If You Live In Northern Ireland But Work In Ireland

If you live in Northern Ireland but are employed in Ireland, and you return home at least once a week, you are a frontier worker. Frontier workers are also known as cross-border workers.

As a frontier worker, you’re entitled to an Irish-issued EHIC as Ireland is the State where you are employed and pay your social security contributions.

To apply you will need:

- your most recent payslip

Missed The Apple Health Renewal Deadline

If youve missed the deadline to renew, but you would like to continue coverage, please contact us as soon as possible. If we find you eligible within 90 days after the date you lost coverage, we will cover you for the period you were without coverage.

The fastest way to renew your lost coverage is to go online. You may also call 1-855-923-4633.

Recommended Reading: Does Short Term Health Insurance Cover Pre Existing Conditions

How Much Is Health Insurance Without A Job

Your healthcare costs are determined by your income level. If you have no income, you can qualify for free coverage. The subsidies are based on your income as a percentage of the poverty level, but there are differences among states, so check with your state’s Medicaid authority to learn what’s available in your area.

Don’t Miss: When Does Health Insurance Stop After Quitting Job

Make Your First Payment

Once your application for health coverage has been submitted, youll need to make your first payment before your coverage can begin.If you are buying an alternative or supplemental health insurance product, make sure you understand how the payments work. The process varies for different products. Also, understand that certain non-insurance products are different from an ACA qualifying plan or a Major Medical planthey are not actual insurance and are only meant as a supplement or short-term solution.In most cases, you will be prompted to enter your credit card information for your first payment, and that information will be passed by eHealth to the insurance company. If your insurance company is not set up to take online payments, eHealth will email you the information you need to make your first payment.

Types Of Health Insurance Plans

When purchasing health insurance, your choices typically fall into one of three categories:

- Traditional fee-for-service health insurance plans are usually the most expensive choice. They offer the most flexibility in choosing health care providers.

- Health maintenance organizations offer lower co-payments and cover the costs of more preventive care. Your choice of health care providers is limited to those who are part of the plan.

- Preferred provider organizations offer lower co-payments like HMOs but give you more options when selecting a provider.

Recommended Reading: Which Statement Is Not True Regarding Underwriting Group Health Insurance

