Effects On Insurance Premiums

The elimination of the individual mandate penalty in 2019 contributed to higher individual market premiums for 2019, because insurers expected that the people likely to drop their coverage after the penalty was eliminated would be healthy, whereas sick people will tend to keep their coverage regardless of whether there’s a penalty for being uninsured.

The penalty’s original purpose was to encourage healthy people to join the risk pool, as a balanced risk pool is necessary for any health insurance product to function.

According to rate filings for 2019 plans, average premiums would have for 2019 if the individual mandate penalty had remained in place .

The primary reason average premiums increased instead of decreasing for 2019 was the elimination of the individual mandate penalty, along with the Trump administration’s efforts to expand access to short-term health plans and association health plans.

Those plans appeal to healthier individuals, so their expansion has the same effect as the penalty repeal, in terms of reducing the number of healthy people who maintain ACA-compliant individual market coverage. Note that although average benchmarkpremiums decreased slightly in 2019, overall average premiums did increase that year.

But because the ACA’s premium subsidies adjust to keep coverage affordable even when premiums increase, the majority of people who buy health plans in the exchanges have continued to do so, and enrollment has grown to a record high as of 2022.

Contact The Experts At New City Insurance

Tax penalties can come as a surprise for people who are not familiar with the 2020 changes to California health insurance coverage. To learn more about the tax penalty for not having health insurance in California or to request a consultation with an insurance professional, contact New City Insurance.

Federal Penalty Applied From 2014 Through 2018

When it comes to encouraging people to have health insurance, the ACA has plenty of carrots, including guaranteed-issue coverage and subsidies to make coverage and care more affordable . But for several years there was also a stick, in the form of a financial penalty for people who failed to maintain health insurance coverage throughout the year.

The penalty was implemented in 2014, and became progressively steeper through 2016. The average penalty for people who were uninsured in 2015 was $470 up from $210 the year before. And according to data from the IRS, the average penalty was $708 for tax filers who owed the penalty for being uninsured in 2016.

For 2017 and 2018, the penalty remained at the same level it was at in 2016. But the penalty was eliminated after the end of 2018, as a result of the Tax Cuts and Jobs Act that was enacted in late 2017 .

The ACA’s individual mandatethe requirement that people maintain minimum essential coverageis still in effect. But there is no longer a federal penalty for non-compliance. So people who are currently uninsured are not subject to a federal penalty. They’re still stuck without health insurance if they end up needing medical care, and unless they experience a qualifying event , they won’t have an opportunity to enroll in coverage until the annual open enrollment period.

Recommended Reading: How Long Cobra Health Insurance

How Do I Enroll In A Health Insurance Plan During Open Enrollment

You can enroll in a health insurance plan online, over the phone, or in person. To enroll, you will need the following information:

- Name, address, email address, social security number, birthday, and proof of citizenship status

- Household size and income if you want to apply for subsidies

- Coverage details and premium for an employer-sponsored plan thatââ¬â¢s available to anyone in your household

- Payment information for your premiums

- Your doctorsââ¬â¢ names and zip codes so that you can check to make sure theyââ¬â¢re in-network

- A list of medications taken by anyone who will be covered under the policy

- If you want to enroll in a catastrophic plan and are 30 or older, youââ¬â¢ll need a hardship exemption.

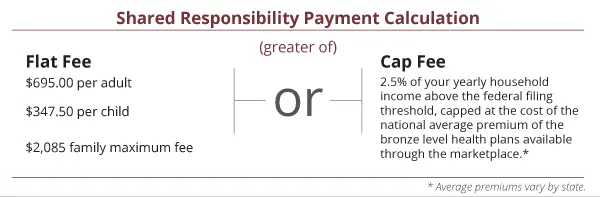

How Big Were The Penalties

The IRS reported that for tax filers subject to the penalty in 2014, the average penalty amount was around $210. That increased substantially for 2015, when the average penalty was around $470. The IRS published preliminary data showing penalty amounts on 2016 tax returns filed by March 2, 2017. At that point, 1.8 million returns had been filed that included a penalty, and the total penalty amount was $1.2 billion an average of about $667 per filer who owed a penalty.

Although the average penalties are in the hundreds of dollars, the ACAs individual mandate penalty is a progressive tax: if a family earning $500,000 decided not to join the rest of us in the insurance pool, they would have owed a penalty of more than $16,000 for 2018. But to be clear, the vast majority of very high-income families do have health insurance.

Today, the median net family income in the United States is roughly $56,500 For 2018, the penalty for a middle-income family of four earning $60,000 was $2,085 . This is far less than the penalty a more affluent family would have paid based on a percentage of their income.

The penalty could never exceed the national average cost for a bronze plan, though. The penalty caps are readjusted annually to reflect changes in the average cost of a bronze plan:

The maximum penalties rarely applied to very many people, since most wealthy households were already insured.

