How To Compare Health Insurance Companies

There are numerous options to find affordable catastrophic health insurance plans depending on your needs and location. Here are a few ways to get started.

- Determine which insurers are active in your area. Coverage options vary widely by county and state.

- Check coverage. When youre shopping, include information about preferred health providers and prescription medications to get a realistic cost estimate.

- Compare premiums, co-pays, and deductibles. Catastrophic health insurance plans have high deductibles with lower premiums but higher out-of-pocket costs. Catastrophic Health Plans sold on the Marketplace pay for 100% of covered expenses after the deductible, so co-pays rarely apply.

- Research industry ratings to measure the companys financial stability. Customer reviews are also helpful for gauging the companys efficiency and member satisfaction.

- Get help. If you need additional help to select an affordable catastrophic insurance plan, reach out to an independent insurance agent or counselor. Resources may be available through various state agencies in your area.

Tammy Burns is an experienced health insurance advisor. She is ACA-certified for health insurance and other ancillary, life, and annuity products.

Is It Worth It To Get Critical Illness Insurance

Choosing if critical illness insurance is right for you will depend on a variety of factors. These factors include what your regular health insurance covers, your current health, your age, your family medical background, and your financial situation. The older you get, the more costly critical illness insurance is.

Healthy Individuals Under Age 30

If you are under 30, you are eligible to purchase catastrophic health coverage. But you should only consider a catastrophic health insurance plan if you rarely get sick, you are not suffering from a chronic medical condition, or your goal is to spend as little as possible on health insurance.

Under the Affordable Care Act, these plans have been a way for young, healthy individuals to avoid paying the individual mandate penalty without spending a lot on health insurance they donât want. This is less important after 2019, though, because Obamacareâs individual mandate was suspended and so thereâs no federal penalty for going without insurance. Depending where you live, your state may still require you to have health insurance coverage.

However, if youâre looking to purchase an individual plan through the Obamacare marketplace, you can likely find other health care plans that arenât much more expensive and that provide more coverage for common medical expenses. If you have employer-sponsored health insurance , your premiums will probably be cheaper than a catastrophic plan.

Additionally, consider pairing a health savings account with your catastrophic health insurance plan. Setting up an HSA helps you save on taxes while also savings for expenses that you catastrophic plan may not cover.

Also Check: How To Get Health Insurance Without Social Security Number

Catastrophic Health Insurance Over 50

Contents

A civil protection plan usually requires you to pay out of pocket for doctor visits and prescription drugs, but the main expenses are covered. These types of expenses can include hospital stays, surgeries, critical care, laboratory tests, and x-rays. You will seldom find pregnancy and maternity care covered by such plans.

Companies that offer retiree C.

Disaster control can be purchased individually or as a group plan. You must pass existing exams. This means that coverage is not covered for conditions that you had before you received coverage. Some examples could be diabetes, emphysema, heart disease, and cancer .

| SL. No |

| AA |

Usually catastrophic health insurance over 50 is taken out by healthier people by the age of 20 and sometimes by people approaching retirement age . Its also a popular alternative for the self-employed who dont have health insurance.

Should You Get Catastrophic Health Insurance?

Depends on. If you are healthy with no pre-existing conditions and dont have access to another health plan, you might be a good candidate for a civil protection plan.

Think you are an older adult with no health problems and just need insurance to cover yourself against major disasters , this type of coverage might be for you. If you dont meet these criteria, you can consider other options.

Aarp Health Insurance Rates Age 62

Obesity-related diseases such as diabetes, heart disease and cancer are also on the rise. As the preventable diseases caused by obesity increase, so too does the cost of health care and the number of Americans without health insurance.

47 million people are not insured, 2.2 million more than in the previous year. Health insurance coverage has increased 87% since 2000, according to AARP.

Many of the uninsured and health insured can take steps to prevent visits to the doctors office or possible life-threatening illnesses by simply eating foods and maintaining weight control while strengthening the main muscle through regular exercise or physical activity.