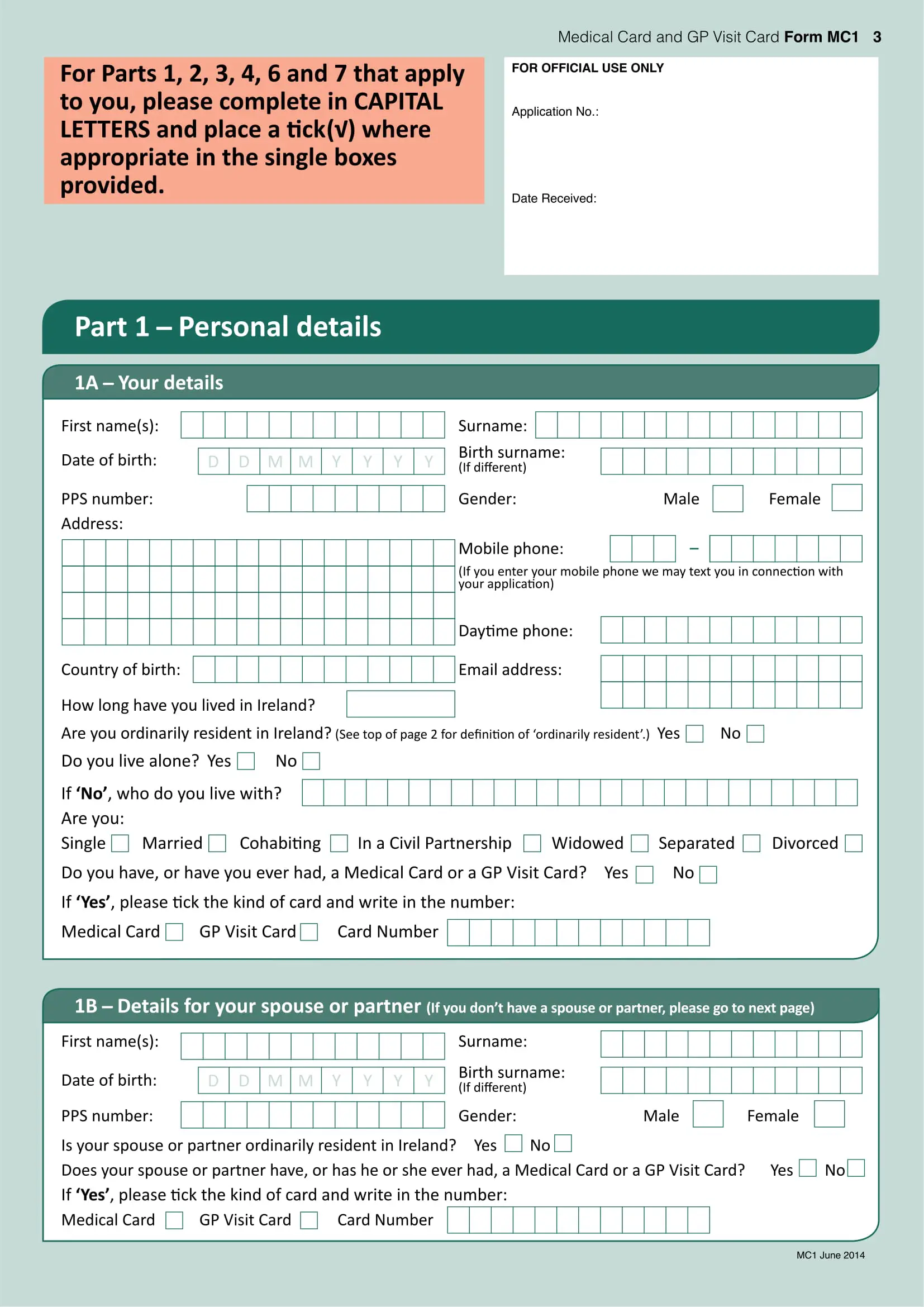

How Do I Apply For Nl Mcp

In order to apply for MCP, you will first need to complete the NL MCP application form below:

Preview

Once you have completed the form, you can either submit it by mail, fax or drop it off physically at an MCP office using their 24-hour mail drop-off slot. Be sure to include copies of appropriate identification and citizenship/immigration documents.

Examples of documents you can submit to prove your identity and citizenship or immigration status are:

- Canadian passport

Canadian Citizens and Permanent Residents may also have to provide the following:

- previous province or territorys health care number or card

- proof that Canadian citizenship/permanent residency status has not been forfeited if returning to Canada after a lengthy stay abroad

- proof of discharge from the Canadian Armed Forces

- proof of release from federal prison

Submit photocopies. Do not send original documents!

The mailing addresses to send your application form are:

Grand Falls-Windsor Office: MCP

Gms Health Insurance Plans

Based in Regina, Saskatchewan, GMS is a proud health insurance provider working to protect you against out-of-pocket healthcare costs and support wellness for you and your family. GMS health insurance plans complement your lifestyle and provide protection for everyday health needs and medical emergencies. And you can save money with the added bonus of receiving discount options to help make your benefit coverage go even farther!

Since 2014, GMS has

- helped generate more than $3 million to upgrade critical equipment for trauma care teams in Regina hospitals

- donated a state-of-the-art digital electrocardiogram testing file management and storage system at the GMS Cardiac Rhythm Device Clinic at Reginas General Hospital

- allowed for facility improvements to enhance patient comfort

- proudly sponsored support for pediatric services

Don’t Miss: How To Keep Insurance Between Jobs

Pay Your First Premium

All plans are guaranteed-issue, which means all individuals are accepted no matter what, so you wont need to wait and see if your plan is accepted or not. Once youve selected a plan, the Marketplace will simply bill you for your portion of the premium and forward the payment to your new insurance carrier.

Once purchased, the plan is yours. Even if you leave your current job, your plan will stay with you since its not tied to your employment.

What Is The Affordable Care Act

The Affordable Care Act provides individuals and families greater access to affordable health insurance options including medical, dental, vision, and other types of health insurance that may not otherwise be available. Under the ACA:

-

You may be able to purchase health care coverage through a state or federal marketplace that offers a choice of plans.

-

Insurers can’t refuse coverage based on gender or a pre-existing condition.

-

There are no lifetime or annual limits on coverage.

-

Young adults can stay on their familys insurance plan until age 26.

