Choosing A Health Insurance Plan

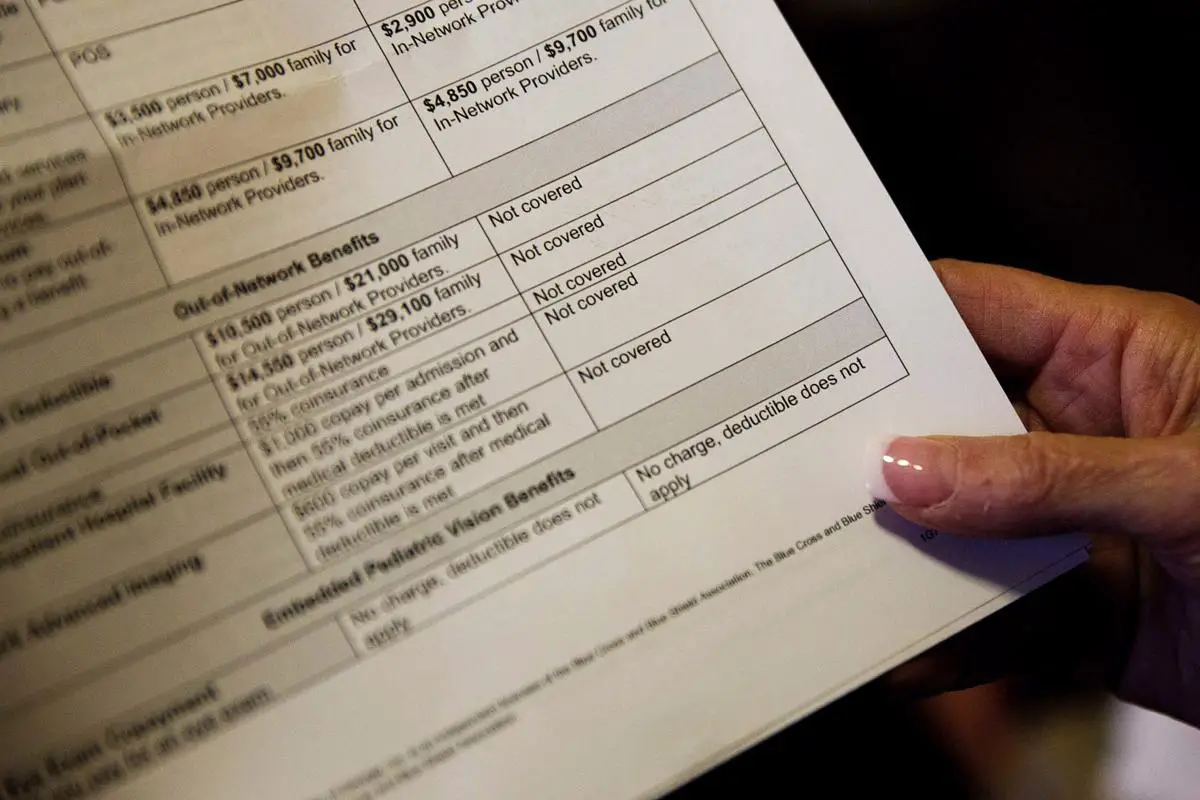

Reading the fine print is important when choosing health care plans. These questions may help:

- Can I go to any doctor, hospital, clinic, or pharmacy I choose?

- Are specialists, such as eye doctors and dentists covered?

- Does the plan cover special conditions or treatments such as pregnancy, psychiatric care, and physical therapy?

- Does the plan cover home care or nursing home care?

- Will the plan cover all medications my physician may prescribe?

- What are the deductibles? This is the amount you must pay each year before your insurance company will begin paying claims.

- Are there any co-payments? This is the amount of money you pay each time you receive medical services or a prescription.

- If there is a dispute about a bill or service, how is it handled?

Low Cost Indiana Healthcare Options Single And Family Plans Available

Low cost Indiana health insurance plans are found very easily on our website. Rates from all of the top Hoosier State carriers such as Anthem Blue Cross and Blue Shield , UnitedHealthcare ), Ambetter, and CareSource are provided so you can quickly consider your Marketplace, Senior, and non-subsidized options. Inexpensive short-term plans are also available if coverage is needed for less than 12 months.