Read Also: Where To Find Health Insurance

What Is The Advantage Of Catastrophic Health Insurance

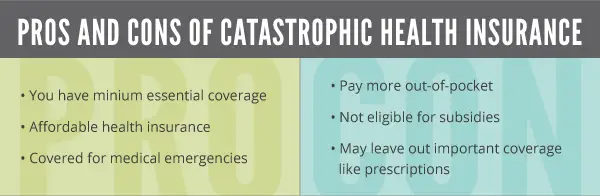

The main advantage of this type of health insurance, also known as a high deductible health plan, is the low premium payments that it offers. The premiums are kept low because the deductible is highin fact catastrophic health insurance is also sometimes called a high deductible health plan.

Catastrophic health insurance is a type of pay-as-you-go service whereby you pay more out-of-pocket for routine checkups and even sick visits to your doctor. The advantage is that you pay lower premiums for health insurance that covers you if something major happens to your health. Once you meet your deductible, your policy will allow for a set percentage of reimbursement, regardless of what type of medical specialist you see or treatment you seek.

Catastrophic Health Insurance Has Been Around Long Before Obamacare

In the old days before the health insurance reform known as Obamacare , catastrophic coverage was just a loose term with no official definition. Catastrophic coverage generally meant a health insurance plan that DID NOT provide you much in the way of certain benefits like regular checkups, preventive care visits or health services for pre-existing medical condition. Catastrophic insurance typically kicked in only if you found yourself suddenly facing serious medical bills. Catastrophic health insurance was coverage in case of a serious injury or hospitalization.

In the old days, catastrophic health insurance plans tended to have very high annual deductibles that is, the insurance company wanted you to pay a lot out of your own pocket toward covered medical care before the insurance company began paying for your services. But low monthly health insurance premiums made these plans appealing for many people, especially for those who didnt expect to use the doctor often and couldnt afford more expensive plans.

Catastrophic plans in the old days tended to appeal most to young adults or to lower-income persons of any age who didnt qualify for Medicaid or employer-based coverage but who wanted a layer of protection just in case. And anyone could buy catastrophic health insurance plans.

Recommended Reading: How Much Does Health Insurance Cost In Georgia

What Are The Costs Of This Insurance Plan

Monthly premiums for catastrophic health plans are typically low. They can range between $175 and $200 a month, depending on your insurer. Unlike other health plans, catastrophic plans do not allow policyholders to use a premium tax credit or subsidies to reduce their premium costs. Regardless of income level, policyholders with a catastrophic plan will have to pay the standard premium amount.

Catastrophic plans have high deductibles, meaning policyholders will have to pay high out-of-pocket costs before their insurance begins to cover their medical expenses. For 2020 plans, the deductible of catastrophic insurance is $8,150. This includes copayments and coinsurance, but does not include monthly premium payments.

Is A Catastrophic Health Insurance Policy Right For Me

Whether a catastrophic health insurance policy is the right coverage for you and any family members depends on quite a few factors. If you are a relatively healthy person, this could work for you. If you need to save money on health insurance because youre currently between jobs or are retired and without medical coverage, catastrophic health insurance could also be right for you.

If, however, you need to take monthly prescriptions, have a condition that requires daily maintenance such as diabetes, or get sick quite often, then this type of policy is probably not a good one for you. Keep in mind that you also need to have the finances to afford the relatively high deductible associated with this type of health insurance, in case a catastrophic health event does occur. Lastly, even after you meet your annual deductible, the insurance company will still only help pay for any medical treatment that it deems necessary.

Check with your insurance company for its list of exclusions before you purchase this policy, so you know whether it is the right one for you.

You May Like: Does Health Insurance Cover Gynecologist

Who Is Eligible To Purchase A Catastrophic Health Insurance Policy

Only select individuals can purchase catastrophic health insurance via the insurance Marketplace. To qualify, you have to be under 30 years old.

Another way to qualify is via the hardship exemption from the individual mandate penalty provision.