-

Seniors who hit the Medicare Prescription Drug Plan coverage gap or “donut hole” can get a discount on medications.

Read the full text of the ACA and learn more about its provisions and relationship to patients, insurers, businesses, and families.

Read Also: Starbucks Open Enrollment

Am I Covered By Nl Mcp When I Am Out Of Province

If you are temporarily out of Newfoundland and Labrador, MCP will cover some of the costs of insured services. Keep in mind, that the full costs of medical services received in another province, territory or country may not be covered, especially outside of Canada. Travel insurance can pay for these services in other provinces and beyond.

If you plan to leave NL for a duration of 30 days or longer, whether for vacation, business or to study, you will need to obtain an Out-of-Province Coverage Certificate to make sure that your MCP coverage will not expire while you are away.

How To Get Cobra

Group health plans must give covered employees and their families a notice explaining their COBRA rights. Plans must have rules for how COBRA coverage is offered, how beneficiaries may choose to get it and when they can stop coverage. For more COBRA information, see COBRA Premium Subsidy. The page links to information about COBRA including:

Read Also: What Insurance Does Starbucks Offer

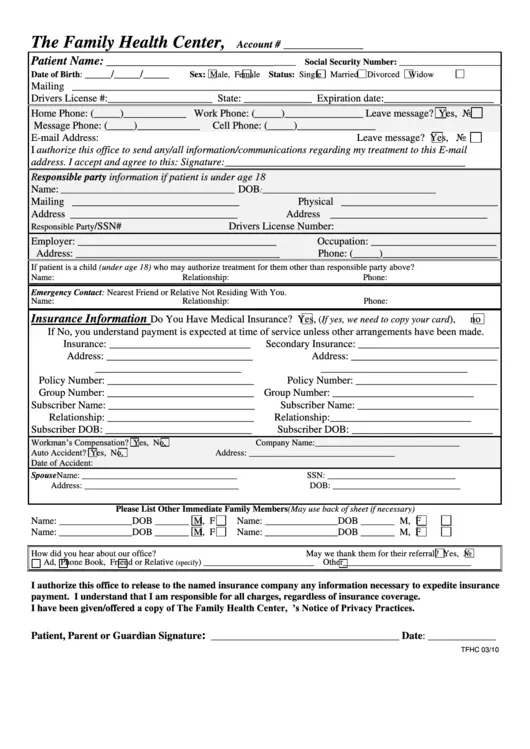

What You Need To Apply:

- The name, address, contact info, and birth date for everyone in your household

- Social security numbers and/or immigration documents

- Employer and income information for everyone in your household. Examples include pay stubs or W2 forms.

- Other income information including Social Security Administration or Supplemental Security Income payments and mentions

- Information about current health coverage for members of your household, including coverage through an employer, a spouse’s employer, or Medicare

How To Get Health Coverage Through Certified Enrollment Partner Websites

You can apply for and enroll in Marketplace health coverage through certified enrollment partner websites:

- Online health insurance sellers: Let you compare all available Marketplace plans in your area

- Insurance company websites: Show you only the Marketplace plans they offer

Note: The only way to get premium tax credits is through HealthCare.gov or a certified enrollment partners website.

Recommended Reading: Kroger Health Insurance Benefits

When Will I Get Coverage

The Family Support Division will process your application and any supporting documentation as soon as they receive it. This can take up to 10 days. Once your application is processed, you will get a letter that lets you know if you are eligible for healthcare coverage or not. If you are approved, you will receive a MO HealthNet Identification Card and information explaining the type of services and coverage you have. You will need to follow the instructions in this letter for your coverage to begin.

Understanding Health Insurance In Saskatchewan

Every year, the government cuts services covered by the Saskatchewan Provincial Health Insurance plan, making residents responsible for paying more of the bill. A supplemental health insurance plan from Special Benefits Insurance Services can help fill the gaps left by the government plan. Additional coverage from our Saskatchewan Health Insurance Plans will limit your out-of-pocket expenses and protect your bottom line.

A single injury or illness can have a devastating impact on your bottom line. Gain peace of mind and the financial protection you need with a health insurance plan from SBIS. With suitable coverage, you can rest assured that you and your family will have access to the care you need without breaking the bank.

