Cover Wherever You Happen To Be

Youll have cover throughout your chosen area including or excluding the USA and emergency cover everywhere if you need to go into hospital for a day or more, even if youve chosen to exclude the USA. That means no matter where you are, you can access expert care quickly.

And if its an emergency and you cant get the treatment you need locally, our team will make sure you get to where you need to be and back home again.

The Advantages Of Short

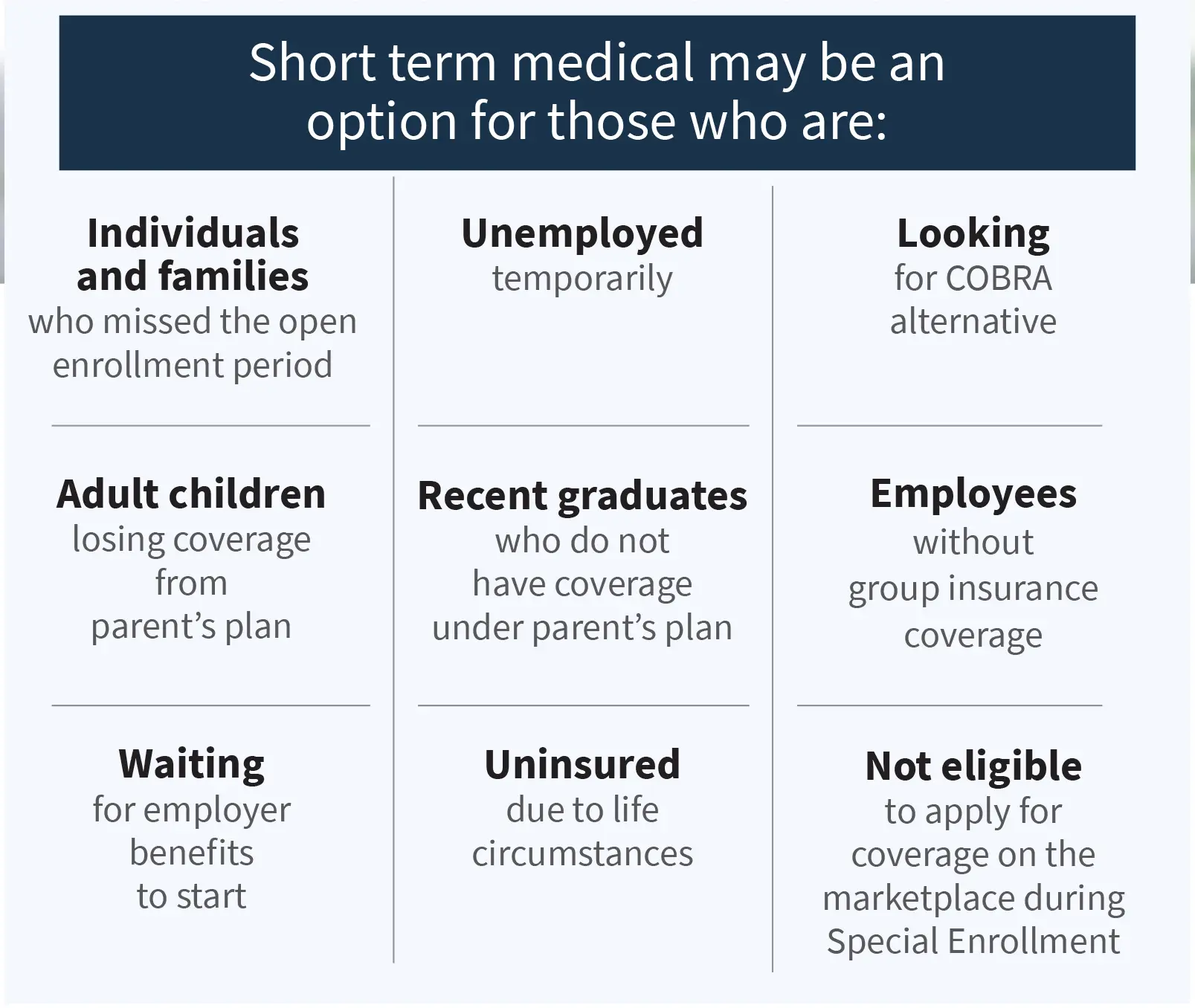

Due to certain limitations and fewer regulations, short-term health insurance plans generally do not make sense as a long-term solution for health insurance needs. However, there are some potential advantages.

- Coverage: Short-term health insurance generally covers unexpected illnesses and injuries, as well as emergency room visits and inpatient and outpatient hospital services. There are many different plan options, so you can choose one that fits your immediate needs.