More individuals than ever can now buy catastrophic health insurance policies as a result of the US government expanding the setlist of conditions that qualify for hardship exemptions.

A few of the hardship qualifications are:

- Bankruptcy

- Man made or natural disasters resulting in significant property damage

- Death of a close family member

- Lack of utility services

It doesn’t matter that the federal penalty for not having insurance was struck out after 2018. It is still necessary to get an exemption before purchasing a catastrophic health insurance policy if you are older than 30 years.

How Much Does Catastrophic Health Insurance Cost

Cost is a major factor that determines which type of health insurance plan you opt into, and its no different with catastrophic health insurance.

Currently, catastrophic health insurance under the Affordable Care Act has high deductibles equal to the average out-of-pocket cost under the ACA. This equals $8,150 for a single applicant in 2020. That means you would be responsible for paying up to this deductible amount before your insurance would begin covering expenses. While the deductible is high, this type of insurance can still save you tens of thousands in hospital visits and stays if a medical emergency were to strike.

Hospital stays in the U.S. cost $15,734 on average in 2017. In this case, youd save $7,584 in medical expenses by obtaining a catastrophic health insurance policy.

Premiums for catastrophic health insurance are less than traditional health insurance, which is why they appeal to so many young or low-income Americans. The average cost of health insurance premiums for individuals averages $400 per month, while family plans average $600 . Your catastrophic health insurance premium would be much lower than these averages, though the price fluctuates depending on your city and insurance provider.

The best way to determine the cost of catastrophic health insurance in your area is by getting a custom quote.

Don’t Miss: How Much Will Health Insurance Cost Me In Retirement

Where Can You Buy Catastrophic Health Plans

Catastrophic health plans are available through the Health Insurance Marketplace for those who are eligible. Remember that if you are over 30, you must qualify for a hardship exemption. The forms are available on healthcare.gov, and you will need to show that you meet specific guidelines for financial hardship, such as those described above.

If I Qualify For An Exemption Can I Get Catastrophic Health Insurance

If you are approved for either a hardship or affordability exemption, it means you may then get a catastrophic health insurance plan, if you choose.

Catastrophic health plans can help protect you from high emergency medical costs, while also covering some essential health benefits like an annual check-up, certain preventive services, and at least three primary care visits before you have met your deductible. However, if you anticipate costs associated with managing a chronic health condition, you may save more with another type of health plan.

Don’t Miss: Can You Get Health Insurance While Pregnant

What Do Catastrophic Health Insurance Policies Cover

Catastrophic health insurance acts as a financial safeguard for young people under 30, with extremely high healthcare costs throughout a year. These policies can offer the same covered benefits which every ACA-compliant health insurance plan is expected to provide.

These benefits also include three copay-covered non-preventative doctor’s visits per year. While most healthcare services count towards a deductible till it is met, a catastrophic health insurance plan differs in that essential health benefits are covered.

Covered in this sense means that they are eligible for the deductible, which, when met, would trigger the policy to pay for the essential health benefits for the rest of the year.

Apart from these specific benefits of non-preventative and preventive care, the deductible still has to be met before the policy begins to pay for your medical expenses. Before the deductible is met, a catastrophic health insurance policyholder can still pay the policy’s negotiated rates instead of the total amount the medical provider charges.

It’s essential to bear in mind that catastrophic health insurance plans typically have high deductibles that most policyholders cannot meet within a year. This deductible can be likened to a yearly out of pocket maximum for some other health insurance plans.