Also Check: Does National Guard Have Health Insurance

Absence Of Medical Services

Contrary to popular belief, health providers are not required by law to provide medical services to individuals without insurance. Only emergency departments are legally bound to provide care.

The Transamerica Center for Health Studies released a report revealing that 62% of Americans have been diagnosed with a chronic health condition, such as high blood pressure, high cholesterol, or being overweight or obese. The study also found that only 56% of uninsured Americans could afford to pay for their routine health expenses.

Dont Miss: Starbucks Insurance Part Time

Similarities & Differences Between Traditional Ira Roth Ira &

In 2006, the Massachusetts legislature passed the Health Care Reform Act, requiring almost all of its citizens to obtain minimum levels of health insurance or face penalties. The law requires the majority of state residents over age 18 who meet minimum income standards to purchase health care coverage or pay penalties when filing state tax returns. The state requires enrollment in plans meeting its minimum creditable coverage levels. If you donât enroll, youâll face monthly penalties.

Read Also: How Us Health Insurance Works

The Evolution Of Workers Compensation

The concept that workers should be protected from and compensated for injury or illness occurring in the workplace came about with the rise of the trade union movement at the beginning of the 20th century. Workers compensation insurance is a direct result of public awareness and outrage at the poor and often dangerous working conditions people were forced to labor under in order to make a living, and the financially devastating effects of worker injury or illness on the worker and the workers dependents.

Workers compensation insurance is the oldest social insurance program in the United States in fact, it is older than both social security and unemployment compensation.

California adopted workers compensation laws in the 1910s along with most other states. Workers compensation is based on a no-fault system, which means that an injured employee does not need to prove that the injury or illness was someone elses fault in order to receive workers compensation benefits for an on-the-job injury or illness.

Since almost every working Californian is protected by the workers compensation system, it is important that employers and employees alike have an understanding of workers compensation insurance and how it works.

Recommended Reading: How To Enroll In Starbucks Health Insurance

The Fee For 2018 Plans And Earlier

- You may owe the fee for any month you, your spouse, or your tax dependents dont have qualifying health coverage . See all insurance types that qualify.

- You pay the fee when you file your federal tax return for the year you dont have coverage.

- In some cases, you may qualify for a health coverage exemption from the requirement to have insurance. If you qualify, you wont have to pay the fee. Learn about health coverage exemptions.

Read Also: What Is Short Term Health Insurance

Employer Mandate Coverage Requirements Since 2016

Employers with 50 or more full-time and/or FTE employees must offer affordable/minimum value medical coverage to their full-time employees and their dependents up to the end of the month in which they turn age 26, or they may be subject to penalties. The amount of the penalty depends on whether or not the employer offers coverage to at least 95% of its full-time employees and their dependents.

Employers must treat all employees who average 30 hours a week as full-time employees.

Dependents include children up to age 26, excluding stepchildren and foster children. At least one medical plan option must offer coverage for children through the end of the month in which they reach age 26. Spouses are not considered dependents in the legislation, so employers are not required to offer coverage to spouses.

No Longer A Federal Penalty But Some States Impose A Penalty On Residents Who Are Uninsured

Although there is no longer an individual mandate penalty or Obamacare penalty at the federal level, some states have implemented their own individual mandates and associated penalties:

Vermont enacted legislation to create an individual mandate as of 2020, but lawmakers failed to agree on a penalty for non-compliance, so although the mandate took effect in 2020, it has thus far been essentially toothless . Vermont could impose a penalty during a future legislative session, but the most recent legislation the state has enacted calls for the state to use the individual mandate information that tax filers report on their tax returns to identify uninsured residents and provide targeted outreach to help them obtain affordable health coverage.

Don’t Miss: Why Short Term Health Insurance

Individual Mandate Penalty Repeal

Former President Trump campaigned on a promise to repeal the ACA and replace it with something else. Republicans in the House passed the American Health Care Act in 2017 but the legislation failed in the Senate, despite repeated attempts by GOP Senators to pass it.

Ultimately, Republican lawmakers passed the Tax Cuts and Jobs Act and President Trump signed it into law in December 2017. Although the tax bill left the rest of the ACA intact, it repealed the individual mandate penalty, as of 2019 .

Although Congress did not repeal anything other than the mandate penalty , a lawsuit was soon filed by a group of GOP-led states, arguing that without the penalty, the mandate itself was unconstitutional.

They also argued that the mandate was not severable from the rest of the ACA, and so the entire ACA should be declared unconstitutional. A federal judge agreed with them in late 2018.

An appeals court panel agreed in late 2019 that the individual mandate is not constitutional, but sent the case back to the lower court for them to decide which provisions of the ACA should be overturned.

The case ultimately ended up at the Supreme Court, where the justices ruled in favor of the ACA. So although there is still no federal penalty for being uninsured, the rest of the ACA has been upheld by the Supreme Court .

What Are My Options For Complying With Obamacare

You have 3 options and two of them involve a penalty:

- Get no insurance and pay a penalty for no health insurance at tax time.