Looking for health insurance in Saskatchewan can be overwhelming. There are a variety of factors to think about. You must review the plans to learn what is covered and not covered, decide what amount of coverage is right for you and your family, and determine how much you can afford to pay.

SBIS has been helping Saskatchewan residents find the health insurance plan thats right for them for more than 25 years. We will save you time and reduce your anxiety by helping you navigate the insurance application process.

When you work with SBIS, you get

To speak with a representative, call Monday through Friday, 8:45 a.m. 4:45 p.m. ET. A representative is available to answer your questions and guide you through the buying process.

Recommended Reading: Kroger Part Time Health Insurance

Qualifying For Passport Renewal In Canada

Citizens enjoy few restrictions to qualify for a Canadian passport.

Adult passport renewal requires you to have a current passport issued within the last 15 years. Children under the age of 16 will need to apply separately for a new child’s passport.

Renewing a passport also requires you to have the same essential identifiers, including:

- Name

- Gender

- Place of birth

If you wish to change this information, you cannot renew your current passport. However, passport offices can issue you a new document with updated information.

Do I Need To Apply For Coverage Every Year If I Already Have Insurance

If you enrolled in a Marketplace health insurance plan during the last enrollment period, your coverage will automatically renew. However, its still important to update your application every year. Make sure that youre auto-enrolled in a plan that best fits your needs, and and that youre getting financial assistance if you qualify.

People with Medicaid or insurance through their job dont have to do anything during the open enrollment period. If you have health insurance through your job, check with your employer to see if you have to update your information. If youre covered through the Medicaid program, your state may periodically confirm your eligibility.

Don’t Miss: 8448679890

How To Apply Apply For Masshealth The Health Safety Net Or The Children’s Medical Security Plan

Online

Applying online is the fastest way to find out which programs you may qualify for.

MassHealth and the Massachusetts Health Connector use the same streamlined application to determine if you qualify for MassHealth, the Health Safety Net, Children’s Medical Security Plan, ConnectorCare plans, or Advance Premium Tax Credits.

To apply online, create a secure online account at the Massachusetts Health Connector. It only takes a couple of minutes.

Worcester, MA 01608Hours: Monday – Friday: 8:00 a.m. to 6:00 p.m.

Born In Birthing Hospital Or With Registered Midwife

If your baby was born in an Ontario hospital with birthing facilities or with a registered midwife, follow these steps to apply:

Your babys new health card will be mailed to you within 8 weeks of the date the Ontario Health Coverage Infant Registration form was submitted.

If hospital staff or the registered midwife gave you the Ontario Health Coverage Infant Registration form and you have questions or concerns about your babys health card, you must contact ServiceOntario.

If hospital staff or the registered midwife do not give you the Ontario Health Coverage Infant Registration form, you may apply for health coverage for your child at either:

49 Place dArmes, 5th floorKingston, ON K7L 5J3

Recommended Reading: What Benefits Does Starbucks Offer Employees

Go To Healthcaregov Or Your State’s Individual Health Insurance Marketplace Website

After the Affordable Care Act was passed, the online Health Insurance Marketplaces were created to help Americans sign up for their own individual health insurance. Usually, youll only be able to sign up for a plan during open enrollment period at the end of the year.

However, if your employer just offered you a reimbursement plan, like a health reimbursement arrangement , then you qualify for a special enrollment period that allows you to shop for a plan outside of the normal enrollment period.

If You Are Living In Ireland

If you are an Irish citizen, Irish pensioner or an EU citizen living in Ireland you can apply for an EHIC:

- in person at your local health office

- online – if you have a medical card or drug payment scheme card and you live in Ireland

You must be living in Ireland and have an address here. You will need to show proof of this.

The card takes about 10 working days and will be posted to you.

Don’t Miss: Starbucks Insurance Cost

Applying For The Medically Needy

Complete Medically Needy Spenddown Appendix E if you applied for health care coverage for someone who is medically needy, but has income greater than the Medicaid limit and wants to be evaluated for a spenddown based on income, resources, and medical expenses. Spenddown works like an insurance policy deductible. The amount of the deductible is called the spenddown liability. Once medical bills are equal to or greater than the spenddown liability, the application will be re-evaluated for Medicaid eligibility.