- Temporary affordability: These plans can fill in gaps in coverage for individuals who are not eligible for or cannot afford traditional health insurance coverage. Short-term health insurance premiums are generally less expensive than ACA or traditional health insurance premiums.

- Timing: Theres no need to wait for an enrollment period you can purchase short-term health insurance at any time. In addition, many short-term health plans can go into effect the day after an application is received. You can also cancel short-term health coverage whenever you like without penalties, such as if you begin a new job and qualify for a special enrollment period to enroll in your employers group health plan.

What Is The Difference Between Long Term And Short Term Insurance

The short term insurance covers possessions, like your home, vehicles, and household appliances etc. The premiums changes either annually or when your circumstances change. For example, if you have an insured car and you exchange it for a new one, youll have to get a new car insurance policy. In contrast, long term insurance is associated with long-term care, like death, disability or retirement. The premiums remain relatively constant over the policys lifetime. Unlike short term insurance, long term insurance covers you or your family financially under the circumstances of death, disability or retirement.

Also Check: Can I Use Health Insurance For Dental

What Does A Short

Every short-term health plan is different in terms of what is and isnt covered.

Short-term medical insurance isnt influenced by the Affordable Care Act . The ACAs minimum essential coverage demands that standard health insurance plans offer a minimum level of coverage. However, theres no minimum essential coverage in short-term health insurance.

Instead, federal regulations allow short-term plans to create coverage plans without any required mandates found in a regular health insurance plan.

In many cases, short-term health insurance plans cover the same services as major medical plans, says Chris Foley, a licensed health insurance broker with Abbot Benefits Group. However, you need to be careful when comparing policies. Some short-term health insurance plans exclude certain preventive care services, which can be very limiting.

So, what do short-term health plans typically cover?

Covered services generally include hospitalizations, outpatient surgeries, emergency room and urgent care visits, doctor visits, and, sometimes, prescription drugs, Foley says.

When shopping for temporary health plans, you should also find out what is not covered.

This will differ with every plan, but here are several services that usually are not part of short-term health plans:

- Mental health and substance abuse

- Outpatient prescription drugs

- Maternity care

An International Standard Of Cover

With our short term plan, you get exactly the same cover, support, and expert global customer service as with the yearly Standard cover level.

With cover for the big bills as well as wide-ranging cancer treatment and emergency help, your health is in safe hands while youre away.

You can also enhance your plan for extra reassurance. Adding out-patient cover means routine scans and tests and trips to the doctor will be included too. And if you think you might fit in some extra travel, our travel insurance will cover you for lost luggage or delayed flights on both business trips and holidays.

Read Also: Can I Cancel My Health Insurance

What It Does And Doesn’t Offer

Since you can typically only have your coverage for one year, these plans will not coverfor long term conditions like maternity, mental health andpre-existing conditions.However, they will provide coverage for new illnesses or injuries while on your trip,including doctor visits and hospitalizations. Travel benefits like trip interruption andlost luggage are also included, so be sure to check the policy wording for details.

Tip:

How Can Short Term Health Insurance Protect You And Your Family

In the event you or a member of your family needs medical treatment before you are eligible for coverage under your provincial plan, short term health insurance will pay for the cost medical emergencies, minimizing your out-of-pocket expenses. Furthermore, having adequate coverage will give you peace of mind, knowing you will be able to get the care you and your family need when you need it without breaking the bank.

Also Check: Does Health Insurance Cover Funeral Costs

Best For Customized Coverage: The Ihc Group/national General

The IHC Group

Why We Chose It: The IHC Group offers the most customizable plans of all the companies we researched. You get a wide range of deductibles and term lengths . Some plans offer the ability to add optional coverage for pre-existing conditions, which can be very important if you have one.

-

Highly customizable plans in all price ranges

-

Telemedicine, check-ups included in some plans

-

X-rays and some other diagnostic exams included

-

Can see your own doctor, or out-of-network

-

Lifetime maximums up to $2,000,000

-

Pre-existing conditions covered on some plans up to $25,000

-

Highly customizable plans exclude many coverages

-

No online registration, must call or email

-

Sports-related injuries not covered

-

Some plans have high deductibles before you can access coverage

-

Some states require joining Communicating for America

IHC Group is an organization of insurance carriers and affiliates that include Independence Holding Company, Standard Security Life Insurance Company of New York, Madison National Life Insurance Company, Independence American Insurance Company and IHC Specialty Benefits. IHC was created in 1980, and has an AM Best financial strength rating of A-.

Examples of IHCs offering include:

For all plans, you have the option of adding dental or vision coverage for a relatively low monthly cost. You can also add hospital insurance, prescription discount plans, and telemedicine consultation options.