- Get cheap insurance and pay a penalty at tax time.

- Enroll in a qualified health plan. This option does not have to be through Covered California to avoid the penalty, but it does have to be a Covered California plan in order to qualify for a government subsidy.

- Enroll in a Health Care Sharing Plan, which is exempt from the penalty and my offer lower premiums than traditional health insurance.

You May Like: Can You Change Your Health Insurance Plan Mid Year

Is The Affordable Care Act Still In Effect For 2022

The Biden-Harris Administration also recently announced a new SEP opportunity for low-income consumers with household incomes under 150% of the Federal Poverty Level who are eligible for premium tax credits under the ACA and ARP, which is approximately $19,000 for an individual and $40,000 for a family of four in 2022.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: Does Employer Health Insurance Cover Pre Existing Conditions

How Is Aca Affordability 2022 Calculated

To calculate ACA affordability for the 2022 tax year under the Rate of Pay Safe Harbor using hourly workers’ earnings, take the employee’s lowest hourly rate as of the first day of the coverage period and multiply it by 130, the minimum total of hours an employee must work on average to be ACA full-time.

Health Insurance: What To Expect When Filing Your Tax Return

Wondering whether you’ll owe a tax penalty for being uninsured? In most states, the answer is no. But if you’re in California, DC, Massachusetts, New Jersey, or Rhode Island, there is a penalty for being uninsured, which is assessed when you file your state tax return. Here’s an overview of how the individual mandate penalty has evolved over time:

You May Like: What Is Aetna Health Insurance

Short Term Health Insurance

During the COVID-19 pandemic, many people have gone through transitional periods and have had a lapse in health care coverage. Short-term health insurance can be a temporary option to protect you from expensive medical bills. You are eligible for short-term coverage if you:

- Change jobs

- Other specific instances

Why Does It Matter Whether People Have Health Insurance

The ACA’s individual mandate penalty was never popular, but rates would have been lower in 2019 if the individual mandate had not been eliminated. And that continues to be baked into the rates that insurers use in subsequent years.

Prior to 2014, there was no mandate, but insurance companies in most states could decline applications or charge additional premiums based on applicants’ medical history.

Once coverage became guaranteed-issue , it became necessary to impose some sort of measure to ensure that people maintain coverage year-round.

Otherwise, people would be more likely to go without coverage when they’re healthy, and only sign up for coverage when they’re in need of health care, which would result in higher premiums .

But as we’ve seen in the years since the individual mandate penalty was eliminated, enrollment in plans through the exchanges has remained quite steady, thanks to the ACA’s premium subsidies, combined with limited enrollment opportunities .

Also Check: When Is The Enrollment Period For Health Insurance 2020

Pros And Cons Upsides And Downsides To Revoking The Health Insurance Penalty

In the words of the great Sir Isaac Newton, with every action, there is an equal and opposite reaction. In the case of the removal of the health insurance mandate, people quit their health insurance when it was no longer required in order to save money. Experts estimate that as many as 4 million people quit their health insurance solely based upon the removal of the health insurance mandate.

The biggest benefit of removing the mandate, especially for healthy young people, is that without having to pay for health insurance, a little more money can stay in ones pocket. Stories have appeared of people who have used the mandate removal to their advantage, and have gotten rid of their insurance, then actually negotiated major health costs on their own and come out ahead of the system.

The downside, of course, is what Obamacare was originally created to avoid- not having health insurance is a major risk. Due to the extreme costs of healthcare in the US, most people without insurance or major savings are only one major medical crisis away from financial ruin or bankruptcy. Consider this- the average cost of an emergency room visit in 2018 was roughly $2000, which is nothing to laugh at, considering that in the pandemic era, surveys show that 25% of Americans have no emergency savings at all.

What If I Want To Enroll In Health Insurance Outside Of Open Enrollment

If you missed the Open Enrollment Period for the year but want to enroll in health insurance, there are generally two options available to you.

First, you might be able to enroll in health insurance coverage if you qualify for a Special Enrollment Period . You may qualify for an SEP if you had a change in your household. This includes marriage, divorce, giving birth to a baby, or adopting a child. You can also qualify for an SEP if you have a change in residence, like a move to a new zip code, new county, new state. Or if youre a student moving for school. If you lose your existing health insurance coverage, you might also be able to qualify for an SEP. You can learn how else you might qualify for a SEP and how to apply for one here.

Second, depending on your income level, you might be able to qualify for Medicaid. Medicaid is the federal insurance program that provides health insurance, and thus medical care, to low-income Americans. Another critical part of Obamacare was that it allowed states the option of expanding their Medicaid programs. They did this by upping the percentage of the federal poverty level a person must earn annually to qualify. If your income level lets you qualify for Medicaid, you can enroll outside of the Open Enrollment Period. And if you qualify, your coverage will start immediately and so will your access to health services.

Don’t Miss: Can You Opt Out Of Health Insurance At Any Time