You Cant Rely Solely On Your Philhealth Benefits

While PhilHealth benefits are helpful in reducing your hospital bills, they arent enough to cover all your medical expenses.

Also, PhilHealth doesnt cover many healthcare services such as check-ups and annual physical exam.

This is where HMO providers bridge the gap. By getting an HMO, youll get a wider coverage for different medical services in the Philippines.

How Do I Choose The Right Health Insurance

Dont just pick a health insurance provider without taking a look at your options first. You need to consider all your choices because not all health insurance policies are the same. Before signing the dotted line, ask yourself the following questions:

- What health coverage/s do I need?

- Does my family have a history of a critical condition I should be prepared for?

- Do I have the financial capacity to fund emergency medical expenses?

- How much am I willing and can afford to pay in premiums?

India Is The Cheapest Offshore Location For Tpa Bpo Says Beroeyour Browser Indicates If You’ve Visited This Link

Third-Party Administrator outsourcing services, including workers’ compensation insurance, healthinsurance, and various employee benefits, continue to gain prominence, especially in India. Companies in developed regions such as Canada and Europe outsource their transactional processes to India,

Insurancenewsnet.com

Don’t Miss: What To Do If You Lose Your Health Insurance Card

Health Insurance Company Ratings

In the health insurance industry, a variety of rating agencies evaluate health insurance companies every year based on factors that include financial strength, customer reviews and policyholder complaints. You can use these metrics to evaluate providers and choose the best insurance company for you. The most common third-party ratings for insurance companies include:

- J.D. Power: J.D. Power is a global marketing information services company that ranks some of the best insurance companies on customer satisfaction. Its rankings give each insurer a number between 0 and 1,000 and use rating factors such as price, customer satisfaction, policy offerings and interaction.

- A.M. Best Financial Strength Rating: A.M. Best is a credit rating agency that gives health insurance companies a financial health score. A++ or “Superior” is the top grade available. Usually, any company above A- is in an above-average financial situation.

- Better Business Bureau : The BBB rating system is a grade given to a company between A+ and F, which is determined by its complaint history and how responsive the company is to complaints.

Checking company ratings and customer evaluations can help you understand what the company values and how it stacks up against its competitors. Then, you can get quotes from these companies to decide which one makes sense for your situation.

How Do I Get Cheap Health Insurance In California

The best way to find the cheapest health insurance in California is to compare policies from multiple health care providers. By getting quotes from several companies, you’ll be able to understand which company has the most expensive rates and why. Finally, by evaluating what you need in a health plan, you will be able to select a policy that fits your needs at an affordable rate.

Read Also: Who Owns Aetna Health Insurance

An Hmo Plan May Be Right For You If:

- You’re shopping for a plan with lower premiums

- You want a plan without a deductible and don’t mind having an out-of-pocket limit

- You need preventive care services such as coverage for checkups and immunizations

*Definitions may vary by plan provider. Please read the provider’s Summary of Benefits.

How Much Is Health Insurance In The Philippines

If you want to avail of PhilHealths insurance, it will cost you 1,400 to 6,600 a year. HMOs insurance costs around 10,000 to 60,000 annually. There are lots of private health insurance in the Philippines and the cheapest one will probably cost around 40,000. The price always differs depending on the health insurance package.

Read Also: Can I Get Health Insurance In Another State

Best For New York: Capital District Physicians’ Health Plan

Capital District Physicians

This physician-directed health plan has some of the highest rated plans in the business. Two plans garnered a 5.0 in overall score from NCQA and were among the six private plans nationally that scored 5.0 in consumer satisfaction. A third plan from CDPHP came in near the top at 4.5, and the company’s Medicare Advantage plan was also a high scorer. The plans are available in 29 of New York’s 62 counties. The company notes that eight out of its 15 board members are physicians.

Health Insurance Rate Changes In The Largest California Counties

Health insurance rates are set by insurance providers and then provided to state regulators for approval. Therefore, it is vital to compare year-over-year rates to understand if your plan increased or decreased for the coming year.

For 2021, most of the seven largest counties in California experienced slight decreases in the average cost of a health insurance policy for a 40-year-old.

Santa Clara County saw the largest increase rising by over 3.24%. This amounted to a year-over-year increase of $19.

| County |

|---|

2019, 2020 and 2021 premiums are for a 40-year-old adult.

Recommended Reading: How To Get Free Health Insurance In Ky

How To Determine The Best Health Insurance Plan

Buying health insurance can be an arduous and confusing process, especially when there are so many options and costs to consider.