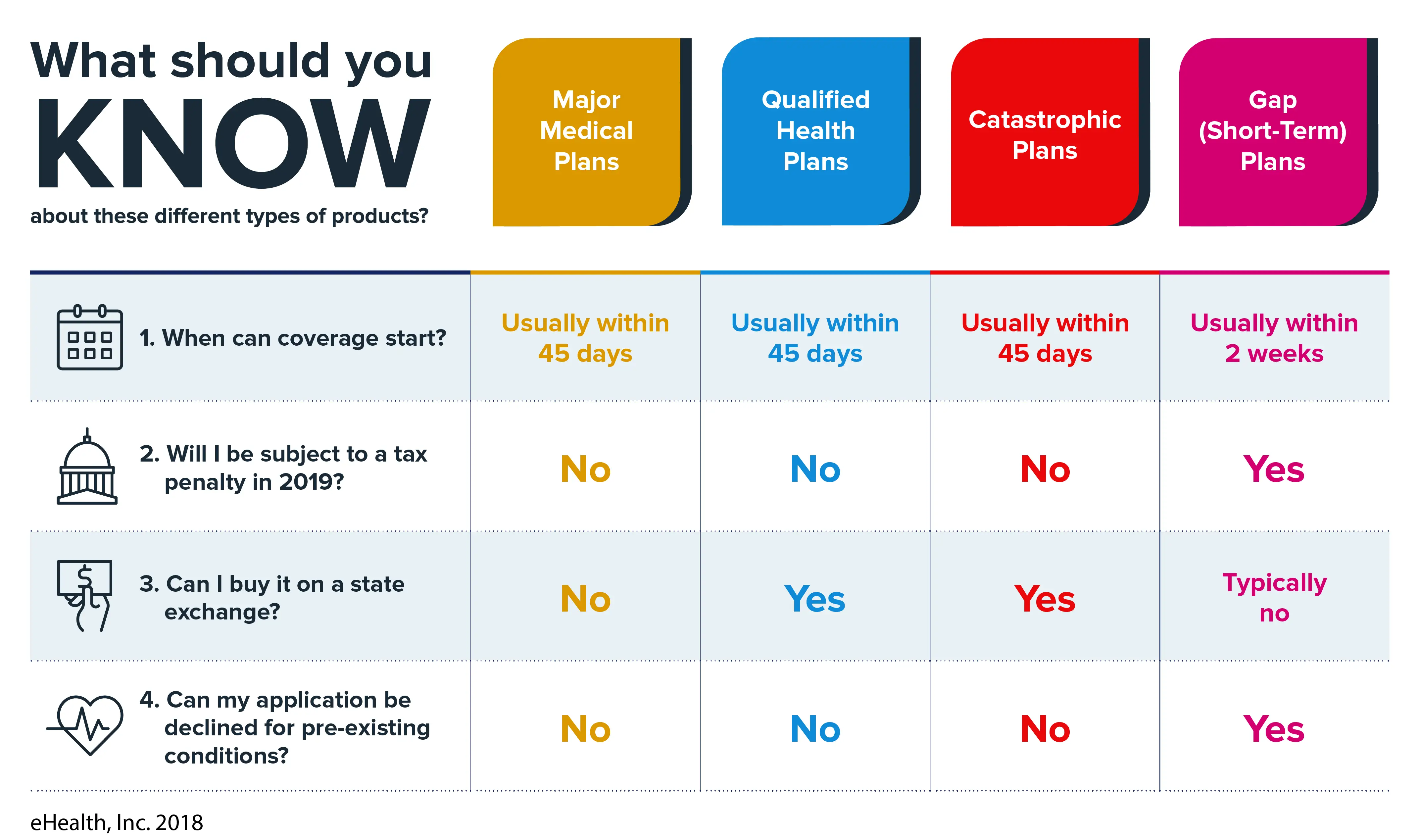

How Do Catastrophic Health Plans Compare To Other Marketplace Plans

Catastrophic plans have the same essential health benefits as other Marketplace plans. Like other Marketplace plans, they also must cover certain preventive health services at no cost. These plans also cover three primary care visits a year before you meet your deductible. Grab our guide to all the preventive care services covered by Marketplace plans to learn more.

Otherwise, all other care you will pretty much pay for out-of-pocket until you meet your deductible. In 2019, the deductible for all Catastrophic plans was $7,900. After you meet that deductible, your Catastrophic plan will pay for all covered care, with no additional copays or coinsurance.

