How To Waive The Student Health Insurance

New Jersey State law requires all institutions of higher education in New Jersey to offer health insurance coverage for purchase by students who are enrolled full-time. NJCU policy requires comprehensive health insurance coverage for all matriculated students who are registered full time and enrolled in a degree-seeking program. NJCU requires all full-time undergraduate and graduate students as defined by the University to carry health insurance. All full time students are automatically charged and must take action if they wish to waive the fee.

Is Medicaid Accepted At The Student Health Center

The Student Health Center is not a Medicaid provider.

All students can use Student Health Center services. There is no cost to see our providers. However, there are charges for lab, x-ray, pharmacy, allergy shots, physical therapy and special procedures. Since we are not a Medicaid provider, students will be responsible for these charges.

Pharmacy: Medicaid will pay for prescriptions filled at the Pharmacy, if written by a Medicaid provider.

New Students: Please Read The Following Requirements For Waiving Usc Student Health Insurance Plan

Your comprehensive health insurance plan must meet the Universitys general requirements listed below. Please note that additional criteria may also be necessary in order for your waiver to be approved.

General Criteria:

- Your plan must be a U.S.-based health insurance plan that is filed and approved in the U.S.

- Students taking courses at our UPC or HSC campuses must have coverage that is comprehensive with no major exclusions and has in-network providers in the Los Angeles area.

- Satellite campus and online distance learners must have comprehensive coverage with no major exclusions and have in-network providers in the zip code where they live and take classes.

- Provide continuous year-round coverage while you are a student at the University of Southern California.

- Your insurance plan must meet the Affordable Care Act criteria. Only plans in compliance with ACA criteria will be accepted. .

- Cover preventive care services at 100%.

- Your plan must have no pre-existing condition exclusion if the plan has a pre-existing condition waiting period, that period has expired.

- Your plan must have no per-injury or per-illness maximum benefit limits.

- Your plan must cover medical services for injury from participation in all types of recreational activities or amateur sports.

- Have an annual combined deductible and out-of-pocket expense of $8,550 or less.

Upon request, you must be able to provide a copy of:

Some reasons why you may not be granted a waiver:

The plan must:

Read Also: What Insurance Does Starbucks Offer

After Submitting Your Waiver Application

Submission of a waiver does not guarantee approval. Once your waiver is submitted, you must log in to Gallagher Student Health to monitor your waiver status.

Communications regarding your waiver are sent by Gallagher Student Health via Constant Contact. Check your spam or junk folder for communications if you have not received any from Gallagher after submitting your waiver. Only approved waivers will result in a credit for SHP. All other waiver statuses will result in SHP enrollment, and you will be responsible for paying the premium.

Waiver Status Descriptions and Required Actions

| Waiver Status |

|---|

| The coverage did not meet the University’s requirements. |

*The University reserves the right to audit approved waivers, and the approval may be rescinded if upon review it is determined the coverage does not meet the University requirements or the student has sponsored funding for SHP .

Gallagher Student Health will email you if your waiver application is approved. If your application is not approved, you will be enrolled in SHP and will be responsible for paying the premium.

If you have questions about the waiver process or application, you may contact Gallagher Student Health 24/7 at .

Premium Refund If You Waive After You’re Billed

Fall students are billed for the fall-semester SHP premium in mid-July. Students starting in January are billed for the spring-semester SHP premium in mid-December. If you waive SHP after you are billed, the premium will be refunded to your Bursar account.

NOTE: If you use any of your SHP benefits before your waiver application is approved, we will not be able to give you a premium refund for the months your plan was in use.

You May Like: Do Starbucks Employees Get Health Insurance

S To Waive Student Health Insurance

Health Insurance Fee Waiver

All registered undergraduate students taking 12 or more credit hours covered by other comparable health insurance, may decline the Coppin State University student health insurance by completing an Online Waiver form in the Fall 2021 beginning August 21, 2021 and Spring 2022 beginning January 22, 2022. For your waiver request to be considered, you must complete this form by the waiver deadline of . If you are experiencing a problem with the waiver site, call 951-3958, prior to the deadline date. Once the waiver request is reviewed, students will be notified via email whether their waiver request has been approved or denied. Print the email and keep as waiver proof for your records. Waivers will not be accepted after the deadline. If you do not waive out of the health insurance by the deadline date, the premium cost for this plan will remain, non-refundable on your tuition bill.

Read Also: Starbucks Dental Insurance

How To Submit A Waiver

If you do not wish to enroll in the United Healthcare student health insurance plan, you must do the following:

- Set up an account with ECI Services.

- Log in and click the Waive-It icon to go to the waiver portal administered by ECI Services.

- Enter your insurance information on the Waiver Form and upload a copy of the front and back sides of your insurance card.