Each day we research and update affordable individual and family policies and illustrate the lowest rates available for Hoosier State residents. NOTE: Several carriers no longer offer private under age-65 coverage in the state, including IU Health Plans, MDwise, PHP, Assurant, Humana, Aetna, and Cigna. In the future, if these companies return, we will include them in our quote engine. Exchange availability is different each year, and new non-Obamacare plans frequently become available. Currently, the only states that offer less than three Marketplace companies are Indiana, Alabama, Alaska, Connecticut, Delaware, DC, Hawaii, Iowa, Kentucky, Maryland, Mississippi, Nebraska, Rhode Island, South Dakota, Vermont, West Virginia, and Wyoming.

The Future Of Small Business Health Insurance

Defined Contribution Plans allow employers to offer health benefits without offering a traditional group health insurance plan. Instead of paying costs for a specific group health plan, employers allocate tax-deductible monthly allowances for their employees to spend on private health insurance and other medical expenses tax-free.

Features of defined contribution plans include the following:

-

Employee Choice employees choose a health insurance plan that best fits their needs.

-

Fixed Cost employers control health care costs by allocating fixed monthly allowances for their employees.

-

Savings employers using Defined Contribution Plans typically cost less than group health plans which results in saving for both the employer and employee.

Don’t Miss: Is It Cheaper Not To Have Health Insurance

Indiana Medicaid Program For Low

Medicaid is a public health insurance program funded by the state and federal government. About 1.2 million Indiana residents have Medicaid.7 This includes 1 in 8 adults under 65 and 1 in 3 children.

Indiana offers Medicaid to low-income residents, including:

- Children under 19

- Parents and caretakers of minor children

- People who are blind or have disabilities

- Individuals 65 or older

- Pregnant women

Each group has its own Medicaid program and income limits. For example, non-disabled adults 19 to 64 get Medicaid through Healthy Plan Indiana. The income limit for this group is $17,780 a year for an individual as of 2019.

Indiana offers a childrens health insurance program called Hoosier HealthWise. A family of four earning up to $5,521 per month as of 2021 can enroll their eligible children. The program is also available to pregnant women with monthly incomes up to $3,093 for a family of two.

You can view all Indiana Medicaid Programs here.

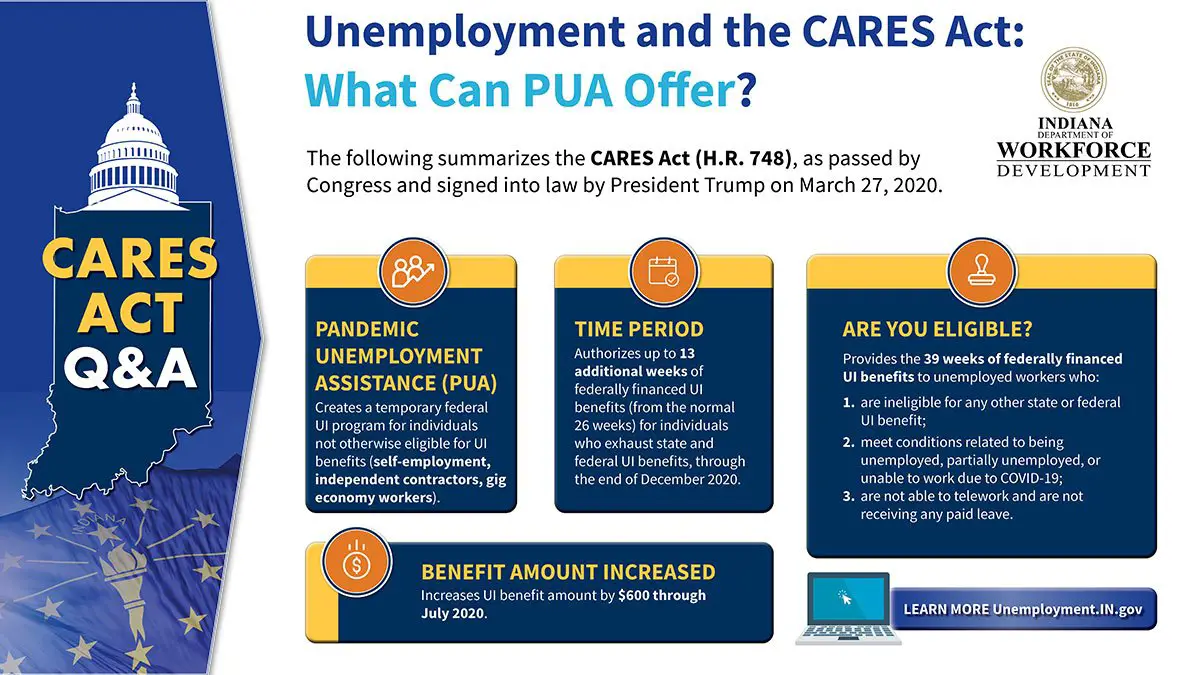

When Your Income Reduces Low

We understand what happens when you no longer have a paycheck. We help find affordable coverage so you can quickly apply online and get covered. Whether you lost a job voluntarily or involuntarily, several options are possible. And you can keep coverage for a month, or until you are eligible for Medicare. In some situations, Medicaid-eligibility may also be available. The choice is yours.