Depending on whether or not you qualify for subsidies on the Marketplace and how often you access health care, you may be better served, value-wise, by a Bronze or Silver Marketplace plan.

Don’t Miss: Is It Illegal To Go Without Health Insurance

Very Few People Enroll In Catastrophic Plans

Because catastrophic plans are not subsidy-eligible, are only available to some enrollees, arent available in all areas, and arent automatically displayed to eligible applicants unless theyre under 30 years old, very few people tend to select these plans. Each year, less than 1% of all exchange enrollees nationwide enroll in catastrophic plans.

Best For Added Benefits: Oscar

Oscar

-

Only available in select markets

-

Smaller provider network

-

Higher-than-average number of complaints

Oscar is a relatively new company that launched in 2012. It offers unique features like virtual urgent care, and you can book visits with healthcare providers from your home and pay $0.

Oscar has an app that syncs with your Google Fit or Apple Health device. You can earn $1 for every day you reach your step goals, up to $100 per year by walking. In California, members can also earn rewards by reaching their sleep goals.

You will also have access to a care teama team of guides and nurses that will help you find the best and most affordable care near you.

Oscar isnt available everywhere. General healthcare plans are available in 19 states. Only five locations have catastrophic plans: New York, Los Angeles, Orange County , San Francisco, and San Antonio.

Because Oscar is so new and is only available in some areas, it has a smaller provider network than some other insurance companies. And its had some growing pains as it expands. In 2020, its National Association of Insurance Commissioners complaint ratio was 4.82, meaning it received nearly five times more complaints than is typical in the industry.

However, Oscar offers unique benefits that make it stand out from other insurers. With its telehealth and rewards program, you can get quality care at a relatively low cost.

Recommended Reading: Do You Pay Health Insurance Monthly Or Yearly

Individuals With A Financial Hardship

People affected by the health insurance mandate may be eligible to avoid the penalty if they claim a hardship exemption. A hardship is a financial situation or other circumstance that prevents you from being able to get health insurance.

You can qualify for an exemption if your income is too low or you otherwise just canât afford health insurance, from the marketplace or from your work. You may also qualify for a hardship if you met one of these circumstances during the year:

-

You were homeless

-

You faced eviction or foreclosure

-

You received a shut-off notice from a utility company

-

You filed for bankruptcy

-

You had substantial medical debt that you couldnât pay

-

You were a victim of domestic violence

-

You suffered the death of a family member

-

A fire, flood, or other disaster resulted in substantial damage to your property

-

Your expenses increased unexpectedly from caring for a sick, disabled, or aging family member

-

You were ineligible for Medicaid because your state didnât expand Medicaid eligibility under Obamacare

Other hardships may qualify you, so talk with your insurance provider if you have a question about a specific situation.

If you do qualify for an exemption, you can claim it on your annual tax return and get money back.

Other Reasons For Low Enrollment

But catastrophic plan enrollment is low for other reasons as well. Even when its easy to see the pricing , catastrophic plans arent always the lowest-cost option for people who dont get premium subsidies. For example, in Cook County, Illinois, the lowest-cost plan for a 27-year-old for 2021 is $212/month , while the lowest-cost catastrophic plan for this person is $220/month. This pricing anomaly with Bronze plans priced below catastrophic plans is rare but does exist.

In some areas, there are no catastrophic plans available. And in some areas, the lowest-cost insurer doesnt offer catastrophic plans, so even if other insurers do, the Bronze plan from the lowest-cost insurer might be less expensive than another insurers catastrophic plan.

And some applicants are specifically looking for HSA-qualified plans so that they can contribute money to an HSA. Catastrophic plans cannot be HSA-qualified high-deductible health plans despite their high deductibles because they cover some non-preventive services before the deductible and because their out-of-pocket maximum is too high.

Catastrophic plans are available both in and out of the ACAs health insurance exchanges, but hardship exemptions for those 30 and older must be obtained from the exchange.

You May Like: What Can I Expect To Pay For Health Insurance