- All waiver requests must be submitted by the first day of classes each semester.

Waiving Coverage Under The Student Health Insurance Plan

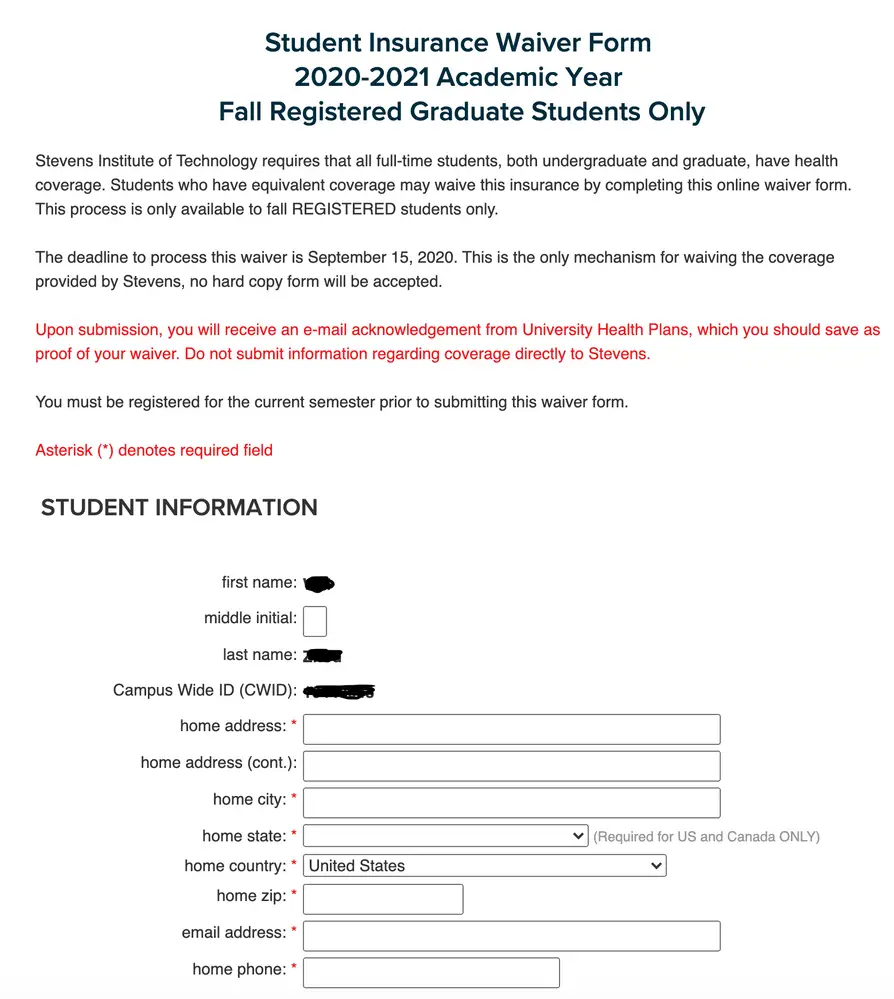

An online waiver form will need to be completed in order to waive the student health insurance plan. Generally the process begins during the summer months to waive coverage for the following academic period. Gallagher Student will have the waiver process and waiver deadline posted on the specific home page of your institution your student is attending.

Log-In Instructions and Deadline Information will be posted on the specifichomepage of the institution your student is attending. You will be asked to provide information on your currenthealth insurance plan, so be sure your current health insurance card is close at hand.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Health Insurance For Students

Colorado School of Mines is committed to the health and well-being of all of its students. Good health is essential to academic success which is why we provide health care coverage to all enrolled degree seeking domestic students, and all international students, regardless of degree status.

Coverage requirements and option to waive insuranceMines requires all students to have adequate health insurance as a condition of enrollment. No distinction is made for part-time versus full-time status. Degree-seeking U.S. citizens and permanent resident students who demonstrate coverage that meets Mines requirements may waive the health insurance provided by Mines using the online enrollment/waiver system. Information on coverage requirements can be found the Measure Up page.

How to WaiveIf you have other adequate health insurance and would like to waive the Student Health Insurance Plan, you must go online to csm.myahpcare.com and complete the online waiver by the deadline dates. The Annual/Fall waiver period begins July 15, 2021 and the waiver deadline is September 8, 2021. The Spring/Summer waiver period opens December 15, 2021 and the deadline to waive is January 26, 2022. Students need to waive or enroll once each academic year.

Important Waiver Change Effective August 1 2021

- We have returned to our pre-COVID waiver options, with the expectation of a return to on-campus studies for the 2021-2022 academic year.

- In the event that there is a sudden unexpected shift in the dynamics related to on-campus studies, HUSHP may adjust these eligibility options. An email communication would be sent out.