There are a few questions to ask yourself if you want to make the search a bit easier. They include:

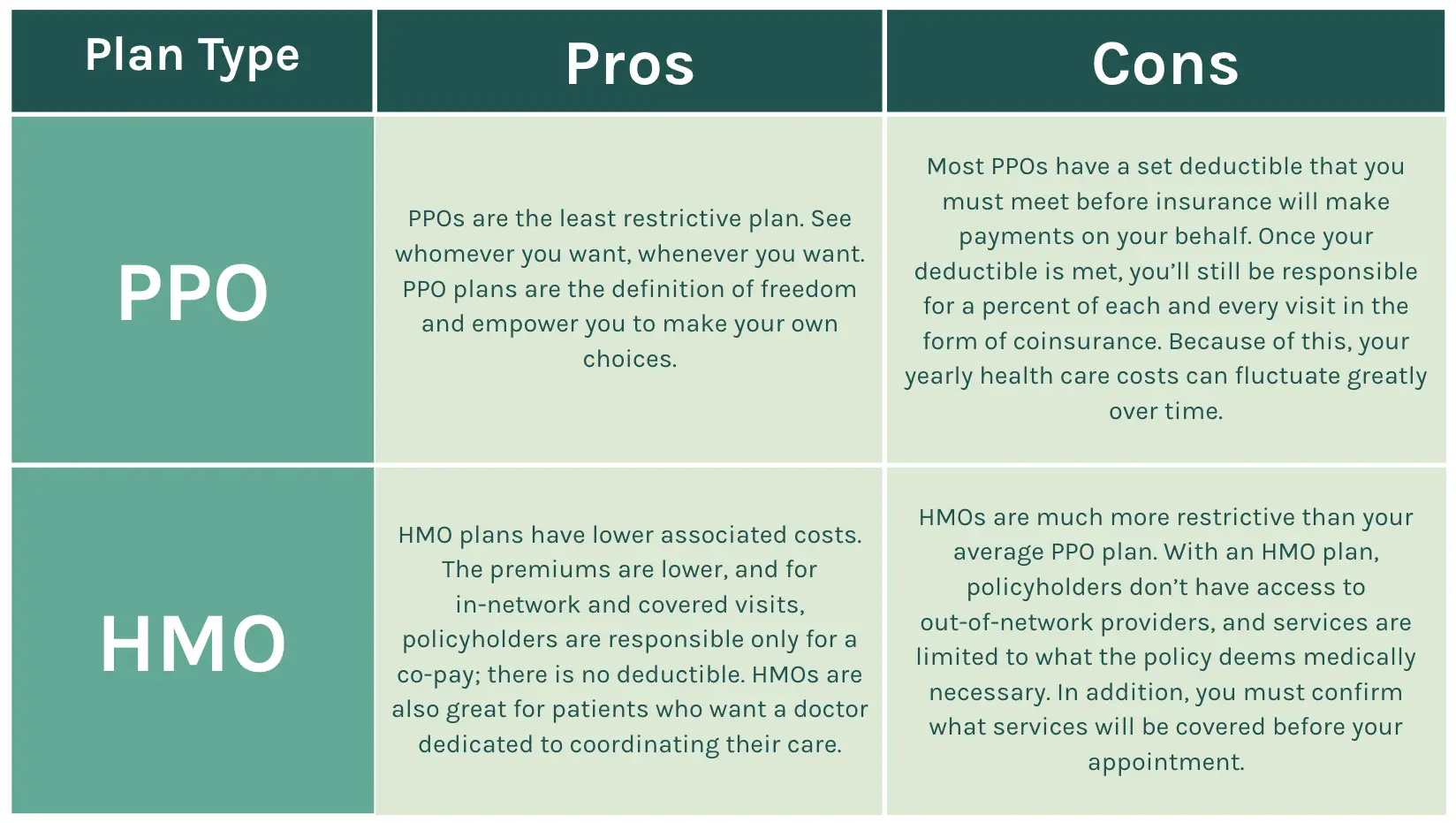

Depending on whether you are choosing an employer-based plan or shopping on the Marketplace, you may also want to compare PPO vs. HMO options. You should also consider whether you need a plan that also provides dental and/or vision coverage.

How Can I Save Time

Time is precious when you’re running your own business. It helps to choose a plan with a customized, easy-to-use online website and mobile app, so you can manage your health whenever, wherever you are. Get health information, find in-network providers, pay your health insurance premiums, view your health care claims, and print temporary ID cards.

And when you have a health issue on your mind, you want answers. It helps to have a health information line to call. Talk to a nurse 24/7 to get information and help finding answers to your health-related questions.