What Is Covered In Short Term Health Insurance Plans

The coverages of a short term health insurance policy depend upon the insurance company. Usually, the following things are covered:

Hospitalization: Expenses related to hospitalization such as bed charges, doctor visits, medicines, room rent, cost of surgeries, operation theater charges, etc.

Ambulance charges: The cost of hiring an ambulance for transporting the patient from one place to another would be covered under short term health insurance.

Expenses related to organ donation: Some insurance companies may cover the cost of undergoing surgery for organ donation.

Health check-ups: Regular health check-ups are conducted on the insured persons to keep a tab on their current health status. This is crucial for detecting an ailment in its early stages.

Pre and post hospitalization: A planned surgery may require treatment before or after getting hospitalized. These charges are covered under a short term policy.

Read Also: Does My Health Insurance Cover Weight Loss Surgery

Cover That Goes Further Than Travel Insurance

Unlike travel insurance, a short-term international health plan will cover your general health as well as emergencies. That means youre covered if you need to have a scan or break your tooth you wont need to wait until you get home to get the treatment you need.

Were available 24/7 too, so theres always someone to speak to in your language. We have the knowledge to help you navigate the local healthcare system or help you with your claim.

Our Top Picks: Short Term Health Insurance Reviews

The annual period known as open enrollment, when you can sign up for health insurance plans that fall under the Affordable Care Act , is just around the corner. In fact, the 2020 open enrollment period runs from Friday, November 1 to Sunday, December 15, 2019.

But theres another choice, known as short-term limited duration health insurance , that offers some consumers an affordable, temporary, limited health coverage option.

Short-term health plans are a temporary option that can provide a certain set of consumers with affordable, albeit limited, coverage while they find a more comprehensive plan. But be cautious these short-term health plans dont comply with the ACAs coverage mandates.

Short-term plans generally do not cover pre-existing conditions and often exclude or severely limit the minimum essential benefits that ACA-compliant plans are required to provide. Maternity care, preventive care, mental health, prescription drugs, and substance use treatment are often not covered by short-term health plans. STLD plans can also impose lifetime and annual dollar limits for certain medical services and raise premium prices based on pre-existing conditions. As a result, they are not recognized as comprehensive traditional health insurance according to federal standards.

While premiums may be lower, short-term regulations are so lax in some states that their significant limitations could put consumers at serious financial and medical risk.

Things to watch out for include:

You May Like: Does Health Insurance Cover Dental Anesthesia

What States Allow Short

Most states allow short-term health insurance.

States that forbid the sale of short-term plans include California, Hawaii, Massachusetts, New Jersey and New York. Other states allow plans, but for a limited time, such as six months.

Some states allow temporary health insurance plans, but no companies offer short-term plans in those states.

What Does Short Term Health Insurance Usually Cover

Short-term plan benefits vary from plan to plan. Its likely that a short term plan will cover some healthcare costs related to emergencies, but wont provide the same level of coverage as an ACA-compliant plan. Additionally, you will not need a referral to see a specialist.

Unlike ACA plans, short term plans can deny you coveragebased on your health or preexisting conditions. Additionally, if you have ashort term plan and you receive care for a preexisting condition your plan maynot cover that care. You may find that you will have to pay more for coveragethrough a short term medical insurance plan.

Therealso may be a cap on how much a short term medical insurance plan will coverannually or in your lifetime. For instance, if your plan covershospitalizations but only u to $5,000 you may have to pay for the rest of yourin hospital care out-of-pocket.

You May Like: How Much Is Health Insurance In Florida

Short Term Health Insurance Market To Gain Substantial Traction Through 2027

The business literature on Short Term Health Insurance market, including the Covid-19 impact analysis, entails comprehensive data on the key factors that will orchestrates the industry growth over the projected timeframe 2021-2027. It does so by critically analyzing the present trends and historical data. Moreover, major growth catalysts, rewarding prospects, and bottlenecks in the market space are enumerated in the intelligence report.

Moreover, accurate predictions pertaining to growth rate and valuation of the market and sub-markets are provided to help investors in making productive investment decisions. The study also elucidates on other quantitative and qualitative data gathered from primary and secondary sources for a holistic view of this industry vertical.

Key Highlights of the Table of Contents:

Product range

- According to the report, the product gamut of the Short Term Health Insurance market comprises Life Insurance and Non-Life Insurance.

- Revenue garnered and market share accumulated by every product segment

- Projected growth rate for every product type over the analysis timeframe

Application terrain

Regional landscape

- Regionally, the Short Term Health Insurance market is bifurcated into North America, Europe, Asia-Pacific, South America, Middle East & Africa, South East Asia.