Medically Needy Spenddown Appendix E

If You Live In Another Eu/eea Member State Or Switzerland

This applies to anyone who does not live in Ireland but lives in the:

- European Economic Area

- Switzerland

If you live in the EU, EEA or Switzerland, you will be entitled to an Irish-issued EHIC if one of the following applies to you:

- you receive a state pension from Ireland and have an Irish-issued E Form/S1 form registered in your country of residence

- you are a worker posted to work in another EEA country or Switzerland by your Irish employer, or a frontier worker living in the EEA and working in Ireland

- you are a family member of a posted worker or of someone working in Ireland and you are not covered in your own right by the EEA country you reside in

If you are not eligible for a Irish-issued EHIC, you should see if you are eligible for an EHIC in the country you are currently living in.

Read Also: Do Starbucks Employees Get Health Insurance

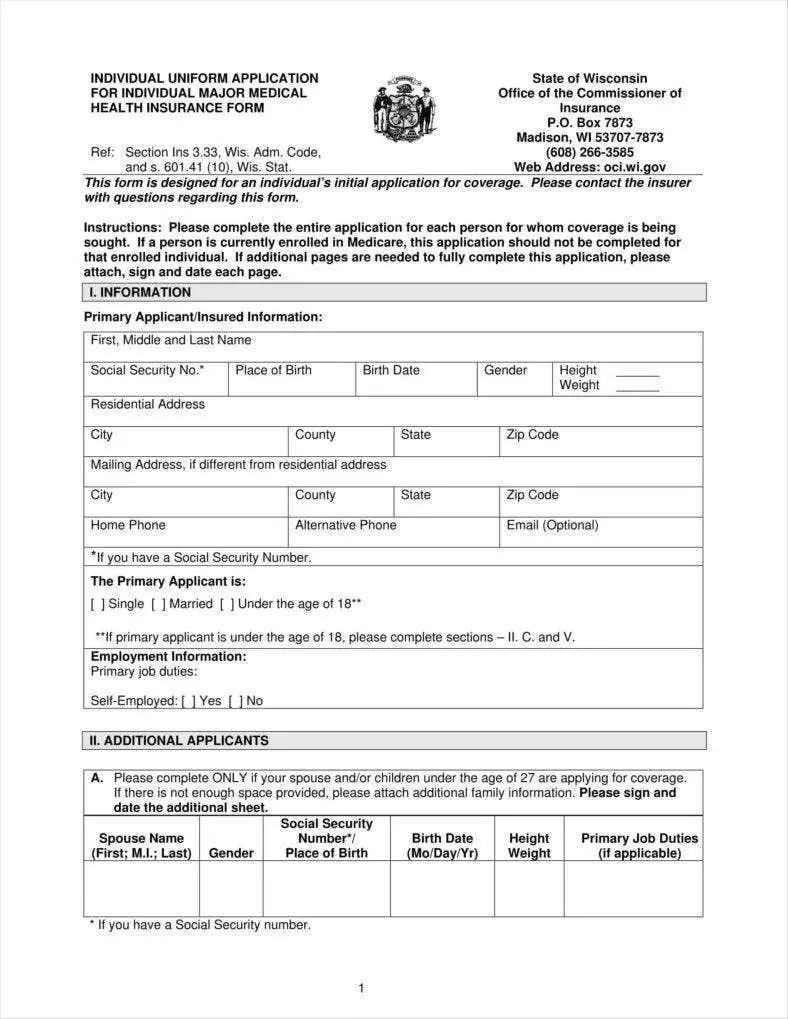

How To Apply For Marketplace Coverage

There are 4 ways to apply for coverage in the Health Insurance Marketplace®:

- Apply online. Visit this page and select your state to get started.

- Apply by phone. Call 1-800-318-2596 to apply for a health insurance plan and enroll over the phone.

- Apply in person. Visit a trained counselor in your community to get information, apply, and enroll in person.

- Apply by mail. Complete a paper application and mail it in.

How To Apply For A Quebec Health Card

The province of Quebec suggests applying for RAMQ within 15 days of settling in the province to avoid delays. Youll need to complete an application form for the health insurance plan.

NOTE: During the COVID-19 pandemic, Quebec and Montreal reception desks are not available for in-person visits. Deposit boxes for documents are available, and you will need to contact by telephone for information on how to process your application. At the time of writing, no photo is required with your application.

Recommended Reading: How Much Do You Pay For Health Insurance

Also Check: Evolve Medical Insurance