- To waive, you must meet the criteria defined below. Regarding the Student Health Fee, students who are studying remotely but are not officially classified with one of the required waiver criteria registration statuses below, will not be eligible for a waiver.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Mandatory Student Health Insurance

Most eligible students enrolled in the UNC System Colleges and Universities are required to have health insurance coverage. Students who meet the eligibility criteria, regardless of in-person or virtual means of instruction, will have to show proof of insurance in order to waive out of Student Blue or be automatically enrolled on the deadline.

Each semester, Student Health Insurance is added to all eligible students’ University accounts. Eligible students must enroll to activate their insurance or complete the online waiver process with their own creditable insurance coverage before the deadline each semester. Once the waiver is verified and approved, the premium will be removed from the students account.

SEMESTER DEADLINES for WAIVE and ENROLL:

FALL – SEPTEMBER 10 SPRING – JANUARY 31

Questions about waive and enroll can be directed to Campus Health at .

If you have questions about whether your financial aid package pays for the UNC System Student Health Insurance, please contact .

Where Are You Studying

Go Local and Student Health Insurance

Are you a student enrolled in a Washington Square or Tandon school studying in your home country either at an NYU campus or online?

If so, you were automatically enrolled in and charged a premium for your schools Basic, Comprehensive, or Tandon student health insurance plan. This ensures you have the insurance coverage you need to access high quality care at the time of an unexpected medical or mental health event. The charge will be reflected on your Bursar bill.

Options

- If you want to keep the Basic, Comprehensive or Tandon student health insurance plan you were automatically enrolled in, no additional steps are required.

- If you do not want to keep the Basic, Comprehensive or Tandon student health insurance plan you were automatically enrolled in:

You May Like: Starbucks Part Time Health Insurance

To Print Your 1095b Form

Coverage after graduation

If you need coverage after August 1, 2020 you have several options:

1.) Coverage with an employer. If you are starting a new job that offers health insurance, check with your employer to see what you need to do and when to enroll.

2.) Coverage under parent’s or spouses health insurance. Because your SHIP coverage ends on August 1, 2020 this can be considered a qualifying event, which may allow you to obtain coverage under your parent’s health insurance if you are under age 26.

3.) Explore coverage options through a reputable online source, such as:

- Connectforhealthco.com

International Student Health Insurance 2021

As an International Student you have the same option as all other Averett University students to either enroll in the student health insurance plan provided by United Healthcare or waive out of this plan by completing the online waiver process at www.firststudent.com.

Averett University requires your health insurance to meet the following minimum standards:

If you need assistance determining if your insurance policy meets these minimum standards please email a copy of your policy to . Your options for purchasing insurance are:

If you have any questions about the new International Student health insurance requirement please contact Tim Cummons by emailing or calling him at 346-4075, extension 1452.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