However, it is important to be aware of Open Enrollment deadlines, since during the OE period, you can enroll for a subsidized Marketplace plan and avoid the 2.5% household income penalty. CHIP may also be available for your children. Open enrollment typically begins in November and lasts for three months.

You May Like: How To Get Good Health Insurance Cheap

How To Enroll In Hip

Get an application

Applications are available online, by mail or by visiting your local Division of Family Resources office. Call 1-877-GET-HIP-9 to find more information about the application process or to find your .

Send in the application with all required information.

Applications are processed within 45 business days once all required information is received. For questions about what to include in your application, call 1-877-GET-HIP-9.

After your application is processed, you will receive a letter by mail telling you if you qualify for the program.

Once you are approved for HIP, you will be assigned to the health plan you chose on your application. . If you do not choose a health plan, one will be selected for you.

Approved applications

If you are approved for HIP, your health plan will mail you a welcome packet.

All HIP members will receive an invoice for their POWER account contribution. HIP POWER account contributions must be paid by the due date stated on the invoice to become enrolled in HIP Plus.

If you selected a health plan on your application, you will also receive an invoice for a Fast Track payment while your application is being processed. Making a Fast Track payment can expedite your enrollment in HIP Plus. To find out more about Fast Track payments, .

Get HIP benefits

All HIP members will receive a letter informing them when coverage starts and how to get the most out of their HIP benefits.

Average Cost Of Health Insurance By Family Size

The cost of health insurance for your family in Indiana will largely be affected by the tier and health plan you select, the number of people covered and their ages. Adding children to your health insurance plan will cost an additional flat rate for coverage until they are 15 years old. Upon reaching age 15, the monthly rate will increase as they grow older.

For example, the average monthly premium on a Silver plan for a family of four, assuming two 40-year-old parents and a child, is $1,169 in Indiana. If you were to add another child to the plan, the monthly premium would increase by $269. For a family of five, the total monthly health insurance rate would be $1,708.

| Family size |

|---|

Adults are 40 years old, while children are 14 or younger.

You May Like: How To Qualify For Government Health Insurance

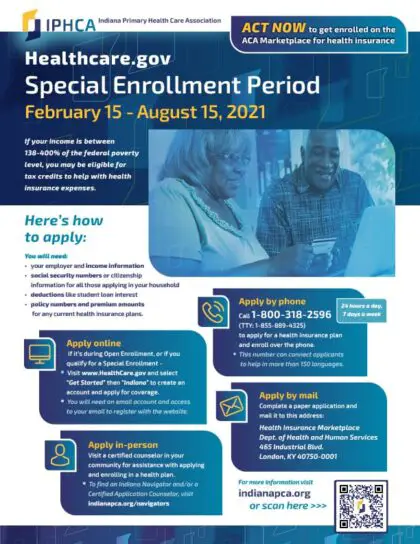

How To Get Help With Obamacare Premiums In Indiana

Premium tax credits help reduce your monthly costs. Theyre offered by the federal government when you apply for Marketplace coverage at Healthcare.gov.

Before 2021, if you earned between one to four times of the federal poverty level, you were eligible for subsidies to help you pay for any metal plan.

In 2021, the federal government expanded subsidies and removed the income cap for premium tax credits. Instead, you would pay no more than 8.5% of your annual household income on health insurance based on the price of the benchmark plan. The federal government would cover the balance through subsidies.

Seventy-one percent of Indiana Marketplace enrollees received premiums tax credits in 2020.6The average subsidy received at this time was $394 per month.

Checking The Application Status

You can examine your application status online or by calling the aforementioned number. You will be needed to provide your case number to check your application status, so you must have one. You must remember that your application has to be finalized and all necessary documentation must be submitted before DRR initiates processing your application. DFR is focused on protecting the privacy of every client. For that reason, DFR will never share or reveal your personal data and information without an underwritten release.