Don’t Miss: Who Accepts Humana Health Insurance

Video Result For What Is The Best Health Insurance Company In The Philippines

TOP 15 Health Insurance Companies in the Philippines

What are the BEST Health Insurance Plans for Senior in…

Top 15 Health Insurance Companies Here In the…

inhealthinsuranceintheininhealthinsurancetheinhealthinsuranceishealthin

greatwww.esquiremag.ph

intheintheinthehealthinisthetheinis

iscompanyisthebesthealthintheinintheisinsuranceinthethethethe

theintheininisisinthe

intheinhealthisishealthinthethethebestis

inhealthinsuranceintheininwhatistheinhealthinsuranceinintheininthein

greatwww.imoney.ph

insurancehealthinsurancehealthintheinhealthinsuranceistheinisinsurancethe

tipgrit.ph

intheininisinthe

theistheinsuranceinintheintheisinistheincompany

healthinsuranceintheinininthehealthinsuranceininthebestinthein

hotgrit.ph

inininisintheinsuranceinhealthininthecompanyisin

hotwise.com

theininsuranceisthetheintheis

besthealthinsuranceininininisbesthealthinsurancecompanythebestthehealthinsurance

bestaurorahealthcare-us.blogspot.com

besthealthinsuranceintheinishealthinsuranceintheininhealthinsuranceishealthinsurancehealthinsuranceinthein

inintheinishealthinsuranceintheinininis

Pacific Cross Health Care Inc

Contact Information:

HMO Rate: Starts at Php 4,482 annually

Formerly Blue Cross, Pacific Cross is a medical, travel, and accident insurance provider in the Philippines and ASEAN. Its medical benefits can be availed not only locally but also overseas. The HMO also has special healthcare plans for OFWs and senior citizens.

HMO Rate: Starts at Php 7,806 annually + Php 250 one-time processing fee

ValuCare has been providing HMO programs to individuals, families, and employees since 1997. Its network consists of over 20,000 physicians and dentists as well as 1,300 hospitals and clinics.

Read Also: Where To Go For Health Insurance

United Healthcare: Best Health Insurance Provider For Add

The United Healthcare name is well recognized and the company certainly has the financial muscle to deliver many benefits to its customers. Its premiums are slightly higher than average, but you may feel the extra outlay is worth it to access the huge, nationwide network. That and the many features that come with the very impressive online access and mobile app United Healthcare offers.

In short, its worth looking at United Healthcare’s plan quotes no matter where you’re based, and though you may find that the prices quoted are a touch higher than some of United Healthcare’s competitors, the extra features and discounts should be factored in.

Why Should You Get A Prepaid Hmo

After breaking down the pros and cons of a prepaid HMO, is it still worth getting?

Well, the answer is an easy yes! and heres why

Its actually something to be happy about because it means youre healthy. However, if you want to make the most out of your converge without getting sick, you can do the following

- If you purchased coverage that includes dental services, use it up before your card expires.

- Most prepaid HMOs have coverage for outpatient check-ups and laboratory exams, so you might as well use that coverage for your own annual physical check-up.

You May Like: How Much Is Health Insurance Through Work

Epo Vs Hmo Health Insurance: Which Plan Is Best

While EPO and HMO health insurance plans have some similarities, they have even more differences. HMO insurance is often termed as an insured product, meaning that the insurance company will pay the cost of the claim if it meets all coverage guidelines.

In comparison, EPO insurance is often termed as a self-insured product in which the employer pays the costs. Another major difference between the two relates to flexibility. EPOs are typically more flexible than HMOs, as HMOs have more strict rules regarding referrals and similar features.

If you are considering your options in terms of cost for EPO vs. HMO health insurance, you will want to consider all aspects of pricing such as premiums and copays. EPO health insurance often has lower premiums than HMOs.

However, HMOs have a bigger network of healthcare providers which more than makes up for it. You may also want to consider your location when choosing a health insurance plan. EPOs are better suited for rural areas than HMOs.

If you loathe paperwork and making phone calls to the insurance company, you may want to avoid EPOs. Most EPO plans require pre-authorization of services. This means that you must get permission directly from the insurance company before acquiring various types of healthcare services.

If you fail to get pre-authorization, you may be stuck paying the entire bill out-of-pocket. Pre-authorizations are put in place to ensure that you are only receiving services that are medically necessary.

What Is Epo Health Insurance

Under an EPO plan, members are required to use hospitals and doctors within their own network. Much like a HMO plan, you cannot go outside of your plans network for care and you will not be covered if you choose to receive care from an out of network provider.

One of the biggest advantages of an EPO plan is the lower cost. EPOs typically cost less than both HMOs and PPOs. Another major perk is that you do not have to get a referral from your primary care doctor to see a specialist.