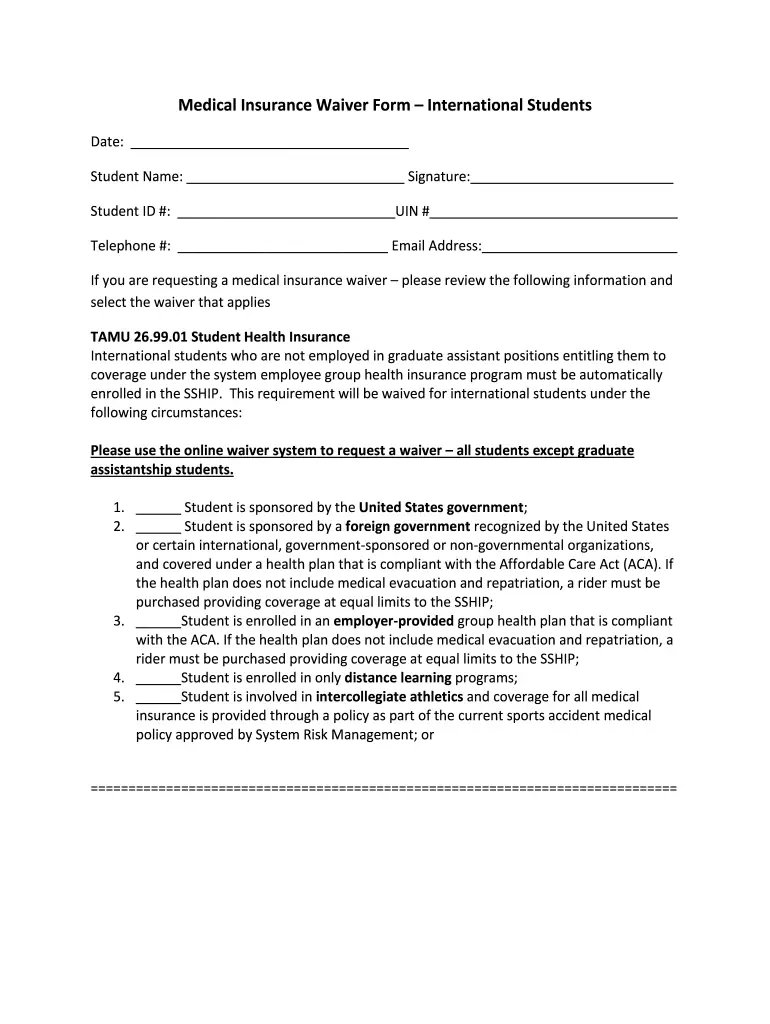

What Are The International Student Insurance Requirements

All International students are required to have health insurance while attending UNC Charlotte. Students may enroll into the Student Health Insurance Plan or they may enroll in another US or home country plan that meets the University’s minimum health insurance requirements. In order to waive the Student Health Insurance Plan, students must complete the online waiver form with Blue Cross Blue Shield.

Your health plan must meet the following minimum requirements:

- Minimum total benefit/coverage of $100,000 per accident or illness

- Plan deductible of no more than $500

- Minimum of $50,000 for medical evacuation

- Minimum of $25,000 for repatriation coverage

- Policy must be active for the entire duration of the academic semester

- Pregnancy and mental health benefits

**Important notice regarding non-US health insurance plans. After completing the online insurance waiver you will be required to send a copy of your policy declaration page for review. All information must be submitted in English and all of the benefits and exclusions of the plan must be clearly stated. If the policy does not meet the minimum requirements and/ or it is not completely in English, the waiver will automatically be declined and students must purchase the University sponsored plan.

Waiver Submission And Approval

How do I know if my waiver request was received?

- A confirmation email is sent within minutes of successfully completing the waiver request. Print and save this email as proof of your waiver. If you dont receive a confirmation email, call Wellfleet customer service, 633-7867, for help.

How long will it take for my waiver to be approved?

- Approval by Wellfleet can take up to three business days, and it can take up to 14 additional business days for UHS and the bursar’s office to complete the process.

What if my waiver request is rejected?

- Audits are performed students whose waivers are rejected during an audit will have an opportunity to correct the information submitted. Waivers not accepted by the university will be recharged to the tuition bill.

Do I have to submit the waiver again in the spring?

- Waivers submitted during the fall semester apply to the entire academic year. Only new or transfer students need to submit the online waiver request for the spring semester.

I have more questions, whom do I contact?

Also Check: Does Starbucks Provide Health Insurance For Part Time Employees

Waive Your School’s Insurance

Welcome to the Waive Your Schools Insurance Center!

This page is for those students who wish to opt-out out of the coverage under their schools student insurance plan. The schools student insurance plan can only be waived if the student has coverage under another acceptable insurance plan.

The first step to waive out of your schools student insurance coverage is to verify that you are an eligible student.

2021-2022 Waiver Information

Are considered a hard waiver student. Hard waiver students are required to have health insurance

Begin the waiver process by following the instructions below.

Hard Waiver Student Waiver Instructions

Waiver Deadlines:

- Summer 1 Deadline Date TBD

- Summer 2 Deadline Date TBD

Once you have completed the waiver form, an email will automatically be sent to the email address you provided notifying you of the waiver request decision.

All waiver decision emails are sent securely from the following companies: Office 365 & Cisco. Please do not delete the email and please check your spam or junk folder.

If you receive a:

Open Enrollment/Waiver Periods

If you are a student in the Fall semester and eligible to purchase coverage and you choose not to enroll/waive coverage before the Annual Enrollment/Waiver Deadline of *September 17, 2021, you will not be eligible to enroll/waive again until the start of the next Fall semester.

*For new dependents or new students in the Spring semester, your open enrollment deadline is TBD.

Qualifying Life Event

How Will The Claims Process For Student Health Insurance Work

The Student Health Center will file insurance claims ONLY for those students who have Student Blue, the Student Health Insurance Plan offered through Blue Cross Blue Shield of North Carolina . Students who carry Student Blue will not be required to pay any fees up front for medical services, with the exception of prescription copays. Once the Student Health Center receives reimbursement from BCBSNC, student accounts may be billed for any charges that are not covered by Student Blue.

Don’t Miss: Does Starbucks Provide Health Insurance For Part Time Employees

Complete Your Online Request For A Waiver At The Aetna Student Health Online Waiver Request System

- All requests for a waiver must be completed online . Make sure you have all of the required information before beginning data cannot be saved from session to session.

- Have a copy of your health insurance ID card and details about your current health insurance plan available for your reference, prior to beginning the waiver request.