Recommended Reading: How Much Does Health Insurance Cost In Ct

Cheapest Health Insurance Coverage By Metal Tier

The average health insurance premium in Indiana for a 40-year-old across all metal tiers is $462 per month. This represents a 10% increase from the average cost of coverage in 2020.

We compared Indiana plans by metal tier and identified the most affordable health insurance policy in the state for each level of coverage. There are four different levels of coverage offered on the state marketplace, and we recommend using the table below as a baseline when comparing the different costs and benefits among metal tiers.

| Metal tier | Monthly cost for a 40-year-old | ||

|---|---|---|---|

| Bronze | Ambetter Essential Care 1 | $8,300 | |

| Ambetter Balanced Care 29 | $5,450 | ||

| Ambetter Secure Care 5 | $1,450 | $6,300 | $441 |

For example, the Ambetter Balanced Care 29 is the cheapest Silver plan. It comes with a minimum monthly premium of $329 for a 40-year-old, but it has a deductible of $5,450. On the other hand, the minimum monthly premium for the cheapest Gold plan, the Ambetter Secure Care 5, is $441. But the Gold health insurance policy has a much more affordable deductible of $1,450.

Cheap Temporary Gap Coverage

Just as it sounds, this type of plan doesnt cost much, and is designed to be kept only 1-12 months. But that may be just enough time for you to obtain medical benefits until the next Open Enrollment, which typically begins in November. For 2020 effective dates, the OE period began on November 1st. We do not recommend a short-term policy as a long-term solution to not having qualified ACA benefits. But if bridging a gap is your goal, its a viable solution, despite not meeting some of the Obamacare mandate requirements.

Short-term often are the best possible solution until the following year, when new Administration plans may be partially available. Although HSA-deposits are not allowed , several higher-deductible options are offered.

Short-term plans do not provide unlimited benefits for as long as you have the policy. Usually, the maximum payout is between $250,000 and $2 million, which still should be enough for the limited amount of time you will keep the plan. Preventive benefits, unlike regular Marketplace policies, are not covered at 100% prior to the deductible, and often are not provided at all. Primary-care physician visits, prescriptions, and Urgent-Care visits are generally subject to a deductible, although a rider can often be added to remove the deductible.

Also Check: How To Get Health Insurance Fast

Individual Health Insurance Tax Subsidies

Beginning 2014, individuals will have access to tax subsidies to buy private health insurance through the public exchange. These subsidies will be for those who enroll in a silver plan through the exchange. The subsidy caps the cost of individual health insurance at 2% – 9.5% of their household income if their household income is less than 400% above the federal poverty line. This equates to roughly $90,000 per year for a family of four.

One Plan Always Covered

MHS offers affordable individual and family health insurance plans that fit your unique needs. Program eligibility depends on your:

- Age

- Any special health needs you may have

Medicaid: To find out if you are eligible for Medicaid, visit the FSSA website.

Marketplace: To find out more about the Health Insurance Marketplace, visit HealthCare.gov.

Medicare: To find out more about Medicare options, visit Medicare.gov.

Learn more about the plans MHS offers by selecting a program below. If you have a question or need help, please call us at 1-877-647-4848. We are here to help!

Don’t Miss: Does Insurance Pay For Home Health Aides

Risk Pool No Longer Available

For single or married persons that have been without health care benefits AND have a serious medical condition , the Indiana Risk Pool was a strong option to consider. However, on January 31, 2014, the ICHIA stopped offering policies since Marketplace enrollment became available. And actually, the program stayed open an extra 31 days to help cover about 7,000 Hoosiers.

Rates were fairly reasonable and if you had been denied coverage and met other specific criteria, you could have easily applied. The program, when active, helped thousands of unemployed and/or low income qualified persons in Indiana obtain health insurance. CHIP is still available for low-income families that need coverage for their children. If your household income excludes you from CHIP-eligibility, Marketplace options are available.

Four Types Of Indiana Small Business Health Insurance Plans

Whether youre looking at individual health insurance or group health insurance, there are several different types of health plans available. The four you should absolutely know are:

PPO Health Insurance Plans,

HSA-Qualified Health Insurance Plans, and

Indemnity Health Insurance Plans.