- Total sales netted and revenue garnered by every region

- Estimated growth rate of each region over 20XX-20XX

What Is Short Term Insurance

Short term insurance is a policy you have with an insurer and includes all types of insurance with the exception of life insurance . The policy is valid for a limited time period and covers areas like car insurance, business insurance, home contents insurance, travel insurance and pet insurance.

No one can predict what will happen tomorrow. For example, who knew how many car crashes would occur between December 2021 and January 2022? Your home might be gutted by fire tonight or be flooded during the rainy seasons. When things like these happen, you can lose your home and worldly possessions.

Could you afford to repair your car if you were involved in a collision? Would you be able to rebuild your home if it burned down or replace or your home contents? For many, the answer is no because they dont have a short term insurance policy.

Short term insurance is a financial guardrail against unexpected misfortunes where your insurer will pay for repairs or replacement, or a lump cash sum, if you claim against a short term insurance policy. The type of payout you receive will depend on the kind of short term insurance you have. In a nutshell, short term insurance repairs or replaces your valuable possessions, such as a car or home and helps finance those unforeseen liabilities that we cannot realistically afford to pay on our own.

Recommended Reading: Does Health Insurance Pay For Assisted Living

Affordable Alternatives To Short

CHIP provides low-cost health coverage to children in families that earn too much to qualify for Medicaid. One of the perks of CHIP is that, like Medicaid, you can apply for it throughout the year to see if you qualify. In some states, CHIP covers pregnant women. Each state has its own rules about who qualifies for CHIP. If you apply for Medicaid coverage to your state agency, youll also find out if your children qualify for CHIP.

- To find coverage for your family visit InsureKidsNow.gov.

- Fill out an application through the Health Insurance Marketplace. If anyone in your family qualifies for Medicaid or CHIP, your information will be sent to your state agency and they will contact you for enrollment.

Medicaid is a state-run and federal program that provides health coverage if you have low income. States set their own guidelines and determine the type, amount, duration, and medical services available within federal guidelines. Federal law requires states to provide mandatory benefits and allows states to choose optional benefits.

Medicare is a federal program that provides health coverage for individuals who are 65 years and older or for people under 65 with specific disabilities, no matter their income. You can apply online even if youre not ready to retire. There are two main ways to get your Medicare coverage: Original Medicare or a Medicare Advantage Plan .

What Is Included In Long Term Insurance

A Long Term health insurance policy offers wider coverage as compared to a short term plan. A long term policy is valid for 2 to 3 years and has many renewal benefits as well. A long term policy can be of different types. For example, an Individual Health policy, Family-Floater plan, Critical Illness cover, Senior citizen plan, etc.

Long Term plans offer medical insurance for a specific type of policyholder depending upon their requirement. Since a long term policy is valid for more time, the coverage is also comprehensive in nature. Additionally, such policies can be fortified with add-ons like Room Rent Waiver, Daily Hospital Cash, Maternity Benefit, etc.

You May Like: What Is The Difference Between Hmo And Ppo Health Insurance

What Are The Downsides Of Short Term Health Insurance Coverage

The biggest downside to temporary health insurance plans is that they dont offer as comprehensive of coverage as an ACA individual plan.

Short term health insurance plans are great for, well, the short term. Apart from that short-term health insurance plans may not be able to offer coverage for the health care you need. You may end up paying more with a short term health insurance plan in bills for uncovered services or deductibles, than you would have with an ACA individual plan. If you think an individual and family health insurance plan sounds like a better option for your needs, check out the individual health insurance options available in your state. eHealth can help you compare ACA plans and see how the stack up against short term health insurance plans.

All this being said, in a pinch, temporary health insurance plans do offer some coverage that can be helpful and protect your wallet.

Its also important to note that depending on where you live you may not be able to get a short term plan. You currently cant get a short term health insurance plan in these states:

- California

How Does Short Term Insurance Work

In short term insurance, the insured person pays a monthly premium based on their individuals risk profile. Insurance companies determine a persons risk profile based on various factors.

If youre taking car insurance, an insurance company like Dialdirect will use your age, the location of your car during the day and overnight, driving experience and previous record of accidents to estimate your risk profile.

A person with a high risk can expect to pay a higher premium than someone who has a lower risk. Risk, in this case, means the probability of causing a car accident.

At Dialdirect, your premium will also depend on the type of vehicle insurance you take. Options available include comprehensive cover, third-party only cover, comprehensive off-road car insurance, and third-party, fire, and theft insurance.

Its advisable to think and assess your needs when you are taking out a short term insurance policy. Speak to a broker to discuss your options.

Recommended Reading: What Is The Average Monthly Cost Of Health Insurance