190. This will cover as many lines as you wish to apply for. If you want to add a line to your license later, the amendment fee is $20, plus the NIPR fee, for each subsequent applications

Fill out your online application on the NIPR New Jersey website.

Read Also: How Long Can My Son Stay On My Health Insurance

I Received Unemployment Compensation In 2021 I Heard The Unemployment

Individuals who have received unemployment insurance were eligible for nearly free premiums regardless of their income in 2021. Unfortunately, this federal benefit is no longer available in 2022. However, 9 in 10 people enrolling at Get Covered New Jersey qualify for financial help. See if you qualify to receive financial help based on your current income and household size.

New Jersey Health Insurance: Find Affordable Plans

See how you can get cheap health insurance in NJ, including marketplace plans, Medicare, and Medicaid.

New Jersey residents have access to several types of health insurance. You can enroll in employer-sponsored coverage through your job, buy a private plan, or even sign up for Medicare or Medicaid.

This guide explains your New Jersey affordable health insurance options in detail.

Recommended Reading: How Much Do Federal Employees Pay For Health Insurance

New Jersey Health Insurance Mandate

Under the New Jersey Health Insurance Market Preservation Act, New Jersey residents must have health insurance beginning January 1, 2019. People who dont have minimum essential coverage may have to pay a penalty. This law is similar to the ACA individual mandate.

Most basic health coverage will satisfy the requirement. This includes health plans offered by employers, Medicare and Medicaid, the Childrens Health Insurance Program , and other MEC programs. Plans that offer only limited benefits like dental and vision do not meet the requirement.

The law applies to people who file income taxes in New Jersey. People who do not have to file a New Jersey return are exempt. Its also possible to get an exemption for other reasons like short gaps in coverage or unaffordable coverage options.

How To Get Health Insurance In Nj

- During open enrollment, which runs from Nov. 1, 2022, through Jan. 31, 2023.

- You can enroll outside of open enrollment if you experience a qualifying life event, but you generally have only 60 days from that event to enroll. This is called a special enrollment period. Qualifying events include certain moves, births and adoptions, loss of employer-provided coverage, marriage, divorce and other special circumstances.

- Consumers with an annual income up to $25,760 for an individual or $53,000 for a family of four qualify for the states Expanded Access Special Enrollment Period, allowing them to enroll any time of the year in plans with low or no monthly premium.

- Those who qualify for NJ FamilyCare can enroll anytime.

Read Also: Can Federal Employees Keep Their Health Insurance After Retirement