Most EPO health insurance plans cover basic medical treatments, as well as preventative care, long-term care, emergencies, and specialist treatment such as physical therapy and surgeries. EPO plans combine the flexibility of Preferred Provider Organization plans with the more stringent regulations of HMOs at a price point that falls between the two.

An EPO plan may be for you if you want the freedom to see specialists without a referral and if you do not mind sticking to healthcare providers in your network.

Also Check: Do I Need A Health Insurance Broker

What Is An Hmo Plan

HMO means “Health Maintenance Organization.” HMO plans offer a wide range of healthcare services through a network of providers who agree to supply services to members. With an HMO you’ll likely have coverage for a broader range of preventive healthcare services than you would through another type of plan. Check out the resource center to see the difference between a PPO and HMO.

How Should You Shop For Health Insurance

When shopping for a health policy, there are several factors to consider. Your location matters, as health plan offerings differ by state and region. Also, think about how often you intend to use healthcare services. If you have a chronic condition and visit the doctor regularly, youd likely need a different type of plan than if you only had preventive care appointments. Finally, look at the financial and customer satisfaction ratings to determine the strength of the insurer.

Read Also: How Much Does A Family Health Insurance Plan Cost

California Health Insurance Plan Ratings 2020

The data is the above ratings table is based on the 2019 results from the California Patient Advocate website.

Not all the insurance companies above are available in San Diego. Only Kaiser, Sharp, Blue Shield, and Health Net are offering individual and family health plans here. The rest offer Group health insurance plans.

If I grade the insurance companies based on my experience as a broker, my rankings would be:

Some people love Kaiser and others hate them. I am neutral and help my clients get the plan that is the best fit for them.

What Is The Difference Of Life And Health Insurance

Life insurance is a contract where upon death of the insured, the insurer is bound to pay a lump sum of money, provided that the insured pays a premium. Payment is also possible in the event of critical illness. Health insurance is a contract between the insurance company and an individual or group that can avail services provided by third parties. Health insurance comes in the form of an HMO, PPO and Medical Insurance. For both instances, the insured pays a premium depending on what the person wants, either monthly, quarterly, semi-annually or annually in exchange of a later payment or discounted services of various providers in the insurance company’s network .

Also Check: Who Qualifies For Health Insurance Subsidies

S In Finding A Good Doctor In The Philippines

Be A Philhealth Member

Being an active PhilHealth member lowers your hospital bills because your Philhealth benefits are deducted first before the HMO pays for the remaining costs.

If youre already a member, update your membership into a self-earning individual member. Continue paying your PhilHealth contributions, too.

Also Read: Complete Guide to Philhealth: Online Registration, Contribution & Benefits

Recommended Reading: What Is Meridian Health Insurance

Humana: Best Health Insurance Company For Seniors

Humana is ranked the fifth largest health insurance provider in the United States, which means that it has a reassuring amount of financial capital behind it. The policies are relatively affordable, though this one only really applies to their HMO plans. But if you’re happy with that and dont mind a specific range of pharmacy options, Humana health insurance is well worth considering.

Humana’s policies for more elderly customers are especially attractive, as many of their competitors hike up their prices substantially for older customers. The fact that Humana doesn’t makes it our top pick for seniors.

How Can I Save Money

Because you’re in business for yourself, your health care costs make a difference to your bottom line. The right health insurance plan can help you save money on out-of-pocket costs. When you visit in-network providers, you get access to the lower rates that they’ve negotiated with your health plan. When you see an out-of-network provider, your costs are typically higher. That’s why it’s important to choose a health plan with in-network health care providers and hospitals in your area.

You May Like: Does Golden Rule Insurance Cover Mental Health

How To Choose The Best Health Insurance For You

There are some questions to ask yourself to ensure youre choosing the best health insurance plan for you, including:

- What will your total costs be? In addition to the monthly premium you pay your insurance company, consider your deductible and what your out-of-pocket costs might look like. Some people would like to have premiums as cheap as possible and are fine with a higher deductible, says Turner, while others prefer the opposite.

- Are your favorite doctors in network? Each insurance company works with a certain network of providers. Before signing up for a plan, ensure that the doctors you want to see are included in the plans network. As a mom, I dont ever want to have my pediatrician not be in my network, says Moore. If you love your OBGYN or your family practice doctor, find out if theyre in network before you sign up, because it can make all the difference.

- What type of plan is it? If you sign up for a Health Maintenance Organization plan, you generally wont be covered if you seek out-of-network care unless its an emergency. If you pick a Point of Service plan, youll be required to get a referral from your primary care physician in order to see a specialist. The kind of plan you choose will affect your out-of-pocket costs.