The plan type that is best for you and your employees depends on what you and your employees want, and how much you are willing to spend. Heres a brief review of the four popular types of health insurance plans:

Don’t Miss: How Much Is Supplemental Health Insurance For Seniors

Get Important News & Updates

Sign up for email and/or text notices of Medicaid and other FSSA news, reminders, and other important information. When registering your email, check the category on the drop-down list to receive notices of Medicaid updates check other areas of interest on the drop-down list to receive notices for other types of FSSA updates.

Indiana And The Affordable Care Act

The Affordable Care Act or Obamacare took effect in 2013. About 900,000 Indiana residents were uninsured at that time compared to 570,000 as of 2019. Thats a drop from a 14% uninsured rate to 9%.1

Indianas decision to expand Medicaid to childless adults under 65 led to more people with health insurance. The state accepted Medicaid expansion under the ACA in 2015.2 Since then, more than 447,000 adults gained coverage due to the expansion.3

You May Like: Do You Have To Have Health Insurance In Arizona

How Do I Apply For Health Insurance In Indiana

Health Insurance is said to be the most important out of all insurance plans, and every family or individual should have a secure and reliable health and medical insurance plan. However, there is a massive lack of awareness regarding the procedure details and the application process for health insurance. If you are from Indiana and are looking to apply for health and medical insurance, worry no more. Read this article to find out everything you need to know about the process and other relevant information!

The good news is: You have more health insurance options available than you think, Indiana!

There are various plans and offers available for medical and health insurance in Indiana. The programs vary in the services covered, and the additional benefits packages are different depending on the cost of each program, but necessary medical necessities are included in every plan. To give yourself a brief idea of the plans available, go through the following list:

How to choose an Insurance Plan?

- Affordability

- Ability to qualify

While living in Indiana, various sites will further help you in searching for and the application process for Health Insurance. Some reliable and helpful resources are:

Health Insurance Coverage For Multiple Years

TriTerm Medical Insurance,2 underwritten by Golden Rule Insurance Company, is short term health insurance that offers coverage for preventive care, doctor office visits, and prescriptions.

- Apply once for insurance coverage terms that equal one day less than 3 years.

- $2 million lifetime maximum benefit per covered person on most plans.

- Eligible expenses for preexisting conditions are covered after 12 months on the plan.

Read Also: What Is Employer Group Health Insurance

Utilize Our Unbiased And Professional Assistance

There are no costs for utilizing this website, and we are committed to saving consumers money and helping you choose the best available plan. We understand that many consumers prefer to do business by phone or email, so our Agency is typically available 24/7. We are live persons! Complete plan descriptions and historical rates are easily provided, along with a simplified enrollment process. While a low premium is the goal of all consumers, low out-of-pocket expenses are equally important.

Senior Medicare Supplement, Advantage, and Plan D prescription drug plans are offered in all counties. Prices, benefits, and out-of-pocket expenses can vary. When policies renew, rates and coverage may also change, although prior notification will be given. Applicants that are under age 65 can easily transition to Senior product coverage. Its also common that one spouse will be Medicare-eligible while the other spouse is covered under a Marketplace plan.

Well review your current options and also keep you informed on statewide and national reform and how it could possibly reduce your rates. The State Exchange Marketplace provides a federal tax subsidy to help pay premiums. The amount of the subsidy is based on your total household income in conjunction with the Federal Poverty Level . We can easily and quickly calculate the amount you are eligible to receive.If you are eligible for Medicaid or Medicare, specific options are available.

Do I Really Need Health Insurance

If youve never purchased health insurance on your own and dont deal with many health issues, it may be tempting to forgo coverage to save on monthly premiums. However, taking advantage of a health plan may help you save on costs in the long run.

While you dont plan to get sick or hurt, you may need health care if youre faced with an unexpected health issue or accident. Plus, even if youre feeling healthy now, annual preventive care may help identify early-stage health issues.

With that in mind, here are three reasons why you may want to consider enrolling in a medical plan:

1. Health care cost savings

Depending on which coverage you choose, your plan may help cover unexpected medical costs. A trip to the ER costs an average of $2,200. Having an insurance plan puts a maximum on your out-of-pocket expenses, which may offer added financial protection. Also, once youve met your plans deductible, some health plans may take care of 60% to 90% of covered expenses.

Health insurance also helps cover preventive screenings, like vaccines and annual check-ups, which are important for maintaining your overall health. While these may not be large expenses, insurance often covers network care, avoiding some out-of-pocket expenses.

2. Avoiding state tax penalties

While you are no longer penalized on a federal level for being uninsured, some places still enforce an individual mandate for health insurance, including:

You May Like: What Is Aetna Health Insurance